Professional Documents

Culture Documents

Day 1 - Excel - Eff Vs

Day 1 - Excel - Eff Vs

Uploaded by

api-661736044Copyright:

Available Formats

You might also like

- 74827448-Ch17 Investment TestbankDocument44 pages74827448-Ch17 Investment TestbankkonyatanNo ratings yet

- Info 1Document28 pagesInfo 1Veejay Soriano Cuevas0% (1)

- Lab 9 CHM 130LL Lewis Dot StructureDocument12 pagesLab 9 CHM 130LL Lewis Dot StructurerajaijahNo ratings yet

- Carbonyls, Phosphine Complexes and Substitution ReactionsDocument66 pagesCarbonyls, Phosphine Complexes and Substitution ReactionsFitriani SariNo ratings yet

- Mary Elizabeth Croft - The Authority HoaxDocument9 pagesMary Elizabeth Croft - The Authority HoaxMichael KovachNo ratings yet

- 2007 Jun Exam PaperDocument20 pages2007 Jun Exam PapertheoggmonsterNo ratings yet

- ACCCOB2 Chapter 4 ExercisesDocument4 pagesACCCOB2 Chapter 4 ExercisesChelcy Mari GugolNo ratings yet

- Richwell Cash Balance UPDATEDDocument12 pagesRichwell Cash Balance UPDATEDRichwell AccountingNo ratings yet

- 3 - IAS 36 SolutionDocument3 pages3 - IAS 36 Solutionsandeshjhanbia021No ratings yet

- Retirement of BondsDocument16 pagesRetirement of BondsEUNICE LAYNE AGCONo ratings yet

- DCF Valuation Compact (Complete) - 3Document4 pagesDCF Valuation Compact (Complete) - 3amr aboulmaatyNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Class Example 1, 3, 6 (Solutions)Document8 pagesClass Example 1, 3, 6 (Solutions)Given RefilweNo ratings yet

- Kpi 4Q 2020Document8 pagesKpi 4Q 2020Felipe GonzalezNo ratings yet

- Intermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDocument43 pagesIntermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDebraWhitecxgn100% (14)

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (33)

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersProto Proffesor TshumaNo ratings yet

- Chun Ling Trial Exam 2022 - P2 (Answers)Document9 pagesChun Ling Trial Exam 2022 - P2 (Answers)Wei WenNo ratings yet

- Jackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning BalancesDocument2 pagesJackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning Balanceslaale dijaanNo ratings yet

- Budget at A Glance: Revenue and Foreign GrantsDocument2 pagesBudget at A Glance: Revenue and Foreign GrantsSafina ChowdhuryNo ratings yet

- MAGML Q3 Accounts For The Period 31.03.2022Document2 pagesMAGML Q3 Accounts For The Period 31.03.2022shoyeb rakibNo ratings yet

- Assessment 1 Far-2 SolutionDocument3 pagesAssessment 1 Far-2 SolutionHadeed HafeezNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- ACY3002 2021 S2 Test Solutions For Students PDFDocument2 pagesACY3002 2021 S2 Test Solutions For Students PDFzuimaoNo ratings yet

- 2 FunctionsDocument17 pages2 FunctionsSalman AhmadNo ratings yet

- Capital Budgeting 1Document5 pagesCapital Budgeting 1Sohaib RiazNo ratings yet

- 16453Document2 pages16453fazal nadeemNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Costing Solution: Ahmed Raza Mir, ACADocument2 pagesCosting Solution: Ahmed Raza Mir, ACAANo ratings yet

- Budget Preparation 2022 TreasDocument11 pagesBudget Preparation 2022 TreasMary Jane Sande GelbolingoNo ratings yet

- Tugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BDocument23 pagesTugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BAdam PalmaleoNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Brief ST 00Document2 pagesBrief ST 00farhad.hossain.hstu43No ratings yet

- Bonds Payable Issued at A PremiumDocument6 pagesBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLANo ratings yet

- Soa 23on81273 May2022Document2 pagesSoa 23on81273 May2022Nyari RecehNo ratings yet

- Annual Budget PreparationDocument24 pagesAnnual Budget PreparationCharles Elquime GalaponNo ratings yet

- GR10 Accounting Practice Exam Memorandum November Paper 1Document7 pagesGR10 Accounting Practice Exam Memorandum November Paper 1morukakgothatso5No ratings yet

- Cscstel 202209 Q3Document12 pagesCscstel 202209 Q3Al TanNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriesKelvin DenhereNo ratings yet

- Valuation Mergers ProjectDocument3 pagesValuation Mergers Projectsuraj nairNo ratings yet

- Adro Mirae 02 Nov 2023 231102 150020Document9 pagesAdro Mirae 02 Nov 2023 231102 150020marcellusdarrenNo ratings yet

- Acc GR 12 I & II 2nd E SCHMDocument8 pagesAcc GR 12 I & II 2nd E SCHMSharomyNo ratings yet

- Dashen Bank 2023 Report 4 Website 2 1Document63 pagesDashen Bank 2023 Report 4 Website 2 1yemaneatakNo ratings yet

- QR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkDocument3 pagesQR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkRajat SinghNo ratings yet

- A-09.21.051 D .NAKUL Holmes BFDocument14 pagesA-09.21.051 D .NAKUL Holmes BFAustin GomesNo ratings yet

- Depreciation MethodDocument2 pagesDepreciation MethodNaila YumnaNo ratings yet

- f-31573740-0 BMRI Penyampaian Bukti Iklan 31573740 Lamp3 PDFDocument1 pagef-31573740-0 BMRI Penyampaian Bukti Iklan 31573740 Lamp3 PDFAbieZen TorettoNo ratings yet

- Jagjeet NotesDocument12 pagesJagjeet NotesPawan TalrejaNo ratings yet

- Dados - de - Mercado - 20210315Document5 pagesDados - de - Mercado - 20210315Market offNo ratings yet

- Unaudited Financial Statements For The Period Ended 31 March, 2022Document2 pagesUnaudited Financial Statements For The Period Ended 31 March, 2022Fuaad DodooNo ratings yet

- Answer Key Final Exam IA 2Document4 pagesAnswer Key Final Exam IA 2Carlos arnaldo lavadoNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- Army Institute of Management, Kolkata Fee Structure MBA - 24 (2020 - 2022)Document1 pageArmy Institute of Management, Kolkata Fee Structure MBA - 24 (2020 - 2022)karan mehtaNo ratings yet

- Bài tập về nhà - Trang tính1Document3 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Document3 pagesRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNo ratings yet

- Bucyrus EMS Cost OptionsDocument8 pagesBucyrus EMS Cost OptionsGere GobleNo ratings yet

- Sangguniang Kabataan of Barangay Calzadang Bayu Municipality of Porac Province of PampangaDocument21 pagesSangguniang Kabataan of Barangay Calzadang Bayu Municipality of Porac Province of PampangaMSWD PORACNo ratings yet

- Assessment 1 (Sol.)Document5 pagesAssessment 1 (Sol.)Hadeed HafeezNo ratings yet

- ACCESSINFINITYLTD Case StudyDocument50 pagesACCESSINFINITYLTD Case StudyRevanth Kumar ReddyNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- YE'22Document12 pagesYE'22parshvaj0312No ratings yet

- A (B (C (Total (: 1,600, and Security C 0.30 X 8,000 2,400Document6 pagesA (B (C (Total (: 1,600, and Security C 0.30 X 8,000 2,400mahisacNo ratings yet

- AKM (Pert.10)Document6 pagesAKM (Pert.10)akunkampusdinaNo ratings yet

- UEMEd - Q4 2023Document23 pagesUEMEd - Q4 2023GZHNo ratings yet

- CryptoDocument6 pagesCryptoNizar AhammedNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- 14 Electrophilic AdditionsDocument49 pages14 Electrophilic Additionsmohammad_1102No ratings yet

- Introduction To CcilDocument69 pagesIntroduction To Ccilanon_517749135No ratings yet

- Aromatic CompoundsDocument55 pagesAromatic CompoundsNadine Bacalangco100% (1)

- Nathan Lisbin Synthetic FFR #2 Synthesis of A Coumarin Laser DyeDocument10 pagesNathan Lisbin Synthetic FFR #2 Synthesis of A Coumarin Laser DyeNate LisbinNo ratings yet

- Cbse Sample Paper For Class 11 ChemistryDocument11 pagesCbse Sample Paper For Class 11 ChemistryAshutosh RautNo ratings yet

- Chapter 1 Periodic TableDocument23 pagesChapter 1 Periodic TablevsyoiNo ratings yet

- 2.7 Group 7 The Halogens Revision SummaryDocument21 pages2.7 Group 7 The Halogens Revision SummaryjingNo ratings yet

- AoF Tutorial02 SpotDocument3 pagesAoF Tutorial02 SpotSeebsNo ratings yet

- Chem 400: Inorganic Chemistry Practice Exam 2Document8 pagesChem 400: Inorganic Chemistry Practice Exam 2rashidNo ratings yet

- Ha 1Document5 pagesHa 1Shubha MangalaNo ratings yet

- Bond Strength (Bond Dissociation Energy) Energy Needed To SeparateDocument4 pagesBond Strength (Bond Dissociation Energy) Energy Needed To SeparateTrinh Tat-TranNo ratings yet

- Parvest FP Eng Lu 1212Document404 pagesParvest FP Eng Lu 1212abandegenialNo ratings yet

- Intermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Document5 pagesIntermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Yuki BarracaNo ratings yet

- Sales - 2nd Week CompilationDocument33 pagesSales - 2nd Week CompilationThirdy DemonteverdeNo ratings yet

- Lecture 6 Kinetic Isotope EffectDocument11 pagesLecture 6 Kinetic Isotope EffectcsnNo ratings yet

- KLEIN Chap 2 HandoutDocument10 pagesKLEIN Chap 2 HandoutJeriz Marie GamboaNo ratings yet

- Tutorial 1Document2 pagesTutorial 1musicslave96No ratings yet

- CPF in Singapore - A Cap Market Boost or DragDocument26 pagesCPF in Singapore - A Cap Market Boost or DragNing LuoNo ratings yet

- Floating Rate Note Pricing V3Document9 pagesFloating Rate Note Pricing V3QuantmetrixNo ratings yet

- American Home v. FF CruzDocument4 pagesAmerican Home v. FF CruzBeltran KathNo ratings yet

- CHM 234: Worksheet #1 Due: Tuesday, August 30 in Class A. Line Angle/Skeletal StructuresDocument7 pagesCHM 234: Worksheet #1 Due: Tuesday, August 30 in Class A. Line Angle/Skeletal StructuresJean OlbesNo ratings yet

- Students Guide To SHELXTLDocument16 pagesStudents Guide To SHELXTLJubin KumarNo ratings yet

- Exp 10 BiochemDocument3 pagesExp 10 BiochemJenn Gosiengfiao80% (5)

- Electrical EstimateDocument7 pagesElectrical EstimateEngr Zain Ul AbaidinNo ratings yet

Day 1 - Excel - Eff Vs

Day 1 - Excel - Eff Vs

Uploaded by

api-661736044Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Day 1 - Excel - Eff Vs

Day 1 - Excel - Eff Vs

Uploaded by

api-661736044Copyright:

Available Formats

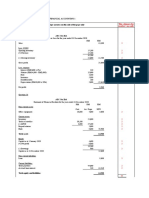

Partial BOND AMORTIZATION SCHEDULE

ENTER VALUES

Issue Date 1/1/2021

Maturity (in years) 3

Payments per year 2

Face Value 700,000

Stated Rate 12%

Market Rate 14%

PRESENT VALUE (Rounded to whole $)

Interest Only (PVA of $1) 200,195

Principal Only (PV of $1) 466,440

Total PV of Bond

Under the Effective Interest Method

(Abbreviation) - Steps (A) - First (B) - Second ( C ) - Third (D) - Last

Outstanding Balance (or Carrying

Effective Interest Expense/ Increase (Decrease) in Value) of Bonds Payable/

Cash Interest Paid/ Received Revenue Discount (Premium) Investment in Bonds

PMT NO. PAYMENT DATE = (SR / 2) * Face Value = (Eff. MR / 2) * Out. Balance = (B) - (A) = Prior (D) + ( C) Difference between Eff. vs. SL Interest

0 1/1/2021 -

1 6/30/2021 42,000 - (42,000) (42,000) (158,667)

2 12/31/2021 42,000 (2,940) (44,940) (86,940) (161,607)

3 6/30/2022 42,000 (6,086) (48,086) (135,026) (164,752)

4 12/31/2022 42,000 (9,452) (51,452) (186,478) (168,118)

5 6/30/2023 42,000 (13,053) (55,053) (241,531) (171,720)

6 12/31/2023 42,000 (16,907) (58,907) (300,438) (175,574)

252,000 (48,438) (300,438) (1,000,438)

Under the Straight Line Method

(Abbreviation) - Steps (A) - First (B) - Third ( C ) - Second (D) - Last

Outstanding Balance (or Carrying

Straight Line Interest Increase (Decrease) in Value) of Bonds Payable/

Cash Interest Paid/ Received Expense/ Revenue Discount (Premium) Investment in Bonds

PMT NO. PAYMENT DATE = (SR / 2) * Face Value = (C ) + (A) = Discount ÷ N Periods = Prior (D) + ( C)

0 1/1/2021 -

1 6/30/2021 42,000 158,667 116,667 116,667

2 12/31/2021 42,000 158,667 116,667 233,333

3 6/30/2022 42,000 158,667 116,667 350,000

4 12/31/2022 42,000 158,667 116,667 466,667

5 6/30/2023 42,000 158,667 116,667 583,333

6 12/31/2023 42,000 158,667 116,667 700,000

252,000 952,000 700,000

Partial BOND AMORTIZATION SCHEDULE

ENTER VALUES

Issue Date 1/1/2021

Maturity (in years) 3

Payments per year 2

Face Value 700,000

Stated Rate 12%

Market Rate 14%

PRESENT VALUE (Rounded to whole $)

Interest Only (PVA of $1) 200,195

Principal Only (PV of $1) 466,440

Total PV of Bond $ 666,634

Under the Effecti

(Abbreviation) - Steps (A) - First

Cash Interest Paid/ Received

PMT NO. PAYMENT DATE = (SR / 2) * Face Value

0 1/1/2021

1 6/30/2021 42,000

2 12/31/2021 42,000

3 6/30/2022 42,000

4 12/31/2022 42,000

5 6/30/2023 42,000

6 12/31/2023 42,000

252,000

Under the Stra

(Abbreviation) - Steps (A) - First

Cash Interest Paid/ Received

PMT NO. PAYMENT DATE = (SR / 2) * Face Value

0 1/1/2021

1 6/30/2021 42,000

2 12/31/2021 42,000

3 6/30/2022 42,000

4 12/31/2022 42,000

5 6/30/2023 42,000

6 12/31/2023 42,000

252,000

$ 466,440

Under the Effective Interest Method

(B) - Second ( C ) - Third (D) - Last

Outstanding Balance (or Carrying

Effective Interest Expense/ Increase (Decrease) in Value) of Bonds Payable/

Revenue Discount (Premium) Investment in Bonds

= (Eff. MR / 2) * Out. Balance = (B) - (A) = Prior (D) + ( C)

666,634 33,366

46,664 4,664 671,299 28,701

46,991 4,991 676,290 23,710

47,340 5,340 681,630 18,370

47,714 5,714 687,344 12,656

48,114 6,114 693,458 6,542

48,542 6,542 700,000 (0)

285,366 33,366

Under the Straight Line Method

(B) - Third ( C ) - Second (D) - Last

Outstanding Balance (or Carrying

Straight Line Interest Increase (Decrease) in Value) of Bonds Payable/

Expense/ Revenue Discount (Premium) Investment in Bonds

= (C ) + (A) = Discount ÷ N Periods = Prior (D) + ( C)

666,634

47,561 5,561 672,195

47,561 5,561 677,756

47,561 5,561 683,317

47,561 5,561 688,878

47,561 5,561 694,439

47,561 5,561 700,000

285,366 33,366

Difference between Eff. vs. SL Interest

(897)

(570)

(221)

153

553

981

0

You might also like

- 74827448-Ch17 Investment TestbankDocument44 pages74827448-Ch17 Investment TestbankkonyatanNo ratings yet

- Info 1Document28 pagesInfo 1Veejay Soriano Cuevas0% (1)

- Lab 9 CHM 130LL Lewis Dot StructureDocument12 pagesLab 9 CHM 130LL Lewis Dot StructurerajaijahNo ratings yet

- Carbonyls, Phosphine Complexes and Substitution ReactionsDocument66 pagesCarbonyls, Phosphine Complexes and Substitution ReactionsFitriani SariNo ratings yet

- Mary Elizabeth Croft - The Authority HoaxDocument9 pagesMary Elizabeth Croft - The Authority HoaxMichael KovachNo ratings yet

- 2007 Jun Exam PaperDocument20 pages2007 Jun Exam PapertheoggmonsterNo ratings yet

- ACCCOB2 Chapter 4 ExercisesDocument4 pagesACCCOB2 Chapter 4 ExercisesChelcy Mari GugolNo ratings yet

- Richwell Cash Balance UPDATEDDocument12 pagesRichwell Cash Balance UPDATEDRichwell AccountingNo ratings yet

- 3 - IAS 36 SolutionDocument3 pages3 - IAS 36 Solutionsandeshjhanbia021No ratings yet

- Retirement of BondsDocument16 pagesRetirement of BondsEUNICE LAYNE AGCONo ratings yet

- DCF Valuation Compact (Complete) - 3Document4 pagesDCF Valuation Compact (Complete) - 3amr aboulmaatyNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Class Example 1, 3, 6 (Solutions)Document8 pagesClass Example 1, 3, 6 (Solutions)Given RefilweNo ratings yet

- Kpi 4Q 2020Document8 pagesKpi 4Q 2020Felipe GonzalezNo ratings yet

- Intermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDocument43 pagesIntermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDebraWhitecxgn100% (14)

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (33)

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersProto Proffesor TshumaNo ratings yet

- Chun Ling Trial Exam 2022 - P2 (Answers)Document9 pagesChun Ling Trial Exam 2022 - P2 (Answers)Wei WenNo ratings yet

- Jackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning BalancesDocument2 pagesJackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning Balanceslaale dijaanNo ratings yet

- Budget at A Glance: Revenue and Foreign GrantsDocument2 pagesBudget at A Glance: Revenue and Foreign GrantsSafina ChowdhuryNo ratings yet

- MAGML Q3 Accounts For The Period 31.03.2022Document2 pagesMAGML Q3 Accounts For The Period 31.03.2022shoyeb rakibNo ratings yet

- Assessment 1 Far-2 SolutionDocument3 pagesAssessment 1 Far-2 SolutionHadeed HafeezNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- ACY3002 2021 S2 Test Solutions For Students PDFDocument2 pagesACY3002 2021 S2 Test Solutions For Students PDFzuimaoNo ratings yet

- 2 FunctionsDocument17 pages2 FunctionsSalman AhmadNo ratings yet

- Capital Budgeting 1Document5 pagesCapital Budgeting 1Sohaib RiazNo ratings yet

- 16453Document2 pages16453fazal nadeemNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Costing Solution: Ahmed Raza Mir, ACADocument2 pagesCosting Solution: Ahmed Raza Mir, ACAANo ratings yet

- Budget Preparation 2022 TreasDocument11 pagesBudget Preparation 2022 TreasMary Jane Sande GelbolingoNo ratings yet

- Tugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BDocument23 pagesTugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BAdam PalmaleoNo ratings yet

- Globus Bank 2021 ABRIDGED FSDocument1 pageGlobus Bank 2021 ABRIDGED FSAwojuyigbeNo ratings yet

- Brief ST 00Document2 pagesBrief ST 00farhad.hossain.hstu43No ratings yet

- Bonds Payable Issued at A PremiumDocument6 pagesBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLANo ratings yet

- Soa 23on81273 May2022Document2 pagesSoa 23on81273 May2022Nyari RecehNo ratings yet

- Annual Budget PreparationDocument24 pagesAnnual Budget PreparationCharles Elquime GalaponNo ratings yet

- GR10 Accounting Practice Exam Memorandum November Paper 1Document7 pagesGR10 Accounting Practice Exam Memorandum November Paper 1morukakgothatso5No ratings yet

- Cscstel 202209 Q3Document12 pagesCscstel 202209 Q3Al TanNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriesKelvin DenhereNo ratings yet

- Valuation Mergers ProjectDocument3 pagesValuation Mergers Projectsuraj nairNo ratings yet

- Adro Mirae 02 Nov 2023 231102 150020Document9 pagesAdro Mirae 02 Nov 2023 231102 150020marcellusdarrenNo ratings yet

- Acc GR 12 I & II 2nd E SCHMDocument8 pagesAcc GR 12 I & II 2nd E SCHMSharomyNo ratings yet

- Dashen Bank 2023 Report 4 Website 2 1Document63 pagesDashen Bank 2023 Report 4 Website 2 1yemaneatakNo ratings yet

- QR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkDocument3 pagesQR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkRajat SinghNo ratings yet

- A-09.21.051 D .NAKUL Holmes BFDocument14 pagesA-09.21.051 D .NAKUL Holmes BFAustin GomesNo ratings yet

- Depreciation MethodDocument2 pagesDepreciation MethodNaila YumnaNo ratings yet

- f-31573740-0 BMRI Penyampaian Bukti Iklan 31573740 Lamp3 PDFDocument1 pagef-31573740-0 BMRI Penyampaian Bukti Iklan 31573740 Lamp3 PDFAbieZen TorettoNo ratings yet

- Jagjeet NotesDocument12 pagesJagjeet NotesPawan TalrejaNo ratings yet

- Dados - de - Mercado - 20210315Document5 pagesDados - de - Mercado - 20210315Market offNo ratings yet

- Unaudited Financial Statements For The Period Ended 31 March, 2022Document2 pagesUnaudited Financial Statements For The Period Ended 31 March, 2022Fuaad DodooNo ratings yet

- Answer Key Final Exam IA 2Document4 pagesAnswer Key Final Exam IA 2Carlos arnaldo lavadoNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- Army Institute of Management, Kolkata Fee Structure MBA - 24 (2020 - 2022)Document1 pageArmy Institute of Management, Kolkata Fee Structure MBA - 24 (2020 - 2022)karan mehtaNo ratings yet

- Bài tập về nhà - Trang tính1Document3 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Document3 pagesRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNo ratings yet

- Bucyrus EMS Cost OptionsDocument8 pagesBucyrus EMS Cost OptionsGere GobleNo ratings yet

- Sangguniang Kabataan of Barangay Calzadang Bayu Municipality of Porac Province of PampangaDocument21 pagesSangguniang Kabataan of Barangay Calzadang Bayu Municipality of Porac Province of PampangaMSWD PORACNo ratings yet

- Assessment 1 (Sol.)Document5 pagesAssessment 1 (Sol.)Hadeed HafeezNo ratings yet

- ACCESSINFINITYLTD Case StudyDocument50 pagesACCESSINFINITYLTD Case StudyRevanth Kumar ReddyNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- YE'22Document12 pagesYE'22parshvaj0312No ratings yet

- A (B (C (Total (: 1,600, and Security C 0.30 X 8,000 2,400Document6 pagesA (B (C (Total (: 1,600, and Security C 0.30 X 8,000 2,400mahisacNo ratings yet

- AKM (Pert.10)Document6 pagesAKM (Pert.10)akunkampusdinaNo ratings yet

- UEMEd - Q4 2023Document23 pagesUEMEd - Q4 2023GZHNo ratings yet

- CryptoDocument6 pagesCryptoNizar AhammedNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- 14 Electrophilic AdditionsDocument49 pages14 Electrophilic Additionsmohammad_1102No ratings yet

- Introduction To CcilDocument69 pagesIntroduction To Ccilanon_517749135No ratings yet

- Aromatic CompoundsDocument55 pagesAromatic CompoundsNadine Bacalangco100% (1)

- Nathan Lisbin Synthetic FFR #2 Synthesis of A Coumarin Laser DyeDocument10 pagesNathan Lisbin Synthetic FFR #2 Synthesis of A Coumarin Laser DyeNate LisbinNo ratings yet

- Cbse Sample Paper For Class 11 ChemistryDocument11 pagesCbse Sample Paper For Class 11 ChemistryAshutosh RautNo ratings yet

- Chapter 1 Periodic TableDocument23 pagesChapter 1 Periodic TablevsyoiNo ratings yet

- 2.7 Group 7 The Halogens Revision SummaryDocument21 pages2.7 Group 7 The Halogens Revision SummaryjingNo ratings yet

- AoF Tutorial02 SpotDocument3 pagesAoF Tutorial02 SpotSeebsNo ratings yet

- Chem 400: Inorganic Chemistry Practice Exam 2Document8 pagesChem 400: Inorganic Chemistry Practice Exam 2rashidNo ratings yet

- Ha 1Document5 pagesHa 1Shubha MangalaNo ratings yet

- Bond Strength (Bond Dissociation Energy) Energy Needed To SeparateDocument4 pagesBond Strength (Bond Dissociation Energy) Energy Needed To SeparateTrinh Tat-TranNo ratings yet

- Parvest FP Eng Lu 1212Document404 pagesParvest FP Eng Lu 1212abandegenialNo ratings yet

- Intermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Document5 pagesIntermediate Accounting 1A Chapter 10 - Investment in Debt Securities Problem 3Yuki BarracaNo ratings yet

- Sales - 2nd Week CompilationDocument33 pagesSales - 2nd Week CompilationThirdy DemonteverdeNo ratings yet

- Lecture 6 Kinetic Isotope EffectDocument11 pagesLecture 6 Kinetic Isotope EffectcsnNo ratings yet

- KLEIN Chap 2 HandoutDocument10 pagesKLEIN Chap 2 HandoutJeriz Marie GamboaNo ratings yet

- Tutorial 1Document2 pagesTutorial 1musicslave96No ratings yet

- CPF in Singapore - A Cap Market Boost or DragDocument26 pagesCPF in Singapore - A Cap Market Boost or DragNing LuoNo ratings yet

- Floating Rate Note Pricing V3Document9 pagesFloating Rate Note Pricing V3QuantmetrixNo ratings yet

- American Home v. FF CruzDocument4 pagesAmerican Home v. FF CruzBeltran KathNo ratings yet

- CHM 234: Worksheet #1 Due: Tuesday, August 30 in Class A. Line Angle/Skeletal StructuresDocument7 pagesCHM 234: Worksheet #1 Due: Tuesday, August 30 in Class A. Line Angle/Skeletal StructuresJean OlbesNo ratings yet

- Students Guide To SHELXTLDocument16 pagesStudents Guide To SHELXTLJubin KumarNo ratings yet

- Exp 10 BiochemDocument3 pagesExp 10 BiochemJenn Gosiengfiao80% (5)

- Electrical EstimateDocument7 pagesElectrical EstimateEngr Zain Ul AbaidinNo ratings yet