Professional Documents

Culture Documents

RBI Circular Dated 06.01.2015 On Credit Information Companies

RBI Circular Dated 06.01.2015 On Credit Information Companies

Uploaded by

dineshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI Circular Dated 06.01.2015 On Credit Information Companies

RBI Circular Dated 06.01.2015 On Credit Information Companies

Uploaded by

dineshCopyright:

Available Formats

ž¸¸£÷¸ú¡¸ ¢£{¸¨¸Ä ¤¸ÿˆÅ

RESERVE BANK OF INDIA

ww.rbi.org.in

RBI/2014-15/458

DNBR(PD).CC.No 019/03.10.01/2014-15 February 6, 2015

All NBFCs

Dear Sirs,

Membership of Credit Information Companies (CICs)

Please refer to circular DNBS(PD).CC. No 200 /03.10.001/2010-11 dated September

17, 2010 and DNBS (PD).CC. No 407/03.10.01/2014-15 dated August 20, 2014

advising all NBFCs to become a member of at least one Credit Information Company

(CIC) and provide credit data in the prescribed format to CIC.

2. Presently, four CICs, viz. Credit Information Bureau (India) Limited, Equifax Credit

Information Services Private Limited, Experian Credit Information Company of India

Private Limited and CRIF High Mark Credit Information Services Private Limited

have been granted Certificate of Registration by RBI. In terms of Section 15 of the

Credit Information Companies (Regulation) Act, 2005 (CICRA), every Credit

Institution shall become member of at least one CIC. Further, Section 17 of CICRA

stipulates that a CIC may seek and obtain credit information from its members

(Credit Institution / CIC) only. As a result, when a Specified User, as defined in

CICRA and Credit Information Companies Regulations, 2006, obtains credit

information on a particular borrower/client from a CIC, it gets only such information

that has been provided to the CIC by its members. This does not include credit

history related to those non-member Credit Institutions with which the borrower/client

has/had a current or a past exposure. To overcome this problem of

incomplete/inaccurate credit information, pros and cons of certain possible

alternatives have been discussed in the Report of the Committee to Recommend

Data Format for Furnishing of Credit information to Credit Information Companies

(Chairman: Shri Aditya Puri) constituted by the Reserve Bank of India (RBI). The

report of the committee can be accessed on the following URL:

http://rbi.org.in/scripts/PublicationReportDetails.aspx?UrlPage=&ID=763

गैर ब कंग विनयमन वभाग , कि य कायालय, 2र मं ज़ल , सटर I, व ड शे ड सटर, कफ परे ड, मुंबई-400 005

ûŸ½›¸:22189131, û¾ÅƬ¸:22163768 ƒÄ-Ÿ¸½¥¸:helpdnbs@rbi.org.in

Department of Non Banking Regulation, Central Office, 2nd Floor, Centre I, WTC, Cuffe Parade, Mumbai – 400 005

Tel No:22189131 Fax No:22163768 Email :helpdnbs@rbi.org.in

¢í¿™ú ‚¸¬¸¸›¸ í¾, ƒ¬¸ˆÅ¸ œÏ¡¸¸½Š¸ ¤¸ढ़¸इ‡

ž¸¸£÷¸ú¡¸ ¢£{¸¨¸Ä ¤¸ÿˆÅ

RESERVE BANK OF INDIA

ww.rbi.org.in

These alternatives along with suggestions/comments obtained from IBA and the

CICs have been examined by RBI. It has been decided that the best option would be

to mandate all Credit Institutions to become members of all CICs and moderate the

membership and annual fees suitably. These instructions would be reviewed in due

course.

3. Attention is also invited to the directive issued under CICRA Sec 11(1) by the

Bank vide DBR.No.CID.BC.59/20.16.056/2014-15 dated January 15, 2015 (copy

enclosed). Accordingly all NBFCs are directed to comply with the directive and

become member of all CICs and submit data (including historical data) to them.

Yours faithfully,

(A. Mangalagiri)

General Manager-in-Charge

गैर ब कंग विनयमन वभाग , कि य कायालय, 2र मं ज़ल , सटर I, व ड शे ड सटर, कफ परे ड, मुंबई-400 005

ûŸ½›¸:22189131, û¾ÅƬ¸:22163768 ƒÄ-Ÿ¸½¥¸:helpdnbs@rbi.org.in

Department of Non Banking Regulation, Central Office, 2nd Floor, Centre I, WTC, Cuffe Parade, Mumbai – 400 005

Tel No:22189131 Fax No:22163768 Email :helpdnbs@rbi.org.in

¢í¿™ú ‚¸¬¸¸›¸ í¾, ƒ¬¸ˆÅ¸ œÏ¡¸¸½Š¸ ¤¸ढ़¸इ‡

ž¸¸£÷¸ú¡¸ ¢£{¸¨¸Ä ¤¸ÿˆÅ

RESERVE BANK OF INDIA

ww.rbi.org.in

DBR.No.CID.BC.59/20.16.056/2014-15

January 15, 2015

Membership of Credit Information Companies (CICs)

In exercise of the powers conferred by sub-section (1) of Section 11 of Credit Information Companies

(Regulation) Act, 2005, Reserve Bank of India, being satisfied that it is necessary and expedient in

the public interest, hereby directs that within three months from the date of this directive,

(i) All Credit Institutions (CIs) shall become members of all CICs and submit data (including historical

data) to them. Further, CICs and CIs shall keep the credit information collected/maintained by them,

updated regularly on a monthly basis or at such shorter intervals as may be mutually agreed upon

between the CI and the CIC in terms of Regulation 10 (a) (i) and (ii) of the Credit Information

Companies Regulations, 2006.

(ii) As a consequence of (i) above, one-time membership fee charged by the CICs, for CIs to become

their members, shall not exceed Rs.10,000 each. The annual fees charged by the CICs to CIs shall

not exceed Rs.5000 each.

(N.S. Vishwanathan)

Executive Director

गैर ब कंग विनयमन वभाग , कि य कायालय, 2र मं ज़ल , सटर I, व ड शे ड सटर, कफ परे ड, मुंबई-400 005

ûŸ½›¸:22189131, û¾ÅƬ¸:22163768 ƒÄ-Ÿ¸½¥¸:helpdnbs@rbi.org.in

Department of Non Banking Regulation, Central Office, 2nd Floor, Centre I, WTC, Cuffe Parade, Mumbai – 400 005

Tel No:22189131 Fax No:22163768 Email :helpdnbs@rbi.org.in

¢í¿™ú ‚¸¬¸¸›¸ í¾, ƒ¬¸ˆÅ¸ œÏ¡¸¸½Š¸ ¤¸ढ़¸इ‡

You might also like

- Fixed Deposit AdviceDocument1 pageFixed Deposit Advicemac martinNo ratings yet

- Report On Marketing Plan of Samsung Company in 2022Document33 pagesReport On Marketing Plan of Samsung Company in 2022Như Hảo100% (2)

- Money Laundering EssayDocument4 pagesMoney Laundering EssayAnmari SablanNo ratings yet

- AdvanceReceipt2021 06 25 14 29 51Document1 pageAdvanceReceipt2021 06 25 14 29 51Piyush AgarwalNo ratings yet

- TALEO - Recruiter User GuideDocument42 pagesTALEO - Recruiter User GuideMarwan SNo ratings yet

- Defence QuestionnaireDocument2 pagesDefence QuestionnaireSumitt SinghNo ratings yet

- TestingDocument1 pageTestingsurajmdlNo ratings yet

- On Skilling of Mahatma Gandhi NREGA Workers: PR Oje C T Unnat I'Document23 pagesOn Skilling of Mahatma Gandhi NREGA Workers: PR Oje C T Unnat I'Kumar Udit100% (1)

- X 0 OMBF0 D E88 Na DLCDocument14 pagesX 0 OMBF0 D E88 Na DLCSUBODHNo ratings yet

- 09 05 23 StatementDocument1 page09 05 23 StatementZiyaur Rahman Iqbal AhmedNo ratings yet

- Functions of Customer Service Department of Machhapuchchhre Bank Limited, Baneshwor Branch, KathmanduDocument48 pagesFunctions of Customer Service Department of Machhapuchchhre Bank Limited, Baneshwor Branch, KathmanduSujan BajracharyaNo ratings yet

- UPSSSC PET Free MCQ Batch Online CourseDocument21 pagesUPSSSC PET Free MCQ Batch Online CourseAbhishek Katiyar0% (1)

- AccountStatement 8245311055 Aug23 195847Document8 pagesAccountStatement 8245311055 Aug23 195847Hell HunterNo ratings yet

- WCa I9 NGOjrp FSDUVDocument15 pagesWCa I9 NGOjrp FSDUVamairNo ratings yet

- Detailed Project Report: Muknogy Micro Finance FoundationDocument23 pagesDetailed Project Report: Muknogy Micro Finance FoundationMadhur DaniNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Undertaking From BorrowerDocument7 pagesUndertaking From BorrowerDivyesh Varun D VNo ratings yet

- Account Statement From 11 Apr 2020 To 11 Oct 2020Document15 pagesAccount Statement From 11 Apr 2020 To 11 Oct 2020AnandapriyaNo ratings yet

- Siddharth FiervExperienceDocument1 pageSiddharth FiervExperienceSiddharthNo ratings yet

- Outstanding Letter: Sub: Outstanding Balance On Your Loan Account - (LAI-00092203, LAI-00082527)Document1 pageOutstanding Letter: Sub: Outstanding Balance On Your Loan Account - (LAI-00092203, LAI-00082527)Kuldeep PanwarNo ratings yet

- Transaction StatementDocument2 pagesTransaction StatementSatya GopalNo ratings yet

- Sanction LetterDocument2 pagesSanction LetterVikas KumarNo ratings yet

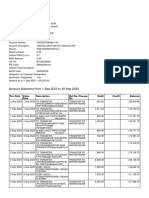

- Account Statement From 1 Mar 2022 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Mar 2022 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePiyush AgarwalNo ratings yet

- RBI Bulletin Oct 2021Document312 pagesRBI Bulletin Oct 2021Sowmya NarayananNo ratings yet

- Bihar PDS ReportDocument152 pagesBihar PDS Reportgopal100% (1)

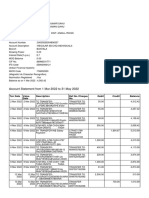

- Account Statement From 1 Apr 2022 To 20 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument13 pagesAccount Statement From 1 Apr 2022 To 20 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancejai vermaNo ratings yet

- Networth - Certificate For IDBIDocument4 pagesNetworth - Certificate For IDBISandip DasNo ratings yet

- Msme FinanceDocument55 pagesMsme FinanceGauri MittalNo ratings yet

- Karan 01-01-To-30-06-22Document105 pagesKaran 01-01-To-30-06-22Raja BhattacharjeeNo ratings yet

- AutorickshawDocument3 pagesAutorickshawsuheal007860704No ratings yet

- Banking and Finance Project 2 PDFDocument32 pagesBanking and Finance Project 2 PDF021 Srushti JagtapNo ratings yet

- RRB NTPC Online Exam 27 January 2021 GK Asked Questions Stage-2Document13 pagesRRB NTPC Online Exam 27 January 2021 GK Asked Questions Stage-2anukriti3sinhaNo ratings yet

- To The Study On Basic NabardDocument23 pagesTo The Study On Basic NabardKunal DeoreNo ratings yet

- Shri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesDocument4 pagesShri Mata Vaishno Devi Shrine Board - Welcome To Online Servicesphool baghNo ratings yet

- HL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448Document2 pagesHL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448KanakaReddyKannaNo ratings yet

- DPwo 63 B8 e TRJQNXVDocument14 pagesDPwo 63 B8 e TRJQNXVpooja muleyNo ratings yet

- Mudra LoanDocument8 pagesMudra LoanVELAYUTHAM95No ratings yet

- Bank of IndiaDocument1 pageBank of IndiaSuryakant PandeyNo ratings yet

- H TNB Ga Oy 2 KL I7 CSSDocument15 pagesH TNB Ga Oy 2 KL I7 CSSEVD18I019 NIMMAKAYALA SUMANTH GOURI MANJUNADHNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- Ek TYO2 Ankl ZFG2 NVDocument7 pagesEk TYO2 Ankl ZFG2 NVAyush yadavNo ratings yet

- General MSME Frequently Asked QuestionsDocument46 pagesGeneral MSME Frequently Asked QuestionsABHISHEK SINGHNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument14 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDileep kumarNo ratings yet

- Statement 271801000009191Document2 pagesStatement 27180100000919121P114 DEEPIKA SNo ratings yet

- TransNum Oct 10 150624Document3 pagesTransNum Oct 10 150624sri ramNo ratings yet

- Lovepreet SinghDocument10 pagesLovepreet SinghNikhil Visa Services100% (1)

- Icici Bank Home Finance Limited - Kandepu Subhash ChandraboseDocument3 pagesIcici Bank Home Finance Limited - Kandepu Subhash ChandraboseBhanu GNo ratings yet

- DtlStatement 08082022055359Document17 pagesDtlStatement 08082022055359Aralt visaNo ratings yet

- List of Self Certified Syndicate Banks (SCSBS) For Syndicate ASBA - 120920141631 - 260220151225Document543 pagesList of Self Certified Syndicate Banks (SCSBS) For Syndicate ASBA - 120920141631 - 260220151225Durwas Mohite100% (1)

- Socio Economic Survey 2019 20 PDFDocument345 pagesSocio Economic Survey 2019 20 PDFNarasimhulu PidemNo ratings yet

- (Federal Bank - A Financial AnalysisDocument11 pages(Federal Bank - A Financial AnalysisutkarshNo ratings yet

- INDIAN OVERSEAS BANK - Group 17 - BOCA GR1Document29 pagesINDIAN OVERSEAS BANK - Group 17 - BOCA GR1simran guptaNo ratings yet

- Guidelines For Petrol Pumps IndiaDocument31 pagesGuidelines For Petrol Pumps IndiaAjay PanghalNo ratings yet

- S 1Document3 pagesS 1Rajesh MullapudiNo ratings yet

- NiyoX-Statement-Jayavani M-01Sep22 - To - 30nov22 - 3cwp9zqDocument26 pagesNiyoX-Statement-Jayavani M-01Sep22 - To - 30nov22 - 3cwp9zqRicha BehraNo ratings yet

- Banking 2Document8 pagesBanking 2Ashwani KumarNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument2 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceNAGENDRA SINGH ShekhawatNo ratings yet

- PaymentReceipt EA90594258 6938661Document1 pagePaymentReceipt EA90594258 6938661202 SAI KRISHNANo ratings yet

- Z Rbup Alp 9 D Ahmc 4 PDocument5 pagesZ Rbup Alp 9 D Ahmc 4 Ppranay.suriNo ratings yet

- RBI Circular For Bank GuaranteesDocument33 pagesRBI Circular For Bank GuaranteessanjeetvermaNo ratings yet

- Statement For The Period From 01/06/2021 To 23/11/2021: Date CHQ NO Naration COD Debit Credit BalanceDocument4 pagesStatement For The Period From 01/06/2021 To 23/11/2021: Date CHQ NO Naration COD Debit Credit BalanceBhuvan BhargavaNo ratings yet

- Account Statement From 1 Mar 2022 To 31 May 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Mar 2022 To 31 May 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSudhir Kumar SahuNo ratings yet

- Data Format For Furnishing of Credit Information To Credit Information Companies and Other Regulatory MeasuresDocument10 pagesData Format For Furnishing of Credit Information To Credit Information Companies and Other Regulatory Measuresopen123qwertNo ratings yet

- Group 6 Fashion Marketing ProjectDocument26 pagesGroup 6 Fashion Marketing Projectapi-610080996No ratings yet

- Stages of Digital Transformation in Competency Management - TejaDocument6 pagesStages of Digital Transformation in Competency Management - TejaImmanuel Teja HarjayaNo ratings yet

- Buy Bitcoins With Credit CardDocument2 pagesBuy Bitcoins With Credit CardJaySiboNo ratings yet

- Reviewer GEd 104 The Contemporary WorldDocument3 pagesReviewer GEd 104 The Contemporary Worldbonna agojoNo ratings yet

- Group3 PizzanadaDocument36 pagesGroup3 Pizzanadatwiceitzyskz100% (1)

- QOS Improvement in MANET Routing by Route Optimization Through Convergence of Mobile AgentDocument6 pagesQOS Improvement in MANET Routing by Route Optimization Through Convergence of Mobile AgentNader JalalNo ratings yet

- Surat Rangkuman Perlindungan: Jaminan Nilai SantunanDocument2 pagesSurat Rangkuman Perlindungan: Jaminan Nilai SantunanWandiieBoomBoomNo ratings yet

- Order ConfirmationDocument1 pageOrder ConfirmationfarwaNo ratings yet

- The Coffee Guy Franchise PackDocument9 pagesThe Coffee Guy Franchise PackLucien MANGANo ratings yet

- Eldama Ravine Technical: and Vocational CollegeDocument2 pagesEldama Ravine Technical: and Vocational CollegeBen ChelagatNo ratings yet

- The Impact of Career Growth On Intentions in The Gen Z Era in Indonesia 1Document3 pagesThe Impact of Career Growth On Intentions in The Gen Z Era in Indonesia 1Gilang RamadhanNo ratings yet

- Final Technical Report. Group 2Document13 pagesFinal Technical Report. Group 2Chamel Jamora RuperezNo ratings yet

- Waiters and Waitress Job DescriptionDocument3 pagesWaiters and Waitress Job Descriptionobabaru gaddis ivanNo ratings yet

- TestBank Evans Ba2 Tif Ch01Document18 pagesTestBank Evans Ba2 Tif Ch01Khaleel AbdoNo ratings yet

- Behaviour of Bem Female Student Toward Purchasing BeautyDocument24 pagesBehaviour of Bem Female Student Toward Purchasing Beautykaladevi21No ratings yet

- Principal of MarketingDocument121 pagesPrincipal of MarketingBindu Devender MahajanNo ratings yet

- 1 - Transact Cheque and Draft Management Foundation (R22)Document62 pages1 - Transact Cheque and Draft Management Foundation (R22)Zakaria AlmamariNo ratings yet

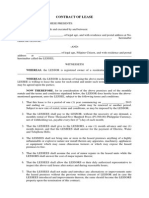

- Contract of Lease FormDocument3 pagesContract of Lease FormHal JordanNo ratings yet

- One Warehouse Multiretailer System With Centralized Stock InformationDocument13 pagesOne Warehouse Multiretailer System With Centralized Stock InformationdeevaNo ratings yet

- Print Application Form - ITI Admissions J&K HILALAHDocument1 pagePrint Application Form - ITI Admissions J&K HILALAHcharming danishNo ratings yet

- Coca Cola Company and Its DiversityDocument2 pagesCoca Cola Company and Its DiversityVíctor VargasNo ratings yet

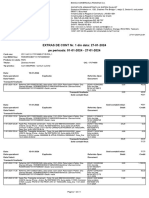

- Pe Perioada: 01-01-2024 - 27-01-2024 EXTRAS DE CONT Nr. 1 Din Data: 27-01-2024Document4 pagesPe Perioada: 01-01-2024 - 27-01-2024 EXTRAS DE CONT Nr. 1 Din Data: 27-01-2024andrei.zbercea04No ratings yet

- 3.7 Logistics Execution PDFDocument11 pages3.7 Logistics Execution PDFIndian Chemistry100% (1)

- Leadership and Public Sector Reform in The Philippines PDFDocument29 pagesLeadership and Public Sector Reform in The Philippines PDFambiNo ratings yet

- TITT - Consultancy Services - Prod OpsDocument74 pagesTITT - Consultancy Services - Prod OpsWale OyeludeNo ratings yet

- Apqc How Organizations Are Using Apqc Process PDFDocument13 pagesApqc How Organizations Are Using Apqc Process PDFsergioivanrsNo ratings yet

- Dissertation On Leadership DevelopmentDocument7 pagesDissertation On Leadership DevelopmentCustomPapersCleveland100% (1)