Professional Documents

Culture Documents

Get Letter

Get Letter

Uploaded by

MACPRAISE HOLDINGSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Get Letter

Get Letter

Uploaded by

MACPRAISE HOLDINGSCopyright:

Available Formats

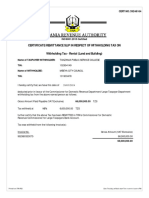

VALUE-ADDED TAX

Verification of Value-Added Tax Declaration

(VAT201)

Issue Date: 05/04/2023

Tax Period: 202303

Case No: 456923163

HUPIC COURIER Registration Number: 4280294853

PO BOX 3005

LETABA

0870

South African Revenue Service

SARS 0800 00 SARS (7277)

Alberton www.sars.gov.za

1528

Dear Taxpayer

VERIFICATION OF VALUE-ADDED TAX DECLARATION (VAT201)

The South African Revenue Service (SARS) thanks you for submitting your VAT201 declaration for the 202303 tax period.

Please note that, in terms of the Tax Administration Act, your VAT201 declaration has been identified for verification as a result of variances detected in

this submission.

Please review your VAT201 declaration against your relevant Value-Added Tax (VAT) calculations and relevant material. If you find any errors, correct

them by submitting a request for correction.

If you cannot find any errors pertaining to the VAT201 declaration, you are required to submit the following relevant material:

The output tax schedule, input tax schedule, all documents relating to capital expenditure claimed (if applicable), and other transactional documents that

would for example, substantiate any increase/decrease in sales, inventory, change in use adjustment or bad debts.

Please ensure that you enclose this original letter when submitting your relevant material, as it contains a unique bar-coded reference which links it to

your VAT account with SARS. A photocopy of this letter will not be accepted by SARS. You may however make a copy of this letter for your records.

Note that SARS only accepts relevant material in A4 format.

Relevant material can be submitted through the following channels:

- At your nearest SARS branch

- By post to the address above

- Electronically via eFiling

Note that you have 21 days from the date of this letter to comply in order to enable SARS to finalise the verification.

It is a criminal offence to wilfully and without just cause fail to provide the relevant material.

Should you have any queries please call the SARS Contact Centre on 0800 00 SARS(7277). Remember to have your registration number at hand when

you call to enable us to assist you promptly.

Sincerely

ISSUED ON BEHALF OF THE COMMISSIONER FOR THE SOUTH AFRICAN REVENUE SERVICE

Registration

4280294853 Form ID: RFDDEC

Number:

Tax Period: 202303 Time Stamp: 20230405

Case No: 456923163 Page of Page: 01/00

Content Version: v0.1.0 Template Version: v0.8.0

You might also like

- TABLE-SPECIAL CIVIL ACTIONS - And-Special-RulesDocument42 pagesTABLE-SPECIAL CIVIL ACTIONS - And-Special-RulesErikha AranetaNo ratings yet

- Biak Na Bato AssDocument5 pagesBiak Na Bato AssAngelica Malacay Revil100% (1)

- Get LetterDocument1 pageGet LetterSephiwe MafilikaNo ratings yet

- INPUT VAT PERIOD November-23Document9 pagesINPUT VAT PERIOD November-23Sephiwe MafilikaNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper Reportnattyman48No ratings yet

- notaDocument1 pagenotavanderamorethNo ratings yet

- 1croso: Order Details Billing SummaryDocument2 pages1croso: Order Details Billing Summarywaleed alkharashiNo ratings yet

- UAE Federal Tax Authority Nov 2023Document1 pageUAE Federal Tax Authority Nov 2023seasonalexportpkNo ratings yet

- Federal Tax AuthorityDocument1 pageFederal Tax AuthoritySatyanarayana BalusaNo ratings yet

- Statement 30042024 15213963Document3 pagesStatement 30042024 15213963modestushaik22No ratings yet

- April 2024 IncomeDocument1 pageApril 2024 IncomeabebechNo ratings yet

- 2024 EdDocument10 pages2024 EdJosé Andrés Concepción TorresNo ratings yet

- SDFDFDocument3 pagesSDFDFAleko IosavaNo ratings yet

- March Report TotDocument1 pageMarch Report Totgetayawokal wendosenNo ratings yet

- Megabit Incon Tax 2016Document1 pageMegabit Incon Tax 2016abebechNo ratings yet

- E0800QH6BHDocument2 pagesE0800QH6BHJonathas Montenegro PitaNo ratings yet

- Bir Form 2307g JNJ Online ShopDocument5 pagesBir Form 2307g JNJ Online ShopReagan RodriguezNo ratings yet

- Session 5Document19 pagesSession 5youssef.oubenaliNo ratings yet

- RSRM RiorexDocument2 pagesRSRM RiorexjwmemojstatNo ratings yet

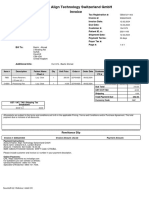

- Align Technology Switzerland GMBH InvoiceDocument1 pageAlign Technology Switzerland GMBH InvoicehamadachampNo ratings yet

- Quotation: Mercantile Produce Brokers (PVT) LTDDocument3 pagesQuotation: Mercantile Produce Brokers (PVT) LTDTharindu gangenathNo ratings yet

- Bill L 1h0032041804574000001afx-000 21013415 26984831 2024 04 18Document2 pagesBill L 1h0032041804574000001afx-000 21013415 26984831 2024 04 18Naveen RNo ratings yet

- Koharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadDocument4 pagesKoharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadBasit RiazNo ratings yet

- Federal Tax AuthorityDocument1 pageFederal Tax Authorityumar.arshad.caNo ratings yet

- Declaration 4230135146936Document4 pagesDeclaration 4230135146936quick PakNo ratings yet

- Factura Vtex Abril 2021Document1 pageFactura Vtex Abril 2021Rayssita espinozaNo ratings yet

- C9714 Assessment NoticeDocument1 pageC9714 Assessment NoticeCharles MakozaNo ratings yet

- ReportDocument1 pageReportflown jeremiahNo ratings yet

- Salesforce Invoice 29376201Document2 pagesSalesforce Invoice 29376201Tino MarcosNo ratings yet

- Tax Code and Period CodeDocument1 pageTax Code and Period CodeThiruNo ratings yet

- CFHDocument1 pageCFHAbhishek SinghNo ratings yet

- Tax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalDocument1 pageTax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web Portalmawamajid2No ratings yet

- Get LetterDocument1 pageGet LettermajortradingzNo ratings yet

- E0800RM4SXDocument2 pagesE0800RM4SXJonathas Montenegro PitaNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportElias Abubeker AhmedNo ratings yet

- Subject Matter: Overview Theory and Basis of TaxationDocument10 pagesSubject Matter: Overview Theory and Basis of TaxationKathNo ratings yet

- E0800R8FKBDocument2 pagesE0800R8FKBJonathas Montenegro PitaNo ratings yet

- VerkoopFactuur SI200268 PDFDocument1 pageVerkoopFactuur SI200268 PDFMohd NazriNo ratings yet

- New Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaDocument1 pageNew Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaKalkidan NigussieNo ratings yet

- L& C 1604E 2023 Form AmendedV3Document2 pagesL& C 1604E 2023 Form AmendedV3fitnessarmy2021No ratings yet

- ReadyStanbic Bank Statement 01072023 31072023 01XXXXXXX8659 2888b3Document1 pageReadyStanbic Bank Statement 01072023 31072023 01XXXXXXX8659 2888b3Pide TanzaniaNo ratings yet

- 2307 WestmontDocument2 pages2307 WestmontMarie Francisco100% (1)

- ASHI RETURNDocument4 pagesASHI RETURNTOUSEEF AHMADNo ratings yet

- 2023 Itr PravinvallikaduDocument18 pages2023 Itr PravinvallikadudennisNo ratings yet

- BILL-138 IVF AMCbill Q-1Document1 pageBILL-138 IVF AMCbill Q-1PankajSharmaNo ratings yet

- FebruaryDocument2 pagesFebruaryMarie TaylaranNo ratings yet

- In2403 0007Document1 pageIn2403 0007seiyfuNo ratings yet

- So2403 0003Document1 pageSo2403 0003seiyfuNo ratings yet

- Income Tax AssessmentDocument3 pagesIncome Tax Assessmentkailong wangNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportZelalem RegasaNo ratings yet

- Muna Noor - OCEC Payment Plan InvoiceDocument1 pageMuna Noor - OCEC Payment Plan InvoiceMaryamsam SamNo ratings yet

- Itemized FINV02553268-2006A 14591571 20200704 2320771 PDFDocument1 pageItemized FINV02553268-2006A 14591571 20200704 2320771 PDFAkshay AKNo ratings yet

- Grand Total Premium: 5,638.00 Commission: 422.85Document1 pageGrand Total Premium: 5,638.00 Commission: 422.85MSONI97No ratings yet

- Acc StatementDocument1 pageAcc Statementakhilesh kumarNo ratings yet

- HOUSE NO. B-18/1208 GALI/MOHALLAH 6, Ferozabad Munawar Hussian ButtDocument2 pagesHOUSE NO. B-18/1208 GALI/MOHALLAH 6, Ferozabad Munawar Hussian ButtMujahid iqbalNo ratings yet

- Account StatementDocument1 pageAccount StatementMmangaliso FodoNo ratings yet

- Scan0014 Statement Merged 044301Document3 pagesScan0014 Statement Merged 044301khosantlakusaNo ratings yet

- Et Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408Document2 pagesEt Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408EstherNo ratings yet

- Launch Jasper ReportDocument1 pageLaunch Jasper ReportZelalem RegasaNo ratings yet

- E0800QUKTLDocument2 pagesE0800QUKTLJonathas Montenegro PitaNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceStuti PandeyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

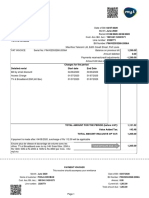

- Eurahel TCSDocument1 pageEurahel TCSMACPRAISE HOLDINGSNo ratings yet

- TapScanner 04-03-2023-13 51Document1 pageTapScanner 04-03-2023-13 51MACPRAISE HOLDINGSNo ratings yet

- CoR 14.3 - 60000015030Document1 pageCoR 14.3 - 60000015030MACPRAISE HOLDINGSNo ratings yet

- COR39Document1 pageCOR39MACPRAISE HOLDINGSNo ratings yet

- Mojaka SteelworkDocument3 pagesMojaka SteelworkMACPRAISE HOLDINGSNo ratings yet

- Eyabo TCS 2023Document1 pageEyabo TCS 2023MACPRAISE HOLDINGSNo ratings yet

- Cor14 1Document1 pageCor14 1MACPRAISE HOLDINGSNo ratings yet

- ApprovedName 60000015029Document1 pageApprovedName 60000015029MACPRAISE HOLDINGSNo ratings yet

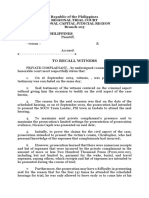

- GR No. 107518, PNOC Shipping & Transport Corp Vs CADocument12 pagesGR No. 107518, PNOC Shipping & Transport Corp Vs CALeopoldo, Jr. BlancoNo ratings yet

- Lantin Vs LantionDocument2 pagesLantin Vs LantionPhilipBrentMorales-MartirezCariagaNo ratings yet

- Republic V DayotDocument1 pageRepublic V DayotDon SalamidaaNo ratings yet

- 099-Vassar Industries Employees Union v. Estrella G.R. No. L-46562 March 31, 1978Document4 pages099-Vassar Industries Employees Union v. Estrella G.R. No. L-46562 March 31, 1978Jopan SJNo ratings yet

- People Vs Labado 98, SCRA 730Document11 pagesPeople Vs Labado 98, SCRA 730Earleen Del Rosario100% (1)

- G.R. No. 140128 Arnold P. Mollaneda vs. Leonida C. UmacobDocument2 pagesG.R. No. 140128 Arnold P. Mollaneda vs. Leonida C. UmacobKathlyn Dacudao100% (1)

- 08-05-16 Hogan Motion For Sanctions With Exhibits OCRDocument49 pages08-05-16 Hogan Motion For Sanctions With Exhibits OCRLaw&Crime100% (1)

- 37th GST Council Meet Final Press Release GSTPW 20092019Document2 pages37th GST Council Meet Final Press Release GSTPW 20092019AVASTNo ratings yet

- Goco vs. PeopleDocument8 pagesGoco vs. PeopleDawn Jessa GoNo ratings yet

- Aaron Wilkerson News Dateline 5-26Document2 pagesAaron Wilkerson News Dateline 5-26DTeacher TuelNo ratings yet

- SpecPro Final Case CompilationDocument195 pagesSpecPro Final Case CompilationRobert MantoNo ratings yet

- CPIC Consent Form September 2017 Fillable - English PDFDocument2 pagesCPIC Consent Form September 2017 Fillable - English PDFLISA VOLPENo ratings yet

- Jurisdiction of Philippine CourtsDocument5 pagesJurisdiction of Philippine CourtsKimiko Nishi HideyoshiNo ratings yet

- Interpretation of StatutesDocument29 pagesInterpretation of StatutesarunNo ratings yet

- The Philippine Budget CycleDocument6 pagesThe Philippine Budget Cycleaige mascodNo ratings yet

- Crimes Against The Fundamental Laws of The StateDocument4 pagesCrimes Against The Fundamental Laws of The StateMarielle Caralipio100% (3)

- Republic of The Philippines Regional Trial Court National Capital Judicial Region Branch 105 People of The PhilippinesDocument2 pagesRepublic of The Philippines Regional Trial Court National Capital Judicial Region Branch 105 People of The PhilippinesPao BrillsNo ratings yet

- 123 VICTORIANO vs. ELIZALDE ROPE WORKERS' UNIONDocument4 pages123 VICTORIANO vs. ELIZALDE ROPE WORKERS' UNIONrobbyNo ratings yet

- Fedcon Policy NotesDocument19 pagesFedcon Policy NotesjuneoNo ratings yet

- Duncan Ninth Circuit Opening Brief by State of CaliforniaDocument81 pagesDuncan Ninth Circuit Opening Brief by State of Californiawolf woodNo ratings yet

- ISABELITA REODICA Vs COURT OF APPEALS and PEOPLE OF THE PHILIPPINESDocument6 pagesISABELITA REODICA Vs COURT OF APPEALS and PEOPLE OF THE PHILIPPINESAnthonyNo ratings yet

- Assignment 1 Law507Document10 pagesAssignment 1 Law507NUR HIDAYAH AZIHNo ratings yet

- Not PrecedentialDocument7 pagesNot PrecedentialScribd Government DocsNo ratings yet

- Catedrilla v. LauronDocument2 pagesCatedrilla v. LauronChristian Roque100% (1)

- Uypitching v. QuiamcoDocument3 pagesUypitching v. QuiamcoNJ Geerts100% (1)

- Bureau of Customs Employees Association v. Teves G.R. No. 181704Document21 pagesBureau of Customs Employees Association v. Teves G.R. No. 181704Marlene Tongson0% (1)

- CommentOpposition DRUGSDocument2 pagesCommentOpposition DRUGSheart leroNo ratings yet

- Mueller Motion To Exclude TestimonyDocument7 pagesMueller Motion To Exclude TestimonyTHROnlineNo ratings yet