Professional Documents

Culture Documents

Etoro

Etoro

Uploaded by

Aryan BhageriaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Etoro

Etoro

Uploaded by

Aryan BhageriaCopyright:

Available Formats

Group 10

eToro has faced several difficulties while entering the US market. Some of the main challenges that

eToro has faced are regulatory compliances, Competition, Market saturation, Brand recognition,

Limited product offerings, Currency offering etc. So to further expand and establish itself in the

market, it could take the following plan of action:

• Expand product offerings: eToro could expand its offerings beyond just stocks and crypto,

and include other asset classes such as mutual funds, bonds, and ETFs to cater to a wider

range of investors.

• Localize content and services: eToro could create localized content and services for the US

market, such as news and analysis specific to US markets and regulations, and customer

service support that is available during US business hours.

• Increase brand awareness: eToro could increase its brand awareness in the US market

through targeted advertising, social media campaigns, and partnerships with US-based

companies, influencers, and media outlets.

• Comply with US regulations: eToro should continue to comply with all US regulations and

seek regulatory approval for any new products or services it plans to launch in the US

market.

• Improve user experience: eToro could improve the user experience of its platform to make

it more appealing and accessible to US investors. This could include simplifying the user

interface, adding educational resources, and improving the mobile app experience.

• Offer competitive pricing: eToro could offer competitive pricing, such as lower trading fees,

to attract new users and remain competitive with other investment platforms in the US

market.

• Expand partnerships: eToro could form partnerships with US financial institutions to

increase its reach and credibility in the US market. These partnerships could help eToro gain

access to new users and expand its product offerings.

• Continue innovation: eToro could continue to innovate and differentiate itself from other

investment platforms in the US market. This could include developing new products and

features, such as a robo-advisory service or social trading tools that are tailored to the

needs of US investors.

Overall, eToro will need to remain focused on providing value to its US customers, complying with

regulations, and differentiating itself from competitors to succeed in the US market. By following

this plan of action, eToro can establish itself as a reputable and successful investment platform in

the US market.

Submitted by:

Aparna – F2022012

Aryan Bhageria – F2022013

Kautubh Nimbalkar – F2022026

Sananda Maity – F2022041

Siddhi Shinde – F2022051

Ziyadali Amlani – F2022062

You might also like

- Nick and Charlie: A Heartstopper Novella by Alice OsemanDocument26 pagesNick and Charlie: A Heartstopper Novella by Alice OsemanI Read YA81% (21)

- Theracrew Play Dough WorkbookDocument30 pagesTheracrew Play Dough WorkbookGilberto Cabral100% (1)

- Global Marketing Answers To Questions 14-19Document16 pagesGlobal Marketing Answers To Questions 14-19InesNo ratings yet

- International MarketingDocument2 pagesInternational MarketingJOSHUA M. ESCOTONo ratings yet

- SWOT Analysis of Voot 2Document7 pagesSWOT Analysis of Voot 2Chandan SrivastavaNo ratings yet

- Wicked Paradise Walkthrough 0.7Document6 pagesWicked Paradise Walkthrough 0.7Văn Long0% (2)

- Ricoh Aficio MP 2000 Troubleshooting ManualDocument108 pagesRicoh Aficio MP 2000 Troubleshooting ManualFadyEl-GizawyNo ratings yet

- Enm PT2Document11 pagesEnm PT2handi2k4No ratings yet

- Ibm ImpDocument3 pagesIbm ImpAastha KohliNo ratings yet

- Lesson 1-5Document62 pagesLesson 1-5armailgm100% (2)

- Short Question's Answer: Course Title: Globalization and Business Course Code: 5101Document8 pagesShort Question's Answer: Course Title: Globalization and Business Course Code: 5101Shajib GaziNo ratings yet

- Int Business Note 1Document5 pagesInt Business Note 1Ruba AlaliNo ratings yet

- IB Answers - Collection 12 08 09Document82 pagesIB Answers - Collection 12 08 09srinikeuuNo ratings yet

- GlobalizationDocument39 pagesGlobalizationrahulj_12No ratings yet

- Strategic Planning and Implementation & Strategic Marketing ManagementDocument16 pagesStrategic Planning and Implementation & Strategic Marketing Managementyuvraj9898No ratings yet

- Unit I Introduction To International MarketingDocument11 pagesUnit I Introduction To International MarketingCharushilaNo ratings yet

- International Business AnswerDocument20 pagesInternational Business Answerp JhaveriNo ratings yet

- International MarketingDocument31 pagesInternational MarketingRaza MalikNo ratings yet

- Marketing Plan of Tesco PLCDocument18 pagesMarketing Plan of Tesco PLCAjay Manchanda100% (1)

- Q1. What Are The Various Entry Methods For International Business?Document41 pagesQ1. What Are The Various Entry Methods For International Business?abhikorpeNo ratings yet

- Framework of International MarketingDocument5 pagesFramework of International Marketingsubbu2raj3372100% (1)

- Chapter 1Document5 pagesChapter 1Linh TranNo ratings yet

- 3rd 2sem IBMDocument12 pages3rd 2sem IBMAmit Vikram OjhaNo ratings yet

- Chapter 14Document6 pagesChapter 14HafizUmarArshadNo ratings yet

- Presentad By: Mohd Zubair 1513370054Document40 pagesPresentad By: Mohd Zubair 1513370054Mohd ZubairNo ratings yet

- 1capstone ReportDocument7 pages1capstone ReportAninda MukherjeeNo ratings yet

- IB Chapter 1 GlobalizationDocument4 pagesIB Chapter 1 GlobalizationTaHir ShEikhNo ratings yet

- ToyotaDocument11 pagesToyotamariamh01247No ratings yet

- Assignment IBTDocument11 pagesAssignment IBTSleyzle IbanezNo ratings yet

- CH 3: Test PrepsDocument4 pagesCH 3: Test PrepsReema AlNo ratings yet

- Victory Portfolio Limited by Rahul GargDocument16 pagesVictory Portfolio Limited by Rahul GargRitika GargNo ratings yet

- Doing Business in Indonesia: 2011 Country Commercial Guide For U.S. CompaniesDocument115 pagesDoing Business in Indonesia: 2011 Country Commercial Guide For U.S. Companiesredhead1978No ratings yet

- Global Firm DefinitionDocument8 pagesGlobal Firm DefinitionAmir HamzahNo ratings yet

- PHD Thesis Related To Stock MarketDocument6 pagesPHD Thesis Related To Stock Marketfc4zcrkj100% (1)

- Finance of CompanyDocument16 pagesFinance of CompanyshikhaNo ratings yet

- First Insights Into BusinessDocument6 pagesFirst Insights Into BusinessLászló Bakk-DávidNo ratings yet

- IBT202 InternationalBusinessandTrade PrelimDocument17 pagesIBT202 InternationalBusinessandTrade PrelimparkcesiaNo ratings yet

- South KoreaDocument116 pagesSouth KoreaAnne Sophie100% (1)

- 06-05 Assignment Module 4 International Pricing - Promotion DecisionsDocument6 pages06-05 Assignment Module 4 International Pricing - Promotion Decisionsbhiwandi pigeonsNo ratings yet

- Unit 39 International Business Issue 2 PDFDocument13 pagesUnit 39 International Business Issue 2 PDFmikeNo ratings yet

- Unit 5 - Reasons For Conducting Business InternationallyDocument2 pagesUnit 5 - Reasons For Conducting Business Internationallyoskar zNo ratings yet

- Q1. What Are The Various Entry Methods For International Business?Document34 pagesQ1. What Are The Various Entry Methods For International Business?amisha2562585No ratings yet

- Reflection Paper 4Document7 pagesReflection Paper 4Victor Muchoki100% (1)

- Chapter 5Document25 pagesChapter 5Abdul Moiz YousfaniNo ratings yet

- Case 14 Yahoo!Document17 pagesCase 14 Yahoo!Kad Saad100% (1)

- Section ADocument12 pagesSection ARajveer deepNo ratings yet

- Evidencia 6 Presentación "Steps To Export"Document7 pagesEvidencia 6 Presentación "Steps To Export"DiiegoRojasHernandezNo ratings yet

- MK0018Document8 pagesMK0018Sny Kumar DeepakNo ratings yet

- Rabea Rashed - 20311562 1-: Goods, Chemicals, Miscellaneous Goods, Plastics, Rubber and TransportationDocument5 pagesRabea Rashed - 20311562 1-: Goods, Chemicals, Miscellaneous Goods, Plastics, Rubber and TransportationRabea Rashed Al SabahiNo ratings yet

- CMA International Business Lecture 01Document11 pagesCMA International Business Lecture 01Emon EftakarNo ratings yet

- Etrade Case StudyDocument31 pagesEtrade Case StudyDoddy Dwi Abdillah RitongaNo ratings yet

- Features of International MarketingDocument3 pagesFeatures of International MarketingBary PatwalNo ratings yet

- National University of Modern Languages Department of Management Sciences Lahore, CampusDocument13 pagesNational University of Modern Languages Department of Management Sciences Lahore, CampusAdnan GulfamNo ratings yet

- The New Business Venture Chapter 4Document5 pagesThe New Business Venture Chapter 4Vishal AnandNo ratings yet

- Mehboob IbDocument11 pagesMehboob IbilyasNo ratings yet

- Note Corporate Finance (Syllabus) Content Mid TermDocument18 pagesNote Corporate Finance (Syllabus) Content Mid TermMd. Asadujjaman SaheenNo ratings yet

- Actividadndenaprendizajen10nnEvidencian6 7362f82fb28a625Document10 pagesActividadndenaprendizajen10nnEvidencian6 7362f82fb28a625JORGENo ratings yet

- 04Document4 pages04tikujoshi2004No ratings yet

- Selecting Entry ModeDocument22 pagesSelecting Entry ModeandiNo ratings yet

- International MarketingDocument5 pagesInternational MarketingJOSHUA M. ESCOTONo ratings yet

- International TradeDocument103 pagesInternational Tradevinothkumararaja824975% (4)

- Social Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesFrom EverandSocial Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesNo ratings yet

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsFrom EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsRating: 4 out of 5 stars4/5 (1)

- High-Profit IPO Strategies: Finding Breakout IPOs for Investors and TradersFrom EverandHigh-Profit IPO Strategies: Finding Breakout IPOs for Investors and TradersNo ratings yet

- BankingDocument1 pageBankingAryan BhageriaNo ratings yet

- Foreign Direct InvestnmentDocument23 pagesForeign Direct InvestnmentAryan BhageriaNo ratings yet

- Ambuja Relative Valuation NDocument19 pagesAmbuja Relative Valuation NAryan BhageriaNo ratings yet

- It Sector ReportDocument25 pagesIt Sector ReportAryan BhageriaNo ratings yet

- Haibram Thodja - Character SheetDocument4 pagesHaibram Thodja - Character SheetlaffonteNo ratings yet

- Iptv-Xxx 18Document5 pagesIptv-Xxx 18Shilpa KumariNo ratings yet

- Sarati Eldamar V 2.0: Mail: E-MailDocument15 pagesSarati Eldamar V 2.0: Mail: E-MailGloringil BregorionNo ratings yet

- Notice For Chinese Bridge Secondary SchoolsDocument3 pagesNotice For Chinese Bridge Secondary Schoolsjchigwende23No ratings yet

- Details of Verified Recruiting AgenciesDocument90 pagesDetails of Verified Recruiting AgenciesNasir AhmedNo ratings yet

- Tymber Klahr ResumeDocument1 pageTymber Klahr Resumeapi-721756367No ratings yet

- CHERRY MW 2310 2.0: Wireless MouseDocument3 pagesCHERRY MW 2310 2.0: Wireless Mousedannyc2008No ratings yet

- 235.2021 ENG ECON CoursebookDocument130 pages235.2021 ENG ECON CoursebookOpal PunyisaNo ratings yet

- A Japanese Book - SHINOYAMA Kishin. Shoku (1992)Document8 pagesA Japanese Book - SHINOYAMA Kishin. Shoku (1992)Simon Palazzi AndreuNo ratings yet

- ColombiaDocument1 pageColombianmulettNo ratings yet

- A. Word, Phrase, Clause, and SentenceDocument5 pagesA. Word, Phrase, Clause, and SentenceDicky ZMNo ratings yet

- Subway Marketing MixDocument20 pagesSubway Marketing MixParul PatelNo ratings yet

- GTPLKCBPLPackageDocument1 pageGTPLKCBPLPackageBijoy NayakNo ratings yet

- Airport Architecture DissertationDocument4 pagesAirport Architecture DissertationWriteMyPaperUK100% (1)

- Voigtlander Bessamatic Single Lens Reflex ManualDocument24 pagesVoigtlander Bessamatic Single Lens Reflex Manualtao leeNo ratings yet

- Elektrobit EBDocument2 pagesElektrobit EBAnshulNo ratings yet

- Discontinuous Transmission, DTXDocument5 pagesDiscontinuous Transmission, DTXSameh GalalNo ratings yet

- Interactive3 Test Unit 7-8 Full AnswersDocument10 pagesInteractive3 Test Unit 7-8 Full AnswersBeregnyei RenátaNo ratings yet

- Kate Sutherland RESUME 021624Document2 pagesKate Sutherland RESUME 021624Kate SutherlandNo ratings yet

- Wajah BuddhaDocument36 pagesWajah BuddhaAlbert YouNo ratings yet

- Taller de La GordaDocument4 pagesTaller de La GordaYALEINIS CARDOZONo ratings yet

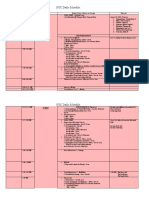

- 2JFJC Master Schedule DailyDocument14 pages2JFJC Master Schedule DailyRhenilyn DaduyaNo ratings yet

- 306 Fillable Resume TemplateDocument3 pages306 Fillable Resume TemplatehazuanizzatNo ratings yet

- FINALEXAM-IN-MIL Doc BakDocument4 pagesFINALEXAM-IN-MIL Doc BakObaidie M. Alawi100% (1)

- Resume-2019 TemplatefinalDocument1 pageResume-2019 TemplatefinalAsad MahmoodNo ratings yet

- Memes 11 Future Directions For Internet Meme ResearchDocument6 pagesMemes 11 Future Directions For Internet Meme ResearchninijosanNo ratings yet