Professional Documents

Culture Documents

FIN448-Final-Exam-Fall2020-Review - MC

FIN448-Final-Exam-Fall2020-Review - MC

Uploaded by

May ChenCopyright:

Available Formats

You might also like

- Chapter 05 Test BankDocument73 pagesChapter 05 Test BankBrandon LeeNo ratings yet

- Dwnload Full Financial Management Core Concepts 4th Edition Brooks Solutions Manual PDFDocument35 pagesDwnload Full Financial Management Core Concepts 4th Edition Brooks Solutions Manual PDFbenboydr8pl100% (15)

- Finaincial Assign 2Document20 pagesFinaincial Assign 2Vaishnav SinghNo ratings yet

- Methods of Payment in International TradeDocument18 pagesMethods of Payment in International Tradeshravan.bhumkar100% (1)

- IntroductionDocument23 pagesIntroductionManika MahajanNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingSheena SoporiNo ratings yet

- Chapter 12Document11 pagesChapter 12Tiger HồNo ratings yet

- Cat FFM S21Document111 pagesCat FFM S21gene houNo ratings yet

- Money Banking FinanceDocument30 pagesMoney Banking Financevitaminlj7No ratings yet

- Capital Budgeting TutorialDocument26 pagesCapital Budgeting Tutorialf20221182No ratings yet

- FM Intro and Financing Capital BudetingDocument54 pagesFM Intro and Financing Capital BudetingMusangabu EarnestNo ratings yet

- Startup Valuation Guide: September 2018Document42 pagesStartup Valuation Guide: September 2018adsadNo ratings yet

- Introduction & Course Overview: Financial ManagementDocument23 pagesIntroduction & Course Overview: Financial ManagementRobin GhotiaNo ratings yet

- Making Capital Investment Decision: Topics CoveredDocument9 pagesMaking Capital Investment Decision: Topics Coveredsirkoywayo6628No ratings yet

- FIN5203 Midterm Exam 2 FL22 ReviewDocument46 pagesFIN5203 Midterm Exam 2 FL22 Reviewmerly chermonNo ratings yet

- Class 9Document25 pagesClass 9Ritesh SinghNo ratings yet

- 15.415x Foundations of Modern Finance: Lecture 1: IntroductionDocument37 pages15.415x Foundations of Modern Finance: Lecture 1: IntroductionyibungoNo ratings yet

- Financing Planning Lec 1Document72 pagesFinancing Planning Lec 1PrinceNo ratings yet

- Handout Fin Man 2307Document6 pagesHandout Fin Man 2307Renz NgohoNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingvitallifeskincareNo ratings yet

- 2019 UOL CF Notes Topic 1Document45 pages2019 UOL CF Notes Topic 1Jiang JinNo ratings yet

- Fin 202 Topic 3Document12 pagesFin 202 Topic 3Jia Wei ChanNo ratings yet

- Ca Final SFM Capital Budgeting Summary (Old Course)Document21 pagesCa Final SFM Capital Budgeting Summary (Old Course)swati mishraNo ratings yet

- ADocument89 pagesAJohn Carlo O. BallaresNo ratings yet

- Financial Training - F2Document29 pagesFinancial Training - F2Swan ye ThutaNo ratings yet

- Financial ManagementDocument70 pagesFinancial Managementrachit guptaNo ratings yet

- Slide CfaDocument295 pagesSlide CfaLinh HoangNo ratings yet

- Chapter 6Document16 pagesChapter 6manthq21404caNo ratings yet

- FM - 1 To 3Document169 pagesFM - 1 To 3FCA Zaid Travel VlogsNo ratings yet

- Chapter2 Without BlanksDocument45 pagesChapter2 Without BlanksMalimveNo ratings yet

- Corporate Finance - Lesson 1Document15 pagesCorporate Finance - Lesson 1Ajay AjayNo ratings yet

- Stonehill College BUS320-4aDocument23 pagesStonehill College BUS320-4asuck my cuntNo ratings yet

- 8-Capital BudgetingDocument89 pages8-Capital BudgetingJohn Francis IdananNo ratings yet

- Pln-Cmams - MERGER AND ACQUISITION PART 2Document31 pagesPln-Cmams - MERGER AND ACQUISITION PART 2dwi suhartantoNo ratings yet

- 2020week 3b ch8 and 9Document42 pages2020week 3b ch8 and 9Cecile KotzeNo ratings yet

- Financial Management PPT Pgdm2010 2Document94 pagesFinancial Management PPT Pgdm2010 2Bettappa patilNo ratings yet

- 125 FdocDocument11 pages125 Fdocsunkist0091No ratings yet

- LectureDocument23 pagesLectureAshish MalhotraNo ratings yet

- Financial Project PlanningDocument34 pagesFinancial Project PlanningRiccardo PappalardoNo ratings yet

- Capital Budgeting: An Investment Decision MethodDocument22 pagesCapital Budgeting: An Investment Decision MethodDhanush GowravNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- AFM - Investment Appraisal - AE - Week 1Document57 pagesAFM - Investment Appraisal - AE - Week 1AwaiZ zahidNo ratings yet

- Slides - Session 5Document49 pagesSlides - Session 5Murte BolaNo ratings yet

- Unit 10Document20 pagesUnit 10sheetal gudseNo ratings yet

- FMCF-unit 1Document57 pagesFMCF-unit 1shagun.2224mba1003No ratings yet

- AE 24 Module 2 Capital Investment AnalysisDocument12 pagesAE 24 Module 2 Capital Investment AnalysisShamae Duma-anNo ratings yet

- Valuation-Income ApproachDocument38 pagesValuation-Income Approachhart kevinNo ratings yet

- Cash Flow With SolutionsDocument80 pagesCash Flow With SolutionsPhebieon MukwenhaNo ratings yet

- Meet 13 - CB COC 0 Cash FlowDocument28 pagesMeet 13 - CB COC 0 Cash FlowKeith YohanesNo ratings yet

- Rps Bahan Ajar 9Document62 pagesRps Bahan Ajar 9GundamSeedNo ratings yet

- Capital Budgeting DecisionsDocument88 pagesCapital Budgeting DecisionsSpidey ModeNo ratings yet

- ch10 - The Basics of Capital BudgetingDocument14 pagesch10 - The Basics of Capital Budgetinganower.hosen61No ratings yet

- Week 4Document73 pagesWeek 4kaikuNo ratings yet

- 5a Unit 2.1 Topic 2.3.3 CashflowsDocument16 pages5a Unit 2.1 Topic 2.3.3 Cashflowssylviekasembe4No ratings yet

- Review SessionDocument25 pagesReview SessionK60 Bùi Phương AnhNo ratings yet

- CoFin - Lecture 4Document51 pagesCoFin - Lecture 4Elliot IseliNo ratings yet

- Chapter 2-Financial Statement AnalysisDocument25 pagesChapter 2-Financial Statement AnalysisNguyen Ha PhuongNo ratings yet

- Module 2Document9 pagesModule 2vinitaggarwal08072002No ratings yet

- Valuation For Investment BankingDocument27 pagesValuation For Investment BankingK RameshNo ratings yet

- Unit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDocument18 pagesUnit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDIVYA PRASOONA CNo ratings yet

- FInMan Chapter 1Document4 pagesFInMan Chapter 1foracademicfiles.01No ratings yet

- Chapter 6 - Investment Decisions - Capital BudgetingDocument21 pagesChapter 6 - Investment Decisions - Capital BudgetingYasir ShaikhNo ratings yet

- FIN448 Practice Final Exam Fall2020 SolutionDocument14 pagesFIN448 Practice Final Exam Fall2020 SolutionMay ChenNo ratings yet

- Fin 448 Final PracticeDocument2 pagesFin 448 Final PracticeMay ChenNo ratings yet

- Fin 448 FinalDocument4 pagesFin 448 FinalMay ChenNo ratings yet

- Practice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementDocument12 pagesPractice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementMay ChenNo ratings yet

- Maths Mania # 053: DIRECTIONS: For The Following Questions, Four Options Are Given. Choose The Correct OptionDocument3 pagesMaths Mania # 053: DIRECTIONS: For The Following Questions, Four Options Are Given. Choose The Correct OptionTUSHAR JALANNo ratings yet

- Inflation Targeting: A New Framework For Monetary Policy?: Ben S. Bernanke and Frederic S. MishkinDocument21 pagesInflation Targeting: A New Framework For Monetary Policy?: Ben S. Bernanke and Frederic S. MishkinSyed Aal-e RazaNo ratings yet

- Sapm 4Document12 pagesSapm 4Sweet tripathiNo ratings yet

- Silicon Valley BankDocument1 pageSilicon Valley BankDaisy BajarNo ratings yet

- Cash Management: By: Anjana Rai ROLL NO:260137Document18 pagesCash Management: By: Anjana Rai ROLL NO:260137anjanaindia3542100% (2)

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocument8 pagesChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanNo ratings yet

- Last Moment 1001 QuestionsDocument14 pagesLast Moment 1001 Questionsjoykumar1987No ratings yet

- ACCA2 1 Handout No. 1 - Conceptual Framework For Financial ReportingDocument3 pagesACCA2 1 Handout No. 1 - Conceptual Framework For Financial ReportingZia May LauretaNo ratings yet

- Commission Invoice: Del Corso Family SRL Calea Bogdanestilor, Nr. 18 300611 Timisoara RomaniaDocument2 pagesCommission Invoice: Del Corso Family SRL Calea Bogdanestilor, Nr. 18 300611 Timisoara RomaniaLorena NegreaNo ratings yet

- Currency INR INR INR INR INR: Income StatementDocument26 pagesCurrency INR INR INR INR INR: Income StatementNikhil BhatiaNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Financial 2TP 1Document4 pagesFinancial 2TP 1Janice Claire EstolonioNo ratings yet

- Chapter # 1: Accounting For Incomplete Records (Single Entry)Document24 pagesChapter # 1: Accounting For Incomplete Records (Single Entry)Umar Zahid100% (1)

- Chapter 22 - Statement of Cash FlowsDocument17 pagesChapter 22 - Statement of Cash Flowsprasad guthiNo ratings yet

- Financial Management Principles and Applications 7Th Edition Titman Test Bank Full Chapter PDFDocument28 pagesFinancial Management Principles and Applications 7Th Edition Titman Test Bank Full Chapter PDFMichelleJenkinsmtqi100% (11)

- HAPPEQUITY FINANCE LP - ShabariSShettyDocument3 pagesHAPPEQUITY FINANCE LP - ShabariSShettyShabari ShettyNo ratings yet

- Investment Management Term PaperDocument13 pagesInvestment Management Term PaperAbubbakarr JallohNo ratings yet

- University of The Punjab: Challan/PV NoDocument1 pageUniversity of The Punjab: Challan/PV Nojutt899No ratings yet

- PTI Financial Statement For Financial Year 2013-14Document7 pagesPTI Financial Statement For Financial Year 2013-14PTI Official100% (3)

- Unit-5 Working Capital ManagementDocument24 pagesUnit-5 Working Capital Managementdevil hNo ratings yet

- Arbitrage and Synthetic InstrumentsDocument12 pagesArbitrage and Synthetic InstrumentsfanizaNo ratings yet

- The Soul of MoneyDocument8 pagesThe Soul of MoneyR SternNo ratings yet

- Soalan Presentation FA 3Document12 pagesSoalan Presentation FA 3Vasant SriudomNo ratings yet

- Current Acc NEWDocument4 pagesCurrent Acc NEWSonu F1No ratings yet

- THE AFRICAN REINSURER June 2010Document52 pagesTHE AFRICAN REINSURER June 2010Obasi NgwutaNo ratings yet

- Sample Resume Columbia SipaDocument1 pageSample Resume Columbia SipafinaZarahNo ratings yet

FIN448-Final-Exam-Fall2020-Review - MC

FIN448-Final-Exam-Fall2020-Review - MC

Uploaded by

May ChenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN448-Final-Exam-Fall2020-Review - MC

FIN448-Final-Exam-Fall2020-Review - MC

Uploaded by

May ChenCopyright:

Available Formats

Advanced Financial Management

Review for

Final Exam

Professor Jian Cai

Help for the Exam

Optional review session

This Sunday, December 20, 1:30 – 2:30 p.m.

Zoom meeting link:

https://wustl.zoom.us/j/91277289103?pwd=aW5INzQyY

nFBVVoyMHFpeUQ2Z0M1QT09

Extra office hours

Next Monday, December 21, 3:00 – 5:00 p.m.

Zoom meeting link:

https://wustl.zoom.us/j/96977389186?pwd=Nk1BYSszK

3RuSTRkK1RFTDQ1TmVUQT09

2 FIN 448 / Jian Cai / Fall 2020

Two Alternative Exam Times

Before the holiday:

Tuesday, December 22, 2020, 12:30 p.m. – 3:30 p.m.

https://wustl.zoom.us/j/97008893230?pwd=TG02WUROQ2x

KZDlZaEd6RTY0d1BNUT09

After the holiday (original exam date):

Monday, January 4, 2021, 3:30 p.m. – 6:30 p.m.

https://wustl.zoom.us/j/92033256940?pwd=QkN3aEZzNWZV

WVRMclZLTk15eEpCUT09

Choose your exam time by midnight on Sunday, December 20.

If no response, take the exam after the holiday on January 4.

3 FIN 448 / Jian Cai / Fall 2020

When, Where, How?

Final Exam

Tuesday, December 22 or Monday, January 4

Start by clicking “Final Exam” under “Quizzes”

on our course site in Canvas

Open-book and open-notes

Individual effort, collaboration not permitted

Join the Zoom meeting for your chosen exam

time, turn on webcam video during the exam

BEST OF LUCK!

4 FIN 448 / Jian Cai / Fall 2020

Advice on Online Exam Taking

Study for the exam as it were closed-book, closed-notes

Familiarity with the topics/steps is the key

Maintain a steady speed; don’t spend too much time on any

individual questions

Choose one way to deliver your answers and stick to it

Type answers inside the exam, or write down answers and

upload files/images, not both

Use all available tools if they help; be prepared & organized

Self-prepared notes with formulas and important processes

Excel can facilitate calculations and model building, but don’t

spend too much time perfecting your Excel file; make it self-

contained and easy to understand if submitting Excel

5 FIN 448 / Jian Cai / Fall 2020

What to Study?

1. Lecture notes for Modules 8 – 14 with

all the solutions to in-class examples

2. Lecture notes for Cases #4 – #6

3. Group Assignments #4 – #6

Practice Problem Sets #6 – #9

Practice Final Exam

A mind with clear and correct timelines, cash

flows, discount rates, and frictions!

6 FIN 448 / Jian Cai / Fall 2020

What NOT to be Covered?

Topics that are discussed only before the

midterm exam: Focus on the topics in the 2nd

half of the course, but valuation concepts and

methods covered in the 1st half of the course

may still be needed to solve financing problems

Case-specific information: No need to retell the

“stories,” but learn the methods & analyses

7 FIN 448 / Jian Cai / Fall 2020

Outline

Review for final exam

Financing: From perfect markets to market

frictions, from capital structure to payout policy

List of examples for various topics/applications

Study guide based on key takeaways

8 FIN 448 / Jian Cai / Fall 2020

Role of Finance Function

Finance function manages flow of cash to/from investors

and investment projects

“Real” Invested

Investment capital

Firm’s Financial Capital

Operations Manager Markets

Operating cash Return to financial

flows asset holders

Valuation Financing

9 FIN 448 / Jian Cai / Fall 2020

Valuation vs. Financing

Conceptually, just flip the signs:

Valuation: Evaluate an investment project

NPV = – CF0 + PV[CF1 + CF2 + CF3 + …]

Up-front Future free

investment cash flows

Financing: Evaluate a financial policy

NPV = + CF0 – PV[CF1 + CF2 + CF3 + …]

Capital Return to

raising investors

Financing’s key differences from Valuation:

Sources of value relevance less clear

No easy formula for optimal policies

10 FIN 448 / Jian Cai / Fall 2020

Valuation Roadmap

𝑁𝑁

𝐸𝐸 𝑊𝑊𝐶𝐶𝑡𝑡

Market Value Price = 𝑃𝑃𝑃𝑃 Cash Flows = � 𝑡𝑡

1 + 𝑟𝑟𝑡𝑡

𝑡𝑡=1

Cash Flows Discount Rate

Coupons 𝑟𝑟𝑡𝑡

Bonds Face Value 𝑌𝑌𝑌𝑌𝑌𝑌

Dividends

Stocks or FCFE

𝑟𝑟𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡𝐸𝐸

Free Cash Flow 𝑟𝑟𝐹𝐹𝐸𝐸𝐹𝐹𝐹𝐹

Firms (to the firm) or FCFF 𝑊𝑊𝑊𝑊𝑊𝑊𝑊𝑊

Incremental Project 𝑟𝑟𝑃𝑃𝐹𝐹𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑡𝑡

Projects (Free) Cash Flow 𝑊𝑊𝑊𝑊𝑊𝑊𝑊𝑊𝐷𝐷𝐸𝐸𝐷𝐷𝐸𝐸𝐷𝐷𝐸𝐸𝑃𝑃𝐷𝐷𝐷𝐷𝐷𝐷

11 FIN 448 / Jian Cai / Fall 2020

Present Value Formulas

The General PV Formula:

𝑊𝑊𝐶𝐶1 𝑊𝑊𝐶𝐶2 𝑊𝑊𝐶𝐶1

𝑃𝑃𝑃𝑃0 = + 2

+ ⋯+ 𝐷𝐷

+⋯

1 + 𝑟𝑟1 1 + 𝑟𝑟2 1 + 𝑟𝑟𝐷𝐷

Cash Flow Stream PV Formula

𝑊𝑊𝐶𝐶1

Perpetuity Constant cash flows forever 𝑃𝑃𝑃𝑃𝑃𝑃0 =

𝑟𝑟

𝐷𝐷

Constant cash flows for 𝑛𝑛 𝑊𝑊𝐶𝐶1 1

Annuity 𝑃𝑃𝑃𝑃𝑊𝑊0 = 1−

periods of time 𝑟𝑟 1 + 𝑟𝑟

𝐷𝐷

Growing Cash flows for 𝑛𝑛 periods of time 𝑊𝑊𝐶𝐶1 1 + 𝑔𝑔

𝑃𝑃𝑃𝑃𝑊𝑊0 = 1−

Annuity growing at a constant rate 𝑔𝑔 𝑟𝑟 − 𝑔𝑔 1 + 𝑟𝑟

Growing Cash flows growing at a 𝑊𝑊𝐶𝐶1

𝑃𝑃𝑃𝑃𝑃𝑃0 =

Perpetuity constant rate 𝑔𝑔 forever 𝑟𝑟 − 𝑔𝑔

12 FIN 448 / Jian Cai / Fall 2020

What Have We Learned since Midterm Exam?

Financing

Perfect Information Payout

Markets Asymmetry Policy

Taxes and Agency

Bankruptcy Conflicts

13 FIN 448 / Jian Cai / Fall 2020

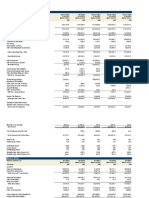

Market Frictions and Financial Policy

Market Varies with which Firm Leverage Debt or Equity Payout Policy

Friction Characteristics: Solutions Structure Solutions

Solutions

Corporate Taxes • Corporate tax rate High debt High payout if τi < τc

• Expected taxable income Low payout to delay

• Non-debt tax-shields repatriation tax

Personal Taxes • Country and time-specific Low debt Repurchases

tax code

Financial • Cash flow uncertainty Low debt ABS debt Low payout

Distress Costs • Nature of assets (e.g., Repurchases

real estate vs. brand)

Asymmetric • Firm reputation Internal funds Short-term debt Low payout to build

Information • Nature of assets (e.g., Debt Private/bank debt internal funds

real estate vs. R&D) Rights offers Private equity Signaling

Manager- • Extent of “free” cash flow High debt Private/bank debt High payout

Shareholder • Corporate governance (e.g., covenants) Dividends

Agency Conflicts • Investor power Private equity

Debtholder- • Value of future growth Low debt Covenants

Equityholder opportunities Convertible debt

Agency Conflicts

14 FIN 448 / Jian Cai / Fall 2020

Perfect Markets

Module 8

Group Assignment #4

Practice Problem Set #6

15 FIN 448 / Jian Cai / Fall 2020

What Is the Difference between Debt and Equity?

Debt Equity

Cash Flow Fixed Residual

Rights Contractual

Control Rights “Contingent control” Voting

- Covenants Board representation

- Default

16 FIN 448 / Jian Cai / Fall 2020

Book vs. Market Value Balance Sheets

Book-value balance sheet (backward looking)

What I bought How I paid for it

Book assets D: Borrowed money

E: Contributed & earned capital

Market-value balance sheet (forward looking)

Cash these assets will generate Who gets it

D: PV(E[CFD])

V = PV(E[FCFF])

E: PV(E[FCFE])

Implies: V = D + E

17 FIN 448 / Jian Cai / Fall 2020

Perfect Capital Markets

1. Investors and firms can trade the same set of

securities at competitive market prices equal to the

present value of their future cash flows.

2. There are no taxes, transaction costs, or issuance

costs associated with security trading.

3. A firm’s financing decisions do not change the cash

flows generated by its investments, nor do they reveal

new information about them.

18 FIN 448 / Jian Cai / Fall 2020

The Modigliani-Miller Propositions

In a perfect capital market:

M&M I: Firm value is unaffected by financing choices.

Investment decisions create NPV, financing decisions just split

up the pie.

M&M II: Both equityholders’ risk and expected return

increase with financial leverage

𝐸𝐸 𝐷𝐷

𝑊𝑊𝑊𝑊𝑊𝑊𝑊𝑊 = 𝑟𝑟𝑈𝑈 (or 𝑟𝑟𝐴𝐴 ) = 𝑟𝑟𝐸𝐸 + 𝑟𝑟𝐷𝐷

𝐸𝐸 + 𝐷𝐷 𝐸𝐸 + 𝐷𝐷

𝐷𝐷

𝑟𝑟𝐸𝐸 = 𝑟𝑟𝑈𝑈 + 𝑟𝑟𝑈𝑈 − 𝑟𝑟𝐷𝐷

𝐸𝐸

19 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (I)

The market value of an asset is the present value of the future

free cash flows that asset can generate.

Financing an asset involves promising a portion of those future

cash flows to the capital provider.

Debt and equity contracts differ on two key dimensions: Cash

flow rights and control rights.

In the absence of market frictions (i.e., perfect capital markets):

Firm value is equal to the sum of the market values of all financial

claims on the firm.

Firm value is not affected by the way the assets were financed.

Increasing financial leverage has two offsetting effects on the

firm’s equity: Increases Risk & Increases Expected Return

20 FIN 448 / Jian Cai / Fall 2020

M&M Applications & Examples

Book and market value balance sheets before and after

financing: Example 8.1 (Bob the Entrepreneur)

Financial policy and shareholder value: Example 8.2 (HP

paying down debt)

Equity issuance and dilution: Example 8.3 (JCPenney

issuing more stock, EPS, and P/E ratio)

Debt issuance, cost of equity, and WACC: Example 8.4

(cheap debt at HMA?)

21 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (II)

We can’t usually get (or lose) something for nothing:

1. Value comes primarily from a firm’s investments. Financing

transactions simply allocate future cash flows in different ways.

2. If we want to claim that financial policy choices create value, we

must identify the specific market friction(s) that are addressed.

3. Equity issuance should not lead to dilution of value per share as

long as shares are sold for a fair market price.

4. Debt financing leads to higher EPS, but this is (at least partly)

compensation for risk – does not mean debt financing is

necessarily better for shareholders.

5. Simply comparing costs of debt and equity without adjusting for

risk is not a reliable way of making optimal financing choices.

22 FIN 448 / Jian Cai / Fall 2020

Taxes and Bankruptcy

Modules 9-10, Case #4

Group Assignments #4, #5

Practice Problem Set #7

23 FIN 448 / Jian Cai / Fall 2020

The Tax Benefit of Debt Formalized

Capitalizing the tax shield value

Every dollar of interest paid saves the firm τc dollars in taxes, where τc is

the corporate tax rate.

The increase in firm value is equal to the present value of all future

expected tax shields (PVTS).

∞

𝐸𝐸 Tax Shield𝑡𝑡

PVTS = � = 𝜏𝜏𝑃𝑃 𝐷𝐷

1 + 𝑟𝑟𝑇𝑇𝑇𝑇 𝑡𝑡

𝑡𝑡=1

Under what assumptions?

1. Debt is kept at a fixed level

2. “Perpetual debt” (continually rolled over) ⇒ PV = CF/r

3. 𝑟𝑟𝑇𝑇𝑇𝑇 = 𝑟𝑟𝐷𝐷 Why?

Under these assumptions:

𝐸𝐸 Tax Shield 𝜏𝜏𝑃𝑃 ∗ 𝐷𝐷 ∗ 𝑟𝑟𝐷𝐷

PVTS = = = 𝜏𝜏𝑃𝑃 𝐷𝐷

𝑟𝑟𝑇𝑇𝑇𝑇 𝑟𝑟𝐷𝐷

24 FIN 448 / Jian Cai / Fall 2020

The Tax Benefit of Debt and Firm Value

Revised M&M I

Adjusted present value (APV) approach:

In perfect markets: 𝑃𝑃𝐿𝐿 = 𝑃𝑃𝑈𝑈

With taxes: 𝑃𝑃𝐿𝐿 = 𝑃𝑃𝑈𝑈 + PVTS ≈ 𝑃𝑃𝑈𝑈 + 𝜏𝜏𝑃𝑃 𝐷𝐷

Cost of capital (WACC) approach:

Effective cost of debt = 𝑟𝑟𝐷𝐷 1 − 𝜏𝜏𝑃𝑃

𝐷𝐷 𝐸𝐸

After-tax WACC (𝑟𝑟𝐿𝐿 ) = 𝑟𝑟𝐷𝐷 1 − 𝜏𝜏𝑃𝑃 + 𝑟𝑟𝐸𝐸

𝑉𝑉 𝑉𝑉

(!) Implications for firm value:

Assume D/VL = 30% ⇒ D = 0.30 × VL

and 40% federal + state tax rate

⇒ τc × D = 0.40 × 0.3 × VL = 0.12 × VL

Yet, about 20% of publicly traded firms have no debt!

25 FIN 448 / Jian Cai / Fall 2020

Discount Rate for Tax Shields with a Target D/V

Ratio (or Target Interest Coverage) Policy

Implications for calculating PVTS

What is the right discount rate?

Future Firm Value

Biggest source of uncertainty is ______________________.

rU

What discount rate reflects this uncertainty? ___________.

rU

Therefore, set rTS = __________ when the firm’s policy is to

maintain a target D/V ratio.

What if firm value is expected to grow over time?

In this case, with a target D/V ratio, the level of debt will grow over

time. We can take this into account by dividing the expected initial

tax shield by (rU – g) when calculating present value of tax shields.

Putting these ideas together, we have

𝐷𝐷 ∗ 𝑟𝑟𝐷𝐷 ∗ 𝜏𝜏𝑃𝑃

PVTS =

𝑟𝑟𝑈𝑈 − 𝑔𝑔

26 FIN 448 / Jian Cai / Fall 2020

PVTS under Different Debt Policies

Rule of thumb: What discount rate to use for tax shields?

Fixed dollar level of debt:

rTS = rD

Target D/V (or similar) policy:

rTS = rU

(and account for growth)

11 FIN 448 / Jian Cai / Fall 2020

Example 9.2: PVTS under Different Debt Policies

You have the following information for Olin Mfg:

All-equity firm, rE = 10%, τc = 35%

Considering issuing $100 million in debt, rD = 4%

Calculate PVTS assuming:

They will maintain a fixed level of debt:

PVTS = τc × D = 35% × 100 = $35 million

They will maintain their new D/V going forward, no growth:

PVTS = τc × D × rD / rU = 35% × 100 × 4% / 10% = $14 million

They will maintain their new D/V going forward, 2% growth:

PVTS = τc × D × rD / (rU – g) = 35% × 100 × 4% / (10% – 2%)

= $17.5 million

12 FIN 448 / Jian Cai / Fall 2020

Examples

rTS and the Cost of Equity Capital 9.2 & 9.3

Intuition:

Tax shields become part of the firm’s (and equityholders’)

cash flows.

If rTS = rU, then adding tax shields does not change the

riskiness of the firm’s overall cash flows.

But, if rTS = rD, then the tax shields are less risky than the

firm’s operating cash flows. This should be reflected in a

lower cost of equity.

Two formulas for rE, depending on your tax-shield discount

rate assumption:

𝐷𝐷

𝑟𝑟𝐸𝐸 = 𝑟𝑟𝑈𝑈 + 𝑟𝑟𝑈𝑈 − 𝑟𝑟𝐷𝐷 Assumes rTS = rU

𝐸𝐸

𝐷𝐷

𝑟𝑟𝐸𝐸 = 𝑟𝑟𝑈𝑈 + 𝑟𝑟𝑈𝑈 − 𝑟𝑟𝐷𝐷 1 − 𝜏𝜏𝑃𝑃 Assumes rTS = rD

𝐸𝐸

27 FIN 448 / Jian Cai / Fall 2020

Example 9.3: PVTS with target D/E

Two (Equivalent) Approaches (Continued)

Approach 1:

PVTS = VL – VU

𝐷𝐷 𝐸𝐸

Pre-tax WACC = rU = 𝑟𝑟 + 𝑟𝑟

𝐷𝐷+𝐸𝐸 𝐷𝐷 𝐷𝐷+𝐸𝐸 𝐸𝐸

0.5 1

= × 6% + × 10% = 8.67%

0.5+1 0.5+1

𝐷𝐷 𝐸𝐸

After-tax WACC = rL = 𝑟𝑟 1 − 𝜏𝜏𝑐𝑐 + 𝑟𝑟

𝐷𝐷+𝐸𝐸 𝐷𝐷 𝐷𝐷+𝐸𝐸 𝐸𝐸

0.5 1

= × 6% × 1 − 0.35 + × 10% = 7.97%

0.5+1 0.5+1

VL = 4.25 / (7.97% – 4%) = $107 mm

VU = 4.25 / (8.67% – 4%) = $91 mm

PVTS = 107 – 91 = $16 million

14 FIN 448 / Jian Cai / Fall 2020

Example 9.3: PVTS with target D/E

Two (Equivalent) Approaches (Continued)

Approach 2:

Now use our result:

Note that a D/E ratio of 0.5 implies an initial debt level of

107 × [0.5/(0.5+1)] = $35.6 million

Suppose we did not have information on expected free cash flows,

but only the initial debt level ($35.6 million). Then,

𝐷𝐷 ∗ 𝑟𝑟𝐷𝐷 ∗ 𝜏𝜏𝑐𝑐 35.6 × 6% × 35%

PVTS = = = $16 million

𝑟𝑟𝑈𝑈 − 𝑔𝑔 8.67% − 4%

15 FIN 448 / Jian Cai / Fall 2020

Examples

PVTS with Personal Taxes 9.1 & 9.4

Define the effective tax advantage of debt as: The % difference in after-

tax cash flows received by investors when the firm pays $1 of EBIT to

investors as dividends/capital gains relative to interest.

After Corporate Tax After Personal Tax

$1 interest 1 1 − 𝜏𝜏𝐸𝐸

$1 dividend/capital gain 1 − 𝜏𝜏𝑃𝑃 1 − 𝜏𝜏𝑃𝑃 1 − 𝜏𝜏𝑃𝑃

Difference (annual CF benefit

𝜏𝜏𝑃𝑃 1 − 𝜏𝜏𝐸𝐸 − 1 − 𝜏𝜏𝑃𝑃 1 − 𝜏𝜏𝑃𝑃

per dollar of interest)

% difference (effective tax 𝜏𝜏𝑃𝑃 1 − 𝜏𝜏𝐸𝐸 − 1 − 𝜏𝜏𝑃𝑃 1 − 𝜏𝜏𝑃𝑃

advantage) 1 − 𝜏𝜏𝐸𝐸

1 − 𝜏𝜏𝑃𝑃 1 − 𝜏𝜏𝑃𝑃

=1− ≡ 𝜏𝜏 ∗

1 − 𝜏𝜏𝐸𝐸

Ignoring personal taxes: PVTS = 𝐷𝐷 � 𝜏𝜏𝑃𝑃

With personal taxes: PVTS = 𝐷𝐷 � 𝜏𝜏 ∗

28 FIN 448 / Jian Cai / Fall 2020

Calculating Cost of Capital when τi > τe

𝐷𝐷 𝐸𝐸

No change to the WACC formula: 𝑟𝑟𝐿𝐿 = 𝑟𝑟𝐷𝐷 1 − 𝜏𝜏𝑐𝑐 + 𝑟𝑟𝐸𝐸

𝑉𝑉 𝑉𝑉

Recall, debt investors will increase their required 𝑟𝑟𝐷𝐷 to

compensate themselves for the extra tax burden

Does impact levering/unlevering cost of equity (i.e.,

calculating rU)

Recall, 𝑟𝑟𝑈𝑈 represents what the cost of equity would be if the

firm were all-equity financed

But, if the firm were all-equity financed, they would no longer

have to pay the premium to compensate debt investors for their

high personal tax rate

22 FIN 448 / Jian Cai / Fall 2020

Calculating Cost of Capital when τi > τe

How to adjust for this:

Define 𝑟𝑟𝐷𝐷∗ as the expected return debt investors would demand

if they faced the same personal tax rate as the equity investors:

𝑟𝑟𝐷𝐷∗ 1 − 𝜏𝜏𝑒𝑒 = 𝑟𝑟𝐷𝐷 1 − 𝜏𝜏𝑖𝑖

1 − 𝜏𝜏𝑖𝑖

𝑟𝑟𝐷𝐷∗ = 𝑟𝑟𝐷𝐷

1 − 𝜏𝜏𝑒𝑒

Use 𝑟𝑟𝐷𝐷∗ to lever/unlever the cost of equity

𝐷𝐷 ∗ 𝐸𝐸

𝑟𝑟𝑈𝑈 = 𝑟𝑟𝐷𝐷 + 𝑟𝑟𝐸𝐸

𝑉𝑉 𝑉𝑉 Constant

𝐷𝐷 D/V

𝑟𝑟𝐸𝐸 = 𝑟𝑟𝑈𝑈 + 𝑟𝑟𝑈𝑈 − 𝑟𝑟𝐷𝐷∗

𝐸𝐸

23 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (III)

Two extreme views of the tax benefit of debt:

Modigliani and Miller: Zero

Standard textbook formula: τcD

The truth is somewhere in the middle.

Factors that limit the value of interest tax shields:

Policies that tie the level of debt to the value of the firm (or cash

flows) make the future tax shields riskier, but also may imply they will

grow over time.

There is a personal tax disadvantage for debt.

The incremental tax benefit of an increase in a firm’s debt is lower:

The more debt a firm already has outstanding

The more volatile is a firm’s earnings

The more non-debt tax shields the firm has access to (for example,

depreciation, investment tax credits, offshore tax havens, etc.)

29 FIN 448 / Jian Cai / Fall 2020

Applications in the Swedish Match Case (#4)

Book and market value balance sheets before and after the

recapitalization

Impact of additional borrowing on share price, credit rating,

and cost of debt

Estimating debt capacity by industry benchmark, target

credit rating, and cash flow method (worst-case scenario,

with and without dividend)

30 FIN 448 / Jian Cai / Fall 2020

SM’s Book Value Balance Sheet

Step 1: Announce planned recapitalization

Step 2: Issue debt (assume SEK 4 billion for now)

Step 3: Use proceeds to buy back equity shares

Currently (see Exhibit 2) After Step 1 (announcement)

Assets: 14,898 D: 3,529 Assets: 14,898 D: 3,529

Other Liab: 6,309 Other Liab: 6,309

E: 5,060 E: 5,060

After Step 2 (issue debt) After Step 3 (repurchase equity)

Assets: 18,898 D: 7,529 Assets: 14,898 D: 7,529

Other Liab: 6,309 Other Liab: 6,309

E: 5,060 E: 1,060

9 FIN 448 / Jian Cai / Fall 2020

SM’s Market Value Balance Sheet

Step 1: Announce planned recapitalization

Step 2: Issue debt (assume SEK 4 billion for now)

Step 3: Use proceeds to buy back equity shares

Currently (see Exhibit 2) After Step 1 (announcement)

Assets (V): D: 3,529 Assets (V): D: 3,529

3,529 + 28,454 = 31,983 + PVTS =

E: 28,454 (P x N) E: 33,103 – 3,529

31,983 31,983 + 1,120 =

= 29,574

33,103

After Step 2 (issue debt) After Step 3 (repurchase equity)

Assets (V): D: 7,529 Assets (V): D: 7,529

33,103 + 4,000 37,103 – 4,000 =

E: 37,103 – 7,529 E: 33,103 – 7,529

(new debt) = 33,103

= 29,574 = 25,574

37,103

10 FIN 448 / Jian Cai / Fall 2020

Debt Capacity: Cash Flow Perspective

What about Dividends?

2004 Dividends Paid = 558 (1.70 per share)

If we are recapitalizing, what effect does an increase in debt have on the

required total dividend payment?

Impact on share price

P = PVTS / initial shares = D c / 322.1 = D 0.28 / 322.1

Change in shares outstanding

N = # shares repurchased = D / P = D / (Initial P + P)

Total dividend payment (keeping DPS constant)

= 1.70 (322.1 – N)

Note dividends are paid with after-tax dollars, so convert to pre-tax dollars:

(Dividends) / (1 – c)

With a SEK 4 billion recap:

P = 4,000 0.28 / 322.1 = 3.48 P = 88.34 + 3.48 = 91.82

N = 4,000 / 91.82 = 43.56

Total dividend payment = 1.70 (322.1 – 43.56) = 473.5

Pre-tax = 473.5 / (1 – 0.28) = 658

25 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (IV)

Borrowing can be supported by assets or by cash flow (in the case

of Swedish Match, primarily cash flow)

Effects of recapitalizations:

Don’t affect total book value, just allocation between debt and equity

Increase total market value by PV of tax shields

Equity stock price should increase by approximately PV of tax shields

divided by shares (based on pre-transaction # of shares)

Guidelines for appropriate debt levels can come from:

Target an industry average leverage ratio

Estimate debt level consistent with the desired credit rating

Evaluate ability to meet interest payments, with enough buffer to

accommodate cash flow volatility

31 FIN 448 / Jian Cai / Fall 2020

Bankruptcy in Imperfect Markets (Real World)

Definitions:

Economic distress: Value of assets is impaired

Financial distress: Firm is unable to meet debt obligations

Economic distress plus high leverage

Cost of financial distress: Difference in firm value between

an all-equity firm in economic distress, and

the same firm in economic distress with high debt

32 FIN 448 / Jian Cai / Fall 2020

Why is Financial Distress Costly?

Sale of assets for less than “full value”

Most likely buyers may also be distressed, and they know you are

desperate to sell

Strategic costs

Constraints on investment allows competitors to take market share

Direct costs of bankruptcy

Legal and administrative fees (lawyers, court costs, etc.)

Consultants

Indirect costs of bankruptcy

Time and attention of senior management

Loss of key employees

Loss of customer confidence

Unwillingness of suppliers to extend trade credit

Disruption in investment projects

“Fire sales” in liquidation

33 FIN 448 / Jian Cai / Fall 2020

The Tax-Bankruptcy Tradeoff

M&M I: 𝑃𝑃𝐿𝐿 = 𝑃𝑃𝑈𝑈

M&M with taxes: 𝑃𝑃𝐿𝐿 = 𝑃𝑃𝑈𝑈 + 𝑃𝑃𝑃𝑃𝑌𝑌𝑃𝑃

Tax-bankruptcy tradeoff: 𝑃𝑃𝐿𝐿 = 𝑃𝑃𝑈𝑈 + 𝑃𝑃𝑃𝑃𝑌𝑌𝑃𝑃

−𝑃𝑃𝑃𝑃 𝐸𝐸 𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝐷𝑟𝑟𝐷𝐷𝐷𝐷𝐷𝐷 𝑊𝑊𝐶𝐶𝐷𝐷𝐷𝐷

Requires three elements:

1. How costly is financial distress when it happens (realized

distress costs)?

2. How likely is financial distress (for a given amount of debt)?

3. How should we think about present values?

34 FIN 448 / Jian Cai / Fall 2020

Valuing Expected Distress Costs

E(Distress Cost) = Realized Cost × Probability of Distress

Realized cost (conditional on financial distress):

Direct + Indirect Cost (10-20% of pre-distress firm value)

Average annualized default probabilities (source: Moody’s, 1970-2011)

Present values: (see derivation next)

Annual (marginal) default probability = p

Realized financial distress cost = c

Discount rate = r f

𝑝𝑝

𝑃𝑃𝑃𝑃 𝐸𝐸 Distress Cost = 𝑐𝑐

𝑝𝑝 + 𝑟𝑟𝑓𝑓

35 FIN 448 / Jian Cai / Fall 2020

Example 10.2: Putting it Together for UST, Inc.

Data on UST, Inc.:

$1 billion in debt

“A” credit rating

Market Value ≈ $6.5 billion

EBITDA = $785 million

Potential realized distress costs for UST (c in the formula)

= cost (% of V) × VU = 20% × $6.5 billion = $1.3 billion

Rating: AAA AA A BBB BB B CCC

Annualized default prob. 0.05% 0.09% 0.23% 0.47% 2.13% 5.38% 12.08%

Avg. Yield (10-yr bonds) 5.60% 5.84% 6.12% 6.84% 8.72% 11.19% --

Avg. EBITDA Interest coverage 18.7 14 10 6.3 3.9 2.3 0.2

Annualized probability of default (“A” rating): 0.23%

16 FIN 448 / Jian Cai / Fall 2020

Example 10.2: Tax-Bankruptcy Tradeoff

PV of expected distress cost (assuming r f = 5%):

𝑝𝑝

𝑃𝑃𝑉𝑉 𝐸𝐸 Distress Cost = 𝑐𝑐

𝑝𝑝 + 𝐷𝐷𝑓𝑓

0.23%

= × $1.3 billion ≈ $57 million

0.23% + 5%

Tax benefit (assuming perpetual debt, τc = 38%, τe = 15%, τi =35%):

1 − 𝜏𝜏𝑐𝑐 1 − 𝜏𝜏𝑒𝑒

PVTS = 𝐷𝐷 1 −

1 − 𝜏𝜏𝑖𝑖

1 − 38% 1 − 15%

= $1 billion × 1 − ≈ 189 million

1 − 35%

Net value gain from leverage ≈ 189 – 57 = $132 million

17 FIN 448 / Jian Cai / Fall 2020

Example 10.2: Optimal Credit Rating

Step 1: Estimate Debt levels for each credit rating

Based on Average Credit Avg. Int. Debt

EBITDA Interest Coverage: Rating Coverage Int. Rate ($mm)

AAA 18.7 5.60% 750

EBITDA / (D × Int. Rate) = Rating Avg.

AA 14.0 5.84% 960

D = EBITDA / (Rating Avg. × Int. Rate) A 10.0 6.12% 1,283

BBB 6.3 6.84% 1,822

BB 3.9 7.70% 2,614

B 2.3 8.72% 3,914

Or, based on Average D/V Ratio: Credit Rating Avg. D/V Debt ($mm)

AAA 0.5% 33

D / VL = D / (VU + D × τ*) = Rating Avg.

AA 8.1% 527

D = Rating Avg. × (VU + D × τ*) A 17.2% 1,118

BBB 27.2% 1,768

BB 43.2% 2,808

B 55.9% 3,634

19 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (V)

Financial distress is costly as it reduces the value of assets beyond the

effects of economic distress, but we don’t really know how costly

Empirical estimates range from 10 to 20% loss of firm value

What firm characteristics would make bankruptcy more/less costly:

Asset tangibility/re-deployability

Importance of long-term relationships with customers, suppliers,

employees

Importance of brand image/reputation

Importance of investment opportunities

Relevant measure for financial policy is the present value of expected

distress costs; default probabilities are modest until debt gets below

investment-grade

This cost needs to be weighed against the potential tax benefits of debt

36 FIN 448 / Jian Cai / Fall 2020

Optimal Leverage with Taxes

and Financial Distress Costs

See Example 10.2 (UST) &

Example 10.3 (Google) for

Optimal Credit Rating

37 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (VI)

We combine the effect of taxes and bankruptcy into a theory of capital structure.

Leverage increases the value of debt interest tax shield but it also increases

financial distress costs.

For low levels of debt, the risk of default is low and the main effect of an increase

in debt is an increase in interest tax shield.

As the level of debt increases, the probability of default increases; consequently,

the costs of financial distress increase, reducing the value of the levered firm.

Both the tax benefit and the distress cost are borne by existing shareholders.

Shareholders would prefer if we balance the two effects.

Ex-ante, this maximizes shareholder value as well as firm value.

Tradeoff theory: Firms should increase their leverage until it reaches the level

for which the firm value is maximized.

At this point, the tax savings that result from increasing leverage are perfectly

offset by the increased probability of incurring the costs of financial distress.

38 FIN 448 / Jian Cai / Fall 2020

Information Asymmetry

Modules 11-12, Case #5

Group Assignment #6

Practice Problem Set #8

39 FIN 448 / Jian Cai / Fall 2020

Information Asymmetry and Its Example

Implications for Securities Issuance 11.1

In a given industry, there are good quality firms (“stars”) and bad quality firms

(“duds”).

As an outside investor, it’s hard to tell which is which.

Information

As a result, “stars” are likely to be undervalued, and “duds” likely to be

overvalued. Asymmetry

But insiders probably know more about the firm’s true value than you do.

One of these firms announces they will issue equity. What’s your assessment of

the likelihood this firm is a star/dud?

The star firm may not be willing to issue since they will be forced to sell shares for

less than fair value, which will lead to real dilution. On the other hand, dud firms

will be happy to issue at inflated prices. If this is the case, if I see a firm willing to

issue new equity, it is more likely they are a dud firm.

So why is it costly for good firms to issue equity?

Investors protect themselves from the possibility of buying a dud firm by

discounting the price they are willing to pay for new securities. This lower price

effectively raises the cost of capital, especially for firms whose true value is high.

40 FIN 448 / Jian Cai / Fall 2020

Solution #1: The “Pecking Order”

Recall: The cost of asymmetric information is that outside investors will discount the price

they are willing to pay for risky securities.

1. Motivation for retaining internal funds: Avoid (less informed) outside investors

2. What if a firm needs external finance: Why is debt better than equity?

Debt is less informationally sensitive than equity, that is, the value of debt securities are less

sensitive to (unknown) information about the firm than are equity securities.

Payoff to

Equity

investor

Debt

VDud VStar

Intuition: Suppose the lottery ticket in our earlier example paid off $51 if heads, $49 if tails.

What would happen to the price when the seller announced he was willing to sell?

Pecking order financing policy:

1. First use internal funds.

2. If no more internal funds, issue debt.

3. Only issue equity as a last resort.

41 FIN 448 / Jian Cai / Fall 2020

Example

Solution #2: Rights Offers 11.2

MONTREAL, June 17 /CNW Telbec/ - Cancor Mines Inc. is pleased to announce that

it will be offering rights to holders of its common shares of record at the close of

business on June 27, 2008 (the "Record Date")… Under the offering, each eligible

shareholder will receive, for each common share held as of the Record Date, one

right evidenced by a fully transferable certificate. Four rights and $0.14 will entitle

the holder to subscribe for one common share of the Company at any time up to

4:00 p.m. on July 31, 2008. A fully subscribed rights offering would raise gross

proceeds of approximately $1,486,680. The proceeds of the offering will be used

for general working capital.

Each shareholder issued an option to buy additional shares at a price below the

current market price ($0.18/share at time of announcement).

Are shareholders giving away value?

No, whatever value they lose on their old shares, they gain on the new shares.

They are just transferring wealth to themselves.

What if I don’t want more shares?

“Fully transferable certificate” ⇒ The rights can be sold.

42 FIN 448 / Jian Cai / Fall 2020

Solution #3: Choice of Lender

Suppose your firm is concerned about getting a fair price for your securities

because of information asymmetry. Which source of debt might be best?

Debt Type Possible Lender Characteristics

Public bonds Dispersed investors

Private placement One or several large out-of-state

pension funds

Bank loan Relationship bank that also

handles my checking and cash

management services

One advantage of a bank (or “relationship lender”) over dispersed (or “arms-length”) lenders is their

ability to gather information about the firm before making a loan. Since they will typically make a

larger investment than a smaller investor, they have greater incentives to spend resources gathering

information. And the firm may be more willing to let one bank come in and do their due diligence

rather than disseminating private information to the broader market (where competitors will also see

it). Finally, banks develop expertise in gathering information about firms by specializing in credit

evaluation and may already have information about the firm as a result of their existing relationship.

43 FIN 448 / Jian Cai / Fall 2020

Solution #4: Choice of Maturity

Suppose your firm is concerned about getting a fair price for your securities

because of information asymmetry. Which debt maturity might be best?

Short Term Long Term

There is likely to be less uncertainty about a firm’s ability to pay back a loan next year than

over their ability to pay back a loan 10 years from now. In that sense, the price investors

are willing to pay for short-term debt is likely to be less sensitive to asymmetric information

than the price of long-term debt.

44 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (VII)

When insiders know more than outsiders about the value

of a firm, risky securities will be discounted in the market

(potentially severely enough to limit investment).

Potential solutions:

Issue the least informationally sensitive securities.

Use a rights offer to issue new shares to existing shareholders.

Issue debt to signal you are a strong firm.

Access private sources of capital (i.e., bank debt).

Use short-term debt.

45 FIN 448 / Jian Cai / Fall 2020

Understand IPOs

IPO terminology & overview in Module 12

Google IPO (Case #5), LinkedIn IPO (Group Assignment #6,

Problem 1), King Digital Entertainment IPO (Practice Final

Exam, Problem 5)

Overview of the IPO process

Over-allotment (the Olin’s Olives example)

IPO cost: Underwriting fee and underpricing

Control rights after IPO

Underwriting process: Auction vs. book building

(the IPO auction example)

The role of investment banks

46 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (VIII)

Things to remember about IPOs:

Information asymmetry is the key market friction at work

Major costs

Underwriter spreads: Traditionally 7%, cheaper for larger deals

Underpricing: 15 – 20% left on the table on average

Types of shares issued

Primary: New shares, generate cash for the firm

Secondary: Existing shares, generate cash for old shareholders

Types of underwriter arrangements

Best efforts: Firm bears the risk of weak demand

Firm commitment: Underwriter bears the risk

Potential price mechanisms

Auctions offer an interesting alternative, but Book-building is dominant

Suggest that firms value the role of investment banks in the process

including certification, eliciting information from firm and investors, and

price stabilization

47 FIN 448 / Jian Cai / Fall 2020

Agency Conflicts

Module 13, Case #6

Group Assignment #6

Practice Problem Set #8

48 FIN 448 / Jian Cai / Fall 2020

Control Rights and Agency Conflicts

I. Manager-Shareholder Agency Conflicts:

What happens when we issue equity?

In practice, equityholders hire a team of professional managers to run the

business on their behalf. → separation of ownership and control.

Managers’ incentives are not always aligned with those of shareholders.

How can financial policy help address this?

High debt may help.

II. Debtholder-Equityholder Agency Conflicts:

What happens when we issue debt?

Debtholders only have contingent control (covenants, default) while most

of the time, equityholders have control over how the assets are managed.

Equityholders may make decisions that benefit themselves, but don’t

maximize firm (or debtholders’) value.

How can financial policy help address this?

Low debt may help.

49 FIN 448 / Jian Cai / Fall 2020

Examples of Conflicts and Solutions

High debt as solution to manager-shareholder agency

conflicts: Example 13.1

Debtholder-equityholder agency conflicts 1 – under-

investment due to debt overhang: Example 13.2

Debtholder-equityholder agency conflicts 2 – wrong

investment due to risk shifting: Example 13.3

Low debt as solution to risk shifting: Example 13.4

Convertible debt as solution to risk shifting:

Examples 13.5, 13.6

50 FIN 448 / Jian Cai / Fall 2020

Manager-Shareholder Agency Conflicts:

High Debt as Solution

How does the financing choice affect Bob’s effort incentives?

Debt financing results in more concentrated equity ownership. As a

result, Bob’s wealth is more sensitive to his effort than it would be if

he were sharing gains and losses with an outside equity investor.

2. Larger firms: The disciplinary role of debt

excess cash

Debt payments limit ________________.

efficiency

Commitment to meet debt payments forces ______________.

8 FIN 448 / Jian Cai / Fall 2020

Overview: Agency and Capital Structure

Raising capital creates two types of agency conflicts:

1. Manager–Shareholder agency conflicts

Arising from separation of ownership and control

2. Debtholder-Equityholder agency conflicts

Option-like feature of equity payoffs creates two distortions

a. Debt overhang: Less willing to contribute new equity capital when

debtholders have the first claim on cash flows

b. Risk shifting: Willing to sacrifice firm value to increase risk

Agency tradeoff:

1. High debt mitigates incentive conflicts between managers and

outside investors

2. But high debt exacerbates conflicts between debt and equity

⇒ Need to think about which types of firms are more/less

exposed to each friction

19 FIN 448 / Jian Cai / Fall 2020

Overview: Agency and Capital Structure

Which types of firms might be more concerned about

manager-shareholder agency conflicts? That is,

candidates for high debt

High cash flow

Low investment opportunities

Weak governance

Examples: Sealed Air, UST

Which types of firms might be more concerned about

debtholder-equityholder agency conflicts? That is,

candidates for low debt

Valuable future investment opportunities (high M/B)

Ability to change the riskiness of assets (R&D intensive firms)

20 FIN 448 / Jian Cai / Fall 2020

Agency and Capital Structure

Raising capital creates two types of agency conflicts:

1. Manager–Shareholder agency conflicts

Arising from separation of ownership and control

2. Debtholder-Equityholder agency conflicts

Option-like feature of equity payoffs creates two distortions

a. Debt overhang: Less willing to contribute new equity capital when

debt holders have the first claim on cash flows

b. Risk shifting: Willing to sacrifice firm value to increase risk

Agency tradeoff:

1. High debt mitigates incentive conflicts between managers and

outside investors

2. But high debt exacerbates conflicts between debt and equity

⇒ Need to think about which types of firms are more/less

exposed to each friction

51 FIN 448 / Jian Cai / Fall 2020

Agency and Capital Structure

Which types of firms might be more concerned about

manager-shareholder agency conflicts? That is,

candidates for high debt

High cash flow

Low investment opportunities

Weak governance

Examples: Sealed Air, UST

Which types of firms might be more concerned about

debtholder-equityholder agency conflicts? That is,

candidates for low debt

Valuable future investment opportunities (high M/B)

Ability to change the riskiness of assets (R&D intensive firms)

52 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (IX)

Financial contracts create two layers of agency conflicts:

Managers make decisions on behalf of outside investors

Equityholders make decisions that affect debt holders

How to limit manager-shareholder agency costs?

High debt

Limits “free cash” at management disposal

Preserves incentives for effort and efficiency

Private (e.g., bank) debt

Provides monitoring

How to limit debtholder-shareholder agency costs?

Low debt

Private (e.g. bank) debt - provides monitoring & covenants

Convertible debt limits “risk shifting” incentives

53 FIN 448 / Jian Cai / Fall 2020

Case #6: Hertz LBO

Sources of value from LBO:

Change in capital structure (high leverage)

Corporate tax shield value

Disciplinary role of debt generates operating improvements

Force disposal of (or reduced investment in) underperforming assets

Change in ownership structure (concentrated private

equityholders)

Closer management oversight leads to operating improvements

Avoid costs of being public (disclosure, regulatory requirements)

Reduce information asymmetry costs in the transaction price

ABS debt

May increase debt capacity or lower cost of debt

54 FIN 448 / Jian Cai / Fall 2020

Case #6: IPO vs. LBO

Comparing sources of value:

Market Friction Addressed by IPO? Addressed by LBO?

Corporate taxes High debt

Financial distress costs Lower leverage ABS debt

Asymmetric information Private equity buyer

- Concentrated private

Agency costs ownership

(manager-shareholder) - High debt level

Other considerations:

% of Hertz sold Small 100%

55 FIN 448 / Jian Cai / Fall 2020

Advantages of ABS Financing for Hertz:

Market Frictions and Debt Capacity

Expand capital supply by gaining access to investment-grade bond market

Several classes of investors are restricted (by choice or regulation) from

investing in below-investment-grade debt

Reduce expected costs of financial distress

Distress probability: “as Hertz acquired (deposed of) cars, it had agreements to

increase (decrease) the ABS debt” (case page 8)

The flexibility to increase (decrease) the level of debt as demand increases

(decreases) reduces the probability of default, especially in a highly cyclical

industry

Legal separation can reduce realized bankruptcy costs

SPV classified as “bankruptcy remote”

“The originator conveyed the assets to the SPV, which transferred ownership of

the assets from the originator to the trust.” (case page 7)

ABS lenders less concerned about losing value in a Hertz bankruptcy (than they

would be if Hertz owned the cars)

In the event of bankruptcy, the assets in the SPV (cars) do not become part of

the bankruptcy estate of Hertz. In that case, the ABS lenders can avoid having

their assets lose value in the bankruptcy process. This reduces the lenders’

perceived cost of financial distress and thereby expands debt capacity.

56 FIN 448 / Jian Cai / Fall 2020

LBO Valuation: PE perspective

Initial 3 – 7 years Exit

Equity Equity

Purchase V2010

Price Debt Debt

Often use interim cash flows to start paying down debt

⇒ From PE firm’s perspective, only 2 “cash flows”:

Initial equity investment

Value of equity at exit

1⁄

𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡𝐸𝐸 𝑉𝑉𝐷𝐷𝐷𝐷𝐸𝐸𝑃𝑃 𝐷𝐷𝑡𝑡 𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡 𝑁𝑁

PE firm’s IRR = −1

𝐼𝐼𝐷𝐷𝐸𝐸𝑡𝑡𝐸𝐸𝐷𝐷𝐷𝐷 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡𝐸𝐸 𝐼𝐼𝐷𝐷𝐷𝐷𝑃𝑃𝐷𝐷𝑡𝑡𝐹𝐹𝑃𝑃𝐷𝐷𝑡𝑡

57 FIN 448 / Jian Cai / Fall 2020

All equity FCFE + net debt issuance – interest × (1 – τc)

A Few Details behind the Projections…

2006 (year 1) 2007 (year 2)

From deal financing Debt (beginning of year) Debt (beginning of year)

EBITDA EBITDA

Assumptions about

operating EBIT EBIT

improvements - Interest expense - Interest expense

EBT EBT

2) do not add back after-tax

interest expenses (which - Taxes - Taxes

1) start with Net Income (not NOPAT)

goes to the debtholders

= Net income = Net income

+ Depreciation & amortization + Depreciation & amortization

+ Δ deferred taxes + Δ deferred taxes

Calculating free cash

flow to equity - Δ Net working capital - Δ Net working capital

- Capital expenditures - Capital expenditures

+/- other non-cash changes +/- other non-cash changes

Assume they use all = CF available to pay down debt = CF available to pay down debt

available FCFE to pay

down debt Debt (end of year) Debt (end of year)

58 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (X)

LBOs simultaneously change capital structure and ownership structure.

Can create value by simultaneously addressing several market frictions.

ABS financing can create additional value by increasing debt capacity.

PE firm exit horizon can limit scope for value creation through tax shields and

private ownership.

Summary of value sources:

Impact to firm (cash flows) Relevant market friction Relevant financial policy change

Interest tax shields Corporate taxes High debt level

Operating improvements Agency costs • High debt level (disciplinary role)

(mgr-shareholder) • Concentrated private ownership

(monitoring)

Higher sales price Information asymmetry Sale to a large private investor (rather

than public investors)

Increased debt capacity Financial distress costs, Change in debt structure (use of ABS

access to investment- financing)

grade credit market

59 FIN 448 / Jian Cai / Fall 2020

Payout Policy

Module 14

Practice Problem Set #9

60 FIN 448 / Jian Cai / Fall 2020

What is Payout Policy?

Free cash flow to equity (FCFE) is what’s left over after the firm:

Earns (after-tax) profits from past investments

Pays obligations to debt holders

Makes necessary new investments

FCFE is the equityholders’ money. What do we do with it?

Three options:

Keep it in the firm (excess cash)

Pay it out to shareholders (dividend)

Repurchase shares

Dividends Repurchase Retain cash

Timing of payout Now Now Later

Form of payout Cash Capital gain Capital gain

61 FIN 448 / Jian Cai / Fall 2020

Example

Dividend Timing 14.2

Dividend is ultimately a decision of the board of directors

Declaration date: Date after which the dividend becomes an

obligation

Payment date: When the checks are sent out

Record date: Determining who gets the dividend

In practice, based on whether you bought the stock before or on/after the

ex-dividend date, which is 2 trading days before the record date

Contrast between dividends and repurchases (few specifics given

on timing or amount of repurchases)

Anticipated price effects

Informational impact (value impact of the financial policy decision):

declaration date

On _____________

Mechanical impact (stock should fall by approximately the value of the

dividend, all else equal): On ___________

ex-dividend date

62 FIN 448 / Jian Cai / Fall 2020

Perfect Markets: Payout Policy Irrelevance

Example 14.1 (three options for the cash)

Example 14.4 (payout level at Apple Inc.)

63 FIN 448 / Jian Cai / Fall 2020

Friction 2: Personal Taxes and Payout Form

Implications for Payout Form:

Change in price on the ex-dividend day (Pcum – Pex) represents the market value of a

dividend

Investors often pay different tax rates on dividends (τd) and capital gains (τe)

Prices should adjust so one can’t make a profit by simply buying the stock the night before

the ex-date and selling it the next morning

Cost of this trade: Pcum

Return from this trade: Pex + DIV × (1–τd) + (Pcum – Pex) × τe

Set them equal and solve for the price difference:

1 − τd <1: cost of paying dividend

Pcum − Pex = DIV

1 − τe >1: paying dividend prefered

1−τd τd −τe

1− = represents the “tax cost” of paying dividends (rather than repurchases)

1−τe 1−τe

Two main implications:

When the effective personal tax rate on dividends is higher than that on capital gains,

there is a tax cost of paying dividends, and the firm can increase market value (all else

equal) by shifting to share repurchases

With effective capital gains tax rates less than rates on dividend income, we should expect

the price drop on the ex-dividend day to be slightly less than the value of the dividend

16 FIN 448 / Jian Cai / Fall 2020

Payout Level and Market Frictions

Market Friction Payout level Why?

Corporate and Depends on - Cash generates taxable interest income

personal taxes τc and τi - Want to earn interest in the lowest tax setting

Financial Distress costs Low Retaining cash builds equity cushion

Manager-shareholder Gets excess cash back to investors before any

High

agency conflicts value can be destroyed

Asymmetric information Preserve cash to be able to finance projects

Low

– “Pecking order” view with internal funds

Asymmetric information High payout can be a credible signal of

High

– “Signaling” view strength and confidence in future cash flows

Most important tradeoff in practice:

Precautionary savings vs. Return cash to shareholders

(Low payout reduces likelihood (High payout mitigates agency

of financial distress and reduces costs of free cash flow)

need for external finance )

64 FIN 448 / Jian Cai / Fall 2020

Payout Form and Market Frictions

Market Friction Payout Form Why?

Personal taxes Repurchases τdividend often > τcapital gain

Delay tax payment on capital gain

Financial Distress costs Repurchases Flexibility of repurchases

Manager-shareholder Dividends Implied commitment of dividends

agency conflicts

Asymmetric information Repurchases Flexibility of repurchases

– “Pecking order” view

Asymmetric information Either - Mgrs repurchase when shares under-valued

– “Signaling” view - High dividend sign of confidence in future CFs

Most important tradeoff in practice:

Discipline of Dividends vs. Tax advantage and

(Limit manager-shareholder flexibility of repurchases

agency conflicts) (Limit financial distress,

information costs)

65 FIN 448 / Jian Cai / Fall 2020

Friction 5: Information Asymmetry

What would the “pecking order” view of capital structure suggest for

payout policy?

Level: High vs. Low

Financing investment with internal funds avoids information asymmetry

costs. To accumulate internal funds, a firm needs to keep payouts low.

Form: Dividends vs. Repurchases

Again, due to the flexibility of repurchases. If investment needs arise, a

firm can temporarily reduce the level of share repurchases in order to

finance the investment with internally generated cash.

Using payout to “signal” firm quality:

Signaling with high dividends (why is it credible?)

If the firm did not have strong future earnings, the high dividend would

increase distress risk and require it to fund future investments with

external security issues (thus bearing the transaction and information

costs associated with issuance).

Signaling with repurchases (why is it credible?)

If the firm is low quality (i.e., overvalued), they would be buying shares for

more than what they are worth.

23 FIN 448 / Jian Cai / Fall 2020

Clientele Effects

Idea: A high dividend policy can attract a certain type of investor clientele

1. Tax clienteles

Different investors face different personal tax rates

Progressive personal tax rates

Tax-exempt institutions (e.g., pension funds, university endowments)

Corporate “dividends received deduction” (70% or more of dividend income is tax

deductible for corporations)

2. Consumption/cash-flow oriented investors

What would M&M say?

In perfect markets, if they held a non-dividend paying stock, they could create a

“homemade dividend” by selling off a fraction of their shares each quarter.

Why is this costly in the real world?

Frequent stock sales incur transaction costs. This creates a preference for

dividend-paying stocks among investors who want to get a regular stream of cash

out of their investments.

3. Institutional investors

Some institutions (e.g., pension funds) are reluctant to invest in non-dividend

paying stocks

66 FIN 448 / Jian Cai / Fall 2020

Key Takeaways (XI)

“The most important determinants of a company’s financial

strategy are its business strategy and the nature and extent

of its investment opportunities”

Firms that (appropriately) pay the highest dividends are:

Low growth

Profitable

Mature, large, and stable

Firms that (appropriately) pay the least dividends are:

High growth

Volatile

Small and young

67 FIN 448 / Jian Cai / Fall 2020

Course Evaluation

evals.wustl.edu

68 FIN 448 / Jian Cai / Fall 2020

You might also like

- Chapter 05 Test BankDocument73 pagesChapter 05 Test BankBrandon LeeNo ratings yet

- Dwnload Full Financial Management Core Concepts 4th Edition Brooks Solutions Manual PDFDocument35 pagesDwnload Full Financial Management Core Concepts 4th Edition Brooks Solutions Manual PDFbenboydr8pl100% (15)

- Finaincial Assign 2Document20 pagesFinaincial Assign 2Vaishnav SinghNo ratings yet

- Methods of Payment in International TradeDocument18 pagesMethods of Payment in International Tradeshravan.bhumkar100% (1)

- IntroductionDocument23 pagesIntroductionManika MahajanNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingSheena SoporiNo ratings yet

- Chapter 12Document11 pagesChapter 12Tiger HồNo ratings yet

- Cat FFM S21Document111 pagesCat FFM S21gene houNo ratings yet

- Money Banking FinanceDocument30 pagesMoney Banking Financevitaminlj7No ratings yet

- Capital Budgeting TutorialDocument26 pagesCapital Budgeting Tutorialf20221182No ratings yet

- FM Intro and Financing Capital BudetingDocument54 pagesFM Intro and Financing Capital BudetingMusangabu EarnestNo ratings yet

- Startup Valuation Guide: September 2018Document42 pagesStartup Valuation Guide: September 2018adsadNo ratings yet

- Introduction & Course Overview: Financial ManagementDocument23 pagesIntroduction & Course Overview: Financial ManagementRobin GhotiaNo ratings yet

- Making Capital Investment Decision: Topics CoveredDocument9 pagesMaking Capital Investment Decision: Topics Coveredsirkoywayo6628No ratings yet

- FIN5203 Midterm Exam 2 FL22 ReviewDocument46 pagesFIN5203 Midterm Exam 2 FL22 Reviewmerly chermonNo ratings yet

- Class 9Document25 pagesClass 9Ritesh SinghNo ratings yet

- 15.415x Foundations of Modern Finance: Lecture 1: IntroductionDocument37 pages15.415x Foundations of Modern Finance: Lecture 1: IntroductionyibungoNo ratings yet

- Financing Planning Lec 1Document72 pagesFinancing Planning Lec 1PrinceNo ratings yet

- Handout Fin Man 2307Document6 pagesHandout Fin Man 2307Renz NgohoNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingvitallifeskincareNo ratings yet

- 2019 UOL CF Notes Topic 1Document45 pages2019 UOL CF Notes Topic 1Jiang JinNo ratings yet

- Fin 202 Topic 3Document12 pagesFin 202 Topic 3Jia Wei ChanNo ratings yet

- Ca Final SFM Capital Budgeting Summary (Old Course)Document21 pagesCa Final SFM Capital Budgeting Summary (Old Course)swati mishraNo ratings yet

- ADocument89 pagesAJohn Carlo O. BallaresNo ratings yet

- Financial Training - F2Document29 pagesFinancial Training - F2Swan ye ThutaNo ratings yet

- Financial ManagementDocument70 pagesFinancial Managementrachit guptaNo ratings yet

- Slide CfaDocument295 pagesSlide CfaLinh HoangNo ratings yet

- Chapter 6Document16 pagesChapter 6manthq21404caNo ratings yet

- FM - 1 To 3Document169 pagesFM - 1 To 3FCA Zaid Travel VlogsNo ratings yet

- Chapter2 Without BlanksDocument45 pagesChapter2 Without BlanksMalimveNo ratings yet

- Corporate Finance - Lesson 1Document15 pagesCorporate Finance - Lesson 1Ajay AjayNo ratings yet

- Stonehill College BUS320-4aDocument23 pagesStonehill College BUS320-4asuck my cuntNo ratings yet

- 8-Capital BudgetingDocument89 pages8-Capital BudgetingJohn Francis IdananNo ratings yet

- Pln-Cmams - MERGER AND ACQUISITION PART 2Document31 pagesPln-Cmams - MERGER AND ACQUISITION PART 2dwi suhartantoNo ratings yet

- 2020week 3b ch8 and 9Document42 pages2020week 3b ch8 and 9Cecile KotzeNo ratings yet

- Financial Management PPT Pgdm2010 2Document94 pagesFinancial Management PPT Pgdm2010 2Bettappa patilNo ratings yet

- 125 FdocDocument11 pages125 Fdocsunkist0091No ratings yet

- LectureDocument23 pagesLectureAshish MalhotraNo ratings yet

- Financial Project PlanningDocument34 pagesFinancial Project PlanningRiccardo PappalardoNo ratings yet

- Capital Budgeting: An Investment Decision MethodDocument22 pagesCapital Budgeting: An Investment Decision MethodDhanush GowravNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- AFM - Investment Appraisal - AE - Week 1Document57 pagesAFM - Investment Appraisal - AE - Week 1AwaiZ zahidNo ratings yet

- Slides - Session 5Document49 pagesSlides - Session 5Murte BolaNo ratings yet

- Unit 10Document20 pagesUnit 10sheetal gudseNo ratings yet

- FMCF-unit 1Document57 pagesFMCF-unit 1shagun.2224mba1003No ratings yet

- AE 24 Module 2 Capital Investment AnalysisDocument12 pagesAE 24 Module 2 Capital Investment AnalysisShamae Duma-anNo ratings yet

- Valuation-Income ApproachDocument38 pagesValuation-Income Approachhart kevinNo ratings yet

- Cash Flow With SolutionsDocument80 pagesCash Flow With SolutionsPhebieon MukwenhaNo ratings yet

- Meet 13 - CB COC 0 Cash FlowDocument28 pagesMeet 13 - CB COC 0 Cash FlowKeith YohanesNo ratings yet

- Rps Bahan Ajar 9Document62 pagesRps Bahan Ajar 9GundamSeedNo ratings yet

- Capital Budgeting DecisionsDocument88 pagesCapital Budgeting DecisionsSpidey ModeNo ratings yet

- ch10 - The Basics of Capital BudgetingDocument14 pagesch10 - The Basics of Capital Budgetinganower.hosen61No ratings yet

- Week 4Document73 pagesWeek 4kaikuNo ratings yet

- 5a Unit 2.1 Topic 2.3.3 CashflowsDocument16 pages5a Unit 2.1 Topic 2.3.3 Cashflowssylviekasembe4No ratings yet

- Review SessionDocument25 pagesReview SessionK60 Bùi Phương AnhNo ratings yet

- CoFin - Lecture 4Document51 pagesCoFin - Lecture 4Elliot IseliNo ratings yet

- Chapter 2-Financial Statement AnalysisDocument25 pagesChapter 2-Financial Statement AnalysisNguyen Ha PhuongNo ratings yet

- Module 2Document9 pagesModule 2vinitaggarwal08072002No ratings yet

- Valuation For Investment BankingDocument27 pagesValuation For Investment BankingK RameshNo ratings yet

- Unit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDocument18 pagesUnit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDIVYA PRASOONA CNo ratings yet

- FInMan Chapter 1Document4 pagesFInMan Chapter 1foracademicfiles.01No ratings yet

- Chapter 6 - Investment Decisions - Capital BudgetingDocument21 pagesChapter 6 - Investment Decisions - Capital BudgetingYasir ShaikhNo ratings yet

- FIN448 Practice Final Exam Fall2020 SolutionDocument14 pagesFIN448 Practice Final Exam Fall2020 SolutionMay ChenNo ratings yet

- Fin 448 Final PracticeDocument2 pagesFin 448 Final PracticeMay ChenNo ratings yet

- Fin 448 FinalDocument4 pagesFin 448 FinalMay ChenNo ratings yet

- Practice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementDocument12 pagesPractice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementMay ChenNo ratings yet

- Maths Mania # 053: DIRECTIONS: For The Following Questions, Four Options Are Given. Choose The Correct OptionDocument3 pagesMaths Mania # 053: DIRECTIONS: For The Following Questions, Four Options Are Given. Choose The Correct OptionTUSHAR JALANNo ratings yet

- Inflation Targeting: A New Framework For Monetary Policy?: Ben S. Bernanke and Frederic S. MishkinDocument21 pagesInflation Targeting: A New Framework For Monetary Policy?: Ben S. Bernanke and Frederic S. MishkinSyed Aal-e RazaNo ratings yet

- Sapm 4Document12 pagesSapm 4Sweet tripathiNo ratings yet

- Silicon Valley BankDocument1 pageSilicon Valley BankDaisy BajarNo ratings yet

- Cash Management: By: Anjana Rai ROLL NO:260137Document18 pagesCash Management: By: Anjana Rai ROLL NO:260137anjanaindia3542100% (2)

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocument8 pagesChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanNo ratings yet

- Last Moment 1001 QuestionsDocument14 pagesLast Moment 1001 Questionsjoykumar1987No ratings yet

- ACCA2 1 Handout No. 1 - Conceptual Framework For Financial ReportingDocument3 pagesACCA2 1 Handout No. 1 - Conceptual Framework For Financial ReportingZia May LauretaNo ratings yet

- Commission Invoice: Del Corso Family SRL Calea Bogdanestilor, Nr. 18 300611 Timisoara RomaniaDocument2 pagesCommission Invoice: Del Corso Family SRL Calea Bogdanestilor, Nr. 18 300611 Timisoara RomaniaLorena NegreaNo ratings yet

- Currency INR INR INR INR INR: Income StatementDocument26 pagesCurrency INR INR INR INR INR: Income StatementNikhil BhatiaNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Financial 2TP 1Document4 pagesFinancial 2TP 1Janice Claire EstolonioNo ratings yet

- Chapter # 1: Accounting For Incomplete Records (Single Entry)Document24 pagesChapter # 1: Accounting For Incomplete Records (Single Entry)Umar Zahid100% (1)

- Chapter 22 - Statement of Cash FlowsDocument17 pagesChapter 22 - Statement of Cash Flowsprasad guthiNo ratings yet

- Financial Management Principles and Applications 7Th Edition Titman Test Bank Full Chapter PDFDocument28 pagesFinancial Management Principles and Applications 7Th Edition Titman Test Bank Full Chapter PDFMichelleJenkinsmtqi100% (11)

- HAPPEQUITY FINANCE LP - ShabariSShettyDocument3 pagesHAPPEQUITY FINANCE LP - ShabariSShettyShabari ShettyNo ratings yet

- Investment Management Term PaperDocument13 pagesInvestment Management Term PaperAbubbakarr JallohNo ratings yet

- University of The Punjab: Challan/PV NoDocument1 pageUniversity of The Punjab: Challan/PV Nojutt899No ratings yet

- PTI Financial Statement For Financial Year 2013-14Document7 pagesPTI Financial Statement For Financial Year 2013-14PTI Official100% (3)

- Unit-5 Working Capital ManagementDocument24 pagesUnit-5 Working Capital Managementdevil hNo ratings yet

- Arbitrage and Synthetic InstrumentsDocument12 pagesArbitrage and Synthetic InstrumentsfanizaNo ratings yet

- The Soul of MoneyDocument8 pagesThe Soul of MoneyR SternNo ratings yet

- Soalan Presentation FA 3Document12 pagesSoalan Presentation FA 3Vasant SriudomNo ratings yet

- Current Acc NEWDocument4 pagesCurrent Acc NEWSonu F1No ratings yet

- THE AFRICAN REINSURER June 2010Document52 pagesTHE AFRICAN REINSURER June 2010Obasi NgwutaNo ratings yet

- Sample Resume Columbia SipaDocument1 pageSample Resume Columbia SipafinaZarahNo ratings yet