Professional Documents

Culture Documents

Steps Towards Financial Freedom

Steps Towards Financial Freedom

Uploaded by

Barun SinghCopyright:

Available Formats

You might also like

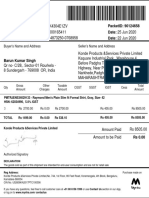

- Myntra Invoice of ShirtDocument1 pageMyntra Invoice of ShirtBarun Singh0% (2)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (19)

- Movie Reaction Paper: The CircleDocument2 pagesMovie Reaction Paper: The Circleswathim123No ratings yet

- Right+to+Travel Massive CitesDocument21 pagesRight+to+Travel Massive CitesMista MurphyNo ratings yet

- TIH Financial Freedom EbookDocument15 pagesTIH Financial Freedom EbookRajeev Kumar PandeyNo ratings yet

- 7 Reasons by Ganesan ThiruDocument28 pages7 Reasons by Ganesan ThirupadmaniaNo ratings yet

- Passive Income: How to Build Wealth Without Trading Time for Money and Achieve Financial Freedom Through Online Business, Entrepreneurship, Real Estate, Stock Market Investing, Dividends, and More.From EverandPassive Income: How to Build Wealth Without Trading Time for Money and Achieve Financial Freedom Through Online Business, Entrepreneurship, Real Estate, Stock Market Investing, Dividends, and More.Rating: 5 out of 5 stars5/5 (45)

- Retire Early (2 Books in 1).Financial Freedom for Beginners + Retire Early with ETF Investing StrategyFrom EverandRetire Early (2 Books in 1).Financial Freedom for Beginners + Retire Early with ETF Investing StrategyNo ratings yet

- Millionaire Mindest: 2 Manuscript in 1 : Financial Freedom for Beginners: How to Become Financially Independent and Retire Early + How to Create Wealth: Live the Life of Your Dreams Creating Success and Being UnstoppableFrom EverandMillionaire Mindest: 2 Manuscript in 1 : Financial Freedom for Beginners: How to Become Financially Independent and Retire Early + How to Create Wealth: Live the Life of Your Dreams Creating Success and Being UnstoppableNo ratings yet

- Financial Planning ArticleDocument3 pagesFinancial Planning ArticlevaradNo ratings yet

- Realistic Guide to Financial Freedom Through: Investing Activity. With step-by-step guide!: How to make millions with a simple investing strategy, part 1, #1From EverandRealistic Guide to Financial Freedom Through: Investing Activity. With step-by-step guide!: How to make millions with a simple investing strategy, part 1, #1No ratings yet

- Middle in Come GroupDocument32 pagesMiddle in Come GroupVirdhi JoshiNo ratings yet

- Financial Freedom: How to make All the Money You Will Ever Need. Your Best Plan for Financial FitnessFrom EverandFinancial Freedom: How to make All the Money You Will Ever Need. Your Best Plan for Financial FitnessNo ratings yet

- 5 Ways To Financial Plan - R KiyosakiDocument6 pages5 Ways To Financial Plan - R KiyosakiArnisador100% (1)

- Introduction To SIMPLUSDocument2 pagesIntroduction To SIMPLUSSoundarya H GNo ratings yet

- The Passive Income Mindset: Smart Ways to Achieve Financial FreedomFrom EverandThe Passive Income Mindset: Smart Ways to Achieve Financial FreedomRating: 3.5 out of 5 stars3.5/5 (6)

- Beginners Guide to Dividend Investing 2020: How to Retire with Dividends: Dividend Investing Beginners Guide, #1From EverandBeginners Guide to Dividend Investing 2020: How to Retire with Dividends: Dividend Investing Beginners Guide, #1No ratings yet

- Beginners Guide to Dividend Investing: How to Retire with Dividends: Dividend Investing Beginners GuideFrom EverandBeginners Guide to Dividend Investing: How to Retire with Dividends: Dividend Investing Beginners GuideNo ratings yet

- Financial Themes: Your Fast Track to Financial Freedom! Learn Everything There Is to Know About Finances and Setting Up Successful Passive Income StreamsFrom EverandFinancial Themes: Your Fast Track to Financial Freedom! Learn Everything There Is to Know About Finances and Setting Up Successful Passive Income StreamsNo ratings yet

- 10 Commandments of Lifestyle InvestingDocument4 pages10 Commandments of Lifestyle InvestingApurva KeniNo ratings yet

- Retirement Planning GuideDocument26 pagesRetirement Planning GuideKalaivani ArunachalamNo ratings yet

- What Is Personal FinanceDocument15 pagesWhat Is Personal Financemavol18877No ratings yet

- A7 - Final Part A WrittenDocument11 pagesA7 - Final Part A Writtenapi-283660433No ratings yet

- Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On InflowsDocument1 pageFin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On InflowsaravindascribdNo ratings yet

- 5 Tips For Hiring AFinancial Advisor - Script For YOUTUBE - PODCAST - Finished ProductDocument7 pages5 Tips For Hiring AFinancial Advisor - Script For YOUTUBE - PODCAST - Finished ProductMahnaz AsifNo ratings yet

- Financial Choices When Starting Your CareerDocument11 pagesFinancial Choices When Starting Your CareerJason CraigNo ratings yet

- On 15th August 2015, PM Narendra Modi Announced This Initiative at The Red Fort As StartDocument10 pagesOn 15th August 2015, PM Narendra Modi Announced This Initiative at The Red Fort As StartHitesh GutkaNo ratings yet

- Investing in Yourself: Financial Riches for a Lifetime and BeyondFrom EverandInvesting in Yourself: Financial Riches for a Lifetime and BeyondRating: 5 out of 5 stars5/5 (2)

- LESSON 1.wealth CreationDocument6 pagesLESSON 1.wealth CreationGRAVES JAKENo ratings yet

- What Is Financial Planning?: Life GoalsDocument16 pagesWhat Is Financial Planning?: Life GoalsrahsatputeNo ratings yet

- Module 4Document25 pagesModule 4Hyacinth FNo ratings yet

- The Modern Guide to Stock Market Investing for Teens: How to Ensure a Life of Financial Freedom Through the Power of Investing.From EverandThe Modern Guide to Stock Market Investing for Teens: How to Ensure a Life of Financial Freedom Through the Power of Investing.No ratings yet

- FinanceDocument2 pagesFinanceKristine Anne ManalastasNo ratings yet

- Passive Income in 2021Document25 pagesPassive Income in 2021Little Saves100% (1)

- Investing 1.0.1 with Purpose: Taking the Mystery out of InvestingFrom EverandInvesting 1.0.1 with Purpose: Taking the Mystery out of InvestingNo ratings yet

- Learn What The Rich KnowDocument60 pagesLearn What The Rich KnowIon-Tudor Rusu100% (2)

- Module Business Finance Chapter 6Document4 pagesModule Business Finance Chapter 6Atria Lenn Villamiel BugalNo ratings yet

- Revised Debate SpeechDocument2 pagesRevised Debate SpeechJay Guiyab UmacamNo ratings yet

- Ideas To Increase Your Income EbookDocument69 pagesIdeas To Increase Your Income EbookSaravananNo ratings yet

- A Legal Walkway For Business Success: Le IntelligensiaDocument63 pagesA Legal Walkway For Business Success: Le IntelligensiaSanjay PrakashNo ratings yet

- Build The Financial Plan Around Your Need HierarchyDocument4 pagesBuild The Financial Plan Around Your Need HierarchyVenkataramani NadarajanNo ratings yet

- Financial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesFrom EverandFinancial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesRating: 3 out of 5 stars3/5 (1)

- The Millionaire in You (Review and Analysis of LeBoeuf's Book)From EverandThe Millionaire in You (Review and Analysis of LeBoeuf's Book)No ratings yet

- You Are the Next Billionaire: Stand Up, Think More, Think Bigger Than Yourself, and Have the Will to Self-Lift in BusinessFrom EverandYou Are the Next Billionaire: Stand Up, Think More, Think Bigger Than Yourself, and Have the Will to Self-Lift in BusinessNo ratings yet

- KMBN FM02 Financial Planning and Tax ManagementDocument25 pagesKMBN FM02 Financial Planning and Tax ManagementShubham SinghNo ratings yet

- Breakthrough Revelation: 2021's Most Viable Path To Financial AbundanceDocument3 pagesBreakthrough Revelation: 2021's Most Viable Path To Financial AbundanceMicky VirusNo ratings yet

- Benefits of Hiring A Financial Advisor-OriginalDocument3 pagesBenefits of Hiring A Financial Advisor-OriginalMahnaz AsifNo ratings yet

- Investment Organizer ToolDocument57 pagesInvestment Organizer ToolBarun SinghNo ratings yet

- Key Takeaways From The MasterclassDocument3 pagesKey Takeaways From The MasterclassBarun SinghNo ratings yet

- RajasthaniDocument15 pagesRajasthaniBarun SinghNo ratings yet

- Timeline - Waste Water Outfall (Revised)Document2 pagesTimeline - Waste Water Outfall (Revised)Barun SinghNo ratings yet

- Relevent CEA Regulation 2010Document3 pagesRelevent CEA Regulation 2010Barun SinghNo ratings yet

- UntitledDocument2 pagesUntitledBarun SinghNo ratings yet

- The Successful Retirement ScorecardDocument1 pageThe Successful Retirement ScorecardBarun SinghNo ratings yet

- Refund FormDocument1 pageRefund FormBarun SinghNo ratings yet

- Secrets To Retire RichDocument41 pagesSecrets To Retire RichBarun SinghNo ratings yet

- Retirement ChecklistDocument1 pageRetirement ChecklistBarun SinghNo ratings yet

- Observations On Revetment DRGDocument1 pageObservations On Revetment DRGBarun SinghNo ratings yet

- Design Calculation and Drawing of Revetment Wall For Transmission Line Tower - DE-C-353Document4 pagesDesign Calculation and Drawing of Revetment Wall For Transmission Line Tower - DE-C-353Barun Singh0% (1)

- CL - 8 - UIMO-2021-Paper-9246-Updated KeyDocument7 pagesCL - 8 - UIMO-2021-Paper-9246-Updated KeyBarun SinghNo ratings yet

- Unified Council Results PDFDocument1 pageUnified Council Results PDFBarun SinghNo ratings yet

- 220KV Interconnection Details of Power Line With Bay at NSPCL, Cable Termination Yard, MSDS-IV & Msds-ViiDocument2 pages220KV Interconnection Details of Power Line With Bay at NSPCL, Cable Termination Yard, MSDS-IV & Msds-ViiBarun SinghNo ratings yet

- Userid Name Sex Class Parentname School Wise List: Sub-JuniorDocument17 pagesUserid Name Sex Class Parentname School Wise List: Sub-JuniorBarun SinghNo ratings yet

- Userid Name Sex Class Parentname School Wise List: JuniorDocument25 pagesUserid Name Sex Class Parentname School Wise List: JuniorBarun Singh100% (1)

- 1MENTAL ABILITY PART - 1 of 4Document59 pages1MENTAL ABILITY PART - 1 of 4Barun SinghNo ratings yet

- Set 1Document5 pagesSet 1Barun SinghNo ratings yet

- Context Diagram D A: User ID Password New Book 0.1Document4 pagesContext Diagram D A: User ID Password New Book 0.1Barun SinghNo ratings yet

- Class 6 FTRE 2013 Previous Year Question PaperDocument16 pagesClass 6 FTRE 2013 Previous Year Question Papershankar.debnath627780% (5)

- 37X5X7 1295 and So On Hence, D 9 Which Gives N 750Document1 page37X5X7 1295 and So On Hence, D 9 Which Gives N 750Barun SinghNo ratings yet

- Kvs Jmo 4Document1 pageKvs Jmo 4Barun SinghNo ratings yet

- Emr Complete A Worktext 2Nd Edition PDF Full Chapter PDFDocument53 pagesEmr Complete A Worktext 2Nd Edition PDF Full Chapter PDFouakkahelth100% (5)

- The Smaller Condition Monitoring Systems That Give You More LexibilityDocument8 pagesThe Smaller Condition Monitoring Systems That Give You More LexibilityEdwin BermejoNo ratings yet

- Lesson Plan Fire FighterDocument3 pagesLesson Plan Fire FighterKatie KalnitzNo ratings yet

- Bahasa Inggris Niaga UtDocument2 pagesBahasa Inggris Niaga UtroziNo ratings yet

- Use To Show An Exact Time: - Two O'clock - Midnight / Noon - The Moment, EtcDocument3 pagesUse To Show An Exact Time: - Two O'clock - Midnight / Noon - The Moment, EtcKasira PammpersNo ratings yet

- User Manual - Ender-6 - V1.2 20200703Document32 pagesUser Manual - Ender-6 - V1.2 20200703aguedetaNo ratings yet

- Hcil - Honda Cars Interview Call LetterDocument3 pagesHcil - Honda Cars Interview Call LetterNeha SharmaNo ratings yet

- Manual de Usuario Ph-MetroDocument16 pagesManual de Usuario Ph-Metrojuan alejandro moyaNo ratings yet

- Use of Headed Reinforcement in Beam - Column JointsDocument24 pagesUse of Headed Reinforcement in Beam - Column JointsHabibi MehediNo ratings yet

- Aerofoam Tapes Catalogue PDFDocument32 pagesAerofoam Tapes Catalogue PDFChloe ChuengNo ratings yet

- How To Identify Maketing Research ProblemDocument2 pagesHow To Identify Maketing Research ProblempavanNo ratings yet

- Waqf Mindset PresentationDocument31 pagesWaqf Mindset PresentationBarjoyai BardaiNo ratings yet

- VCH Pew w19 Cultural Responsiveness - Asian AmDocument17 pagesVCH Pew w19 Cultural Responsiveness - Asian Amapi-235454491No ratings yet

- Demand ForecastingDocument20 pagesDemand ForecastingShahbaz Ahmed AfsarNo ratings yet

- C4+ Maintenance ManualDocument28 pagesC4+ Maintenance Manualnorizam77100% (1)

- Paf College Lower Topa: Application Form For Admission in Class VIII-2022 (WEB)Document9 pagesPaf College Lower Topa: Application Form For Admission in Class VIII-2022 (WEB)muazNo ratings yet

- Global SecurityDocument1 pageGlobal SecurityNeil MNNo ratings yet

- Potent Drugs HandlingDocument4 pagesPotent Drugs HandlingOMKAR BHAVLENo ratings yet

- Evertz 7720DAC-A4 1v2 ManualDocument12 pagesEvertz 7720DAC-A4 1v2 ManualErik VahlandNo ratings yet

- ACN Micro Project-1Document23 pagesACN Micro Project-1ashutosh dudhaneNo ratings yet

- Pennsylvania Wing - Aug 2006Document28 pagesPennsylvania Wing - Aug 2006CAP History LibraryNo ratings yet

- Thermaline Heat Shield PDSDocument4 pagesThermaline Heat Shield PDSfrosted296No ratings yet

- ACI Basic - LEARN WORK ITDocument12 pagesACI Basic - LEARN WORK ITravi kantNo ratings yet

- How To Refill HP Cartridge in General V 2Document8 pagesHow To Refill HP Cartridge in General V 2Raymond Aldrich NgoNo ratings yet

- FinanceDocument26 pagesFinanceBhargav D.S.No ratings yet

- United States Court of Appeals, Fourth CircuitDocument4 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Hannah Gonzales ResumeDocument2 pagesHannah Gonzales Resumeapi-500481504No ratings yet

- Research Paper On Emotional StabilityDocument8 pagesResearch Paper On Emotional Stabilityegw48xp5100% (1)

Steps Towards Financial Freedom

Steps Towards Financial Freedom

Uploaded by

Barun SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steps Towards Financial Freedom

Steps Towards Financial Freedom

Uploaded by

Barun SinghCopyright:

Available Formats

AN INTRO TO

6 Steps Towards

Financial Freedom

An introductory guide to become financially

free and how to succeed at it.

Jigish Patel - jigish@jpfinancial.in - 9892202415

Table of

Contents

Introduction

Chapter 1 – What is Financial Freedom?

Chapter 2 – Financial Freedom Fund

Chapter 3 – Assuring Financial Freedom

Chapter 4 – Building Financial Freedom

Chapter 5 – Cashing out Financial Freedom

Conclusion

Jigish Patel - jigish@jpfinancial.in - 9892202415

1

CHAPTER ONE

What is Financial

Freedom?

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

Many a time you might have read or heard a lot about Financial

Planning or Financial Freedom planning. What does Financial

Freedom Planning (FFP) mean? When one can claim that he is

financially free? Many times we misunderstand “being Debt Free”

to “Financial Freedom”. But it’s not true. Being debt-free is just one

aspect of achieving Financial Freedom. Being Debt free requires

you to repay all your current liability like Home Loan, Auto Loan,

Personal Loan while Achieving financial Freedom involves being

free from working for money.

In one’s life when a person is earning enough to cover his

household expenses, insurance premiums, and EMIs, we believe

that the person is having a financial Freedom. While actually the

fact is that, when a person requires compulsorily to give the time

or efforts to earn the required amount of money to fulfill all the

commitments as mentioned above he/she cannot be said to

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

achieve financial freedom. So if you are into the job paying you a

handsome salary or into the business giving you big profits which

are enough to take care of all your expenses and pay for liability,

you might feel that you are Financially Free. But it’s the biggest

“MYTH”.

Then how one can check whether he is financially free? It’s very

easy and simple. While you wake up in to the morning from your

bed, ask yourself, is it necessary to go for a job or doing business

to earn the money you need to survive and to pay for the debt? If

your answer is YES, then you are not financially free. But if your

answer is NO, then you are undoubtedly financially free.

When we say “Mr. X works for XYZ Ltd.” who do you think is the

employer and who is the employee? Obviously Mr. X is an

employee and working for his employer which is XYZ Ltd. Similarly

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

when we say “I work for Money” who is the master and who is the

employee. In the given situation “I” is the employee working for the

“Money” (employer). So unless in your life Money starts working

for you, you can’t claim to be financially free.

There are two ways through which one can generate the money

which is required to survive. Active Income generation is the stage

where a person involves himself/herself to earn the Money. Salary,

Business Income, Professional Fees Etc, are some of the

examples of Active Income generation and requires Human to give

time or to put his/her skills to earn this income. The other way of

generating the required income is Passive income generation.

Passive income doesn’t require you to work for money. The flow of

Passive Income continues, even if you stop working. Interest,

dividends, Rental income, etc are the example of Passive income.

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

For being financially free one needs to plan his activity and

investments in such a way as to shift oneself from the stage “Man

at Job” to “Money at Job”.

In lesson no 2 we shall learn how to calculate the fund required for

financial freedom?

Jigish Patel - jigish@jpfinancial.in - 9892202415

2

CHAPTER TWO

Financial Freedom

Fund

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

The majority of people I have met who are working into the

different field has made my belief very firm. I believe that majority

of the population doing jobs or doing business are if asked a

question about their most desired passion, it is observed that their

passion, in reality, is far away from what they are engaged in their

professional life. Someone loving a painting or photography or

dancing is not into the profession or being a painter, photographer,

or dancer. Some people are very much interested in doing social

work or want to spend time doing some charity. But all of these

people are not able to follow their dream and they work as a job

man or businessman into the area where they are not much

passionate about. It seems to be an idealist situation for someone

to do something which they have dreamt for the whole of their life.

Why? Because they are not financially free and that’s why their

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

first priority by force is to “work for Money”. Financial Freedom is

the stage which if achieved will allow you to do all those things

which you actually wanted to do. So financial freedom is not only

about being free from work but it is allowing yourself to do only

those things which you love to do.

So, how to achieve Financial Freedom?

Simply putting you need to build enough Assets through which

give the regular cash flow which is more than required for the

living. For example, if you need on an average Rs. 600000 a year

for your household and all other expenses. So you need to create

an asset that gives you this required sum of Rs. 600000 to you in

terms of interest or rent or royalty or dividend. So if, you build up

the corpus of 1 cr and invest into the bank fixed deposit fetching

you 6% per annum interest, then irrespective of you going on a job

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

or doing any business you will get the regular income. Another

example is you try and create the corpus which is enough to buy

some property that is able to give you the rental income or Rs.

600000. In nutshell, you need to create a mix of assets whether it

is debt, equity, real estate, etc which can give you the passive

income of Rs. 600000 in total in form of interest or rent or dividend

etc.

So for achieving the financial freedom you need to first find out

how much corpus you need to build up to be able to generate the

passive income. We will call that fund the Financial Freedom

Fund. Financial Freedom Fund is the corpus required to buy the

mix of assets that can generate the passive income which will

allow you today to retire irrespective you have attained the age of

retirement as per the norms of society or not.

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

Calculating this financial freedom fund is very crucial and a little bit

difficult. There are some important things you need to keep in

mind while calculating the target corpus. Things which you need to

keep in mind are,

1) Calculating the exact money required for the household

expenses

2) Projecting the future financial liability

3) Keeping in mind the future Inflation

4) Deciding the right asset mix

5) Existing debt repayment schedule

There are many more thing s which one needs to keep in mind.

But the above are the major areas that are crucial to finding out

the FFF (Financial Freedom Fund).

Jigish Patel - jigish@jpfinancial.in - 9892202415

What is Financial Freedom

Ability to follow your passion

In short, FFF is the function of corpus which is able to generate

the sum total of the present value of all the current and future

expenses and EMIs you are supposed to pay till the lifetime.

Seeking the help of the Professional Financial planner is advisable

for all. Once the FFF is calculated then you can adapt the right

investment strategy to achieve that targeted Financial Freedom

Fund. By doing that exercise you will also get to know that how

many years you are going to take to achieve Freedom from

“working for Money”.

Jigish Patel - jigish@jpfinancial.in - 9892202415

Financial Freedom Fund

Calculate your Financial Freedom Fund

I have tried to make the process of achieving financial

freedom in a simpler manner. I personally call it the ABC

of Financial Freedom. It’s a three-step approach towards

achieving financial freedom. If one follows all the steps

religiously the chances of getting early retirement, by will,

are very high.

The following are the three stages or the steps towards

achieving Financial Freedom, which I call ABC of Financial

Freedom.

1) Assuring (Man at Job)

In this stage, the Man is at the job all the time and he

ensures the financial freedom for him and his family

irrespective of his physical presence.

Jigish Patel - jigish@jpfinancial.in - 9892202415

Financial Freedom Fund

Calculate your Financial Freedom Fund

2) Building (Man + Money at Job)

Here one needs to adapt the investment strategy and to

follow the right asset allocation plan which suits his risk

profile to start building the Financial Freedom Fund. This is

the stage where Man and Money both are in Job. A man

works for the money and invests in some investment

avenue and Money also works by fetching the returns from

the investments done by man.

3) Cashing (Money at Job)

This is the stage where you accumulate all your

investments reallocate those into the assets which start

giving you the Passive income.

Jigish Patel - jigish@jpfinancial.in - 9892202415

3

CHAPTER THREE

Assuring Financial

Freedom

Jigish Patel - jigish@jpfinancial.in - 9892202415

Assuring Financial Freedom

It’s about you and your family

Financial Freedom is not the individual goal or dream it’s a

dream for the family. So when I say I want to achieve

financial freedom, I am not talking about only myself. This

is the stage wherein the absence of you, your family also

enjoys the same financial freedom.

So before achieving Financial Freedom it is very important

that you assure the financial freedom irrespective of you

being there or not. Assurance is the stage where an

earning person ensures that even in case of the

unfortunate demise of himself/herself, the family of his or

her will get the Financial Freedom Fund.

Jigish Patel - jigish@jpfinancial.in - 9892202415

Assuring Financial Freedom

It’s about you and your family

As building up the Financial Freedom fund is a process that

requires the disciplined investment over a period of a few years, it

requires man to work for money till the FFF is build up. This stage

requires “Man at Job” cent percent.

Once the Financial freedom fund is calculated you need to find out

the gap which you required to bridge between the Financial

Freedom Fund and your current assets and investments. And

whatever gap is found out is to be bridged by the Insurance.

Assurance is the stage where you need to use Life Insurance to

bridge up the gap:

Financial Freedom Fund – your current assets – current life

insurance sum assured = Buy Life Insurance

Jigish Patel - jigish@jpfinancial.in - 9892202415

Assuring Financial Freedom

It’s about you and your family

Let’s take an example

In this example to make it simple to understand I would ignore the

inflation and time value of money.

Mr. Prem is a family man having a wife and daughter into the

family. Some of the data regarding his expense liability and

investments are as below.

Monthly Household expense: Rs 25000

Amount needed for the higher education of Daughter: Rs. 500000

Amount needed for the marriage of Daughter: Rs. 700000

Current Outstanding Home Loan: Rs. 1200000

Current total investment value: Rs. 700000

Life Insurance Sum Assured: Rs. 300000

Jigish Patel - jigish@jpfinancial.in - 9892202415

Assuring Financial Freedom

It’s about you and your family

In the above case let’s, first of all, find out the Financial Freedom

Fund.

Considering the rate of the interest in the bank deposit is currently

8% then Mr. Prem needs around Rs. 3125000 for taking care of

his household expenses. Rs. 3125000 if invested in FD then it

would fetch Rs. 300000 as a yearly interest at 8% rate of the

return which is around Rs. 25000 a month. so total financial

freedom fund is the sum total of Rs. 3125000 plus the current and

future liability minus his investments and

Life insurance. In this case, it would be

Jigish Patel - jigish@jpfinancial.in - 9892202415

Assuring Financial Freedom

It’s about you and your family

Rs. 37,50,000 (to take care of the household expenses)

+ Rs. 12,00,000 (Outstanding Home Loan)

+ Rs. 5,00,000 (Daughter’s Education)

+ Rs. 7,00,000 (Daughter’s Marriage)

Rs. 61,50,000 (FINANCIAL FREEDOM FUND)

-Rs. 7,00,000 (Investments)

-Rs. 3,00,000 (Current Life Insurance)

Rs. 51,50,000 (GAP TO BE BRIDGED FOR ASSURING

FINANCIAL FREEDOM)

Jigish Patel - jigish@jpfinancial.in - 9892202415

Assuring Financial Freedom

It’s about you and your family

In the case of Mr. Prem, his Financial Freedom Fund requirement

is Rs. 61,50,000 and the value of the investments and the current

life insurance are 10 lacs. So there is a gap of Rs. 51,50,000

which he needs to build up through regular investments. So it is

required for Mr. Prem for buying one a life insurance policy giving

the Sum Assured equal to Rs. 51,50,000. The best choice for

Assuring financial freedom through life insurance is to buy the

Pure Risk cover also known as the Term Plan. So with the least

cost, one can Assure his Financial Freedom.

In the next chapter, we shall learn Building Financial Freedom

Fund.

Jigish Patel - jigish@jpfinancial.in - 9892202415

4

CHAPTER FOUR

Building Financial

Freedom

Jigish Patel - jigish@jpfinancial.in - 9892202415

Build Financial Freedom

SIP by SIP

Once you have Assured that your family would certainly

get financial freedom even in your absence then starts the

second and most important part of achieving financial

freedom. The second step towards achieving financial

freedom is Building the Financial Freedom Fund (FFF).

The gap between the Financial Freedom Fund and the

current value of your investment is the corpus required to

be build up over a period of time through a wise investment

strategy.

Continuing with the earlier example in the previous case

the required Financial Freedom Fund was Rs. 61,50,000

for Mr. Prem, while the value of his current investments

Jigish Patel - jigish@jpfinancial.in - 9892202415

Build Financial Freedom

SIP by SIP

were Rs. 7,00,000. So in the case of Mr. Prem, we need to add

Rs. 54,50,000 in his investment basket. Targeted corpus or Rs.

54,50,000 lacs is to be achieved through various investments.

If Mr. Prem’s monthly income is Rs. 46,700 then he would leave

with a surplus of around 21,700 per month as the household

expenses of Mr. Prem is Rs. 25,000/- p.m. Assuming Rs. 4000/-

p.m. is the premium he pays for the life insurance policies. Then

he will be left with Rs. 17,700/- p.m. as an investible surplus.

Mr. Prem wants to get the Financial Freedom in 12 years.

So first of all we need to find out how much rate of return should

any investment require to give the corpus of Rs. 54,50,000 lacs by

investing Rs. 17,700/- p.m. in 12 years. The required rate of return

in this case would be approx. 15% CAGR (Compounded Annual

Growth Rate).

Jigish Patel - jigish@jpfinancial.in - 9892202415

Build Financial Freedom

SIP by SIP

If Mr. Prem by mistake opts to invest in postal recurring giving 6%

CAGR return or any other instrument which gives the rate of

return lesser than 15% CAGR, he would not be able to achieve his

financial freedom in 12 years.

If by mistake Mr. Prem opts for the Postal recurring giving 6% pa

return it would take him around 15 years and 8 months to achieve

the Financial Freedom. So by selecting the wrong instrument one

might end up wasting some of the very important years of his life

in the slavery of Money, which otherwise he would have to spend

doing what he actually loves to do the most.

Instead, had Mr. Prem found out the investment avenue yielding

20% CAGR he would have achieved the financial freedom in just

around 9.5 years only.

Jigish Patel - jigish@jpfinancial.in - 9892202415

Build Financial Freedom

SIP by SIP

So in Nutshell,

For building up the Financial Freedom Fund, you need to

a.) Find out the investible surplus.

b.) Find out how much rate of return is required.

c.) Selecting the right investment option giving the required

rate of return.

d.) And investing regularly without fail

If asked to common man, In how many years would he be wanting

to get Financial Freedom? The answer would be as soon as

possible. So what to do?

Jigish Patel - jigish@jpfinancial.in - 9892202415

Build Financial Freedom

SIP by SIP

My personal suggestion would be to do a SIP into the Diversified

Equity Mutual Fund having a long track record. As being a

common man and putting a lot of hard work earning money it is

difficult for someone for doing a research on where to invest?

Given many investment options carrying different characteristics it

very difficult and in fact sometimes it is confusing also for

someone who knows little about investments.

Investment in the Diversified Equity Mutual Fund with a proven

track record through SIP (Systematic Investment Plan) will give

you the better inflation-adjusted returns with much lesser risk.

In this phase of Achieving financial freedom, Man works for

money, earns it, and invests it. Money invested would also earn

some return for Man. That is why I say that for Building up the

Financial Freedom Fund, both men and money need to work

simultaneously.

Jigish Patel - jigish@jpfinancial.in - 9892202415

5

CHAPTER Five

Cashing Financial

Freedom

Jigish Patel - jigish@jpfinancial.in - 9892202415

Cashing Financial Freedom

Focus on regular Income and Growth

This is the final stage of achieving and enjoying financial

freedom. At the beginning of this stage, the Financial

Freedom Fund is already built through various investment

strategies. In this stage, one needs to reallocate his

Financial Freedom Fund into the various investment from

which he would get the passive income which is sufficient

for giving him the passive income required by him for one’s

livelihood and future financial requirements.

In this stage of life, one needs to move out of his money

from the assets which are considered riskier and buy those

assets which are not risky and gives stable income flow.

Some of the examples of these kinds of assets are Bank

Jigish Patel - jigish@jpfinancial.in - 9892202415

Cashing Financial Freedom

Focus on regular Income and Growth

FD, Pension Funds which provides annuity, Bonds, Postal MIS, a

Real estate with good rental yields, etc.

The most important thing which one needs to keep in mind during

this phase is, then passive income should come without liquidating

the assets themselves. For example, if Tree is an asset and one is

expecting a passive income then he should generate the income

by selling fruits of the tree and not by selling the wood. If you try

chopping wood by cutting the tree then it makes no sense, in such

instance, one will be able to enjoy financial freedom only for a

short period of time, and once the assets are exhausted one will

have to once again start running after money.

Jigish Patel - jigish@jpfinancial.in - 9892202415

Cashing Financial Freedom

Focus on regular Income and Growth

Example:

For simplicity let’s take an example of Mr. Ramesh Patel.

Assuming he has no further financial liability other than the regular

household expenses, and his monthly household expense is Rs.

25000/-. Mr. Ramesh Patel has gone through the first two stages

of the ABC of Financial Freedom and now has built the Financial

Freedom Fund worth Rs. 5000000/-. So now Mr. Ramesh can

either invest this sum of 50 lacs into the FD giving him the monthly

post-tax interest of equal to or more than Rs. 25000/ per month.

Or Mr. Ramesh can buy some real estate property fetching the

rental income of Rs. 25000/- or more per month. He can also

invest in some debt fund or hybrid fund and start withdrawing Rs

25,000 per month systematically through a systematic withdrawal

plan.

Jigish Patel - jigish@jpfinancial.in - 9892202415

Cashing Financial Freedom

Focus on regular Income and Growth

So generating the Passive income without damaging assets is the

third and final step of achieving Financial Freedom. In this stage,

money works hard to generate income and one can do whatever

he or she loves to do.

Systematic Withdrawal Plans of Mutual fund is one of the best

ways of generating regular cash flow for your need. It also gives

you the chance of capital appreciation. Simple putting, even after

withdrawing every month form your investments, your financial

freedom fund can still increase every year which can help you to

fight future inflation.

Happy Financial Freedom!

Jigish Patel - jigish@jpfinancial.in - 9892202415

“ “

Financial Freedom is mental,

Emotional and Educational

process.

Robert Kiyosaki

Jigish Patel - jigish@jpfinancial.in - 9892202415

Consult

Financial Advisor Now

It is always advisable to consult a financial advisor

who can help you in creating a roadmap towards

your financial freedom and also to help you to stick

to it in disciplined manner.

ALL THE BEST

Jigish Patel - jigish@jpfinancial.in - 9892202415

You might also like

- Myntra Invoice of ShirtDocument1 pageMyntra Invoice of ShirtBarun Singh0% (2)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (19)

- Movie Reaction Paper: The CircleDocument2 pagesMovie Reaction Paper: The Circleswathim123No ratings yet

- Right+to+Travel Massive CitesDocument21 pagesRight+to+Travel Massive CitesMista MurphyNo ratings yet

- TIH Financial Freedom EbookDocument15 pagesTIH Financial Freedom EbookRajeev Kumar PandeyNo ratings yet

- 7 Reasons by Ganesan ThiruDocument28 pages7 Reasons by Ganesan ThirupadmaniaNo ratings yet

- Passive Income: How to Build Wealth Without Trading Time for Money and Achieve Financial Freedom Through Online Business, Entrepreneurship, Real Estate, Stock Market Investing, Dividends, and More.From EverandPassive Income: How to Build Wealth Without Trading Time for Money and Achieve Financial Freedom Through Online Business, Entrepreneurship, Real Estate, Stock Market Investing, Dividends, and More.Rating: 5 out of 5 stars5/5 (45)

- Retire Early (2 Books in 1).Financial Freedom for Beginners + Retire Early with ETF Investing StrategyFrom EverandRetire Early (2 Books in 1).Financial Freedom for Beginners + Retire Early with ETF Investing StrategyNo ratings yet

- Millionaire Mindest: 2 Manuscript in 1 : Financial Freedom for Beginners: How to Become Financially Independent and Retire Early + How to Create Wealth: Live the Life of Your Dreams Creating Success and Being UnstoppableFrom EverandMillionaire Mindest: 2 Manuscript in 1 : Financial Freedom for Beginners: How to Become Financially Independent and Retire Early + How to Create Wealth: Live the Life of Your Dreams Creating Success and Being UnstoppableNo ratings yet

- Financial Planning ArticleDocument3 pagesFinancial Planning ArticlevaradNo ratings yet

- Realistic Guide to Financial Freedom Through: Investing Activity. With step-by-step guide!: How to make millions with a simple investing strategy, part 1, #1From EverandRealistic Guide to Financial Freedom Through: Investing Activity. With step-by-step guide!: How to make millions with a simple investing strategy, part 1, #1No ratings yet

- Middle in Come GroupDocument32 pagesMiddle in Come GroupVirdhi JoshiNo ratings yet

- Financial Freedom: How to make All the Money You Will Ever Need. Your Best Plan for Financial FitnessFrom EverandFinancial Freedom: How to make All the Money You Will Ever Need. Your Best Plan for Financial FitnessNo ratings yet

- 5 Ways To Financial Plan - R KiyosakiDocument6 pages5 Ways To Financial Plan - R KiyosakiArnisador100% (1)

- Introduction To SIMPLUSDocument2 pagesIntroduction To SIMPLUSSoundarya H GNo ratings yet

- The Passive Income Mindset: Smart Ways to Achieve Financial FreedomFrom EverandThe Passive Income Mindset: Smart Ways to Achieve Financial FreedomRating: 3.5 out of 5 stars3.5/5 (6)

- Beginners Guide to Dividend Investing 2020: How to Retire with Dividends: Dividend Investing Beginners Guide, #1From EverandBeginners Guide to Dividend Investing 2020: How to Retire with Dividends: Dividend Investing Beginners Guide, #1No ratings yet

- Beginners Guide to Dividend Investing: How to Retire with Dividends: Dividend Investing Beginners GuideFrom EverandBeginners Guide to Dividend Investing: How to Retire with Dividends: Dividend Investing Beginners GuideNo ratings yet

- Financial Themes: Your Fast Track to Financial Freedom! Learn Everything There Is to Know About Finances and Setting Up Successful Passive Income StreamsFrom EverandFinancial Themes: Your Fast Track to Financial Freedom! Learn Everything There Is to Know About Finances and Setting Up Successful Passive Income StreamsNo ratings yet

- 10 Commandments of Lifestyle InvestingDocument4 pages10 Commandments of Lifestyle InvestingApurva KeniNo ratings yet

- Retirement Planning GuideDocument26 pagesRetirement Planning GuideKalaivani ArunachalamNo ratings yet

- What Is Personal FinanceDocument15 pagesWhat Is Personal Financemavol18877No ratings yet

- A7 - Final Part A WrittenDocument11 pagesA7 - Final Part A Writtenapi-283660433No ratings yet

- Fin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On InflowsDocument1 pageFin Planning Goes Beyond Saving Taxes: Monitor Your Budget To Keep Tabs On InflowsaravindascribdNo ratings yet

- 5 Tips For Hiring AFinancial Advisor - Script For YOUTUBE - PODCAST - Finished ProductDocument7 pages5 Tips For Hiring AFinancial Advisor - Script For YOUTUBE - PODCAST - Finished ProductMahnaz AsifNo ratings yet

- Financial Choices When Starting Your CareerDocument11 pagesFinancial Choices When Starting Your CareerJason CraigNo ratings yet

- On 15th August 2015, PM Narendra Modi Announced This Initiative at The Red Fort As StartDocument10 pagesOn 15th August 2015, PM Narendra Modi Announced This Initiative at The Red Fort As StartHitesh GutkaNo ratings yet

- Investing in Yourself: Financial Riches for a Lifetime and BeyondFrom EverandInvesting in Yourself: Financial Riches for a Lifetime and BeyondRating: 5 out of 5 stars5/5 (2)

- LESSON 1.wealth CreationDocument6 pagesLESSON 1.wealth CreationGRAVES JAKENo ratings yet

- What Is Financial Planning?: Life GoalsDocument16 pagesWhat Is Financial Planning?: Life GoalsrahsatputeNo ratings yet

- Module 4Document25 pagesModule 4Hyacinth FNo ratings yet

- The Modern Guide to Stock Market Investing for Teens: How to Ensure a Life of Financial Freedom Through the Power of Investing.From EverandThe Modern Guide to Stock Market Investing for Teens: How to Ensure a Life of Financial Freedom Through the Power of Investing.No ratings yet

- FinanceDocument2 pagesFinanceKristine Anne ManalastasNo ratings yet

- Passive Income in 2021Document25 pagesPassive Income in 2021Little Saves100% (1)

- Investing 1.0.1 with Purpose: Taking the Mystery out of InvestingFrom EverandInvesting 1.0.1 with Purpose: Taking the Mystery out of InvestingNo ratings yet

- Learn What The Rich KnowDocument60 pagesLearn What The Rich KnowIon-Tudor Rusu100% (2)

- Module Business Finance Chapter 6Document4 pagesModule Business Finance Chapter 6Atria Lenn Villamiel BugalNo ratings yet

- Revised Debate SpeechDocument2 pagesRevised Debate SpeechJay Guiyab UmacamNo ratings yet

- Ideas To Increase Your Income EbookDocument69 pagesIdeas To Increase Your Income EbookSaravananNo ratings yet

- A Legal Walkway For Business Success: Le IntelligensiaDocument63 pagesA Legal Walkway For Business Success: Le IntelligensiaSanjay PrakashNo ratings yet

- Build The Financial Plan Around Your Need HierarchyDocument4 pagesBuild The Financial Plan Around Your Need HierarchyVenkataramani NadarajanNo ratings yet

- Financial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesFrom EverandFinancial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesRating: 3 out of 5 stars3/5 (1)

- The Millionaire in You (Review and Analysis of LeBoeuf's Book)From EverandThe Millionaire in You (Review and Analysis of LeBoeuf's Book)No ratings yet

- You Are the Next Billionaire: Stand Up, Think More, Think Bigger Than Yourself, and Have the Will to Self-Lift in BusinessFrom EverandYou Are the Next Billionaire: Stand Up, Think More, Think Bigger Than Yourself, and Have the Will to Self-Lift in BusinessNo ratings yet

- KMBN FM02 Financial Planning and Tax ManagementDocument25 pagesKMBN FM02 Financial Planning and Tax ManagementShubham SinghNo ratings yet

- Breakthrough Revelation: 2021's Most Viable Path To Financial AbundanceDocument3 pagesBreakthrough Revelation: 2021's Most Viable Path To Financial AbundanceMicky VirusNo ratings yet

- Benefits of Hiring A Financial Advisor-OriginalDocument3 pagesBenefits of Hiring A Financial Advisor-OriginalMahnaz AsifNo ratings yet

- Investment Organizer ToolDocument57 pagesInvestment Organizer ToolBarun SinghNo ratings yet

- Key Takeaways From The MasterclassDocument3 pagesKey Takeaways From The MasterclassBarun SinghNo ratings yet

- RajasthaniDocument15 pagesRajasthaniBarun SinghNo ratings yet

- Timeline - Waste Water Outfall (Revised)Document2 pagesTimeline - Waste Water Outfall (Revised)Barun SinghNo ratings yet

- Relevent CEA Regulation 2010Document3 pagesRelevent CEA Regulation 2010Barun SinghNo ratings yet

- UntitledDocument2 pagesUntitledBarun SinghNo ratings yet

- The Successful Retirement ScorecardDocument1 pageThe Successful Retirement ScorecardBarun SinghNo ratings yet

- Refund FormDocument1 pageRefund FormBarun SinghNo ratings yet

- Secrets To Retire RichDocument41 pagesSecrets To Retire RichBarun SinghNo ratings yet

- Retirement ChecklistDocument1 pageRetirement ChecklistBarun SinghNo ratings yet

- Observations On Revetment DRGDocument1 pageObservations On Revetment DRGBarun SinghNo ratings yet

- Design Calculation and Drawing of Revetment Wall For Transmission Line Tower - DE-C-353Document4 pagesDesign Calculation and Drawing of Revetment Wall For Transmission Line Tower - DE-C-353Barun Singh0% (1)

- CL - 8 - UIMO-2021-Paper-9246-Updated KeyDocument7 pagesCL - 8 - UIMO-2021-Paper-9246-Updated KeyBarun SinghNo ratings yet

- Unified Council Results PDFDocument1 pageUnified Council Results PDFBarun SinghNo ratings yet

- 220KV Interconnection Details of Power Line With Bay at NSPCL, Cable Termination Yard, MSDS-IV & Msds-ViiDocument2 pages220KV Interconnection Details of Power Line With Bay at NSPCL, Cable Termination Yard, MSDS-IV & Msds-ViiBarun SinghNo ratings yet

- Userid Name Sex Class Parentname School Wise List: Sub-JuniorDocument17 pagesUserid Name Sex Class Parentname School Wise List: Sub-JuniorBarun SinghNo ratings yet

- Userid Name Sex Class Parentname School Wise List: JuniorDocument25 pagesUserid Name Sex Class Parentname School Wise List: JuniorBarun Singh100% (1)

- 1MENTAL ABILITY PART - 1 of 4Document59 pages1MENTAL ABILITY PART - 1 of 4Barun SinghNo ratings yet

- Set 1Document5 pagesSet 1Barun SinghNo ratings yet

- Context Diagram D A: User ID Password New Book 0.1Document4 pagesContext Diagram D A: User ID Password New Book 0.1Barun SinghNo ratings yet

- Class 6 FTRE 2013 Previous Year Question PaperDocument16 pagesClass 6 FTRE 2013 Previous Year Question Papershankar.debnath627780% (5)

- 37X5X7 1295 and So On Hence, D 9 Which Gives N 750Document1 page37X5X7 1295 and So On Hence, D 9 Which Gives N 750Barun SinghNo ratings yet

- Kvs Jmo 4Document1 pageKvs Jmo 4Barun SinghNo ratings yet

- Emr Complete A Worktext 2Nd Edition PDF Full Chapter PDFDocument53 pagesEmr Complete A Worktext 2Nd Edition PDF Full Chapter PDFouakkahelth100% (5)

- The Smaller Condition Monitoring Systems That Give You More LexibilityDocument8 pagesThe Smaller Condition Monitoring Systems That Give You More LexibilityEdwin BermejoNo ratings yet

- Lesson Plan Fire FighterDocument3 pagesLesson Plan Fire FighterKatie KalnitzNo ratings yet

- Bahasa Inggris Niaga UtDocument2 pagesBahasa Inggris Niaga UtroziNo ratings yet

- Use To Show An Exact Time: - Two O'clock - Midnight / Noon - The Moment, EtcDocument3 pagesUse To Show An Exact Time: - Two O'clock - Midnight / Noon - The Moment, EtcKasira PammpersNo ratings yet

- User Manual - Ender-6 - V1.2 20200703Document32 pagesUser Manual - Ender-6 - V1.2 20200703aguedetaNo ratings yet

- Hcil - Honda Cars Interview Call LetterDocument3 pagesHcil - Honda Cars Interview Call LetterNeha SharmaNo ratings yet

- Manual de Usuario Ph-MetroDocument16 pagesManual de Usuario Ph-Metrojuan alejandro moyaNo ratings yet

- Use of Headed Reinforcement in Beam - Column JointsDocument24 pagesUse of Headed Reinforcement in Beam - Column JointsHabibi MehediNo ratings yet

- Aerofoam Tapes Catalogue PDFDocument32 pagesAerofoam Tapes Catalogue PDFChloe ChuengNo ratings yet

- How To Identify Maketing Research ProblemDocument2 pagesHow To Identify Maketing Research ProblempavanNo ratings yet

- Waqf Mindset PresentationDocument31 pagesWaqf Mindset PresentationBarjoyai BardaiNo ratings yet

- VCH Pew w19 Cultural Responsiveness - Asian AmDocument17 pagesVCH Pew w19 Cultural Responsiveness - Asian Amapi-235454491No ratings yet

- Demand ForecastingDocument20 pagesDemand ForecastingShahbaz Ahmed AfsarNo ratings yet

- C4+ Maintenance ManualDocument28 pagesC4+ Maintenance Manualnorizam77100% (1)

- Paf College Lower Topa: Application Form For Admission in Class VIII-2022 (WEB)Document9 pagesPaf College Lower Topa: Application Form For Admission in Class VIII-2022 (WEB)muazNo ratings yet

- Global SecurityDocument1 pageGlobal SecurityNeil MNNo ratings yet

- Potent Drugs HandlingDocument4 pagesPotent Drugs HandlingOMKAR BHAVLENo ratings yet

- Evertz 7720DAC-A4 1v2 ManualDocument12 pagesEvertz 7720DAC-A4 1v2 ManualErik VahlandNo ratings yet

- ACN Micro Project-1Document23 pagesACN Micro Project-1ashutosh dudhaneNo ratings yet

- Pennsylvania Wing - Aug 2006Document28 pagesPennsylvania Wing - Aug 2006CAP History LibraryNo ratings yet

- Thermaline Heat Shield PDSDocument4 pagesThermaline Heat Shield PDSfrosted296No ratings yet

- ACI Basic - LEARN WORK ITDocument12 pagesACI Basic - LEARN WORK ITravi kantNo ratings yet

- How To Refill HP Cartridge in General V 2Document8 pagesHow To Refill HP Cartridge in General V 2Raymond Aldrich NgoNo ratings yet

- FinanceDocument26 pagesFinanceBhargav D.S.No ratings yet

- United States Court of Appeals, Fourth CircuitDocument4 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Hannah Gonzales ResumeDocument2 pagesHannah Gonzales Resumeapi-500481504No ratings yet

- Research Paper On Emotional StabilityDocument8 pagesResearch Paper On Emotional Stabilityegw48xp5100% (1)