Professional Documents

Culture Documents

A

A

Uploaded by

AzlanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A

A

Uploaded by

AzlanCopyright:

Available Formats

a.

The contribution margin per unit is:

Contribution margin per unit = Selling price per unit - Variable costs per unit Variable costs

per unit = Direct materials + Direct labor + Variable overhead + Variable selling expenses

Variable costs per unit = $1.90 + $2.85 + $1.25 + $2.00 = $8.00 Contribution margin per unit

= $12.00 - $8.00 = $4.00

b. The break-even units can be calculated as follows:

Break-even point in units = Total fixed costs ÷ Contribution margin per unit Total fixed costs

= Total fixed overhead + Total fixed selling and administrative expenses Total fixed costs =

$44,000 + $37,900 = $81,900 Break-even point in units = $81,900 ÷ $4.00 = 20,475 units

c. To calculate the number of units that Sokolov must produce and sell to earn operating

income of $9,000, we can use the following formula:

Operating income = (Unit contribution margin × Number of units) - Fixed costs $9,000 =

($4.00 × Number of units) - ($44,000 + $37,900) $9,000 = $4.00N - $81,900 $90,900 =

$4.00N Number of units = $90,900 ÷ $4.00 = 22,725 units

d. Income statement for Sokolov Company:

Sales revenue: 22,725 units × $12.00 per unit = $272,700 Variable costs: 22,725 units ×

$8.00 per unit = $181,800 Contribution margin: $272,700 - $181,800 = $90,900 Fixed costs:

$44,000 + $37,900 = $81,900 Operating income: $90,900 - $81,900 = $9,000

2.

You might also like

- High Low Method ExercisesDocument4 pagesHigh Low Method ExercisesPhoebe Llamelo67% (12)

- Revise Mid TermDocument43 pagesRevise Mid TermThe FacesNo ratings yet

- DocxDocument6 pagesDocxLeo Sandy Ambe CuisNo ratings yet

- Accounting Problems and SolutionsDocument3 pagesAccounting Problems and SolutionsKavitha Ragupathy100% (1)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Numerical Exercise On Cost Behavior ClassificationDocument2 pagesNumerical Exercise On Cost Behavior ClassificationnaimNo ratings yet

- PRACTICE-EXERCISES-Management AccountingDocument7 pagesPRACTICE-EXERCISES-Management AccountingEdric JadeNo ratings yet

- 4524 Robby Wangsa Saputra 1601226743 AkuntansiDocument3 pages4524 Robby Wangsa Saputra 1601226743 AkuntansiGatau JdodksjsjNo ratings yet

- Answer For Final PracticeDocument5 pagesAnswer For Final Practicedimas suryaNo ratings yet

- Accounting MBA: Solutions For Chapter 12.CVPDocument4 pagesAccounting MBA: Solutions For Chapter 12.CVPAhmad AzizanNo ratings yet

- ACT 202 (18), Mehedi Hasan Polash, 1620850030Document1 pageACT 202 (18), Mehedi Hasan Polash, 1620850030MH PolashNo ratings yet

- Notes CVP 2009, 2017Document13 pagesNotes CVP 2009, 2017Aaron ForbesNo ratings yet

- Final Managerial 2013 SolutionDocument6 pagesFinal Managerial 2013 SolutionRanim HfaidhiaNo ratings yet

- Detailed ProfitDocument8 pagesDetailed Profitotienoderrick123No ratings yet

- Prepared by DR - Hassan Sweillam University of 6 of October, EgyptDocument18 pagesPrepared by DR - Hassan Sweillam University of 6 of October, EgyptjgjghNo ratings yet

- Current AssetDocument4 pagesCurrent AssetThuyNo ratings yet

- MA Chap 5Document19 pagesMA Chap 5Lan Tran HoangNo ratings yet

- Acc349 P8-2A P11-4ADocument3 pagesAcc349 P8-2A P11-4AkskimblerNo ratings yet

- Revision CVPDocument18 pagesRevision CVPMostafa MahmoudNo ratings yet

- Engineering Management 3000/5039: Tutorial 2 - SolutionsDocument7 pagesEngineering Management 3000/5039: Tutorial 2 - SolutionsSahanNo ratings yet

- Variable and Absorption CostingDocument7 pagesVariable and Absorption CostingWendors WendorsNo ratings yet

- Acct 260 CHAPTER 8Document25 pagesAcct 260 CHAPTER 8John Guy0% (1)

- Kid - Questions and AnswerDocument4 pagesKid - Questions and AnswersurvivalofthepolyNo ratings yet

- A. $800,000 B. $600,000 C. $440,000 D. $200,000Document15 pagesA. $800,000 B. $600,000 C. $440,000 D. $200,000sino akoNo ratings yet

- Jawaban Assignment#8 - A. JuliadiDocument2 pagesJawaban Assignment#8 - A. JuliadiSubdit KPKPPNo ratings yet

- Ankitastic Exams Solutions MCQ and Long AnswerDocument29 pagesAnkitastic Exams Solutions MCQ and Long AnswerAnkitastic tutoring ServicesNo ratings yet

- Practice Questions.Document11 pagesPractice Questions.MUHAMMAD AHSAN SIDDIQUINo ratings yet

- Soal AkmenDocument5 pagesSoal AkmenAyhuNo ratings yet

- ZoroDocument11 pagesZoroDrinNo ratings yet

- Cost Volume Profit AnalysisDocument81 pagesCost Volume Profit AnalysisLalitha Sravanthi100% (1)

- Chapter 2 - Cost Concepts, Information SystemsDocument42 pagesChapter 2 - Cost Concepts, Information SystemsFaizan ChNo ratings yet

- Chapter 02 Test BankDocument13 pagesChapter 02 Test BankNada AlhenyNo ratings yet

- Cost Volume Profit Analysis-1Document15 pagesCost Volume Profit Analysis-1Eniola OgunmonaNo ratings yet

- Eastermarginalcosting 2020Document22 pagesEastermarginalcosting 2020GodfreyFrankMwakalingaNo ratings yet

- Review Sheet Exam 2Document17 pagesReview Sheet Exam 2photo312100% (1)

- Tutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Document3 pagesTutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Hu-Ann KeymistNo ratings yet

- Chapter-05 CVP RelationshipDocument29 pagesChapter-05 CVP RelationshipShahinul Kabir100% (4)

- CH 03 SolDocument4 pagesCH 03 Solbhavin_tannaNo ratings yet

- Ankitastic Exams SolutionsDocument30 pagesAnkitastic Exams SolutionsAnkitastic tutoring ServicesNo ratings yet

- (Done) Activity-Chapter 2Document8 pages(Done) Activity-Chapter 2bbrightvc 一ไบร์ทNo ratings yet

- Chapter No. 4 Break-Even and Cost-Volume-Profit Analysis: Week 11Document19 pagesChapter No. 4 Break-Even and Cost-Volume-Profit Analysis: Week 11BabarNo ratings yet

- Cost Behavior and Cost-Volume-Profit AnalysisDocument56 pagesCost Behavior and Cost-Volume-Profit Analysisjeela1No ratings yet

- AccountingDocument14 pagesAccountingHelpline100% (1)

- Bài ToánDocument2 pagesBài ToánHoàng Yến NhiNo ratings yet

- Activity 05: 202180927 - VISTA, MARK LESTER A. Ol33E21 - Bs Accountancy Olcae09 - Financial Accounting and ReportingDocument6 pagesActivity 05: 202180927 - VISTA, MARK LESTER A. Ol33E21 - Bs Accountancy Olcae09 - Financial Accounting and ReportingVexana NecromancerNo ratings yet

- Break Even MathDocument2 pagesBreak Even MathMuhammad Akmal HossainNo ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- Cost-Volume-Profit Analysis Problems: CalculateDocument3 pagesCost-Volume-Profit Analysis Problems: CalculateAsma Hatam100% (7)

- Costing MethodsDocument2 pagesCosting Methodsايهاب حسنىNo ratings yet

- Absorption and Variable CostingDocument6 pagesAbsorption and Variable CostingEvangelista, Trisha Gael V.100% (1)

- Corporate Finance Management: Sumaira Riaz Test 1Document4 pagesCorporate Finance Management: Sumaira Riaz Test 1olga marnicaNo ratings yet

- CH 5 HWDocument8 pagesCH 5 HWCha Chi BossNo ratings yet

- Managerial Accounting: Osama KhaderDocument37 pagesManagerial Accounting: Osama Khaderroaa ghanimNo ratings yet

- Mglmod 9Document15 pagesMglmod 9Joyce Anne TilanNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- Chapter 3 Part 1Document5 pagesChapter 3 Part 1Aya MasoudNo ratings yet

- Managerial MidtermDocument6 pagesManagerial MidtermIqtidar KhanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Latihan Soal Bab 4 (Ricardo Chen - 2102111151)Document10 pagesLatihan Soal Bab 4 (Ricardo Chen - 2102111151)AzlanNo ratings yet

- NAME: M. Azlan Rifa'i NIM: 2102113036 Subject: Financial Statement Analysis Title: Analyzing Investment Activities A) Current AssetDocument5 pagesNAME: M. Azlan Rifa'i NIM: 2102113036 Subject: Financial Statement Analysis Title: Analyzing Investment Activities A) Current AssetAzlanNo ratings yet

- Week 5 (Ricardo Chen - 2102111151)Document2 pagesWeek 5 (Ricardo Chen - 2102111151)AzlanNo ratings yet

- Syllabus FsaDocument3 pagesSyllabus FsaAzlanNo ratings yet

- Financial Statement Analysis AsssignmentDocument2 pagesFinancial Statement Analysis AsssignmentAzlanNo ratings yet

- AUIDT Analysis Auidt Report Form Indonesia and American in Term of Audit StructureDocument3 pagesAUIDT Analysis Auidt Report Form Indonesia and American in Term of Audit StructureAzlanNo ratings yet

- Kelompok Akuntansi - C: Pre-Test ToeflDocument1 pageKelompok Akuntansi - C: Pre-Test ToeflAzlanNo ratings yet

- Chapter 2 Summary Financial Statement AnalysisDocument5 pagesChapter 2 Summary Financial Statement AnalysisAzlanNo ratings yet

- Kelompok Akuntansi - B: Pre-Test ToeflDocument1 pageKelompok Akuntansi - B: Pre-Test ToeflAzlanNo ratings yet

- 2021 Brochure EnglishDocument2 pages2021 Brochure EnglishAzlanNo ratings yet

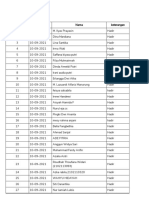

- AbsensiDocument2 pagesAbsensiAzlanNo ratings yet