Professional Documents

Culture Documents

International Finance (FBE 464) : Department of Finance Marshall School of Business University of Southern California

International Finance (FBE 464) : Department of Finance Marshall School of Business University of Southern California

Uploaded by

Soumitro ChakravartyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Finance (FBE 464) : Department of Finance Marshall School of Business University of Southern California

International Finance (FBE 464) : Department of Finance Marshall School of Business University of Southern California

Uploaded by

Soumitro ChakravartyCopyright:

Available Formats

International Finance (FBE 464)

Department of Finance Marshall School of Business University of Southern California

Spring 2007 Tel: 740-7558 email: baizhu@marshall.usc.edu http://www-rcf.usc.edu/~baizhu/ Office Hours: M 4:00 6:00pm TTH 2:00 3:00pm or by appointment

Professor Baizhu Chen HOH701C

This course will focus on decision making in an international context. It covers major topics in international financial markets. These topics are necessary materials to be learnt by anyone who is interested in pursuing a career in international investment, international banking, international trade or multinational corporations. In this course, we will discuss the foreign exchange markets. In particular, we will cover the spot exchange rate, forward exchange rate, currency futures and options. We will discuss the roles of these different instruments in risk management. Balance of payments and international monetary system are also topics to be discussed. We will also discuss the purchasing power parity and interest rate parity, the two parity conditions that are the foundations for international finance. COURSE REQUIREMENTS: Alan Shapiro, Multinational Financial Management, 8th edition, John Wiley & Sons, 2006 Reading Packet: The reader contains articles and cases for class discussion Wall Street Journal is required: I encourage you to bring to classes any relevant issues in the Wall Street Journal or other magazines for discussion. This will enrich our knowledge and experience. It also helps to bridge the gap between the theories and real world issues. Lecture notes will be posted in the BLACKBOARD system under the course number for downloading. You should be able to access the BLACKBOARD by typing your userid and password of your UNIX account. For more information of the BLACKBOARD, please contact the Keck Center. COURSE EVALUATION: Requirements for the course include three group projects (20%), Statistics Review Assignment (5%), two examinations (45%), five homework assignments (total 15%) and class participation (15%). Class participation may alter your grade by as much as one level. The final grade is based on a curve. I adhere roughly to the school guidelines: An average grade of 3.15 out of 4.00 for undergraduate elective courses. This translates loosely into something like 30-35% A, 45-50% B, 15-20% C, and 0-10% D&E. I do not assign letter grades to individual exams and homework assignments. However, I will give you complete distributions for each grade and you can apply the scale indicated above.

Group Project (3) Midterm Exam Final Exam Homework (5) Statistics Review Assignment Class Participation

20% 20% 25% 15% 5% 15%

Examinations will consist of multiple choice questions, numerical problems, and in some cases short essays. All exams are closed-book, closed-notes. Each exam will cover the required readings from the text and all the material covered in class. Each student has an option to drop the midterm examination score, and shift the entire midterm weight to the final examination. Homework: Each student is responsible for turning in her or his homework at the beginning of class on the due dates. Should he or she for any reasons turn in the homework assignment after the due dates, his or her scores will be discounted 10% for every hour the homework is overdue up to a maximum of 50% discount. You get full credit for an honest effort in doing the homework and turning it in on time; you will not be graded on the accuracy of your answers. I will hand out answers when I return the homework. I encourage you to work on the homework problems with your classmates or your team. However, each student must submit his or her own homework! Group Projects: Students must form teams of 3 - 5 for these assignments. Students who do not have a team will be assigned teams in class. Teams are asked to submit one report per project. Statistics Review Assignment is not to be graded. It is an individual assignment. You get full credit for an honest effort in doing this assignment and turning it in on time. Divorce Laws: A very important skill in the business world is the ability to work with other people in order to accomplish a given task, and to function effectively even if you don't like the other team members. There are invariably conflicts of personality, conflicts of motives, or conflicts of schedules in a team. The first step is to recognize that there is a difficulty and try to resolve it within the team promptly. The working definition of "promptly" is: Before the first team project is due. Occasionally it is not possible to resolve conflicts satisfactorily in this relatively short time period. In those cases, I urge you to come to me as early as possible. I will keep your difficulties confidential and I will try to change the team arrangements without penalizing or embarrassing anyone! No one should have to remain in a disfunctional team! Remember that the later you get a divorce the fewer your options are going to be. I am not planning to use Peer Evaluations to determine if everyone has contributed equitably. If a team does not seek a divorce I assume that all the team members are contributing equitably to the work. Violations of academic integrity standards will be treated seriously. "The use of unauthorized materials, communication with fellow students during an examination, attempting to benefit from the work of another student, and similar behavior that defeats the intent of an examination or other class work is unacceptable to the University. It is often difficult to distinguish between a culpable act and inadvertent behavior resulting from the nervous tensions that accompany examinations. Where a clear violation has occurred, however, the instructor may disqualify the student's work as unacceptable and assign a failing mark on the paper." Make-up Exams: Current department policy to which I adhere is No makeup midterm and final exams will be allowed. If you have an extenuating circumstance that prevents you from taking the exams, discuss your reasons with me BEFORE the time of the exam. Current department policy is that a student may not be given a make-up exam unless he or she has obtained written permission from the course instructor in advance. In addition, you must be able to document your extenuating circumstance.

Any student requesting academic accommodations based on a disability is required to register with Disability Services and Programs (DSP) each semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure the letter is delivered to me (or my TA) as early in the semester as possible. DSP is located in STU 301 and is open 8:30 a.m. - 5:00 p.m. Monday through Friday. The phone number for DSP is (213) 740-0776 This is a contract for this course between you and me. If you want a grade from this class, implicitly you have to follow this contract.

SCHEDULE

Date

Week 1: 1/8

Topic

Course Introduction. Get acquainted. Discussion of the case studies and reports. The Foreign Exchange Market ch. 7 Readings: Review of Statistical Tools

Assignment Due

Week 2: 1/15 Week 3: 1/22

NO CLASS The Foreign Exchange Market ch. 7 The Euromarkets ch. 13 A Yen For Risk, The Economist, May 11, 2006

MLK Holiday Statistics Review Assignment Due

Week 4: 1/29

Currency Futures and Options Markets ch. 8 Case: Lufthansa, Ivey Case 9B00N0022, 2000

Problem set #1 due.

Week 5: 2/5

Currency Futures and Options Markets ch. 8 Currency Swaps ch. 9

Project 1: Forward/Spot project due.

Week 6: 2/12

Balance of Payments ch. 5 Case: The U.S. Current Account Deficit, HBS 5-706-008 "The price of privilege", The Economist, September 22, 2005 Anatomy of thrift, The Economist, September 22, 2005 The global saving glut and the U.S. current account deficit, April 14, Remark by Ben Bernanke

Problem set #2 due.

Week 7: 2/19 Week 8: 2/26 Week 9: 3/5

NO CLASS Balance of Payments ch. 5 Review Midterm.

Presidents Day Problem set #3 due.

Date

Week 10: 3/12 Week 11: 3/19 NO CLASS

Topic

Assignment Due

Spring Break

The Determination of Exchange Rates - ch. 2 Case: China To Float or Not to Float (A)? A Sinking Feeling, The Economist, Jan. 5, 2006 As Fight Heats up Over China Trade, Business is Split, The Wall Street Journal, September 4, 2003 Ups and downs, The Economist, August 17, 2006

Week 12: 3/26

Parity Conditions in International Finance and Currency Forecasting - ch. 4 Mc Currencies, The Economist, May 25, 2006 Instant Returns, The Economist, October 5, 2006 Yen and Yang, the Economist, Sept. 28, 2006

Project 2: Forex Properties project due.

Week 13: 4/2

Parity Conditions in International Finance and Currency Problem set #4 due. Forecasting - ch. 4

Week 14: 4/9

The International Monetary System ch. 3 Markets to the Rescue, The Wall Street Journal, October 13, 1998 The Dollars World: Adios, Peso? The Wall Street Journal, Robert Barro, August 15, 2001 Whats in a Peg? The Economist, October 31, 2002 Not Even a Cat to rescue, the Economist, April 20, 2006

Project 3: IRPT project due.

Week 15: 4/16

Country Risk Analysis - ch. 6 International Portfolio Investment ch. 15 Case: China To Float or Not to Float (D)? Who wants to be a trillionaire? the Economist, Oct. 26,

Problem set #5 due..

2006 Week 16: 4/23 Review, catch up

Week 17: 4/30

Final Exam

7:00 - 9:00 pm.

You might also like

- PM Playbook PDFDocument192 pagesPM Playbook PDFMM83% (6)

- How to Ace That Macroeconomics Exam: The Ultimate Study Guide Everything You Need to Get an AFrom EverandHow to Ace That Macroeconomics Exam: The Ultimate Study Guide Everything You Need to Get an ARating: 5 out of 5 stars5/5 (1)

- Syllabus 1Document4 pagesSyllabus 1Taylor ChristopherNo ratings yet

- ECN 110B: World Economic History II: SPRING 2021 University of California, DavisDocument11 pagesECN 110B: World Economic History II: SPRING 2021 University of California, DavisLarry HiggontopsNo ratings yet

- MBA 6223 Fall 2015 SyllabusDocument8 pagesMBA 6223 Fall 2015 Syllabusmkiv74No ratings yet

- The Concept of NursingDocument14 pagesThe Concept of NursingHarry PendiemNo ratings yet

- FIN 320 Money and BankingDocument4 pagesFIN 320 Money and Bankingtanvir1674No ratings yet

- ECOS369F14Document4 pagesECOS369F14Edward ZhouNo ratings yet

- Syllabus Macro 1Document5 pagesSyllabus Macro 1pratyush1984100% (1)

- Econ 332 Economic Analysis of Labor Markets: Case Western Reserve UniversityDocument3 pagesEcon 332 Economic Analysis of Labor Markets: Case Western Reserve UniversityHiramCortezNo ratings yet

- ECON471: Behavioral Economics: Maximiano@purdue - EduDocument8 pagesECON471: Behavioral Economics: Maximiano@purdue - EduIsgandar JafarzadeNo ratings yet

- ECON471: Behavioral Economics: Maximiano@purdue - EduDocument8 pagesECON471: Behavioral Economics: Maximiano@purdue - EduIsgandar JafarzadeNo ratings yet

- SyllabusDocument4 pagesSyllabusJessicaNo ratings yet

- Development EconomicsDocument9 pagesDevelopment Economicsbilllin12345No ratings yet

- MultinationalFinanceSyllabusSpring2008 d1Document6 pagesMultinationalFinanceSyllabusSpring2008 d1wendelNo ratings yet

- 3451 Simon PDFDocument5 pages3451 Simon PDFEdmund ZinNo ratings yet

- UT Dallas Syllabus For Fin6301.502.11s Taught by Arzu Ozoguz (Axo101000)Document10 pagesUT Dallas Syllabus For Fin6301.502.11s Taught by Arzu Ozoguz (Axo101000)UT Dallas Provost's Technology GroupNo ratings yet

- 1503-Ub0044-Whitelaw - Portfolio ManagementDocument6 pages1503-Ub0044-Whitelaw - Portfolio ManagementaakashchandraNo ratings yet

- 1401 b403388 MaggioriDocument6 pages1401 b403388 Maggioriduchelucia20No ratings yet

- Winecoff Y376 Fall2014Document10 pagesWinecoff Y376 Fall2014W. K. WinecoffNo ratings yet

- International Monetary Economics Professor Laura Veldkamp SyllabusDocument6 pagesInternational Monetary Economics Professor Laura Veldkamp Syllabuskterink007No ratings yet

- UT Dallas Syllabus For Ba4345.001.07s Taught by Mary Chaffin (Chaf)Document5 pagesUT Dallas Syllabus For Ba4345.001.07s Taught by Mary Chaffin (Chaf)UT Dallas Provost's Technology GroupNo ratings yet

- SyllabusDocument3 pagesSyllabusHenry LiuNo ratings yet

- Syllabus Cacm 11001 007 Spring 2010Document4 pagesSyllabus Cacm 11001 007 Spring 2010Muhammad Saad AyubNo ratings yet

- Financial Statements SyllabusFall2016Document6 pagesFinancial Statements SyllabusFall2016MD PrasetyoNo ratings yet

- EconS10bSyllabus Summer2020 Draft PDFDocument5 pagesEconS10bSyllabus Summer2020 Draft PDFAmir HosseinNo ratings yet

- EconS10bSyllabus Summer2020 Draft PDFDocument5 pagesEconS10bSyllabus Summer2020 Draft PDFAmir HosseinNo ratings yet

- Syllabous-UConn Spring 2021 On Line M and BDocument7 pagesSyllabous-UConn Spring 2021 On Line M and BJames PritchardNo ratings yet

- Syllabus - 425 - W17 - 003 - NFDocument4 pagesSyllabus - 425 - W17 - 003 - NFbobNo ratings yet

- FIN330 Financial Markets and Institutions Syllabus: Course DescriptionDocument4 pagesFIN330 Financial Markets and Institutions Syllabus: Course DescriptionRichard LajaraNo ratings yet

- Econ 1104 Syllabus - Fall 19Document4 pagesEcon 1104 Syllabus - Fall 19Vu Minh LongNo ratings yet

- Jones Syllabus2022Document8 pagesJones Syllabus2022Hung Cuong VUONGNo ratings yet

- UT Dallas Syllabus For Ba3360.5e1.11f Taught by Monica Brussolo (Meb049000)Document6 pagesUT Dallas Syllabus For Ba3360.5e1.11f Taught by Monica Brussolo (Meb049000)UT Dallas Provost's Technology GroupNo ratings yet

- Syllabus 4950 Fall 2017 PDFDocument4 pagesSyllabus 4950 Fall 2017 PDFAnonymous 6aucop26GXNo ratings yet

- Economics EastasiaDocument7 pagesEconomics EastasiaLuis Andres Salazar MoraNo ratings yet

- Syllabus 543Document4 pagesSyllabus 543Venkatesh KaulgudNo ratings yet

- Intermediate Microeconomics - SyllabusDocument3 pagesIntermediate Microeconomics - SyllabusKatherine SauerNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement Analysisztanga7@yahoo.comNo ratings yet

- FIN 303 Syllabus Spring 2015Document4 pagesFIN 303 Syllabus Spring 2015Samir ReddyNo ratings yet

- Advanced Corporate Finance (Mesznik) SP2016Document7 pagesAdvanced Corporate Finance (Mesznik) SP2016darwin12No ratings yet

- Neuropsychology: Office HoursDocument3 pagesNeuropsychology: Office HoursLincoln HasanNo ratings yet

- Fin435 2011 SpringDocument4 pagesFin435 2011 SpringHa MinhNo ratings yet

- Stanford Graduate School of Business Mgtecon 300: Growth and Stabilization in The Global EconomyDocument7 pagesStanford Graduate School of Business Mgtecon 300: Growth and Stabilization in The Global EconomyJesus PerezNo ratings yet

- UT Dallas Syllabus For Psy3333.001.11f Taught by John Barfoot (jwb043000)Document4 pagesUT Dallas Syllabus For Psy3333.001.11f Taught by John Barfoot (jwb043000)UT Dallas Provost's Technology GroupNo ratings yet

- Investing in People Cascio Boudreau 2nd EditionDocument3 pagesInvesting in People Cascio Boudreau 2nd Editiondjlee19870% (1)

- Introduction To Microeconomics William C. Wood: Woodwc@jmu - EduDocument5 pagesIntroduction To Microeconomics William C. Wood: Woodwc@jmu - EduSyed Khawar RazaNo ratings yet

- Syllabus Intermediate MicroDocument6 pagesSyllabus Intermediate MicroKarunambika ArumugamNo ratings yet

- FBE 421: Financial Analysis and Valuation Spring 2013Document5 pagesFBE 421: Financial Analysis and Valuation Spring 2013Gabriel PereyraNo ratings yet

- UT Dallas Syllabus For Aim2302.001.09s Taught by Zhonglan Dai (zxd051000)Document6 pagesUT Dallas Syllabus For Aim2302.001.09s Taught by Zhonglan Dai (zxd051000)UT Dallas Provost's Technology GroupNo ratings yet

- Course Syllabus Business Law 280: Business Law I Professor Dosanjh Spring 2004Document7 pagesCourse Syllabus Business Law 280: Business Law I Professor Dosanjh Spring 2004Kyle MagallanesNo ratings yet

- Syllabus Fina6216 FinalDocument4 pagesSyllabus Fina6216 Finalobliv11No ratings yet

- Carlson School of Management Finance 4242W Corporate Investment DecisionsDocument12 pagesCarlson School of Management Finance 4242W Corporate Investment DecisionsNovriani Tria PratiwiNo ratings yet

- FNCE 208/731 International Corporate Finance: Course DescriptionDocument6 pagesFNCE 208/731 International Corporate Finance: Course DescriptionTepongTalamNo ratings yet

- 2022S Mgec11Document5 pages2022S Mgec11Mick MendozaNo ratings yet

- Advanced Principles Corporate FinanceDocument6 pagesAdvanced Principles Corporate Financeveda20No ratings yet

- McDaniel 315 S20-2Document6 pagesMcDaniel 315 S20-2Justin WienerNo ratings yet

- Drug War - Course SyllabusDocument5 pagesDrug War - Course SyllabusRobert PattonNo ratings yet

- UMUCStats SyllabusDocument13 pagesUMUCStats SyllabusldlewisNo ratings yet

- Principles of Microeconomics (9th Edition) (Paperback)Document4 pagesPrinciples of Microeconomics (9th Edition) (Paperback)Shilpa KishoreNo ratings yet

- Econ 102 SyllabusDocument6 pagesEcon 102 SyllabusMichael MattheakisNo ratings yet

- Debt Instruments & Markets SyllabusDocument6 pagesDebt Instruments & Markets SyllabustnmartistNo ratings yet

- USApplicants The Concise SAT I Strategy GuideFrom EverandUSApplicants The Concise SAT I Strategy GuideRating: 1 out of 5 stars1/5 (1)

- Risk Management & InsuranceDocument1 pageRisk Management & InsuranceSoumitro ChakravartyNo ratings yet

- Spiritual Intelligence From The Bhagavad-Gita For 05 - Satpathy-2Document18 pagesSpiritual Intelligence From The Bhagavad-Gita For 05 - Satpathy-2Soumitro ChakravartyNo ratings yet

- APAME 2017 The Dark Side of PublishingDocument67 pagesAPAME 2017 The Dark Side of PublishingSoumitro ChakravartyNo ratings yet

- If SupplementaryDocument1 pageIf SupplementarySoumitro ChakravartyNo ratings yet

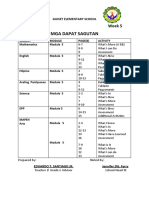

- Mga Dapat Sagutan: Grade 6 - EARTH Week 5Document3 pagesMga Dapat Sagutan: Grade 6 - EARTH Week 5Jhun SantiagoNo ratings yet

- English Project ON Interview of Dr. Apj Abdul Kalam: CLASS - XII ScienceDocument18 pagesEnglish Project ON Interview of Dr. Apj Abdul Kalam: CLASS - XII ScienceDron Sharma100% (6)

- WHLP HOPE 1 Week 8Document2 pagesWHLP HOPE 1 Week 8Marianne GonzalesNo ratings yet

- Book Review Tomlinson 2013Document3 pagesBook Review Tomlinson 2013Darío Luis BanegasNo ratings yet

- Running Head: Writing An Apa Paper 1Document10 pagesRunning Head: Writing An Apa Paper 1puesyo666No ratings yet

- PT1 Revision - Practice Questions (Answers)Document4 pagesPT1 Revision - Practice Questions (Answers)aliza42043No ratings yet

- Syllabus POLS101 Wiener 2023Document6 pagesSyllabus POLS101 Wiener 2023garance0811No ratings yet

- Castillo Et - Al (Physical Activities Among Grade 6 Pupils in Remote Teaching and Learning) FINAL PAPERDocument91 pagesCastillo Et - Al (Physical Activities Among Grade 6 Pupils in Remote Teaching and Learning) FINAL PAPERSamantha Angelica PerezNo ratings yet

- Course Syllabus 2021 (Panitikan NG Pilipinas)Document8 pagesCourse Syllabus 2021 (Panitikan NG Pilipinas)Ryan B. ArdidonNo ratings yet

- New Course Specification Template (2020)Document30 pagesNew Course Specification Template (2020)Ahmed ElkomyNo ratings yet

- Banco Mundial - Evaluaciones A Gran EscalaDocument163 pagesBanco Mundial - Evaluaciones A Gran EscalaCristian Alejandro Lopez VeraNo ratings yet

- 6 MAK HallidayDocument1 page6 MAK Hallidayel_seba_varasNo ratings yet

- How We Organize OurselvesDocument9 pagesHow We Organize Ourselvesapi-262652070No ratings yet

- Reference ZazaDocument3 pagesReference ZazaAnonymous vWpnvDdWXNo ratings yet

- Signature (For Hard Copy Letter) : SourceDocument10 pagesSignature (For Hard Copy Letter) : SourceAngelia Vitria WulansariNo ratings yet

- Cardona Sub Office Memo On Municipal Meet 2024Document8 pagesCardona Sub Office Memo On Municipal Meet 2024jovin2917No ratings yet

- Chapter 5 System Development and Program Change Activities PT 9Document2 pagesChapter 5 System Development and Program Change Activities PT 9Hiraya ManawariNo ratings yet

- Proposal Letter For The Jsprom PDF FreeDocument3 pagesProposal Letter For The Jsprom PDF FreeChristian Ancen AlforoNo ratings yet

- Simplification Quiz 45Document6 pagesSimplification Quiz 45mecixey919No ratings yet

- Cambridge IGCSE™: Mathematics 0580/22Document7 pagesCambridge IGCSE™: Mathematics 0580/22Jahangir KhanNo ratings yet

- Early Life and Involvement in The Freedom Movement: 7. Khudiram BoseDocument3 pagesEarly Life and Involvement in The Freedom Movement: 7. Khudiram BosevimalNo ratings yet

- Classroom AgreementsDocument1 pageClassroom AgreementsMontseNANo ratings yet

- Activity 3. Target Method MatchDocument3 pagesActivity 3. Target Method MatchCarlito T. GelitoNo ratings yet

- General Procrastination ScaleDocument3 pagesGeneral Procrastination ScaleAngelito B. PampangaNo ratings yet

- 5175 PlumbingDocument9 pages5175 PlumbingZeeshan HasanNo ratings yet

- Assignment 1 SENGDocument7 pagesAssignment 1 SENGManzur AshrafNo ratings yet

- Project Director or Senior Project ManagerDocument5 pagesProject Director or Senior Project Managerapi-78785489No ratings yet