Professional Documents

Culture Documents

Determinants of Tax Awareness: A Systematic Literature Review

Determinants of Tax Awareness: A Systematic Literature Review

Uploaded by

Yi Ning Chiah EnyoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Determinants of Tax Awareness: A Systematic Literature Review

Determinants of Tax Awareness: A Systematic Literature Review

Uploaded by

Yi Ning Chiah EnyoCopyright:

Available Formats

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

International Journal of Business and Economy (IJBEC)

eISSN: 2682-8359 | Vol. 4 No. 3 [September 2022]

Journal website: http://myjms.mohe.gov.my/index.php/ijbec

DETERMINANTS OF TAX AWARENESS: A SYSTEMATIC

LITERATURE REVIEW

Nur Marliana Mohamad1*, Norlaila Md Zin2 and Suzana Sulaiman3

1

Jabatan Pengurusan dan Sains Sosial, Kolej Yayasan Pelajaran Johor, Kulai, MALAYSIA

23

Faculty Accountancy, Universiti Teknologi Mara, Shah Alam, MALAYSIA

*Corresponding author: nurmarliana@kypj.edu.my

Abstract: Tax awareness among the society is important

Article Information: since it is one of the main factors that contribute to tax

Article history: compliance among taxpayers. This study aimed to

systematically review, consolidate, and integrate the

Received date : 21 August 2022 findings of various empirical studies in the literature to

Revised date : 30 August 2022 identify the factors affecting tax awareness. Out of the

Accepted date : 4 September 2022

Published date : 10 September 2022 identified and screened 310 related studies, a total of 14

articles were included in this systematic review. A

To cite this document: frequency analysis was conducted on these selected

articles to look into the factors, theorical components,

Mohamad, N. M.., Md Zin, N., &

Sulaiman, S. (2022).

methodological approaches, countries of the origin,

DETERMINANTS OF TAX sample size, and the studies’ distribution by year. The

AWARENESS: A SYSTEMATIC results showed that tax knowledge, attitude, tax morale

LITERATURE REVIEW. and tax socialization are among the most factors

International Journal of Business and influencing tax awareness. As for theories, the Planned

Economy, 4(3), 303-315.

Behaviour and Attribution theories are the mostly

applied theories in the literature related to tax

awareness. In terms of distribution, the largest share of

the studies was attributed to Indonesia, followed by

Malaysia and Turkey. Methodologically, majority of the

studies are quantitative in nature, and then scientific

approach. Government, tax authorities and related

parties can utilize the findings of this study to improve

tax awareness for better compliance in future.

Keywords: Tax Awareness, Tax Compliance, Theory of

Planned Behavior (TPB).

303

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

1. Introduction

The issue of non-tax compliance has become a major concern globally since the

implementation of self-assessment system. Non-compliance with tax laws impedes the ability

of the government to collect taxes efficiently in both developed and developing countries, and

Malaysia has no exemption. Recently, the Inland Revenue Board Malaysia (IRBM) detected a

total of 31,598 entities comprising individuals, businesses, companies, and others who have

yet to report their actual income in which this has contributed to the country's direct tax leakage

of RM 665 million (Sinar Harian, 2022). Further investigation revealed that a total of 23,751

entities were constituted by individuals, while another 7,847 were from businesses, companies,

and others. Alarmed by this statistic, the Malaysian government has outlined three approaches

to mitigate non-compliance issues, i.e. through awareness, education, and service. These

approaches are in line with the suggestion by Othman et al. (2020) who asserted that the level

of tax compliance among taxpayers in a country reflect the level of knowledge about taxation

system among its citizens.

Previous studies in the literature have provided the evidence to show that tax awareness is

among the major factors that influence tax compliance (Adimasu, 2017; Indah & Setiawan,

2020; Lisa & Hermanto, 2018; Nurkhin et al., 2018; Oktaviani et al., 2020; Wicaksono &

Lestari, 2017; Zanaria & Lestari, 2020). For instance, Wicaksono and Lestari (2017) revealed

the significant influence of the taxpayers’ attitude on their tax compliance. In line with these

studies, Sanusi et al. (2021) suggested that introducing tax awareness at a young age is

necessary to prevent non-compliance among the citizens in the future. In fact, according to the

study by the Organisation for Economic Co-operation and Development (OECD), tax

awareness and literacy is the key driver that contributes to shape the tax culture of a country,

whereby the people managed to develop an understanding about the consequences of both

paying and not paying taxes on their daily activities (OECD, 2021a). Given the importance of

tax awareness towards tax compliance, it seems necessary to investigate factors that influence

awareness towards taxes so that tax compliance behavior can be improved from the ground up.

Meanwhile, several previous studies attempted to find the factors that influence tax awareness

among individuals. In some research, tax awareness is associated with factors such as the tax

education received by individuals (Baykan & Cek, 2019; Gergerlioğlu & Гергерлиоглу, 2022;

Tjen & Wicaksono, 2022), tax knowledge (Hamid et al., 2019; Hardiningsih et al., 2020;

Muawanah & Gajayana, 2021; Oktaviani et al., 2020; Panjaitan et al., 2018; Pattiasina et al.,

2021; Sanusi et al., 2021; Savitri, 2015), taxpayers’ attitude (Gergerlioğlu & Гергерлиоглу,

2022; Hamid et al., 2019; Panjaitan et al., 2018; Sanusi et al., 2021; Tambun, 2022), tax morale

(Sanusi et al., 2021; Tambun, 2022), the role of tax authorities (Sanusi et al., 2021; Tenreng et

al., 2021), subjective norms(Panjaitan et al., 2018), tax amnesty (Panjaitan et al., 2018), tax

sanction (Hardiningsih et al. et al., 2020; Tenreng et al., 2021), tax socialization(Hardiningsih

et al., 2020; Oktaviani et al., 2020; Savitri, 2015) service quality (Muawanah & Gajayana,

2021; Savitri, 2015), expediency of tax id number (Savitri, 2015), trust in government(Hamid

et al., 2019), tax literacy (Upa et al., 2021) and social environment (Upa et al., 2021). The

above studies have shown that there are varying factors at present which could significantly

impact tax awareness among the citizens.

304

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

Despite the significance of tax awareness, there seems to be lack of studies that focused on the

factors that could impact the tax awareness among individual taxpayers. Additionally, there

were also no agreement among the previous studies on a relevant theory that can act as a

guidance or reference for research practitioners and scholars who aim to understand and

explore issues and aspects related to taxpayers’ awareness. Furthermore, most of the existing

studies in the literature are empirical and quantitative in nature. Thus, it is not an exaggeration

if stated that there is still no review article that discusses the factors that affect tax awareness

among individuals based on database searching.

In line with the above, the main purpose of this study is to review, consolidate, and integrate

relevant findings obtained from the systematic review of previous studies in the literature in

order to identify the factors which may contribute towards tax awareness among individual

taxpayers in the society. Other than that, this systematic review study also aims to look into the

theories which have been used and discussed in the identified studies in order to suggest the

direction of future work for other researchers, scholars, and policymaker alike as they seek to

study and understand tax awareness in this country.

This paper is comprised of six sections. In the previously discussed section, the issues and the

purpose of this study have been presented. Next, the methodogical approach in implementing

this study is elaborated. Following the method section, the conducted review of previous

studies related to the scope of this study is explained. The fourth section presents the findings

obtained from this systematic review, and the fifth section presents the discussions of the study

findings in detailed. Finally, the six section explains the limitations and direction of future

work, and concludes the study findings.

2. Method

This study employed a quantitative method in performing the systematic reviews of the related

studies in the literature in order to identify the factors as well as other aspects that contribute

to the tax awareness among individual taxpayers. The systematic literature review was

performed using the online method by involving a collection of articles in the literature related

to tax awareness. In order to collect the articles which are relevant to the topic and scope of

this paper, specific key terms, such as ‘tax awareness’, ‘taxpayers’ awareness’, and ‘factors

affect tax awareness’ were used in performing the search. The article search involved online

scholarly databases, such as Scopus, Science Direct, Emerald Insight, Web of Science and

ResearchGate. At the end of the article search process, a total of 310 articles were extracted

from these databases for further analysis. Following this, two screening activities was

conducted. The first screening was done to narrow down and eliminate the articles which are

deemed as unrelated to the topic of this study. From this first screening, a total of 277 articles

were removed from the database of article collection. Next, the second screening involved the

researchers’ manual activities in reading the articles by their title, abstract, as well as the article

content. As a result, 19 more articles were removed due to the unrelated scope and duplication.

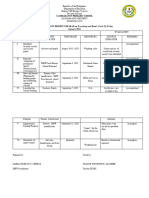

Figure 1 illustrates the whole process of article collection and screening.

305

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

Figure 1: Processes Done in Selecting Articles Related to the Scope of the Study

No of records identified through

database searching

Scopus (n=64)

Science Direct (n=53)

Emerald Insight (n=44)

Web of Science (n=49)

Initial (n=310) Screening 1 =

277 removed

Total (n=33)

Screening 2 =

19 removed

Net (n=14) included

Finally, the screened and selected articles were further analyzed quantitatively in which a

frequency analysis was implemented using the statistical software in order to identify and

record the factors influencing tax awareness as well as other details such as theories,

methodological approach, countries, respondents involved, and sample size of the studies.

3. Literature Review

The initial scope of the study involved individual taxpayers. However, it was observed from

the review that there are limited articles that can be extracted from the literature which

specifically related to the investigation of factors affecting tax awareness among individual

taxpayers. Due to this reason, the systematic review in this study also included other articles

that studied the impacts on tax awareness among small and medium enterprises. The final

extracted articles were summarized in Table 1 with a brief summary of each article. As an

example, Pattiasina et al. (2021) and Oktaviani et al. (2020) in Indonesia confirmed that tax

knowledge and tax socialization have a significant effect on tax awareness. Similarly, Hamid

et al., 2019, identified the relationships between tax knowledge and attitude with tax awareness.

As indicated in their study results, higher level of tax knowledge and better attitude will

contribute towards increasing the people’s understanding of tax system and laws. Their

findings are in line with other research conducted by Panjaitan et al., (2018) who confirmed

that taxpayer’s attitude and tax knowledge have positive effect on tax awareness among Small

Medium Enterprise in Medan. Furthermore, tax amnesty is also found to have a positive

relationship with tax awareness in Panjaitan's (2018) study. Nevertheless, other factors such as

306

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

trust in government and tax system (Hamid et al., 2019) and subjective norms (Panjaitan et al.,

2018) were found to have a negative relationship with tax awareness.

Meanwhile, according to Tambun (2022), nationalism’s attitude and tax morale have a

significant relationship on tax awareness among taxpayers. As concluded by Tambun, the first

strategy for the government to increase tax awareness among taxpayers is by increasing the tax

morale, and then followed by the attitude of nationalism. In similar vein, the research conducted

by Tenreng et al., (2021) proved that the role of tax authorities and tax sanctions are effective

in increasing taxpayer awareness. Muawanah and Gajayana (2021) also discussed that taxes

knowledge and fiscal services quality positively and significantly affects taxpayers’ awareness.

Based on the findings by Savitri (2015), tax socialization, tax knowledge, and quality of service

were noted as the factors which significantly impacted the taxpayers’ tax awareness; on the

other hand, expediency of tax id number did not have a significant relationship with the tax

awareness. Similarly, Hardiningsih et al. (2020) concluded that tax knowledge, tax sanction,

and tax socialization have positive impact on tax awareness among taxpayers.

In the perspective of future taxpayers, a study in Indonesia (Upa et al. 2021) found that tax

literacy and social environment have a positive impact on the level of tax awareness among

secondary school students. Another study in Indonesia by Tjen and Wicaksono (2022)

discussed that after the tax education session, students' level of tax awareness rose.

Additionally, students who are familiar with the tax authority website and those who have

studied taxes before the event showed a greater increase in tax awareness. Meanwhile, in

Malaysia, according to Sanusi et al., (2021) tax knowledge, tax attitude, and tax morals were

found to have a significant relationship towards tax awareness among students in higher

learning institutions. On the other hand, the role of tax authorities was found to have a negative

relationship on tax awareness among the students (Sanusi et al., 2021).

Despite the importance of tax education and knowledge towards tax awareness, several other

studies found a contradicting evidence. For instance, the studies by Gergerlioğlu and

Гергерлиоглу (2022) and Baykan and Cek (2019) in Turkey showed that tax education has no

significant impact on tax awareness among students. Moreover, Gergerlioğlu and

Гергерлиоглу revealed that there is not much difference among the attitudes of students who

received tax courses and those who did not receive tax courses. Nevertheless, Baykan and Cek

suggested that tax education should be introduced at an earlier level of education to develop

tax awareness among the future taxpayers. This is in line with Othman et al., (2020) who

recommended that tax education should be formally introduced at secondary school to raise

future taxpayer’s awareness toward taxes.

Table 1: Summary of the Reviewed Articles

Author/ Theory/ Independent Dependent Sample Findings

year/ Models Variable Variable size/

country Applied methods

Gergerlioğlu Nil Tax education Tax 538 University There is not much

and Attitude consciousnes students/ difference among the

Гергерлиоглу s Quantitative attitudes of students who

(2022) received tax courses and

Turkey those who did not receive

tax courses.

Tjen & Nil Tax education Tax 693 taxpayers Students’ tax awareness

Wicaksono program awareness Quantitative levels increased after the

(2022) tax education program.

307

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

Indonesia

Sanusi et al., Nil Tax Tax 224 Significant positive

(2021) knowledge awareness respondents’ relationship between tax

Malaysia Tax morale students/ knowledge, tax morale and

The role of tax Quantitative attitude towards tax

authorities awareness were

discovered. However, no

relationship was found

between the role of tax

authorities and tax

awareness

Panjaitan et TPB Taxpayers’ Tax 344 There is a significant

al., et al., attitude awareness respondents/ influence of the Taxpayer’s

(2018) Taxpayers’ Tax Quantitative Attitude, tax knowledge

Indonesia knowledge compliance and tax amnesty towards

Subjective tax awareness. There is no

norms significant effect of

Tax amnesty subjective norms on tax

awareness.

Tenreng et al., Slippery Tax sanction Tax 100 active The role of tax authorities

(2021) Slope The roles of awareness taxpayers/ and tax sanctions proved

Indonesia Framwork tax authorities Tax Scientific effective in increasing

compliance approach taxpayer awareness

Pattiasina et TPB Taxation Tax 120 The results of this study

al., (2021) knowledge awareness respondents indicate that tax knowledge

Indonesia Tax Tax Individual and tax socialization have a

socialization compliance taxpayers/ significant relationship

Quantitative towards tax awareness.

Oktaviani et Nil Taxpayer Tax 95 respondents The results of the study

al., (2020) knowledge awareness taxpayers/ reveal that taxpayer

Indonesia Taxation Tax Quantitative knowledge and taxation

socialization compliance socialization had a

significant effect on

taxpayer awareness.

Muawanah & Nil Taxes Tax 100 individual Taxes knowledge and

Gajayana, knowledge awareness taxpayers/ fiscal services quality

(2021) Fiscal services Tax Quantitative positively and significantly

Indonesia quality compliance affects taxpayers’

awareness.

Savitri (2015) Attributio Tax Tax 100 taxpayers/ The tax socialization, tax

Indonesia n Theory socialization awareness Quantitative knowledge and quality of

TPB Tax Tax service were affecting the

knowledge compliance tax awareness while

Quality of expediency of tax id

service number does not affect the

Expediency of tax awareness.

tax id number

Baykan & Cek Nil Education Tax 82 students/ Students who are receiving

(2019) about tax awareness Quantitative education about tax show

Turkey Tax low levels of tax awareness

perception and perceptions.

Tambun TPB Nationalism’s Tax 180 There is a significant direct

(2022) Attitude and Awareness respondents effect on nationalism and

Indonesia Tax Morals Taxpayer Taxpayers/ tax morale on tax

Compliance Quantitative awareness.

Hamid et al., Equity Tax Tax 300 e- There are relationship

(2019) theory knowledge Awareness commerce/ between tax knowledge

Malaysia Tax attitude Quantitative and attitude with tax

awareness. While, trust in

308

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

Trust in government and tax system

government has negative relationship

with tax awareness.

Upa et al., Nil Tax literacy Tax 398 The tax literacy variable

(2021) and social awareness respondents of has a significant effect on

Indonesia environment school tax awareness and the

students/ social environment has a

Quantitative significant effect on tax

awareness.

Hardiningsi et Attributio Tax Tax 196 taxpayers/ Tax knowledge, tax

al., (2020) n theory knowledge awareness Quantitative sanction and tax

Indonesia Tax sanction Tax socialization have positive

Tax compliance relationship towards tax

socialization awareness

4. Findings

4.1 Most Important Factor for Tax Awareness

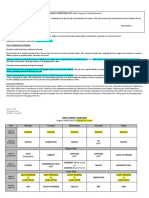

As indicated in Figure 2, the systematic review of articles in study showed that the most

important factors that influence tax awareness among individual taxpayers are related to TPB

which are tax knowledge (Hamid et al., 2019; Hardiningsih et al., 2020; Muawanah &

Gajayana, 2021; Oktaviani et al., 2020; Panjaitan et al., 2018; Pattiasina et al., 2021; Sanusi et

al., 2021; Savitri, 2015), attitude (Hamid et al., 2019; Panjaitan et al., 2018; Sanusi et al., 2021;

Tambun, 2022), and tax socialization (Hardiningsih et al., 2020; Oktaviani et al., 2020; Savitri,

2015). Furthermore, tax morale is also an essential factor for tax awareness (Sanusi et al., 2021;

Tambun, 2022).

Factors influencing tax awareness

Tax Sanction 1

Social Environment 1

Tax Literacy 1

Expediency of Tax ID… 1

Service Quality 1

The Role of Tax Authorities 1

Tax Amnesty 1

Tax Morale 2

Tax Socialization 3

Tax Attitude 4

Tax Knowledge 8

0 2 4 6 8 10

Figure 2: Factors Influencing Tax Awareness

4.2 Theories of Tax Awareness

In addition to the above finding, the review of the identified studies also revealed the major

focus on the application of TPB in describing the behavioural intention among the taxpayers

and its influence on tax awareness (Figure 3). Apart from TPB, the Attribution theory was also

discussed in the studies in the literature. Other theories, such as Social Learning theory,

Expected Utility theory, and Equity theory were marginally used. However, it was also found

309

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

that 50% of the identified studies did not use or discuss any theory to explain the relationship

that exists between tax variables.

Theories of tax awareness

Equity Theory 1

Expected Utility Theory 1

Social Learning Theory 1

Attibution Theory 2

Theory Planned Behavior 4

0 1 2 3 4 5

Figure 3: Theories of Tax Awareness

4.3 Countries of Origin of the Reviewed Studies

As shown in Figure 4, Indonesia contributes the largest number of the related studies, followed

by Malaysia and Turkey.

Countries

Turkey 2

Malaysia 2

Indonesia 10

0 2 4 6 8 10 12

Figure 4: Countries of the Studies

4.4 Methodological Approach

In terms of the methodological approach, majority of the studies employed the quantitative

method of data collection. The plausible reason could be because the main focus of this study

is on individual taxpayers, and thus the easiest and most practical way to extract relevant

primary data from this type of respondents is through the use of survey-based method, such as

questionnaire.

Methodological Approach

7%

Quantitative

Scientific Approach

93%

Figure 5: Methodological Approach of the Studies

310

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

4.5 Sample Size

Based on the analysis, it was found that the quantitative studies have accounted for 93% of the

total studies identified. For these quantitative studies, the sample size applied for the data

collection varied significantly from 82 to 693 respondents. The calculated mean of this sample

size was 248.

4.6 Studies Distribution by Year

The importance of tax awareness can also be observed by the number of studies published in

the literature. As can be seen from Figure 6, the number of studies conducted on tax awareness

increased significantly from 2015 to the middle of 2022. This suggests the increasing scholarly

focus on tax awareness. Meanwhile, the constant trend from 2019 to 2020 could be due to the

impact of COVID-19 in which the pandemic has caused disruptions to various socio-economic

areas, including tax administration and public services. As reported by OECD (2021b), the

COVID-19 crisis has led to severe deterioration in public finances, which put forward the need

for restructuring tax and expenditure policies.

6

5

4

3

2

1

0

2015 2016 2017 2018 2019 2020 2021 2022

Figure 6: Chronology of the Studies (Yearly Distribution)

5. Discussion

It is of vital importance to identify the factors that influence tax awareness since these factors

can provide a basic understanding on the ways or solutions for encouraging taxpayers to do

voluntary compliance with tax-related laws and regulation (Nadiah et al., 2019). Overall, based

on the systematic review of the literature, this study has identified several factors that affect

the tax awareness, namely tax education, tax knowledge, tax literacy, attitude, tax morale, tax

socialization, service quality, social environment, expediency tax ID, tax amnesty, tax sanction,

and the role of tax authorities. These factors may suggest the areas for developing a conceptual

framework of tax awareness which is applicable for analyzing and discussing the role of tax

awareness for the society’s tax compliance.

Most importantly, in line with other studies, this study put forward the importance of enhancing

tax awareness among both individual and future taxpayers for sustainable sources of funding

for social and public development programmes. Tax is an important source of income for a

nation’s development, and thus people’s awareness on their obligation is necessarily vitality.

Multiple studies have shown that higher tax awareness is associated with a higher tax

compliance, in which such level can be achieved with a necessary level of education and

knowledge on the taxation system (Shahnaz et al., 2022). Furthermore, as observed from the

yearly distribution of the studies, the increasing trend could be an important indication or

311

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

reflection of the importance of tax awareness in the body of knowledge, thus putting forward

the need to improve tax compliance among the society in future.

Moreover, tax awareness relates to multi-faceted aspect of human’s cognitive and behavioral

understandings. This study also revealed that the theoretical applications in describing the

behavioral intention among the taxpayers and its influence on tax awareness, particularly TPB.

Other than TPB, the study findings also identified several other theories related to the study on

tax awareness, such as Social Learning theory, Expected Utility theory, and Equity theory. As

suggested by Muzakkir et al. (2019), the best approach to investigate the determinants of

individual behavior is through the application of TPB. Similarly, their study identified the

determinant effect of the theory and tax knowledge on taxpayer compliance.

As for implication, findings obtained in this study would be very beneficial for decision makers

and policy makers alike by focusing on these factors so that the tax awareness can be increased

thus comply with tax laws in future. As for research practitioners and researchers, this study

has provided a useful summary of the key findings from various previous studies in the

literature, thus it would be helpful to assist them to identify gaps, while looking into potentials

and emerging challenges in extending the study.

6. Limitations of the Study and Future Work

Despite the significance of the study findings, there are several limitations to be considered.

Firstly, the systematic review only involved 14 studies of the total identified studies. Therefore,

it is suggested that future studies to expand the database of articles so that the findings could

be more representative and generalizable. Secondly, findings obtained in this study were also

limited since they were based on individual taxpayers and small medium enterprises. Although

the scope of the study was individual taxpayers, the inclusion of small medium enterprise was

done due to the lack of studies which focused only on individual taxpayers. Considering this,

it is recommended for future research to extend the literature by conducting empirical studies

that involve not only individual taxpayers, but also future taxpayers, i.e., school and university

students. Other than that, this study was also limited since most extracted studies were related

to three countries, namely Indonesia, followed by Malaysia and Turkey. Therefore, it is

proposed that future empirical studies can be done on developing countries, specifically those

involved the use of the theory of TPB, Attribution Theory, and Social Learning Theory. Finally,

there is also a need for the findings of this study to be examined more empirically. In line with

this need, future work may explore the investigation of factors such as tax education, tax

knowledge, tax socialization, tax morale, social environment and other relevant factors which

constitute the behavioural approach. This may be useful for explaining how the tax awareness

can vary by the types of taxpayers, either individual or future taxpayers.

7. Conclusion

In conclusion, through the systematic review, this study has identified the factors which could

affect the tax awareness among individual taxpayers. The obtained findings have also provided

relevant statistical and empirical evidence based on the literature studies which discussed

aspects related to tax awareness. In implementing the systematic review, 14 articles were

extracted from a total of 310 identified articles. Further frequency analysis was conducted

based on these articles to identify the factors as well as other relevant data, i.e. theorical

components, methodological approaches, countries of origin, sample size, and the studies’

distribution by year. Based on the study findings, it was observed that tax knowledge, attitude,

312

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

tax morale and tax socialization are among the most factors which influence tax awareness

among the taxpayers. As for the theories, the theory of Planned Behaviour and Attribution

theory were found to be the most applied and discussed theories in the literature studies related

to tax awareness. Based on distribution, the largest share of studies was attributed to Indonesia,

followed by Malaysia and Turkey. Methodologically, majority of the studies were quantitative

in nature, and many others were scientific approach. In the light of the study findings and

limitations, suggestions for future works were also highlighted.

8. Acknowledgement

It is a pleasure to acknowledge all the roles of those involved in the completion of this study.

The authors are grateful to the Kolej Yayasan Pelajaran Johor (KYPJ) which provides facilities

as well as the staff for their assistance to carry out this research.

References

Adimasu, N. A. (2017). Tax Awareness and Perception of Tax Payers and Their Voluntary Tax

Compliance Decision: Evidence From Individual Tax Payers in Snnpr, Ethiopia.

International Journal of Scientific and Research Publications, 7(11), 686. www.ijsrp.org

Baykan, H., & Cek, K. (2019). Article University Students’ Perceptions and Awareness of Tax.

10(December), 157–160.

Gergerlioğlu, U., & Гергерлиоглу, У. (2022). Sociology and psychology of taxation

Социология и психология налогообложения Tax Education and the Attitude of

University Students Towards Tax Consciousness: The Case of University of Externado

(Colombia) Налоговое образование и отношение студентов к налоговому сознанию:

опыт университета Экстернадо (Колумбия).

Hamid, N. A., Sabli, N., Sanusi, S., & Rasit, Z. A. (2019). Factors Influencing Tax Awareness

among E-commerce Small and Medium- Sized Enterprises (SMEs) in Malaysia Factors

Influencing Tax Awareness among E-commerce Small and Medium-Sized Enterprises

(SMEs) in Malaysia ABSTRACT: December.

Hardiningsih, P. (2020). The Determinants of Taxpayer Compliance with Tax Awareness as a

Mediation and Education for Moderation The Determinants of Taxpayer Compliance with

Tax Awareness as a Mediation and Education for Moderation. January.

https://doi.org/10.24843/JIAB.2020.v15.i01.p05

Indah, N. P. I. P., & Setiawan, P. E. (2020). The Effect of Tax Awareness, Taxation Sanctions,

and Application of E-Filing Systems In Compliance With Personal Taxpayer Obligations.

American Journal of Humanities and Social Sciences Research (AJHSSR), Vol:4(No: 3),

Hal: 440-446.

Lisa, O., & Hermanto, B. (2018). The Effect of Tax Amnesty and Taxpayer Awareness to

Taxpayer Compliance with Financial Condition as Intervening Variable. International

Research Journal of Management, IT & Social Sciences, 5(2), 1–10.

https://sloap.org/journals/index.php/irjmis/article/view/90%0AThe

Muawanah, U., & Gajayana, U. (2021). The Influence of Tax Knowledge and Quality of Service

Tax Authorities to the Individual Taxpayer Compliance through Taxpayer Awareness.

March.

Muzakkir, M., Indrijawati, A., & Syamsuddin, S. (2019). The Determinant Effect of Theory of

Planned Behavior and Tax Knowledge on Taxpayer Compliance. International Journal of

Innovative Science and Research Technology, 4(1), 31-41.

313

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

Nadiah Abd Hamid, Nurul Fashrina Roselan, Tengku Fairuz Tengku Embong, Nor Hasnah

Mad Saheh, Nurshamimi Sabli, ... & Norfadzilah Rashid (2019). Factors influencing tax

awareness among e-commerce Small and Medium-Sized Enterprises (SMEs) in Malaysia.

International Journal of Management and Business Research, 9, 237-246.

Nurkhin, A., Novanty, I., Muhsin, M., & Sumiadji, S. (2018). The Influence of Tax

Understanding, Tax Awareness and Tax Amnesty toward Taxpayer Compliance. Jurnal

Keuangan Dan Perbankan, 22(2). https://doi.org/10.26905/jkdp.v22i2.1678

Oktaviani, R. M., Kurnia, H., Sunarto, & Udin. (2020). The effects of taxpayer knowledge and

taxation socialization on taxpayer compliance: the role of taxpayer awareness in

developing Indonesian economy. Accounting, 6(2), 89–96.

https://doi.org/10.5267/j.ac.2019.12.004

Organisation for Economic Co-operation and Development [OECD] (2021a, November 24).

Taxpayer education is a key tool to transform tax culture and increase voluntary

compliance. https://www.oecd.org/tax/taxpayer-education-is-a-key-tool-to-transform-tax-

culture-and-increase-voluntary-compliance.htm

Organisation for Economic Co-operation and Development [OECD] (2021b, October 14).

OECD Policy Responses to Coronavirus (COVID-19): Tax and fiscal policies after the

COVID-19 crisis. https://www.oecd.org/coronavirus/policy-responses/tax-and-fiscal-

policies-after-the-covid-19-crisis-5a8f24c3/

Othman, R., Ismail, Z., & Nawawi, N. (2020). Introducing Formal Tax Education in Secondary

School: A Survey on Malaysian Public’s Perception. August. https://doi.org/10.4108/eai.1-

11-2019.2293991

Panjaitan, H. (2018). Effect of Awareness Against Taxpayers Tax Compliance, Small And

Medium Enterprises In Medan. 9(9), 465–475.

Pattiasina, V., Papua, U. Y., Noch, M. Y., Papua, U. Y., Sondjaya, Y., Papua, U. Y., Papua, U.

Y., Anakotta, F. M., & Pattimura, U. (2021). Extension of Moderated Mediation Model

Knowledge of Taxation and Tax Compliance by Tax Socialization and Taxpayer

Awareness. 27(2).

Sanusi, S., Abdullah, N. H. N., Chin, L. T., Rastam, F., & Rozzani, N. (2021). Tax Awareness

Among Students from Higher Learning Institutions in Malaysia: Education Area as A

Moderator. International Journal of Economics and Management, 15(1), 89–102.

Savitri, E. (2015). The Effect of Tax Socialization, Tax Knowledge, Expediency of Tax ID

Number and Service Quality on Taxpayers Compliance With Taxpayers Awareness as

Mediating Variables. 211(September), 163–169.

https://doi.org/10.1016/j.sbspro.2015.11.024

Shahnaz Noorul Amin, Putri Zaqqeya Amin Buhari, Abu Sufian Yaacob, & Zubery Iddy

(2022). Exploring the Influence of Tax Knowledge in Increasing Tax Compliance by

Introducing Tax Education at Tertiary Level Institutions. Open Journal of Accounting,

11(2), 57-70. https://doi.org/10.4236/ojacct.2022.112004

Tambun, S. (2022). The Influence of Nationalism’s Attitude and Tax Morals on Taxpayer

Compliance through Tax Awareness. 14(1), 1–7. https://doi.org/10.20448/2002.141.1.7

Tenreng, M. (2021). Complience Tax Complience Taxation System Framework in Indonesia.

1(6), 1114–1124. https://doi.org/10.48047/rigeo.11.06.129

Tjen, C., & Wicaksono, P. T. (2022). Tax Education and Tax Awareness: A Study on the Pajak

Bertutur Indonesian Tax Education and Tax Awareness: A Study on the Pajak Bertutur

Indonesian Tax Education Program. May, 4–5.

314

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

International Journal of Business and Economy

eISSN: 2682-8359 | Vol. 4, No. 3, 303-315, 2022

http://myjms.mohe.gov.my/index.php/ijbec

Upa, V. A., Suparta, N. K. G. S., & Karundeng, F. E. F. (2021). The Effect of Tax Literation

and Social Environment on Tax Awareness in High School Students. Review of Behavioral

Aspect in Organizations and Society, 3(1), 21-34.

Wicaksono, M., & Lestari, T. (2017). Effect of Awareness, Knowledge and Attitude of

Taxpayers Tax Compliance for Taxpayers in Tax Service Office Boyolali. International

Journal of Economics, Business and Accounting Research (IJEBAR), 1(01), 12–25.

https://doi.org/10.29040/ijebar.v1i01.236

Zanaria, Y., & Lestari, A. A. (2020). The Influence of Tax Comprehension, Tax Awareness and

Tax Sanctions Toward Tax Obedience of SME’s. 436(2010), 916–921.

https://doi.org/10.2991/assehr.k.200529.193

315

Copyright © 2022 ACADEMIA INDUSTRY NETWORKS. All rights reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Detailed Lesson PlanDocument6 pagesDetailed Lesson Plannancy sese100% (4)

- Reading Keys 2 - Unit 1 - Studying AbroadDocument6 pagesReading Keys 2 - Unit 1 - Studying AbroadSiêu Nhân100% (1)

- Sol2e Int Progress Test 03ADocument5 pagesSol2e Int Progress Test 03AMargo ZiopliukeNo ratings yet

- (Encyclopedia of Language and Education 6) Arthur Van Essen (Auth.), Leo Van Lier, David Corson (Eds.) - Encyclopedia of Language and Education - Knowledge About Language-Springer Netherlands (1997)Document298 pages(Encyclopedia of Language and Education 6) Arthur Van Essen (Auth.), Leo Van Lier, David Corson (Eds.) - Encyclopedia of Language and Education - Knowledge About Language-Springer Netherlands (1997)PabloVicari100% (1)

- Motivation Theories Tamil AjayDocument26 pagesMotivation Theories Tamil Ajaysenthilkumar56@50% (2)

- Death of A Salesman Literature Practice Worksheets Sample PagesDocument9 pagesDeath of A Salesman Literature Practice Worksheets Sample PagesYagami ShmuelNo ratings yet

- SS 19 Module 2Document9 pagesSS 19 Module 2Azriel Mae BaylonNo ratings yet

- Etm Kelompok 6Document8 pagesEtm Kelompok 6NiftaNo ratings yet

- VetMed Week Souvenir Program February 18-22, 2013Document20 pagesVetMed Week Souvenir Program February 18-22, 2013baruruydNo ratings yet

- ABDC Journals List by RatingDocument35 pagesABDC Journals List by RatingstaimoukNo ratings yet

- Grade 5 Class Program PrototypeDocument5 pagesGrade 5 Class Program PrototypeRem Rem DamianNo ratings yet

- Module 12 1creating Postive School CultureDocument29 pagesModule 12 1creating Postive School CultureArben EchagueNo ratings yet

- Hpu II Je 2015Document15 pagesHpu II Je 2015gaur_shashikant4432No ratings yet

- Publishing Addiction Science: A Guide For The Perplexed. Thomas F. Babor Et Al.Document407 pagesPublishing Addiction Science: A Guide For The Perplexed. Thomas F. Babor Et Al.Bibliografia em Pesquisa em Energia e AmbienteNo ratings yet

- v.3 9 September 2014: Prof. A. A. (Louis) Beex Beex@vt - Edu Lindner@vt - EduDocument4 pagesv.3 9 September 2014: Prof. A. A. (Louis) Beex Beex@vt - Edu Lindner@vt - EdutenpointerNo ratings yet

- Duncan Banntyne Case StudyDocument2 pagesDuncan Banntyne Case StudyMegat Muhammad Hussin100% (2)

- Action Research ProposalDocument9 pagesAction Research ProposalJackiecundieffNo ratings yet

- End-of-Course Reflection Paper/QuestionnaireDocument2 pagesEnd-of-Course Reflection Paper/QuestionnaireSally NollebaNo ratings yet

- Time Travel Homework IdeasDocument8 pagesTime Travel Homework Ideasoeqtpxrmg100% (1)

- API SGP DS2 en Excel v2 4005408Document25 pagesAPI SGP DS2 en Excel v2 4005408malibabu .gembaliNo ratings yet

- Edu 103: Developments and Resources in Educational TechnologyDocument8 pagesEdu 103: Developments and Resources in Educational Technologyasish t vargheseNo ratings yet

- General Specifications For The Listening TestDocument7 pagesGeneral Specifications For The Listening TestDon AgustínNo ratings yet

- Contemporary ArtsDocument19 pagesContemporary ArtsMarl Rina EsperanzaNo ratings yet

- RecruitmentDocument5 pagesRecruitmentannamalai_s8733230% (1)

- Catch-Up Friday Action PlanDocument2 pagesCatch-Up Friday Action PlanJim Bryan Wabina Vergara91% (32)

- Unit Plan For English - LiteratureDocument16 pagesUnit Plan For English - LiteratureDomagoj BosnNo ratings yet

- Teacher'S Activity/Students ActivityDocument3 pagesTeacher'S Activity/Students ActivityAnonymous pwOxQuNo ratings yet

- CS-F03 - Employment Application FormDocument6 pagesCS-F03 - Employment Application FormIdrus IsmailNo ratings yet

- Chapter 6.metacogntionDocument18 pagesChapter 6.metacogntionKusum SharmaNo ratings yet

- UF Chris Busey GrievanceDocument7 pagesUF Chris Busey Grievanceryan turbevilleNo ratings yet