Professional Documents

Culture Documents

Red Flmingo Refund

Red Flmingo Refund

Uploaded by

Rahul SharmaCopyright:

Available Formats

You might also like

- PDF 730748670270723Document1 pagePDF 730748670270723Technical Cell, CoA, Vellayani KAUNo ratings yet

- ACK471398560140723Document1 pageACK471398560140723Dashing ParthiNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BAnamikaNo ratings yet

- Kailash 23 24Document1 pageKailash 23 24ffytgod940No ratings yet

- ACK292417110240623Document1 pageACK292417110240623bpsrik123 reddyNo ratings yet

- ACK565404030200723Document1 pageACK565404030200723Sumit SainiNo ratings yet

- PDF 606688550220723Document1 pagePDF 606688550220723Rishabh GuptaNo ratings yet

- Ranjit 23-24Document1 pageRanjit 23-24Radha SureshNo ratings yet

- ACK311245620280623Document1 pageACK311245620280623KakuNo ratings yet

- Acknowledgement PDF ITR4Document1 pageAcknowledgement PDF ITR4pradhan.khordhaNo ratings yet

- GSTR3B 07aasfb3116c1zs 012023Document4 pagesGSTR3B 07aasfb3116c1zs 012023VIKRAMJEET SINGHNo ratings yet

- Manjot Singh ITR 2023Document1 pageManjot Singh ITR 2023parwindersingh9066No ratings yet

- PDF 154521810310723Document1 pagePDF 154521810310723MUNPL HRNo ratings yet

- 829785700290723-Manoj BakshDocument1 page829785700290723-Manoj BakshArchana BakshNo ratings yet

- Ratnapal Dadarao Wasnik Itr 22-23Document1 pageRatnapal Dadarao Wasnik Itr 22-23tax advisorNo ratings yet

- Ack23 24eDocument1 pageAck23 24emanishgoyani225No ratings yet

- ACK307406671260923Document1 pageACK307406671260923jdas7061No ratings yet

- GSTR3B 07aasfb3116c1zs 032023Document4 pagesGSTR3B 07aasfb3116c1zs 032023VIKRAMJEET SINGHNo ratings yet

- PDF 472850270150723Document1 pagePDF 472850270150723Pijush SinhaNo ratings yet

- PDF 604326750311223Document1 pagePDF 604326750311223bghosh00112233No ratings yet

- PDF 615803240220723Document1 pagePDF 615803240220723mohammadgausraza229No ratings yet

- ACK121410260310723Document1 pageACK121410260310723Krishana RanaNo ratings yet

- Nishar ItrDocument1 pageNishar ItrE-Ticket 40 RTNo ratings yet

- PDF 713440460260723Document1 pagePDF 713440460260723Siddhant SinghaniaNo ratings yet

- Itr VDocument1 pageItr VArchana DeyNo ratings yet

- PDF 140177240270722-1Document1 pagePDF 140177240270722-1Rahul RampalNo ratings yet

- PDF 472218730150723Document1 pagePDF 472218730150723pankajNo ratings yet

- PDF 791882560280723Document1 pagePDF 791882560280723akshithreddy101No ratings yet

- PDF 596320240210723Document1 pagePDF 596320240210723Deepika SNo ratings yet

- GSTR3B 07aasfb3116c1zs 052023Document4 pagesGSTR3B 07aasfb3116c1zs 052023VIKRAMJEET SINGHNo ratings yet

- PDF 732787000270723Document1 pagePDF 732787000270723ankit singhNo ratings yet

- ACK561746320200723Document1 pageACK561746320200723seetharamn90No ratings yet

- 2020-21 ItDocument95 pages2020-21 Itsriharidhana.financialservicesNo ratings yet

- GSTR3B - 22-23 FebruaryDocument4 pagesGSTR3B - 22-23 FebruaryLogesh Waran KmlNo ratings yet

- Itr Kumud 2223Document1 pageItr Kumud 2223zilliontravels2022No ratings yet

- ACK145529740310723Document1 pageACK145529740310723rk512811No ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BAnamikaNo ratings yet

- Harcharan Singh 2023-2024Document1 pageHarcharan Singh 2023-2024thinkpadt480tNo ratings yet

- Bhumika ItrDocument1 pageBhumika ItrbahrawatfpoNo ratings yet

- ACK250797860170623Document1 pageACK250797860170623Moon KnightNo ratings yet

- Hardeep Singh ITR 2023Document1 pageHardeep Singh ITR 2023parwindersingh9066No ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- PDF 614708330220723Document1 pagePDF 614708330220723BhupenderNo ratings yet

- ACK122475750310723Document1 pageACK122475750310723GAURAV AGARWALNo ratings yet

- Ack 527247960180723Document1 pageAck 527247960180723Aman AroraNo ratings yet

- Ack Fnups3286n 2022-23 338831280310722Document1 pageAck Fnups3286n 2022-23 338831280310722Sumit SainiNo ratings yet

- PDF 103085610250722Document1 pagePDF 103085610250722Sam SargeNo ratings yet

- PDF 119002240310723Document1 pagePDF 119002240310723srinivasarao achallaNo ratings yet

- ACK721265490260723Document1 pageACK721265490260723Chirantan BanerjeeNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BRidhimaNo ratings yet

- GSTR3B 29aaifa3562d1zl 022020Document3 pagesGSTR3B 29aaifa3562d1zl 022020HEMANTH kumarNo ratings yet

- PDF 390099030080723Document1 pagePDF 390099030080723Arun Kumar SinhaNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAfsar AliNo ratings yet

- ACK576076730200723Document1 pageACK576076730200723Sourav MohapatraNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:738268150270723 Date of Filing: 27-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:738268150270723 Date of Filing: 27-Jul-2023ramsurat9354285355No ratings yet

- PDF 823957150150722Document1 pagePDF 823957150150722Niteesh HegdeNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:569224350200723 Date of Filing: 20-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:569224350200723 Date of Filing: 20-Jul-2023tdsbolluNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BPatel SumitNo ratings yet

- A.Y 2021 2022 ReceiptDocument1 pageA.Y 2021 2022 ReceiptAman BishtNo ratings yet

- GSTR1 - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document1 pageGSTR1 - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR1 - 08bhupa6318m2zt - 062022 April To June 2022Document4 pagesGSTR1 - 08bhupa6318m2zt - 062022 April To June 2022Rahul SharmaNo ratings yet

- GSTR1 - 08bhupa6318m2zt - 092022 July To Sep 2022Document4 pagesGSTR1 - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Rahul SharmaNo ratings yet

- Form GST REG-06: (Amended)Document3 pagesForm GST REG-06: (Amended)Rahul SharmaNo ratings yet

- UntitledDocument2 pagesUntitledRahul SharmaNo ratings yet

Red Flmingo Refund

Red Flmingo Refund

Uploaded by

Rahul SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Red Flmingo Refund

Red Flmingo Refund

Uploaded by

Rahul SharmaCopyright:

Available Formats

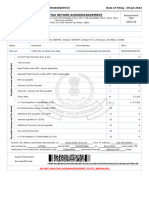

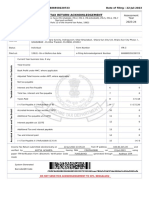

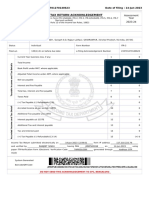

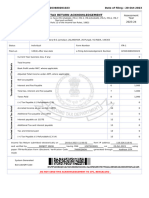

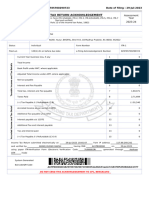

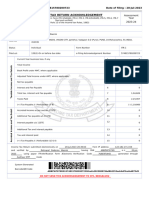

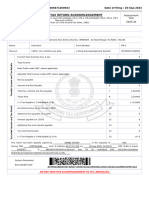

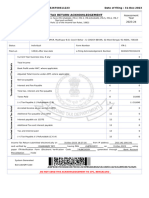

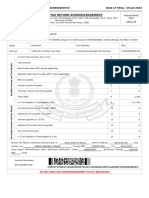

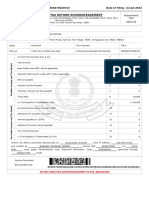

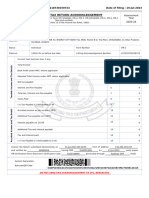

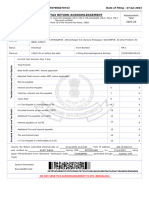

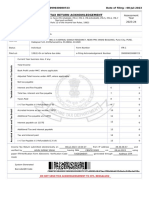

FORM-GST-RFD-01

T

[See rule 89(1)]

Application for Refund

Taxpayer Details

1. GSTIN/Temp ID 08HOFPK0233B1ZF

F

2. Legal Name KAUSHLESH

3. Trade name Red Flamingo

4. Type of Taxpayer Regular

5. Ground of refund claim Refund of Excess Balance in Electronic Cash Ledger

6. ARN -

A

Refund Amount Details

Balance Available in Cash Ledger (in INR)

Tax Interest Penalty Fee Others

Integrated Tax 14271 0 0 0 0

Central Tax 238 0 0 0 0

R

State/UT Tax 238 0 0 0 0

Cess 0 0 0 0 0

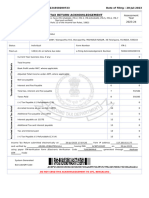

Refund Claimed (in INR)

Tax Interest Penalty Fee Others Total

Integrated Tax 14270 0 0 0 0 14270

Central Tax 0 0 0 0 0 0

State/UT Tax 0 0 0 0 0 0

Cess 0 0 0 0 0 0

Total 14270 0 0 0 0 14270

Note: Please note that the recoverable dues shall be deducted by the Proper Officer, from the refund amount claimed, while processing the

T

refund.

Details of Bank account selected in RFD-01 (Original)

S.No. Particulars Details

i Bank Account Number 361405500457

F

ii Name of the Bank ICICI BANK LIMITED

iii Branch F-300 NEW SANGANER ROAD SHYAM

ROAD JAIPUR PINCODE-302019

iv IFSC icic0003614

A

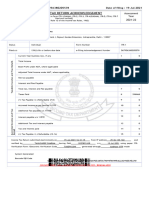

Supporting Documents :

No Supporting documents found.

You might also like

- PDF 730748670270723Document1 pagePDF 730748670270723Technical Cell, CoA, Vellayani KAUNo ratings yet

- ACK471398560140723Document1 pageACK471398560140723Dashing ParthiNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BAnamikaNo ratings yet

- Kailash 23 24Document1 pageKailash 23 24ffytgod940No ratings yet

- ACK292417110240623Document1 pageACK292417110240623bpsrik123 reddyNo ratings yet

- ACK565404030200723Document1 pageACK565404030200723Sumit SainiNo ratings yet

- PDF 606688550220723Document1 pagePDF 606688550220723Rishabh GuptaNo ratings yet

- Ranjit 23-24Document1 pageRanjit 23-24Radha SureshNo ratings yet

- ACK311245620280623Document1 pageACK311245620280623KakuNo ratings yet

- Acknowledgement PDF ITR4Document1 pageAcknowledgement PDF ITR4pradhan.khordhaNo ratings yet

- GSTR3B 07aasfb3116c1zs 012023Document4 pagesGSTR3B 07aasfb3116c1zs 012023VIKRAMJEET SINGHNo ratings yet

- Manjot Singh ITR 2023Document1 pageManjot Singh ITR 2023parwindersingh9066No ratings yet

- PDF 154521810310723Document1 pagePDF 154521810310723MUNPL HRNo ratings yet

- 829785700290723-Manoj BakshDocument1 page829785700290723-Manoj BakshArchana BakshNo ratings yet

- Ratnapal Dadarao Wasnik Itr 22-23Document1 pageRatnapal Dadarao Wasnik Itr 22-23tax advisorNo ratings yet

- Ack23 24eDocument1 pageAck23 24emanishgoyani225No ratings yet

- ACK307406671260923Document1 pageACK307406671260923jdas7061No ratings yet

- GSTR3B 07aasfb3116c1zs 032023Document4 pagesGSTR3B 07aasfb3116c1zs 032023VIKRAMJEET SINGHNo ratings yet

- PDF 472850270150723Document1 pagePDF 472850270150723Pijush SinhaNo ratings yet

- PDF 604326750311223Document1 pagePDF 604326750311223bghosh00112233No ratings yet

- PDF 615803240220723Document1 pagePDF 615803240220723mohammadgausraza229No ratings yet

- ACK121410260310723Document1 pageACK121410260310723Krishana RanaNo ratings yet

- Nishar ItrDocument1 pageNishar ItrE-Ticket 40 RTNo ratings yet

- PDF 713440460260723Document1 pagePDF 713440460260723Siddhant SinghaniaNo ratings yet

- Itr VDocument1 pageItr VArchana DeyNo ratings yet

- PDF 140177240270722-1Document1 pagePDF 140177240270722-1Rahul RampalNo ratings yet

- PDF 472218730150723Document1 pagePDF 472218730150723pankajNo ratings yet

- PDF 791882560280723Document1 pagePDF 791882560280723akshithreddy101No ratings yet

- PDF 596320240210723Document1 pagePDF 596320240210723Deepika SNo ratings yet

- GSTR3B 07aasfb3116c1zs 052023Document4 pagesGSTR3B 07aasfb3116c1zs 052023VIKRAMJEET SINGHNo ratings yet

- PDF 732787000270723Document1 pagePDF 732787000270723ankit singhNo ratings yet

- ACK561746320200723Document1 pageACK561746320200723seetharamn90No ratings yet

- 2020-21 ItDocument95 pages2020-21 Itsriharidhana.financialservicesNo ratings yet

- GSTR3B - 22-23 FebruaryDocument4 pagesGSTR3B - 22-23 FebruaryLogesh Waran KmlNo ratings yet

- Itr Kumud 2223Document1 pageItr Kumud 2223zilliontravels2022No ratings yet

- ACK145529740310723Document1 pageACK145529740310723rk512811No ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BAnamikaNo ratings yet

- Harcharan Singh 2023-2024Document1 pageHarcharan Singh 2023-2024thinkpadt480tNo ratings yet

- Bhumika ItrDocument1 pageBhumika ItrbahrawatfpoNo ratings yet

- ACK250797860170623Document1 pageACK250797860170623Moon KnightNo ratings yet

- Hardeep Singh ITR 2023Document1 pageHardeep Singh ITR 2023parwindersingh9066No ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- PDF 614708330220723Document1 pagePDF 614708330220723BhupenderNo ratings yet

- ACK122475750310723Document1 pageACK122475750310723GAURAV AGARWALNo ratings yet

- Ack 527247960180723Document1 pageAck 527247960180723Aman AroraNo ratings yet

- Ack Fnups3286n 2022-23 338831280310722Document1 pageAck Fnups3286n 2022-23 338831280310722Sumit SainiNo ratings yet

- PDF 103085610250722Document1 pagePDF 103085610250722Sam SargeNo ratings yet

- PDF 119002240310723Document1 pagePDF 119002240310723srinivasarao achallaNo ratings yet

- ACK721265490260723Document1 pageACK721265490260723Chirantan BanerjeeNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BRidhimaNo ratings yet

- GSTR3B 29aaifa3562d1zl 022020Document3 pagesGSTR3B 29aaifa3562d1zl 022020HEMANTH kumarNo ratings yet

- PDF 390099030080723Document1 pagePDF 390099030080723Arun Kumar SinhaNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAfsar AliNo ratings yet

- ACK576076730200723Document1 pageACK576076730200723Sourav MohapatraNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:738268150270723 Date of Filing: 27-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:738268150270723 Date of Filing: 27-Jul-2023ramsurat9354285355No ratings yet

- PDF 823957150150722Document1 pagePDF 823957150150722Niteesh HegdeNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:569224350200723 Date of Filing: 20-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:569224350200723 Date of Filing: 20-Jul-2023tdsbolluNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BPatel SumitNo ratings yet

- A.Y 2021 2022 ReceiptDocument1 pageA.Y 2021 2022 ReceiptAman BishtNo ratings yet

- GSTR1 - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document1 pageGSTR1 - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR1 - 08bhupa6318m2zt - 062022 April To June 2022Document4 pagesGSTR1 - 08bhupa6318m2zt - 062022 April To June 2022Rahul SharmaNo ratings yet

- GSTR1 - 08bhupa6318m2zt - 092022 July To Sep 2022Document4 pagesGSTR1 - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 062022 April To June 2022Rahul SharmaNo ratings yet

- Form GST REG-06: (Amended)Document3 pagesForm GST REG-06: (Amended)Rahul SharmaNo ratings yet

- UntitledDocument2 pagesUntitledRahul SharmaNo ratings yet