Professional Documents

Culture Documents

Standard 4c-d Lesson 1 Assignment 4

Standard 4c-d Lesson 1 Assignment 4

Uploaded by

CHANIYA VINSON0 ratings0% found this document useful (0 votes)

17 views1 pageYou were hired for a new job with an annual salary of $_____. According to your first pay stub:

- Your gross monthly pay was $____

- Total deductions for health insurance, taxes, and retirement were $____

- Your net pay or take-home amount for the month was $____

Original Description:

My first paycheck worksheet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentYou were hired for a new job with an annual salary of $_____. According to your first pay stub:

- Your gross monthly pay was $____

- Total deductions for health insurance, taxes, and retirement were $____

- Your net pay or take-home amount for the month was $____

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views1 pageStandard 4c-d Lesson 1 Assignment 4

Standard 4c-d Lesson 1 Assignment 4

Uploaded by

CHANIYA VINSONYou were hired for a new job with an annual salary of $_____. According to your first pay stub:

- Your gross monthly pay was $____

- Total deductions for health insurance, taxes, and retirement were $____

- Your net pay or take-home amount for the month was $____

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

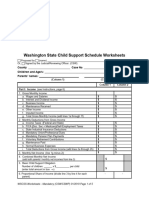

Assignment #4 Standard 4c-d Lesson 1/1 Name: _______________________________

My First Paycheck

1. Select one of the careers you worked with in the previous assignment. Your annual salary at your new

job is $_____________ a year. You are paid once a month.

2. Use the following information to complete the following chart that represents your pay stub.

A. Write your gross monthly pay

B. Your company offers health insurance Question Description Amount

.Single coverage is $50.00 per pay A. Gross Monthly Pay $

period. Married coverage is $150.00 B. Health Insurance $

per pay period.

C. Federal Income Tax $

C. Federal Income Tax is 12.20%

(gross pay X 0.122 = deduction). D. Social Security $

E. Medicare $

D. Social Security Tax is 6.20%

(gross pay x 0.062 = deduction). F. State Income Tax $

E. Medicare Tax is 1.45% G. Retirement $

(gross pay x 0.0145 = deduction) H. TOTAL Deductions $

F. State Income Tax is 3.00% I. Net Pay $

(gross pay x 0.03 = deduction)

G. Retirement is 7.00%

(gross pay x 0.07 = deduction) (NOT a mandatory deduction)

H. Calculate total deductions for the pay period.

I. Compute your net pay by subtracting Total Deductions from Gross Monthly Pay. This is your take-

home pay.

3. Fill out the following paycheck for the amount of your net pay.

Your Employer’s Signature

Assignment #4 Standard 4c-d Lesson 1/1

You might also like

- Payroll Canadian 1st Edition Dryden Test BankDocument38 pagesPayroll Canadian 1st Edition Dryden Test Bankriaozgas3023100% (18)

- Business Math 2nd Quarter Module #2Document34 pagesBusiness Math 2nd Quarter Module #2John Lloyd Regala100% (5)

- Test Bank For Financial Accounting 11th Edition Albrecht DownloadDocument50 pagesTest Bank For Financial Accounting 11th Edition Albrecht Downloadkarenmorrisszqyjrbegn100% (35)

- Pay Stub WorksheetDocument3 pagesPay Stub WorksheetJacob OrrNo ratings yet

- Pay Slip Template CLSURVDocument1 pagePay Slip Template CLSURVArthur Vincent CabatinganNo ratings yet

- Chapter 7 TBDocument25 pagesChapter 7 TBJaasdeepSingh0% (1)

- Budget WsDocument2 pagesBudget Wsapi-376482253No ratings yet

- QuestionDocument29 pagesQuestionMichael Johnson0% (1)

- Business Math - W4 - W5 - Wage EarnersDocument7 pagesBusiness Math - W4 - W5 - Wage Earnerscj100% (4)

- Payroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFDocument37 pagesPayroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFhebexuyenod8q100% (7)

- ABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsDocument9 pagesABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsArchimedes Arvie Garcia100% (1)

- TaxDocument14 pagesTaxXinyi JiangNo ratings yet

- Pearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test BankDocument25 pagesPearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test BankMarkHalldxaj100% (43)

- Pearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test BankDocument36 pagesPearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test Bankresegluerud59d100% (27)

- Fin Exam ADocument14 pagesFin Exam AtahaalkibsiNo ratings yet

- Epp - Exam2 - Spring2023 - MOD 2Document10 pagesEpp - Exam2 - Spring2023 - MOD 2MasaNo ratings yet

- Acct 4220 Additional Review Questions For Final ExamDocument5 pagesAcct 4220 Additional Review Questions For Final ExamrakutenmeeshoNo ratings yet

- FL All Family 131 Financial Declaration - 2016 09 26Document6 pagesFL All Family 131 Financial Declaration - 2016 09 26mom2asherloveNo ratings yet

- Public Finance 9Th Edition Gayer Test Bank Full Chapter PDFDocument28 pagesPublic Finance 9Th Edition Gayer Test Bank Full Chapter PDFmaximusthang6iiz100% (8)

- Getting Paid Math 2.3.9.A1 PDFDocument3 pagesGetting Paid Math 2.3.9.A1 PDFLyndsey BridgersNo ratings yet

- 2011 Sworn Financial StatementDocument7 pages2011 Sworn Financial StatementKendra KoehlerNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- TABL2751 Sample Calculation Questions For Quiz 1Document2 pagesTABL2751 Sample Calculation Questions For Quiz 1Peper12345No ratings yet

- Chapter 10 Review For Test 2023Document6 pagesChapter 10 Review For Test 2023Fausto SosaNo ratings yet

- Mathematical Literacy Grade 12 Term 1 Week 2 - 2021Document11 pagesMathematical Literacy Grade 12 Term 1 Week 2 - 2021saishabhawanipersad3No ratings yet

- TN TLDocument21 pagesTN TL2121013027No ratings yet

- BusinessMath Module5 13-16Document64 pagesBusinessMath Module5 13-16Precious SarcillaNo ratings yet

- Business Mathematics 4TH Quarter Week 3Document4 pagesBusiness Mathematics 4TH Quarter Week 3John Calvin GerolaoNo ratings yet

- Kansas Child Support WorksheetDocument4 pagesKansas Child Support Worksheeth8phv2rcqhNo ratings yet

- Dwnload Full Pearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test Bank PDFDocument20 pagesDwnload Full Pearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test Bank PDFsportfulscenefulzb3nh100% (16)

- Financial Maths - Study Notes 2021Document4 pagesFinancial Maths - Study Notes 2021Samara DiasNo ratings yet

- GDLNDocument2 pagesGDLNKenneth HunterNo ratings yet

- Pay Slip TemplateDocument1 pagePay Slip TemplateJohn Rheymar TamayoNo ratings yet

- Financial Statement: Anne Attorney John DoeDocument11 pagesFinancial Statement: Anne Attorney John DoeBenoitNo ratings yet

- ModuleDocument6 pagesModuleGe Ne VieveNo ratings yet

- FR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Document10 pagesFR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Nah HamzaNo ratings yet

- Pensions Practice QuizDocument10 pagesPensions Practice QuizJyNo ratings yet

- Posttest in Business Mathematics: First Quarter S.Y. 2021 - 2022Document3 pagesPosttest in Business Mathematics: First Quarter S.Y. 2021 - 2022Adrian CatapatNo ratings yet

- Individual Deductions Solutions Manual ProblemsDocument10 pagesIndividual Deductions Solutions Manual ProblemsSarah Marie Layton50% (2)

- Individual Taxation 2013 7th Edition Pratt Test BankDocument21 pagesIndividual Taxation 2013 7th Edition Pratt Test Bankrobertmasononiqrbpcyf100% (16)

- Reading A Paystub Worksheet WsDocument1 pageReading A Paystub Worksheet Wsapi-256439491No ratings yet

- Total-Compensation-Calculator For OA 1-11-24 - 1Document1 pageTotal-Compensation-Calculator For OA 1-11-24 - 1ai.rajmikNo ratings yet

- Gross To Net Pay - 50000Document1 pageGross To Net Pay - 50000api-173610472No ratings yet

- Find The Amount Given ThatDocument8 pagesFind The Amount Given ThatGeorgeAruNo ratings yet

- Quarterly Contribution and Wage Adjustment Form (DE 9ADJ) : Date Requested: April 8, 2021Document2 pagesQuarterly Contribution and Wage Adjustment Form (DE 9ADJ) : Date Requested: April 8, 2021free3gy22c 6 36121No ratings yet

- Waiver of Interest FormsDocument9 pagesWaiver of Interest FormsJordan MillerNo ratings yet

- Module 2 Slides - Employment TaxesDocument30 pagesModule 2 Slides - Employment Taxesjciy4No ratings yet

- Seminar 04 - Task SolutionDocument5 pagesSeminar 04 - Task SolutionJuliana CabreraNo ratings yet

- Fa 4 (BM) 2QDocument4 pagesFa 4 (BM) 2QChristine Joyce LudoviceNo ratings yet

- 1 6 QuizDocument12 pages1 6 Quizdaejina64No ratings yet

- WSCSS - Worksheets2019 01Document5 pagesWSCSS - Worksheets2019 01mom2asherloveNo ratings yet

- Payroll Fundamentals Practice TestDocument10 pagesPayroll Fundamentals Practice Testmohitkashap869No ratings yet

- Individuals Cq3bDocument2 pagesIndividuals Cq3bMohitNo ratings yet

- Pay Slip TemplateDocument1 pagePay Slip TemplateWeslie VillejoNo ratings yet

- Nutes and Bolts of BudgetingDocument33 pagesNutes and Bolts of BudgetingChandra shekharNo ratings yet

- BM-Q2-Quarterly ExamDocument3 pagesBM-Q2-Quarterly ExamJerralyn AlvaNo ratings yet

- Business Mathematics Gross and Net EarningsDocument7 pagesBusiness Mathematics Gross and Net EarningsZeus MalicdemNo ratings yet

- Ch11 WRD25e InstructorDocument72 pagesCh11 WRD25e InstructorFiskal Reguler 15No ratings yet

- Forward Budgeting: A Paperless and Electronic Household Budget SystemFrom EverandForward Budgeting: A Paperless and Electronic Household Budget SystemNo ratings yet