Professional Documents

Culture Documents

Stockmock Positions

Stockmock Positions

Uploaded by

kumar mhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stockmock Positions

Stockmock Positions

Uploaded by

kumar mhCopyright:

Available Formats

StockMock

POSITIONS

ATM :

Square Off :

Wait & Trade :

Move SL to Cost :

Re-Entry / Re-Execute :

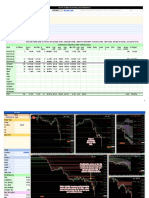

Include Total Lot Action Type Strike Option Type Wait & Trade

True 1 Lot BUY Futures

True 1 Lot SELL Futures

Entry Time : 15:00

Target Profit :

Protect The Profits :

Banknifty data available from Mon Jan 02 2017, Nifty data available from Fri Feb 15 2

Nifty lot size is considered 75 uptil Thu Jul 22 2021 and

Banknifty lot size is considered 2

From Date : Thu Mar 09 2023

Type INTRADAY

* Please Note that real re

Slippages % : 0 (0.5% Slippages are already included for options strategies)

Vix : 1 99

Group By : Expiry

Mon

Estimated Margin (On 6 Apr) Rs 2.45L

Overall Profit Rs 10110 (4%)

Avg Day Profit Rs 594 (0.24%)

Max Profit Rs 10367 (4.24%)

Max Loss Rs -8523 (-3.48)%

Win% (Days) 59% (10)

Loss% (Days) 41% (7)

Avg Monthly Profit Rs 9478 (3.87%)

Avg Profit On Win Days Rs 3406 (1.39%)

Avg Loss On Loss Days Rs -3421 (-1.40%)

Lot Size 2

Max Drawdown (MDD) Rs -16433(-6.71%)

MDD Days (Recovery Period) 25 (9 Days - Running) (15 Mar 2023 - Running)

Return to MDD Ratio NA

Max Winning Streak 4 Days

Max Losing Streak 3 Days

Expectancy NA

Day Wise Breakup

stockmock.in Mon Tue Wed Thu Fri

2023 -8994 2915 3024 12373 792

Total -8994 2915 3024 12373 792

stockmock.in Jan Feb Mar Apr May

2023 0 0 5743 4367 0

Total 0 0 5743 4367 0

kumarmh16+91 814****388

POSITIONS

Spot

Leg

False

False

False

Target Profit Stop Loss Trail Stop Loss Re-entry Index Expiry

N MONTHLY

BN MONTHLY

Exit Time : 15:01

Stop Loss :

available from Fri Feb 15 2019, and Finnifty data available from Wed Oct 19 2022.

5 uptil Thu Jul 22 2021 and 50 after Thu Jul 22 2021.

nifty lot size is considered 25.

To Date : Sun Apr 09 2023

* Please Note that real results may vary from backtest results you see here. Do enough research before doing live trades.

* StockMock has stopped considering 9:15 candle data for practical results.

* Inbuilt Slippages (0.5%) are now included for options strategies in every backtest.

RESULT

Tue Wed Thu Fri Sat

Monthly Breakup

Jun Jul Aug Sep Oct Nov

0 0 0 0 0 0

0 0 0 0 0 0

Dec Total MDD ROI

0 10110 -16433 4%

0 10110 -16433 4%

Include Date Profit Exit Time Max Profit/Loss India VIX

True 09-Mar-2023 10367 2023-03-10(Fri) 15:01 12075/-669 12.61 - 13.47

True 10-Mar-2023 8061 2023-03-13(Mon) 15:01 9769/-496 13.51 - 16.26

True 13-Mar-2023 -1966 2023-03-14(Tue) 15:01 6475/-2739 16.28 - 16.19

True 14-Mar-2023 5362 2023-03-15(Wed) 15:01 5801/-2347 16.23 - 16.05

True 15-Mar-2023 352 2023-03-16(Thu) 15:01 7244/-2246 15.97 - 16.22

True 16-Mar-2023 -2 2023-03-17(Fri) 15:01 3749/-3312 16.26 - 14.8

True 17-Mar-2023 -5129 2023-03-20(Mon) 15:01 0/-10292 14.9 - 16.31

True 20-Mar-2023 -8523 2023-03-21(Tue) 15:01 936/-9261 16.36 - 15.07

True 21-Mar-2023 431 2023-03-22(Wed) 15:01 3326/-1180 15.02 - 14.82

True 22-Mar-2023 2326 2023-03-23(Thu) 15:01 2854/-2904 14.85 - 14.28

True 23-Mar-2023 2008 2023-03-24(Fri) 15:01 5553/0 14.36 - 15.19

True 24-Mar-2023 783 2023-03-27(Mon) 15:01 5314/-666 15.02 - 15.18

True 27-Mar-2023 -2526 2023-03-28(Tue) 15:01 3226/-2769 15.17 - 15.13

True 28-Mar-2023 -2878 2023-03-29(Wed) 15:01 0/-6734 15.11 - 13.98

Include Date Profit Exit Time Max Profit/Loss India VIX

True 31-Mar-2023 -2923 2023-04-03(Mon) 15:01 1263/-4572 12.91 - 12.69

True 03-Apr-2023 4021 2023-04-05(Wed) 15:01 5096/-247 12.7 - 12.48

True 05-Apr-2023 346 2023-04-06(Thu) 15:01 2318/-3507 12.47 - 11.79

Expiry: 29 MAR 2023, Net Profit: 8666, Average Day Profit: 619

N Gap Up/Down BN Gap Up/Down N Prev Day H/L BN Prev Day H/L N Spot Change

17.65 ( 0.1%) -44.45 ( -0.11%) Day Open > PDH - -223 ( 17608.6-17385.5)

-227

-145.8 ( -0.83%) -451.5 ( -1.09%) Day Open < PDL Day Open < PDL

( 17383.15-17156.2)

9 ( 0.05%) -129.35 ( -0.32%) - - -94 ( 17142.7-17048.8)

6.25 ( 0.04%) -42.3 ( -0.11%) - - -45 ( 17048.2-17003.2)

-42

123.15 ( 0.72%) 366.5 ( 0.93%) - Day Open > PDH

( 17018.55-16976.55)

137

22.5 ( 0.13%) 10.2 ( 0.03%) - -

( 16976.45-17113.6)

126.2 ( 0.74%) 309.8 ( 0.79%) Day Open > PDH Day Open > PDH -149 ( 17094.2-16944.8)

171

-33.45 ( -0.2%) -86 ( -0.22%) - -

( 16943.15-17114.25)

72 ( 0.42%) 237.7 ( 0.6%) - Day Open > PDH 25 ( 17119.15-17144.5)

69.95 ( 0.41%) 141.3 ( 0.35%) Day Open > PDH Day Open > PDH -29 ( 17140.35-17110.9)

-133

-54.5 ( -0.32%) -162.9 ( -0.41%) Day Open < PDL Day Open < PDL

( 17094.7-16961.75)

-0.7 ( 0%) -61.65 ( -0.16%) - - 44 ( 16999.3-17043.6)

39.25 ( 0.23%) 89.35 ( 0.23%) - - -89 ( 17050.25-16961.1)

77

46.05 ( 0.27%) 113.75 ( 0.29%) - -

( 16953.95-17030.95)

Expiry: 27 APR 2023, Net Profit: 1444, Average Day Profit: 481

N Gap Up/Down BN Gap Up/Down N Prev Day H/L BN Prev Day H/L N Spot Change

129.65 ( 0.76%) 321.1 ( 0.8%) Day Open > PDH Day Open > PDH 27 ( 17364.7-17392.15)

162

68.2 ( 0.39%) 87.15 ( 0.21%) Day Open > PDH Day Open > PDH ( 17384.1-17546.25)

24.25 ( 0.14%) 159.25 ( 0.39%) - Day Open > PDH 54 ( 17548.25-17602.4)

ay Profit: 619

BN Spot Change N Fut Change BN Fut Change (1) N Buy 1 lot Futures

-11695

-887 ( 41308.6-40422) -234 ( 17660-17426.1) -882 ( 41447-40564.5)

-763 ( 17660-17426.1=-233.9)

-11015

-790 ( 40407.7-39617.75) -220 ( 17422.3-17202)

( 40551.8-39788.75) ( 17422.3-17202=-220.3)

-2855

-97 ( 39580.6-39483.85) -57 ( 17190.85-17133.75) -36 ( 39745.55-39710)

-353 ( 17190.85-17133.75=-57.1)

-3470

-314 ( 39475.45-39161.6) -69 ( 17133.8-17064.4)

( 39703.25-39349.95)

-91 ( 17133.8-17064.4=-69.4)

-1917

-116 ( 39203.45-39087.2) -38 ( 17078.35-17040)

358 ( 39405.65-39314.85)

289 ( 17078.35-17040=-38.35)

7223

144 ( 17045.25-17189.7)

( 39098.35-39455.95)

-146 -190 ( 39325.45-39614.45) ( 17045.25-17189.7=144.45)

-9515

-175 ( 39538.8-39363.4)

( 39358.85-39212.45) ( 17175.75-16985.45) 704 ( 17175.75-16985.45=-190.3)

9077

736 ( 39192.8-39928.65) 182 ( 16984.55-17166.1)

( 39364.1-40068.15) ( 16984.55-17166.1=181.55)

17 ( 39948.5-39965.7) 4 ( 17171.65-17176) -9 ( 40096.65-40088.1) 217 ( 17171.65-17176=4.35)

-143 ( 39935.45-39792.4) -41 ( 17172.9-17131.6) -176 ( 40055.65-39880) -2065

-151 -382 ( 17172.9-17131.6=-41.3)

-7535

-344 ( 39776.3-39432)

( 17119.45-16968.75) ( 39868.35-39486.6)

115 ( 17119.45-16968.75=-150.7)

3663

111 ( 39499.2-39609.95) 73 ( 17006.2-17079.45)

( 39566.95-39682.1) ( 17006.2-17079.45=73.25)

-32 ( 39579.45-39547.85) -104 ( 17087-16983.4) -106 ( 39678.15-39572) -5180 ( 17087-16983.4=-103.6)

2245

224 ( 39531.5-39755.7) 45 ( 16977.75-17022.65) 205 ( 39554-39758.95)

( 16977.75-17022.65=44.9)

y Profit: 481

BN Spot Change N Fut Change BN Fut Change (1) N Buy 1 lot Futures

149

188 ( 40624.65-40813) 16 ( 17448.75-17464.7) 798 ( 17448.75-17464.7=15.95)

215 ( 40856.6-41005.45)

151

( 40791.65-41006.35) 156 ( 17459.1-17615.1) ( 40995.65-41146.8) 7800 ( 17459.1-17615.1=156)

1365

57 ( 41012.2-41069.05) 27 ( 17620.05-17647.35) 41 ( 41174.8-41215.55)

( 17620.05-17647.35=27.3)

(2) BN Sell 1 lot Futures

22063 ( 41447-40564.5=-882.5)

19076

( 40551.8-39788.75=-763.05)

889 ( 39745.55-39710=-35.55)

8833

( 39703.25-39349.95=-353.3)

2270

( 39405.65-39314.85=-90.8)

-7225

( 39325.45-39614.45=289)

4385 ( 39538.8-39363.4=-175.4)

-17601

( 39364.1-40068.15=704.05)

214 ( 40096.65-40088.1=-8.55)

4391

( 40055.65-39880=-175.65)

9544

( 39868.35-39486.6=-381.75)

-2879

( 39566.95-39682.1=115.15)

2654

( 39678.15-39572=-106.15)

-5124

( 39554-39758.95=204.95)

(2) BN Sell 1 lot Futures

-3721

( 40856.6-41005.45=148.85)

-3779

( 40995.65-41146.8=151.15)

-1019

( 41174.8-41215.55=40.75)

Date Day Profit Exit Time Max Profit/Loss

Date Day Profit Date Day Time Max Profit

3/9/2023 Thu 10367 2023-03-10 Fri 15:01 12075

3/10/2023 Fri 8061 2023-03-13 Mon 15:01 9769

3/13/2023 Mon -1966 2023-03-14 Tue 15:01 6475

3/14/2023 Tue 5362 2023-03-15 Wed 15:01 5801

3/15/2023 Wed 352 2023-03-16 Thu 15:01 7244

3/16/2023 Thu -2 2023-03-17 Fri 15:01 3749

3/17/2023 Fri -5129 2023-03-20 Mon 15:01 0

3/20/2023 Mon -8523 2023-03-21 Tue 15:01 936

3/21/2023 Tue 431 2023-03-22 Wed 15:01 3326

3/22/2023 Wed 2326 2023-03-23 Thu 15:01 2854

3/23/2023 Thu 2008 2023-03-24 Fri 15:01 5553

3/24/2023 Fri 783 2023-03-27 Mon 15:01 5314

3/27/2023 Mon -2526 2023-03-28 Tue 15:01 3226

3/28/2023 Tue -2878 2023-03-29 Wed 15:01 0

3/31/2023 Fri -2923 2023-04-03 Mon 15:01 1263

4/3/2023 Mon 4021 2023-04-05 Wed 15:01 5096

4/5/2023 Wed 346 2023-04-06 Thu 15:01 2318

Max Profit/Loss India VIX N Gap Up/Down BN Gap Up/Down

Max Loss Entry Exit Point Percent Point Percent

-669 12.61 13.47 17.65 0.1 -44.45 -0.11

-496 13.51 16.26 -145.8 -0.83 -451.5 -1.09

-2739 16.28 16.19 9 0.05 -129.35 -0.32

-2347 16.23 16.05 6.25 0.04 -42.3 -0.11

-2246 15.97 16.22 123.15 0.72 366.5 0.93

-3312 16.26 14.8 22.5 0.13 10.2 0.03

-10292 14.9 16.31 126.2 0.74 309.8 0.79

-9261 16.36 15.07 -33.45 -0.2 -86 -0.22

-1180 15.02 14.82 72 0.42 237.7 0.6

-2904 14.85 14.28 69.95 0.41 141.3 0.35

0 14.36 15.19 -54.5 -0.32 -162.9 -0.41

-666 15.02 15.18 -0.7 -61.65 -0.16

-2769 15.17 15.13 39.25 0.23 89.35 0.23

-6734 15.11 13.98 46.05 0.27 113.75 0.29

-4572 12.91 12.69 129.65 0.76 321.1 0.8

-247 12.7 12.48 68.2 0.39 87.15 0.21

-3507 12.47 11.79 24.25 0.14 159.25 0.39

N Prev Day H/L BN Prev Day H/L N Spot Change BN Spot Change

N Prev Day H/L BN Prev Day H/L Spot Change Entry Spot Exit Spot Spot Change

Day Open > PDH - -223 17608.6 17385.5 -887

Day Open < PDL Day Open < PDL -227 17383.15 17156.2 -790

- - -94 17142.7 17048.8 -97

- - -45 17048.2 17003.2 -314

- Day Open > PDH -42 17018.55 16976.55 -116

- - 137 16976.45 17113.6 358

Day Open > PDH Day Open > PDH -149 17094.2 16944.8 -146

- - 171 16943.15 17114.25 736

- Day Open > PDH 25 17119.15 17144.5 17

Day Open > PDH Day Open > PDH -29 17140.35 17110.9 -143

Day Open < PDL Day Open < PDL -133 17094.7 16961.75 -344

- - 44 16999.3 17043.6 111

- - -89 17050.25 16961.1 -32

- - 77 16953.95 17030.95 224

Day Open > PDH Day Open > PDH 27 17364.7 17392.15 188

Day Open > PDH Day Open > PDH 162 17384.1 17546.25 215

- Day Open > PDH 54 17548.25 17602.4 57

BN Spot Change N Fut Change BN Fut Change

Entry Spot Exit Spot Fut Change Entry Fut Exit Fut Fut Change Entry Fut

41308.6 40422 -234 17660 17426.1 -882 41447

40407.7 39617.75 -220 17422.3 17202 -763 40551.8

39580.6 39483.85 -57 17190.85 17133.75 -36 39745.55

39475.45 39161.6 -69 17133.8 17064.4 -353 39703.25

39203.45 39087.2 -38 17078.35 17040 -91 39405.65

39098.35 39455.95 144 17045.25 17189.7 289 39325.45

39358.85 39212.45 -190 17175.75 16985.45 -175 39538.8

39192.8 39928.65 182 16984.55 17166.1 704 39364.1

39948.5 39965.7 4 17171.65 17176 -9 40096.65

39935.45 39792.4 -41 17172.9 17131.6 -176 40055.65

39776.3 39432 -151 17119.45 16968.75 -382 39868.35

39499.2 39609.95 73 17006.2 17079.45 115 39566.95

39579.45 39547.85 -104 17087 16983.4 -106 39678.15

39531.5 39755.7 45 16977.75 17022.65 205 39554

40624.65 40813 16 17448.75 17464.7 149 40856.6

40791.65 41006.35 156 17459.1 17615.1 151 40995.65

41012.2 41069.05 27 17620.05 17647.35 41 41174.8

N Fut Change (1) N Buy 1 lot Futures (2) BN Sell 1 l

Exit Fut Profit Entry Price Exit Price Difference Strike Profit

40564.5 -11695 17660 17426.1 -233.9 22063

39788.75 -11015 17422.3 17202 -220.3 19076

39710 -2855 17190.85 17133.75 -57.1 889

39349.95 -3470 17133.8 17064.4 -69.4 8833

39314.85 -1917 17078.35 17040 -38.35 2270

39614.45 7223 17045.25 17189.7 144.45 -7225

39363.4 -9515 17175.75 16985.45 -190.3 4385

40068.15 9077 16984.55 17166.1 181.55 -17601

40088.1 217 17171.65 17176 4.35 214

39880 -2065 17172.9 17131.6 -41.3 4391

39486.6 -7535 17119.45 16968.75 -150.7 9544

39682.1 3663 17006.2 17079.45 73.25 -2879

39572 -5180 17087 16983.4 -103.6 2654

39758.95 2245 16977.75 17022.65 44.9 -5124

41005.45 798 17448.75 17464.7 15.95 -3721

41146.8 7800 17459.1 17615.1 156 -3779

41215.55 1365 17620.05 17647.35 27.3 -1019

(2) BN Sell 1 lot Futures

Entry Price Exit Price Difference Strike

41447 40564.5 -882.5

40551.8 39788.75 -763.05

39745.55 39710 -35.55

39703.25 39349.95 -353.3

39405.65 39314.85 -90.8

39325.45 39614.45 289

39538.8 39363.4 -175.4

39364.1 40068.15 704.05

40096.65 40088.1 -8.55

40055.65 39880 -175.65

39868.35 39486.6 -381.75

39566.95 39682.1 115.15

39678.15 39572 -106.15

39554 39758.95 204.95

40856.6 41005.45 148.85

40995.65 41146.8 151.15

41174.8 41215.55 40.75

You might also like

- Homework 2 MGMT 41150 Key PDFDocument6 pagesHomework 2 MGMT 41150 Key PDFLaxus DreyerNo ratings yet

- Checkpoint Exam 3 (Study Sessions 16-19, 1)Document11 pagesCheckpoint Exam 3 (Study Sessions 16-19, 1)Bảo TrâmNo ratings yet

- Chap08 Pbms SolutionsDocument25 pagesChap08 Pbms SolutionsDouglas Estrada100% (1)

- Solutions Chapter 8 Futures and OptionsDocument12 pagesSolutions Chapter 8 Futures and OptionsDian Putra PrasetyaNo ratings yet

- Stockmock PositionsDocument16 pagesStockmock Positionskumar mhNo ratings yet

- Stockmock PositionsDocument13 pagesStockmock Positionskumar mhNo ratings yet

- BNF Pos - StockmockDocument14 pagesBNF Pos - StockmockSatish KumarNo ratings yet

- Nifty Pos - StockMockDocument15 pagesNifty Pos - StockMockSatish KumarNo ratings yet

- Stockmock PositionsDocument16 pagesStockmock Positionskumar mhNo ratings yet

- Short Straddle StockMockDocument263 pagesShort Straddle StockMockHemanth raoNo ratings yet

- 100 PT Stop Loss - 9.30 - StockMockDocument324 pages100 PT Stop Loss - 9.30 - StockMockbayagani rakeshNo ratings yet

- PositionaLearner AlgoReportDocument2 pagesPositionaLearner AlgoReportSabah SaleemNo ratings yet

- PDF Report-1163880230324Document7 pagesPDF Report-1163880230324ravibv2305No ratings yet

- Kim'S Trade Summary and Statistics: Link Jingjang TraderDocument4 pagesKim'S Trade Summary and Statistics: Link Jingjang TraderMorello SiméonNo ratings yet

- Nifty Test StockMockDocument23 pagesNifty Test StockMockHarish PatelNo ratings yet

- DRM - Futures Market - Lecture - 1 - March 19, 2024 - PPT - ACVDocument12 pagesDRM - Futures Market - Lecture - 1 - March 19, 2024 - PPT - ACVf20221319No ratings yet

- Strategy Tester Voltrap DiamondDocument1 pageStrategy Tester Voltrap DiamondThobib OtaiNo ratings yet

- PDF Report-1163892230324Document7 pagesPDF Report-1163892230324ravibv2305No ratings yet

- PDF Report-1161121230323Document7 pagesPDF Report-1161121230323ravibv2305No ratings yet

- Backtesting ReportDocument7 pagesBacktesting ReportSatvik JainNo ratings yet

- Taxpnl FY2023 2024Document3 pagesTaxpnl FY2023 2024First ChoiceNo ratings yet

- Corporate Case StudiesDocument68 pagesCorporate Case StudiesAnand RajNo ratings yet

- Kim's Trade Summary and StatisticsDocument25 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Ykfuhrc2qlwoy Sz9o39ugv007dw10g-Qulys5vfqpkDocument3 pagesYkfuhrc2qlwoy Sz9o39ugv007dw10g-Qulys5vfqpkrkchoudhary03012006No ratings yet

- Pdfreport 2335062240108Document7 pagesPdfreport 2335062240108vemulakondavenky7No ratings yet

- KimlolDocument9 pagesKimlolMorello SiméonNo ratings yet

- AllRounder AlgoReportDocument2 pagesAllRounder AlgoReportSabah SaleemNo ratings yet

- Kim's Trade Summary and StatisticsDocument10 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Kim's Trade Summary and StatisticsDocument11 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Kim's Trade Summary and StatisticsDocument4 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- PDF Report-1213468230428Document7 pagesPDF Report-1213468230428ravibv2305No ratings yet

- Portfolio ReportDocument3 pagesPortfolio Reporttanaysaraf2022No ratings yet

- 5 M15 StrategyTesterDocument2 pages5 M15 StrategyTesterridwankhoiriNo ratings yet

- Report 17465782309277Document7 pagesReport 17465782309277Nitin TomarNo ratings yet

- Q5 Feb SmesterDocument2 pagesQ5 Feb SmesterDanyal ChaudharyNo ratings yet

- Date: 2023-05-04: Corporate G SecDocument3 pagesDate: 2023-05-04: Corporate G SecRonit SinghNo ratings yet

- Chapter 6 - Hospitality and Related ServicesDocument50 pagesChapter 6 - Hospitality and Related ServicesLongNo ratings yet

- StatementDocument12 pagesStatementsupertraderNo ratings yet

- May 1st Audit - Central (Mercado)Document11 pagesMay 1st Audit - Central (Mercado)Alyssa Mae GuroNo ratings yet

- PassiveIncomeEarner AlgoReportDocument2 pagesPassiveIncomeEarner AlgoReportSabah SaleemNo ratings yet

- Taxp&l Xxizm Fy2024-2025Document5 pagesTaxp&l Xxizm Fy2024-2025Surendra SorenNo ratings yet

- MB137076624R7Document4 pagesMB137076624R7SiddharthNo ratings yet

- 8 SemanasDocument2 pages8 Semanasapi-408124642No ratings yet

- Jayavarthana NDocument2 pagesJayavarthana NViralyNo ratings yet

- Caps TrendDocument5 pagesCaps TrendNiraj KumarNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2021.08.16 17:30:54 UTCDocument3 pagesCash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2021.08.16 17:30:54 UTCSoma Sundaram NNo ratings yet

- Canara Rob Emerging Equitties FundDocument1 pageCanara Rob Emerging Equitties Fundjaspreet AnandNo ratings yet

- IPO - Market Update - Jul'2023Document92 pagesIPO - Market Update - Jul'2023Никита МузафаровNo ratings yet

- PV pfs-5 YearsDocument36 pagesPV pfs-5 YearsjsphdvdNo ratings yet

- Deposit Rate Chart: Credit Suisse AGDocument2 pagesDeposit Rate Chart: Credit Suisse AGRohit RoyNo ratings yet

- ThetaEarner AlgoReportDocument2 pagesThetaEarner AlgoReportSabah SaleemNo ratings yet

- Trade DateDocument16 pagesTrade Datecps2502No ratings yet

- PNL Report 20-Jun-23Document20 pagesPNL Report 20-Jun-23Manish JainNo ratings yet

- Kim's Trade Reviews +161 50, +150 22 Aft Comm, 3 TradesDocument4 pagesKim's Trade Reviews +161 50, +150 22 Aft Comm, 3 TradesMorello SiméonNo ratings yet

- Sovrenn Times 02 May 2023Document10 pagesSovrenn Times 02 May 2023xyzNo ratings yet

- CF-Export-05-03-2024 18Document11 pagesCF-Export-05-03-2024 18v4d4f8hkc2No ratings yet

- Tax Report 28-Jul-23Document20 pagesTax Report 28-Jul-23BIRUPAKHYA SAHUNo ratings yet

- Market Share Jan09Document2 pagesMarket Share Jan09The Pinnacle TeamNo ratings yet

- Nrp-Nse: Nimeshkumar Rajeshbhai PatelDocument2 pagesNrp-Nse: Nimeshkumar Rajeshbhai PatelNimesh PatelNo ratings yet

- Sovrenn Times 12 Feb 2024Document45 pagesSovrenn Times 12 Feb 2024Reshu DuggalNo ratings yet

- PDF Report-1522638230824Document6 pagesPDF Report-1522638230824Manu S KashyapNo ratings yet

- Ab5431 20220105 Combined Margin StatementDocument1 pageAb5431 20220105 Combined Margin Statementthotada durga prasadNo ratings yet

- SWP MAF - Jun'22Document6 pagesSWP MAF - Jun'22Deepak GoyalNo ratings yet

- Emmett T.J. Fibonacci Forecast ExamplesDocument9 pagesEmmett T.J. Fibonacci Forecast ExamplesAnantJaiswal100% (1)

- Assignment 2Document7 pagesAssignment 2ojasvi kathuriaNo ratings yet

- Financial Theory and Corporate PolicyDocument958 pagesFinancial Theory and Corporate PolicyDiego Ontaneda100% (1)

- Treasury and Risk Management PDFDocument25 pagesTreasury and Risk Management PDFShanidNo ratings yet

- EconomicsDocument27 pagesEconomicschirag jainNo ratings yet

- Dynamic Trader Daily Report: Today's LessonDocument3 pagesDynamic Trader Daily Report: Today's LessonBudi MulyonoNo ratings yet

- CH 13 Hull OFOD8 TH EditionDocument31 pagesCH 13 Hull OFOD8 TH EditionAlex WanowskiNo ratings yet

- Chapter 1 Financial MarketsDocument32 pagesChapter 1 Financial Markets09 CHAN CHUI YAN S2ENo ratings yet

- ScotiaBank-JUN-25-Weekly FX CFTC Commitments of TradersDocument4 pagesScotiaBank-JUN-25-Weekly FX CFTC Commitments of TradersMiir ViirNo ratings yet

- Idx Monthly September 2020 PDFDocument129 pagesIdx Monthly September 2020 PDFAlexNo ratings yet

- Recommendations of Narsimha CommitteeDocument10 pagesRecommendations of Narsimha CommitteePrathamesh DeoNo ratings yet

- 3 ITF-Exchange Risk ManagementDocument16 pages3 ITF-Exchange Risk ManagementParvesh AghiNo ratings yet

- Satisfaction Level of Investors With Their Broking FirmDocument81 pagesSatisfaction Level of Investors With Their Broking FirmVijaysinh Parmar50% (2)

- Chap 9Document7 pagesChap 9GinanjarSaputra0% (1)

- (Bret-Rouzaut, Nadine, Favennec, Jean-Pierre) Oil PDFDocument291 pages(Bret-Rouzaut, Nadine, Favennec, Jean-Pierre) Oil PDFanellbmcNo ratings yet

- A Project Report On Technical Analysis of Automobile Sector at Geojit PNB ParibasDocument62 pagesA Project Report On Technical Analysis of Automobile Sector at Geojit PNB ParibasBabasab Patil (Karrisatte)No ratings yet

- Special Class Managing Interest Rate RisksDocument7 pagesSpecial Class Managing Interest Rate Risksmiradvance studyNo ratings yet

- LC Onfeed CBTDocument1 pageLC Onfeed CBTPhương NguyễnNo ratings yet

- Investment AlternativesDocument14 pagesInvestment AlternativesAnjaliPrasadNo ratings yet

- Vanguard VTDocument186 pagesVanguard VTRaka AryawanNo ratings yet

- Dynamic Trader Daily Report: Protective Stop Adjustment On CopperDocument5 pagesDynamic Trader Daily Report: Protective Stop Adjustment On CopperBudi MulyonoNo ratings yet

- Trading Futures With: By: Dr. Charles B. SchaapDocument7 pagesTrading Futures With: By: Dr. Charles B. SchaapMilind Bidve100% (6)

- Paper - 2: Strategic Financial Management: Alfa Ltd. Beta LTDDocument23 pagesPaper - 2: Strategic Financial Management: Alfa Ltd. Beta LTDDinesh MaheshwariNo ratings yet

- Book 1 Chapter 2Document4 pagesBook 1 Chapter 2Tanveer AhmadNo ratings yet

- ZalameaDocument2 pagesZalameajohnmiggyNo ratings yet

- Gic WeeklyDocument12 pagesGic WeeklycampiyyyyoNo ratings yet