Professional Documents

Culture Documents

PRELIMQUIZ2

PRELIMQUIZ2

Uploaded by

Mathew EstradaCopyright:

Available Formats

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- ICT HandbookDocument40 pagesICT HandbookAKASH PAL100% (2)

- 5.AUDITING ProblemDocument111 pages5.AUDITING ProblemAngelu Amper68% (22)

- Acc 308 - Week4-4-2 Homework - Chapter 13Document6 pagesAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- Financial Asset Debt Securities Practice QuizDocument3 pagesFinancial Asset Debt Securities Practice QuizMarjorie PalmaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- Renko TradingDocument25 pagesRenko TradingBors György88% (17)

- Xtreme Binary Bot Users GuideDocument12 pagesXtreme Binary Bot Users GuideboniNo ratings yet

- Business Finance II (Content) PDFDocument327 pagesBusiness Finance II (Content) PDFLouis ChinNo ratings yet

- Series 65 Test SpecsDocument8 pagesSeries 65 Test SpecsAd100% (1)

- Fractals and AlligatorDocument2 pagesFractals and AlligatorzooorNo ratings yet

- Acc412 NCLDocument3 pagesAcc412 NCLNychi SitchonNo ratings yet

- Compound Financial Instruments and Note PayableDocument4 pagesCompound Financial Instruments and Note PayablePaula Rodalyn MateoNo ratings yet

- Illustrative CasesDocument1 pageIllustrative CasesIm NayeonNo ratings yet

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNo ratings yet

- FA BondsDocument2 pagesFA BondsAllessa FrezaNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Document1 pageINTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Ronn Robby RosalesNo ratings yet

- Intermediate Accounting 2Document88 pagesIntermediate Accounting 2Mj ArbisonNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- Bonds Payable Problem - QuizzerDocument3 pagesBonds Payable Problem - QuizzerLouiseNo ratings yet

- Topic 03 Non-Current Liabilities - Bonds Payable: Intermediate Accounting 2 - Bernadette L. Baul, CPADocument4 pagesTopic 03 Non-Current Liabilities - Bonds Payable: Intermediate Accounting 2 - Bernadette L. Baul, CPAhIgh QuaLIty SVTNo ratings yet

- A. 65,000 Loss B. 5,000 Loss D. 65,000 GainDocument3 pagesA. 65,000 Loss B. 5,000 Loss D. 65,000 GainLyn AbudaNo ratings yet

- 1st Deptals - Current Liabilities To Bonds Payable Answer KeyDocument3 pages1st Deptals - Current Liabilities To Bonds Payable Answer KeyKatrina MarzanNo ratings yet

- FAR 2 Bonds Payable Illustrations ProblemsDocument3 pagesFAR 2 Bonds Payable Illustrations ProblemsCyrss BaldemosNo ratings yet

- Factors To Four Decimal Places.)Document2 pagesFactors To Four Decimal Places.)EmersonNo ratings yet

- BONDSDocument3 pagesBONDSjdjdbNo ratings yet

- Financial Liabilities P1Document1 pageFinancial Liabilities P1James AngklaNo ratings yet

- Investment in Bonds / Financial Assets at Amortized CostDocument1 pageInvestment in Bonds / Financial Assets at Amortized CostSteffanie Olivar0% (1)

- Accounting Sample ProblemDocument2 pagesAccounting Sample ProblemMissie Jane AnteNo ratings yet

- Additionial TanongDocument28 pagesAdditionial Tanongboerd77No ratings yet

- 1 - Notes Payable and Bonds Payable - Part 1Document1 page1 - Notes Payable and Bonds Payable - Part 1John Wendell EscosesNo ratings yet

- Financial Accounting II RequirementDocument27 pagesFinancial Accounting II RequirementAnonymousNo ratings yet

- Financial Accounting Part 2Document5 pagesFinancial Accounting Part 2Christopher Price0% (1)

- AUD PROB Activity May 18Document2 pagesAUD PROB Activity May 18Kent Judehilee BacalNo ratings yet

- Borrowing Cost ProbDocument10 pagesBorrowing Cost ProbYoite MiharuNo ratings yet

- HW On Receivable Financing ADocument3 pagesHW On Receivable Financing ARedNo ratings yet

- Unit ActivityDocument3 pagesUnit Activitygabburiel013No ratings yet

- Bonds Payable by J. GonzalesDocument7 pagesBonds Payable by J. GonzalesGonzales JhayVeeNo ratings yet

- HANDOUT - Bonds PayableDocument4 pagesHANDOUT - Bonds PayableMarian Augelio PolancoNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- University of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1Document3 pagesUniversity of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1fghhnnnjmlNo ratings yet

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- Review 124: Noemi Jane O. DinsayDocument59 pagesReview 124: Noemi Jane O. Dinsaymarites yuNo ratings yet

- AUDTG 421 - Quiz No. 5 5d5100aa29722Document2 pagesAUDTG 421 - Quiz No. 5 5d5100aa29722Carmela FloresNo ratings yet

- Chapter 10Document21 pagesChapter 10RBNo ratings yet

- CE On Debt SecuritiesDocument2 pagesCE On Debt SecuritiesJean Pierre IsipNo ratings yet

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- Comprehensive Exam QuestionsDocument33 pagesComprehensive Exam QuestionsTrisha Mae LandichoNo ratings yet

- Midterm Exam in Intermediate 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesMidterm Exam in Intermediate 2: Identify The Choice That Best Completes The Statement or Answers The QuestionGolden KookieNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- SemiDocument7 pagesSemiNanzNo ratings yet

- Discussion Problems InvestmentsDocument2 pagesDiscussion Problems InvestmentsSamantha Nicole ValdezNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- FA2 03 Bonds Payable PDFDocument3 pagesFA2 03 Bonds Payable PDFdasdsadsadasdasdNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Ce P1 12-13Document13 pagesCe P1 12-13shudayeNo ratings yet

- Acctg 100C 07Document1 pageAcctg 100C 07lov3m3No ratings yet

- Kisi-Kisi Soal Mid PA2Document6 pagesKisi-Kisi Soal Mid PA2Anthie AkiraNo ratings yet

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- Assignment - Funds and Other InvestmentsDocument2 pagesAssignment - Funds and Other InvestmentsJane DizonNo ratings yet

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- JK Lasser's New Rules for Estate, Retirement, and Tax PlanningFrom EverandJK Lasser's New Rules for Estate, Retirement, and Tax PlanningNo ratings yet

- Statistical Analysis With Software ApplicationDocument22 pagesStatistical Analysis With Software ApplicationMathew EstradaNo ratings yet

- IT Application Tools in BusinessDocument22 pagesIT Application Tools in BusinessMathew EstradaNo ratings yet

- Strategic Business AnalysisDocument20 pagesStrategic Business AnalysisMathew EstradaNo ratings yet

- English 2 - PT 1 - Common and Proper NounsDocument1 pageEnglish 2 - PT 1 - Common and Proper NounsMathew EstradaNo ratings yet

- English 2 PT2 - Journal Writing Action WordsDocument2 pagesEnglish 2 PT2 - Journal Writing Action WordsMathew EstradaNo ratings yet

- PT2 Multiplication Tables of 3 and 4Document6 pagesPT2 Multiplication Tables of 3 and 4Mathew EstradaNo ratings yet

- ENG.2 PT 2 - BOOKLET Parts of A BookDocument1 pageENG.2 PT 2 - BOOKLET Parts of A BookMathew EstradaNo ratings yet

- ENG.2 PT 1 - Elements of The StoryDocument2 pagesENG.2 PT 1 - Elements of The StoryMathew EstradaNo ratings yet

- English - 2 - PT - 1 - Common - and - Proper - Nouns JCDocument1 pageEnglish - 2 - PT - 1 - Common - and - Proper - Nouns JCMathew EstradaNo ratings yet

- Nitesh Pandurang Pangle: GOTS / Approved ZDHC Gateway / RegisteredDocument325 pagesNitesh Pandurang Pangle: GOTS / Approved ZDHC Gateway / RegisteredContra Value BetsNo ratings yet

- Cap3 Problems ContDocument1 pageCap3 Problems ContProf. LUIS BENITEZNo ratings yet

- Wa0024Document4 pagesWa0024samyakkatariaamityNo ratings yet

- Week 5 - ch17Document61 pagesWeek 5 - ch17bafsvideo4No ratings yet

- TD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Document18 pagesTD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Stan J. CaterboneNo ratings yet

- Brookdale Public White Paper February 2015Document18 pagesBrookdale Public White Paper February 2015CanadianValueNo ratings yet

- FinanceDocument5 pagesFinancePiyushNo ratings yet

- AFFIDAVIT OF UNDERTAKING For ZING BMADocument2 pagesAFFIDAVIT OF UNDERTAKING For ZING BMABernard AsperinNo ratings yet

- UntitledDocument30 pagesUntitledTaukirNo ratings yet

- SEC Reports Used in SEC FilingsDocument2 pagesSEC Reports Used in SEC FilingsSECfly. IncNo ratings yet

- Difference Between Fundamental and Technical AnalysisDocument6 pagesDifference Between Fundamental and Technical Analysistungeena waseemNo ratings yet

- CH 17Document22 pagesCH 17sumihosaNo ratings yet

- Cash App June 2023 Account StatementDocument7 pagesCash App June 2023 Account Statementlorielys0909No ratings yet

- Wealth Management Assignment 8: 1. What Are Mutual Funds?Document2 pagesWealth Management Assignment 8: 1. What Are Mutual Funds?Darshan ShahNo ratings yet

- Tugas 1 - IyanDocument3 pagesTugas 1 - IyaniyanNo ratings yet

- Take Out Stops PDFDocument25 pagesTake Out Stops PDFandrew LBK83% (6)

- Project On Commodity FutureDocument15 pagesProject On Commodity Futureharshildodiya4uNo ratings yet

- Chapter 3 Problems - Ia Part 2Document16 pagesChapter 3 Problems - Ia Part 2KathleenCusipagNo ratings yet

- Enigma G-12 Trading ManualDocument18 pagesEnigma G-12 Trading ManualOscar GuerreroNo ratings yet

- Little Book TradingDocument1 pageLittle Book TradingZoghbi AchrefNo ratings yet

- Tma Aug 2022Document124 pagesTma Aug 2022Nivan MultiplesNo ratings yet

- CFTC Commitments of Traders Report - CMX (Futures Only 21 Avril 2021)Document2 pagesCFTC Commitments of Traders Report - CMX (Futures Only 21 Avril 2021)Pirlo TottiNo ratings yet

- India Glycols 2018-19 PDFDocument162 pagesIndia Glycols 2018-19 PDFPuneet367No ratings yet

- Analysis of Capital Structure and Dividend Policy Textile Industries in Bangladesh (Term Paper On Corporate Finance)Document14 pagesAnalysis of Capital Structure and Dividend Policy Textile Industries in Bangladesh (Term Paper On Corporate Finance)mukulful2008No ratings yet

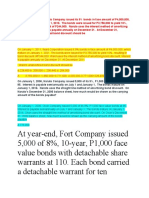

PRELIMQUIZ2

PRELIMQUIZ2

Uploaded by

Mathew EstradaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRELIMQUIZ2

PRELIMQUIZ2

Uploaded by

Mathew EstradaCopyright:

Available Formats

On November 1, 2018, Mason Company issued P8,000,000 of 10-year, 8% term bonds dated

October 1, 2018. The bonds were sold to yield 10% with total proceeds of P7,000,000 plus

accrued interest. Interest is paid every April 1 and October 1.

What amount should be reported as accrued interest payable on December 31, 2018?

Answer: 160,000

On July 1, 2018, Tara Company issued 4,000 of 8%, P1,000 face value bonds payable for

P3,504,000. The bonds were issued to yield 10%.

The bonds are dated July 1, 2018 and mature on July 1, 2028. Interest is payable

semiannually on January 1 and July 1.

Using the effective interest method, what amount of the bond discount should be

amortized for the six months ended December 31, 2018?

Ans: 15,200

On January 31, 2018, Beau Company issued P3,000,000 maturity value, 12% bonds for

P3,000,000 cash. The bonds are dated December 31, 2017 and mature on December 31,

2027. Interest is payable semiannually on June 30 and December 31.

What amount of accrued interest payable should be reported on September 30, 2018?

Ans: 90,000

Recording estimated warranty expense in the current year best follows which accounting

principle?

Ans: Matching

On January 1, 2018, Carrow Company issued 10% bonds in the face amount of P1,000,000

that mature on January 1, 2028.

The bonds were issued for P886,000 to yield 12%, resulting in bond discount of P114,000.

The entity used the interest method of amortizing bond discount. Interest is payable on

January 1 and July 1.

For the year ended December 31, 2018, what amount should be reported as bond interest

expense?

Ans: 106,510

An entity receives an advance payment for special order goods that are to be manufactured

and delivered within 6 months. The advance payment shall be reported in the entity’s

balance sheet as

Ans: Current Liability

Statement 1: The discount on bonds payable and the premium on bonds payable shall be

considered separate from the bonds payable account.

Statement 2: Both accounts shall be treated inconsistently as valuation accounts of the bond

liability.

Ans:

Both statements are False

Any contract that gives rise to a financial asset of one entity and a financial liability or equity

instrument of another entity

Ans: Financial Instrument

Aye Company is authorized to issue P5,000,000 of 6%, 10-year bonds dated July 1, 2018

with interest payments on June 30 and December 31. When the bonds are issued on

November, 1, 2018, the entity received cash of P5,150,000 including accrued interest.

What is the discount or premium on bonds payable?

Ans: 50,000 bond premium

On April 1, 2018, Greg Company issued at 99 plus accrued interest, 2,000 of 8% P1,000 face

value bonds. The bonds are dated January 1, 2018, mature on January 1, 2028, and pay

interest on January 1 and July 1. The entity paid bond issue cost of P70,000.

From the bond issuance, what is the net cash received?

Ans: 1,950,000

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- ICT HandbookDocument40 pagesICT HandbookAKASH PAL100% (2)

- 5.AUDITING ProblemDocument111 pages5.AUDITING ProblemAngelu Amper68% (22)

- Acc 308 - Week4-4-2 Homework - Chapter 13Document6 pagesAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- Financial Asset Debt Securities Practice QuizDocument3 pagesFinancial Asset Debt Securities Practice QuizMarjorie PalmaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- Renko TradingDocument25 pagesRenko TradingBors György88% (17)

- Xtreme Binary Bot Users GuideDocument12 pagesXtreme Binary Bot Users GuideboniNo ratings yet

- Business Finance II (Content) PDFDocument327 pagesBusiness Finance II (Content) PDFLouis ChinNo ratings yet

- Series 65 Test SpecsDocument8 pagesSeries 65 Test SpecsAd100% (1)

- Fractals and AlligatorDocument2 pagesFractals and AlligatorzooorNo ratings yet

- Acc412 NCLDocument3 pagesAcc412 NCLNychi SitchonNo ratings yet

- Compound Financial Instruments and Note PayableDocument4 pagesCompound Financial Instruments and Note PayablePaula Rodalyn MateoNo ratings yet

- Illustrative CasesDocument1 pageIllustrative CasesIm NayeonNo ratings yet

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNo ratings yet

- FA BondsDocument2 pagesFA BondsAllessa FrezaNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Document1 pageINTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Ronn Robby RosalesNo ratings yet

- Intermediate Accounting 2Document88 pagesIntermediate Accounting 2Mj ArbisonNo ratings yet

- Toaz - Info Valix Problems Shedocx PRDocument30 pagesToaz - Info Valix Problems Shedocx PRDaniella Mae ElipNo ratings yet

- Bonds Payable Problem - QuizzerDocument3 pagesBonds Payable Problem - QuizzerLouiseNo ratings yet

- Topic 03 Non-Current Liabilities - Bonds Payable: Intermediate Accounting 2 - Bernadette L. Baul, CPADocument4 pagesTopic 03 Non-Current Liabilities - Bonds Payable: Intermediate Accounting 2 - Bernadette L. Baul, CPAhIgh QuaLIty SVTNo ratings yet

- A. 65,000 Loss B. 5,000 Loss D. 65,000 GainDocument3 pagesA. 65,000 Loss B. 5,000 Loss D. 65,000 GainLyn AbudaNo ratings yet

- 1st Deptals - Current Liabilities To Bonds Payable Answer KeyDocument3 pages1st Deptals - Current Liabilities To Bonds Payable Answer KeyKatrina MarzanNo ratings yet

- FAR 2 Bonds Payable Illustrations ProblemsDocument3 pagesFAR 2 Bonds Payable Illustrations ProblemsCyrss BaldemosNo ratings yet

- Factors To Four Decimal Places.)Document2 pagesFactors To Four Decimal Places.)EmersonNo ratings yet

- BONDSDocument3 pagesBONDSjdjdbNo ratings yet

- Financial Liabilities P1Document1 pageFinancial Liabilities P1James AngklaNo ratings yet

- Investment in Bonds / Financial Assets at Amortized CostDocument1 pageInvestment in Bonds / Financial Assets at Amortized CostSteffanie Olivar0% (1)

- Accounting Sample ProblemDocument2 pagesAccounting Sample ProblemMissie Jane AnteNo ratings yet

- Additionial TanongDocument28 pagesAdditionial Tanongboerd77No ratings yet

- 1 - Notes Payable and Bonds Payable - Part 1Document1 page1 - Notes Payable and Bonds Payable - Part 1John Wendell EscosesNo ratings yet

- Financial Accounting II RequirementDocument27 pagesFinancial Accounting II RequirementAnonymousNo ratings yet

- Financial Accounting Part 2Document5 pagesFinancial Accounting Part 2Christopher Price0% (1)

- AUD PROB Activity May 18Document2 pagesAUD PROB Activity May 18Kent Judehilee BacalNo ratings yet

- Borrowing Cost ProbDocument10 pagesBorrowing Cost ProbYoite MiharuNo ratings yet

- HW On Receivable Financing ADocument3 pagesHW On Receivable Financing ARedNo ratings yet

- Unit ActivityDocument3 pagesUnit Activitygabburiel013No ratings yet

- Bonds Payable by J. GonzalesDocument7 pagesBonds Payable by J. GonzalesGonzales JhayVeeNo ratings yet

- HANDOUT - Bonds PayableDocument4 pagesHANDOUT - Bonds PayableMarian Augelio PolancoNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- University of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1Document3 pagesUniversity of Luzon College of Accountnacy Acc 412 - NCL Part 2 NAME: - Problem 1fghhnnnjmlNo ratings yet

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- Review 124: Noemi Jane O. DinsayDocument59 pagesReview 124: Noemi Jane O. Dinsaymarites yuNo ratings yet

- AUDTG 421 - Quiz No. 5 5d5100aa29722Document2 pagesAUDTG 421 - Quiz No. 5 5d5100aa29722Carmela FloresNo ratings yet

- Chapter 10Document21 pagesChapter 10RBNo ratings yet

- CE On Debt SecuritiesDocument2 pagesCE On Debt SecuritiesJean Pierre IsipNo ratings yet

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- Comprehensive Exam QuestionsDocument33 pagesComprehensive Exam QuestionsTrisha Mae LandichoNo ratings yet

- Midterm Exam in Intermediate 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesMidterm Exam in Intermediate 2: Identify The Choice That Best Completes The Statement or Answers The QuestionGolden KookieNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- SemiDocument7 pagesSemiNanzNo ratings yet

- Discussion Problems InvestmentsDocument2 pagesDiscussion Problems InvestmentsSamantha Nicole ValdezNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- FA2 03 Bonds Payable PDFDocument3 pagesFA2 03 Bonds Payable PDFdasdsadsadasdasdNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Ce P1 12-13Document13 pagesCe P1 12-13shudayeNo ratings yet

- Acctg 100C 07Document1 pageAcctg 100C 07lov3m3No ratings yet

- Kisi-Kisi Soal Mid PA2Document6 pagesKisi-Kisi Soal Mid PA2Anthie AkiraNo ratings yet

- Accounting Sample ProblemsDocument9 pagesAccounting Sample Problemsjoong wanNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- Assignment - Funds and Other InvestmentsDocument2 pagesAssignment - Funds and Other InvestmentsJane DizonNo ratings yet

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- JK Lasser's New Rules for Estate, Retirement, and Tax PlanningFrom EverandJK Lasser's New Rules for Estate, Retirement, and Tax PlanningNo ratings yet

- Statistical Analysis With Software ApplicationDocument22 pagesStatistical Analysis With Software ApplicationMathew EstradaNo ratings yet

- IT Application Tools in BusinessDocument22 pagesIT Application Tools in BusinessMathew EstradaNo ratings yet

- Strategic Business AnalysisDocument20 pagesStrategic Business AnalysisMathew EstradaNo ratings yet

- English 2 - PT 1 - Common and Proper NounsDocument1 pageEnglish 2 - PT 1 - Common and Proper NounsMathew EstradaNo ratings yet

- English 2 PT2 - Journal Writing Action WordsDocument2 pagesEnglish 2 PT2 - Journal Writing Action WordsMathew EstradaNo ratings yet

- PT2 Multiplication Tables of 3 and 4Document6 pagesPT2 Multiplication Tables of 3 and 4Mathew EstradaNo ratings yet

- ENG.2 PT 2 - BOOKLET Parts of A BookDocument1 pageENG.2 PT 2 - BOOKLET Parts of A BookMathew EstradaNo ratings yet

- ENG.2 PT 1 - Elements of The StoryDocument2 pagesENG.2 PT 1 - Elements of The StoryMathew EstradaNo ratings yet

- English - 2 - PT - 1 - Common - and - Proper - Nouns JCDocument1 pageEnglish - 2 - PT - 1 - Common - and - Proper - Nouns JCMathew EstradaNo ratings yet

- Nitesh Pandurang Pangle: GOTS / Approved ZDHC Gateway / RegisteredDocument325 pagesNitesh Pandurang Pangle: GOTS / Approved ZDHC Gateway / RegisteredContra Value BetsNo ratings yet

- Cap3 Problems ContDocument1 pageCap3 Problems ContProf. LUIS BENITEZNo ratings yet

- Wa0024Document4 pagesWa0024samyakkatariaamityNo ratings yet

- Week 5 - ch17Document61 pagesWeek 5 - ch17bafsvideo4No ratings yet

- TD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Document18 pagesTD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Stan J. CaterboneNo ratings yet

- Brookdale Public White Paper February 2015Document18 pagesBrookdale Public White Paper February 2015CanadianValueNo ratings yet

- FinanceDocument5 pagesFinancePiyushNo ratings yet

- AFFIDAVIT OF UNDERTAKING For ZING BMADocument2 pagesAFFIDAVIT OF UNDERTAKING For ZING BMABernard AsperinNo ratings yet

- UntitledDocument30 pagesUntitledTaukirNo ratings yet

- SEC Reports Used in SEC FilingsDocument2 pagesSEC Reports Used in SEC FilingsSECfly. IncNo ratings yet

- Difference Between Fundamental and Technical AnalysisDocument6 pagesDifference Between Fundamental and Technical Analysistungeena waseemNo ratings yet

- CH 17Document22 pagesCH 17sumihosaNo ratings yet

- Cash App June 2023 Account StatementDocument7 pagesCash App June 2023 Account Statementlorielys0909No ratings yet

- Wealth Management Assignment 8: 1. What Are Mutual Funds?Document2 pagesWealth Management Assignment 8: 1. What Are Mutual Funds?Darshan ShahNo ratings yet

- Tugas 1 - IyanDocument3 pagesTugas 1 - IyaniyanNo ratings yet

- Take Out Stops PDFDocument25 pagesTake Out Stops PDFandrew LBK83% (6)

- Project On Commodity FutureDocument15 pagesProject On Commodity Futureharshildodiya4uNo ratings yet

- Chapter 3 Problems - Ia Part 2Document16 pagesChapter 3 Problems - Ia Part 2KathleenCusipagNo ratings yet

- Enigma G-12 Trading ManualDocument18 pagesEnigma G-12 Trading ManualOscar GuerreroNo ratings yet

- Little Book TradingDocument1 pageLittle Book TradingZoghbi AchrefNo ratings yet

- Tma Aug 2022Document124 pagesTma Aug 2022Nivan MultiplesNo ratings yet

- CFTC Commitments of Traders Report - CMX (Futures Only 21 Avril 2021)Document2 pagesCFTC Commitments of Traders Report - CMX (Futures Only 21 Avril 2021)Pirlo TottiNo ratings yet

- India Glycols 2018-19 PDFDocument162 pagesIndia Glycols 2018-19 PDFPuneet367No ratings yet

- Analysis of Capital Structure and Dividend Policy Textile Industries in Bangladesh (Term Paper On Corporate Finance)Document14 pagesAnalysis of Capital Structure and Dividend Policy Textile Industries in Bangladesh (Term Paper On Corporate Finance)mukulful2008No ratings yet