Professional Documents

Culture Documents

BBA Syllabus (2021-22)

BBA Syllabus (2021-22)

Uploaded by

swamiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBA Syllabus (2021-22)

BBA Syllabus (2021-22)

Uploaded by

swamiCopyright:

Available Formats

SCHOOL

OF

COMMERCE AND MANAGEMENT

(SCM)

Bachelor of Business Administration

Duration - 3 Years (6 Semesters)

Maximum Duration - 6 Years

Curriculum Structure

(Academic Session 2021-22 Onwards)

Om Sterling Global University

Bachelor of Business Administration

PROGRAM OBJECTIVES

The objective of BBA program is to inculcate the students with junior level managerial and

personnel requirements in industry, service and government sector. The program structure is

aimed at delivering and imparting knowledge and skills of functional areas of management in

various organizations.

LEARNING OUTCOMES

The BBA program will equip the students with the fundamental understanding about the various

disciplines and functions of business management. They will be able to recognize features and

roles of businessmen, entrepreneur, managers, consultant, which will help learners to possess

knowledge and other soft skills and to react aptly when confronted with critical decision making.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 2

Om Sterling Global University

Common Instructions and Guideline for all semesters and subjects

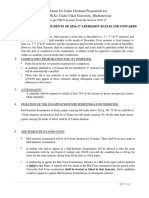

1 Question Paper Pattern

(i) Where the End Term Examination is of Maximum 60 Marks

Section A: MCQ/Fill in blanks/Short answer questions (up to 25 words) 5 x2 marks = 10

marks. All five questions are compulsory.

Section B: Analytical/Problem Solving questions (up to 100 words) 4 x 5 marks = 20

marks. Candidate has to answer four questions out of five.

Section C: Descriptive/ Analytical/Problem solving question 2 x 15 marks = 30 marks.

Candidates have to answer two questions out of three.

(ii) Where the End Term Examination is of Maximum 30 Marks

Section A: MCQ/Fill in blanks/Short answer questions (up to 25 words) 5 x1 marks = 5

marks. All five questions are compulsory.

Section B: Analytical/Problem Solving questions (up to 100 words) 4 x 2.5 marks = 10

marks. Candidate has to answer four questions out of five.

Section C: Descriptive/ Analytical/Problem solving question 2 x 7.5 marks = 15 marks.

Candidates have to answer two questions out of three.

2 Continuous Assessment: All courses undertaken by students are evaluated during the

semester using internal system of continuous assessment. The students are evaluated on

class /tutorial participation, assignment work, lab work, class tests, mid-term tests,

quizzes and end semester examinations, which contribute to the final grade awarded for

the subject. Students will be notified at the commencement of each courses about the

evaluation methods being used for the courses and weightages given to the different

assignments and evaluated activities. Here marks obtained in the internal assessment and

end semester examination are added together and a 10-point grading system will be used

to award the student with on overall letter grade for the course (subject).

Distribution of Marks

1) Courses without Practical Components

(a) Attendance Class participat ion - 05 Marks

(b) Assignment s, Class Tests, Quizzes, Projects, Seminar etc. - 15Marks

40 Marks

(c) Midterm Test I - 10 Marks

(d) Midterm Test II - 10Marks

(e) End –Term Examination - } 60 Marks

__________________________________________

Total 100 Marks

(ii)Courses with Practical Components only

Internal Practical Examination and Continuous Progress- 50

End –Term Examination (Practical) - 50

Total : 100

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 3

Om Sterling Global University

Grade distribution in a course/Subject

To assess the performance of a student the grading & grade point system as given below in the

table.

Sr. % of Marks Performance Letter Grade Grade Point

No.

1 ≥ 90% & ≤100% Outstanding O 10

2 ≥ 80% &<90% Excellent A+ 9

3 ≥ 70% &<80% Very Good A 8

4 ≥ 60% &<70% Good B+ 7

5 ≥ 50% &<60% Above B 6

Average

6 ≥ 45% &<50% Average C 5

7 ≥ 40% &<45% Pass D 4

8 < 40% Fail F 0

9 Absent Fail Ab 0

1. A student has to obtain minimum ‘D’ grade in theory & practical to pass in a course/subject

and to earn credit for that subject.

2. For award the Grade in a course/subject, marks obtained in Internal Assessment and

External Assessment are added together provided the student has obtained a minimum of

40% marks in Internal Assessment as well as External Assessment separately and

Combined Grade is awarded in the course/subject as per grading system given above. In

case a student fails to secure a minimum of 40% marks in Internal Assessment or

External Assessment or in both Internal Assessment and External Assessment, the

Combined Grade awarded is Grade F (Fail).

3. Student has to reappear in the external examination or internal examination or both of

theory & practical, if he/she has been awarded ‘F’ grade or Absent (Ab) in any

course/subject.

4. For non credit course only Satisfactory or Unsatisfactory shall be indicated instead of

letter grade and this will not be counted for computation of SGPA or CGPA.

5. Semester Grade Point Average (SGPA)

SGPA for a semester is calculated as under, after the student has passed in all the

courses/subjects of a semester.

k k

SGPA Credits of Subject i Grade Points for Subject i Credits of Subject i

i 1 i 1

Where k = No. of Courses/Subjects in Semester.

6. Cumulative Grade Point Average (CGPA)

CGPA is calculated as under, after the student has passed in all the courses/subjects of all

the semesters of the program as per prescribed scheme of studies.

N N

CGPA Credits of Semester j SGPA of Semester j Total Credits of Semester j

j 1 j 1

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 4

Om Sterling Global University

Where N = Total Number of Semester in the Program.

7. Conversion of Grade Point Average Into Percentage of Marks

For conversion of Grade point Value of CGPA for all the semester, into percentage of

marks; the CGPA is to be multiplied by 10

(% Marks= 10 X CGPA).

8. Award of Division (Course/Subject to earning of total prescribed credit of all the

semester):

1 7.5 ≤ CGPA I Division with Distinction

2 6 ≤ CGPA < 7.5 I Division

3 5 ≤ CGPA < 6 II Division

4 4.5 ≤ CGPA < 5 Pass

Calculation of SGPA and CGPA:

Example:

Table 2

Courses Credits Letter Grade Credit Grade

Grade Value Value Points

A 3 B+ 7 3x7 21

B 3 A 8 3x8 24

C 3 A+ 9 3x9 27

D 2 A 8 2x8 16

TOTAL 11 88

In this case SGPA= Total Grade Points 88 = 8.0

Credits 11

Suppose the SGPA in two successive semesters are 7.0 and 8.0 with 26 and 24 respective course

credits, then the

CGPA = 7x26+8x24 = 374 = 7.48

26+24 50

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 5

Om Sterling Global University

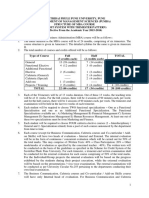

BBA-1st Semester

Teaching

Sr. Course Total Evaluation Scheme Exam.

Course Title Schedule Credit

No Code Hours Hours

L T P Internal External Total

Business BBA-101

1 4 0 0 4 4 40 60 100 3

Organization**

Business BBA-102

2 3 1 0 4 4 40 60 100 3

Statistics

Financial BBA-103

3 3 1 0 4 4 40 60 100 3

Accounting**

Micro BBA-104

4 3 1 0 4 4 40 60 100 3

Economics**

Communication BAEN-151

5 4 0 0 4 4 40 60 100 3

Skills**

Environmental BSES-151

6 3 0 0 3 3 40 60 100 3

Studies**

BBA-121

7 Seminar 0 0 2 2 1 50 - 50 3

Total 20 3 2 25 24 290 360 650

Note:

** Subjects are common with B.Com. and B.Com. (H)

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 6

Om Sterling Global University

BBA 2nd Semester

Teaching Total

Sr. Course Evaluation Scheme Exam.

Course Title Schedule Hour Credit

No. Code Hours

L T P s Internal External Total

Principles of

1 Management BBA-201 4 0 0 4 4 40 60 100 3

Organizational BBA-204

2 4 0 0 4 4 40 60 100 3

Behaviour

Business

3 Communication BBA-205 4 0 0 4 4 40 60 100 3

**

Financial BBA-206

4 4 0 0 4 4 40 60 100 3

Reporting

Management BBA-207

5 3 1 0 4 4 40 60 100 3

Accounting

Computer BTCS-251

6 2 0 0 2 2 20 30 50 3

Applications

Computer

7 Applications– BTCS-221 0 0 2 2 1 25 25 50 3

Practical

Comprehensive BBA-221

8 0 0 0 0 1 50 - 50 3

Viva-Voce-I

Total 21 1 2 24 24 295 355 650

Note:

** Subjects are common with B. Com. and B. Com. (H)

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 7

Om Sterling Global University

BBA 3rd Semester

Teaching

Sr. Course Total Evaluation Scheme Exam.

Course Title Schedule Credit

No. Code Hours Hours

L T P Internal External Total

Business

1 Legislation – I BBA-301 4 0 0 4 4 40 60 100 3

Fundamentals BBA-304

2 4 0 0 4 4 40 60 100 3

of Banking*

Indian

3 Financial BBA-305 4 0 0 4 4 40 60 100 3

System*

Purchase and

4 Material BBA-306 4 0 0 4 4 40 60 100 3

Management

Database

5 Management BBA-307 2 0 0 2 2 20 30 50 3

System

Performance BBA-308

6 4 0 0 4 4 40 60 100 3

Measurement

Internal

7 Control and BBA-309 4 0 0 4 4 40 60 100 3

Data analytics

Database

Management

8 0 0 2 2 1 25 25 50 3

System – BBA-321

Practical

Total 26 0 2 28 27 285 415 700

Note:

*The subjects are common with B.Com.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 8

Om Sterling Global University

BBA 4th Semester

Teaching

Sr. Course Total Evaluation Scheme Exam.

Course Title Schedule Credit

No. Code Hours Hours

L T P Internal External Total

Business

1 Legislation – II BBA-401 4 0 0 4 4 40 60 100 3

Human Resource BBA-402

2 Management* 4 0 0 4 4 40 60 100 3

Marketing BBA-403

3 4 0 0 4 4 40 60 100 3

Management*

Production &

4 Operations BBA-404 4 0 0 4 4 40 60 100 3

Management

Business

5 Research BBA-405 4 0 0 4 4 40 60 100 3

Methodology

Fundamentals of BBA-407

6 2 0 0 2 2 20 30 50 3

E-Commerce*

Financial

7 Statement BBA-408 4 0 0 4 4 40 60 100 3

Analysis

Fundamentals of

8 E-Commerce – BBA-421 0 0 2 2 1 25 25 50 3

Practical*

Total 26 0 2 28 27 285 415 700

Note:

*The subjects are common with B. Com.

Note: Immediately after the completion of the IV semester examination, the students shall

proceed for their Summer Training of 4 weeks duration. The Summer Training Reports

prepared after the completion shall be assessed in the V semester as a compulsory course.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 9

Om Sterling Global University

BBA 5th Semester

Teaching

Sr. Course Total Evaluation Scheme Exam.

Course Title Schedule Credit

No. Code Hours Hours

L T P Internal External Total

Entrepreneurship

1 Development** BBA-501 4 0 0 4 4 40 60 100 3

Indian Taxation BBA-503

2 4 0 0 4 4 40 60 100 3

System – I

Management BBA -

3 Information 505 2 0 0 2 2 20 30 50 3

System

Investment

Decision and

4 4 0 0 4 4 40 60 100 3

Decision BBA-506

Analysis

Corporate BBA-507

5 4 0 0 4 4 40 60 100 3

Finance

Management

Information

6 0 0 2 2 1 25 25 50 3

System – BBA-521

Practical

Summer Training BBA-522

7 0 0 0 0 3 50 50 100 3

Report

Total 18 0 2 20 22 255 345 600

Note:

**The subjects are common with B.Com. & B. Com. (H)

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 10

Om Sterling Global University

BBA 6th Semester

Teaching

Sr. Course Total Evaluation Scheme Exam.

Course Title Schedule Credit

No. Code Hours Hours

L T P Internal External Total

Business Ethics

1 and Corporate 4 0 0 4 4 40 60 100 3

Governance* BBA-601

Strategic BBA-603

2 4 0 0 4 4 40 60 100 3

Management

Indian Taxation BBA-604

3 4 0 0 4 4 40 60 100 3

System – II

Personality and

4 Soft Skills BBA-605 4 0 0 4 4 40 60 100 3

Development*

Enterprise Risk

5 and Professional BBA-606 4 0 0 4 4 40 60 100 3

Ethics

Computer BTCN-

6 Networking and 651 2 0 0 2 2 20 30 50 3

Internet

Computer

Networking and BTCN-

7 0 0 2 2 1 25 25 50 3

Internet – 621

Practical

Comprehensive BBA-621

8 0 0 0 0 2 - 50 50 3

Viva-Voce-II

Total 22 0 2 24 25 245 405 650

Note:

* The Subjects are common with B.Com.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 11

Om Sterling Global University

BBA

First Semester

BBA-101: Business Organization

(The subject is common with BCOM-102)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Business – Concept, nature and scope, business as a system, business objectives, business and

environment interface, distinction between business, commerce and trade.

Unit-II

Forms of business organization – Sole proprietorship, partnership, joint stock company, types of

company, cooperative societies; choice of a suitable form of business organization.

Unit-III

Profit Maximization vs Social Responsibility of Business; Business Ethics and Values; Code of

Conduct and Corporate Governance, Concept and role of MNCs; Transactional Corporations

(TNCs); International Business Risks.

Unit-IV

Government and business interface; stock exchange in India; business combination – concept

and causes; chambers of commerce and industries in India – FICCI, CII Association.

Text & Reference Books:

1. Vasishth , Neeru , Business Organization, Taxman, New Delhi.

2. Talloo, Thelman J., Business Organizational and Management, TMH, New Delhi.

3. Tulsian, P.C., Business Organization, Pearson Education, New Delhi.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 12

Om Sterling Global University

BBA-102: Business Statistics

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

3L+1T+0P End Term Exam: 3 Hours

Unit-I

Statistics: Meaning, evolution, scope, limitations and applications; data classification; tabulation

and presentation: meaning, objectives and types of classification, formation of frequency

distribution, role of tabulation, parts, types and construction of tables, significance, types and

construction of diagrams and graphs.

Unit-II

Measures of Central Tendency and Dispersion: Meaning and objectives of measures of central

tendency, different measure viz. arithmetic mean, median, mode, geometric mean and harmonic

mean, characteristics, applications and limitations of these measures; measure of variation viz.

range, quartile deviation mean deviation and standard deviation, co-efficient of variation.

Unit-III

Correlation and Regression: Meaning of correlation, types of correlation – positive and negative

correlation, simple, partial and multiple correlation, methods of studying correlation; scatter

diagram, graphic and direct method; properties of correlation co-efficient, rank correlation,

coefficient of determination, lines of regression, co-efficient of regression, standard error of

estimate.

Unit-IV

Index numbers and time series: Index number and their uses in business; construction of simple

and weighed price, quantity and value index numbers; test for an ideal index number, components

of time series viz. secular trend, cyclical, seasonal and irregular variations, methods of estimating

secular trend and seasonal indices; use of time series in business forecasting and its limitations,

calculating growth rate in time series.

Text & Reference Books:

1. Gupta, S.P. & M.P. Gupta, Business Statistics.

2. Davis: Business Staisticsusuing Excel, Oxford University Press.

3. Gupta, C.B., An Introduction to Statistical Methods.

4. Beri , G, Business Statistics, TMH, Delhi.

5. Sancheti, S.C. & V.K. Kapoor, Statistical Methods.

6. Ellhans, D.N., Fundamentals of Statistics.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 13

Om Sterling Global University

BBA-103: Financial Accounting

(The subject is common with BCOM-101)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

3L+1T+0P End Term Exam: 3 Hours

Unit-I

Meaning and scope of accounting, nature of financial accounting principles, basis of

accounting; accounting process – from recording of business transaction to preparation of

trial balance.

Unit-II

Depreciation accounting; Preparation of final accounts (non-corporate entities) along with

major adjustments.

Unit-III

Rectification of errors; Accounts of non-profit organization, Joint venture accounts

Unit-IV

Hire purchase and installment purchase system accounting; Consignment accounts

Text & Reference Books:

1. Gupta R.L., Advanced Accounting Vol. I, Sultan Chand & Sons, New Delhi.

2. Mukherjee and Hanif, Financial Accounting, TMH, New Delhi.

3. Shah: Basic Financial Accounting, Oxford University Press.

4. Grewal T.S. and M.C. Shukla, Advanced Accounting Vol. I, S. Chand & Sons, New Delhi.

5. Maheshwari S.N., Advanced Accounting Vol. I, Vikas Publications, Delhi.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 14

Om Sterling Global University

BBA-104: Micro Economics

(The subject is common with BCOM-103)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

3L+1T+0P End Term Exam: 3 Hours

Unit-I

Nature and scope of micro economics, determinants of demand and law of demand, price,

cross and income elasticity, law of supply, elasticity of supply, competitive equilibrium;

consumer’s equilibrium- utility and indifference curve approaches.

Unit-II

Short run and long run production functions, laws of returns; optimal input combination;

Classification of costs; short run and long run lost curves and their interrelationship;

internal and external economies of scale, revenue curves; optimum size of the firm; factors

affecting the optimum size, location of firms.

Unit-III

Equilibrium of the firm and industry – perfect competition, monopoly, monopolistic

competition, discriminating monopoly, aspects of non-price competition; oligopalistic

behavior.

Unit-IV

Characteristics of various factors of production; marginal productivity theory and modern

theory of distribution; determination of rent; quasi rent; alternative theories of interest and

wages.

Text & Reference Books:

1. Sethi, Anjanee and Adhikari, Bhavana, TMH, Delhi.

2. D. Salvatore, Principles of Microeconomics, Oxford University Press.

3. Mark Hirschey, Managerial Economics, Thomson, South Western, New Delhi.

4. R H Dholkia and A.N. Oza, Microeconomics for Management Students, Oxford

University Press, New Delhi.

5. P.L. Mehta, Managerial Economics, Sultan Chand, New Delhi.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 15

Om Sterling Global University

BAEN-151: Communication Skills

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Grammar, Comprehension and Vocabulary Building:

Passive Voice, Reported Speech, Conditional Sentences, Modal Verbs, Linking Words

(Conjunctions), Reading Comprehension, Vocabulary- Synonyms, Antonyms, Homonyms,

Homophones and One- Word Substitution

Subject-Verb Agreement, Types of Sentences, Sentence Transformation, Punctuation,

Prepositions.

Unit-II

Composition:

Job Application and Curriculum Vitae Writing, Business Letter Writing, Paragraph Writing,

Report Writing Précis Writing, Notices, Agenda and Minutes, Office Memorandum, Essay

Writing, E-mail Writing.

Unit-III

Fundamentals Of Communication:

Meaning, Importance and Cycle of Communication, Media and Types of Communication,

Verbal and Non-Verbal Communication, Barriers to Communication, Formal and Informal

Channels of Communication, Divisions of Human Communication and Methods to improve

Interpersonal Communication, Qualities of Good Communication, 7 C’s of Communication.

Unit-IV

Oral Communication:

Principles of Effective Oral Communication, Media of Oral Communication

Interviews: Importance of Interviews, Types of Interview, Essential Features, Structure,

Guidelines for Interviewer, Guidelines for interviewee.

Art of Listening: Good listening for improved Communication, Art of Listening, Meaning,

Nature and importance of listening, Principles of Good Listening, Use of Visual Aids in

Presentation, PowerPoint Presentation, Group Discussion, Importance of Group Discussion.

Text & Reference Books:

1. Communication Skills : SK Jha and Meena Malik

2. CS Rayudu: Communication, Himalayan Pub. House

3. Malera Treece: Successful Communication

4. Boyce& Hull: Business Communication Today, McGraw Hill

5. Prof. K. Mohan: Communication Skills and Report Writing

6. Balasubramniam: Speech Sounds

7. FT Wood: English Grammar

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 16

Om Sterling Global University

BSES-151: Environmental Studies

Credit: 03 Max. Marks: 100 (Internal: 40, External: 60)

3L+0T+0P End Term Exam: 3 Hours

Unit-I

The Multi-disciplinary nature of Environmental Studies/Science, Definition, Scope, Importance,

and Need for public awareness.

Dams and their effects on forests and tribal people, Use and over-utilization of surface and

ground water, floods, drought, conflicts over water, Dams: Benefits and problems,

Environmental effects of extracting and using mineral resources, Effects of modern agriculture,

fertilizer-pesticide problems, water logging, salinity, case studies, Renewable and non-renewable

energy sources, use of alternate energy sources.

Ecosystems, Concept of an ecosystem, Structure and function of an ecosystem; producers,

consumers and decomposers, Energy flow in the ecosystem, Ecological succession, Food chains,

food webs and ecological pyramids.

Biodiversity and its conservation, Hot-spots of biodiversity, Threats to biodiversity,

Conservation of biodiversity: In-situ and Ex-situ conservation of biodiversity.

Unit-II

Environmental Pollution: Definition, causes, effects and control measures of: Air pollution,

Water pollution, Soil pollution, Marine pollution, Noise pollution, Thermal pollution, Nuclear

hazards.

Solid waste Management: Causes, effects and control measures of urban and industrial wastes.

Fireworks, their impacts and hazards.

Pollution case studies.

Unit-III

Social Issues and the Environment, From Unsustainable to Sustainable development, Urban

problems related to energy, Water conservation, rain water harvesting, watershed management,

Resettlement and rehabilitation of people; its problems and concerns, Environmental ethics:

Issues and possible solutions, Consumerism and waste products, Environmental Legislation

(Acts and Laws), Issues involved in enforcement of environmental legislation.

Human Population and the Environment, Population growth, variation among nations with case

studies, Population explosion – Family Welfare Programmes and Family Planning Programmes,

Human Rights, Value Education, Women and Child Welfare.

Unit-IV

Disaster management: floods, earthquake, cyclone and landslides. Man-made Disaster: such as

Fire, Industrial Pollution,Nuclear Disaster, Biological Disasters, Accidents (Air, Sea,Rail &

Road), Structural failures (Building and Bridge) War & Terrorism etc.Causes, effects and

practical examples for all disasters.

Prediction, Early Warnings and Safety Measures of Disaster.

Role of Information, Education, Communication, and Training in disaster management.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 17

Om Sterling Global University

Text & Reference Books:

1. Environmental Science: G. Tyler Miller

2. Environmental Laws: Universal Law Series

3. Earth and Atmospheric Disaster Management : Nature and Manmade: C. K. Rajan, Navale

Pandharinath

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 18

Om Sterling Global University

BBA-121: Seminar

Credit: 01 Max. Marks: 50 (Internal: 50, External: 00)

0L+0T+2P End Term Exam: 3 Hours

The objectives of this Seminar course are to:

o Understanding of the basics of the application of the various models of verbal and non-

verbal communication in the social and professional sphere

o Develop the following skills in the students-

By the end of the course a student is expected to be able:

To understanding the importance of intonation, word and sentence stress for improving

communicative competence, identifying and overcoming problem sounds.

To establish a repo with the audience.

To present his/her ideas clearly and confidently.

To address the queries from the audience.

General Guidelines:

Students are required to prepare a presentation.

The content of presentation can be on any topic from the core subject.

Students are required to submit hard as well as soft copy of the presentation to the

concerned teacher.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 19

Om Sterling Global University

BBA

Second Semester

BBA-201: Principles of Management

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction – nature and process of management, basic managerial roles and skills, nature

of managerial work; approaches to management – classical, human relations and

Behavioural , systems and contingency approaches; contemporary issues and challenges.

Unit-II

Planning and decision making – concept, purpose and process of planning, kinds of plans,

strategic planning, tactical planning and operational planning, goal setting, MBO; decision

making – nature and process, behavioural aspects of decision making, forms of group

decision making in organizations.

Unit-III

Organizing and leading elements of organizing – division of work, departmentalization,

distribution of authority, coordination; organization structure and design; leadership – nature

and significance, leadership styles, behavioural and situational approaches to leadership.

Unit-IV

Management control – nature, purpose and process of controlling, kinds of control system,

prerequisites of effective control system, resistance to control, controlling techniques, social

audit.

Text & Reference Books:

1. Griffin, Ricky W, Management, Biztantra, New Delhi

2. Tripathi, P C and Reddy, P N, Principles of Management, TMH, Delhi

3. Rao, VSP, Management, Excel Books, New Delhi

4. Stoner, Freeman and Gilbert, Jr. Management, Pearson Education, New Delhi

5. Weihrich, Heinz and Harold Koontz, Management: A Global Perspective, TMH,

N. Delhi

6. Robbins, S.P., Management, Pearson Education.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 20

Om Sterling Global University

BBA-204: Organizational Behaviour

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction – Concept and scope of organizational behaviour, historical development of

organizational behaviour, organization behaviour processes, emerging trends and hanging

profiles of workforce.

Unit-II

Individual Processes – Personality, values, attitudes, perception, learning and motivation.

Unit-III

Team Processes – Interpersonal communication, group dynamics, teams and teamwork,

decision-making, conflict and negotiation in workplace, power and politics.

Unit-IV

Organizational processes – Elements of organization structure, organizational structure

and design, organizational culture, organizational change.

Text & Reference Books:

1. Bhattacharya: Organization Behaviour, Oxford University Press.

2. Robbins, S.P., Organizational Behaviour, Pearson Education, New Delhi

3. McShane, Steven L, Mary Von Glinow and Radha R. Sharma, Organizational

Behaviour, Tata McGraw Hill, New Delhi

4. Pareek, Udai, Understanding Organizational Behaviour, Oxford University Press,

New Delhi

5. Griffin, Ricky W, and Gregory Moorhead, Organizational Behaviour, Houghton

Mifflin Company

6. New Storm, Organizational Behaviour, Tata McGraw Hill, Delhi

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 21

Om Sterling Global University

BBA-205: Business Communication

(The subject is common with BCOM-205)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Business Communication –meaning & importance. Defining Communication, Purpose,

Process, elements, difficulties in communication, and conditions for successful communication.

Basic forms of Communication, Barriers to effective communication, basic models &

communication, 7C’s of for effective business communication.

Unit-II

Organizational Communication: Importance of communication in management, Formal and

Informal Communication, Grapevine and how to handle it. Developing positive personal

attitudes, Communication training for managers, Communication structure in an organization,

Corporate Communication, PR skills.

Unit-III

Presentation Skills: Presentation on any chosen topic, oral presentations, principles of oral

presentations, factors affecting presentations, sales presentation.

Unit-IV

Business Etiquette: Understanding etiquette, Cross-cultural etiquette, Business manners,

Business to business etiquette. Effective customer care.

Text & Reference Books:

1. Koneru, Arun, Professional Communication, Tata McGraw Hill, New Delhi

2. Monipally, M.M., Business Communication Strategies, Tata McGraw Hill, New Delhi

3. Das, Biswajit and Ipseeta Satpathy, Business Communication and Personality Development,

Excel Books, New Delhi

4. McGrath, E.H., Basic Managerial Skills for All, Prentice Hall of India, New Delhi

5. Rai, Urmila and S.M. Rai, Business Communication, Himalaya Publishing House, Mumbai

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 22

Om Sterling Global University

BBA-206: Financial Reporting

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Presentation of Financial Statements:: Users of the financial statements and their needs,

purposes and uses of each statement, major components and classifications of each statement,

limitations of each financial statement, various financial transactions affect the elements of

each of the financial statements, relationship among the financial statements preparation of

balance sheet, income statement, statement of changes in equity, and statement of cash flows

(indirect method).

Unit-II

Integrated Reporting: Define integrated reporting (IR), integrated thinking, and the

integrated report, primary purpose of IR, fundamental concepts of value creation, the six

capitals, and the value creation process, elements of an integrated report; i.e., organizational

overview and external environment, governance, business model, risks and opportunities,

strategy and resource allocation, performance, outlook, and basis of preparation and

presentation, benefits and challenges of adopting IR Part 1 – Section A.2. Recognition,

measurement, valuation, and disclosure.

Unit-III

Valuation of Asset and Liabilities: Valuation of accounts receivable, including timing of

recognition and estimation of the allowance for credit losses, distinguish between receivables

sold (factoring) on a with-recourse basis and those sold on a without-recourse basis, and

determine the effect on the balance sheet, effect on income and on assets of using different

inventory methods, effects of inventory errors, debt security types: trading, available-for-

sale, and held-to-maturity, valuation of debt and equity securities, accounting for impairment

of long-term assets and intangible assets, including goodwill. Effect on financial statements

when using either the assurance warranty approach or the service warranty approach for

accounting for warranties.

Unit-IV

Leases, Revenue recognition and Income measurement: Distinguish between operating

and finance leases, presentation of operating and finance leases, revenue recognition

principles to various types of transactions, revenue recognition for contracts with customers

using the five, steps required to recognize revenue, matching principle with respect to

revenues and expenses and be able to apply it to a specific situation, treatment of gain or loss

on the disposal of fixed assets, expense recognition practices.

GAAP-IFRS: Differences between U.S. GAAP and IFRS: (i) expense recognition, with

respect to share-based payments and employee benefits; (ii) intangible assets, with respect to

development costs and revaluation; (iii) inventories, with respect to costing methods,

valuation, and write-downs (e.g., LIFO); (iv) leases, with respect to lessee operating and

finance leases;(v) long-lived assets, with respect to revaluation, depreciation, and

capitalization of borrowing costs; and (vi) impairment of assets, with respect to

determination, calculation, and reversal of loss.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 23

Om Sterling Global University

Text & Reference Books:

1. ASB (1999) Statement of Principles for Financial Reporting , London, ASB.

2. Elliott, B. and Elliott, J. (2009) Financial Accounting and Reporting (13th edn), Harlow,

Essex, Pearson Education Limited.

3. IASB (1989) Framework for the Preparation and Presentation of Financial Statements ,

London, IASB.

4. IASB (2010) Conceptual Framework for Financial Reporting , London, IASB.

5. Smith, T. (1992) Accounting for Growth , UK, Century Business.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 24

Om Sterling Global University

BBA-207: Management Accounting

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

3L+1T+0P End Term Exam: 3 Hours

Unit-I

Strategic Planning: Analysis of external and internal factors affecting strategy, Long-

term mission and goals, Alignment of tactics with long-term strategic goals, Strategic

planning models and analytical techniques, Characteristics of successful strategic planning

process.

Unit-II

Budgeting Concepts and Forecasting Methods: Operations and performance goals,

Characteristics of a successful budget process, Resource allocation, Other budgeting

concepts, Regression analysis, Learning curve analysis, Expected value.

Unit-III

Budget Methodologies: Annual business plans (master budgets), Project budgeting,

Activity-based budgeting, Zero-based budgeting, Continuous (rolling) budgets, Flexible

budgeting.

Unit-IV

Annual profit plan and supporting schedules: Operational budgets, Financial budgets,

Capital budgets. Top-level planning and analysis: Pro forma income, Financial

statement projections, Cash flow projections.

Text & Reference Books:

1. Anthony Robert, Reece, Principles of Management Accounting; Richard D. Irwin Inc.

Illinois.

2. Khan M.Y. and Jain P.K., Management Accounting; Tata McGraw Hill, New Delhi.

3. Kaplan R.S. and Atkinson A.A., Advanced Management Accounting, Prentice India

International, New Delhi.

4. Dr. S.N. Maheshwari : Principles of Management Accounting, Sultan Chand & Sons, New

Delhi

5. I.M. Pandey : Management Accounting, Vikas Publication

6. Debarshi Bhattachharya : Management Accounting, Pearson Publication

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 25

Om Sterling Global University

BTCS-251: Computer Applications

Credit: 02 Max. Marks: 50 (Internal: 20, External: 30)

2L+0T+0P End Term Exam: 3 Hours

Unit-1

Introduction of Computers- Generations, Operating Systems, Types of Computers, Block

Diagram of Computers, Classifications of Computers, Memory & its types, Input devices,

output devices & memory devices, Applications of Computers.

Unit-II

Number Systems, Positional & Non Positional Number System, binary number system,

octal number system, hexadecimal number system & their conversions. Operating System,

types of operating system, Networking, its types & applications, Virus & firewalls.

Network topologies, FTP. HTTP.

Unit-III

Introduction to windows, working with windows. Understanding MS Office, Word

Processing Basics, opening & closing document, working with its Menus. Introduction to

MS Excel, working with MS Excel.

Unit-IV

Introduction to MS Power point, creation of slides, working with its menus. Introduction to

MS Access, creating tables & working with Tables.

Text & Reference Books:

1. P.K.Singh, Computer Fundamentals, BPB Publications

2. B.Ram, Computer Fundamentals, New Age Publications.

3. Sandra Cable, MS Office 365 & Office 2019.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 26

Om Sterling Global University

BTCS-221: Computer Applications -Practical

Credit: 01 Max. Marks: 50 (Internal: 25, External: 25)

0L+0T+2P End Term Exam: 3 Hours

List of Practical’s

1. Working with Windows, Changing system Date & Time.

2. Changing Display Properties, To Add or Remove, Changing Mouse Properties.

3. Working with MS Word,

4. Prepare Document by using various menus.

5. Working on Mail merge.

6. Introduction of MS Excel.

7. Prepare Mark sheet using MS Excel.

8. Introduction to MS Power Point.

9. Prepare Presentation by applying Formatting tools.

10. Prepare Presentation by inserting various Design animations.

11. Working with various menus of PowerPoint

12. Introduction to MS Access.

13. Creating tables using MS Access.

14. Working with various Menus of MS Access

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 27

Om Sterling Global University

BBA-221: Comprehensive Viva-Voce-I

Credit: 01 Max. Marks: 50 (Internal: 50, External: 00)

0L+0T+0P End Term Exam: 3 Hours

A viva-voce will be conducted on the basis of 1 st & 2nd Semester

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 28

Om Sterling Global University

BBA

Third Semester

BBA-301: Business Legislation – I

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction: Characteristics of a Company, Concept of Lifting of Corporate Veil, Emerging

Types of Companies. Formation of Company –Promotion & Registration, Pre-incorporation

Contract and Provisional Contracts. Memorandum of Association, Articles of Association,

Doctrine of Constructive Notice, Doctrine of Ultra-Vires, Doctrine of Indoor Management.

Unit-II

Prospectus and Statement in Lieu of Prospectus, Red-Herring Prospectus. Share Capital – Kinds

of Shares, Book Building Process, Information Memorandum, Dematerlization of Shares,

ASBA System, Transfer & Transmission of Shares, Buyback of Shares.

Unit-III

Members and Shareholders – Their Rights and Duties. Management – Directors, Classification

of Directors, Disqualification, Appointment, Legal Position, Powers and Duties, Disclosures of

Interest, Removal of Directors.

Unit-IV

Board Meetings, Other Managerial Personnel and Remuneration, Digital Signatures of

Directors. Winding Up-Concept and Modes.

Text & Reference Books:

1. Kannal, S., & V.S. Sowrirajan, “Company Law Procedure”, Taxman’s Allied Services (P) Ltd.,

New Delhi (Latest Edn).

2. Ramaiya, A., “A Ramaiya’s Guide to Companies Act”, Lexis Nexis Butterworths Wadhwa,

Nagpur.

3. Singh, Harpal, “Indian Company Law”, Galgotia Publishing, Delhi.

4. Singh, Avtar, “Company Law”, Eastern Book Company, Lucknow

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 29

Om Sterling Global University

BBA-304: Fundamentals of Banking

(The subject is common with BCOM-304)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Bank – Concept, Classification their objectives & functions. Bank Management Concept,

Functions, Importance.

Unit-II

Legal framework of regulation of banks: Banking Regulation Act 1949 and main amendments,

RBI Act 1934 and main amendments, Functions of RBI.

Unit-III

Sources and Uses of Funds in Banks; Value Chain Analysis in Banking Industry. Trends in

Banking: Universal Banking, Project Financing, Merchant banking, E- Banking, Credit cards,

banking Ombudsman Scheme. Banker-customer relationship.

Unit-IV

Banking technology: computerization, internet, mobile and ATMs, security issues, priority

Sector lending; performance analysis of banks.

Text & Reference Books:

1. Justin Paul and Padmalatha Suresh, Management of Banking and financial Services, TMH,

Delhi

2. M. Ravathy Sriram and P.K. Bamanan, Core banking solution, PHI

3. Jyotsna Sethi and Nishevan Bhatia, Elements of Banking and Insurance, PHI

4. Vijayaragavan Iyengar, Introduction to Banking, Excel Books Pvt. Itd.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 30

Om Sterling Global University

BBA-305: Indian Financial System

(The subject is common with BCOM-305)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Meaning, nature and role of capital market, features of developed capital market, reforms in the

capital market, regulatory framework of capital market, capital market instruments and

innovation in financial instruments.

Unit-II

Primary capital market scenario in India, primary market intermediaries, primary market

activities, methods of raising resources from international market; secondary market scenario in

India, reforms in secondary market, organization and management, trading and settlement,

listing of securities, stock market index, steps taken by SEBI to increase liquidity in the stock

market.

Unit-III

Meaning, need and benefits of depository system in India, difference between demat and

physical share, depository process, Importance of Debt market in capital market, participant in

the debt market, types of instrument treated in the Debt market, primary and secondary segments

of debt market.

Unit-IV

Role and policy measures relating to development banks and financial institution in India,

products and services offered by IFCI, IDBI, IIBI, SIDBI, IDFCL, EXIM Bank, NABARD and

ICICI Meaning and benefits of mutual funds, types of mutual funds, SEBI guidelines relating to

mutual funds.

Text & Reference Books:

1. Pathak, Bharati V, The Indian Financial System, Pearson Education

2. Khan, M. Y, Indian Financial System, Tata McGraw Hill

3. Bhole, L M, Financial Institutions and Markets, Tata McGraw Hill

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 31

Om Sterling Global University

BBA-306: Purchase and Material Management

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Purchasing: meaning, role, objectives and functions; organization of purchase management and

its relationship with other departments; five R’s of purchasing (right quality, right quantity, right

source, right time and right price.

Unit-II

Determination and description of material quality; vendor rating, selection, development and

relations; evaluating suppliers efficiency; price determination and negotiation; make or buy

decisions; purchase: procedures and documentation.

Unit-III

Materials Management: meaning, objectives, importance, functions and organization materials

information system; standardization, simplification and variety reduction; value analysis and

engineering.

Unit-IV

Stores Management: meaning, objectives, importance and functions, stores layout; classification

and codification; inventory control of spare parts; materials logistics-warehousing management,

materials handling, traffic and transportation; disposal of scrap, surplus and obsolete materials.

Text & Reference Books:

1. Dobler& Burt, Purchasing and Supply Management: Text & Cases, Tata McGraw Hill

Publishing Company Ltd., New Delhi

2. Nair, Purchasing and Material Management, Vikas Publishing House, New Delhi

3. Gopal Krishnan, P., Handbook of Materials Management, Prentice Hall of India Pvt. Ltd., New

Delhi

4. Gopalakrishnana, P. & Sundarshan, M., Materials Management: An Integrated Approach,

Prentice Hall of India Pvt. Ltd., New Delhi

5. Bhat, K. Shridhara, Materials Management, Himalaya Publishing House

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 32

Om Sterling Global University

BBA-307: Data Base Management System

Credit: 02 Max. Marks: 50 (Internal: 20, External: 30)

2L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction to data base management system – Data versus information, record, file; data

dictionary, database administrator, functions and responsibilities; file-oriented system versus

database system.

Unit-II

Database system architecture – Introduction, schemas, sub schemas and instances; data base

architecture, data independence, mapping, introduction to data models, types of database

systems.

Unit-III

Data base security – Threats and security issues, firewalls and database recovery; techniques of

data base security; distributed data base.

Unit-IV

Data warehousing and data mining – Emerging data base technologies, internet, database, digital

libraries, multimedia data base, mobile data base, spatial data base Lab: Working over

Microsoft Access.

Text & Reference Books:

1. Navathe, Data Base System Concepts 3rd, McGraw Hill

2. Date, C.J., An Introduction to Data Base System, Addision Wesley

3. Singh, C.S., Data Base System, New Age Publications, New Delhi

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 33

Om Sterling Global University

BBA-308: Performance Measurement

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Cost and variance measures and Responsibility centers and reporting segments:

Comparison of actual to planned results, Use of flexible budgets to analyze performance,

Management by exception, Use of standard cost systems, Analysis of variation from standard

cost expectations, Types of responsibility centers, Transfer pricing, Reporting of organizational

segments.

Unit-II

Performance measures: Product profitability analysis, Business unit profitability analysis,

Customer profitability analysis, Return on investment, Residual income, Investment base issues,

Key performance indicators (KPIs), Balanced scorecard.

Unit-III

Measurement concepts and Costing systems: Cost behavior and cost objects, Actual and

normal costs, Standard costs, Absorption (full) costing, Variable (direct) costing, Joint and by-

product costing, Job order costing, Process costing, Activity-based costing, Life-cycle costing.

Overhead costs: Fixed and variable overhead expenses, Plant-wide vs. departmental overhead,

Determination of allocation base, Allocation of service department costs.

Unit-IV

Supply Chain Management and Business process improvement: Lean resource management

techniques, Enterprise resource planning (ERP), Theory of constraints, Capacity management

and analysis, Value chain analysis, Value-added concepts, Process analysis, redesign, and

standardization, Activity-based management, Continuous improvement concepts, Best practice

analysis, Cost of quality analysis, Efficient accounting processes.

Text & Reference Books:

1 Performance Management System - R K Sahu

2 Performance Management: Toward Organizational Excellence by T V Rao

3 Performance Management: It's About Performing - Not Just Appraising by Prem Chandha

4 Audit & Assurance INT (ACCA) ISDC Becker Publishing

5 Audit & Assurance INT (ACCA) BPP Publishing

6 Audit & Assurance INT (ACCA) Kaplan Publishing

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 34

Om Sterling Global University

BBA-309: Internal Control and Data Analytics

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Governance, Risks And Compliance: Definition of corporate governance – governance

practices – governance in corporations – corporate governance process – Internal control –

Sarbanes – Oxley Act. Assessment and management of risks – Risk assessment factors –

objectives of internal control – roles and responsibilities regarding internal controls – PCAOB

approach – COSO framework – Components of internal control. Internal auditing – scope of

internal auditing – Internal Control according to IIA (Institute of Internal auditors).

Unit-II

Systems Control And Security Measures: Control procedures – The control process – Types

of control – Segregation of duties – Independent checks & verification – safeguarding controls –

pre-numbered forms – Specific document flow – Compensating controls. Systems control and

information security – Meaning of information security – Three goals of information security –

Steps in creating an information security plan – systems development controls – physical

controls – logical controls – input, processing and output controls – Computer Assisted Audit

Techniques (CAATs) – storage controls. Security measures – Inherent risks of the internet –

use of data encryption – firewalls – Routine backup and offsite rotation – Business Continuity

Planning.

Unit-III

Information Systems And Data Governance: Management Information system – ERP

system – Accounting Information System – Accounting cycles – Data, databases and Data Base

Management Systems (DBMS) – Early database structures – Relational Database structure –

Data Base Administrator(DBA) – data dictionary – schema – Online Analytical Processing

(OLAP) – data warehouse – Enterprise Performance Management. Data governance – meaning

& overview – characteristics of data governance - data governance focus areas – Concept of

COBIT 5 – COBIT 5- five key principles – Conversion of COBIT 5 to COBIT 2019 – data life

cycle – Record retention policy – COSO Framework (Internal control for data governance) –

Limitations of internal control. Technology Enabled Finance Transformation: Systems

Development Life Cycle (SDLC) – phases and component steps of a traditional SDLC –

Program Change Control – End user Vs Centralised computing – Business Process Analysis and

Design – Robotics Process Automation – Artificial Intelligence – Cloud computing –

Blockchain – smart contracts.

Unit-IV

Data Analytics And Big Data: Business Intelligence – Data analytics – Data Mining – Simple

regression – Multiple regression – Standard error – Aspects of regression analysis – various

approaches to quantify and understand risk – Predictive analytics – Exploratory Data Analysis –

What-if analysis. Big data – characteristics of Big data – Uses of big data – Key technologies

from big data – data management, data mining, Hadoop, in-memory analytics, predictive

analytics, text mining – limitations of big data – data visualisation – statistical control charts –

Pareto diagrams – histograms – Fishbone diagrams – box plots – Line charts and scatter plots –

Bubble and pie charts – Limitations of visualisations – best practices for visualisation tools.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 35

Om Sterling Global University

Text & Reference Books :

1. Abdullah Alawadhi et. Al (2015), Audit Analytics and Continuous Audit – Looking Toward the

Future, American Institute of Certified Public Accountants, Inc. New York, NY.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 36

Om Sterling Global University

BBA-321: Data Base Management System - Practical

Credit: 01 Max. Marks: 50 (Internal: 25, External: 25)

0L+0T+2P End Term Exam: 3 Hours

Note: Create a database and write the programs to carry out the following operation:

Create tables and specify the Questionnaires in SQL

1- Add a record in the database

2-Delete a record in the database

3- Modify the record in the database

4- To implement the restrictions on the table

5- List all the records of database in ascending order.

6- To implement the structure of the table.

7- To Implement Oracle function.

8- To implement the concept of grouping of Data

9- To implement the concept of Joins

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 37

Om Sterling Global University

BBA

Fourth Semester

BBA-401: Business Legislation - II

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Law of Contract (1872): Nature of contract; Classification; Elements of a valid contract,

Performance of contract; Discharge of contract; Remedies for breach of contract. Indemnity and

Guarantee.

Unit-II

Sale of Goods Act 1930: Formation of contracts of sale; Goods and their classification, price;

Conditions, and warranties; Transfer of property in goods; Performance of the contract of sales;

Unpaid seller and his rights, sale by auction; Hire purchase agreement.

Unit-III

Negotiable Instrument Act 1881: Definition of negotiable instruments; Features; Promissory

note; Bill of exchange & cheque; Holder and holder in the due course; Crossing of a cheque,

types of crossing; Negotiation; Dishonuor and discharge of negotiable instrument.

Unit-IV

The Consumer Protection Act 1986: Foreign Exchange Management Act 2000: Definitions and

main provisions.

Text & Reference Books:

1. Desai T.R.: Indian Contract Act, Sale of Goods Act and Partnership Act; S.C. Sarkar & Sons

Pvt. Ltd., Kolkata..

2. Khergamwala J.S: The Negotiable Instruments Act; N.M.Tripathi Pvt. Ltd, Mumbai.

3. Singh Avtar: The Principles of Mercantile Law; Eastern Book Company, Lucknow.

4. Kuchal M.C: Business Law; Vikas Publishing House, New Delhi.

5. Kapoor N.D: Business Law; Sultan Chand & Sons, New Delhi.

6. Chandha P.R: Business Law; Galgotia, New Delhi.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 38

Om Sterling Global University

BBA-402: Human Resource Management

(The subject is common with BCOM-401)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction – nature and scope of human resource management, HRM objectives and functions,

HRM policies, HRM in globally competitive environment; strategic human resource

management.

Unit-II

Acquiring human resources – human resource planning, job analysis and job design, employee

involvement, flexible work schedule, recruitment, selecting human resources, placement and

induction, right sizing.

Unit-III

Developing human resources – employee training, training need assessment, training methods

and evaluation, cross-cultural training, designing executive development programme,

techniques of executive development, career planning and development.

Unit-IV

Enhancing and rewarding performance – establishing the performance management system,

establishing rewards and pay plans, employee benefits, ensuring a safe and healthy work

environment.

Text & Reference Books:

1. Jyothi: Human Resource Management, Oxford University Pres

2. Bohlander George and Scott Snell, Management Human Resources, Thomson Learning,

3. Bhattacharyya, Dipak Kumar, Human Resource Management, Excel Books, New Delhi

4. Cascio, Wayne F., Managing Human Resources, Tata McGraw Hill, New Delhi

5. DeCenzo, David A, and Stephan P. Robbins, Fundamentals of Human Resource Management,

Wiley India, New Delhi

6. DeNisi, Angelo S, and Ricky W Griffin, Human Resource Management, Biztantra, New Delhi

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 39

Om Sterling Global University

BBA-403: Marketing Management

(The subject is common with BCOM-403)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction to Marketing; difference between marketing and selling; core concepts of

marketing; marketing mix; marketing process; marketing environment.

Unit-II

Determinants of consumer behaviour; consumer’s purchase decision process (exclude industrial

purchase decision process); market segmentation; target marketing; differentiation and

positioning; marketing research; marketing information system.

Unit-III

Product and product line decisions; branding decisions; packaging and labeling decisions;

product life cycle concept; new product development; pricing decisions.

Unit-IV

Marketing channels: - retailing, wholesaling, warehousing and physical distribution, conceptual

introduction to supply chain management, conceptual introduction to customer relationship

marketing; promotion mix:- personal selling, advertising, sales promotion, publicity.

Text & Reference Books:

1.Kotler, Philip, Kevin Lane Keller, Abraham Koshy &Mithileshwar Jha, Marketing

Management, Pearson Education, New Delhi

2. Palmer: Introduction to Marketing, Oxford University Press.

3. Sakena, Rajan, Marketing Management, McGraw Hill, New Delhi

4. Zikmund, William G, Marketing, Cengage Learning, New Delhi

5. Panda, Tapan K, Marketing Management, Excel Books, New Delhi

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 40

Om Sterling Global University

BBA-404: Production & Operations Management

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Production/Operations Management: Introduction, evaluation, major long term and short term

decisions; objectives, importance and activities; difference between products and services (from

POM view point.

Unit-II

Meaning and types of Production Systems: Production to order and production to stock; plant

location; factors affecting locations and evaluating different locations; plant layout: meaning,

objectives, characteristics and types; plant layout and materials handling.

Unit-III

Production Planning and Control: Meaning, objectives, advantages and elements, PPC and

production systems, sequencing and assignment problems; work study: meaning, objectives,

prerequisites and procedure; procedure and tools of methods study, procedure and techniques of

work measurement.

Unit-IV

Inventory Control: Objectives, advantages and techniques (EOQ model and ABC analysis);

quality control: meaning and importance; inspection, quality control charts for variables and

attributes and acceptance sampling; maintenance; importance and types.

Text & Reference Books:

1. Chary, Production and Operation Management, TMH, Delhi.

2. Bedi: Production and Operation Management, Oxford University Press.

3. Nair, Production and Operation Management, TMH, Delhi.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 41

Om Sterling Global University

BBA-405: Business Research Methodology

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Business Research – Meaning, types, managerial value of business research; theory and research

– components, concept, constructs definition variables, proposition and hypothesis, deductive

and inductive theory; nature and process and importance of problem definition, purpose and

types of research proposal, ingredients of research proposal.

Unit-II

Research Design – Meaning, classification and elements of research design, methods and

categories of exploratory research, basic issues in experimental design, classification of

experimental design; concept and their measurement, measurement scales.

Unit-III

Sample design and sampling procedure, determination of sample size, research methods of

collecting primary data, issues in construction of questionnaire.

Unit-IV

Stages of data analysis, nature and types of descriptive analysis, univariant and divariat tests of

statistical significance, meaning and types of research report, ingredients of research report.

Text & Reference Books:

1. Copper, Business Research Methods, Tata McGraw Hill.

2. Shekharan Uma, Business Research Methods, John Wiley Publications.

3. Zikmud, Business Research Methods, Cenage Publications.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 42

Om Sterling Global University

BBA-407: Fundamentals of E-Commerce

(The subject is common with BCOM-407)

Credit: 02 Max. Marks: 50 (Internal: 20, External: 30)

2L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction – meaning, nature, concepts, advantages and reasons for transacting online,

categories of e-commerce; planning online business, assessing requirement for an online

business, designing, developing and deploying the system, one to one enterprise.

Unit-II

Technology for online business – internet, IT infrastructure; middleware contents: text and

integrating e-business applications; mechanism of making payment through internet: online

payment mechanism, electronic payment systems, payment gateways, visitors to website.

Unit-III

Applications in e-commerce – e-commerce applications in manufacturing, wholesale, retail and

service sector, tools for promoting website; plastic money: debit card, credit card; laws relating

to online transactions.

Unit-IV

Virtual existence – concepts, working, advantages and pitfalls of virtual organizations,

workface, work zone and workspace and staff less organization; security in e-commerce: digital

signatures, network security, data encryption secret keys, data encryption.

Text & Reference Books:

1. Murty, C.V.S., E-Commerce, Himalaya Publications, New Delhi.

2. Kienam, Managing Your E-Commerce business, Prentice Hall of India, N.Delhi.

3. Kosiur, Understanding E-Commerce, Prentice Hall of India, N.Delhi.

4. Kalakota, Whinston , Frontiers of Electronic Commerce, Addison Wesley.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 43

Om Sterling Global University

BBA-408: Financial Statement Analysis

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Common Size Financial Statement Analysis: Balance sheet and income statement, prepare and

analyze common-size financial statements; i.e., calculate percentage of assets and sales,

respectively; also called vertical analysis. Comparative Statement Analysis: Balance sheet and

income statement, prepare a comparative financial statement horizontal analysis; i.e., calculate

trend year over year for every item on the financial statement compared to a base year, calculate

the growth rate of individual line items on the balance sheet and income statement.

Unit-II

Financial Ratios: Liquidity: calculate and interpret the current ratio, the quick (acid-test) ratio,

the cash ratio, the cash flow ratio, and the net working capital ratio. Leverage: calculate and

interpret, operating leverage, financial leverage, fixed charge coverage (earnings to fixed

charges), interest coverage (times interest earned), and cash flow to fixed charges, debt-to-equity,

long-term debt-to-equity, and debt-to total assets. Activity: calculate and interpret accounts

receivable turnover, inventory turnover, and accounts. Payable turnover: calculate and interpret

day’s sales outstanding in receivables, days sales in inventory, and days purchases in accounts

payable, calculate and interpret total assets turnover and fixed asset turnover. Profitability:

calculate and interpret gross profit margin percentage, operating profit margin percentage, net

profit margin percentage, and earnings before interest, taxes, depreciation, and amortization

(EBITDA) margin percentage. Market: calculate and interpret the market/book ratio and the

price/earnings ratio and other market ratios.

Unit-III

Profitability Analysis: Factors that contribute to inconsistent definitions of “equity,”“assets,”

and “return” when using ROA and ROE ,return on total assets of a change in one or more

elements of the financial statements, factors to be considered in measuring income, including

estimates, accounting methods, disclosure incentives, and the different needs of users

importance of the source, stability, and trend of sales and revenue relationship between revenue

and receivables and revenue and inventory the effect on revenue of changes in revenue

recognition and measurement methods calculation and interpreting the gross profit margin

distinguish between gross profit margin, operating profit margin, and net profit margin and

analyze changes in the components of each define and perform a variation analysis (percentage

change over time)calculate and interpret sustainable equity growth.

Unit-IV

Special Issues: Understand the impact of foreign exchange fluctuations in the accounting for

foreign operations, impact of inflation on financial ratios and the reliability of financial ratios,

distinguish between book value and market value; and distinguish between accounting profit and

economic profit, determinants and indicators of earnings quality, and explain why they are

important

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 44

Om Sterling Global University

Text & Reference Books:

1. 1. Foster, George, Financial Statement Analysis, Pearson Ecducation Incl., Second

Edition.

2. Gupta, R.L. and Radhaswamy, M., Advanced Accountancy Sultan Chand & Sons,

New Delhi.

3. Shukla, M.C., Grewal, T.S. and Gupta, S.C., Advanced Accounts, S. Chand

& Company, New Delhi.

4. Anthony R.N., D.F. Hawkins and K.A. Merchant, Accounting: Text and

Cases , McGraw Hill, 1999

5. Jawahar Lal, Accounting Theory and Practice, Himalaya Publishing House

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 45

Om Sterling Global University

BBA-421: Fundamentals of E-Commerce – Practical

(The subject is common with BCOM-421)

Credit: 01 Max. Marks: 50 (Internal: 25, External: 25)

0L+0T+2P End Term Exam: 3 Hours

E-Commerce Interaction: Comparison Shopping in B2C, Exchanges Handling in B2B,

Interaction Examples: Virtual Shopping Carts.

E-Commerce Applications: Online Store, Online Banking, Credit Card Transaction

Processing.

Mini Project in E-Commerce: Developing a small E-Commerce product catalog using ASP/MS

SQL.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 46

Om Sterling Global University

BBA

Fifth Semester

BBA-501: Entrepreneurship Development

(The subject is common with BCOM-501)

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Entrepreneurship- Meaning, Nature and Scope. Characteristics and Qualities of a Successful

Entrepreneur. Relationship between Entrepreneurship Development and Economic

Development.

Unit-II

Promotion of a Venture: Opportunities analysis; external environmental analysis- economic,

social and technological; competitive factors; legal requirements of establishment of a new unit

and rising of funds; Venture capital sources and documentation required.

Unit-III

Entrepreneurial Behaviour: Innovation and entrepreneur; entrepreneurial behaviour and psycho-

theories, social responsibility. Role, relevance and achievements of Entrepreneurial Development

Programmes (EDP); Role of government in organizing EDP’s critical evaluation.

Unit-IV

Stages of growth model, Business crisis, Barriers to small firm, growth Factors in continued

entrepreneurship in small firms, International entrepreneurship.

Text & Reference Books:

1. Dollinger Marc J, Entrepreneurship: Strategies and Resources,, Irwin Press

2. Hisrich Robert D and Peters Michael P, Entrepreneurship, TMH New Delhi

3. Kuratko Donald F and Hodgetts Richard M. Entrepreneurship: A Contemporary Approach

Harcourt College Publisher.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 47

Om Sterling Global University

BBA-503: Indian Taxation System - I

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Basic concepts of income tax, residential status ad tax incidence, income exempted from tax.

Unit-II

Income from salaries, income from house property and income from profits and gains of business

and profession.

Unit-III

Income from capital gains, income from other sources, set off and carry forward of losses,

clubbing of income, deduction of tax at source, advanced payment of tax.

Unit-IV

Deductions from gross total income, assessment of individuals, assessment of companies.

Text & Reference Books:

1. Malhotra H.C., Income Law and Practice, Sahitya Bhawan Publication

2. Singhania V.K, Student Guide to Income Tax, Taxmann’s Publication

3. Lal B.B., Income Tax Law and Practice

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 48

Om Sterling Global University

BBA-505: Management Information System

Credit: 02 Max. Marks: 50 (Internal: 20, External: 30)

2L+0T+0P End Term Exam: 3 Hours

Unit-I

Introduction to Management Information Systems, History of MIS, Impact of MIS, Role

and Importance, MIS Categories, Managers and Activities in IS, Types of Computers

Used by Organizations in Setting up MIS, Hardware support for MIS.

Unit-II

The Structure of Management Information System, Types of Management Systems

Concepts of Management Organization, MIS at Management levels, Strategic Level

Planning, Operational Level Planning,

Unit-III

Enterprise Resource Planning: Introduction, Basics of ERP, Evolution of ERP,

Enterprise Systems in Large Organizations, Benefits and Challenges of Enterpris e

Systems, E-Enterprise System: Introduction: Managing the E-enterprise, Organisation

of Business in an E-enterprise, E-business, E-commerce, E-communication, E-

collaboration.

Unit-IV

Security and Ethical Issues: Introduction, Control Issues in Management Information

Systems, Security Hazards, Ethical Issues, Technical solutions for Privacy Protection.

Text & Reference Books:

1. Management Information systems- managing information technology in the internet worked

enterprise- jams. A O’Brien – Tata McGraw Hill publishing company limited, 2002.

2. Management Information Systems - Laaudon& Laudon PHI ISBN 81-203-1282-1.1998.

3. Management Information systems- S. Sadogopan.PHI 1998Edn. ISBN 81-203-1180- 9

4. Information systems for modern management - G.R. Murdick PHI, 2nd Edition.

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 49

Om Sterling Global University

BBA-506: Investment Decision and Decision analysis

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Cost/volume/profit analysis: Relevant data concepts - cost-volume-profit analysis - marginal

analysis - make vs. buy decisions - Multiple Breakeven points - Margin of Safety - Profit

performance and alternative operating levels - Analysis of multiple products - Sensitivity

analysis using CVP analysis - Impact of Income taxes on CVP analysis.

Unit-II

Marginal analysis: Relevant costs- sunk costs - opportunity costs - avoidable costs - explicit

and implicit costs - Split-off point - Joint production costs - separable processing costs - relevant

revenues, Calculate total cost- average fixed cost, average variable cost, and average total cost.

Introduction of new product - Accepting or rejecting special orders - Making or buying a

product or service - Selling a product or performing additional processes and selling a more

value-added product - Adding or dropping a segment - Effect of operating income on various

decisions - Impact of income taxes on marginal analysis - Capacity considerations.

Unit-III

Pricing: Various pricing methodologies including market comparable, cost-based and

value-based approaches - Impact of cartels on pricing - Short run equilibrium price for the firm

in pure, monopolistic, oligopoly and monopoly competitions - Target pricing and target costing -

Value engineering - Target operating income - Value-added costs and non-value-added costs -

Price elasticity of demand using midpoint formula - Elastic and inelastic demand - Total revenue

given changes in price, demand as well as elasticity - Product life cycle and the stages of product

life - Market structure considerations.

Capital budgeting process: Stages of capital budgeting - Incremental cash flows - Capital

Budgeting and steps in developing capital budget - Cash flow estimates - discounted cash flow

concepts - Effects of inflation on capital budgeting analysis - Hurdle rate - Qualitative

considerations involved in capital budgeting - Role of Post-audit in the capital budgeting process

-Income tax considerations - Evaluating uncertainty.

Unit-IV

Capital investment analysis methods: Net present value - Internal rate of return - Payback -

Payback periods and discounted payback periods– advantages and disadvantages - Comparison

of investment analysis methods - Mutually exclusive projects. Alternative approaches to deal

with risk in capital budgeting - sensitivity analysis, scenario analysis, and Monte Carlo

simulation - Risk adjusted discount rate - income tax implications for investment decisions - risk

analysis - and real options.

Text & Reference Books:

1. Khan and Jain, Financial Management, Tata McGraw Hill, New Delhi

2. Srivastava: Financial Management, Oxford University Press.

3. Pandey, I.M., Financial Management, Vikas Publishing House, New Delhi

4. Kishore, R., Financial Management, Taxman’s Publishing House, New Delhi

Scheme & Syllabus of BBA For Session 2021-22 onwards Page 50

Om Sterling Global University

BBA-507: Corporate Finance

Credit: 04 Max. Marks: 100 (Internal: 40, External: 60)

4L+0T+0P End Term Exam: 3 Hours

Unit-I

Risk and return: Calculating return - Types of risk - Relationship between risk and return.

Rate of return - Systematic and Unsystematic risk - Types of risk – credit risk - foreign