Professional Documents

Culture Documents

Midterm Test - Second Chance!

Midterm Test - Second Chance!

Uploaded by

Lê Thái Thiên HươngOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Test - Second Chance!

Midterm Test - Second Chance!

Uploaded by

Lê Thái Thiên HươngCopyright:

Available Formats

11:04 29/03/2023 Midterm test - Second Chance!

Câu hỏi 1

Chưa trả lời

Đạt điểm 2,00

Đặt cờ

Please explain the benefits and the advantages of all factors that affect the cost of capital of MNCs.

Kích thước tối đa cho các tập tin mới: 20MB

Files

Accepted file types

All file types

Câu hỏi 2

Chưa trả lời

Đạt điểm 6,00

Đặt cờ

CYZ Inc. in Korean plans to build new manufacturing to produce and sell products in Vietnam. The initial investment for the manufactory is financed 35% by debt and 65%

by issuing new stock. The company has to pay loan principal by straight-line method in 3 years. The Inc. plans to reinvest retained earnings to expand the production

line.

The Vietnamese government imposes a 15% income tax, a 10% withholding tax and does not have any restrictions on remitting funds. The annual fixed asset depreciation

rate is 25% and the 85% remaining value of the fixed asset is recognized as after-tax salvage value.

The company forecasts the detailed business activities of the project for the next three years as follows.

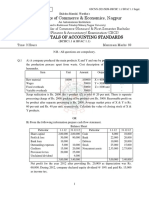

1Loan interest rate 12%

2Cost of issuing stock 14%

3Retained earnings 15%

4Initial Investment KRW 2,000,000.00

Year 0 Year 1 Year 2 Year 3

5The demand for products per year (unit)

30,000 40,000 50,000

6Selling price per unit (VND) 1,500

1,000 1,200

7Variable cost per unit (VND) 250 230 220

8Annual lease and other fixed expenses (VND)

1,000,000 1,000,000 1,000,000

9Spot exchange rate (KRW/VND) 18.00

18.00 19.00 20.00

10Forward exchange rate (KRW/VND) 18.00

18.00 18.00

% hedging of the remitted fund after

11 90.0%

withholding taxes

a Weighted Average Cost of Capital

b Interest expenses

c Loan principal payment

d Annual Fixed asset depreciation

e Salvage value

f Annual Retained earing

g NPV in non-hedging case

h NPV in hedging case

https://lms.uef.edu.vn/mod/quiz/attempt.php?attempt=459492&cmid=303174 2/3

11:04 29/03/2023 Midterm test - Second Chance!

g g

Please upload your full calculation

Kích thước tối đa cho các tập tin mới: 20MB

Files

Accepted file types

All file types

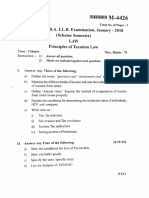

Câu hỏi 3

Chưa trả lời

Đạt điểm 2,00

Đặt cờ

Please explain how the increasing or decreasing of subsidiary financing affects the global capital structure

of MNCs. If the foreign creditor wants to charge a higher loan rate, please explain why and how does the

parent company handle that to keep the global capital structure unchanged?

Kích thước tối đa cho các tập tin mới: 20MB

Files

Accepted file types

All file types

◄ Group Project Chuyển tới...

https://lms.uef.edu.vn/mod/quiz/attempt.php?attempt=459492&cmid=303174 3/3

You might also like

- Farfetch: Sales InvoiceDocument1 pageFarfetch: Sales Invoiceason lifeNo ratings yet

- Team Assignment #3 GFCM - 2023-2024Document2 pagesTeam Assignment #3 GFCM - 2023-2024nkvkdkmskNo ratings yet

- RF162220888US Live-Life-Claim Thomas James Brown BeyDocument1 pageRF162220888US Live-Life-Claim Thomas James Brown Beykingtbrown5090% (10)

- Chapters 5-6: Use The Following For The Next Two QuestionsDocument9 pagesChapters 5-6: Use The Following For The Next Two QuestionsJane Ruby Jenniefer67% (3)

- Financial Management:: Professional Level Suggested Answers Nov-Dec 2020Document13 pagesFinancial Management:: Professional Level Suggested Answers Nov-Dec 2020Md Aliul AlimNo ratings yet

- Lesson 5: Assessment of Learning Template Task 1: Need or Want?Document4 pagesLesson 5: Assessment of Learning Template Task 1: Need or Want?Mikayla CornthwaiteNo ratings yet

- Case 2 Marking SchemeDocument22 pagesCase 2 Marking SchemeHello100% (1)

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- CJ Darcl ProfileDocument27 pagesCJ Darcl ProfileShiva Rajeti (Manager - Business Development, Bangalore RO)No ratings yet

- Year1 Year 2 Year 3 Revenue From Business Activity Net Profit Before Tax InvestmentDocument4 pagesYear1 Year 2 Year 3 Revenue From Business Activity Net Profit Before Tax InvestmentAnh Duong PhamNo ratings yet

- Time Value of MOneyDocument10 pagesTime Value of MOneyManroop SinghNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- Investment Linked Statement of Account: Reg. No 199002477ZDocument8 pagesInvestment Linked Statement of Account: Reg. No 199002477Zgunat dhanapalNo ratings yet

- BIM-FDB-BI Tools QuotationDocument1 pageBIM-FDB-BI Tools QuotationHsu Let Yee HninNo ratings yet

- Leverage - Financial ManagementDocument7 pagesLeverage - Financial Managementyogeshjhanwar402No ratings yet

- 0 Repayment Schedule 19-34-13Document1 page0 Repayment Schedule 19-34-13salan salanNo ratings yet

- 5-2 Cost ImpactsDocument6 pages5-2 Cost ImpactsOctavio HerreraNo ratings yet

- 2 FunctionsDocument17 pages2 FunctionsSalman AhmadNo ratings yet

- Ans Part 1Document17 pagesAns Part 1Kushagra BurmanNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- 3E Excell Worksheet DDocument18 pages3E Excell Worksheet DMirayya AidarovaNo ratings yet

- Buildings (Abc)Document4 pagesBuildings (Abc)Deeb AyyobNo ratings yet

- FM Previous Year Questions 2020-2023Document18 pagesFM Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- Final SumsDocument12 pagesFinal SumsMaryNo ratings yet

- Particulers Quantity: Project CostDocument26 pagesParticulers Quantity: Project CostRashan GidaNo ratings yet

- BANTIDocument23 pagesBANTIvikas guptaNo ratings yet

- FM RTP Merge FileDocument311 pagesFM RTP Merge FileAritra BanerjeeNo ratings yet

- Advance 3Document14 pagesAdvance 3pari maheshwariNo ratings yet

- Full Complete ModelDocument18 pagesFull Complete ModelSyed Mohammad Kishmal NNo ratings yet

- Interest Rate (Pa) : 0.08 Compound Periods: 4 Number of Years: 5Document5 pagesInterest Rate (Pa) : 0.08 Compound Periods: 4 Number of Years: 5SGNo ratings yet

- Mutual FundDocument5 pagesMutual FundSoumojit ChatterjeeNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- Maharashtra EB Sale No Yes Mar No: Wind Power Project - Financial StatementDocument5 pagesMaharashtra EB Sale No Yes Mar No: Wind Power Project - Financial Statementaby_000No ratings yet

- Institute of Management, Nirma UniversityDocument2 pagesInstitute of Management, Nirma UniversityhimanshiNo ratings yet

- Case Study Team 12Document2 pagesCase Study Team 12Vidya Hegde KavitasphurtiNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Government Guarantee Management ReportDocument2 pagesGovernment Guarantee Management ReportIntanNo ratings yet

- Financial ModelDocument1 pageFinancial ModelintangiblegiftsofficialNo ratings yet

- Rfo ComputationDocument1 pageRfo ComputationMyraNo ratings yet

- DCF ModelDocument29 pagesDCF ModelPATMON100% (7)

- Cash-27 2 2023Document2 pagesCash-27 2 2023Thu VuNo ratings yet

- Biotech Valuation Model 2Document21 pagesBiotech Valuation Model 2w_fibNo ratings yet

- Mgac CustomDocument123 pagesMgac CustomJoana TrinidadNo ratings yet

- DTA's Morning Cafe-04th Oct 2021Document1 pageDTA's Morning Cafe-04th Oct 2021aaryinfoNo ratings yet

- FINAL BOQ For Huawei Visa Bidding 2022-2023Document14 pagesFINAL BOQ For Huawei Visa Bidding 2022-2023A.T Puteri SastrawidjayaNo ratings yet

- Debt Bulletin-Govt. of The PunjabDocument4 pagesDebt Bulletin-Govt. of The PunjabSaqib JoyiaNo ratings yet

- ADVANCED CORPORATE FINANCE 3rd TermDocument11 pagesADVANCED CORPORATE FINANCE 3rd TermdixitBhavak DixitNo ratings yet

- IA BorrowingDocument4 pagesIA Borrowingczarina salazarNo ratings yet

- 132 Financial Analysis 3Document17 pages132 Financial Analysis 3Anis BidaniNo ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- Girum Tsega PerfectDocument13 pagesGirum Tsega PerfectMesi YE GINo ratings yet

- Ch11 PDFDocument6 pagesCh11 PDFnagendra reddy panyamNo ratings yet

- BM40002 Introduction To-Finantial ManagementDocument4 pagesBM40002 Introduction To-Finantial ManagementNitin MauryaNo ratings yet

- S16 - Scenario Manager - NPV - ClassDocument11 pagesS16 - Scenario Manager - NPV - ClassABHAY VEER SINGHNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementakshaymatey007No ratings yet

- BUSI331 PROJECT 1 - Jatinderpal Gill - 3005301Document23 pagesBUSI331 PROJECT 1 - Jatinderpal Gill - 3005301sunnygilliganNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Contract Note Cum Tax Invoice: RD1986 Deebak SDocument4 pagesContract Note Cum Tax Invoice: RD1986 Deebak SDeebak SNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- Instant Noodle CompanyDocument8 pagesInstant Noodle CompanyIsabella GimaoNo ratings yet

- Submission Cover Sheet Company Research ProjectDocument29 pagesSubmission Cover Sheet Company Research ProjectLê Hoàng Long NguyễnNo ratings yet

- RepaymentSchedule_H400HLP0476535Document6 pagesRepaymentSchedule_H400HLP0476535Msreepal ReddyNo ratings yet

- Relife (Competitive, Financial and User Engagement)Document14 pagesRelife (Competitive, Financial and User Engagement)fitri nurul kamilaNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in Viet NamFrom EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNo ratings yet

- Chart TitleDocument3 pagesChart TitleLê Thái Thiên HươngNo ratings yet

- Grading Rubric For Group Presentation (80%) : (1 Point)Document2 pagesGrading Rubric For Group Presentation (80%) : (1 Point)Lê Thái Thiên HươngNo ratings yet

- Hi, Everyone: Human Resourse Management Lecture: Dang Thanh Thuy, Mba Group 3Document46 pagesHi, Everyone: Human Resourse Management Lecture: Dang Thanh Thuy, Mba Group 3Lê Thái Thiên HươngNo ratings yet

- Unit 5 - Group 2Document16 pagesUnit 5 - Group 2Lê Thái Thiên HươngNo ratings yet

- Job Analysis: Lecturer Dang Thanh Thuy, MBADocument28 pagesJob Analysis: Lecturer Dang Thanh Thuy, MBALê Thái Thiên HươngNo ratings yet

- McCants TextDocument11 pagesMcCants TextasadasdaNo ratings yet

- Siebert - The Half and The Full Debt CycleDocument10 pagesSiebert - The Half and The Full Debt CycleMarcosNo ratings yet

- International Marketing 16th Edition Cateora Test BankDocument119 pagesInternational Marketing 16th Edition Cateora Test Banksharon100% (34)

- Central Banking Development and GrowthDocument2 pagesCentral Banking Development and GrowthJessa CastanedaNo ratings yet

- Financial Reporting and Analysis 7th Edition Revsine Solutions Manual DownloadDocument71 pagesFinancial Reporting and Analysis 7th Edition Revsine Solutions Manual DownloadRuth Hillyer100% (21)

- Ca Inter GST Module 1Document46 pagesCa Inter GST Module 1sukritisuman2No ratings yet

- Malinab Aira Bsba FM 2-2 Activity 5Document13 pagesMalinab Aira Bsba FM 2-2 Activity 5Aira MalinabNo ratings yet

- The Determinants of Liquidity Risk of CoDocument18 pagesThe Determinants of Liquidity Risk of CoNguyễn Thị Ngọc LàiNo ratings yet

- Government Intervention On Agricultural Goods Imports in Developing Countries: A Survival Necessity or An Unnecessary Protectionism?Document10 pagesGovernment Intervention On Agricultural Goods Imports in Developing Countries: A Survival Necessity or An Unnecessary Protectionism?International Journal of Innovative Science and Research TechnologyNo ratings yet

- TVM Sums & SolutionsDocument7 pagesTVM Sums & SolutionsRupasree DeyNo ratings yet

- Changing Role of Trade Union in IndiaDocument3 pagesChanging Role of Trade Union in Indiashikha100% (1)

- LogDes FinalDocument163 pagesLogDes FinalRihana Nhat KhueNo ratings yet

- Foreign Trade Policy of India (A)Document18 pagesForeign Trade Policy of India (A)18arshiNo ratings yet

- Manjinder Kaur E-Mail:Sohni - G@hotmail - Com To, The HR ManagerDocument6 pagesManjinder Kaur E-Mail:Sohni - G@hotmail - Com To, The HR ManagerJessica JenkinsNo ratings yet

- Trade Like A Stock Market WizardDocument74 pagesTrade Like A Stock Market WizardIts KrakenNo ratings yet

- Primefettle Inc..Document2 pagesPrimefettle Inc..yigov19191No ratings yet

- Commercial Invoice PDFDocument3 pagesCommercial Invoice PDFNSS KumarNo ratings yet

- Amadeus B2B Wallet EbookDocument19 pagesAmadeus B2B Wallet EbookCHEIKH AbdarahmanNo ratings yet

- BL Sillas Giratoria ACTUALDocument2 pagesBL Sillas Giratoria ACTUALAlejandra Mamani FloresNo ratings yet

- Practice Problems Ch. 9 International Trade and Comparative AdvantageDocument7 pagesPractice Problems Ch. 9 International Trade and Comparative AdvantageGabby CustodioNo ratings yet

- Eco211 - Infographics - Group 5Document6 pagesEco211 - Infographics - Group 5AmaninaYusriNo ratings yet

- Questions - Principles of Taxation LawDocument12 pagesQuestions - Principles of Taxation LawAmogha Gadkar100% (1)

- International Trade TheoriesDocument38 pagesInternational Trade Theoriestrustme77No ratings yet

- This Study Resource Was: Investment Policy StatementDocument3 pagesThis Study Resource Was: Investment Policy StatementShaikh Saifullah KhalidNo ratings yet

- Sco RusoilDocument3 pagesSco RusoilMusuhan Sama Cacing100% (1)