Professional Documents

Culture Documents

Automobile-Apr03 2023

Automobile-Apr03 2023

Uploaded by

coureOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Automobile-Apr03 2023

Automobile-Apr03 2023

Uploaded by

coureCopyright:

Available Formats

Sector Update

Automobiles

Stellar show

Summary

Sector: Automobile

Led by pre-buying and seasonality, CV and tractor player reported strong growth on m-o-m.

View: Positive M&M outperformed its peers in domestic PV market.

Key surprises: (1) TVSM and MSIL reported 40.5 % and 75.0% increase in export sales on m-o-m basis

and (2) with 31.7% m-o-m growth, HMCL have reported volumes above 5 lakh units.

Coverage universe

Preferred Picks –

CMP

Company Reco PT (Rs) OEMs: Ashok Leyland, M&M, Maruti, TVS Motors and Tata Motors.

(Rs)

Auto Ancillaries: Amar Raja Batteries, Bosch, Greaves Cotton, Lumax Auto Technologies, Schaeffler

Alicon Castalloy India and Gabriel India.

704 BUY 1,159

Limited #

Amara Raja Batteries 587 BUY 696 OEMs clocked strong numbers in March as most players in our coverage reported volumes that

beat our estimates. CV and tractor players were expected to report strong volumes, while TVSM

Apollo Tyres 323 BUY 372 and MSIL have surprised in export volume performance. Further HMCL has reported volumes above

five lakh units after a gap of five months. We believe festive season during last 8-10 days of month,

Ashok Leyland 141 BUY 181 seasonality and pre buying before the implementation of BSVI phase 2 norms from April have

supported the wholesales in March, while retails have been partially impacted due to inauspicious

Bajaj Auto 3,994 BUY 4,151 period in beginning of the month (Holashtak) and unseasonal rains.

CV segment continue to outperform: The CV segments continue to report robust set of numbers,

Balkrishna Industries 1,942 Hold 2,163 given ALL, TML, VECV and M&M reported 28.8%, 28.1%, 63.3% and 6.9% m-o-m growth in volumes

respectively in March. The growth in CV volumes, supported by traction in core industry, partial

Bosch BUY 21,929 return of replacement demand and seasonality. Along with that, the anticipated price hike due to

19,264 implementation of BSVI phase 2 norms from April has drove pre-buying in CV segment.

Eicher Motors 3,002 BUY 3,579 M&M outperformed its peers in domestic PV market: Despite healthy demand as seen in the

robust order book the wholesales uptick in March was relatively at slower pace, given MSIL was

Escorts Kubota 1,872 Positive 2,278 facing production constraint in certain models. MSIL’s production came down by 3.6% m-o-m to

154,148 units in March 2023. Further dealers have been indicating for a slow movement in entry-

Exide Industries $ 180 BUY 215 level products and high waiting period in high end-products. In March, M&M has outperformed

its peers in domestic market. In domestic market while M&M and TML reported 18.6% m-o-m

Gabriel India 140 BUY 217 and 2.8% m-o-m increase in sales, MSIL reported 10.4% m-o-m decline in sales. While MSIL has

reported decline in domestic sales, it reported highest-ever monthly export volumes in March.

GNA Axles 804 BUY 1,121 MSIL reported 9.8% m-o-m decline in domestic volumes (including supper carry) and 75% m-o-m

increase in export volumes and hence its total volumes declined by mere 1.3% m-o-m.

Greaves Cotton 131 BUY 183 EV segment: Momentum continued: The legacy players continue to do well in EV segment. Most

of the players have been constructive on the growth prospects in the EV segment. This was the

Hero Motocorp 2,434 BUY 3,006 consecutive second month when TVSM has sold more than 15,000 electric scooters. In March

TVSM registered 1.0% m-o-m decline in electric scooter sales to 15,364 units. For Tata Motors,

Lumax Auto

278 BUY 288 this was the consecutive fourth month when it reported m-o-m increase in EV sales and now its

Technologies#

monthly EV volume surpassed 6,500 units. In March 2023 TML sold 6509 electric cars compared

M&M @ $ 1,172 BUY 1,550 to 5,318 units in February 2023.

BSVI phase 2 norms implemented from April: The implementation of BSVI phase 2 norms

Mahindra CIE

361 Positive 457 from April 2023 would increase manufacturing cost for OEMs, which they are passing on to the

Automotive

customers. Effective from April 2023 (1) TML is increasing prices by 5% in CV segment, (2) HMCL

Maruti Suzuki 8,500 BUY 10,965 is increasing prices upto 2% and (3) MSIL is increasing prices by 0.8%. While the implementation

of new norms is translating into a cost pressure for OEMs, it would enhance growth opportunities

Ramkrishna Forgings 282 BUY 329 for powertrain solution players such as Bosch on possible increase in content per vehicle. It is

estimated that Bosch would have an opportunity to increase content per vehicle by 1.6x/1.8x in

Schaeffler India 2,902 BUY 3,328 MHCV/ LCV segment on implementation of BSVI phase 2 norms compared to the content per

vehicle during BSIV emission norms.

Sundram Fasteners # 993 BUY 1,110 Sector view

Suprajit Engineering # 345 BUY 403 Despite challenges in the rural segment, unseasonal rain and price hikes OEMs have reported strong

numbers in March 2023. Maruti and TVSM surprised on export volumes front, while HMCL reported

Tata Motors # 424 BUY 516 total volumes above 5 lakh units after September 2022. Going forward the rural recovery is key things

to watch out as rural segment drives the performance of the domestic motorcycle segment. While

TVS Motors $ 1,085 BUY 1,303 tractor segment has been registering strong volume growth trend, the growth is likely to moderate

in coming year due to high base. Similarly, OEMs are guiding for a 5-7% growth in PV segment in

VST Tillers and FY24 due to high base. A focused and balanced approach towards EV projects is helping the legacy

2,394 Neutral 2,445

Tractors Limited players in building up a markable presence in EV segment as most of the listed OEMs are preparing

@ MM & MVML; # Consolidated; vigorous plans for EV segment, which can survive even on withdrawal of the subsidy support. Export

$ core business valuation; UR Under Review volumes are expected to improve from Q1FY24 onwards.

Source: Company data, Sharekhan estimates Preferred picks: Among OEMs, we largely prefer four-wheeler over two wheelers as two-wheeler

space is still at the improvement stage. Ashok Leyland is expected to benefit from the ongoing upsurge

in CV segment. While historically M&M’s growth was largely driven by the tractor segment, however

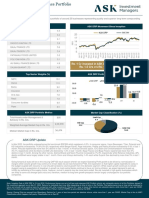

Price chart now the automotive segment is also contributing significant portion to the operating performance.

Maruti is expected to regain its market share on successful launch of new products. Despite weakness

180.0 in export volume, we believe increasing traction in its EV business augurs well for TVS Motor. Tata

160.0 Motors is assumed to register improvement in all three key segments (domestic PV, CV and JLR) on

improvement in semiconductor chip supplies. We like Bosch due to its technology leadership and rise

140.0 in content per vehicle on implementation of new emission norms. Amara Raja is expected to be a key

beneficiary of improvement in replacement demand in battery segment and probable value unlocking

120.0

in its EV related projects. The performance of Greaves Cotton in expected to improve on revival of

100.0 its EV business. Lumax Auto Technologies is expected to be benefitted from its new acquisition and

likely increase in its revenue mix. Schaeffler India is improving its export revenue mix and increasing

Jan-21

Mar-21

May-21

Jan-22

Mar-22

May-22

Jan-23

Mar-23

Sep-21

Sep-22

Jul-21

Jul-22

Nov-21

Nov-22

localization to improve overall profitability. We like Gabriel India due to its focus on EV projects and

inorganic growth opportunity.

Nifty 50 Nifty Auto

Key risks

Source: NSE India, Sharekhan Research

Our forecasts can be affected if semiconductor chip shortage (in premium segment) and geopolitical

situation aggravates or gets delayed along with deterioration in macros.

April 03, 2023 1

Sector Update

Valuation

EPS P/E (x)

Company CMP Reco PT (Rs)

FY22 FY23E FY24E FY22 FY23E FY24E

Alicon Castalloy Limited # 704 BUY 1,159 15.0 34.6 59.7 46.9 20.4 11.8

Amara Raja Batteries 587 BUY 696 29.9 36.8 44.9 19.6 15.9 13.1

Apollo Tyres 323 BUY 372 10.1 15.4 23.8 31.8 21.0 13.6

Ashok Leyland 141 BUY 181 1.8 3.3 6.6 76.4 42.8 21.5

Bajaj Auto 3994 BUY 4,151 162.6 197.2 225.8 24.6 20.3 17.7

Balkrishna Industries 1942 Hold 2,163 73 61 76 26.6 31.7 25.6

Bosch 19264 BUY 21,929 413 491 644 46.7 39.2 29.9

Eicher Motors 3002 BUY 3,579 61 103 122 48.9 29.2 24.6

Escorts Kubota 1872 Positive 2,278 73.0 58.7 75.4 25.0 31.0 24.8

Exide Industries $ 180 BUY 215 9 11 12 16.2 16.1 14.5

Gabriel India 140 BUY 217 6 9 13 22.5 15.3 11.0

GNA Axles 804 BUY 1,121 41 59 68 19.4 13.5 11.8

Greaves Cotton 131 BUY 183 -2 3 6 NA 39.3 21.1

Hero Motocorp 2434 BUY 3,006 124 135 172 19.7 18.0 14.2

Lumax Auto Technologies# 278 BUY 288 12 15 18 23.6 19.0 15.7

M&M @ $ 1172 BUY 1,550 43 62 71 22.1 15.4 16.5

Mahindra CIE Automotive 361 Positive 457 10.4 18 22 30.0 17.4 16.8

Maruti Suzuki 8500 BUY 10,965 256 346 392 33.2 24.6 21.7

Ramkrishna Forgings 282 BUY 329 15 21 27 18.8 13.7 10.3

Schaeffler India 2902 BUY 3,328 40 56 66 72.1 51.6 44.2

Sundram Fasteners # 993 BUY 1,110 24 33 42 41.2 30.0 23.7

Suprajit Engineering # 345 BUY 403 11 14 20 30.4 23.9 17.1

Tata Motors # 424 BUY 516 -28.0 4.6 32.8 NA 92.2 12.9

TVS Motors $ 1085 BUY 1,303 32 42 47 32.8 24.9 23.3

VST Tillers and Tractors Limited 2394 Neutral 2,445 96 124 153 24.4 18.9 15.7

@ MM & MVML; # Consolidated; $ core business valuation; UR Under Review; Source: Company data, Sharekhan estimates

April 03, 2023 2

Sector Update

OEM’s volume performance in March 2023 – above estimates

Ashok Leyland (ALL): Volumes – March 2023 – above estimates: ALL reported 18.9% y-o-y and 28.8%

mom increase in volumes to 23,926 units (against estimate of 19,500 units).

Eicher Motors: Volumes- March 2023 - RE: in line with estimates, VECV : above estimates: Royal Enfield

reported 6.7% y-o-y and 1.0% mom increase in volumes to 72,235 units (against estimate of 72,000 units).

VECV reported a 103.3% y-o-y and 63.3% mom increase in volumes to 11,906 units (against an estimate of

7,800 units).

Escorts Kubota (EKL): Volumes- March 2023 - above estimates: EKL reported 2.3% y-o-y and 31.9% mom

increase in total volumes to 10,305 units (against estimate of 7,900 units).

Hero MotoCorp (HMCL): Volumes- March 2023 - above estimates : HMCL reported 15.4% y-o-y and 31.7%

mom increase in total volumes to 519,342 units (against estimate of 420,000 units).

M&M: Volumes – March 2023 – above estimates: Automotive segment reported 21.0% y-o-y and 12.4%

mom increase in sales to 66,091 units (against estimate of 62,350 units). Tractor segment reported 17.6%

y-o-y and 35.8% mom increase in sales to 35,014 units (against estimate of 29,000 units).

Maruti Suzuki (MSIL): Volumes- March 2023 - above estimates: MSIL reported 0.2% y-o-y and 1.3% mom

decline in total volumes to 170,071 units (against estimate of 157,000) on the back of robust performance

in export volumes. While domestic volumes declined by 2.7% y-o-y and 9.8% mom, the export volumes

increased by 13.7% y-o-y and 75.0% mom.

Tata Motors (TML) : Volumes – March 2023 – above estimates: TML reported 1.7% y-o-y and 14.2% mom

increase in volumes to 91,048 units ( against estimate of 84,800 units). PV segment registered 4.1% y-o-y

and 2.5% mom increase in volumes to 44,225 units, while CV segment registered 0.5% y-o-y decline but

28.1% mom increase in volumes to 46,823 units.

TVS Motors (TVSM) : Volumes- March 2023 - above estimates: TVSM reported 3.0% y-o-y and 14.8%

mom increase in volumes to 317,152 units (against an estimate of 280,000 units) led by strong recovery in

export volumes on a mom basis. Domestic sales increased by 22.1% y-o-y and 8.7% mom. Export declined

by 31.6% y-o-y but increased by 40.5% mom.

April 03, 2023 3

Sector Update

Segment wise performance

PV segment: M&M outperforms the pack

In March M&M has outperformed its peers in domestic market, given M&M has reported the highest growth

in m-o-m basis compared to TML and MSIL.

Given most of the players have been receiving healthy order book the growth momentum would be

maintained in PV segment albeit at lower pace due to high base.

Domestic PV segment - volumes

Company Mar-23 Mar-22 YoY (%) Feb-23 MoM (%)

Maruti* 1,35,928 1,40,102 -3.0 1,51,738 -10.4

M&M 35,997 27,603 30.4 30,358 18.6

Tata Motors 44,044 42,293 4.1 42,862 2.8

Source: Company; Sharekhan Research

CV segment: Uptick continue

CV segment, as expected performed strongly in March due to seasonality and prebuying -ahead of

implementation of BSVI phase 2 norms, given vehicle prices are increasing by 3-5% in CV segment on

implementation of new norms.

All the key players have reported healthy growth in March on m-o-m basis.

TML has witnessed healthy demand in heavy truck segment from infra, e-Commerce, construction, and

mining segment. Further replacement demand was also robust during the month.

CV segment - volumes

Company Mar-23 Mar-22 YoY (%) Feb-23 MoM (%)

Ashok Leyland 23,926 20,123 18.9 18,571 28.8

Tata Motors 46,823 47,050 -0.5 36,565 28.1

Eicher (VECV) 11,906 5,856 103.3 7,289 63.3

M&M 22,282 19,837 12.3 20,843 6.9

Source: Company; Sharekhan Research

Tractor segment: strong performance on m-o-m despite high base

While unseasonal rain in some parts of the country has hit retail sales but the wholesales remain strong in

March 2023.

Going forward the moderation in growth is likely due to high base and strong volume performance in last

2 years.

Tractor segment - volumes

Company Mar 23 Mar-22 YoY (%) Feb-23 MoM (%)

M&M 35,014 29,763 17.6 25,791 35.8

Escorts 10,305 10,074 2.3 7,811 31.9

Source: Company; Sharekhan Research

April 03, 2023 4

Sector Update

Two-wheeler segment : HMCL showed decent performance

Despite headwinds and challenges, two wheeler players have performed relatively better in March 2023.

Mass market players like HMCL and TVSM have performed better than premium market player – Royal

Enfield.

Total Two wheeler segment - volumes

Company Mar 23 Mar-22 YoY (%) Feb-23 MoM (%)

Hero Motocorp 5,19,342 4,50,154 15.4 3,94,460 31.7

TVS Motor 3,07,559 2,92,918 5.0 2,67,026 15.2

Eicher 72,235 67,677 6.7 71,544 1.0

Source: Company; Sharekhan Research

Domestic volumes: CV, tractor and HMCL outperformed

OEMs reported a wide divergence in domestic volume growth trend in March 2023

Except Royal Enfield and Maruti Suzuki, all players in our coverage have reported m-o-m increase in

volumes.

Despite high base CV players and tractor players have reported strong double-digit growth on m-o-m

basis, partially supported by pre buying and seasonality.

Hero MotoCorp reported strong double-digit growth on m-o-m basis on the back of low base.

Domestic volumes trend

Company Mar 23 Mar-22 YoY (%) Feb-23 MoM (%)

Hero Motocorp 5,02,730 4,15,764 20.9 3,82,317 31.5

Eicher Motors (RE) 59,884 58,477 2.4 64,436 -7.1

TVSM 2,42,115 1,98,230 22.1 2,22,745 8.7

Ashok Leyland 22,885 18,556 23.3 17,568 30.3

Tata Motors CV 45,307 44,425 2.0 35,144 28.9

Tata Motors PV 44,044 42,293 4.1 42,862 2.8

M&M Tractors 33,622 28,112 19.6 24,619 36.6

M&M Automotive 63,976 51,483 24.3 56,551 13.1

Maruti 1,39,952 1,43,899 -2.7 1,55,094 -9.8

Source: Company; Sharekhan Research

Export volumes: MSIL, TVSM and RE outperformed

In contrast to expectations, OEMs performed better in export markets.

Despite a challenging environment, leading exporters like – TVSM, Royal Enfield, MSIL have reported

strong growth on m-o-m basis in March 2023.

Export volumes trend

Company Mar 23 Mar-22 YoY (%) Feb-23 MoM (%)

Hero MotoCorp 16,612 34,390 -51.7 12,143 36.8

Eicher Motors (RE) 12,351 9,200 34.3 7,108 73.8

TVSM 75,037 1,09,724 -31.6 53,405 40.5

Ashok Leyland 1,041 1,567 -33.6 1,003 3.8

Tata Motors CV 1,516 2,625 -42.2 1,421 6.7

Tata Motors PV 181 173 4.6 278 -34.9

M&M Tractors 1,392 1,651 -15.7 1,172 18.8

M&M Automotive 2,115 3,160 -33.1 2,250 -6.0

Maruti 30,119 26,496 13.7 17,207 75.0

Source: Company; Sharekhan Research

April 03, 2023 5

Sector Update

Company-wise performance for March 2023

Maruti Suzuki Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

Dom PV 1,39,952 1,43,899 -2.7 1,55,094 -9.8 17,06,811 14,14,277 20.7

Exp PV 30,119 26,496 13.7 17,207 75.0 2,59,333 2,38,376 8.8

Total Sales 1,70,071 1,70,395 -0.2 1,72,301 -1.3 19,66,144 16,52,653 19.0

M&M Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

PVs 35,997 27,603 30.4 30,358 18.6 3,59,253 2,25,895 59.0

CVs & 3W 27,979 23,880 17.2 26,193 6.8 3,07,106 2,07,196 48.2

Total Dom 63,976 51,483 24.3 56,551 13.1 6,66,359 4,33,091 53.9

Exp 2,115 3,160 -33.1 2,250 -6.0 32,107 32,510 -1.2

Total Auto 66,091 54,643 21.0 58,801 12.4 6,98,466 4,65,601 50.0

Tractor 35,014 29,763 17.6 25,791 35.8 4,07,545 3,54,698 14.9

Total Sales 1,01,105 84,406 19.8 84,592 19.5 11,06,011 8,16,916 35.4

Tata Motors Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

CV 46,823 47,050 -0.5 36,565 28.1 4,13,539 3,56,843 15.9

PV 44,225 42,466 4.1 43,140 2.5 5,41,163 3,70,563 46.0

Total Sales 91,048 89,516 1.7 79,705 14.2 9,54,702 7,27,406 31.2

Escorts Kubota Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

Total Sales 10,305 10,074 2.3 7,811 31.9 1,03,290 94,228 9.6

Ashok Leyland Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

MHCV 16,773 13,990 19.9 12,668 32.4 1,24,109 73,885 68.0

LCV 7,153 6,133 16.6 5,903 21.2 68,096 54,441 25.1

Total Sales 23,926 20,123 18.9 18,571 28.8 1,92,205 1,28,326 49.8

Eicher Motors Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

CV 11,906 5,856 103.3 7,289 63.3 79,623 61,680 29.1

2W Royal Enfield 72,235 67,677 6.7 71,544 1.0 8,34,895 6,02,268 38.6

Hero Motocorp Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

Total Sales 5,19,342 4,50,154 15.4 3,94,460 31.7 53,28,546 49,44,150 7.8

TVS Motors Mar-23 Mar-22 YoY(%) Feb-23 MoM(%) FY23 FY22 YoY(%)

2W 3,07,559 2,92,918 5.0 2,67,026 15.2 35,12,954 31,37,703 12.0

3W 9,593 15,036 -36.2 9,124 5.1 1,71,609 1,71,875 -0.2

Total Sales 3,17,152 3,07,954 3.0 2,76,150 14.8 36,84,563 33,09,578 11.3

Source: Company data, Sharekhan estimates; ^ Monthly runrate

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

April 03, 2023 6

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive

this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved) and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views

expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their

securities and do not necessarily reflect those of SHAREKHAN. The analyst and SHAREKHAN further certifies that neither he or his

relatives or Sharekhan associates has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in

the securities of the company at the end of the month immediately preceding the date of publication of the research report nor have

any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company.

Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and

no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in

this document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either, SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Ms. Binkle Oza; Tel: 022-61169602; email id: complianceofficer@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com.

Registered Office: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar (West), Mumbai – 400 028,

Maharashtra, INDIA, Tel: 022 - 67502000/ Fax: 022 - 24327343. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI (CASH / F&O/

CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN 20669;

Research Analyst: INH000006183.

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Flipping Markets: Trading Plan 2.0Document51 pagesFlipping Markets: Trading Plan 2.0Frisella Tobing100% (4)

- Types of Accounting Source DocumentsDocument4 pagesTypes of Accounting Source Documentsnyasha chanetsaNo ratings yet

- Adversary Complaint Filed Into Bankruptcy CourtDocument34 pagesAdversary Complaint Filed Into Bankruptcy CourtJanet and James100% (1)

- Poa SbaDocument14 pagesPoa Sbaroyal100% (1)

- Uruk, The First City - Mario LiveraniDocument110 pagesUruk, The First City - Mario LiveraniC. P.50% (4)

- Automobiles 01-Mar-2023Document5 pagesAutomobiles 01-Mar-2023vaibhav vidwansNo ratings yet

- India - Sector Update - AutomobilesDocument6 pagesIndia - Sector Update - AutomobilesAnupam TripathiNo ratings yet

- PrabhudasDocument8 pagesPrabhudasSaketh DahagamNo ratings yet

- Auto Volumes - February 2022: PV, CV Space Continues To OutshineDocument5 pagesAuto Volumes - February 2022: PV, CV Space Continues To OutshineNailesh MahetaNo ratings yet

- Automobiles 27-Mar-2023Document6 pagesAutomobiles 27-Mar-2023vaibhav vidwansNo ratings yet

- Automobiles Feb02 2022Document5 pagesAutomobiles Feb02 2022Shayan RCNo ratings yet

- A Mar A Raja BatteriesDocument12 pagesA Mar A Raja Batteriesjoshhere141No ratings yet

- Automobiles 27-Apr-2023Document5 pagesAutomobiles 27-Apr-2023vaibhav vidwansNo ratings yet

- Automobile Sales-November 2019-Monthly Sales Update-2 December 2019Document5 pagesAutomobile Sales-November 2019-Monthly Sales Update-2 December 2019darshanmadeNo ratings yet

- AmaraRaja CoverageDocument13 pagesAmaraRaja CoverageJayangi PereraNo ratings yet

- Rounded Recovery Broadens Opportunity Pie : (Exhibit 1)Document16 pagesRounded Recovery Broadens Opportunity Pie : (Exhibit 1)naman makkarNo ratings yet

- Exide Industries Equity Research ReportDocument9 pagesExide Industries Equity Research ReportAadith RamanNo ratings yet

- AutomobileDocument2 pagesAutomobilekishorepatil8887No ratings yet

- AXIS SEC - Hero Motocorp LTDDocument5 pagesAXIS SEC - Hero Motocorp LTDRanjan BeheraNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument9 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- UNOMINDA - Investor Presentation - 08-Feb-23 - TickertapeDocument32 pagesUNOMINDA - Investor Presentation - 08-Feb-23 - Tickertapedeepak pareekNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Battery Industry in IndiaDocument43 pagesBattery Industry in IndiaSamrat ManchekarNo ratings yet

- Automobiles: Lockdown, RM Inflation Dent EarningsDocument8 pagesAutomobiles: Lockdown, RM Inflation Dent EarningsPrahladNo ratings yet

- HSIE Results Daily - 15 Feb 24-202402150648003692167Document8 pagesHSIE Results Daily - 15 Feb 24-202402150648003692167Sanjeedeep Mishra , 315No ratings yet

- Axis Securities Auto Monthly Volume UpdateDocument7 pagesAxis Securities Auto Monthly Volume UpdateAditya SoniNo ratings yet

- Bharat Bijlee LTD Re Instating Coverage June 23 27jun2023114342Document14 pagesBharat Bijlee LTD Re Instating Coverage June 23 27jun2023114342Sunil ParikhNo ratings yet

- Auto - 4QFY19 Results Preview - HDFC Sec-201904120846431602685Document13 pagesAuto - 4QFY19 Results Preview - HDFC Sec-201904120846431602685Sonakshi AgarwalNo ratings yet

- Rhb-Report-My Auto-Autoparts Sector-Update 20221228 Rhb-3141236207350025963ab74465501a 1672212144Document6 pagesRhb-Report-My Auto-Autoparts Sector-Update 20221228 Rhb-3141236207350025963ab74465501a 1672212144Premier Consult SolutionsNo ratings yet

- EN Stellantis NV Q1 2023 Press ReleaseDocument6 pagesEN Stellantis NV Q1 2023 Press Releaseyouxin.cuiNo ratings yet

- Passenger Vehicle Sales Expected To Be Robust in July - Report - The Economic TimesDocument2 pagesPassenger Vehicle Sales Expected To Be Robust in July - Report - The Economic TimescreateNo ratings yet

- Automobiles: Revival Momentum To ContinueDocument5 pagesAutomobiles: Revival Momentum To ContinueRatan PalankiNo ratings yet

- Rhb-Report-My Auto-Autoparts Sector-Update 20230117 Rhb-483379665709538263c5cdd47633e 1673939044Document8 pagesRhb-Report-My Auto-Autoparts Sector-Update 20230117 Rhb-483379665709538263c5cdd47633e 1673939044Premier Consult SolutionsNo ratings yet

- ICRA Report 2 WheelersDocument6 pagesICRA Report 2 WheelersMayank JainNo ratings yet

- Auto Ancilliary Report - Feb23Document9 pagesAuto Ancilliary Report - Feb23adityaNo ratings yet

- Pick of The Week: Profit-Making Opportunities Even To Short-Term InvestorsDocument5 pagesPick of The Week: Profit-Making Opportunities Even To Short-Term InvestorsAnubhav GuptaNo ratings yet

- Investor Presentation: Q3 FY 2023 February 08, 2023Document31 pagesInvestor Presentation: Q3 FY 2023 February 08, 2023SouravBasakNo ratings yet

- IDirect Monthly AutoVolumes Nov19Document5 pagesIDirect Monthly AutoVolumes Nov19Dushyant ChaturvediNo ratings yet

- RHB Report My - Auto Autoparts - Sector Update - 20220615 - RHB 893413786324219462a90e281e20aDocument7 pagesRHB Report My - Auto Autoparts - Sector Update - 20220615 - RHB 893413786324219462a90e281e20aPremier Consult SolutionsNo ratings yet

- Makreting Plan Tango by AsadDocument22 pagesMakreting Plan Tango by AsadAsad MehmoodNo ratings yet

- Auto Nov20 Volume Preview - 271120 - OthersDocument9 pagesAuto Nov20 Volume Preview - 271120 - OthersRig MalikNo ratings yet

- Competitiveness at BajajDocument27 pagesCompetitiveness at Bajaja.resumesNo ratings yet

- Automobile-MSU-June 2022 - 04072022 - Retail-04-July-2022-540612220Document18 pagesAutomobile-MSU-June 2022 - 04072022 - Retail-04-July-2022-540612220Himanshu GuptaNo ratings yet

- Automobiles: Angels Outweighing DemonsDocument14 pagesAutomobiles: Angels Outweighing DemonsbradburywillsNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument18 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Ashok Leyland LTD.: Xlri BM 2007 09 BFA AssignmentDocument13 pagesAshok Leyland LTD.: Xlri BM 2007 09 BFA AssignmentNischay AgarwalNo ratings yet

- Pick of The Week: Profit-Making Opportunities Even To Short-Term InvestorsDocument5 pagesPick of The Week: Profit-Making Opportunities Even To Short-Term InvestorsEquity NestNo ratings yet

- Initiating Coverage Maruti SuzukiDocument13 pagesInitiating Coverage Maruti SuzukiAditya Vikram JhaNo ratings yet

- India - Sector Update - AutomobilesDocument21 pagesIndia - Sector Update - AutomobilesRaghav RawatNo ratings yet

- Amara Raja Vs ExideDocument50 pagesAmara Raja Vs ExideVarun BaxiNo ratings yet

- ALB - Albemarle CorporationDocument9 pagesALB - Albemarle Corporationdantulo1234No ratings yet

- MotoGaze - ICICI February 2013Document18 pagesMotoGaze - ICICI February 2013Vivek MehtaNo ratings yet

- Internship at Rosy Blue SecuritiesDocument12 pagesInternship at Rosy Blue SecuritiesKrish JoganiNo ratings yet

- ACMIIL Retail Research Investment Idea - Timken India LimitedDocument9 pagesACMIIL Retail Research Investment Idea - Timken India Limitedrajesh singhviNo ratings yet

- Rhb-Report-My Auto-Autoparts Sector-Update 20221220 Rhb-455520052830373463a0e2ea31079 1671616235Document6 pagesRhb-Report-My Auto-Autoparts Sector-Update 20221220 Rhb-455520052830373463a0e2ea31079 1671616235Premier Consult SolutionsNo ratings yet

- AxisCap - Craftsman Automation - IC - 23 Feb 2022Document61 pagesAxisCap - Craftsman Automation - IC - 23 Feb 2022vandit dharamshi100% (1)

- Bharat Forge: CMP: INR649 Creating Value Beyond Core To Forge AheadDocument20 pagesBharat Forge: CMP: INR649 Creating Value Beyond Core To Forge Aheadpal kitNo ratings yet

- Two-Wheeler Sector: Shape Shifting in The Wake of BS-VI and ElectrificationDocument64 pagesTwo-Wheeler Sector: Shape Shifting in The Wake of BS-VI and Electrificationadityakhanna83No ratings yet

- An Outlook On Indian Two Wheeler IndustryDocument18 pagesAn Outlook On Indian Two Wheeler IndustryPankaj Goenka100% (1)

- AngelTopPicks October 2020 PDFDocument12 pagesAngelTopPicks October 2020 PDFRony GeorgeNo ratings yet

- Amara Raja Batteries - Initiating Coverage ICICIdirectDocument25 pagesAmara Raja Batteries - Initiating Coverage ICICIdirectanandvisNo ratings yet

- Automobiles: Auto Volumes Dec'18 - Muted Wholesales!Document10 pagesAutomobiles: Auto Volumes Dec'18 - Muted Wholesales!rchawdhry123No ratings yet

- News ArticlesDocument20 pagesNews ArticlesPriya GoyalNo ratings yet

- Starter Motors & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandStarter Motors & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Starter Motors & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandStarter Motors & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- FST-3 (16-June-2024) (EH) PaperDocument50 pagesFST-3 (16-June-2024) (EH) PapercoureNo ratings yet

- FST-4 (20-June-2024) (EH) Paperror - (.1)Document51 pagesFST-4 (20-June-2024) (EH) Paperror - (.1)coureNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Et - Mar 23Document2 pagesEt - Mar 23coureNo ratings yet

- FST-4 (20-June-2024) (EH) Solutio.nDocument31 pagesFST-4 (20-June-2024) (EH) Solutio.ncoureNo ratings yet

- Heet - Mar 23Document2 pagesHeet - Mar 23coureNo ratings yet

- T - Mar 23Document1 pageT - Mar 23coureNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- GlobalDocument5 pagesGlobalcoureNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Bharat Electronics LTD: Guidance Achievement Wards Off Near-Term Growth ConcernsDocument7 pagesBharat Electronics LTD: Guidance Achievement Wards Off Near-Term Growth ConcernscoureNo ratings yet

- Back To The Future: Margins Still Matter: ThematicDocument247 pagesBack To The Future: Margins Still Matter: ThematiccoureNo ratings yet

- NUVAMADocument11 pagesNUVAMAcoureNo ratings yet

- Apr03 2023Document4 pagesApr03 2023coureNo ratings yet

- 2024 Service GuideDocument8 pages2024 Service Guideapi-274081075No ratings yet

- Final PaperDocument14 pagesFinal Paperapi-609740598No ratings yet

- Tchibo Ideas: Leveraging The Creativity of CustomersDocument14 pagesTchibo Ideas: Leveraging The Creativity of CustomersSarvagya JhaNo ratings yet

- IB Business and Management Notes, SLDocument6 pagesIB Business and Management Notes, SLbush0234No ratings yet

- Pre-Qualification - of - Suppliers - F - 2023-2025Document17 pagesPre-Qualification - of - Suppliers - F - 2023-2025Lawrence KyaloNo ratings yet

- Truth in Lending ActDocument2 pagesTruth in Lending ActKriztel CuñadoNo ratings yet

- Chapter 2: Non-Linear Equations: Nguyen Thi Minh TamDocument26 pagesChapter 2: Non-Linear Equations: Nguyen Thi Minh TamPhương Anh Nguyễn0% (1)

- Wfvt618 Es - 1000 at 10 Bar VT - Advanced (60hz) KsaDocument152 pagesWfvt618 Es - 1000 at 10 Bar VT - Advanced (60hz) KsaMostafa SharafNo ratings yet

- Mid Sem Exam - RoutineDocument15 pagesMid Sem Exam - Routineshashikant chitranshNo ratings yet

- What Is Contract Performance?Document5 pagesWhat Is Contract Performance?paco kazunguNo ratings yet

- Inflation in 2022Document2 pagesInflation in 2022Lea Moureen KaibiganNo ratings yet

- Sample CIBIL Report - IndividualDocument63 pagesSample CIBIL Report - IndividualNeeraj DaultaniNo ratings yet

- Quiz Buku Piut HutDocument4 pagesQuiz Buku Piut HutargarinirizqiayuNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Lettergoldenretriever854No ratings yet

- 7453 RSA Data Discovery For Archer - Customer Presentation v4Document19 pages7453 RSA Data Discovery For Archer - Customer Presentation v4Tarpan Stefan AlexandruNo ratings yet

- Archway Publishing Guide 1Document8 pagesArchway Publishing Guide 1NeelNo ratings yet

- The Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusDocument37 pagesThe Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusMohammed Al-YagoobNo ratings yet

- Study of Commodity MarketDocument84 pagesStudy of Commodity MarketTasmay EnterprisesNo ratings yet

- The New India Assurance Co. LTDDocument3 pagesThe New India Assurance Co. LTDsarath potnuriNo ratings yet

- Business Environment Analysis of ItalyDocument14 pagesBusiness Environment Analysis of ItalyAnkit TiwariNo ratings yet

- Transaction ReceiptDocument1 pageTransaction ReceiptbabucpyNo ratings yet

- SDoC 000733 - Arco & Colo LED Ceiling LightsDocument2 pagesSDoC 000733 - Arco & Colo LED Ceiling LightsRussell GouldenNo ratings yet

- Cheat Sheet - ReadingsDocument2 pagesCheat Sheet - ReadingsNicola GrecoNo ratings yet

- Assignment 1 SMDocument4 pagesAssignment 1 SMAnam Shoaib67% (3)

- Accounting Information System - Chapter 5 - ReviewerDocument8 pagesAccounting Information System - Chapter 5 - ReviewerSecret LangNo ratings yet