Professional Documents

Culture Documents

Fortune Itr 2008-09

Fortune Itr 2008-09

Uploaded by

anon-573467Copyright:

Available Formats

You might also like

- Case Study of Stryker CorporationDocument5 pagesCase Study of Stryker CorporationYulfaizah Mohd Yusoff100% (6)

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Soal Latihan PersekutuanDocument6 pagesSoal Latihan PersekutuanRio DjaraNo ratings yet

- Assignment Print View Lesson 6 PDFDocument8 pagesAssignment Print View Lesson 6 PDFnewonemadeNo ratings yet

- Stanley Fischer - Essays From A Time of Crisis PDFDocument550 pagesStanley Fischer - Essays From A Time of Crisis PDFIsmael ValverdeNo ratings yet

- ITRDocument1 pageITRpradip_jsr13No ratings yet

- Anuj ASAPM2826N ITR-VDocument1 pageAnuj ASAPM2826N ITR-Vapi-27088128No ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKishor VibhuteNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAshwini oRNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Itr-V Aaifp5094r 2007-08 2554600241007Document1 pageItr-V Aaifp5094r 2007-08 2554600241007dharmendraganatra2No ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- Alrpr6574n Itr VDocument1 pageAlrpr6574n Itr Vanon-511097100% (1)

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villageitkrishna1988No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- PDF 383187620040816Document1 pagePDF 383187620040816Ender gamerNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSanjeet SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBimal Kumar MaityNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- 2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFDocument1 page2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFvscomputersNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- Itr-V Aaifp5094r 2009-10 97108320300909Document1 pageItr-V Aaifp5094r 2009-10 97108320300909dharmendraganatra2No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRakesh MauryaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRakesh MauryaNo ratings yet

- 2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFDocument1 page2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFLEo GEnji KhunnuNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageMukesh DSNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagesamaadhuNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormvenkubaiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageGolu GuptaNo ratings yet

- 2019 08 25 22 36 30 211 - 1566752790211 - XXXPN9296X - AcknowledgementDocument1 page2019 08 25 22 36 30 211 - 1566752790211 - XXXPN9296X - AcknowledgementBibhudatta TripathyNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuraj Dev MahatoNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- 2018 09 25 14 48 26 422 - 1537867106422 - XXXPT2924X - Acknowledgement PDFDocument1 page2018 09 25 14 48 26 422 - 1537867106422 - XXXPT2924X - Acknowledgement PDFAnand ThakurNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- 2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFDocument1 page2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFJayanta Sur RoyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZIRWA ENTERPRISESNo ratings yet

- Vikrant It RDocument1 pageVikrant It RShankar SagarNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- Simandhar EducationDocument10 pagesSimandhar EducationAishwarya SolankiNo ratings yet

- College CatastropheDocument7 pagesCollege CatastropheAndrew Yazhgur0% (1)

- Partnership ConceptsDocument7 pagesPartnership ConceptsMariel TagubaNo ratings yet

- Funds Management ReportDocument26 pagesFunds Management ReportAmir MughalNo ratings yet

- Private Equity and Private Debt Investments in IndiaDocument83 pagesPrivate Equity and Private Debt Investments in Indiamahimnakandpal26No ratings yet

- A. Intax NotesDocument13 pagesA. Intax NotesIssy BNo ratings yet

- FAU Session 3 Audit Evidence, Materiality and Procedure 2Document16 pagesFAU Session 3 Audit Evidence, Materiality and Procedure 2BuntheaNo ratings yet

- Islamic Financial InstrumentsDocument16 pagesIslamic Financial InstrumentsMuhammad ArslanNo ratings yet

- Summary of Ias 41 - AgricultureDocument3 pagesSummary of Ias 41 - AgricultureJoana TatacNo ratings yet

- Financial Ratios Analysis (Hupseng Industries Berh - 231117 - 120915Document55 pagesFinancial Ratios Analysis (Hupseng Industries Berh - 231117 - 120915Iylia hanisNo ratings yet

- 83CHaUCat1rO1vRgwgGhPkH0Eupo7x9E UnlockedDocument1 page83CHaUCat1rO1vRgwgGhPkH0Eupo7x9E UnlockedBike RaiderNo ratings yet

- Insurance & Risk Management JUNE 2022Document11 pagesInsurance & Risk Management JUNE 2022Rajni KumariNo ratings yet

- Audited Financial Statements - ATRAM AsiaPlus Equity FundDocument29 pagesAudited Financial Statements - ATRAM AsiaPlus Equity FundKnivesNo ratings yet

- P AccoDocument9 pagesP Acco224252No ratings yet

- DT Notes (Part I) For May & Nov 23Document246 pagesDT Notes (Part I) For May & Nov 23Tushar MalhotraNo ratings yet

- Republic of The Philippines) City of Cagayan de Oro) S.SDocument3 pagesRepublic of The Philippines) City of Cagayan de Oro) S.Skenneth tamalaNo ratings yet

- Financial Inclusion in India: A Theoritical Assesment: ManagementDocument6 pagesFinancial Inclusion in India: A Theoritical Assesment: ManagementVidhi BansalNo ratings yet

- Bank Branch LFAR CA Ketan SaiyaDocument32 pagesBank Branch LFAR CA Ketan SaiyaJovamar MendozaNo ratings yet

- Companies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CARODocument28 pagesCompanies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CAROCA Rishabh DaiyaNo ratings yet

- A Project Report On Loan Procedure of Consumer Durable Product at Bajaj Finserv LendingDocument65 pagesA Project Report On Loan Procedure of Consumer Durable Product at Bajaj Finserv LendingHusna Majid50% (2)

- Accounting 1 Review Series Worksheet ExercisesDocument14 pagesAccounting 1 Review Series Worksheet ExercisesKayle Mallillin100% (2)

- Stockholders' Equity - No.3Document40 pagesStockholders' Equity - No.3Carl Agape DavisNo ratings yet

- MENA Region Vehicle-Insurance Companies ResearchDocument10 pagesMENA Region Vehicle-Insurance Companies ResearchJoseph MassinoNo ratings yet

- Philippine Stock Exchange Power PointDocument16 pagesPhilippine Stock Exchange Power PointEd Leen Ü100% (4)

- Chapter - V Data Analysis & InterpretationDocument26 pagesChapter - V Data Analysis & InterpretationMubeenNo ratings yet

- Chapter I Teori AkuntansiDocument24 pagesChapter I Teori AkuntansiHeru Kurnia AzraNo ratings yet

Fortune Itr 2008-09

Fortune Itr 2008-09

Uploaded by

anon-573467Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fortune Itr 2008-09

Fortune Itr 2008-09

Uploaded by

anon-573467Copyright:

Available Formats

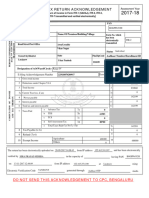

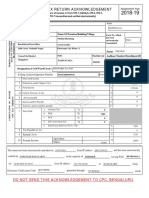

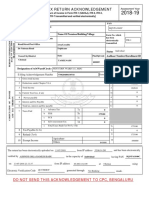

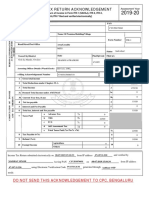

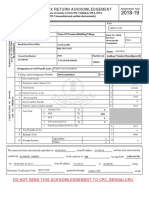

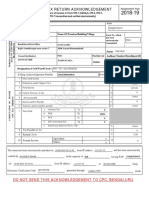

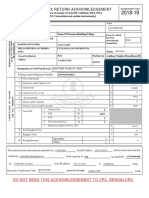

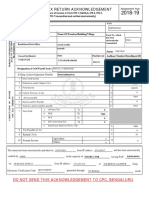

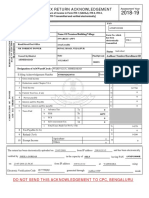

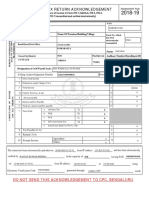

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM

[Where the data of the Return of Income/Fringe Benefits in Form ITR-1, ITR-2, ITR-3,

ITR-V 2008-09

ITR-4, ITR-5, ITR-6 & ITR-8 transmitted electronically without digital signature]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

PERSONAL INFORMATION AND THE

PRASAD MANOHAR PARSEKAR

AAJPP2267M

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village Form No. which

TRANSMISSION

B-1, FLAT NO.710 RASHMI ENCLAVE has been

electronically ITR-4

Road/Street/Post Office Area/Locality transmitted (fill

MIRA ROAD (EAST) SHANTI PARK the code)

Status (fill the

code) INDL

Town/City/District State Pin

Designation of Assessing Officer

THANE

MAHARASHTRA 401107

DC/AC, CIR 2, THANE

E-filing Acknowledgement Number 40552860270908 Date(DD/MM/YYYY) 27-09-2008

1 Gross total income 1 5192561

2 Deductions under Chapter-VI-A 2 120648

3 Total Income 3 5071910

a Current Year loss, if any 3a 0

COMPUTATION OF INCOME

4 Net tax payable 4 1406298

AND TAX THEREON

5 Interest payable 5 0

6 Total tax and interest payable 6 1406298

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 1423078

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 1423078

8 Tax Payable (6-7d) 8 0

9 Refund (7e-6) 9 16780

10 Value of Fringe Benefits 10

BENEFITS AND TAX THEREON

COMPUTATION OF FRINGE

11 Total fringe benefit tax liability 11

12 Total interest payable 12

13 Total tax and interest payable 13

14 Taxes Paid

a Advance Tax 14a

b Self Assessment Tax 14b

c Total Taxes Paid (14a+14b) 14c

15 Tax Payable (13-14c) 15

16 Refund 16

VERIFICATION

I, PRASAD MANOHAR PARSEKAR (full name in block letters), son/ daughter of MANOHAR PARSEKAR

solemnly declare to the best of my of solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules

thereto which have been transmitted electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount

of total income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act,

1961, in respect of income and fringe benefits chargeable to income-tax for the previous year relevant to the assessment year 2008-09. I further declare

that I am making this return in my capacity as authorized signatory and I am also competent to make this return and verify it.

Sign here Date 25-09-2008 Place THANE

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No

Date

Seal and signature of

receiving official AAJPP2267M4405528602709088F0B974B5E08A0429C88AB46BAE4DD527955AD94

You might also like

- Case Study of Stryker CorporationDocument5 pagesCase Study of Stryker CorporationYulfaizah Mohd Yusoff100% (6)

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Soal Latihan PersekutuanDocument6 pagesSoal Latihan PersekutuanRio DjaraNo ratings yet

- Assignment Print View Lesson 6 PDFDocument8 pagesAssignment Print View Lesson 6 PDFnewonemadeNo ratings yet

- Stanley Fischer - Essays From A Time of Crisis PDFDocument550 pagesStanley Fischer - Essays From A Time of Crisis PDFIsmael ValverdeNo ratings yet

- ITRDocument1 pageITRpradip_jsr13No ratings yet

- Anuj ASAPM2826N ITR-VDocument1 pageAnuj ASAPM2826N ITR-Vapi-27088128No ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKishor VibhuteNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAshwini oRNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Itr-V Aaifp5094r 2007-08 2554600241007Document1 pageItr-V Aaifp5094r 2007-08 2554600241007dharmendraganatra2No ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- Alrpr6574n Itr VDocument1 pageAlrpr6574n Itr Vanon-511097100% (1)

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villageitkrishna1988No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- PDF 383187620040816Document1 pagePDF 383187620040816Ender gamerNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSanjeet SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBimal Kumar MaityNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- 2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFDocument1 page2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFvscomputersNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- Itr-V Aaifp5094r 2009-10 97108320300909Document1 pageItr-V Aaifp5094r 2009-10 97108320300909dharmendraganatra2No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRakesh MauryaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRakesh MauryaNo ratings yet

- 2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFDocument1 page2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFLEo GEnji KhunnuNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageMukesh DSNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagesamaadhuNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormvenkubaiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageGolu GuptaNo ratings yet

- 2019 08 25 22 36 30 211 - 1566752790211 - XXXPN9296X - AcknowledgementDocument1 page2019 08 25 22 36 30 211 - 1566752790211 - XXXPN9296X - AcknowledgementBibhudatta TripathyNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuraj Dev MahatoNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- 2018 09 25 14 48 26 422 - 1537867106422 - XXXPT2924X - Acknowledgement PDFDocument1 page2018 09 25 14 48 26 422 - 1537867106422 - XXXPT2924X - Acknowledgement PDFAnand ThakurNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- 2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFDocument1 page2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFJayanta Sur RoyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZIRWA ENTERPRISESNo ratings yet

- Vikrant It RDocument1 pageVikrant It RShankar SagarNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- Simandhar EducationDocument10 pagesSimandhar EducationAishwarya SolankiNo ratings yet

- College CatastropheDocument7 pagesCollege CatastropheAndrew Yazhgur0% (1)

- Partnership ConceptsDocument7 pagesPartnership ConceptsMariel TagubaNo ratings yet

- Funds Management ReportDocument26 pagesFunds Management ReportAmir MughalNo ratings yet

- Private Equity and Private Debt Investments in IndiaDocument83 pagesPrivate Equity and Private Debt Investments in Indiamahimnakandpal26No ratings yet

- A. Intax NotesDocument13 pagesA. Intax NotesIssy BNo ratings yet

- FAU Session 3 Audit Evidence, Materiality and Procedure 2Document16 pagesFAU Session 3 Audit Evidence, Materiality and Procedure 2BuntheaNo ratings yet

- Islamic Financial InstrumentsDocument16 pagesIslamic Financial InstrumentsMuhammad ArslanNo ratings yet

- Summary of Ias 41 - AgricultureDocument3 pagesSummary of Ias 41 - AgricultureJoana TatacNo ratings yet

- Financial Ratios Analysis (Hupseng Industries Berh - 231117 - 120915Document55 pagesFinancial Ratios Analysis (Hupseng Industries Berh - 231117 - 120915Iylia hanisNo ratings yet

- 83CHaUCat1rO1vRgwgGhPkH0Eupo7x9E UnlockedDocument1 page83CHaUCat1rO1vRgwgGhPkH0Eupo7x9E UnlockedBike RaiderNo ratings yet

- Insurance & Risk Management JUNE 2022Document11 pagesInsurance & Risk Management JUNE 2022Rajni KumariNo ratings yet

- Audited Financial Statements - ATRAM AsiaPlus Equity FundDocument29 pagesAudited Financial Statements - ATRAM AsiaPlus Equity FundKnivesNo ratings yet

- P AccoDocument9 pagesP Acco224252No ratings yet

- DT Notes (Part I) For May & Nov 23Document246 pagesDT Notes (Part I) For May & Nov 23Tushar MalhotraNo ratings yet

- Republic of The Philippines) City of Cagayan de Oro) S.SDocument3 pagesRepublic of The Philippines) City of Cagayan de Oro) S.Skenneth tamalaNo ratings yet

- Financial Inclusion in India: A Theoritical Assesment: ManagementDocument6 pagesFinancial Inclusion in India: A Theoritical Assesment: ManagementVidhi BansalNo ratings yet

- Bank Branch LFAR CA Ketan SaiyaDocument32 pagesBank Branch LFAR CA Ketan SaiyaJovamar MendozaNo ratings yet

- Companies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CARODocument28 pagesCompanies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CAROCA Rishabh DaiyaNo ratings yet

- A Project Report On Loan Procedure of Consumer Durable Product at Bajaj Finserv LendingDocument65 pagesA Project Report On Loan Procedure of Consumer Durable Product at Bajaj Finserv LendingHusna Majid50% (2)

- Accounting 1 Review Series Worksheet ExercisesDocument14 pagesAccounting 1 Review Series Worksheet ExercisesKayle Mallillin100% (2)

- Stockholders' Equity - No.3Document40 pagesStockholders' Equity - No.3Carl Agape DavisNo ratings yet

- MENA Region Vehicle-Insurance Companies ResearchDocument10 pagesMENA Region Vehicle-Insurance Companies ResearchJoseph MassinoNo ratings yet

- Philippine Stock Exchange Power PointDocument16 pagesPhilippine Stock Exchange Power PointEd Leen Ü100% (4)

- Chapter - V Data Analysis & InterpretationDocument26 pagesChapter - V Data Analysis & InterpretationMubeenNo ratings yet

- Chapter I Teori AkuntansiDocument24 pagesChapter I Teori AkuntansiHeru Kurnia AzraNo ratings yet