Professional Documents

Culture Documents

Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052

Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052

Uploaded by

TJ JanssenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052

Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052

Uploaded by

TJ JanssenCopyright:

Available Formats

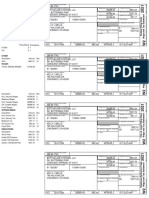

2020 W-2 and EARNINGS SUMMARY

Employee Reference Copy

This blue section is your Earnings Summary which provides more detailed

Wage and Tax

W-2 Statement

Copy C for employee’s records.

2020

OMB No. 1545-0008

information on the generation of your W-2 statement. The reverse side

includes instructions and other general information.

d Control number Dept. Corp. Employer use only

907891 CHIC/BD9 A 1232

c Employer’s name, address, and ZIP code

SPIRE MISSOURI INC

700 MARKET STREET

ST LOUIS MO 63101

1. Your Gross Pay was adjusted as follows to produce your W-2 Statement.

Batch #03296

Wages, Tips, other Social Security Medicare MO. State Wages,

e/f Employee’s name, address, and ZIP code Compensation Wages Wages Tips, Etc.

Box 1 of W-2 Box 3 of W-2 Box 5 of W-2 Box 16 of W-2

TIMOTHY W JANSSEN

4812 LITTLE FOX COURT Gross Pay 131,297.97 131,297.97 131,297.97 131,297.97

IMPERIAL MO 63052 Plus GTL (C-Box 12) 69.72 69.72 69.72 69.72

Less 401(k) (D-Box 12) 13,099.80 N/A N/A 13,099.80

b Employer’s FED ID number a Employee’s SSA number

Less Other Cafe 125 1,866.00 1,866.00 1,866.00 1,866.00

43-0368139 XXX-XX-9864

1 Wages, tips, other comp. 2 Federal income tax withheld Reported W-2 Wages 116,401.89 129,501.69 129,501.69 116,401.89

116401.89 19748.77

3 Social security wages 4 Social security tax withheld

129501.69 8029.10

5 Medicare wages and tips 6 Medicare tax withheld

129501.69 1877.77

7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 2. Employee Name and Address.

11 Nonqualified plans 12a See instructions for box 12

12b D

C 69.72 TIMOTHY W JANSSEN

14 Other 13099.80 4812 LITTLE FOX COURT

12c DD 7341.00

12d IMPERIAL MO 63052

13 Stat emp. Ret. plan 3rd party sick pay

X

15 State Employer’s state ID no. 16 State wages, tips, etc.

MO 11153083 116401.89

17 State income tax 18 Local wages, tips, etc.

5401.00

19 Local income tax 20 Locality name ¤ 2020 ADP, Inc.

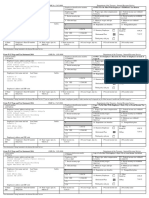

1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld

116401.89 19748.77 116401.89 19748.77 116401.89 19748.77

3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld

129501.69 8029.10 129501.69 8029.10 129501.69 8029.10

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

129501.69 1877.77 129501.69 1877.77 129501.69 1877.77

d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only

907891 CHIC/BD9 A 1232 907891 CHIC/BD9 A 1232 907891 CHIC/BD9 A 1232

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

SPIRE MISSOURI INC SPIRE MISSOURI INC SPIRE MISSOURI INC

700 MARKET STREET 700 MARKET STREET 700 MARKET STREET

ST LOUIS MO 63101 ST LOUIS MO 63101 ST LOUIS MO 63101

b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number

43-0368139 XXX-XX-9864 43-0368139 XXX-XX-9864 43-0368139 XXX-XX-9864

7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 9 10 Dependent care benefits 9 10 Dependent care benefits

11 Nonqualified plans 12a See instructions for box 12 11 Nonqualified plans 12a

12 11 Nonqualified plans 12a

C 69.72 C 69.72 C 69.72

14 Other 12b D 13099.80 14 Other 12b D 13099.80 14 Other 12b D 13099.80

12c DD 7341.00 12c DD 7341.00 12c DD 7341.00

12d 12d 12d

13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay

X X X

e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code

TIMOTHY W JANSSEN TIMOTHY W JANSSEN TIMOTHY W JANSSEN

4812 LITTLE FOX COURT 4812 LITTLE FOX COURT 4812 LITTLE FOX COURT

IMPERIAL MO 63052 IMPERIAL MO 63052 IMPERIAL MO 63052

15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc.

MO 11153083 116401.89 MO 11153083 116401.89 MO 11153083 116401.89

17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc.

5401.00 5401.00 5401.00

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

Federal Filing Copy MO.State Reference Copy MO.State Filing Copy

Wage and Tax Wage and Tax Wage and Tax

W-2 Statement

Copy B to be filed with employee’s

OMB

2020 No. 1545-0008

Federal Income Tax Return.

W-2 Statement 2020

OMB No. 1545-0008

Copy 2 to be filed with employee’s State Income Tax Return.

W-2 Statement OMB

2020

Copy 2 to be filed with employee’s State Income Tax Return.

No. 1545-0008

Instructions for Employee in Pub. 571). Deferrals under code G are limited to $19,500. Deferrals R—Employer contributions to your Archer MSA. Report on Form 8853,

under code H are limited to $7,000. Archer MSAs and Long-Term Care Insurance Contracts.

Box 1. Enter this amount on the wages line of your tax return. However, if you were at least age 50 in 2020, your employer may S—Employee salary reduction contributions under a section 408(p)

Box 2. Enter this amount on the federal income tax withheld line of have allowed an additional deferral of up to $6,500 ($3,000 for section SIMPLE plan (not included in box 1)

your tax return. 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount T—Adoption benefits (not included in box 1). Complete Form 8839, Qualified

Box 5. You may be required to report this amount on Form 8959, is not subject to the overall limit on elective deferrals. For code G, the Adoption Expenses, to compute any taxable and nontaxable amounts.

Additional Medicare Tax. See the Instructions for Forms 1040 and limit on elective deferrals may be higher for the last 3 years before you V—Income from exercise of nonstatutory stock option(s) (included in

1040-SR to determine if you are required to complete Form 8959. reach retirement age. Contact your plan administrator for more boxes 1, 3 (up to social security wage base), and 5). See Pub. 525,

Box 6. This amount includes the 1.45% Medicare Tax withheld on all information. Amounts in excess of the overall elective deferral limit must Taxable and Nontaxable Income, for reporting requirements.

Medicare wages and tips shown in box 5, as well as the 0.9% be included in income. See the Instructions for Forms 1040 and

1040-SR. W—Employer contributions (including amounts the employee elected to

Additional Medicare Tax on any of those Medicare wages and tips contribute using a section 125 (cafeteria) plan) to your health savings

above $200,000. Note: If a year follows code D through H, S, Y, AA, BB, or EE, you account. Report on Form 8889, Health Savings Accounts (HSAs).

Box 8. This amount is not included in box 1, 3, 5, or 7. For made a make-up pension contribution for a prior year(s) when you were Y—Deferrals under a section 409A nonqualified deferred compensation plan

information on how to report tips on your tax return, see the in military service. To figure whether you made excess deferrals,

Instructions for Forms 1040 and 1040-SR. consider these amounts for the year shown, not the current year. If no Z—Income under a nonqualified deferred compensation plan that fails to

year is shown, the contributions are for the current year. satisfy section 409A. This amount is also included in box 1. It is subject

You must file Form 4137, Social Security and Medicare Tax on to an additional 20% tax plus interest. See the Instructions for Forms

Unreported Tip Income, with your income tax return to report at least A—Uncollected social security or RRTA tax on tips. Include this tax on 1040 and 1040-SR.

the allocated tip amount unless you can prove with adequate records Form 1040 or 1040-SR. See the Instructions for Forms 1040 and 1040-SR.

AA—Designated Roth contributions under a section 401(k) plan

that you received a smaller amount. If you have records that show B—Uncollected Medicare tax on tips. Include this tax on Form 1040 or

the actual amount of tips you received, report that amount even if it 1040-SR. See the Instructions for Forms 1040 and 1040-SR. BB—Designated Roth contributions under a section 403(b) plan

is more or less than the allocated tips. Use Form 4137 to figure the C—Taxable cost of group-term life insurance over $50,000 (included in DD—Cost of employer-sponsored health coverage. The amount

social security and Medicare tax owed on tips you didn’t report to reported with code DD is not taxable.

boxes 1, 3 (up to social security wage base), and 5)

your employer. Enter this amount on the wages line of your tax EE—Designated Roth contributions under a governmental section

return. By filing Form 4137, your social security tips will be credited D—Elective deferrals to a section 401(k) cash or deferred arrangement. 457(b) plan. This amount does not apply to contributions under a

to your social security record (used to figure your benefits). Also includes deferrals under a SIMPLE retirement account that is part tax-exempt organization section 457(b) plan.

of a section 401(k) arrangement.

Box 10. This amount includes the total dependent care benefits that FF—Permitted benefits under a qualified small employer health

your employer paid to you or incurred on your behalf (including E—Elective deferrals under a section 403(b) salary reduction agreement reimbursement arrangement

amounts from a section 125 (cafeteria) plan). Any amount over F—Elective deferrals under a section 408(k)(6) salary reduction SEP GG—Income from qualified equity grants under section 83(i)

$5,000 is also included in box 1. Complete Form 2441, Child and G—Elective deferrals and employer contributions (including nonelective HH—Aggregate deferrals under section 83(i) elections as of the close

Dependent Care Expenses, to compute any taxable and nontaxable deferrals) to a section 457(b) deferred compensation plan of the calendar year

amounts. H—Elective deferrals to a section 501(c)(18)(D) tax-exempt Box 13. If the “Retirement plan” box is checked, special limits may apply

Box 11. This amount is (a) reported in box 1 if it is a distribution organization plan. See the Instructions for Forms 1040 and 1040-SR for to the amount of traditional IRA contributions you may deduct. See Pub.

made to you from a nonqualified deferred compensation or how to deduct. 590-A, Contributions to Individual Retirement Arrangements (IRAs).

nongovernmental section 457(b) plan, or (b) included in box 3 and/or J—Nontaxable sick pay (information only, not included in box 1, 3, or 5) Box 14. Employers may use this box to report information such as

5 if it is a prior year deferral under a nonqualified or section 457(b) state disability insurance taxes withheld, union dues, uniform payments,

plan that became taxable for social security and Medicare taxes this K—20% excise tax on excess golden parachute payments. See the

Instructions for Forms 1040 and 1040-SR. health insurance premiums deducted, nontaxable income, educational

year because there is no longer a substantial risk of forfeiture of your assistance payments, or a member of the clergy’s parsonage allowance

right to the deferred amount. This box shouldn’t be used if you had a L—Substantiated employee business expense reimbursements

(nontaxable) and utilities. Railroad employers use this box to report railroad

deferral and a distribution in the same calendar year. If you made a retirement (RRTA) compensation, Tier 1 tax, Tier 2 tax, Medicare tax,

deferral and received a distribution in the same calendar year, and M—Uncollected social security or RRTA tax on taxable cost of and Additional Medicare Tax. Include tips reported by the employee to

you are or will be age 62 by the end of the calendar year, your group-term life insurance over $50,000 (former employees only). See the employer in railroad retirement (RRTA) compensation.

employer should file Form SSA-131, Employer Report of Special the Instructions for Forms 1040 and 1040-SR.

Wage Payments, with the Social Security Administration and give Note: Keep Copy C of Form W-2 for at least 3 years after the due date

N—Uncollected Medicare tax on taxable cost of group-term life for filing your income tax return. However, to help protect your social

you a copy. insurance over $50,000 (former employees only). See the Instructions security benefits, keep Copy C until you begin receiving social

Box 12. The following list explains the codes shown in box 12. You for Forms 1040 and 1040-SR. security benefits, just in case there is a question about your work

may need this information to complete your tax return. Elective P—Excludable moving expense reimbursements paid directly to a record and/or earnings in a particular year.

deferrals (codes D, E, F, and S) and designated Roth contributions member of the U.S. Armed Forces (not included in box 1, 3, or 5)

(codes AA, BB, and EE) under all plans are generally limited to a Q—Nontaxable combat pay. See the Instructions for Forms 1040 and

total of $19,500 ($13,500 if you only have SIMPLE plans; $22,500 1040-SR for details on reporting this amount.

for section 403(b) plans if you qualify for the 15-year rule explained

Department of the Treasury - Internal Revenue Service

NOTE: THESE ARE SUBSTITUTE WAGE AND TAX STATEMENTS AND ARE ACCEPTABLE FOR FILING WITH YOUR FEDERAL, STATE AND LOCAL/CITY INCOME TAX RETURNS.

This information is being furnished to the Internal

Revenue Service. If you are required to file a tax Notice to Employee

return, a negligence penalty or other sanction may

be imposed on you if this income is taxable and Do you have to file? Refer to the Instructions for Forms W-2. Be sure to get your copies of Form W-2c from your

you fail to report it.

1040 and 1040-SR to determine if you are required to file employer for all corrections made so you may file them

IMPORTANT NOTE: a tax return. Even if you don’t have to file a tax return, you with your tax return. If your name and SSN are correct but

In order to insure efficient processing,

may be eligible for a refund if box 2 shows an amount or if aren’t the same as shown on your social security card, you

attach this W-2 to your tax return like this

you are eligible for any credit. should ask for a new card that displays your correct name

Earned income credit (EIC). You may be able to take the at any SSA office or by calling 800-772-1213. You may also

(following agency instructions):

EIC for 2020 if your adjusted gross income (AGI) is less visit the SSA website at www.SSA.gov.

than a certain amount. The amount of the credit is based Cost of employer-sponsored health coverage (if such

on income and family size. Workers without children could cost is provided by the employer). The reporting in box

qualify for a smaller credit. You and any qualifying children 12, using code DD, of the cost of employer-sponsored

must have valid social security numbers (SSNs). You can’t health coverage is for your information only. The amount

take the EIC if your investment income is more than the reported with code DD is not taxable.

TAX RETURN specified amount for 2020 or if income is earned for Credit for excess taxes. If you had more than one

services provided while you were an inmate at a penal employer in 2020 and more than $8,537.40 in social

institution. For 2020 income limits and more information, security and/or Tier 1 railroad retirement (RRTA) taxes

visit www.irs.gov/EITC. See also Pub. 596, Earned Income were withheld, you may be able to claim a credit for the

THIS Credit. Any EIC that is more than your tax liability is excess against your federal income tax. If you had more

OTHER refunded to you, but only if you file a tax return.

FORM than one railroad employer and more than $5,012.70 in

W-2’S

W-2 Clergy and religious workers. If you aren’t subject to Tier 2 RRTA tax was withheld, you may also be able to

social security and Medicare taxes, see Pub. 517, Social claim a credit. See the Instructions for Forms 1040 and

Security and Other Information for Members of the Clergy 1040-SR and Pub. 505, Tax Withholding and Estimated

and Religious Workers. Tax.

Corrections. If your name, SSN, or address is incorrect,

correct Copies B, C, and 2 and ask your employer to correct

your employment record. Be sure to ask the employer to file

Form W-2c, Corrected Wage and Tax Statement, with the

Social Security Administration (SSA) to correct any name,

SSN, or money amount error reported to the SSA on Form

Department of the Treasury - Internal Revenue Service Department of the Treasury - Internal Revenue Service Department of the Treasury - Internal Revenue Service

You might also like

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (1)

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Federal Income Tax OUTLINEDocument22 pagesFederal Income Tax OUTLINErufus.kingslee3327100% (7)

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- 2019 W2 2020120235817 PDFDocument3 pages2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenNo ratings yet

- W2 & Earnings: Vanessa Sapien GonzalezDocument4 pagesW2 & Earnings: Vanessa Sapien GonzalezVANESSA SAPIEN GONZALEZNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document3 pagesOMB No. 1545-0008 OMB No. 1545-0008balackoNo ratings yet

- Jeff Nippard'S Upper Lower - 6X/Week Spreadsheet: IMPORTANT: On The Right, Enter Your 1RM Loads in TheDocument80 pagesJeff Nippard'S Upper Lower - 6X/Week Spreadsheet: IMPORTANT: On The Right, Enter Your 1RM Loads in TheTJ JanssenNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- Statements 3750Document6 pagesStatements 3750ytprem agu100% (2)

- TGDocument2 pagesTGpr995No ratings yet

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- SMChap 013Document49 pagesSMChap 013testbank100% (5)

- Wage and Income - KULU - 101484197429Document2 pagesWage and Income - KULU - 101484197429Raymond KabutanoNo ratings yet

- MH0ihh081h6754910230616041100202 PDFDocument2 pagesMH0ihh081h6754910230616041100202 PDFLogan GoadNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (1)

- 20212Document2 pages20212carriemccabe0% (1)

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- AjaxDocument2 pagesAjaxaccount.enquiry6770No ratings yet

- W2 Matthew RussellDocument2 pagesW2 Matthew Russellmatthewrussell661No ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- Anil Gupta 2021 w2Document2 pagesAnil Gupta 2021 w2Kawljeet Singh KohliNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- County of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Document37 pagesCounty of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Manuel ChavezNo ratings yet

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Document4 pagesKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonNo ratings yet

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument26 pagesU.S. Individual Income Tax Return: Standard Deductionnischal.khatri07No ratings yet

- 2021 w2Document1 page2021 w2Candy ValentineNo ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument3 pagesWage and Tax Statement Wage and Tax StatementNathan VosNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- Loan AppDocument9 pagesLoan Appanon-209253100% (1)

- New Hire Paperwork 2021aDocument27 pagesNew Hire Paperwork 2021aTom BondalicNo ratings yet

- 2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Document2 pages2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Minerva BetancourtNo ratings yet

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogbolo100% (1)

- FTF 2022-04-19 1650352254304Document8 pagesFTF 2022-04-19 1650352254304Charles GoodwinNo ratings yet

- Johnnys w4 PDFDocument2 pagesJohnnys w4 PDFAnthony OrozcooNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- Javier A Valdez 2107 BAMBOO ST. Mesquite TX 75150Document2 pagesJavier A Valdez 2107 BAMBOO ST. Mesquite TX 75150javiercreatesNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- Tax Return Transcript - MORA - 103921412180Document7 pagesTax Return Transcript - MORA - 103921412180Nicole MoralesNo ratings yet

- X Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnDocument12 pagesX Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnjonathanNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- January 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Document8 pagesJanuary 6, 2021 Zechariah Kennedy 612 Colony Lakes DR Lexington, SC 29073-6742Zechariah Kennedy100% (1)

- FTF 2023-03-20 1679339077907Document15 pagesFTF 2023-03-20 1679339077907ayogbolo100% (1)

- NY CA 01-01-1953 9984 TXPRDocument98 pagesNY CA 01-01-1953 9984 TXPRAdmin OfficeNo ratings yet

- 2020 - TaxReturn ColeDocument12 pages2020 - TaxReturn Coletroymc101No ratings yet

- Agosto 11Document1 pageAgosto 11dakpi479No ratings yet

- Fext 2022-04-17 1650241773772 PDFDocument2 pagesFext 2022-04-17 1650241773772 PDFFera PetersonNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDocument3 pages05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallNo ratings yet

- Edgar JDocument2 pagesEdgar Japi-585014034No ratings yet

- 2021 Tax Return: Prepared ByDocument6 pages2021 Tax Return: Prepared BySolomonNo ratings yet

- W2 & Earnings: Kelly L WellsDocument5 pagesW2 & Earnings: Kelly L Wellshala100% (1)

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- 34 Wihh 504331 H 0714320240524151104202Document3 pages34 Wihh 504331 H 0714320240524151104202jamelmhunt22No ratings yet

- UntitledDocument17 pagesUntitledTJ JanssenNo ratings yet

- Invoice: Premium CabinetsDocument2 pagesInvoice: Premium CabinetsTJ JanssenNo ratings yet

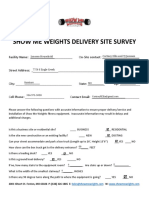

- Show Me Weights Delivery Site Survey: Cortney Ellis and TJ Janssen Janssen HouseholdDocument2 pagesShow Me Weights Delivery Site Survey: Cortney Ellis and TJ Janssen Janssen HouseholdTJ JanssenNo ratings yet

- 556 Hickory Manor Arnold MO 63010: B1Document1 page556 Hickory Manor Arnold MO 63010: B1TJ JanssenNo ratings yet

- Statement Details: Your Account SummaryDocument3 pagesStatement Details: Your Account SummaryTJ JanssenNo ratings yet

- Timothy W. Janssen, JR.: 4812 Little Fox Ct. Imperial, MO 63052 Cell: 314-288-4884Document1 pageTimothy W. Janssen, JR.: 4812 Little Fox Ct. Imperial, MO 63052 Cell: 314-288-4884TJ JanssenNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenNo ratings yet

- Us Ob Transvaginal - Details: Study ResultDocument4 pagesUs Ob Transvaginal - Details: Study ResultTJ JanssenNo ratings yet

- Participant Distribution Notice: Plan Name: Spire Savings Plan Plan Number: 75525 Date Generated: December 7, 2022Document10 pagesParticipant Distribution Notice: Plan Name: Spire Savings Plan Plan Number: 75525 Date Generated: December 7, 2022TJ JanssenNo ratings yet

- Veggies Only (Up To 2 Cups of Whatever Veggies You Want)Document2 pagesVeggies Only (Up To 2 Cups of Whatever Veggies You Want)TJ JanssenNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialMia JacksonNo ratings yet

- US Internal Revenue Service: Irb03-35Document101 pagesUS Internal Revenue Service: Irb03-35IRSNo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- W2 2010Document2 pagesW2 2010Rick Nunns100% (2)

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Document2 pagesProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenNo ratings yet

- AjaxDocument2 pagesAjaxaccount.enquiry6770No ratings yet

- Tax Research AssignmentDocument8 pagesTax Research Assignmentanon_768972800100% (1)

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- Wage and Income - PAGE - 104600922025Document3 pagesWage and Income - PAGE - 104600922025manuelkenzie10No ratings yet

- StatementDocument2 pagesStatementLuis HarrisonNo ratings yet

- A Primer On The Impact of The New Economic Stimulus Laws and IRC 409A On Executive Compensation in Mergers and AcquisitionsDocument48 pagesA Primer On The Impact of The New Economic Stimulus Laws and IRC 409A On Executive Compensation in Mergers and AcquisitionsArnstein & Lehr LLPNo ratings yet

- Employer Specail Wage Report Social-Security-Form-SSA-131Document2 pagesEmployer Specail Wage Report Social-Security-Form-SSA-131DellComputer99No ratings yet

- Wage and Income - THOM - 102746942918Document12 pagesWage and Income - THOM - 102746942918Mark ThomasNo ratings yet

- 34 Wihh 504331 H 0714320240524151104202Document3 pages34 Wihh 504331 H 0714320240524151104202jamelmhunt22No ratings yet

- w2 FINALDocument10 pagesw2 FINALmuhammad mudassarNo ratings yet