Professional Documents

Culture Documents

3.4.3 Test (TST) - Credit and Debt (Test)

3.4.3 Test (TST) - Credit and Debt (Test)

Uploaded by

Jessica RoperCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3.4.3 Test (TST) - Credit and Debt (Test)

3.4.3 Test (TST) - Credit and Debt (Test)

Uploaded by

Jessica RoperCopyright:

Available Formats

3.4.

3

Test (TST): Credit and Debt Test

Personal Financial Literacy Name:

Date:

Part I: Short-Answer Questions (40 points)

1. What is the difference between revolving credit and installment credit? Define each

term, and give two examples of each type of loan. Then explain which type of loan is

more practical for day-to-day purchases, and why. (8 points)

2. Explain the difference between a fixed interest rate and a variable interest rate.

Identify one advantage and one disadvantage of each type of interest rate. (8 points)

3.4.3 Test (TST): Credit and Debt 1/4

Copyright © 2022 Apex Learning Inc. Use of this material is subject to Apex Learning's Terms of Use. Any unauthorized

copying, reuse, or redistribution is prohibited.

3. What is an annual percentage rate (APR)? Describe one similarity and one

difference between the APR and the interest rate on a credit card or loan. Why would

the APR differ from a creditor's posted interest rate? In your response, also explain

how borrowers can use the APR to evaluate loan options, and describe why

borrowers should be wary of low introductory APRs. (8 points)

4. What should someone do if they have accumulated considerable debt? Describe at

least four ways in which a person can monitor and reduce their overall debt. (8

points)

5. What is bankruptcy? Define the term, and then explain why it should be considered

a last resort for borrowers. Then describe three negative impacts of declaring

bankruptcy. (8 points)

3.4.3 Test (TST): Credit and Debt 2/4

Copyright © 2022 Apex Learning Inc. Use of this material is subject to Apex Learning's Terms of Use. Any unauthorized

copying, reuse, or redistribution is prohibited.

Part II: Application and Critical Thinking (20 points)

6. Sean is ready to take out a loan to buy his first car. He is tempted to buy a car that

costs more than he can really afford. Based on what you have learned, what advice

would you give Sean? Your response should include the following information: Why

might it be better for Sean to buy a less expensive car? What risks are involved in

borrowing money that he cannot repay? Consider both the short- and the longer-term

impacts. (20 points)

3.4.3 Test (TST): Credit and Debt 3/4

Copyright © 2022 Apex Learning Inc. Use of this material is subject to Apex Learning's Terms of Use. Any unauthorized

copying, reuse, or redistribution is prohibited.

Copyright © 2022 Apex Learning Inc. Use of this material is subject to Apex Learning's Terms of Use. Any unauthorized

copying, reuse, or redistribution is prohibited. Apex Learning ® and the Apex Learning Logo are registered trademarks of

Apex Learning Inc.

3.4.3 Test (TST): Credit and Debt 4/4

Copyright © 2022 Apex Learning Inc. Use of this material is subject to Apex Learning's Terms of Use. Any unauthorized

copying, reuse, or redistribution is prohibited.

You might also like

- AET Unit 301 Task BDocument5 pagesAET Unit 301 Task Bsharon.shawNo ratings yet

- CC Sem VBV BRDocument3 pagesCC Sem VBV BRjocianemarcelino1No ratings yet

- 3.1.5 Practice - Making A Smart Automobile Purchase (Practice)Document4 pages3.1.5 Practice - Making A Smart Automobile Purchase (Practice)Jessica RoperNo ratings yet

- Maths (Repaired)Document57 pagesMaths (Repaired)Maduranga WijesooriyaNo ratings yet

- m92 Specimen Coursework AssignmentDocument38 pagesm92 Specimen Coursework AssignmentNur MieyraNo ratings yet

- 2.4.3 Test (TST) - Savings and Investing (Test)Document4 pages2.4.3 Test (TST) - Savings and Investing (Test)Jessica RoperNo ratings yet

- Creditcardrush JSONDocument31 pagesCreditcardrush JSONduece bizNo ratings yet

- 12AM 2 Orit ALP Workbook - Week 5 SPODocument47 pages12AM 2 Orit ALP Workbook - Week 5 SPOJan Paulo OritNo ratings yet

- 4.4.3 Test (TST) - Financial Aid (Test)Document3 pages4.4.3 Test (TST) - Financial Aid (Test)Nia MitchellNo ratings yet

- Performance Criteria WeightingDocument9 pagesPerformance Criteria WeightingDante MutzNo ratings yet

- AbstractDocument11 pagesAbstractYana SarahNo ratings yet

- 10 CH 17 SchedulingDocument48 pages10 CH 17 SchedulingDarsh MenonNo ratings yet

- MATH 353 - StatisticsDocument212 pagesMATH 353 - Statisticsprincesskaydee555No ratings yet

- Education Management Information System (EMIS) PDFDocument6 pagesEducation Management Information System (EMIS) PDFmarchkotNo ratings yet

- Prismatic CompassDocument2 pagesPrismatic CompassAA034 Shruti DugarNo ratings yet

- MC Team DevelopmentDocument2 pagesMC Team DevelopmentNhan Phan0% (1)

- 4a Bulk Water Meter Installation in Chamber DrawingPEWSTDAMI004 PDFDocument1 page4a Bulk Water Meter Installation in Chamber DrawingPEWSTDAMI004 PDFRonald ValenciaNo ratings yet

- Final Report - Draft - Feasibility RPLDocument76 pagesFinal Report - Draft - Feasibility RPLmajaliwaally100% (1)

- Direct Instruction Lesson Plan TemplateDocument3 pagesDirect Instruction Lesson Plan Templateapi-487904263No ratings yet

- Vehicle Financing Products PDFDocument22 pagesVehicle Financing Products PDFNurulhikmah RoslanNo ratings yet

- RPE - M05 Notes - Databases & Research MetricsDocument24 pagesRPE - M05 Notes - Databases & Research MetricsBhavana VenkatNo ratings yet

- Hire-Purchase Act 1967 (Inclusive of Act A1384)Document35 pagesHire-Purchase Act 1967 (Inclusive of Act A1384)jason0% (1)

- NC Motor Vehicle Mechanic Modile 2023Document273 pagesNC Motor Vehicle Mechanic Modile 2023Clarence MasukuNo ratings yet

- Final Exam - Company Law, 2 Sem, 2020Document8 pagesFinal Exam - Company Law, 2 Sem, 2020Tiana Ling Jiunn LiNo ratings yet

- ICT-enhanced Innovative Pedagogy in TVETDocument19 pagesICT-enhanced Innovative Pedagogy in TVETP'tit Ger100% (1)

- Assessment Tips-ABET-GloriaRogers PDFDocument30 pagesAssessment Tips-ABET-GloriaRogers PDFhugonikNo ratings yet

- Chapter 6 - Developing Fundamental PLC Wiring Diagrams and Ladder Logic Programs PDFDocument86 pagesChapter 6 - Developing Fundamental PLC Wiring Diagrams and Ladder Logic Programs PDFFogape TitiNo ratings yet

- Vane Shear TestDocument15 pagesVane Shear TestCzarlon Jade LactuanNo ratings yet

- Universiti Teknologi Mara: Civil Engineering Problems. (P6)Document9 pagesUniversiti Teknologi Mara: Civil Engineering Problems. (P6)Nasiruddin HakimiNo ratings yet

- Riicwd509e S2Document45 pagesRiicwd509e S2Birendra GCNo ratings yet

- Stability of StructureDocument5 pagesStability of StructureNur AtiqahNo ratings yet

- CEL 2103 - CLASS MATERIAL WEEK 7 - SUPPORTING DETAILS - Teacher PDFDocument6 pagesCEL 2103 - CLASS MATERIAL WEEK 7 - SUPPORTING DETAILS - Teacher PDFSharip Maxwell100% (1)

- Chapter 1 SubstructureDocument20 pagesChapter 1 SubstructureHaritharan ManiamNo ratings yet

- Use of Computers in Textile Industry - by - AbuBakkar MarwatDocument29 pagesUse of Computers in Textile Industry - by - AbuBakkar MarwatAbu Bakkar67% (3)

- M - 1.3 - Training DesignDocument38 pagesM - 1.3 - Training DesignLGED Manikganj100% (1)

- Suleiman Anaf Yahya PDFDocument64 pagesSuleiman Anaf Yahya PDFFery AnnNo ratings yet

- IE Lab Manual Final 2019 PDFDocument32 pagesIE Lab Manual Final 2019 PDFSwami SharmaNo ratings yet

- ACFrOgA sJ0r nfLyuJ2u4iUiM8Jx6CPV6IRHMYHHqs3JbkRRO0RE2-bz6LX0gP6Uw5n3K44Lz-ihAxvNNjGTHXmP02xmvZ03FkXboNaiLL0FvSPHmfTOK 8V6xTpp0 PDFDocument10 pagesACFrOgA sJ0r nfLyuJ2u4iUiM8Jx6CPV6IRHMYHHqs3JbkRRO0RE2-bz6LX0gP6Uw5n3K44Lz-ihAxvNNjGTHXmP02xmvZ03FkXboNaiLL0FvSPHmfTOK 8V6xTpp0 PDFchang tze linNo ratings yet

- Cambridge IELTS 17 Test 1 Writing Task 2Document4 pagesCambridge IELTS 17 Test 1 Writing Task 2info.igeduNo ratings yet

- 2021 Jce Business StudiesDocument6 pages2021 Jce Business StudiesMalack Chagwa100% (2)

- Sample Examination Answer Sheet - OmrDocument6 pagesSample Examination Answer Sheet - OmrMoses NzukiNo ratings yet

- Higher Diploma in Electrical EngineeringDocument195 pagesHigher Diploma in Electrical EngineeringYIM REXNo ratings yet

- Sharebility Uganda PitchDocument13 pagesSharebility Uganda PitchMukalele RogersNo ratings yet

- Assignment 154Document18 pagesAssignment 154NUREEN HUMAIRANo ratings yet

- Indexanalysis Balance Sheet and Income STTMN (IncompletefullDocument21 pagesIndexanalysis Balance Sheet and Income STTMN (IncompletefullSkiller XNo ratings yet

- Intermediate Track II: September 2000 Minneapolis, MinnesotaDocument60 pagesIntermediate Track II: September 2000 Minneapolis, MinnesotaFayDulNo ratings yet

- By Robert Brown and Leon Gottlieb: Chapter 3: Loss ReservingDocument40 pagesBy Robert Brown and Leon Gottlieb: Chapter 3: Loss ReservingChrisBaconNo ratings yet

- Ictdbs506 A2Document7 pagesIctdbs506 A2Ardra AsokNo ratings yet

- Project Guidelines From Mumbai University PDFDocument11 pagesProject Guidelines From Mumbai University PDFzafar mapkarNo ratings yet

- Concrete DefectDocument63 pagesConcrete DefectMuhammad hairi HasrulNo ratings yet

- Consent LetterDocument1 pageConsent LetterpawaryogeshNo ratings yet

- Lab 06 SolDocument4 pagesLab 06 Solomar aghaNo ratings yet

- Catalysis in Biodiesel Production - A Review PDFDocument22 pagesCatalysis in Biodiesel Production - A Review PDFMariuxiNo ratings yet

- Application of An Expert System For Assessment and Evaluation of Higher Education Courses To Identify Fast and Slow LearnersDocument4 pagesApplication of An Expert System For Assessment and Evaluation of Higher Education Courses To Identify Fast and Slow LearnersEditor IJTSRDNo ratings yet

- CPCCBC5005A Student Assessment Task 3Document9 pagesCPCCBC5005A Student Assessment Task 3Shah ZeeshanNo ratings yet

- CHEMISTRY Holiday HomeworkDocument27 pagesCHEMISTRY Holiday Homeworkmtayyab zahidNo ratings yet

- CSSP Grad Manual PDFDocument78 pagesCSSP Grad Manual PDFrandolf_cogNo ratings yet

- Eng105 Course Outline Fall 2020Document6 pagesEng105 Course Outline Fall 2020api-536941060No ratings yet

- Differentiated Planning and Learning For Upper Primary Units 1 3Document134 pagesDifferentiated Planning and Learning For Upper Primary Units 1 3Gabriel MashoodNo ratings yet

- NSUT Academic Programme CBCSDocument23 pagesNSUT Academic Programme CBCSJeet ShethNo ratings yet

- ICT Paper 2 Question of Mock Test. 2021Document11 pagesICT Paper 2 Question of Mock Test. 2021Anonymous RPGElSNo ratings yet

- Exam Assessment Brief INPA6212Document8 pagesExam Assessment Brief INPA6212lishanyapillay1No ratings yet

- Samiksha Ingle TYBMSDocument19 pagesSamiksha Ingle TYBMSKrishna YadavNo ratings yet

- Easi Pay FormDocument2 pagesEasi Pay Formjw lauNo ratings yet

- Банковская выписка TD USADocument2 pagesБанковская выписка TD USAanastasiya DubininaNo ratings yet

- Creditreport 1597869732925 PDFDocument134 pagesCreditreport 1597869732925 PDFDed Maroz0% (1)

- A Survey of Mid Day Meal in Upper Primary Schools in Karandighi BlockDocument21 pagesA Survey of Mid Day Meal in Upper Primary Schools in Karandighi BlockJoysree DasNo ratings yet

- Altaf Shaikh - SOADocument2 pagesAltaf Shaikh - SOAGaurav GujrathiNo ratings yet

- Database Calon PegawaiDocument12 pagesDatabase Calon PegawainadyaNo ratings yet

- SN An SKMDocument11 pagesSN An SKMcanNo ratings yet

- Calculation of PensionDocument3 pagesCalculation of PensionAnwar BokhariNo ratings yet

- Lesson 4.2 Mathematics of Finance NotesDocument37 pagesLesson 4.2 Mathematics of Finance NotestemplaalexanderjhonNo ratings yet

- 2023 04 12 - StatementDocument6 pages2023 04 12 - StatementRay JouwenaNo ratings yet

- e-StatementBRImo 714201036008532 Dec2023 20231227 164433Document5 pagese-StatementBRImo 714201036008532 Dec2023 20231227 164433umiyahraditNo ratings yet

- Wa0007.Document16 pagesWa0007.spcreation4329No ratings yet

- Daily Report Statistical Recap: Category Today MTD Last Year MTD YTD Last Year YTD % Var % VarDocument7 pagesDaily Report Statistical Recap: Category Today MTD Last Year MTD YTD Last Year YTD % Var % VarPrabhu1793No ratings yet

- 3901 LN1Document3 pages3901 LN1Ayushmaan BhattacharjiNo ratings yet

- PFM Assignment 1Document3 pagesPFM Assignment 1coconutcrabNo ratings yet

- Estatement20230609 000350816Document8 pagesEstatement20230609 000350816Dila WwfNo ratings yet

- Januari 2024Document2 pagesJanuari 2024Avoeel CeozzNo ratings yet

- T3 - Bbfa4014 CrciDocument27 pagesT3 - Bbfa4014 CrciLaw KanasaiNo ratings yet

- Mills MarchDocument3 pagesMills MarchAli HassanNo ratings yet

- Wa0009.Document34 pagesWa0009.Tejas GaubaNo ratings yet

- Key Facts Statement 4742588Document9 pagesKey Facts Statement 4742588jay20bdNo ratings yet

- Exercises MortgagesDocument2 pagesExercises MortgagesNicu BotnariNo ratings yet

- Cimb MacDocument3 pagesCimb MacanisNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatDevender RajuNo ratings yet

- Banking SystemDocument2 pagesBanking Systemagus pratamaNo ratings yet

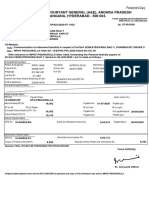

- Office of The Accountant General (A&E), Andhra Pradesh & Telangana, Hyderabad - 500 004Document1 pageOffice of The Accountant General (A&E), Andhra Pradesh & Telangana, Hyderabad - 500 004venkat yeluriNo ratings yet