Professional Documents

Culture Documents

Company Detailed Report - Pakistan International Bulk Terminal Limited

Company Detailed Report - Pakistan International Bulk Terminal Limited

Uploaded by

Abdullah UmerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Detailed Report - Pakistan International Bulk Terminal Limited

Company Detailed Report - Pakistan International Bulk Terminal Limited

Uploaded by

Abdullah UmerCopyright:

Available Formats

Initiation: Pakistan International Bulk Terminal Limited

Jun 03, 2021

Pakistan International Bulk Terminal

Look beyond the past

Best Equity research report (Runner up) – 2020

Best Equity Trader (Runner up) – 2019

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

1

Initiation: Pakistan International Bulk Terminal Limited

Look beyond the past Jun 03, 2021

We initiate coverage on Pakistan’s sole dirty cargo handling terminal, PIBTL, with a “BUY” stance. Bloomberg Ticker: PIBTL PA

Although the stock has recovered sharply from recent lows, the stock has underperformed the broad Target Price PKR/sh 13.8

market by 22% CYTD and offers a decent entry point. Our June-22 DCF based target price of PKR Closing price PKR/sh 11.3

13.8/share offers an upside of 22% from the last closing. The TP does not incorporate a potential

Upside % 22%

expansion scenario, which could further add PKR 2.5/share to the valuation (upside: 44%).

Stance Positive

3M Avg. daily value traded PKR mn 78.7

The company has overcome the initial challenges, where low utilization levels created problems, amid

No of shares mn 1,786

high fixed costs and hefty debt repayments. Now, with the improvement in balance sheet strength (debt

Market Cap PKRbn 20.2

to assets at 33%), the company is set to ride the country’s economic growth cycle. We expect company’s

Market Cap USDmn 130.7

accumulated losses to turn green by FY22, which would enable dividend payouts from FY23 (even after

accounting for 25% equity investment for expansion). Reducing leverage is also expected to make PIBTL Free float Market Cap PKRbn 10.1

eligible for addition in the Islamic index (KMI) in Jun-21 revision, which would broaden the investor base Free float Market Cap USDmn 65.4

and could lead to a re-rating. Source: Bloomberg, PSX, IIS Research

Capacity utilization set to max out in FY22: Although, the terminal achieved COD in Jul-17, capacity Key highlights FY20 FY21E FY22E FY23E

remained underutilized at 23% in FY18 due to competition from Karachi Port Trust (KPT) which offered Coal handled-mn tons 8.6 10.5 12.0 12.0

significantly cheaper rates. The radical shift in terminal utilization was witnessed after the Supreme Terminal utilization 72% 88% 100% 100%

Court decision to ban coal handling at KPT in June-18, citing environmental concerns. Ever since this EPS 0.6 1.2 0.9 1.1

decision, PIBTL has seen a steady rise in its utilization, where it is set to achieve ~88% utilization in FY21 DPS - - - 0.8

vs 72% in previous two years. We estimate PIBTL to reach full capacity in FY22 after the commissioning FCFE/share (0.0) 0.4 0.8 1.0

of Lucky Electric Power Company Limited (LEPCL) having annual coal demand of ~2.2mn tons and BVPS 7.8 12.7 13.7 14.8

expected increase in cement demand. P/E 17.6 9.2 12.1 10.0

P/BV 1.4 0.9 0.8 0.8

Expansion scenario looks more plausible now: The talks around expansion of coal handling capacity Dividend Yield 0.0% 0.0% 0.0% 6.6%

from 12mn tons to 16mn tons has been surfacing for quite sometime. However, now with the economic Earnings growth n.m 91.5% -23.8% 20.7%

trajectory becoming more clear, we believe the expansion looks more plausible. As per our channel ROE 8.5% 11.9% 7.1% 7.9%

checks, LECPL has not developed its jetty for coal handling and is likely to acquire services of PIBTL. We ROA 3.8% 6.4% 4.4% 5.2%

understand that eventually LECPL would shift to local coal; however, the development is expected to Source: Company Accounts, IIS

take ~4 years. In our view, the company has sufficient balance sheet strength to avoid a right issue. Research

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

2

Initiation: Pakistan International Bulk Terminal Limited

Valuation snapshot Jun 03, 2021

Since the project has a limited life (40 years), we have not assumed any extension beyond that

FY23 earnings sensitivity to Tariff increase & Coal handled

and have calculated cashflows up to FY40. We have used a 15% cost of equity for our DCF

Tariff increase (%)

based valuation, yielding June-22 DCF based target price of PKR 13.8/share offering an upside

1.1 0.0% 0.5% 1.0% 1.5%

of 22%.

Coal handled (mn

8 0.2 0.2 0.2 0.2

9 0.4 0.4 0.4 0.5

In the next year, company earnings growth is not very attractive due to presence of net

tons)

10 0.6 0.7 0.7 0.7

exchange gain on foreign debt in FY21 (~PKR610mn or PKR0.34/share) vs expected exchange

11 0.9 0.9 0.9 0.9

losses in coming years on the back of PKR devaluation. The P/E might also seem stretched on

12 1.1 1.1 1.2 1.2

the current operations; however, it is important to note that depreciation accounts for

PKR0.7/share in annual earnings. Thus, a P/E based analysis might not be reflective of the

improvement in company’s performance.

We have not incorporated expected capacity expansion by the company in our base case

valuation. However, as an upside case, we have discussed the impact (please refer to page 6).

Key risks to valuation: i) Reversal of Supreme Court decision on coal handling ban from KPT, ii) PKR

appreciation, and iii) Lower utilization due to terminal congestion in case of higher LNG imports at

Port Qasim, iv) delay in COD of Lucky Electric power plant.

Valuation-PKR mn FY23E FY24E FY25E FY26E FY27E FY28E FY29E FY30E FY31E FY32E FY33E FY34E FY35E FY36E FY37E FY38E FY39E FY40E

FCFE 1,629 1,866 2,098 2,343 2,598 2,897 4,429 5,156 5,387 5,623 5,865 6,112 6,365 6,624 6,886 7,153 7,423 10,112

PV- FCFE 1,417 1,411 1,379 1,339 1,291 1,251 1,664 1,684 1,530 1,388 1,259 1,141 1,033 935 845 763 689 816

Sum of PV 21,834

Plant scrap value 3,044

Discounted value of scrap 246

Cash 2,623

Total Equity Value 24,703

FCFE based June-22 target price (PKR/share) 13.8

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

3

Initiation: Pakistan International Bulk Terminal Limited

A look at Pakistan’s coal consumption Jun 03, 2021

In the last five years, Pakistan coal consumption has grown from mere 8.7mn tons in Pakistan coal demand & supply- seaborne trade

FY15 to 25.7mn tons consumption in FY20. The radical shift in the coal demand

continue to dominate consumption basket

witnessed after installation of 4,620MW coal-based power projects under the umbrella

30.0

of CPEC. At the same time, another major chunk of growth was seen from the cement

25.7

sector, where sector consumption recorded at 10.2mn tons in FY19 compared to 3.5mn

25.0

tons in FY15. During this period, the cement industry expanded its capacity from 46mn in 21.1

FY15 to 56mn tons in FY19, reflecting new capacity addition of 10.38mn tons.

20.0 18.0

Out of the total coal imported in the country during FY20, PIBTL handled 53% of the 15.0

volume due to availability of IPPs own jetties. Contrary to the last 5-year growth in coal 11.2

consumption due to the power sector, we believe that country’s coal consumption would 10.0 8.7 9.0

be driven by the cement sector more profoundly once local & imported coal-based

power projects are completed. 5.0

PIBTL sector wise coal handling demand-Mn tons 0.0

16.0 14.0 14.5 FY15 FY16 FY17 FY18 FY19 FY20E

13.6 Unit: Mn Tons

14.0 12.0 Local coal Land route imports Seaborne imports Total demand

12.0 10.2

10.0 8.6 Source: IIS Research, Energy year book, PBS

8.0

6.0

4.0

2.0

0.0

FY20 FY21E FY22E FY23E FY24E FY25E

Cement Power Textile Chemical Trader Others Total

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

4

Initiation: Pakistan International Bulk Terminal Limited

Demand outlook suggests capacity to exhaust in FY22 Jun 03, 2021

The uptick in coal handling demand in FY21 on the back of resumption in economic

activities indicates terminal capacity exhaustion in the next two years. During 2QFY21,

Industry wise volume handled in FY20

PIBTL has already achieved 98% coal terminal utilization (2.95mn tons). After 6%

incorporating 3.34mn cargo in 4QFY21 (based on the vessel schedule up to June 15, 6% CEMENT

2021), full-year coal handling is expected to reach 10.5mn tons (88% utilization). POWER

8%

TRADER

Currently, capacity utilization is largely driven by the demand push from the cement Coal handled TEXTILE

industry. The cement sector constituted 55% of the company’s total handled volumes in 7%

~8.6mn tons

CHEMICAL

FY20. Post Covid-19 lockdown, the cement sector's pent-up demand resulted in a 19% 55%

YoY increase in cement offtake in 10MFY21. Foreseeing the exhaustion of current OTHERS

capacity, the local cement industry has announced 22mn tons of capacity expansion

18%

which is likely to come online in FY24. This additional cement capacity is expected to

result in 3.3mn additional coal demand by FY24 (PIBTL can cater 1.5mn tons out of this).

Another major quantum of demand (2.2mn tons) is expected to materialize from the

commissioning of the Lucky Electric power plant in FY22. Coincided with the demand

push from the local cement industry, terminal capacity of 12mn tons is likely to exhaust

in FY22, hinting towards capacity expansion in the near term.

Cement Industry Coal Demand FY20 FY21E FY22E FY23E FY24E FY25E Lucky Electric Power plant will add further 2.2mn tons in FY23

Cement Industry Capacity-mn tons 65.6 71.1 71.1 76.3 93.0 93.0 Plant Capacity-MW 660

Cement dispatches 47.8 57.8 63.6 68.0 72.8 77.9 Plant efficiency 39%

Cement industry utilization 73% 81% 89% 89% 78% 84% Plant Heat rate-btu/kwh 8,749

Estimated Coal Demand from Cement 10.4 12.6 13.9 14.8 15.9 17.0 Coal heating value-btu/kg 22,860

PIBTL coal handling-Cement 4.7 5.7 6.3 6.8 7.2 7.7 Coal req. per unit-kg 0.38

PIBTL share in cement coal demand 46% 46% 46% 46% 46% 46% Coal Req-Mn tons 2.2

Incremental volumes potential vs FY21 0.6 1.0 1.5 2.0

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

5

Initiation: Pakistan International Bulk Terminal Limited

Expansion to add PKR2.5/share to the valuation Jun 03, 2021

In view of the terminal capacity exhaustion in the near term, the possibility of capacity Capacity expansion layout assumptions

expansion cannot be ruled out. Recently, company has also booked PKR 9.2bn surplus of Capacity expansion 4 Mn Ton

revaluation of assets in 3QFY21 which has strengthened the balance sheet further, hinting Capex 60Mn USD

towards capacity expansion. Currently, terminal coal handling capacity can be extended up to

Year FY22

16mn tons by incurring USD 50-60mn CAPEX. As per our discussions with the management, the

CAPEX financing in PKR Mn 9,672

majority of CAPEX will be incurred for equipment purchase. We have estimated this expansion

Equity (%) 25%

to add PKR 2.5/share to the company value.

Equity 2,418

Debt (%) 75%

Lucky Electric Power plant is expected to use terminal for four years: After getting generation

license based on imported coal as a primary fuel source in 2016, Lucky Electric applied for a Debt 7,254

modification in the license due to change in primary fuel from imported coal to Thar coal (as Debt to Assets after new debt 37%

directed by PPIB) which was duly accepted by NEPRA. Mark up rate K+3%

Tenure (Semi annual) 10

Considering the COD & expansion timeline of SECMC Phase I & Phase II, the third phase is likely Source: IIS Research

to take a minimum of four years for development along with the transport infrastructure to

Port Qasim from Thar. As per our channel checks, multiple requests filed by Lucky Electric for

developing their jetty at Port Qasim have not been entertained by the PQA.

SECMC Phase-II SECMC Phase-III

SECMC Phase-I

COD: Sep-22 COD: N/A

COD: July-19

Plants: Thal Plants: Siddique

Plants: Engro

Nova, Thar Sons Energy,

Thar Power

Energy Lucky Electric

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

6

Initiation: Pakistan International Bulk Terminal Limited

Healthy cashflows would enable dividends payout from FY23 Jun 03, 2021

Due to a major turnaround in PIBTL's earnings this year on the back of higher utilization, PICT payout history CY15 CY16 CY17 CY18 CY19 CY20

EPS 23 25 26 20 20 24

the company's free cash flows to equity is expected to turn positive in FY21. However, DPS 27 27.5 23.8 17.6 18 25

due to likely expansion in sight, we have assumed a dividend payout in FY23 of PKR Payout (%) 120% 109% 93% 90% 92% 102%

0.75/share (i.e., 60% payout).

PIBTL is likely to follow the path of PICT in terms of dividend payout: Pakistan Loans Obtained by PICT Last installment year USD Mn

IFC- Loan A 2013 8

International Containers Terminal Limited (PICT) comes under the umbrella of the IFC- Loan B 2014 2

Marine Group of Companies (sponsors of PIBTL). The company is operating in the IFC- II & III Loan 2015 14

country since 2002 with 21 years concessionary period granted by the Karachi Port Trust. IFC- Loan IV 2018 10

OFID- Loan I 2013 8

Through different foreign lenders, the company had obtained USD 53mn financing for its OFID- Loan II & III 2015 9

project. After 13 years of operations, the company had paid 75% of its total outstanding OFID- Loan IV 2018 3

debt. Resultantly, a healthy payout has been witnessed since CY15. Total 53

PIBTL FCFE/share

Loans Obtained by PIBTL Last installment year USD Mn PKR Mn

1.4 IFC 2027 27

1.3

OFID 2027 26

1.2 1.2 Term financing facility 2029 3,900

1.0 1.0 Musharka financing 2028 3,300

Total 53 7,200

0.8 0.8 Source: IIS Research, company accounts

0.6

0.4 0.4

0.2

- (0.0)

FY20 FY21E FY22E FY23E FY24E FY25E

(0.2)

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

7

Initiation: Pakistan International Bulk Terminal Limited

Inclusion in Islamic index could lead to a re-rating Jun 03, 2021

Sharia Compliant criteria PIBTL position by the end of FY21

Listing in Islamic Index could lead to bull run: After achieving debt to

Interest bearing debt to Total Assets <37% 24%

total Assets ratio of 33% by the end of 3QFY21, the company is all set to Non-compliant investments to Total Assets <33% 0%

be listed under PSX-KMI All Share Index, which comprises all Sharia- Non-compliant income to Total Revenue <5% 0.73%

compliant companies. This listing could lead to a bull run for company Illiquid Assets to Total Assets >25% 88%

stock price in the short run.

Net Liquid Assets/Share < Market Price/Share (6.2)

Free float should be atleast 5% of the total ostanding shares 50%

Ban on Cement/Clinker exports from Karachi Port Trust can be an

upside trigger: As a part of the agreement between Port Qasim & PIBTL,

the company has set up 4mn capacity for cement/clinker exports. This PIBTL Coal Tariff Break up- USD/Ton

capacity remains idle due to the availability of competitive terminal

rates at Karachi Port Trust. Our channel checks suggest that KPT charges

around PKR 350/ton for cement/clinker exports, whereas PIBTL charges 0.2

USD 5.70/ton tariff (PKR 872/ton). The primary reason behind Vessel Handling Tariff-Ship 1.0

to Shore

uncompetitive rates of PIBTL is PQA royalty of USD 2.27/ton (PKR

347/ton). However, the possibility of cement/clinker exports from KPT PQA Royalty charges

Tariff ~ USD

cannot be ruled out, considering the same happened with the coal 6.7/ton 3.2

Ancillary service

imports ban by the Supreme Court of Pakistan in 2018.

Misscellanous charges 2.3

In addition to this, Karachi Port congestion remains a major impediment

in cement/clinker exports, with food imports taking priority in berthing.

This congestion results in 5-7 days of ship discharge which can be

reduced to 1-1.5 days upon using the PIBTL terminal.

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

8

Initiation: Pakistan International Bulk Terminal Limited

Company Background Jun 03, 2021

Pakistan International Bulk Terminal Limited was established in Pakistan on March 22nd, Shareholding Pattern Stake

2010 as a public limited company. The company entered into Build, Operate, & Transfer Marine Group of Companies 50.7%

agreement with the Port Qasim Authority in Nov-10 for 30 years for 12mn & 4mn coal International Finance Corporation 9.5%

and cement handling, respectively. Jahangir Siddiqui Co. Limited 7.1%

Others 32.7%

No. of shares (mn) 1,786

Construction work on the terminal started in 2012 with an initially envisaged amount of

As on June 30th, 2020

USD 175mn and expected COD of 2015 having a total capacity of 12mn tons cargo

handling (coal, cement & clinker). Later on, COD extended to 2017 due to the addition of

4mn capacity with CAPEX increasing to USD 283mn. In the final phase of the project, due

to the installation of additional equipment for automation, COD was delayed further to

finally being achieved on July 3rd, 2017, by incurring ~USD 300mn CAPEX. This increase

in CAPEX caused a burden for the company in its initial years due to higher debt and

depreciation, and led to two right issues.

Supreme Court decision proved to be a game changer for PIBTL: Capacity utilization at

the terminal remained substantially low after achieving COD, with FY18 utilization

recording at 23%. Coal handling at Karachi Port Trust remained a fundamental reason

behind such low utilization of the terminal. However, citing environmental concerns, the

Supreme Court of Pakistan has completely banned imported coal handling at Karachi

Port Trust in June-18. Following this decision, terminal utilization swiftly shoots up, and

PIBTL recorded capacity utilization of 73% in FY19.

Sponsor details: Marine group of companies is one the largest & the most diversified

cargo handling and logistics group operating in the country since 1964. Among nine

companies of the group, two of them are listed on PSX, i.e., PIBTL & PICT.

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

9

Initiation: Pakistan International Bulk Terminal Limited

Financial Snapshot Jun 03, 2021

PIBTL Key ratios FY18 FY19 FY20 FY21E FY22E FY23E FY24E FY25E FY26E FY27E FY28E FY29E FY30E

EPS (1.8) (1.3) 0.6 1.2 0.9 1.1 1.3 1.5 1.7 1.9 2.1 2.3 2.4

DPS - - - - - 0.8 0.8 1.0 1.0 1.3 1.5 2.3 2.8

EBITDA/Ton-PKR (259) 61 466 493 415 447 476 502 531 561 593 625 660

EBITDA/Ton-USD (2.4) 0.4 2.9 3.1 2.6 2.7 2.8 2.8 2.9 2.9 3.0 3.0 3.0

Gross margin -42% 28% 32% 31% 32% 33% 33% 34% 34% 35% 36% 36% 37%

ROE -19% -19% 9% 12% 7% 8% 9% 10% 10% 11% 12% 12% 12%

ROA -9% -8% 4% 6% 4% 5% 6% 7% 8% 9% 10% 11% 11%

Depreciation per share-net of tax 0.6 0.7 0.5 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7

FCFE per share (1.0) (1.5) (0.0) 0.4 0.8 1.0 1.2 1.3 1.5 1.6 1.8 2.7 3.2

Debt to Asset 46% 51% 48% 31% 27% 23% 19% 15% 11% 6% 1% 0% 0%

Debt to Assets ex islamic financing 35% 41% 38% 24% 21% 18% 15% 12% 8% 5% 1% 0% 0%

EV/EBITDA (45.3) 66.4 8.4 6.0 5.6 4.6 3.9 3.3 2.7 2.1 1.6 1.2 0.9

Coal handled-mn tons 2.7 8.6 8.6 10.5 12.0 12.0 12.0 12.0 12.0 12.0 12.0 12.0 12.0

Utilization 23% 71% 72% 88% 100% 100% 100% 100% 100% 100% 100% 100% 100%

Income Statement -PKR mn FY18 FY19 FY20 FY21E FY22E FY23E FY24E FY25E FY26E FY27E FY28E FY29E FY30E

Sales 8,004 9,459 11,234 12,670 13,294 13,895 14,523 15,179 15,865 16,583 17,332 18,115 18,934

Gross Profit (817) 2,232 3,049 3,499 4,027 4,327 4,618 4,903 5,220 5,551 5,898 6,261 6,638

Operating Profit (1,132) 1,805 2,560 2,991 3,464 3,722 3,968 4,203 4,466 4,737 5,020 5,313 5,614

Exchange (loss)/gain (264) (2,749) (159) 610 (209) (181) (150) (116) (80) (40) - - -

Finance cost 1,265 1,823 1,126 965 778 690 555 416 272 124 30 - -

PBT (3,214) (2,531) 1,646 2,710 2,351 2,837 3,320 3,773 4,263 4,774 5,249 5,666 6,083

PAT (2,635) (2,404) 1,144 2,192 1,669 2,014 2,357 2,679 3,027 3,389 3,727 4,023 4,319

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

10

Initiation: Pakistan International Bulk Terminal Limited

Financial Snapshot Jun 03, 2021

Balance Sheet-PKR mn FY18 FY19 FY20 FY21E FY22E FY23E FY24E FY25E FY26E FY27E FY28E FY29E FY30E

Fixed Assets 27,754 27,209 26,254 33,793 32,531 31,249 29,949 28,629 27,290 25,931 24,552 23,152 21,732

Current Assets 1,404 2,695 3,414 4,534 5,805 7,658 8,464 9,543 10,468 11,695 12,829 15,127 16,904

Total Assets 29,158 29,904 29,668 38,327 38,336 38,907 38,412 38,173 37,758 37,627 37,381 38,279 38,636

Non-Current Liabilities 12,476 13,652 12,410 12,485 10,947 9,392 7,765 6,062 4,277 2,486 1,986 1,986 1,986

Current Liabilities 4,360 3,407 3,263 3,105 2,983 3,096 3,211 3,335 3,463 3,520 2,281 1,835 1,891

Total Liabilities 16,836 17,059 15,673 15,590 13,930 12,488 10,976 9,397 7,741 6,006 4,267 3,821 3,877

Share capital 14,860 17,861 17,861 17,861 17,861 17,861 17,861 17,861 17,861 17,861 17,861 17,861 17,861

Accumulated Profit (2,538) (5,016) (3,866) (1,578) 91 2,105 3,123 4,462 5,703 7,306 8,801 10,144 10,444

Total Shareholder's equity 12,322 12,845 13,995 16,283 17,952 19,966 20,984 22,323 23,564 25,167 26,661 28,005 28,305

Free cash flow statement-PKR mn FY18 FY19 FY20 FY21E FY22E FY23E FY24E FY25E FY26E FY27E FY28E FY29E FY30E

Cash flow from operations 510 (329) 1,303 2,788 3,729 4,008 4,320 4,611 4,919 5,241 5,537 5,832 6,127

Capex (2,875) (444) (521) (539) (569) (550) (531) (512) (492) (473) (452) (432) (411)

Add: Interest expense 898 1,295 799 965 778 690 555 416 272 124 30 - -

Free cash flows to Firm (1,467) 521 1,581 3,214 3,938 4,148 4,344 4,514 4,698 4,893 5,115 5,400 5,716

Less: Interest expense (898) (1,295) (799) (965) (778) (690) (555) (416) (272) (124) (30) - -

Change in borrowings 602 (1,955) (785) (1,534) (1,782) (1,668) (1,705) (1,743) (1,783) (1,824) (1,791) (500) -

Free cash flows to Equity holders (1,762) (2,728) (3) 715 1,378 1,789 2,084 2,355 2,644 2,944 3,294 4,900 5,716

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

11

Initiation: Pakistan International Bulk Terminal Limited REP-092

Jun 03, 2021

Disclaimer

Ismail Iqbal Securities (Pvt.) Limited does not warrant the timeliness, sequence, accuracy or completeness of this information. In no event will Ismail Iqbal Securities

(Pvt.) Limited be liable for any special, indirect, incidental, or consequential damages without limitation which includes lost revenues, lost profits, or loss of

prospective economic advantage resulting from the use of the information or for any omission or inaccuracies resulting from the use of information from this market

Disclosures

Ismail Iqbal Securities (Pvt) Limited, hereinafter referred to as IISPL, acts as a market maker in the security(ies) mentioned in this report. IISPL, its officers, directors,

associates or their close relatives might have financial interests in the security(ies) mentioned in this report, including a significant financial interest (1% of the

value of the securities of the subject company). IISPL is doing business, or seeking to to do business, with the company(ies) mentioned in this report, and therefore

receives/has received/intending to receive compensation from these company(ies) in a non-research capacity.

IISPL has previously or might in the future trade or deal in the subject company in a manner contrary to the recommendation in this report, due to differences of

opinion between the research department and sales desk or traders, and investment time period differences.

The analyst associated with the writing of this report either reports directly to the research department head or is the department head. The department head in

turn reports directly to the Chief Executive Officer of IISPL. The analyst's compensation is not determined by nor based on other business activities of IISPL.

Research reports are disseminated through email or mail/courier to all clients at the same time. No class of client or internal trading person gets this report in

advance of other clients. Due to factors outside of IISPL's control, including speed of the internet, some clients may receive the report before others.

Monetary compensation of research analysts is neither determined nor based on any other service(s) that IISPL offers, and the compensatory evaluation is not

influenced nor controlled by anyone belonging to a non-research department. Further, the research analysts are headed by the Head of Research, who reports

Recommendations are based on the following conditions:

Rating criteria Stance

(Target Price/Current Price - 1) > 10% Positive

(Target Price/Current Price - 1) < -10% Negative

9% > (Target Price/Current Price -1) > -9% Neutral

Investors should carefully read the definitions of all rating used within every research report. In addition, research reports carry an analyst’s independent view and

investors should ensure careful reading of the entire research reports and not infer its contents from the rating ascribed by the analyst. Ratings should not be used or

relied upon as investment advice. An investor’s decision to buy, hold or sell a stock should depend on said individual’s circumstances and other considerations.

Valuation Methodology

To arrive at our period end target prices, IISPL uses different valuation methadologies including

Discounted cash flow (DCF, DDM)

Relative Valuation (P/E, P/B, P/S etc.)

Equity & Asset return based methodologies (EVA, Residual Income etc.)

Analyst Disclaimer

The author(s) of this report hereby certifiies that this report accurately reflects her/his/their own independent opinions and views as of the time this report went

into publication and that no part of her/his/their compensation was, is or will be affected by the recommendation(s) in this report.

The research analyst or any of her/his/their close relatives do not have a financial interest in the securities of the subject company aggregating more than 1% of the

value of the company and the research analyst or their close relatives have neither served as a director/officer in the past 3 years nor received any compensation

from the subject company in the past 12 months. The Research analyst or her/his/their close relatives have not traded in the subject security in the past 7 days and

will not trade for 5 days post publication of the report.

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

12

Initiation: Pakistan International Bulk Terminal Limited REP-092

Jun 03, 2021

Contact Us

Branch Office:

C-132 (B), Miran Mohammed Shah Road,

KDA Scheme 1, Karachi, Pakistan

Stock Exchange Office:

407 Karachi Stock Exchange Building

Stock Exchange Road, Karachi, Pakistan

Executives

Ahfaz Mustafa Chief Executive Officer (92-21) 3430 2182-4 Ext: 101 ahfaz.mustafa@ismailiqbal.com

Equity Research Team

Fahad Rauf Head of Research (92-21) 3432 0375 fahad.rauf@ismailiqbal.com

Ajay Kumar Research Analyst (92-21) 3430 2184 Ext: 403 ajay.kumar@ismailiqbal.com

Abdullah Umer Research Analyst (92-21) 3430 2184 Ext: 406 abdullah.umer@ismailiqbal.com

Talha Idrees Research Analyst (92-21) 3430 2184 Ext: 407 talha.idrees@ismailiqbal.com

Muqeet Naeem Research Analyst (92-21) 3430 2184 Ext: 405 muqeet.naeem@ismailiqbal.com

Osama Polani Research Analyst (92-21) 3430 2184 Ext: 405 osama.polani@ismailiqbal.com

Equity Sales Team

Nazim Abdul Muttalib EVP– Head of Broking (92-21) 3430 2176 nazim.silat@ismailiqbal.com

Jawwad Aboobakar EVP– Head of Business Development (92-21) 3430 2177 jawwad@ismailiqbal.com

Azfar Bin Aman EVP - Head of Sales (92-21) 3430 2173-9 azfar@ismailiqbal.com

Fakhar Z. Khan VP Sales (92-21) 3246 1659 fzkhan@ismailiqbal.com

Muhammad Umair VP Sales (92-21) 3430 2173-9 m.umair@ismailiqbal.com

Adnan Hussain Equity Dealer (92-21) 3430 2173-9 adnan.hussain@ismailiqbal.com

Abdullah Umer abdullah.umer@ismailiqbal.com Phone: (+92-21) 34302184, Ext 406

13

You might also like

- The Operating System 2Document274 pagesThe Operating System 2kkwalarNo ratings yet

- Argus Phosphates Report-March 16, 2023Document13 pagesArgus Phosphates Report-March 16, 2023Abdullah UmerNo ratings yet

- Argus Nitrogen - March 16, 2023Document11 pagesArgus Nitrogen - March 16, 2023Abdullah UmerNo ratings yet

- Marriott Rooms ForecastingDocument6 pagesMarriott Rooms ForecastingShivam AgarwalNo ratings yet

- Pakistan Insight - 20201111 - NPL PA - MoU Talks To MakeDocument4 pagesPakistan Insight - 20201111 - NPL PA - MoU Talks To MakeshoaibNo ratings yet

- Investment Strategy Semba BankDocument147 pagesInvestment Strategy Semba BankAnsharah AhmedNo ratings yet

- Insight: HUBC PA: On Growth Trajectory Pakistan PowerDocument5 pagesInsight: HUBC PA: On Growth Trajectory Pakistan PowerShoaib A. KaziNo ratings yet

- LOTTE Chemical Pakistan LTD (LOTCHEM) : Recovery in Primary Margins To Drive ProfitabilityDocument13 pagesLOTTE Chemical Pakistan LTD (LOTCHEM) : Recovery in Primary Margins To Drive ProfitabilityAli CheenahNo ratings yet

- Container Corporation India LTD - Initiating Coverage - Dalal and Broacha - BuyDocument15 pagesContainer Corporation India LTD - Initiating Coverage - Dalal and Broacha - BuyvineetwinsNo ratings yet

- IJM Corporation: ResearchDocument4 pagesIJM Corporation: Researchjcw288No ratings yet

- JK Lakshmi Cement LTDDocument12 pagesJK Lakshmi Cement LTDViju K GNo ratings yet

- Stalwart of Bio-Economy Revolution!Document22 pagesStalwart of Bio-Economy Revolution!nitinmuthaNo ratings yet

- Initiating Coverage Cherat Cement Company LTD 2Document10 pagesInitiating Coverage Cherat Cement Company LTD 2faiqsattar1637No ratings yet

- Binging Big On BTG : BUY Key Take AwayDocument17 pagesBinging Big On BTG : BUY Key Take AwaymittleNo ratings yet

- Mughal Iron and Steels LimitedDocument1 pageMughal Iron and Steels LimitedbinraziNo ratings yet

- Ultratech Cement Limited: Outlook Remains ChallengingDocument5 pagesUltratech Cement Limited: Outlook Remains ChallengingamitNo ratings yet

- 01 05 18 PDFDocument5 pages01 05 18 PDFmehwish shahNo ratings yet

- Gadang - Bags ECRL Project PDFDocument3 pagesGadang - Bags ECRL Project PDFAHMADNo ratings yet

- Luck 6Document2 pagesLuck 6Tughral HilalyNo ratings yet

- Pakistan Power Generation SectorDocument48 pagesPakistan Power Generation Sectoriamhummad100% (2)

- Power Grid: CMP: Inr197 Expect Strong Double-Digit Irrs in TBCB ProjectsDocument12 pagesPower Grid: CMP: Inr197 Expect Strong Double-Digit Irrs in TBCB ProjectsdcoolsamNo ratings yet

- True Friend Sekuritas PTBA AnalysisDocument7 pagesTrue Friend Sekuritas PTBA Analysisyasinta faridaNo ratings yet

- PASH Pakistan Strategy (21588)Document21 pagesPASH Pakistan Strategy (21588)Junaid ArsahdNo ratings yet

- Itm Analyst Presentation 3q22Document28 pagesItm Analyst Presentation 3q22Satria Bagas SaputraNo ratings yet

- Construction Sector: Limited Impact of Second COVID Wave On ExecutionDocument3 pagesConstruction Sector: Limited Impact of Second COVID Wave On ExecutionLavanya SubramaniamNo ratings yet

- All About Pakistan's Oil & Gas Exploration CompaniesDocument13 pagesAll About Pakistan's Oil & Gas Exploration CompaniesFahad HussainNo ratings yet

- Engro Polymer and Chemical Limited (EPCL) : Expansion On The CardsDocument13 pagesEngro Polymer and Chemical Limited (EPCL) : Expansion On The CardsAli CheenahNo ratings yet

- Petronet LNG (PLNG IN) : Q2FY21 Result UpdateDocument6 pagesPetronet LNG (PLNG IN) : Q2FY21 Result UpdateRakeshNo ratings yet

- Coal LPL and PKGPDocument2 pagesCoal LPL and PKGPSaad YousufNo ratings yet

- Indian Railway Finance Corporation LTD: SubscribeDocument5 pagesIndian Railway Finance Corporation LTD: SubscribeSunnyNo ratings yet

- Petronet Motilal OswalDocument8 pagesPetronet Motilal OswaljoeNo ratings yet

- Mkango Resources : Advanced REE Play Funded To Construction DecisionDocument37 pagesMkango Resources : Advanced REE Play Funded To Construction DecisionAdam DziubinskiNo ratings yet

- AngelBrokingResearch STFC Result Update 3QFY2020Document6 pagesAngelBrokingResearch STFC Result Update 3QFY2020avinashkeswaniNo ratings yet

- Cochin Shipyard: Capital GoodsDocument8 pagesCochin Shipyard: Capital GoodsSonakshi AgarwalNo ratings yet

- Diversified: Infrastrcutrue, Power, MiningDocument12 pagesDiversified: Infrastrcutrue, Power, Miningjoking_111No ratings yet

- Insight Alpha - 20210726 - GHNL PA - Venturing Into The SUV SegmentDocument5 pagesInsight Alpha - 20210726 - GHNL PA - Venturing Into The SUV SegmentMuhammad Ovais AhsanNo ratings yet

- Mirae Asset Securities Co., Ltd. NCEM@EY 211108 - Mirae Asset Sekuritas Indonesia - Cement Outlook 1HDocument20 pagesMirae Asset Securities Co., Ltd. NCEM@EY 211108 - Mirae Asset Sekuritas Indonesia - Cement Outlook 1HNiyati TiwariNo ratings yet

- Jasa Armada Indonesia: Equity ResearchDocument4 pagesJasa Armada Indonesia: Equity ResearchyolandaNo ratings yet

- Large CapDocument24 pagesLarge Capanil_justme9827No ratings yet

- YTL Corporation: Earnings Momentum To ContinueDocument17 pagesYTL Corporation: Earnings Momentum To Continuephantom78No ratings yet

- CMP: INR155 Under-Recoveries To Vanish by end-FY19Document6 pagesCMP: INR155 Under-Recoveries To Vanish by end-FY19anjugaduNo ratings yet

- RecDocument28 pagesRecChirag ShahNo ratings yet

- Aug-2010-Citi Indonesia ConferenceDocument67 pagesAug-2010-Citi Indonesia ConferenceFatchul WachidNo ratings yet

- Serba Dinamik Holdings Outperform : Upstream DiversificationDocument5 pagesSerba Dinamik Holdings Outperform : Upstream DiversificationAng SHNo ratings yet

- WSBP Research ReportDocument17 pagesWSBP Research ReportMarcella ReginaNo ratings yet

- Serba Dinamik Holdings Outperform: Dynamic PlayDocument21 pagesSerba Dinamik Holdings Outperform: Dynamic PlayAng SHNo ratings yet

- NMDC LTD: ESG Disclosure ScoreDocument6 pagesNMDC LTD: ESG Disclosure ScoreVivek S MayinkarNo ratings yet

- Equirus Securities - CG Power and Industrial Solutions - Initiating Coverage Note - 10.04.2022Document41 pagesEquirus Securities - CG Power and Industrial Solutions - Initiating Coverage Note - 10.04.2022SaurabhNo ratings yet

- JK Cement Updt Feb20Document5 pagesJK Cement Updt Feb20darshanmaldeNo ratings yet

- 93743325Document29 pages93743325aazaidiNo ratings yet

- RIL 2Q FY19 Analyst Presentation 17oct18Document75 pagesRIL 2Q FY19 Analyst Presentation 17oct18Raghunath GuruvayurappanNo ratings yet

- Voltamp Transformers (VAMP IN) : Management Meet UpdateDocument6 pagesVoltamp Transformers (VAMP IN) : Management Meet UpdateDarwish MammiNo ratings yet

- IEEFA Presentation - Indonesia's Downstream Coal Plans Add Up To A Black Hole - Jan 22Document21 pagesIEEFA Presentation - Indonesia's Downstream Coal Plans Add Up To A Black Hole - Jan 22ik43207No ratings yet

- Trimegah Coal - Hello Old Economy, I'm BackDocument46 pagesTrimegah Coal - Hello Old Economy, I'm BackRizki Jauhari IndraNo ratings yet

- Kgi PTT 239026Document11 pagesKgi PTT 239026dtNo ratings yet

- Welcorp q2 Business UpdatesDocument8 pagesWelcorp q2 Business UpdatesVivek AnandNo ratings yet

- Coal India: CMP: INR130 Volumes Rise As Power Demand RecoversDocument12 pagesCoal India: CMP: INR130 Volumes Rise As Power Demand RecoversSathwik PadamNo ratings yet

- Petronas Gas Berhad Maintain: Key Investment HighlightsDocument3 pagesPetronas Gas Berhad Maintain: Key Investment Highlightsgee.yeap3959No ratings yet

- HFCL - Initiating Coverage - KSL 210521Document14 pagesHFCL - Initiating Coverage - KSL 210521Dhiren DesaiNo ratings yet

- Strong Order Book Promises Revenue Growth: KNR's Healthy OrderDocument10 pagesStrong Order Book Promises Revenue Growth: KNR's Healthy OrderNimesh PatelNo ratings yet

- IP COAL - PTBA - 26 Aug 2022Document6 pagesIP COAL - PTBA - 26 Aug 2022rizky lazuardiNo ratings yet

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanNo ratings yet

- Diwali Dhanotsav Portfolio 2023Document22 pagesDiwali Dhanotsav Portfolio 2023pramodkgowda3No ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- Argus Phosphates Report-Jan 19, 2023Document13 pagesArgus Phosphates Report-Jan 19, 2023Abdullah UmerNo ratings yet

- Bloomberg Green Markets NTR@CN 2023-01-13Document37 pagesBloomberg Green Markets NTR@CN 2023-01-13Abdullah UmerNo ratings yet

- Bloomberg Green Markets ABUK@EY 2023-03-31Document32 pagesBloomberg Green Markets ABUK@EY 2023-03-31Abdullah UmerNo ratings yet

- OMCs LICENSES BY OGRADocument1 pageOMCs LICENSES BY OGRAAbdullah UmerNo ratings yet

- Company Detailed Report-Pakistan Aluminium Beverage Cans LimitedDocument17 pagesCompany Detailed Report-Pakistan Aluminium Beverage Cans LimitedAbdullah UmerNo ratings yet

- Apple Seeks India Labor Reform in Push To Diversify Beyond China - BloombergDocument3 pagesApple Seeks India Labor Reform in Push To Diversify Beyond China - BloombergAbdullah UmerNo ratings yet

- UBS Got Credit Suisse For Almost Nothing - BloombergDocument17 pagesUBS Got Credit Suisse For Almost Nothing - BloombergAbdullah UmerNo ratings yet

- FERTILIZER REVIEW - Oct-2021Document18 pagesFERTILIZER REVIEW - Oct-2021Abdullah UmerNo ratings yet

- Pakistan FERTILIZER REVIEW - SEPTEMBER-2022Document21 pagesPakistan FERTILIZER REVIEW - SEPTEMBER-2022Abdullah UmerNo ratings yet

- State of Industry Report 2022Document252 pagesState of Industry Report 2022Abdullah UmerNo ratings yet

- 303 Production and Operation Management Ajay PDFDocument10 pages303 Production and Operation Management Ajay PDFAnkita Dash100% (1)

- Return Merchandise Authorization Form: For Office Use OnlyDocument1 pageReturn Merchandise Authorization Form: For Office Use OnlyMastura S Ayed Mosleh100% (1)

- Answer Key PTDocument42 pagesAnswer Key PTMJ ArboledaNo ratings yet

- Internal - External ReportsDocument2 pagesInternal - External ReportsSarahCariagaNo ratings yet

- Final PaperDocument9 pagesFinal PaperSuhardi 1910247902No ratings yet

- The Field of AccountingDocument3 pagesThe Field of AccountingAyu NingsihNo ratings yet

- Business Plan Electrical Shop - PDF - Pricing - Retail - 1634010961447Document21 pagesBusiness Plan Electrical Shop - PDF - Pricing - Retail - 1634010961447Amon100% (1)

- Radiomuseum Grundig Konzertschrank Ks490we Export 456917Document2 pagesRadiomuseum Grundig Konzertschrank Ks490we Export 456917brenodesenneNo ratings yet

- New Product Development Unit 1Document22 pagesNew Product Development Unit 1Vinod MohiteNo ratings yet

- Telephone HandlingDocument7 pagesTelephone HandlingCicatrizeNo ratings yet

- Inventory ManagementDocument4 pagesInventory ManagementHarshill BairariaNo ratings yet

- OSHA Recordkeeping HandbookDocument185 pagesOSHA Recordkeeping HandbookSheyda RB100% (1)

- Customer Satisfaction: A Comparative Study of Public and Private Sector Banks in BangladeshDocument8 pagesCustomer Satisfaction: A Comparative Study of Public and Private Sector Banks in BangladeshKRUPALI RAIYANINo ratings yet

- Project Planning and Development ProcessDocument15 pagesProject Planning and Development Processjoy dungonNo ratings yet

- 55908551177Document3 pages55908551177junaidi 9No ratings yet

- 632dea5fbb6c8 Sample Question Booklet NEO 2022Document59 pages632dea5fbb6c8 Sample Question Booklet NEO 2022HariniNo ratings yet

- Who Are Our Customers and How Do We Serve Them?: The Seven Questions of Marketing StrategyDocument4 pagesWho Are Our Customers and How Do We Serve Them?: The Seven Questions of Marketing StrategyYuvraj KaranNo ratings yet

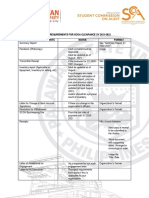

- General Requirements For Scoa Clearance Sy 2021-2022 Documents/Requirements Notes FormatDocument2 pagesGeneral Requirements For Scoa Clearance Sy 2021-2022 Documents/Requirements Notes FormatIan Jayson BaybayNo ratings yet

- EXAMPLE 20.1: Hotel Reservations: Inventory ManagementDocument2 pagesEXAMPLE 20.1: Hotel Reservations: Inventory Managementkael invokerNo ratings yet

- ITIL® 4 Managing Professional TransitionDocument25 pagesITIL® 4 Managing Professional Transitionpolen chheangNo ratings yet

- Case Study 2Document2 pagesCase Study 2hazel chanNo ratings yet

- 8 Corporate Strategy - GrowthDocument62 pages8 Corporate Strategy - GrowthKimberly Antonella Perez RoncalNo ratings yet

- Government Management and Strategic ManagementDocument57 pagesGovernment Management and Strategic ManagementMary Ann GumatayNo ratings yet

- RU SOM PGDM 2020 2022 II Sem PGDM 410 Operation Research Final Exam Question Paper PDFDocument4 pagesRU SOM PGDM 2020 2022 II Sem PGDM 410 Operation Research Final Exam Question Paper PDFKipyegon ErickNo ratings yet

- Work Breakdown StructureDocument6 pagesWork Breakdown Structurerashipare656No ratings yet

- GE Power DigitalDocument12 pagesGE Power DigitalAleksandar PaunoskiNo ratings yet

- Guidelines For The Deploymentdelivery of It Packages Under DCP Fy 2020Document5 pagesGuidelines For The Deploymentdelivery of It Packages Under DCP Fy 2020Boyet CabutihanNo ratings yet

- Goal Atlas Cascade Model of Strategy and Strategy MappingDocument3 pagesGoal Atlas Cascade Model of Strategy and Strategy MappingAbeer AzzyadiNo ratings yet