Professional Documents

Culture Documents

w2-2020 Fillabalbe Blank

w2-2020 Fillabalbe Blank

Uploaded by

muhammad mudassarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

w2-2020 Fillabalbe Blank

w2-2020 Fillabalbe Blank

Uploaded by

muhammad mudassarCopyright:

Available Formats

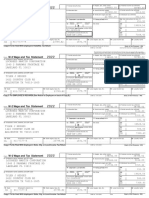

a Employee’s social security number Safe, accurate, Visit the IRS website at

OMB No. 1545-0008 FAST! Use www.irs.gov/efile

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

vv

5 Medicare wages and tips 6 Medicare tax withheld

hb 7 Social security tips 8 Allocated tips

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

o

d

e

13 Statutory Retirement Third-party 12b

employee plan sick pay C

o

d

e

14 Other 12c

C

o

d

e

12d

C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form W-2 Wage and Tax Statement

Copy B—To Be Filed With Employee’s FEDERAL Tax Return.

2020 Department of the Treasury—Internal Revenue Service

This information is being furnished to the Internal Revenue Service.

You might also like

- Case Study - SeasideDocument2 pagesCase Study - SeasideVamsi Krishna20% (5)

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008SuheilNo ratings yet

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument1 pageWage and Tax Statement: Copy C-For Employee'S RecordslidiaNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerhossain ronyNo ratings yet

- Magnum Management Corp One Cedar Point DR Sandusky Oh 44870Document7 pagesMagnum Management Corp One Cedar Point DR Sandusky Oh 44870Hermes Andrés LugmañaNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- CLC Preparing Your Employment Value PropositionDocument36 pagesCLC Preparing Your Employment Value PropositionGuru Chowdhary100% (1)

- Powertech India Case Analysis Fas S2Document6 pagesPowertech India Case Analysis Fas S2josemon george0% (1)

- IRS Form W2Document2 pagesIRS Form W2nurulamin00023No ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerGlendaNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSADocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSAJohn LNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerIgnacio Manzanares EstebanNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerAlberto R. JuarezNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerdtoxidNo ratings yet

- Main Irs Form W 2 Wage and Tax StatementDocument11 pagesMain Irs Form W 2 Wage and Tax Statementjeffery lamarNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerJessi EliasNo ratings yet

- w2 PDFDocument6 pagesw2 PDFNEKRONo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerHot HeartsNo ratings yet

- IRS W-2 (2007v) by Forms in Word 1-29-07Document11 pagesIRS W-2 (2007v) by Forms in Word 1-29-07MARIELLE ZIZZANo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- FW 2Document1 pageFW 2jttaxNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- Wage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentDocument2 pagesWage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentVicky KeNo ratings yet

- W2_2023-2Document6 pagesW2_2023-2SravanpalNo ratings yet

- PYW221S_EE-2Document1 pagePYW221S_EE-2biozitNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- w2 FINALDocument10 pagesw2 FINALmuhammad mudassarNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- US Internal Revenue Service: Fw2as - 2001Document12 pagesUS Internal Revenue Service: Fw2as - 2001IRSNo ratings yet

- Untitled 3Document1 pageUntitled 3Gregory SMithNo ratings yet

- Annemarie BednarDocument3 pagesAnnemarie BednarSmerling PaulinoNo ratings yet

- Edgar Flores W-2 FormDocument1 pageEdgar Flores W-2 Formethannguyen939No ratings yet

- 2021 W2 Edgar FloresDocument1 page2021 W2 Edgar FloresDAISY CRAINNo ratings yet

- Marcus Roberts W-2 FormDocument1 pageMarcus Roberts W-2 Formwolfandcookies6No ratings yet

- 2021 W2 Marcus RobertsDocument1 page2021 W2 Marcus RobertsDAISY CRAINNo ratings yet

- Pyw223s EeDocument1 pagePyw223s EeSean KingNo ratings yet

- 61 F 28319 Bcac 1Document1 page61 F 28319 Bcac 1MickeyNo ratings yet

- Wage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Document1 pageWage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Isaac OlagbemisoyeNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- XXX-XX-8635 1486.48 105.99: Wage and Tax StatementDocument6 pagesXXX-XX-8635 1486.48 105.99: Wage and Tax Statementsheyla vergaraNo ratings yet

- US Internal Revenue Service: fw2 - 2005Document10 pagesUS Internal Revenue Service: fw2 - 2005IRSNo ratings yet

- US Internal Revenue Service: fw2 - 2001Document12 pagesUS Internal Revenue Service: fw2 - 2001IRSNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- Heb W2-2022Document1 pageHeb W2-2022dmireles81No ratings yet

- XXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084Document6 pagesXXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084CR FNo ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- Magnum Management Corp 8039 Beach BLVD Buena Park Ca 90620Document7 pagesMagnum Management Corp 8039 Beach BLVD Buena Park Ca 90620SamNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- Your 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2Document7 pagesYour 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2bassomassi sanogoNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument6 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atFer BONo ratings yet

- LA w2 NewDocument1 pageLA w2 Newchde795No ratings yet

- w2 - Blankss FillableDocument3 pagesw2 - Blankss Fillablemuhammad mudassarNo ratings yet

- Tax Foundation FF6241Document5 pagesTax Foundation FF6241muhammad mudassarNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument2 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employermuhammad mudassarNo ratings yet

- U.S. Corporation Income Tax Return: Type OR PrintDocument6 pagesU.S. Corporation Income Tax Return: Type OR PrintMarie Carag100% (1)

- w2 FINALDocument10 pagesw2 FINALmuhammad mudassarNo ratings yet

- Factory Inspector Form No.-27 (New)Document11 pagesFactory Inspector Form No.-27 (New)MangeshNo ratings yet

- RBS SlidesDocument26 pagesRBS SlidesMohan BennyNo ratings yet

- Corporate Social ResponsibilityDocument24 pagesCorporate Social ResponsibilityJose Lester Correa DuriaNo ratings yet

- General MotorsDocument17 pagesGeneral MotorsRobNo ratings yet

- Service BlueprintDocument3 pagesService Blueprintahmed aliNo ratings yet

- Henry Fayol Word 2003Document11 pagesHenry Fayol Word 2003Richard AustinNo ratings yet

- Preventive MaintenanceDocument42 pagesPreventive MaintenanceAmirul AriffNo ratings yet

- HR AssignmentDocument2 pagesHR AssignmentWaleed AamirNo ratings yet

- HR Practices of Independent TelevisionDocument14 pagesHR Practices of Independent TelevisionAdnan Efad0% (1)

- The Evolution of Management ThoughtDocument42 pagesThe Evolution of Management Thoughtamu_kcNo ratings yet

- HR PresentationDocument64 pagesHR PresentationJahan ZaibNo ratings yet

- The Ultimate Sales Machine: Turbo Charge Your Business With Relentless Focus On 12 Key StrategiesDocument6 pagesThe Ultimate Sales Machine: Turbo Charge Your Business With Relentless Focus On 12 Key Strategiesalle_72No ratings yet

- Paper Industries Corporation VS LaguesmaDocument2 pagesPaper Industries Corporation VS LaguesmaColBenjaminAsiddao100% (1)

- Job Analysis Information Sheet OkDocument5 pagesJob Analysis Information Sheet OkCarlos Korompis100% (1)

- Employment Agreement Template v2Document2 pagesEmployment Agreement Template v2diegoneespinalNo ratings yet

- Department of Labor: Dol4nDocument3 pagesDepartment of Labor: Dol4nUSA_DepartmentOfLabor100% (2)

- MGT 220 Organizational BehaviorDocument15 pagesMGT 220 Organizational BehaviorDulce Maria GudiñoNo ratings yet

- Tafere W. (Assistant Professor)Document5 pagesTafere W. (Assistant Professor)yohanes getnetNo ratings yet

- Dol 4 NDocument3 pagesDol 4 Njobs1526No ratings yet

- E10. Human Resources FilesDocument4 pagesE10. Human Resources FilesRaj_Jai03No ratings yet

- Dessler - 04 Job AnalysisDocument12 pagesDessler - 04 Job AnalysisAlam SmithNo ratings yet

- T205B TMA Case Study Fall 2016Document9 pagesT205B TMA Case Study Fall 2016Emad KhanNo ratings yet

- BUSM3201 Topic 1 What Is HRMDocument14 pagesBUSM3201 Topic 1 What Is HRMZhang Wenjie ShaunNo ratings yet

- Labor Law and Legislation Midterm Quiz 2Document5 pagesLabor Law and Legislation Midterm Quiz 2Santi Seguin100% (1)

- Oracle HRMS PTO Accrual Plan SetupDocument5 pagesOracle HRMS PTO Accrual Plan SetupSAJJADNo ratings yet

- The Employment Law in MalaysiaDocument42 pagesThe Employment Law in Malaysiahowealth8No ratings yet

- Chapter 32 Agency Formation and DutiesDocument4 pagesChapter 32 Agency Formation and DutiesJerry WongNo ratings yet