Professional Documents

Culture Documents

Disinformation Index Inc 2021 990

Disinformation Index Inc 2021 990

Uploaded by

Gabe Kaminsky0 ratings0% found this document useful (0 votes)

450 views36 pagesObtained by Gabe Kaminsky of the Washington Examiner

Original Title

Disinformation Index Inc 2021 990 (1) (2)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentObtained by Gabe Kaminsky of the Washington Examiner

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

450 views36 pagesDisinformation Index Inc 2021 990

Disinformation Index Inc 2021 990

Uploaded by

Gabe KaminskyObtained by Gabe Kaminsky of the Washington Examiner

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 36

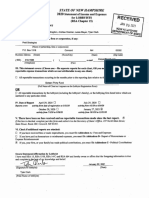

** PUBLIC DISCLOSURE COPY **

990 Return of Organization Exempt From Income Tax

Form |Under section 50%(c), §27, or 4947(a\1) ofthe Internal Revenue Code (except private foundations]

> Do not enter social security numbers on this form as it may be made public.

Peal D> Goto writs. gowFonm90 for instructions and the latest information Rapecton

1k For the 2021 calender yoo, or Tax year boglnning ‘and ending

B genus, [ENone of oxsnzaton Employer entation number

(Sits | DISINFORMATION INDEX INC.

[Site [Doing business as, 85-2450338

(S}E5" Phumbor and see (FP bor falls dekardioseetaaarss) —[Roonute [E Telophove number

21750 HARDY OAK BLVD flo4a (240366.

‘yor town, state o province, county, and ZP oTrign postal code Gtonreepet apa

SAN ANTONIO, TX 78258 Hla iets a group eum

[F heme and ecco o cp! ocr EE ————] " ‘orsuoorinates? (Ives (X)No

SAME AS C ABOVE HH) wet ern estes LINO

i Tacenempt tau [KISDI(0|9) [150i] Ja Geatnay Tear parE] No. taco tt. Se mstuctons

“J Website: > DI SINFORMATTONINDEX. ORG Ho) Group exemption number De

i Form of organization: [1] Gorporaton_[__] Tost_[__] Associaton [Ther > [x Yea of ormaton: 2020] m Site of agai domicie: DE

Parti] Summary

“1 Brief describe he organization's mission or most sgnticant avis: A_NONPARTISAN ORGANIZATION THAT

3)" Cousnrs’ DieiNroRMAnTON sors IN THE UNTTED STATES AND GLOBALEY

2 GhooKthisbox P [_l the orpaniatondcontinied ts Operations or iposed of mre fan 2536 of net ase

I 3 Number of voting members of the governing body (Part Vi, line 1a) 3 3

8 | 5 Numbororintependet votng members ofthe govering body (Par Vv, nef) * 3

8 | 5 Total number of individuals employed in calendar year 2021 (Part V, line 2a) Ss 5

3 | 6 Toalnumberof voters estate necessay) 6 z

§ | 7 Total urveated business revenve from Pat Vil column (0), ine 12 7a v.

‘b Net unrelated business taxable income from Form 990-T, Part | line 11 [7b | oO.

Brior Year Gurant Year

1g & Corton and grant Pr Vi ne th senna [345,000 570, 000,

| © Program service revenue (Part Vill, ine 29) 0. 553,089.

E | 10 investmentincome (Par Vil coh (A), ines 3, &, and 76) LA oe

| 41 other revenue (Part Vil, column (A), nes 5, 83, 8, 9e, 106, and 116) 0, o

12._Total revenue - add lines 8 through 17 (must equal Part Vill, column (A), line 12) 345, 000- 1,123,089

13" Grants and ania munts paid Pat, cola A hes 13) 0

14 Benes pad to oor members Part IX, eokinn (ne 4) 0

15. Salaries, other compensation, employee benefits (Part IX, column (A), ines 5:10) 0. 302, 513-

16a Professional fundraising fees (Part IX, column (A, fine 1). v-| o.

' Total fundraising expenses (Part I, column ©), ne 25) Pe

17 Othor expenses (Part IX, column (A, ines 112-110, 114246)

18 Total expenses. Add lines 13-17 (must equal Par, con (A), Ine 25) 85,170,

Expenses

[___106, 014.

| 408,527.

19 Revenue less expenses. Subtract ine 18 from line 12 714,562.

i End of Year

20 Total assets (Part, ine 16) 022,105.

21 Total bites (Par, Boe 26) 47,717.

Nt assets or fund balances. Subtract ie 21 from ine 20 OTE, 392.

[Parr [Signature Block .

Und eras of perry dearth ave afd Ts eur cud eocompanvng Sede and slau, ado te But Ty Krawalpy and oT, Te

‘ue, corel and compe Deca of epate aterhan of based on leomatn of whieh prepress any knoe.

Sign

Here

‘May the RS anus this retum with the preparer shown above? Soe instructions Yes_[_INo

‘samo; 082) LHA. For Paperwork Reduction Act Notice, see the separate instructions. Form 990 2025)

SEE SCHEDULE 0 FOR ORGANIZATION MISSION STATEMENT CONTINUATION

Fo 990 oe DISINFORMATION INDEX_INC. 85-2450338 page?

fatement of Program Service Accomplishments

‘Check if Schedule © contains a response or note to any line in this Part I x)

“1 Bily describe tne organkzatio's mission

DISINFORMATION INDEX IS A NONPARTISAN ORGANIZATION THAT COMBATS

ION BOTH IN THE UNITE! ES_AND 7

CREATION OF PUBLIC RATINGS OF MEDIA SOURCES THAT ASSESS THEIR”

DISINFORMATION IN ERIA.

2 Did the organization undertake any signiicant program services during the year which were not sted onthe

‘prior Form 990 or $9027 (ves CXINo

Yes," deserbe these new services on Schedule O.

‘8 Did the organization cease conducting, oF make significant changes in how it conducts, any program services? Clves [X]No

tes," describe these changes on Schedule ©.

4 Describe the erganization’s program service accomplishments foreach of ts three largest program services, as measured by expenses.

Seaton 501(0}3) and 01(6(@) organizations are required to report the amount of grants and allocations to others, the total expenses, and

revenve, i any for each program service reported.

a a S18, 138. wnrasmows ) fenced 553,089.)

DISINFORMATION INDEX PROVIDES EDUCATIONAL TOOLS, MATERIALS,

IR IN THE MEDIA INDUSTRY'S

UNDERSTANDING ABOUT DISINFORMATION ON THE INTERNET TA

DISINFORMATION INDEX’S ACTIVITIES FOCUS ON FOUR KEY APPROACHES TO

COMBATING DISINFORMATION:

DUCATI! DISINF 7 FORMATION INDEX WILL

PROVIDE EDUCATIONAL TOOLS AND MATERIALS THROUGH A WEBSITE, CONFERENCES —

AND SEMINARS, AND DISCUSSION GROUPS TO INCREASE UNDERSTANDING AMONG THE_

PUBLIC REGARDING DISINFORMATION ON THE INTERNET AND IN THE MEDIA. THESE

ACTIVITIES WILL CONSTITUTE APPROXIMATELY 30% OF DISINFORMATION INDEX'S

OVERALL ACTIVITIES. OOSOSSCSCSOCCCCCCCCSCOCCCCCCSCSC~S

(Ge V (eee pausarmes Y fons, y

6 ase Veeene vpasane anol 7 paewes, 7

“44 Other program services (Desatbe on Schedule}

(oevwns nrg gomcts ) tare )

fe Toa program sonics expenses 318,138.

T Fom 890 2021

este eens SEE SCHEDULE 0 FOR CONTINUATION(S)

3

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

om 990 (2004 DISINFORMATION INDEX INC. 85-2450338 paged

rt \ecKlist of Required Schedules

—|res]¥e

1 tsthe oxgaizaton described section SOc) or 494711) (ther than a private foundation?

1" '¥es," complete Schedule A a |x

2 \sthe organization requted o compete Schedule 8, Schecie of Cantroutord Se nstuctions ¥

30d the organization engage in dct orindrec political campaign acts on behal of rin opposton to canddates for

publ ofc? if "Yes," complete Schedule C, Pat a{ |x

44 Section 51(¢K9) organizations. Di he organization engage in lobbying aces, or have a secon 8% election net

clung the tax year? "Yes," complete Schedule C, Pat! LA x

'5 isthe erganaation a secon £01(¢4), 50116), oF 801(eK6 arganzation ha receives membership dues, assessments,

slmlaramourts as defined in Re. Proc. 96197 Is," complete Sahedul C, Part s| |x

{Dic he organization maintain any done advised funds or any similar funds or acaunts for which donors have the ight to

provide advice onthe dstrbuton or ivestment of amountsin such funds or accounts? I "Yes." compate SchoauleD. Pat! | 6 |__| X

7 Didthe oganizaton receive or hod a conservation easement, ncudng easements to preserve open space,

the envierment, isto land areas, or histre structures? Yes, completo Sched, Part 7| |x

8 _Didthe orgaizaton maintain colectons of works of ar, istorical easues, or oer sila asset? "es," compiots

Send, Pati e| |x

9 Didthe organization epetan amount n Pat Xie 21, fr escrow or stock acount abit, eve as a Gstodan for

amounts not sted in Pat Xo provide cre counseng, det management, red rea, or debt negotiation serices?

11 "Yes," complete Schedule , Part IV ° x

10 Did he crganization, cect ox through a related organization, ld assets anrveaited endowments

orn quasi endowments "Ys, complete Scheie D, Pat V 7 10

11 tte organization's answer o ay othe folowing questions is "Yes, then compete Schedule O, Pats Vl Vil, oF

a appcabe

{2 Did the ganization report an amount rand, bulking, and equipment i Pat, ine 107/f"Yes," complete Schedule D,

Pat vs sal |x

' Dane ogarzaton report an amount or nvesiments oer secures Pat ne 42, that eS or oreo etal

sao reported in Part X. tne 162 "Yes, compete Schedule O, Pat Vi ww] | x

© Did the ganization report an amount for nvestments program eaten Pat Xe 13, thats 5 or mae of otal

asses reported in Pat x ne 167 I "Yes," complete Schedule, Prt Vi tte

4 id the orgaizaen report an amount for oer asses Part X ne 15, that is 5% or more oft total assets reported

Part X, be 162 I "Ys," complete Schedule D, Part ssa} x

«Did ne organization report an amaunt for aer habits in art ine 257 "Yaa, complete Senedie by Pat te] [X

{Did he organization's separate or consoldated anc statements forthe tx year nce a footnote that adresses

the oqganzation’s bit for uncertain tx postions under FIN 48 (ASC 740) "Yes, complete Sched, Part X aw] [x

‘20 Di the ganization obtain separate, independent audtedthancia statements fr the tx year? "Ys," complete

SoheduileD, Pats X and ta] |x

Was the erganization incudedin consolidated, independent audited financial statemért forthe ax Your?

{r¥s," andi tho ergniatin answered "No" fre 12a, then completing SchedieO, Parts XI and option! rw] |x

13. Is the organization a school described in section 170(0)(1)/AMi)? If "Yas," complete Schedule E 13 x

“a_i he organization manta an offlcs, employees, or agers outside of the Ute States? 7

© Di the organization nave aggregate revenues or expenses of more than $10,000 tom grantmaking, tundiasing, business,

investment, and program sevice actives outside the United States, or aggregate foreign investments valved at $100 000

cor more? i Yes,” complete Schedule F, Pats and Iv vw] | x

15. Did thecxgnizton rpor on Pat cotinn (tne 3 more than 5,000 of rans or ther bsstance oor for any

torelgn organzation? Is, complete Schedule F, Parts and \ ss| |x

16 Did he organization report on Pat, coli (Ine 2, more tan SS,c00 ot agrogate gran oot” asatance to

ofr foreign individuals "Ys," complete Sched F, Parts Mand | |x

17 Othe organization report total of more than $15,000 of expenses for rossi nding Senvces on Par

coturm (nes 6 ard 1107 "Ye," complet Schedule , Part! See nstructens v|_ |x

18 id tne ogarizaton report more than $15,000 total ot nealing event goss Noone an canrsign on Pal, es

teand 8a? 1 "es," complete Schedule G, Patt | |x

19 ig the organization report more than $16,000 of goss ncome tom gaming aches on Pat i nea es

complete Schedule G, Part \ 0 x

20a, Dithe organization operate one or mare hospital ais? if Ves" compete Sched H 20a} |X

® If°Yex" tone 200, the organization tach a copy of ts auded financial statements to hist? 200

21 idte organization opart more than $5,000 of grants eather assistance to any domestic organization or

domestic goverment on Past elu, ne 171 "es," complete Sched Pars land al |x

a recess 4 Form 980 2020

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

Fom 900 2021 DISINFORMATION INDEX INC. 85-2450338 paged

[PartV | GheckIst of Required Schedules contuea

Yes [No

22 Did the organization report more than $5,000 of grants or other assistance to or for domestic individuals on

PartX, column (A, ne 2? 17 Yes," compote Schedule, Parts and 22 x

23. Did the organization ancwer "Yes" to Pat Vil, Section A, Ine 8,4, or5, about compensation ofthe organization's curent

and former offcers, directors, tustes, key employees, and highest compensated employees? I "Yes," complete

Schedule J 2 x

‘24a id the organization havea tax-exempt bond issue wth an outstanding principal amount of more than $100,000 as of the

last day ofthe year, that was issued after Dacember 31, 20027 "es," answer Ines 24b through 24d and compete

‘Schedule K.IF'No,* go tone 252 240 x

Dic the organtation rvest any proceeds of tax-exempt bonds beyond a temporary period exception? ab

«Did he organization maintain an escrow account other than a refunding escrow at any time during the year to defease

any tacexempt bonds? te

«Did the organization act as an “on behalf of issuer for bonds cutstanding at any tie during the year? ad

25a Section 501(eK3}, 5044), and 501(cK29) organizations. Did the organization engage in an excess benefit

‘transaction with a ciequalied person during the year? If "Yes," complete Schedule, Part 250 x

bs the organcation aware that it engaged in an excess beneft transaction with a disqualed person ina prior year, and

that the transaction has not been reported on any of the organization's peor Forms 990 or 90-EZ? I "Yes," complete

Schedule L, Part 1 asy| |

126 Did the organzation report any amount on Pat X, ine § oF 22, or recewvabies from or payables to any Curent

orformer officer, director, trustee, Key employee, creator or founder, substantial contributor, oF 35%

controled entiy or family member of any ofthese parsons? I "Yes," complete Schedule L, Parti 2 x

127i the organization provide a grantor other assstahce to any cument of former officer, dector, trustee, Key employee,

creator or founder, substantia contributor or employee thereof, a grant selection comeities member, orto a 35% controlled

entity (ncluding an employee tnereo) or family member of any ofthese persons? if"Yes,” complete Schedule L, Parl a x

28 Was the organization a party toa business transaction wit one of the folowing partes (see the Schedule L, Part IV,

instructions for appicabe fing thresholds, conditions, and exception):

Accurrent or former officer, director, trustee, key empoyee, creator or founder, or substantial contbutor? Mt

"Yes," complete Schedule, Part IY 2ea| | x

A famay member of any individual described Inne 28a? "Yes, “compote Scheauie L, Par WV 260 x

© A.35% controled entity of ene or more inviduals andlor organizations described in ine 28a or 2807"

"Yes," complete Schedule L, Part IV 2e0| | X

129 Dig the organization receive more than $25,000 In non cash contributions? If"Yes," complete Schedule Mt 2 ¥

‘90 Did the organization receive contributions ofa, historical treasures, or other similar assets, or qualified conservation

contributions? i "Yes," complete Schedule M 20 x

81 Did the organization iquidat, terminate, oF dissoive and cease operations? If "Yes," compete Schedule N, Part 34 x

32 id the organization sal, exchange, aispose of, or transfer mor than 25% ofits net assets?if Yes,” complete

Schedule, Part 22 x

33 Did the organization ovm 10086 ofan entity disregarded as separate trom the organization under Regulations.

sections 301.77012 and 307.7701.9? If "Yes," complete Schedule R, Part / 3 x

934 Was the organization related to any taxexempt or taxable ently? If Yes," complete Schedule, Pat Ii, 1, and

Part Vine 1 oa |X

{350 Did the organization have a controlled entity within the meaning of section ST2(0K13)? se x

bb If *Yes" to line 35a, id the organization receive any payment from or engage in any transactoo witha controled entty

within the meaning of section 512(0\13}? "Yes," compete Schedule R, Pat V, tne 2 35

26 Seotion 60'(¢)3) organizations. Dc the organization make any transfers to an exempt nofchartable related organization?

11 Yes," complete Schedule R, Part V, tne 2 6 x

37 Did the organization conduct more than 5% of ts actvtios trough an entity that f not a elated organization

and thats teated asa partnership for federal income tax purpeses? I "Yes," complete Schedule R, Part VI or x

‘98 Did the organization complete Schedule O and provide explanations on Schedule Ofor Par VI, ing 11D and 197

‘Note: All Form 990 filers are required to complete Schedule O Ll se | X

Part V] Statements Regarding Other IRS Filings and Tax Compliance

Check it Schedule O contains a response or note to any ine in this Part V CI

‘ [ves | No

‘1a Enter the number reported in box: of Fm 1086, Enter- not applicable te 3

'b Enter the number of Forms W.2G incuded on tne 12. Enter 0:iPnot appicable tb

«Did the organization comply with backup wihhokiing rus fr reportable paymonts to vendors and reportable garing

(gambling) wionings to prize winners? \ +e |X

Tins 120821 5 Form 990 (2027)

09460216 758560 27684.000 2021-05050 DISINFORMATION INDEX INC. 27684_01

Form 990 2024 DISINFORMATION INDEX INC. 85-2450338 paged

Part V fements Regarding Other IRS Filings and Tax Compliance (continued)

Yes [No

2a, Enter the number of employees reported on Form WS, Transmital of Wage ane Tax Statements

ted for the calendar year ening with or within the year covere by this retum 20

bb tatleast ones reported online 2a, cid the ganization fo all required federal employment tax retums?, a» | x

‘Note: Ithe sum of nes 1a and 2a Is greater than 250, you may be required toe-ie. See hstructions,

Did the organization have unrelated business gross Income of $1,000 or mare dung the year? a x

bit "Yes," has i fled a Form 990.7 fr this year? if "No" to ne 3b, prove an explanation on Schedule O Ey

4a_At anytime during the calendar year, ds the organization have an interest in, @ signature or other authority over, @

financial account in foreign country (such a8 bank account, secutties account, or other financial account)? 4a x

bb IF-¥es," enter the name ofthe foreign country PP

‘See instructions for ling requirements for FinCEN Form 114, Ropot of Foreign Bank and Financial AGsounts (FBAR)

Sa_Was the organization a party toa prohibited tax shelter transaction at any tne during the tax year? - ba x

'b Did any taxable party not the organization that twas or party toa prohibited tax sheter transaction? cy x

1s" fine Sa or 5b, dl the organization fle Form 8886-7? [oe

{6a Does the organization have annual gross receipts that are normaly greater than $100,000, and aid te organization solic

‘any contributions that wee not tax deductible as chartable contributions? 6a x

bb 1f"Yes," ithe orgarizatonincluce with every slat an express statement that such controutions or gifts

wore not tax deductbie? 7 se &

7 Organizations that may receive deductibio contributions under section 1704),

‘29 id the organization aceiv a payment in excuse of $75 mad party a a conbuton and party fox goods and sarees povided tthe payor? | a x

bb If*Yes," cid the organization notity the donor ofthe value of the goods or services proved? >

© Did the organization sel, exchange, or otherwise depose of tangible personal property for which twas required

to fle Form 82827 0 x

4. 1F*¥es," indicate the number of Forms 8262 fled during the year 7

‘© Did the organization receive any funds, ect oF inarectly, to pay premiums on personal beneft contract? Te x

1 Did the organization, during the year, pay premiums, dectly or Inrectiy, on a personal benefit contract? 7 x

4 Ifthe organization recelved a contribution of qualified intlectual property, did the organization fle Form 8899 as required? | 7@

fh Ifthe organization received a contrbution of cars, boats, aplanes, or other vehlles, dé the organization fle a Form 1008-67 | 7h

8 Sponsoring organizations maintaining donor advised funds. Did @ danor advised fund maintained by the

“sponsoring organization have excess business holdings at any time during the year? 8

9 Sponsoring organizations maintaining donor advised func.

{Did the sponsoring organization make any taxable distributions under section 49667 90

bid the sponsoring organization make a distribution to a donor, donor advisor, or related person? 9.

10 Section 501(c)7) organizations. Ente:

2 Intiation fees and capital contributions incuded on Part Vil, ine 12 +00.

Gross recaipts, included on Form 990, Par il, ne 12, for pubic use of ck facies 08.

11 Section $01(c)12) organizations. Enter:

{Gross income from members or shareholders - aia.

Gross income from other sources, onot net amounts due or paid Yo ther sources againet

amounts due of recelved fom thee) +1

‘12a. Section 4947(a\1) non-exempt charitable rusts (ste organzation fing Form 990 in leu af Form 10417 ea

_IF*¥os,"entor the amount of tax exempt interest received or accrued dung the year 12

13 Section $01(¢)29) qualified nonprofit health insurance feeuers. ;

2 Is the ganization licensed to issue qualified heath plans in more than one state? 132,

Note: See the instructions for addtional information the organization must report on Schedule O.

b_Enterthe amount of reserves the organization i required to maintain by te states in which the

‘organization is Icensed to isaue qualified heatin plans 320

Enter the amount of reserves on hand - Gise.

“V4a_Oic the organization recelve any payments for indoor tanning services during the tax year? = wal [x

bb 1f°Yes," hast fled a Form 720 to report these payments? if "No," provide an explanation an Schecdyle O 540

15 {the organization subject to the section 4960 tax on payment(s) of more than $1,000,000 in remunetation oF

‘excess parachute payment(s) during the year? 15 x

I1°Yes," see the instructions and fle Form 4720, Schedule N. 7

16 isthe organization an educational institution subject to the section 4968 excso tax on net investment income? 16 x

ifs," complete Form 4720, Schedule 0.

17 Section 501(¢)(21) organizations. Did the rust, any dsqualfied person or mine operator engage in any

activities that would resutin the imposition of an excise tax under section 4951, 4952 or 49537 7

Ves," complete Form 6063

“emer teen e Form 980 2027)

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC, 27684_01

Form 990 (2001), DISINFORMATION INDEX INC. 85-2450338

Page 6

Part VI] Governance, Management, and Disclosure. For each "Yes" response fo Ines? Trough 7b Below, and fore Wo" response

to ine 8, 86, or 10b below, describe the cumstances, processes, or changes on Schedule ©. See instructions.

check i Schedule © contains a response or note to any ne M tis Part V

‘Section A. Governing Body and Management

ib.)

%

ma

Ent the number of voting members of the governing body at the end ofthe tax year 1

Yea

Ne

there are materia dferences in voting ahs among members ofthe governing ody, ofthe governing

body dlgated broad authority oan executive commie or siiar commie, explain on Schade 0

Enter the numberof voting members inclded on ine ta, above, who are Independent »

Did any officer, director, trustee, or key employee have a famay relationship ora business relationship with any ther

fice, hector, tuste, or key empoyes?

ia the organization delegate contol over management duties customary performed by or under the dvect supervision

cf officer, drectos, trustees, or key employees toa management company or other person?

id the organization make any significant changes to ts goveming documents since the prior Form 90 was fou?

Dic the organization become aware during the year ofa significant diversion of the organization's assets?

Dia the organization have members or stockholders?

1a the organization have members, stockholders, or otter persons wha had the power to ect or appoint one or

‘more members of the governing body?

‘Ace any governance decisions ofthe o;ganization reserved to (or subject to approval by) members, stockholders, or

persons other than the governing body’?

Did the organization contmporaraousy document the matings ld ar writen actions undartakan ding he yar byte flowing:

The governing body?

Each committe wih authoriy to at on Beha of he govemnag body?

|s there any officer, director, trustee, or key employes Isted in Part Vl, Section A who cannat be reached atthe

crganization's malig address? “Yos," provide the names and addresses on Schedule O

pel eloel oe [oe

A

»

ele

»|

‘Section B. Policies nis Section & requests information about potcies Not required by the itornal Revenue Code)

100

»

ta

10

8

“

6

Dic the organization have local chapters, branches, or aflates?

I1*¥es," al the organization have writen policies and procedures governing the activites of such chapters, afiates,

and branches to ensure ther operations are consistent withthe organization's exempt purposes?”

Has the organization provided a complete copy ofthis Form 990 to a members of is governing body before fling the fom?

DDeserbe on Sched O the process, any, used by the organization to review this Form 980.

Did the organization havea writen confit of interest policy? f‘No,* goto ine 13

Wore otfows, ectrs, or ustees and key employes equted to disclose annually interests tat could ive rise to confit?

id the organization regulary an consistently monitor and enforce compliance withthe polcy? I "Yes," descube

(on Schedule O how this was done

id the organization have a witen whisiobiower policy?

‘ic the organization have a witten document retention and destruction potcy?

id the process for determining compensation ofthe following persons incluxe@ review and approval by independent

persons, comparablty data, and contemporaneous substantiation ofthe deiberation and decision?

‘The organization's CEO, Executive Director, or top management official

‘other offeers or key employees ofthe organization

It "Yes" tone 15a oF 180, describe the process on Schedule ©. See instructions.

id the organization invest in, contribute assets to, or participate in a jot venture or Simla arrangement wth a

taxable entty during the year? $

I¥-Ye," di the organization folow a wetten poy or procedure requiring the organization Yo evaluate is participation

in ont venture anangements under apicabe federal ax la, and take sleps to safeguard the organization's

somo status with respect to such arrangements?

Yea

Wa)

41a |X

20

12

3

4

150

150

460

160

Seation C. Disclosure

7

ist the states with which a copy of his Form 990 le requredto be flea» ___ NONE

118 Section 6104 requires an organization to make is Forms 1028 (1024 or 1024 applicable), 980, jd 9507 (eecton SOT(e}@)s ony avalable

forpublelnapecton.ndeatehow you made thee evatable. Check a hat po

Tolownwebste Xl Ancth'swetste LK] Upon request {1 omer xian oh Schedule 0)

19 Describe on Schedule O whether (and i 0, how) the organization made its governing documents, confit of interest policy, and financial

statements avaiable to the pubic during he tax year

[ARDY OAK BLVD, STE 104, PMB 1427, SAN ANTONIO,\ TX 7

Form 990 (202)

7

09460216 758560 27684.000 2021-05050 DISINFORMATION INDEX INC.

27684_|

01

‘For! 2021) DISINFORMATION INDEX INC. 85-2450338 page?

[Part Vif Gomponsation of Officors, Directors, Trustees, Roy Employees, Fighast Componsated

Employees, and Independent Contrectore

Check if Schedule O contains a response or note to any line in this Part Vil oO

Secon Afters, Drectr,Truses, Key Employees, and Highest Conpensied Employes

qn Conmia s be lral pene eqife tobe td: Repo copenston rth clon year Sung wo WAN Te @UANERUONS TD

* Lutaloftm operate caren ote decor tao eter etiuaeo eicoon opardan of runt oampereatn,

cot ecus Bra fro carpean as ale

Lat athe opanatn's curt key employes ny. Sethe nso fr define ey enpoyes*

Latter rvs cepted eros tytn oer maze or Sh roca

ale Componcabon bor orFormW-2, Frm ab MIS. anorDoxt of em O98 NEC) oF moro Tan SOO om te or gsnston day foed aan.

Lert ota certo tre ews, ey onpeyenn on fe ocomreti elojen wishes mre to S100000

mpcratiecsgrasber ron onttion ts uy abe grantees

tata przali' former ater of wutes et eve te capac 2 ome ect or tae of te oan,

srr tan S00 Seperate bee eperkanen se ot omaha

Sareea del

1 check this box neither the o

ization nor any related organization compensated any cunent officer, doctor, or wustee,

0 ®@ © o © @

Name and tile ve62 | ona cZSStEC me | _Reportabio Reportable | estimated

hous per |sSutsepetcresss% | compensation | compensation | amount of

‘week ‘rom ‘rom related ter

istany the operations | conpersation

hours or exgenizaton | warovemscr | “rom tne

wanoseuisc | 1096NE>) | organization

“099NEO) ‘and reated

cxganizatons

w

a

8,115.

SECRETARY o.

Gp

‘TREASURER (THRU 11/23/21) Oo.

we

SREASORER (AS OF 11/23/21)

rar oe Form 980 2029)

8

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

orm 990 202%) DISINFORMATION INDEX INC. 85-2450338 _page8

Part Vill section A Oticere, Directors, Trustees, Key Employees, and Highest Componsatod Employees cartnun

a ® © © © a

Name and tive average |, 2OsHOn, | Reportable Reportabe | estimated

ours per |\Scsiseesr 2s | eampensaten | compensation | amauntot

week [tori tenetvees | om ‘fom related other

(istany the ergancatons | compensation

hour or |; ergantaton | warraaowasc’ | ~ tom te

rebated [| | warososaiscr |" 10s6nec) | organization

feraoricavon| eke “029NEC) and lated

baal 2 esl e ‘organizations:

tee) ele

“We Subtotal U[e,ii5.

Total rom continuation sheets to Pert Vi, Section A > os o-

4 Total (ad ines th and 1c) > O.[8,i15.

2 Total numberof india (nckxng bu ot bred to hase sted above) who recahed mor then $100,000 oeponabie,

compencatn trom the organization p> 9

Te.

30d he organization ss any former oficer, decor, tte, Key employee or highest compensated employon on

ne 12? I "Yes," compete Schedule Jforsuch indica... o| Ix

4 Forany individual sted one 1, the sum of reportable competi and ater compensation fom he organization

and elated organizations greater than $160,0007 "Ys," complete Schedule. for such incu «| |x

55 Did any person tstedon ne 1 receive or accrue compensation rom any urate organization rnd for srvices

tothe organization "Yes," complete Schedule Jer sych person s| |x

SeationB. ndependent Contractors

7 Complete Wis able for you five highest compenssied independent conralas that eoeved more than $100,00 of compensation fom

{he ganization. Report compensation or the exons yer ending vith o wi the organization's tx ea

® a) @

Name and business adsress___ NONE, Desdhpton of services Compensaton

oy

2 Total umber ofndependent conractore(nduding Buk nt lied to hase tod abov) who oosved ore than

_$100,000 of compensation rom the rganizaton D> 0

T Form 890 02

9

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

Foun $99 (2021) DISINFORMATION INDEX INC. 85-2450338 raged

(Part Vii'| Statement of Revenue

‘Check Schedule 0 contains a response oF noe to any ne inthis Part Vi i

~ Tay ey co w)

otarevenue [Related rexempt| unrelated | Raven ocd

function revenue fousiness revenue. {mx unde

event cgctone 812-514

Federated campaigns fa

Membership dues 19

Fundraising events he

Related organizations id

Government grants (contbutions) [He

‘Nother contbutons, its, pans, and

smilaramountsnatincudadatow . [w| 570,000.

Nena contre revded mines [gh

Total. Add ines 1att B|_570,000.|

Business Cows

RESEARCH LICENSING REV [519100 | 553, 089.|" 553, 089.

yam Service

Pot

‘ivotner program servos revenue

“Total Add ines 20.21 p | 553,089.

‘3 Investment income (ncuding dividends, interest, and

‘other sinar amounts) >

4 Income trom iwestment of taxcexempt bong proceeds De

5 Royalties >

heat [Personal

62 Gross ents

Less:rentalexpenses [6b

© Rentalincome or toss) [ee

1. Not rantalncome or (os)

7a Gross amount rom ss of

asses oar than nvotory [7a

Less: castor thar bass

and sales epenses 20]

© Gain or oss) ire

Nt gain o (oss) >

{8 a. Gross come tom fundraing events (not

Including $ of

contributions reported an ine Te) See

Party, tne 18| 2a]

b Less: drect expenses [so

Net income or (ios) fom fundraising events _ e

9 a. Gross income trom gaming actives. See ;

Part, ine 19 svn |

b Less: direct expenses 0b \

‘© Net income or oss) from gaming actives >

10 a Gross sales of inventory, les rtums a

ou

= >

jSecurties | wOwner

other Revenue

and aowances

Less: cost of good sid i

.¢_Net income or oss) from sales of Inventory > 4,

caness Goon

"

Migeollaneous

Revenue

‘iter revere

Total. Add ines 113-114 >

Total revenue. Soe nstcions > 125, 08y.| 553,085 T.

[ao eames Farm B80 021)

10

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684 _01

»

4

Form 990 2021) DISINFORMATION INDEX INC. 85-2450338 page 10

irt IX | Statement of Functional Expenses

re

‘Cheok if Schedule O contains a response or note to any line Pa = cf LJ

aa cee

Fei onaronenee rato | rogaiieoee | vomertinne | eons

apcrean perio aici

2 Senatineaenement

« Cosecpartertrienods

¢. Sartannoteneruos an

‘trustees, and key employees. 59,646. 41,752.) 17,894.

sonata occ nee

‘persons described in section 4958(c\3)(B)

7 Other salaries and wages 187, 968.

section 401) and 400() employer contributions) 16, 226.

9 Otheremployee benefits 18,353.

Peapaatrins i

1 een eaainad

vue

Legal 7 37,298. : .

pectin See: Se

Soe

Peco tuapesine

‘column (A), amount, st ne 119 expenses on Sch 0) 6,000. 6,000.|

1 meembyiapencen

44 Information technology. : 5,629.

toe a

Ppsonials

tse

& rmasteeacincnees

Srovnscicas oloainoa soa

Denn pecans

ea

Bateonsines

23° Insurance " TH, 560] 1,838. IZ, 722

‘24 Other expenses emi expenses nat covered T

above (List mscolarenus expenses on ie 240

line 24 amount axcoods 10% of ine 25, clu (),

rout, kt ne 24e expanses on Schedule O}

REVIEWS 24,315, 24,315,

PILOT CosTs 7,574. T, 574

EDUCATION

BANK FEE 280. 280

‘Alotner expense

Tota tnctona epeses.AaaToes Tivougiéas | 408, S27-| 318,138] T0585

eit at, Compe sine cyte pana

teprte inclu (it ots rom aconbiad

ecucaonal campaign nda sfeaton

Coenen Let sor 26085700

eae want For 980;2021)

11

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

BB soce

Form 990 (2024) DISINFORMATION INDEX INC. 85-2450338 page 11

[artic {Balance Shest a

Check t Schedule O contains «response ornate any ne m tis Part TC

@ @

Beginneg of yoar End of year

7 Cash-ronnterest bearing 19S, BIT 377,617.

2 Savings and temporary cash investments. Ife io.

‘3. Pledges and grants recewabie, net 3

4 Accounts receivabo, not 4 248,889.

'5 Loans and other receivables trom any cuenta former oto, dct,

trustee, key empoyee, creator or founder, substan contbutor, oF 35%

controled entity or famiy member of any ofthese persons 5

{6 Loans and other receivables from other disqualified persons as defined

Lunde section 4958\0(1), ana persons described in section 425 (¥8) 6

g | 7 Notes and ioans receivable, net 7

| © trveorestorsaleor se 8

9 Prepaid expenses and detered charges °

40a. Land, buildings, and equipment: cost or oer

basis, Complete Pat Vi of Schedule D 108

Less: accumulated depreciation 100, 100

11 investments public traded secuities i

12 Investments ther secure. Seo Part, ine 11 12

43 investments programreated. Se Part V, tne 14 13

14 Intangiie assets, ts 4

15 Other assets, See Part ine 1 — “59,980. 15| 395,593.

| 16 Tota assots, Ac ns 1 though 15 (mist equine 33) TB8T.[e | 1,022,109.

17 Accounts payable and accrued expenses, 7 aT, TIT.

18 Grants payabie 78

19 Defored revenue 30

20. Taxexempt bond kaos oon 20

21° Escrow orcustoial account tabi. Complete Part Wot Schedule 21

g |22 Loan and ther payabs to any current or former oicer, rector,

© | cust, key employee, creator or founder, substantial contuter, oF 59%

| controled entty or amy member of any of nese persons 2

3 |.23 secured mertgages and notes payable to unelated third partes 2

224 Unsecured noes and loans payable to unrelated thir parties 24

25. Other abies (nctusing federal income tax, payables o related thi

pares, and other labios not neluded on ines 17:2). Complete Pat X

ot Schedule D 57. 25

26 Total tabllties. Add lines 17 through 25 37 -[ 26

Organizations that follow FASB ASC 958, check here Be UXT

$ | andcompete tines 27, 28,32, and 33.

8 |2r Notassets witout donor retictions . 259,830.| a 974,392.

& | 26 ot assots with donor rstetions 28

B | organizations that donot tlw FASB ASC 958, check here’ be] ;

| __anc-complete tines 29 through 33. g

2 [22 Capital stock or rust principal, or current funds \ 2

[22 Paenorcantatsupus, ra tun, ime ie 20

31 Retained earings, endowment. accumulated income, orother funds 3

Z | 32 totainet assets or und balances 259, 830. a2 974,392.

33_Tolaliabilses and net assot/und balances 259, 887.| 9 | 1,022,109.

¥, Fo 990 e221)

12

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

Form 990 (2001) DISINFORMATION INDEX INC. 85-2450338 page 12

art XI] Reconciliation of Net Assets

(Chock it Schedule © contains a response oF note to any ine in this Part XL Oo

1 Total revenue (must equal Part Vill, column (A) tine 12), 1 1,123,089.

2 Total expenses (must equal Pat IX, column (A), ine 25) 2 408,527.

3. Revenue less expenses. Subtract ine 2 rom line 1 3 14,562.

4 Not assets or fund balances at beginning of year (must equal Pat X line 32, column (A) 4 59,830.

5 Net unrealized gains Qosses) on Investments, 5

6 Donated services and use of facies 6

7 Investment expenses 7

8 Prior period adjustments 8

8 Other changes in net assets or fund balances (explain on Schedule O) 2 0

10 Net assets or fund balances at end of year. Combine ines 3 through 9 (must equal Part X, line 32,

column (3) 10 974,392.

Part Xill Financial Statements and Reporting

Check it Schedule O contains a response or note to any ine inthis Part Xt ml

Yes | No

1. Accounting method used to prepare the Form 980: [—]casn [3] Accrual 1) other

It the organization changed its method of accounting from a prior year or checked "Other," explain on Schedule O.

2a Were the organization's financial statements compiled or reviewed by an independent accountant? 2a x

IF "Yes," check a box below to incicate whether the financial statements for the year were compiled or reviewed on @

separate basis, consoldated basis, or bath: _

[1 separate basis [1 consoiiated basis” [_] Both consolidated and separate basis

1b Wore the organization's nancial statements audited by an independent accountant?” 2b x

It *Yes," check a box below to indicate whether the financial statements forthe year were audited on a separate basi,

‘consolidated basis, orboth:

(separate basis [—] consolidated basis] Both consolidated and separate basis

‘© If *Yes! to line 2a oF 2b, does the organization have a committee that assumes responsibilty for oversight ofthe aucHt,

‘review, or compilation of ts financial statements and selection of an independent accountant? sone [20

Ifthe organvation changed elther ts oversight process or selection process during the tax year, explain on Schedule O.

‘8a As a result ofa federal award, was the organization required to undergo an aut or aus as set forth in the Single Audit

‘Act and OMB Gircular A133? . = 32 x

b If"Yes,* did the organization undergo the required auch or auds? If the organization dié not undergo the required aud

‘or audits, explain why on Schedule O and describe any steps taken to undergo such audits 3b

Forn 980 (2029)

»,

\

13

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684 _01

fmee Public Charity Status and Public Support sare sens,

Complete Whe orgatzation ea section 501cX9) organization ora section | 2021

4947(a\1) nonexempt charitable trust.

emettneraney Aitach to Form 990 or Form 990-£2. ‘Open to Pubic

ineraltoere tre Goto wnwire.gowFormeod or insvuctions and the latest information. Inspection

Tame of the organiation Employer Identification number

DISINFORMATION INDEX INC. 85-2450338

[PaRT [Reason Tor Public Charly Status. ct rganzatons moat Compa Ts pak] Se FETUETONS

‘Tre opiate not pate foundation because Wes: For les 1 Trough 1, check aly oe box)

1 Lol Actureh, convention of churches, or association of churches desctbed section 170K KAM

2 J Acne! descr in atction TOOK HANI. tach Senecio € orm S00)

2 [J Anoeptal ora cooperative hospital sevice oranzaton desorbed in setion 17 KHAKI.

4 [J Americal research xgantaton operated nconincton tha hosp! escbedin section 171 KAY Ener ne spt’ name,

cy, ad tate:

5 [1] Anorganization operated for the benefit of a college or university owned or operated by a governmental unit described in

section TOK NARI. (Corplte Pa I)

© (1 Atedera stat, ole goverment or governmentalunt desctiedn socton Y7ORASYAK

7 [I morganzaton ht nomaly receives a eubetantl par fs suppor oma goversmntal unt orm the genes pube desorbed h

section {TOBKINAK (Comite Pat I}

#1 Acommunty tut descibed in section 7OXKAKW, (Compete Pat)

9 [J Anagrcutural serch orparzation described n section TOK HAN) operated h conunction wth land grant cologe

cr ueraty ora n-and gan cole of aout oe Instructions). Entre aie, ly, and sat ote colege

10 [El an crgeniton tet noma eves () mos tan 68/89 fs Sippont fom ConibiRGns, RombuTSip Tos, and ios oa om

actives lated tos exempt unto, subject to cata exception: nd (2) no mar than 3 /3% ots supp fom goss mvestent

income and ulated bushes table income Jess section 1 ay tom businesses aoqured bythe oanzalon ate une 9, 1875.

See section Sok (Campa Pat i)

11 (51 Avcrganzaton ererized and operated excuse to test for publi aly. ee section 0

12 J Anaspantaton organized and operated excusvl forthe Benet of operate nctone oot cay out the purposes of one of

rere pub euppoted organza desorbed in econ SOA) or ection Sa See section 00K). heck the box on

Ines 20 through 1 tat describes the ype of supporting xganaton and caplet nes 20, 2, and 12a

2 1 Typel-A sunporing organization operaed, supervised, or conta by ts supped ganization), yay by avng

the supprted organization the power toreqary apport reat a majorty of the rectors or trusts ofthe supporting

orcaizaton. You must complete Part v, Sections And 8

Type sipporing organization supensed or contol in coonecton wih ks supported organizations by having

contol or management ofthe supporting orpntaten vested the sare persons that contol or manage tho supported

crganzatons). You must complete Pat V, Sections A and C.

© (21 Typet unctonalntegretd. A suporing egaiatin operated hcomnecon vt, and unctonaly tegrated wth,

te supported organization (seston). You must complete Part, Sections A, D, and E.

[1 Type non-unctionaliy integrated. A supporting organization operated in connection with its supported organization(s)

thats not inetoralyntopatad Te organization goeraly mut etsy a detiouton requirement and an etenvenes

requirement (268 nstuctons).You must complete Pat IV, Sections A and, and art V.

© 5 check ns box te organization recewed a ten determination fom the IFS thats a Type Type Type

‘unctoeay tegrated or Type tt nen unctonayIiepated supporting oration,

Enter he ruber of supported organizations . Cc

Provide the folowing formation about the supported organizaton(

Tame of upparted WEN | Gi typo of ecennzaton [UTES Aran otanatay | WI AnO OTe

orinuatin {Geoered on tines 110 Yea [No [22 oo aructons | suppor foo abuts)

shove ss nections

Totat n

[LHA For Paperwork Reduction Act Notice, eee the Instructions for Form O00 or 9G0-EZ, reszy ova0z2 "Schedule A (Form 090) 2021

Schedule (Form 260) 2024 DISINFORMATION INDEX INC. 85-2450338 pager

Part il] Support Schedule Tor Organizations Described in Sections T7OBNTVANIW] and T7OTNTAT

(Complete ony ityou checked the box on ine 5, 7, or 8 of Part | ori the organization fate to qualty under Par Il he organization

fais to quay under the tests sted below, pease compat Pat I)

Section A. Public Support

‘alenaaryar oral yearbepinning wD] —(eyz017 | pane | tore | cayaaeo [year Wioa

4 Git, grants, contbutns, and

membership fees received. Oo not

Include any “unusual grants)

2. Taxrevenuestviod forthe organ

italion’s benef and ether paid

or expended on ts behat

3 The valve of services or facies

‘umished by a governmental unit to

the erganzation without charge

4 Total. Ags ines 1 trough 3

55 The potion of total contributions

by each person (ther than a

‘governmental unt or pubsey

supported organization) inctded

on ine 1 that exceeds 2% of the

amount shown on ine 11,

column ()

6 Public support Sinednn sam ink 7

‘ection B. Total Support

aryear(orfacalyearbesinaoT Be] (@)2017_ [207s | tej2oie [iayaneoT1ey2028 Teal

7 Amounts trom ine 4

8 Gross income from nares,

vider, payments received on

‘seouties loans, ets, yates,

snd income rom smiar sources

9 ‘Netincome rom unelated business

actites, whether or not the

Dusiess regularly cared on

40 Other income. Do nat include gain

orlos rom te ale of captl

assets ©xpan h Pat Vi)

41 Total suppoct. i ines 7 tcugh 70 =|

42 Gross recep from elated activites, ee (eee nsrucTons) 2

1 First Syears. ithe Form 990 is for the organcation's rst second, thir, fourth, o fih tax year asa section 601163)

‘organization, check this box and stop here . al

Bestion C. Computation of Public Support Percentage

“W#Publc suppor percentage for 2021 ine 8, cour (9, cived by tne 1, cou : 7 %

45. Pubcsuppor percentage trom 2020 Scheoule A, Parl, ne 14 : 15 %

16039 73% support test - 202. the organzation id rat check the Box on in 1S, and ne 14:9 15% or mre check he box and

‘stop her. Te organization qualiies a a publi supported organization OO

30 179% support test - 2020 he organization a not check a box on line 19 or 1a, and hw 15 f 33 1/0% or more, check his box

‘and stop here. The organization qualifies as @ pubicly supported organization oO

{7a 196 tects and-dreumstances est 2021. th ofutaton di pt ches boxe 1a or 16, ain a a rae,

and the ergenzaon mets the facsendchourtaces et, tack ns box and top er. Epan hPa how he oganzaton

meets the facts-and-circumstances test. The organization quaifies as a publicly supported organization pi

'b 10% -facts-and-ciroumstances test - 2020. If the organization did not check a box on line 13, 16aMBb, or 17a, and live 15 is 10% oF

mr and orprieaton meets lctandckoumsanees est cack hs bor and stop ere. pin Pa Rete _

‘organization meets the tacts-and-circumstances test. The organization qualifies as @ publicty supported organization >)

1. Prat foundation, to oan not ceca on ne 19, 65,16, 17017, chek ts hoxand wo ninians p>]

en

15

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

‘Schedule A Form 960) 2021 DISINFORMATION INDEX INC. 85-2450338 pages.

jchedule Tor Organizations Described in Section SUS(a)2)

(Complete ony you checked the box on ine 10 of Pat orf te oxganization fed to qualify under Par Il the organization fails to

qualty under the tests Histed below, please complete Patt)

Section A. Public Support

Calendar yar (or seal year begining i) >] (2) 2077 wa (e209 (2020 (202i Wie

1 its, grants, contributions, and

‘membership fo9s received. (Do not

Include any "unusual grants) 345, 000.| 570,000] 915,000.

2. Gross receipts from admissions,

‘merchandise sod or services per

formed, or facies fumed

tnpanzaten'staxoxonpt puree 553, 089.| 553,089.

3 Gross receipts trom activities that

are not an unrelated trade oF bus:

inees under seation 513,

4 Tax revenues levied forthe organ

laaton's bene and ether paid to

‘or expended on its behalt

5 Te value of serioes or facies

‘umished by govemmental unit to

the oganzaton wahout charge

© Total Ad Ines 1 though 5 TES VOU| a as vos] ae wes

7a Amounts ncided on ines 1,2 and 5

‘3 received from disqualified persons: oO.

barman nt on 200 9 ed

iodine game a te

fener ine 3 ar 405,886.| 405,886.

(© Add lines 7a and 7b “ 405,886.

062,203,

Punk sumor ina i

Section fotal Support

Calendar year oalyor Begining >| _ (2017 | —@yeo1e | —ta)z019 | —raaom | (e)200% ‘ie

@. Amounts rom ine 6 stS Goo oes] at os

40a Gross income rom nies,

Shiders, payments receved on

Souris lana ret, royates,

Sd nome rom sre sources

b Une business xb neome

(less section 511 taxes) from businesses.

queda une 9,175

‘Add nes 10a and 100

41° Netincome rom unread biness

activities not included on tne 10b,

‘nether or not the business ia

regulary carried on

42 Otherincome. Do not iicide gait

Or oss from the sae of capital

assets (Blan n Part Vi) $a5-00T

49 Total suppor astra, 1m 1 a 12) Tins, 005] 1/400, 005.

14 First S years. the Form 900 ls forthe oqganiations fre, second, third, tout, Or fh tax year as a sotion 501/218) organizaton,

check this box and stop here.

Section C. Computation of Public Support Percentage

"18 Publ support percentage for 2021 (ine 8, column (f, dvded by ine 18, column () 6

18_Pubic support percentage from 2020 Schedule A, Part, ine 15, 6

Section D. Computation of Investment Income Percentage x

"7_Investment Income percentage fr 2021 (ine 10e, column (divided by Eve 13, cokurin () 7 %

48. Investment income percentage trom 2020 Schedule A, Pat Il ne 17 2 %

192.98 1/0% support tests - 2021. the organization dd et check the boon ine 4, and ne ¥5'8 more an 3896, and Ine 17 enol

tee than 3 1, check is box andstop here. The onenzalon quails as a puble supported aricaion a)

1)39 79% suppert test - 202. he organization di ot checka box en ie 14 ore 10 and ie ele more han 3, and

tne 18 snot more than 88 1%, check he box andetop here. The rgnzaton ques a a publety sipporecrganzaton ..... Be]

20_Prlat foundation te canzaton dint hack a hoxan ie 4 8,1, chock his xan se Wsnicions eo

‘soca ovonea ‘Schedule A (Farm 080) 2024

16

09460216 758560 27684.000 2021-05050 DISINFORMATION INDEX INC. 27684_01

Schedule A Form 990) 2021 DISINFORMATION INDEX INC. 85-2450338 pages

[Part IV] Supporting Organizations

(Compete ony it you checked a box in ine 12 on Part | I you checked box 12a, Pat |, complete Sections A

_and BI you checked box 12b, Part}, complete Sections A and G.I you checked box 12, Pat |, complete

‘Sections A, D,and E. I you checked box. 124, Par |, complete Sections A and D, and complete Part V)

Section A. All Supporting Organizations,

Yes | No.

1 Arealof the organzation’s supported organizations Isted by name inthe organization's governing

documents? I "No,* descrbe in Part VI ow the supported organizations are designated. If designated by

lass or purpose, describe tne designation If historic and continuing relationship, explain 1

2 Did the organization have any supported organization that does not have an IRS determination of status

under section $09(a(1) or (2)? IF "Yes," explain in Part VI now the organization determined that the supported

‘organization was described in section 509() oF (2 2

320d the organization have a suppertes organization described In section 501(c),(6), 0 (67? "Yes," answer

tines 3b and 2¢ below. 2

'b id the organization confirm that each supported organization qualified under section 5014, (5), or (6) and

satisfied the public suppor tests under section 509)? If Yes," describe in Part VI vnen and how the

‘exganization made the determination 2

{© Di the organization ensure that al support to such organizations was used exchuswely fr section 1701¢X2NB)

purposes? If "Yes," exp n Part VI what controls the organization put place fo ensure such use 2

‘4a. Was any supported organization not organized inthe United States (Yoregn supported organization’? If

Yes," and if you checked box 128 or 12b in Part |, answer lines 4b and 4c below. 4a

'b 0c the organization have uimate contro and discretion in deciding whether to make grants to the foreign

supported organization? If "Yes," describe n Part Vow the organization had such contol and ascretion

‘spite being controled o supervised by or in connocton with its supported organization. 4

«© 0d the organtzation support any foreign supported organization that does not have an IRS determination

Under sections 501(6(3) and 508%a)) or (27? IF "Yes," explain in Part VI what controls the organization used

taensure tht al support to the foreign supported organization was used exclisivly for section 170) 2NB)

purposes. ae

‘5a_ Did the organization add, substtute, or remove any supported organizations during the tax year? if "Yes,"

answer ines 5 and Sc Below (i applicable). Also, provide deta in Part VI including () he names and EIN

rumbers ofthe supported organizations added, substituted, ar removed) the reasons fr each such action;

(9 the authonty under the organization's organizing document authoring such action; and (v) ow the action

was accompished (such as by amendment fo the organting document) 50

Type |or Type only. Was any adied or substituted supported organization part ofa class already

esignated inthe organization's organizing document?

{© Substitutions only. Vas the substitution the resuit ofan event beyond the erganizaion’s contro”?

{6 Dic the organization provide support (whether in the form of grants or the provision of services or facies} to

anyone other than (its supported oxganizations, (individuals that are par ofthe chantable class

benefited by one or more ofits supported organizations, oi) other supporting organizations that aso

support or Benet ne or more of the fing organization's suppored organizations? If "es," provide deta in

Part Vt : 6

7 Dic the organization provide a grant, loan, compensation, or other smiar payment toa substantial contributor

(as define in section 4858(c)(8NC), a famy member ofa substantial contributor, ora 35% controlled entity with

regard to a substantial contributor? ites," complete Part lof Schedule L (Form 990). rm

{2 Did the organization make a loan to a dlaquaifed person (as defined in section 4958) not descibed an Ene 7?

18 "Ves," complete Part of Schedule L (Form 980). v 8

‘83. Was te organization controled drectly or indirect at any time dung the tax year by one of more

lisqualfied persons, a detined in section 4946 (other than foundation managers and organvations described

in section 509(aK) or (2)? "Yes, provide dota in Part VL 92

1b 01d one oF more cisqualfied persona (as deffed online 9) hold a controling interet in any entity fh which

‘tne supporting erganization hal an interest? Yes," prove deta Part VI. i

© Dida disqusified person (as defined on line Ga) have an ownership interest, or derive any personal Benefit

‘rom, asets in which the supporting organization aso had an intrest? "Yes, "provide deal in Part Wi 9

10a. Was the organization subject to the excess business holaings rues of section 4943 because of section |

4949(9 garding certain Type Il supporting organtations, and al Type li non functionally integrated

‘supporting organizations)? I "Yes," answer ne 10b below. 00

'b Did the organization have any excess business holdings in the tax year? (Use Schedule C, Farm 4720, to

termine whether ne exganizaton had excess business holings) \ 400

‘Schedule A (Form 880) 2021

ee

17

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

wl A (Fam 990) 2021 DISINFORMATION INDEX INC. 85-2450338 pages

Part IV] Supporting Organtzations continued)

Yes] No

111 Has the organization accepted agit or contribution from any of the folowing persons?

2A person who drectly or indirectly controls, ether alone or together with persons described on lines 11b and

‘Vc below, the governing body ofa supported organization? ta

»b Atamiy member of a person describes on ne 11a above? 1

{© A.35% controled entity ofa person described on tne 11a or11b above?M "Yes" one 17a, 110, oF 11e, provide

deta in Parti. t10

Section B. Type | Supporting Organizations

Yes[ No.

1 Didthe governing body, mamber ofthe governing boy, ofers acting inthe ofc capac, or membership of one or

more supported organizatons have the power to reguary appa or eect at least amajorty ofthe organization's oftcer,

‘roctor or rusts at al tes ding the tax yea"? "NO," casero Part Vow te supported organo)

ttt operted, persed, or contosed to organization’ acts. the organza had ore than one supported

trgantzation,descrbe how the powers to appoint andlor remove offer directors, or ustees were alocated among the

Supported oganzatons and wha condons or resclon, Hany, applet such powers during Ue x ea 1

2 Did the organization operate forthe benef of any supported organization other than the supported

xganication() that operated, supersed, or contd the supporting organtation? "Yes," explan in

Part Vi now providing such benef cared out he purposes of the supported organizations) that operated

suparied. or controled the support exganzato.. 2

‘Section C. Type ll Supporting Organizations

1 Were a majo of the oqganzation's directors or trustees during the tx year also a marty ofthe rectors

or trustees of exch ofthe organization's supported organizations}? I "No," describe in Part Wow contro

‘ormenagerent ofthe supporting organization wes vested inthe same persons that conteed or managed

the supported erganization(s 4

Section D. All Type Ill Supporting Organizations

Yes] No.

1 Did the exganzation provide to each ofits supported organizations, by the last day of the fith month ofthe

‘organization's tax year, () wien notice describing the type and amount of support proved during the prio tax

year, (1a copy of the Form 990 that was most recently fled as ofthe date of notation, an (a) copies ofthe

‘organization's goveming documents in etecton the date of ntication, tothe extent not previously provided” 4

2. Wiere any of the organization's officers, directors, or trustees ether () appointed or elected by the supported

‘xganization(s) oi) serving on the governing body ofa supported organization? If*No, "explain Part VI how

{ne organization maintained a close and continuous working relationship withthe supported erganizaton(). 2

‘3. By reason ofthe relatonship described on tine 2, ahove, ci the organization's supported organizations have a

‘Significant voice inthe organization's investment policies and in directing the use of the organization's

income or assets at altimes during the tax year? I "Yes," describe in Part VI the role the organization's

unpaid apenas payed te z

Section E: Type Il Functionally Intograted Supporting Organizations

Ghali tron He mtd te Setin td a e eg FO Ta Gai Wo ao DEFT

aCe he gincao setae Aces Tet np he Pw

> Cline ouonzaton te pert of eet ef supped eenenee- Cont tné 3 bab

¢ Cine onmantonsuppote gore ty, Seber Par ho jas sepponede govronanta ety ue RVC

2 scutes Test Arower Ines and blo. ° ves] Re

Did eubtry ao oe ernetor cing ng the year dec fuer the exer pone of

the supponederancatont) wich re craton wea repent? IY" then Prt Waray

those cepertedergentafone snd expan otc ace oly herent arr poss,

tow be operator an tapeate fo Pee copped earn ad ete oration datemicd

tht te son tha att ce A

b Dale etn cecrbadon re 2, above, coat ace tt bere rere’ iolemert,

nner nr oftarprentoe’suatas otras wou hae bom ongogea tte yp

So pamiceeeetl Rcsyenng peste BatRonpeler ogpamil ralmuce mal ch

thts ects ut rhe creas mncheent.

2. Puente Supported Orgran, Anewe nes Se and blow,

‘2. Did the organization have the power to regularly appoint or elect a majority of the officers, directors, or *

‘nustees of each ofthe supported organizations? I "Yes" or "No" provide tals n Part WI 3a

'b Did the organization exercise a substantial dogree of direction over the policies, programs, and activities of each

tits supported organizations? I Ves," describe in Part Vi the role played by the ganization inthis regard o>

‘Game ores ‘Seheduie A (Form 90) 2001

18

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

A fom can ar) DISINFORMATION INDEX_INC. 85-2450338 pases

‘ype Ill Non-Functionallly integrated 509(a)(@) Supporting Organizations

7 [Theckcnere te organization salsed the integral Pat Test asa qualifying tust on Nov. 20, 1970 @xplan Park VI. See structions.

AlLother Type i nonfunctional integrated supporting organizations must complete Sections A through E.

Section A Adjusted Net Income (A Poe Yes

TH Gurvent ear

(eptionad

‘Not shor tm capital gain

Recoveries of por year disuibuions

‘Other gross ncome (se8 instructions)

‘Ada ines 1 through.

oprociation and depletion

Portion of operating expenses pald or now Tor production Or

colection of gross income or for management, conservation, or

‘maintenance of property held for preducton of income (se instructions)

7_Other expenses (see instruction

Adjusted Net Income (subtract ines 5,6, 20d 7 om ine 4) a

Section B - Minimum Asset Amount Ee Boren yee

7) Aagregate far market value of al non exemptuse assole (se

instnsctions for shot tax year or assets hed for part of yea)

"a_Average monty value of secures 72

ib Average monthly eash balances tb

{6 Fair market valve of other non enompt use aS8e15| te

‘

Total (add nes ta, 1b, and te) = rn

Discount clamod fr blockage or other factors

{explain in detain Part vo:

2 Acquistion indebtedness appicable to non exomptuse assets

‘3 Subtiact ne 2 from ine 1.

“4 Cash deemed hel fr exempt use Enter 0.015 ofna 3 fr greater amount,

520 inetrvetions).

_Net value of non-xemptuse assets subtract ine 4 rom ine 3)

(6 Mutipy ines by 0.036.

77 Recoveries of proryear distributions

Minimum Asset Amount (94 ine 7 10 0

Section ¢ - Distributable Amount Curent Year

‘Adjusted net ncome for prior year (rom Section A ine B, column A)

Enter 0.85 of ine 1

‘Minimum asset amount fr por year (rom Section B, ne 6, column.

Entor greater of ine? or eS.

Income tx imooved in prior year

Distributable Amount. Subtract le 5 Wom ine 4, unloss subject

emergency temporary reduction (2@ instructions) 6

7 L_J Check nee ifthe curent years the organization’ frat as anon functionally tegrated Type I supporing organization (ee

instctions

° ‘Schedule A (Form 990) 202%

19

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

ule A (Form 990) 2001 DISINFORMATION INDEX INC.

85-2450338 page?

Part V | Type ill Non-Functionally Integrated 509(a)(3) Supporting Organizations continuo

Section D - Distributions

‘Current Your

'1_ Amounts paid to supported exgarizaions to accompish exempt purposes

7

‘2 Amounts paid to perform activity that directly furthers exempt purposes of supported

‘organizations, n excess of income rom acti

‘Administrative expanses pald to accomplish exempt purposes of supported organizations

‘Araunts paid to acquire exempt use ass0t5,

‘ther distbutions (describe hy Part VD. See instructions.

“otal annual distributions. Add nes 1 through 6.

a

4

‘5 Qualifiod set aside amounts (prior IRS approval required - provide details n Part Vi

6

7

8

Distributions to attentive supported organizations to which the organization is responsive

(provide dealt in Part VI. See instructions.

‘2 Distibutable amount for 2021 from Section G, tne 6

70 Line 6 amount aiviged by ne 9 amount

0

‘Section E- Distribution Allocations (se instructions) Excess Distributions

oO

Undercistributions

Pre-2024,

1)

Distributable

‘Ammount for 2024

11_Distibutable amount for 2021 from Section 6, tne 6

‘2 Underdstributions, any, for years prot to 2021 eason-

‘blo cause requited - expla in Part Vb, Seo instructions.

3_Excoss distibutions caryover, fan, to2024

From 2016

From 2017 :

From 2019

From 2020

b

fe From 2018

s

f

“Tota of ines Sa trough Se

‘Anplie to 2021 disibutable amount

‘a Applied to underaistributions of prior years

h

i

‘Carryovor rom 2016 not apple (see instructions)

Remainder, Subtract Ines 9g, 9, and 3ifrom ine Sf

4 Distrbutions for 2021 rom Section D,

foe 7: $

2 Applied to underdistibulions of pear years

1b Applied to 2021 aistrbutabie amount

‘© Remainder. Sublract ines 4a and 4b rom ine &

'5 Remaining underdatioutons for years prior 2021,

any. Subtract nes 3g and a from line 2. For esut greater

than zero, explain Part VI Soe intructions.

Remaining underaistibutins for 2027. Subtract ines 3h

and 4b trom ine 1. For result greater than zero explain in

Part Vi. Sep instructions.

7 Excess elstibutions carryover to 2022. Ada ines 3

and 4c.

‘B_Breaksown otine 7

Excess rom 2017, r

Excess from 2018

‘Bxo09e fom 2020

»

‘e Exoase trom 279

@

‘Exo2ss from 2021

sammy ov0422

20

, ‘Schedule A (Form 880) 2021

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

‘Schedule A (Form 990) 202% DISINFORMATION INDEX INC. 85-2450338 pages

Part VI] Supplemental Information. Provide the explanations required by Part I, ine 10; Part, ine 17a or 170; Part Il, tne 12;

Part N, Section lines 1, 2,30, 30, 40,40, 5,6, 9, 9b, 96, 11a, 11D, and 14: PartlV, Section lings 1 and 2; Par iV, Section O,

line 1: Par IV, Section ines 2 and 3; Part IV; action E, Ines 16, 2a, 2, 3a, and Sb; Part V, tne 1; Part V, Soction 8, ine 16; Part,

‘Section D, ines 6,6, and B; and Part V, Section E, nes 2,8, and 6. Also complete this pat for any addtional information,

(Geeinstrctions}

SCHEDULE A, PART III

THE ORGANIZATION'S INITIAL YEAR 2020 WAS A SHORT TAK YEAR.

“Fame rane ‘Schedule A (Form 690) 2021

21

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

** PUBLIC DISCLOSURE COPY **

Schedule B Schedule of Contributors Ce No 15450047

(Form 990) tact ‘orm 990 or Form .

ouinete can > cote womirsgoFoma0 tr hte! nrmaton 2021

Name ofthe organization ‘Employer Identification number

DISINFORMATION INDEX INC. 85-2450338

‘Grganization type (check one:

Fiters of: Section:

Form 990 or 990-E2, CE) sorte, 3 >) enter number) organization

oer renee chrtale ts not tet a private foundation

ser pot esaiaton

Fom 990° 01649 exam rite ounaton

1 Complete if the organization answered "Yes" on Form 990, 202

partie 8 7,679, 184¥0, 14,190" 14 Se, 1, 20 OF ab

in tte ay Dettach to Form 900. pen to Public

ieee Go to wnwirs govfFormt0 for natructions and the atest information. Inspection

Name ofthe organization Employer identication numbor

DISINFORMATION INDEX INC. 85-2450338

[Pan] Organizations Maintaining Donor Advised Funds or Other Similar Funds oF Accounts. compitet tne

rcuatonansnered "os" on fom 980 Par. tne

Ta) Donoracvised nds (Hy FanGe ana oer acooUTTS

4) Total number at end of year

2 Aggregate valu of centrbntions to (during yea)

3 Agaregate valve of grants from (dung year)

4) Aggregate value at end of year

'5 Did the organization torn all donors and donor advieors in wring thatthe asseta held n donor advised funds

‘are the organization's property, subject to the organization's exclusive legal control? Coves Cine

{6 Did the organcatin inform all grantees, donors, and donor advisors in wring that grant funds can be used only

for chartable purposes and not for the beneft ofthe donor ar don advisor, o for any other purpose contering

impermissible private benefit? Clves [1 no

Parti Conservation Easements, Conpit ihe aration answered Vos" on For 666, Pat We 7

‘PurBosel@ of conservation easements held by the organization (chook al that

resonator pubis for exams, eceatonorecucaton)L-] Pesenation ota hstorcalyimpoant nd aes

Jrrcecton ovata habia Clrveseratn ota cerned nore stctire

Presenaton of open space

2 Complete nes 2 hrugn 2d he organza eta qld consent contin he fom of cannon semen nthe ast

ay of te tx yar Tall ae nd fe Tax Yor

“Tota raner of conearatonssements ze

b Total acreage ested by concretion esas A

©. Nunbe of conservation easements on acer Histo ircture waded (a 2

€: ember of consent easements cid ne aequed ater 7/2599, and noon asta ste

feted nthe atonal Reiser : 2a

{8 Number consetlon easerans mode arson, ested, eigused oem he oganzaton Gung ox

yeu

4 Number af iat wher proper auto consenaton easement ilosted

5 Does ie orancsten nave unten plc eardng the perade monkong,hepisTon, handing ot

ttn and enecement of te conser eset? ve Cine

6 Stat and vonteerhours devoted Yo moang. spel, hang oli nd encrcigcarsotion esas dug te year

>

1 Anant expanse in moritn, inspecting, handing of vations, and efrcng corset easerents dung the yar

mS

‘Does anc const easement reported on ine 20) above sty the requements of section 170619

and scien 709A? Cive Cine

© InPar dese howe onnzaton repr cansvaon easements ns even and expanse satan and

balance shee, andincie,tapplcabe, he et ofthe oonce to the xgrzatn' dnl aterens that desrbes the

ceria’ ccuring x conaeatneaserer,

Part lil] Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets.

Compete fhe rpaation sword Yoo on Form 90, Prt. ne 8 r

7a ie organization elected, as pemfed under FASB ASG 858, oo to roport na Voverlatoron and balance dal wats

cfr, trl tenures oor snr easel for pubke esto, eatin, evan uherance of ube

service provide in Pat tet of the foot ots ancl tatemens thal doscbes these fos.

b feneoranaton sete, ae peed under FASB ASC 58 torepon nis revenue statement anablace sheet works of

ar, stra Years, or ce ensreaets hel for ube extn, education, eeu uherance pubis soe,

prove efolowng amount ring to these tee a

(7, Revenve cluded on Form 880, Pat Ine 1 te BS

Gi) Asvts ced in Form 60, Pat Ps

2. tine ranetonreceved ord works Gat ital esis or chasm assets or tancalgan, provide

the following amounts required to be reported under FASB ASC 958 relating to these items: 4

a: evr ntdedon Form 90, Par a1 bs

Acts induced in For 90, Par bs

THA Fer Paperwork Reduction Act Notice, eee tensions for Form 90. {Saheb rm 390) 2021

26

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684_01

Scnedue 0 Form e0)2001__DISINFORMATION INDEX_INC. 85-2450338 page?

[Part il | Organizations Maintaining Collections of Ar, Historical Treasures, oF Other Similar Assets(coninved)

‘Using the exgarization’s aquisition, accession, and othe recods, check any ofthe folowing that wake sigicant use ofits

Collection tems (check all that apply): 7

a J Pubic estitstion (7) Loan or exchange program

» CT schotarty research © Clomer

J preseration or ture generations

4 Provide a descrnton of te orgnzatin'scolectons and expan how they futher te organization's exempt purpose in Part.

5 Ourng the year ca the organization sole or receive donations of at tora treasures, or ther sar assets

Ta Tse rgarzaon an ape tsb, costco rer lorie con ions of a ait atcha

fnFom®00, Punk? i ; lve Cline

"Yeo" expla hearer in Pal and cot eon abl:

te

1

1e

tf

© Begining balance

4. Addtons during the year

Distributions during the year

Ending balance

2a. Did the organtation include an amount on Fon 890, Part X, ine 21, for escrow or custodial account habit?

_It"¥es," explain he arrangement in Part Xl_Check here ifthe explanation has been provided on Part Xl 5

Part V_[ Endowment Funds. Complete the organization answered "Yes" on Form 990, Part 1, ne 10.

{ay Garren year [ (0) Prior year — | (o) "Wo years DaGt [(ay Toa yeas DAE | (o our oars Back

No.

‘2 Beginning of year balance

Contributions

»

Net investment earings, gains, and iossos

‘

Gantsorscolasips

er expenare fo ain

sd prosrars

‘moive expenses

End ot yearbatice

2 Provide tn entimatd poreage te canon year endbaanc he To, hina Ra a

2 Boars destratedo unsanownert

© Pomanent endowment

& Termendowmon! Be x

‘ie prcotags of ea, Ban Be eu eva 00%

0. Re re endownent uns ot te posession fhe rpanztin tat are hed and adintered forthe razon

by:

0 Unltd nga

Oi) Related egantzatons

Yes cnn a athe lated ranzatons ised srequied on Sched i?

4 Descrbetn Pa lhe mtended ung of he ogentzaton's endowment as

Part VI |Land, Buildings, and Equipment.

Cte ne orgatizatnareverd "Yes on Form 90, Pare 11, See Form 90 Pat Ine 1.

Descptin of propery (a Gost crater] 8) Gostor er *] ey Aocuruated | —(@Boonva

tasstevesinent_| "base omens |“ dopecaten

Te nd

Bukings

‘© Leasehold improvements

4 Equipment

2 other

eta. Aad ines.

through te. (Column (d) must equal Form 990, Part X, column (B), tne 10c,) > o.

(Form 990) 2021

* 27

09460216 758560 27684.000 2021.05050 DISINFORMATION INDEX INC. 27684 _01

edule D (Fom 990)2021__ DISINFORMATION INDEX INC. 85-2450338 pages

Part Vil| Investments ~ Other Securities.

Complete if the organization answered "Yes" on Form 880, PartV, ne 11b. See Form 980, Part, in 12.

Ta DEST oT Senay O° CATE Potdra arm Town | Tb) Book valve {Gl Method of valuation: Cost or end atyoar Marat vale

(0) Financial derivatives

(2) Closely held equity interests

(@) Other

®

iat equal Farm 690, Pax ot (O)ine 12)

Investments - Program Related.

CCompiete if the organization answered "Yes" on Form 980, Part Vine 1c. See Form $80, Part X tine 13.

{@) Deserption ofinvestment (@)B00k valve {e) Matha of valuation: Cost or endofyear market value

Total. (Go (rust qual Form 660, Par Xoo (eine 1)

Part IX] Other Assets.

Complete ithe organization answered "Yes" on Form $80, Pat WV, ine 11d. Se Form 890, Part X tine 15.

(@)Descripton Ty BOoK vale

@)_DUE_FROM_AN FOUNDATION

Teta, (Column (must equal Form 090, Par X col (jin 15),

Part X ] Other Liabilities. ?

Complete it the organization answered "Yes" on Form 990, Part I, ine 110 or 11f. S90 Form 950, Part X ine 26.

{@) Description of aby ByBooK ae

() Federalncome taxes

Tea, [Solan raat oa Fo 00 Pat al] >

2 Unblly for uncer tax posts n Pa, provide thet of te footnote tow organza racist that apne he

cxgaizatn's ably or unceia x postions under FASB ASC 740, Check re the text fhe oval as bean proved Pa]

‘Schedule O (Form O00) 2021