Professional Documents

Culture Documents

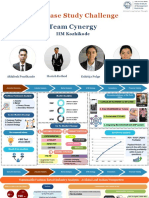

Costing Final Mindmap

Costing Final Mindmap

Uploaded by

betsyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing Final Mindmap

Costing Final Mindmap

Uploaded by

betsyCopyright:

Available Formats

Costing Introduction Material Cost Labor/Employee Cost Overheads Methods of Costing Techniques of Costing Cost Sheet Definitions Cost

Overheads Methods of Costing Techniques of Costing Cost Sheet Definitions Cost Accounting Activity Based Costing Lean System

Responsibility Inventory Control Definitions Single or Output Uniform Costing Conversion Cost = Direct Integrated/Integral Activity based costing (ABC) is Lean: Reduce Waste and

Classification Labor+ Direct Expense + an alternative to traditional way Improve Speed, Six Sigma:

Marginal (Indirect labor+ Indirect of overhead accounting. reduce Defect and Improve

Costing materials+ indirect expense) Capability

Cost Centers: Accountable for CAS-7 Cement, Daily, Mining, Coal, Bricks, In this accounting methods cost

=Prime Cost- Direct material + Traditional Methods based on

incurrence of cost Paper, Steel, Sugar Mills, Dairies, and financial accounting

Factory/Production/ Factory/Manufacturing OH Machine hours labour hours, Leans means small steps in

Job Ticket : Job tickets are Breweries, Flour Mills records are integrated

Revenue: Accountable for Manufacturing OH ABC is based on Cost Driver Improvement and BPS is giant

given to all workers where time

generation of revenue Leap

for commencing the job is Batch Costing Non-integrated/cost control Usefulness of ABC

recorded as well as the time Back flush accounting is a manufacturing

Profit: Responsible for Imputed Cost are notional cost

when the job is completed Stock Keeping do not involve any cash outlay accounting system where the costing of a product

generation of revenue and

incurrence of expenditure expense,Deprecation, Repair Pen, Toy, Drugs, Tyres, Tubes, In this cost and financial and the inventory consumed are calculated at the

Labor Cost Card : This card is Maintenance of factory Capitalized Cost, initially they When High amount of

Shoes, Drugs transactions are kept separately point of completion of the manufacturing process

meant for a job, which involves overhead

Investment: Responsible for building, Indirect Labor, are recorded as assent and later

several operations or stages of Tools of lean System

profatibility, capital investment Primary Packaging, Insurance Each batch is treated as a cost unit. treated as expense Wide-Range of Products

completion. Instead of giving one Cost of Plant and Machinery

decision making

card to each worker, only one Batch costing is type of Job Costing Cost Object is anything for

Presence of non-volume related activities

card is passed on to all workers which a separate measurement

Classification of Office and Administrative OH JIT: Reduce Waster through

So there must be a level of quantity at which is required Stiff competition

Time and Job Card: This card is sum of etup machine cost and carrying cost Pull Production

a combined record, which costs is minimum. Such a level is called Difference Between Standard

shows both, the time taken for Definitions

By Nature or Element Salary of staff, repair and Economic Batch Quantity (EBQ) and this level cost and actual cost is called

completion of the job as well as maintenance of office building, both the cost are equal Variance Takt Time, Heijunka, SMED, Cell Build

By Variability of Behavior the attendance time. Depreciation of Office Building,

Bin cards & Stock Ledge Stationary, Account and Audit time spent by worker in factory ABC costing is an accounting methodology that assigns

By Functions Idle Time: Difference between JIDOKA: Reduce Waste

Expense is called time keeping costs to activities rather than product or services and

employee paid and time spent Through Controlling Defects

apportion cost over cost

By Controllability Allocation is the process of

Selling and Distribution OH object/jobs/products/customer/services.

identification of overheads with

By Normality

Unavoidable: Tea break, to cost centers. Cost Pool: It represents a Poke Yake, Andon, Automation,

reach, Gap between Jobs Job Costing group of various individual cost 5 Whys, Line Stops, Build In

By cost for Managerial Decision Making

Salesman Commission, Apportionment is done in case items. Quality

(treated as direct cost)

Advertisement, Sales office of those overhead items which

Normal Idle time: Wait for Job, expense cannot be wholly allocated to a Under ABC OH-cost is allocated

Furniture making, Repairing, Tools of Kaizen

Imputed Cost: Notional cost Material, Instructions (treated For Cost sheet Costs are particular department. based on activities, in

Printing press, Painting

for which no involvement of as prodiction cost) Delivery Van, Transit classified on the basis of traditional methods OH-costs

cash Insurance, Secondary Costs which are ascertained were grouped under cost

Job Costing is same as batch Functions

Abnormal: Breakdown of packaging, Warehouse and Cold after they have been incurred centers and later cost is 5S. TPM,Value Stream

costing except job itself become a

Capitalized Cost: Initially machine, Unavailability of storage Expense, Bed Debt are known as Historical Cost assigned to product cost on the Mapping, PDCA, Quaity Circle

cost unit

recorded as assets and later Valuation of Material issue Raw material basis such as direct labor/prime

treated as expenses In standard price method

Suitable for diverse nature of Jobs cost

Concealed idel time: Cleaning, materials are priced at

Discretionary Cost: such cost Grass cutting(P&L account) pre-determined rate In traditional methods costing

Accounting for OHs Contract Costing

are not tied to cause and effect Marginal Cost is an increase in overheads are first related to

relationship Work Measurment aims at Maximum possible productive

total cost that results from a cost centers and later cost is

determining the effective time one unit increase in output capacity of a plant when no

assigned to cost units (product,

Engineered Cost: Clear cause required to complete a job Allocation Contract Costing is also known as Terminal operating time is lost is called service, time or combination)

and effect relationship costing. It is variant of Job Costing Marginal Cost= Prime Cost+ VOH Theoretical Capacity

in ABC OH are related to

Overtime: Actual houral more Apportionment

Explicit cost: Out of pocket cost Master budget denotes the activities or grouped into cost

than normal time Most of the cost are direct in nature Variable cost or marginal cost is

involving immediate payment pools, later they are related to

also termed as direct cost, summary of Functional Budget

of cash ex: salary, interest, Depreciation is taken as part of direct Cost cost objects

Wage Plans activity cost, volume cost or

out-of-pocket cost Costing approach that uses

Implicit Cost: Do not involve Work Certified always in terms

any immediate cash payment, of contract price broad average for charging

Fixed Cost is also called time

not recorded in books, also overhead uniformly to products

Differential Piece Rate (3) cost, period cost, standby cost,

called economic cost Work Uncertified always in or services is known as cost

capacity cost, or constant cost

terms of ocst smoothing or peanut butter

Period Cost: These are those costing.

costs which are necessary for Taylor Debit

production and which will not Cost smoothing can lead to one product

be incurred if there is no under cost and one more cost its called cross

production, also called subsidization

If the workers are efficient, they Material, Labor, Depreciation,

inventory cost, ex: direct should be paid @ 120% of the Money to subcontractor ,

material, Direct labor Cooper's Cost Hierarchy

normal piece rate and if they Overheads

are inefficient, they should be

Period Cost:These are those

paid @ 80% of the normal piece Credit

costs which are not necessary

rate Unit Level Activities: Those

for production and are incurred

activities for which the

even if there is no production,

Merrick consumption of resources can

ex: Showroom rent, salary Material Returned, be identified with the number

WIP, Work Certified of units produced

Cost Control Re-Apportionment and Work Uncertified

Up to 83% of production - Normal piece Batch level Activities: Activities

rate such as setting up of machines

Preventive Action, ends when 83% to 100% of production - 110% of

ordinary piece rate Product Level Activities: These activities are

target are achieved

Above 100% of production - 120% of performed to support different product in line

ordinary piece rate example: Designing the products, producing

Cost Reduction parts specifications

Gant Task and Bonus

Facilities level activities: These

Corrective Action, no visible end are the activities which can not

If Service department provide

be directly attributed to

service only to production

combination of time rate, individual units. These

department Direct Method is used Retention Money: Sometimes some part of

bonus and piece rate plan. activities are necessary to

money that is due to contractor is held back as a

sustain the manufacturing

Production below standard - Guaranteed If SD provide service to not only PD but safeguard available to the contractee in case the

process. Example: maintenance

time rate does nor receive services from other SD contractor is not able to fulfill one or more of

of building, Plant security.

Production at standard - Bonus of 20% use Non-Reciprocal/Step-Ladder, the conditions

[normally] of time rate Step-Down method

Practical applications of ABC

Production above standard - High piece rate

Standard Costing

for the entire output If SD1 provide service to not

only PD but also other SD2 and Cash Ratio: The contractee may pay a fixed

Bonus System Plan (Hasley and Rowen) SD2 provide Service to SD1 use percentage, say 80% or 90% of the work As a Decision Making Tool

reciprocal Method certified, depending upon the term of the

contract. This is known as Cash Ratio

To increase performance and

Simultaneous: Cost of one profitability of organization

service department to

production department using ABC can help in find specific

Cost Plus Control: The value of control is

percentage. cost for an activity

Under Hasley Weir plan determined by adding an agreed % of profit

employee gets 33.33% instead to the total cost. It is used when contract of

Trial and Error: Cost of one cost can't be calculated reasonably. As Activity based Management

of 50% service cost center is

apportioned to another service

Barth Variable Sharing Plan Escalation Clause: Contractor can revise the

cost center.

price of contract in case of increase of The use of ABC tool to manage

Repeated: Cost of one service prices of material, labor etc due to macro the cost of activity level is

department is apportioned to economic or any other reason. known as activity based

PD and SD management

De escalation Clause or Reserve Clause’ to

provide for any future decrease in price etc. Various analysis in ABM

Absorption so that the benefit may be passed on to the

Labor/Employee Turnover contractee

Cost driver Analysis

Charging of OH to cost Units Process Costing

Activity Analysis

Absorption Basis •Textiles mills , weaving

• Chemical works Value added activities

• Oil refining

% of direct material/prime • Cement manufacture Non-value added activities

cost/direct labor cost/labor • Paper manufacture

• Food processing Performance analysis

hour rate/machine hour rate/

rate per unit of output • Steel mills

• Paint manufacture ABM in Business

• Soap making

• Sugar works

• Confectionaries (Biscuits) Cost Reduction

Cost of Labor Turnover

• Plastic manufacture, etc

Business Process

Operation costing is Re-engineering: Examining

1. Preventive Cost: Preventive Costs also known as Hybrid business process and making a

refer to all those items of expenditure Product Costing substantial change ro how org.

which are incurred in order to keep currently operate

the Type of OH Rates FIFO at current Cost, Oldest

workers satisfied ex: Medical Service, Inventory SOld IFrst Benchmarking: Comparing one

Welfare segment of ABC to another

LIFO , Newest Inventory Sold First

segment

2. Replacement Costs are those costs which are

During Inflation use FIFO and

incurred for the recruitment and training of new Performance management

During Deflation use LIFO

hands and the resulting losses, wastages and

lowering of productivity due to the inexperience and Abnormal Gain and Loss Facilitate Activity Based

inefficiency of the new labor force. Budgeting (ABB)

ABB analyses the resource

input or cost of each activity so

helps in better planning and

Blanket OH rate refers to budgeting.

computation of one single

overhead rates for whole

Process A/c

factory, it is different from

Departmental OH rate which

refer to separate OH for each

cost center or department Debit Side

Treatment of Under

and Over absorbed Materials used

OH

Employee Cost/Labor

Direct Expense

Depreciation, repairs,

maintenance, insurance

Production Overheads

Rent, power, light, gas, water bills

Capacity Abnormal Process Gain/yield

Credit Side

Installed/Rated capacity Historical Costing

Practical/Operational capacity

Normal Process loss

Normal Capacity It is ascertainment of cost after

Abnormal Process Loss

they have been incurred

Actual capacity

Idle capacity Absorption Costing

Credited to process account but

debited to Costing profit and

loss account

Normal Idle It is practice of charging all

Transfers costs, both variable and fixed to

Ab-normal Idle operation. This differs from

Finished Stock marginal costing where fixed

Costing of Special Items cost are excluded.

Cost of Sales

Sales Budget And Budgetary Controls

Abnormal Gain A/c

Master Budget is also called

Summary Budget

Debit Side

Budgeted P/L statement

Normal Loss

Budgeted Balance Sheet

Costing P&L A/c

Budgeted Cash

Flow Statement/

Credit Side Cash Budget

Principal Budget Factor: A

factor which limits the activities

By

of the organization

Process- 1

A/C Flexible Budget: recognize the

difference b/w variable,

abnormal Gain

semi-variable and fixed cost

depending on activity levels

Operating/Service

In ZBB budget are prepared for

each activities rather than

functional department

Budgeted Ratio

Multiple/composite

Bicycles, Soft drinks

Costing.mmap - 2/12/2021 - Anvesha Arora

You might also like

- Neimen Marcus Retail Pricing - AshlynGravesDocument42 pagesNeimen Marcus Retail Pricing - AshlynGravesAshlyn GravesNo ratings yet

- FABM 2 - Comprehensive TaskDocument3 pagesFABM 2 - Comprehensive TaskJOHN PAUL LAGAO100% (1)

- FORMULAS For CALCULATING RATES1 PDFDocument4 pagesFORMULAS For CALCULATING RATES1 PDFBasara MladenNo ratings yet

- Quality Manual: September 2003Document25 pagesQuality Manual: September 2003Swas SwastiNo ratings yet

- Point of Sale - SystemDocument11 pagesPoint of Sale - SystemJohn Bryll Puebla AgbayNo ratings yet

- Intermediate Accounting 16e PDFDocument84 pagesIntermediate Accounting 16e PDFMiharu Kim100% (1)

- Global Sourcing and Contract ManagementDocument2 pagesGlobal Sourcing and Contract Managementzahidul islam zahidNo ratings yet

- GD & T Tolerance Stack UpDocument19 pagesGD & T Tolerance Stack UpHemantNo ratings yet

- Evaluation of The Target Costing Model in The Textile and Apparel IndustryDocument5 pagesEvaluation of The Target Costing Model in The Textile and Apparel IndustryTI Journals PublishingNo ratings yet

- Margin Calculator 1Document10 pagesMargin Calculator 1prasad_kcpNo ratings yet

- Tipos de Tratamientos PDFDocument1 pageTipos de Tratamientos PDFJose PerezNo ratings yet

- BASE Textiles LimitedDocument76 pagesBASE Textiles LimitedPushpa BaruaNo ratings yet

- Problem #1Document19 pagesProblem #1Francia YañezNo ratings yet

- Cost Management SystemDocument12 pagesCost Management SystemdianaNo ratings yet

- Steel and Pipes For Africa Price ListDocument1 pageSteel and Pipes For Africa Price ListLazuardhy Vozika Futur100% (1)

- Harsh ElectricalsDocument7 pagesHarsh ElectricalsR GNo ratings yet

- 05 Dash Board - Reprocess & Rejection Dyed FabricDocument2 pages05 Dash Board - Reprocess & Rejection Dyed Fabricsky textiles300No ratings yet

- DYEING - FINISHING Price - Paramount To Prmiyar GardenDocument1 pageDYEING - FINISHING Price - Paramount To Prmiyar Gardenasrknit1No ratings yet

- Time & Action Calendar Format - Apparel ManufacturingDocument2 pagesTime & Action Calendar Format - Apparel ManufacturingAhsan AryanNo ratings yet

- Cost Sheet STDDocument1 pageCost Sheet STDSabbir Hossain ImranNo ratings yet

- Ev ThreadDocument1 pageEv ThreadGurjeevAnandNo ratings yet

- Fine Rubber Powders From Rubber Crumb & Buffings: Anne & Russ EvansDocument8 pagesFine Rubber Powders From Rubber Crumb & Buffings: Anne & Russ EvansPeter Jake Patriarca100% (1)

- FAM - Assignment 01Document13 pagesFAM - Assignment 01Indika DissanayakeNo ratings yet

- Fulltext01 PDFDocument71 pagesFulltext01 PDFVincentTKNo ratings yet

- 2) in STN-2 Cycle Time Is OUT As Loading Time Is More in Both Fixture Than Welding TimeDocument1 page2) in STN-2 Cycle Time Is OUT As Loading Time Is More in Both Fixture Than Welding TimeKARTICK PRASADNo ratings yet

- RP Tools & Materials PricelistDocument18 pagesRP Tools & Materials PricelistJose Antonio Siñani VilteNo ratings yet

- Costing For A Spinning MillDocument14 pagesCosting For A Spinning MillSakthivel JegarajanNo ratings yet

- 14.72 KL PP FRP TankDocument24 pages14.72 KL PP FRP TankmaheshdgavaliNo ratings yet

- Blended Cost BOMs - Rev 1Document30 pagesBlended Cost BOMs - Rev 1RJLockNo ratings yet

- Cost Estimate For Tricked Out 14 X 14 CabinDocument3 pagesCost Estimate For Tricked Out 14 X 14 CabinAlex Tango FuegoNo ratings yet

- T-Shirt Layout PlanDocument1 pageT-Shirt Layout PlanHemel100% (1)

- PWC Case Study Challenge: Team CynergyDocument16 pagesPWC Case Study Challenge: Team CynergyDeepakbalajiNo ratings yet

- Flexible Electronics: Presented by Ashwin.k 4SN14EC704Document16 pagesFlexible Electronics: Presented by Ashwin.k 4SN14EC704Aswin PrEmrajNo ratings yet

- Cycle Time Calculation-Unit - 12 - Automated - Manufacturing - Systems PDFDocument34 pagesCycle Time Calculation-Unit - 12 - Automated - Manufacturing - Systems PDFzainikamal1975No ratings yet

- KRC (U-3,4) Factory Monthly KSM (May-22 To July-22)Document34 pagesKRC (U-3,4) Factory Monthly KSM (May-22 To July-22)Nitta Mallik100% (1)

- Anna Cox - Flexcon Case Study - 2021Document6 pagesAnna Cox - Flexcon Case Study - 2021api-570942908No ratings yet

- Khanna Paper Mills: Case StudyDocument1 pageKhanna Paper Mills: Case StudySankar MNo ratings yet

- PVC R RateDocument2 pagesPVC R RateKaushal LahotiNo ratings yet

- Far LZ400895Document10 pagesFar LZ400895Soubhagya BeheraNo ratings yet

- Modified Jacket Proposal Modified Cost SheetDocument1 pageModified Jacket Proposal Modified Cost SheetabdullahNo ratings yet

- Target Costing: Ludwigsburg VMDocument11 pagesTarget Costing: Ludwigsburg VMkashi3027No ratings yet

- Man Power PlanningDocument56 pagesMan Power PlanningsdmanojkumarNo ratings yet

- Solder Paste LiteratureDocument1 pageSolder Paste LiteraturescmeswarNo ratings yet

- Visit: Knitwear MerchandisingDocument20 pagesVisit: Knitwear MerchandisingKishor MahmudNo ratings yet

- Optimizing Efficiency: FabricationDocument7 pagesOptimizing Efficiency: FabricationVivek Kumar SinghNo ratings yet

- Blazer SMVDocument3 pagesBlazer SMVRADWAN RAHAT100% (1)

- Key Success Factors For Industrial EngineersDocument11 pagesKey Success Factors For Industrial EngineersAli Akbar NaqviNo ratings yet

- Costing Large ScaleDocument8 pagesCosting Large Scalekirubakaran janaNo ratings yet

- Supply Chain Indicators Guideline V2Document18 pagesSupply Chain Indicators Guideline V2Arturo TorresNo ratings yet

- Factors Which Affect The Cost ofDocument19 pagesFactors Which Affect The Cost ofsuchi_mohan08No ratings yet

- IEMS Module 5Document31 pagesIEMS Module 5VenkatramananNo ratings yet

- Garment Sample Costing Sheet by OCSDocument3 pagesGarment Sample Costing Sheet by OCSvidhya kamalNo ratings yet

- Case 3 Levi Jeans Case StudyDocument5 pagesCase 3 Levi Jeans Case StudyIan Trinh-truc50% (2)

- Assignment Toyota Case Study MsbeDocument2 pagesAssignment Toyota Case Study MsbeAmodh SehgalNo ratings yet

- Jacket O.BDocument26 pagesJacket O.BVikas KewatNo ratings yet

- Zero Based Costing Training: Course ContentsDocument1 pageZero Based Costing Training: Course ContentsAshutosh ChauhanNo ratings yet

- Iron and Steel Products Update 27mac2014Document13 pagesIron and Steel Products Update 27mac2014mfakhrudNo ratings yet

- Tip Speed Calculation: RPM CalculationDocument13 pagesTip Speed Calculation: RPM CalculationNishant InamdarNo ratings yet

- Cru Market OverviewDocument26 pagesCru Market OverviewOwm Close CorporationNo ratings yet

- Taylor Shirts Inc. - Operations ManagementDocument8 pagesTaylor Shirts Inc. - Operations ManagementGeneNo ratings yet

- List of Manufacturing Processes - Wikipedia, The Free EncyclopediaDocument9 pagesList of Manufacturing Processes - Wikipedia, The Free EncyclopediaKhalid SheikhNo ratings yet

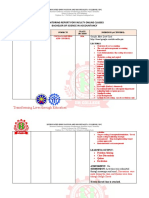

- Monitoring Report For Faculty Online Classes Bachelor of Science in AccountancyDocument8 pagesMonitoring Report For Faculty Online Classes Bachelor of Science in AccountancyJay AnnNo ratings yet

- ms04 Cost Behavior and Cost ClassificationDocument8 pagesms04 Cost Behavior and Cost ClassificationdigididoghakdogNo ratings yet

- Cms Placement Brochure Mba Fulltime 2019 20Document40 pagesCms Placement Brochure Mba Fulltime 2019 20Aagam JainNo ratings yet

- Ethics Between Theory and Practice Social Responsibility in The Romanian Business EnvironmentDocument11 pagesEthics Between Theory and Practice Social Responsibility in The Romanian Business EnvironmentViorica MituNo ratings yet

- Chapter 8Document31 pagesChapter 8laurenbondy44No ratings yet

- Assignment 4 - CH 14 - OM12EDocument11 pagesAssignment 4 - CH 14 - OM12EMuhammad FauzanNo ratings yet

- Do Loyal Customers Really Pay For More Services PDFDocument20 pagesDo Loyal Customers Really Pay For More Services PDFkaruneshNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNo ratings yet

- Consolidated LabRel CasesDocument190 pagesConsolidated LabRel CasesEloisa Katrina MadambaNo ratings yet

- PHYSICAL EVIDENCE and SERVICESCAPESDocument17 pagesPHYSICAL EVIDENCE and SERVICESCAPESPreet Kaur0% (1)

- Fol No BilinguesDocument24 pagesFol No BilinguesMaria Isabel Pérez OrtegaNo ratings yet

- IPL Midterms ReviewerDocument24 pagesIPL Midterms ReviewerShammah Rey MahinayNo ratings yet

- Financial Shenanigans Checklist - Hurricane CapitalDocument10 pagesFinancial Shenanigans Checklist - Hurricane CapitalTrinh NgocNo ratings yet

- Draft IP Policy Template As of Aug 26Document24 pagesDraft IP Policy Template As of Aug 26ramilsanchez@yahoo.comNo ratings yet

- Capital Budgeting PPT 2Document32 pagesCapital Budgeting PPT 2Sakshi SharmaNo ratings yet

- VFC Meeting 8.31 Discussion Materials PDFDocument31 pagesVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNo ratings yet

- RTM Chapter OneDocument6 pagesRTM Chapter OneAhmd HfzNo ratings yet

- Introduction For UPSDocument19 pagesIntroduction For UPSteju_690% (1)

- Daftar Akun Dan Saldo Awal NeracaDocument6 pagesDaftar Akun Dan Saldo Awal Neracayesi mustikariniNo ratings yet

- QBO Cert Exam Module 7 - 8Document114 pagesQBO Cert Exam Module 7 - 8John AnthonyNo ratings yet

- UNCEFACT-BRS-Business Requirements Specifications - Cross Industry Invoincing Process-Archivo-BRS - CII - v2.0.6Document49 pagesUNCEFACT-BRS-Business Requirements Specifications - Cross Industry Invoincing Process-Archivo-BRS - CII - v2.0.6RE TPNo ratings yet

- All Lecture MaterialsDocument283 pagesAll Lecture MaterialsNaomi Amare100% (2)

- Previous Years : Reliance Industrie SDocument13 pagesPrevious Years : Reliance Industrie SAditya KumarNo ratings yet

- WsCube Tech Paid-Ads-CourseDocument4 pagesWsCube Tech Paid-Ads-CourseProf.Mustansar HussainNo ratings yet

- 14 Deloitte Presentation 2 Slide Per PageDocument46 pages14 Deloitte Presentation 2 Slide Per PagemihailtomaNo ratings yet

- Product PositioningDocument3 pagesProduct PositioningNizar AhamedNo ratings yet

- Schneider 5. Selling To Consumers OnlineDocument46 pagesSchneider 5. Selling To Consumers OnlineRaisa HossainNo ratings yet

- Marketing of Insurance Services PDFDocument19 pagesMarketing of Insurance Services PDFRajeshsharmapurangNo ratings yet

- Theoretical Framework and Hypothesis DevelopmentDocument19 pagesTheoretical Framework and Hypothesis Developmentgaturora67% (6)