Professional Documents

Culture Documents

Pcit Versus Vinita Chaurasia - 22.11.22 - Dismissed

Pcit Versus Vinita Chaurasia - 22.11.22 - Dismissed

Uploaded by

Sunil KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pcit Versus Vinita Chaurasia - 22.11.22 - Dismissed

Pcit Versus Vinita Chaurasia - 22.11.22 - Dismissed

Uploaded by

Sunil KumarCopyright:

Available Formats

$~1

* IN THE HIGH COURT OF DELHI AT NEW DELHI

+ ITA 638/2019

PRINCIPAL COMMISSIONER OF

INCOME TAX (CENTRAL)-2 ..... Appellant

Through: Mr Zoheb Hossain, Sr. St. Counsel

with Mr Vipul Agrawal, Jr. St.

Counsel, Mr Parth Semual, Jr. St.

counsel for Income Tax Department.

versus

VINITA CHAURASIA ..... Respondent

Through: Mr. Arta Trana Panda, Advocate.

% Date of decision: 22nd November, 2022

CORAM:

HON'BLE MR. JUSTICE MANMOHAN

HON'BLE MS. JUSTICE MANMEET PRITAM SINGH ARORA

JUDGMENT

MANMEET PRITAM SINGH ARORA, J (Oral):

ITA 638/2019

1. Present appeal has been filed by Revenue challenging the order dated

05th October, 2018 passed by Income Tax Appellate Tribunal (‘ITAT’) in

ITA No. 5957/DEL/2015 and C.O. NO. 38/DEL/2016 for the Assessment

Year (‘AY’) 2007-08.

2. Learned counsel for the Revenue states that ITAT erred in deleting the

addition of Rs.34,06,11,102/- without analysing and considering the

ITA 638/2019 Page 1 of 6

Signature Not Verified

Digitally Signed By:PRAMOD

KUMAR VATS

Signing Date:26.11.2022

19:19:12

contents and the words of the seized document, identified in the appeal as

page no. 5 of Annexure A-1 (‘Seized Document’). He states that as per the

said Seized Document the Vasant Square Mall was acquired by the Assessee

for Rs.32,85,37,354/- before 1st October 2006, which was undisclosed in the

Income Tax Return (‘ITR’) of the Assessee. He states that the ITAT erred in

deleting the addition of Rs.1.20 Crores on account of receipt of rent, without

considering that the amount of rent pertaining to period from 1st October

2006 to 31st March 2007, was undisclosed in the ITR. He states that as per

the Seized Document, the Vasant Square Mall was in the possession of the

Assessee before 01st October 2006 and the rent started with effect from 01st

October 2006.

3. He states that ITAT erred in relying upon the decision of this court in

the case of Assessee for AY 2010-11. He states that the Assessment order in

the year under consideration was framed under Section 147 read with 143(3)

of the Act and ITAT erred in holding that the proceedings were not

maintainable. He further, states that ITAT failed to consider that a perusal of

the Seized Document, reveals that the Assessee had invested a sum of

Rs.32,85,37,354/- with M/s Suncity Project Pvt. Ltd. before 01st October

2006.

4. We have perused the paper book and considered the submissions of

the learned counsel for the Revenue. The Assessment order was passed by

the Assessing Officer (‘AO’) under Section 147 read with 143(3) of the Act.

The original return was filed on 31st July 2007 under Section 139(1) of the

Income Tax Act, 1961 (‘the Act’) declaring the total income of

Rs.4,70,97,930/-. There was search and seizure operation on 29th April, 2008

and in consequence thereof, the reassessment had been completed under

ITA 638/2019 Page 2 of 6

Signature Not Verified

Digitally Signed By:PRAMOD

KUMAR VATS

Signing Date:26.11.2022

19:19:12

Section 153A read with Section 143(3) of the Act at the returned income of

Rs.4,70,97,930/- vide order dated 29th December, 2010.

5. The case of the Assessee was subjected to further scrutiny in view of

the distinct search conducted in the case of one Mr. Lalit Modi on 19th June,

2009 and consequently, proceedings under Section 153C of the Act were

initiated against the Assessee and assessment was framed vide order dated

29th December, 2011 at the total income of Rs.4,70,97,930/-.

6. Subsequently, on the basis of the Seized Document found during the

search of Mr. Lalit Modi, the AO issued a Section 148 notice dated 28th

March, 2014 on the basis of the satisfaction recorded. The ITAT has

returned a finding that AO based on the seized Annexure A-1 (page no. 5)

alone, without any further investigations, made additions and passed the

impugned assessment order.

7. The ITAT has held that the additions made by the AO are factually

incorrect, illegal and arbitrary. The finding of the ITAT reads as under:

7…..Further, assessment order made by the Assessing Officer is

factually incorrect and additions were made on illegal and arbitrary

basis. The Assessing Officer has not brought on record any details or

evidences which could corroborate investment of a sum of Rs.

32,85,37,354/- before 01-10-2006 with M/s. Suncity Project Pvt. Ltd.

The entire dispute is with reference to Annexure- A-l page 5 which is

in the context of purchase of property vide sale deed dtd. 13/05/2009

and Assessing Officer himself has considered this annexure in A.Y.

2010-11 and made addition to the extent of Rs. 19,02,68,289/-. This

document has no relevance to any undisclosed income relating to year

under reference. There is thus no case of any income escaping

assessment or any tangible material which has relevance to A.Y.

2007-08. Submission of revenue before the Tribunal is merely general

observation on issue of reopening u/s. 147 and does not make

reference to any details or evidence of any undisclosed income

relating to A.Y. 2007-08. All these submission of the Ld. AR could not

be contradicted by the Revenue at the time of the hearing. Once the

ITA 638/2019 Page 3 of 6

Signature Not Verified

Digitally Signed By:PRAMOD

KUMAR VATS

Signing Date:26.11.2022

19:19:12

very same addition has been deleted in A.Y. 2010-11 by the Tribunal

& confirmed by the Hon'ble Delhi High Court, there is no case for any

action u/s. 147 in the A.Y. 2007-08.

8. The ITAT has further returned a finding of fact that the entire basis of

the AO for making the additions to the assessable income of the Assessee is

a single document i.e. page no. 5 of Annexure A-1[Seized Document]. The

ITAT observed that no fresh material has been taken into account by the AO

for reopening the assessment under Section 147 of the Act. The relevant

finding of the ITAT reads as under:

“…..

In the present case, though there was search in case of assessee on

29/04/2008 pursuant to which Assessing Officer initiated action

u/s. 153A of the Act, in the absence of any incriminating material,

returned income was accepted vide assessment order u/s. 153A dtd.

29/12/2010. But because of the search in case of Mr. Modi and

Annexure -1 found therein, the addition was made in the present

case. The entire basis for making the additions to the assessable

income of the Assessee was a single document i.e., Annexure A-1.

The attempt at making additions on the basis of Annexure A-1,

without any further investigation on the above lines, is bound to be

rendered unsustainable in law. In the present case, no reason was

assigned by the Assessing Officer or any fresh material was taken

into account by the Assessing Officer for reopening the assessment

u/s 147 of the Act. The said action of the Revenue was challenged

before the Hon'ble High Court and the Hon'ble High Court has

given a finding of dismissing the appeal of the Revenue therein. The

finding of the Hon'ble High Court is applicable in the present case

and therefore, the action u/s 147 of the Act itself is not

maintainable and is quashed. Thus, appeal of the Revenue is

dismissed and cross objection of the Assessee is allowed.”

9. We have also perused the judgment of this Court in ITA 1004/2015

and ITA 1005/2015 in the assessee’s own case in the reassessment

proceedings undertaken under Section 153C of the Act pursuance to the

ITA 638/2019 Page 4 of 6

Signature Not Verified

Digitally Signed By:PRAMOD

KUMAR VATS

Signing Date:26.11.2022

19:19:12

search on Mr. Lalit Modi. We find that the Seized Document, described as

page no. 5 of Annexure A-1, was specifically deliberated upon by the

learned predecessor Division Bench and this Court has returned a

categorical finding on merits to hold that the said document does not afford

any ground or justification to the AO for making additions on the said basis.

The relevant paragraph of judgement reads as follows:

“…..

26. Turning to the document itself, Mr. Shivpuri urged that the

further presumption in Section 292C(1)(ii) would stand attracted

viz., that the contents of the document should be presumed to be

true. His submission was that the said presumptions have not been

rebutted by the Assessee and, therefore, whatever was said in the

document should be taken to be sufficient proof of concealment of

the income by the Assessee.

27. The Court is unable to accept the above submission of Mr.

Shivpuri. The Court in this regard notices that the detailed

interrogation of Mr. Modi revealed the source of the document and

the fact that Mr. Modi was not the author of the document. Mr.

Modi had suggested that it was some other broker who had given

him the said document as a ‘proposal’. There appears to have been

no attempt made by the AO to enquire into the matter further to

find out if at all there was any such other broker who had prepared

the document. Further, there is no attempt also made to ascertain

whether the prevalent market value of the space purchased by the

Assessee could at all fetch the value indicated in the document

which is Rs.32,85,37,354. This was too fundamental an issue to be

left un-investigated. The AO appears to have proceeded purely on

conjectures as regards what the document has stated without

noticing the internal contradictions and inconsistencies. For

instance, the document talks of rent payable for a period from 2006

onwards where in fact even according to the Revenue the Assessee

purchased the property on 13th May, 2009. The shifting of the

burden on the Assessee without making these basic enquiries to

unearth the truth of the document could not have been accepted

and was rightly commented upon by the ITAT. The entire basis for

making the additions to the assessable income of the Assessee was

a single document i.e., Annexure A-1. The attempt at making

additions on the basis of Annexure A-1, without any further

investigation on the above lines, is bound to be rendered

unsustainable in law.

ITA 638/2019 Page 5 of 6

Signature Not Verified

Digitally Signed By:PRAMOD

KUMAR VATS

Signing Date:26.11.2022

19:19:12

28. Therefore, even as regards the merits of the additions made by

the AO, the Court funds no error having been committed by the

ITAT in deleting them.”

(Emphasis Supplied)

10. In view of the factual finding returned by ITAT in the assessment

proceedings to the effect that no fresh material was taken into account by the

AO for making additions in the present proceedings and the sole basis for

making the additions was the Seized Document, we find that the issues

raised in the present appeal are covered in favour of the assessee and against

the Revenue by the judgment of this Court dated 18th May 2017. The

additions were deleted by the Court after detailed examination of the merits.

The Special leave petition filed against the said judgment also stands

dismissed. We therefore find that no substantial question of law arises from

the impugned order of the ITAT. The appeals is dismissed.

MANMEET PRITAM SINGH ARORA, J

MANMOHAN, J

NOVEMBER 22, 2022/hp

ITA 638/2019 Page 6 of 6

Signature Not Verified

Digitally Signed By:PRAMOD

KUMAR VATS

Signing Date:26.11.2022

19:19:12

You might also like

- Return To Work LetterDocument1 pageReturn To Work LetterDamanManda85% (13)

- Motivational LetterDocument1 pageMotivational Letterramazi941No ratings yet

- 148 On Suspicious Quashed HC DelDocument18 pages148 On Suspicious Quashed HC DelNeena BatlaNo ratings yet

- Augustus Capital JudgmentDocument23 pagesAugustus Capital Judgmentchrispattinson06No ratings yet

- 151-Reopening-Sanction ITAT IMPDocument31 pages151-Reopening-Sanction ITAT IMPNeena BatlaNo ratings yet

- 292b-Mistake-Notice Wrong Name Company SCDocument20 pages292b-Mistake-Notice Wrong Name Company SCNeena BatlaNo ratings yet

- Navneet Dutta Vs ITO Revision of ClaimDocument4 pagesNavneet Dutta Vs ITO Revision of ClaimAnkur ShahNo ratings yet

- TS 333 ITAT 2013DEL TS 333 ITAT 2013DEL SPX India PVT LTDDocument5 pagesTS 333 ITAT 2013DEL TS 333 ITAT 2013DEL SPX India PVT LTDbharath289No ratings yet

- DCIT Vs Toshvin Analytical Private Limited ITAT MumbaiDocument3 pagesDCIT Vs Toshvin Analytical Private Limited ITAT MumbaiCA Prakash Chandra BhandariNo ratings yet

- 2024:BHC-OS:3877-DB: 1/8 Itxa-1491-2019Document8 pages2024:BHC-OS:3877-DB: 1/8 Itxa-1491-2019Shreyas ShrivastavaNo ratings yet

- Alok Bhandari Anr. vs. ACIT ITAT DelhiDocument7 pagesAlok Bhandari Anr. vs. ACIT ITAT DelhivedaNo ratings yet

- 1614060815-5446 Bhupendra JainDocument8 pages1614060815-5446 Bhupendra Jainakhil layogNo ratings yet

- 1614324619-ITA 5044 Arya Process EquipmentDocument6 pages1614324619-ITA 5044 Arya Process Equipmentakhil layogNo ratings yet

- In The High Court of Delhi at New DelhiDocument18 pagesIn The High Court of Delhi at New DelhiSambasivam GanesanNo ratings yet

- Sky Light Hospitality LLP V Assistant Commissioner of Income Tax, New DelhiDocument9 pagesSky Light Hospitality LLP V Assistant Commissioner of Income Tax, New DelhiRaghav NaiduNo ratings yet

- Nitin Parkash Vs DCIT ITAT MumbaiDocument11 pagesNitin Parkash Vs DCIT ITAT MumbaiPuru GuptaNo ratings yet

- Delivery - Westlaw IndiaDocument13 pagesDelivery - Westlaw IndiaDisha LohiyaNo ratings yet

- Per Rajpal Yadav, Judicial MemberDocument5 pagesPer Rajpal Yadav, Judicial MemberSrijan MishraNo ratings yet

- Coon Ol: First DivisionDocument52 pagesCoon Ol: First DivisionMaria Diory Rabajante100% (1)

- 10348632004520708481351refno4550-4553 14 Dcit vs. New Delh Hotels LTDDocument15 pages10348632004520708481351refno4550-4553 14 Dcit vs. New Delh Hotels LTDPrakhar MishraNo ratings yet

- Dated This The 2 Day of November 2016 Present The Hon'Ble MR - Justice Jayant Patel AND The Hon'Ble MR - Justice Aravind KumarDocument32 pagesDated This The 2 Day of November 2016 Present The Hon'Ble MR - Justice Jayant Patel AND The Hon'Ble MR - Justice Aravind KumarKinjal KeyaNo ratings yet

- In The High Court of Delhi at New Delhi % Date of Decision: 10.03.2022 W.P. (C) 6158/2021 and CM APPL. 19532/2021Document7 pagesIn The High Court of Delhi at New Delhi % Date of Decision: 10.03.2022 W.P. (C) 6158/2021 and CM APPL. 19532/2021venugopal murthyNo ratings yet

- Adoption of Stamp Valuation As Sale Consideration Is Not Justified Without Any Evidence - ITAT MumbaiDocument17 pagesAdoption of Stamp Valuation As Sale Consideration Is Not Justified Without Any Evidence - ITAT MumbaiDhanraj SharmaNo ratings yet

- आयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Document8 pagesआयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Saksham ShrivastavNo ratings yet

- Anil Marda 143 2 NoticeDocument32 pagesAnil Marda 143 2 NoticeLNo ratings yet

- Undisclosed Income Discussed by The Delhi High Court Holding Three Former Jharkhand Mukti Morcha MPs Liable To Pay TaxDocument59 pagesUndisclosed Income Discussed by The Delhi High Court Holding Three Former Jharkhand Mukti Morcha MPs Liable To Pay TaxLive LawNo ratings yet

- Revenue WS JDocument13 pagesRevenue WS JSidhaarthNo ratings yet

- In The Income Tax Appellate Tribunal "A" Bench: Bangalore Before Shri N. V. Vasudevan, Vice President and Shri Jason P Boaz, Accountant MemberDocument12 pagesIn The Income Tax Appellate Tribunal "A" Bench: Bangalore Before Shri N. V. Vasudevan, Vice President and Shri Jason P Boaz, Accountant MemberKushwanth Soft SolutionsNo ratings yet

- 2017 39 1501 32212 Judgement 17-Dec-2021Document19 pages2017 39 1501 32212 Judgement 17-Dec-2021Jatinder SinghNo ratings yet

- CIT vs. Dilibagh Rai AroraDocument5 pagesCIT vs. Dilibagh Rai AroraSricharan RNo ratings yet

- Indo Office Solutions (P) Ltd. Versus ACIT, Central Circle-17, New DelhiDocument6 pagesIndo Office Solutions (P) Ltd. Versus ACIT, Central Circle-17, New DelhiAshish GoelNo ratings yet

- Judgment Ito Vs Jawahar Singh CC No 141 3 Dated On 8 February 2010Document16 pagesJudgment Ito Vs Jawahar Singh CC No 141 3 Dated On 8 February 2010Rubal SandhuNo ratings yet

- DCIT v. Punjab Retail - ITAT IndoreDocument17 pagesDCIT v. Punjab Retail - ITAT IndorekalravNo ratings yet

- ETA Star Infopark - WatermarkDocument73 pagesETA Star Infopark - WatermarkRahul KumarNo ratings yet

- 4 Bonifacio Sy Po Vs CTA GR No. 81446Document10 pages4 Bonifacio Sy Po Vs CTA GR No. 81446Jeanne CalalinNo ratings yet

- 4 Bonifacio Sy Po Vs CTA GR No. 81446 PDFDocument10 pages4 Bonifacio Sy Po Vs CTA GR No. 81446 PDFJeanne CalalinNo ratings yet

- Cit (A)Document8 pagesCit (A)Raaja ThalapathyNo ratings yet

- JHC 491832Document11 pagesJHC 491832Kunal NawaleNo ratings yet

- DCIT Vs Force Motors Limited ITAT PuneDocument11 pagesDCIT Vs Force Motors Limited ITAT PuneNIMESH BHATTNo ratings yet

- In The Income Tax Appellate Tribunal "B" Bench, Ahmedabad Before Shri Pradip Kumar Kedia, Accountant Member & Shri Mahavir Prasad, Judicial MemebrDocument47 pagesIn The Income Tax Appellate Tribunal "B" Bench, Ahmedabad Before Shri Pradip Kumar Kedia, Accountant Member & Shri Mahavir Prasad, Judicial MemebrshantXNo ratings yet

- IndexDocument10 pagesIndextanmaystarNo ratings yet

- Tata Motors CaseDocument12 pagesTata Motors CaseRiddhiraj SinghNo ratings yet

- Supreme Court: Basilio E. Duaban For PetitionerDocument4 pagesSupreme Court: Basilio E. Duaban For PetitionermgbautistallaNo ratings yet

- Key Propositions 148 SHRI KAPIL GOELDocument89 pagesKey Propositions 148 SHRI KAPIL GOELRajivShahNo ratings yet

- DIT v. Jyoti Foundation (2013) 357 ITR 388 (Del.)Document5 pagesDIT v. Jyoti Foundation (2013) 357 ITR 388 (Del.)madhusudhan u aNo ratings yet

- Hotel Diwanki Building, Daman, INCOME TAX OFFICE, Hotel Diwanji Building, Devkanand, DAMAN, Gujarat, 396210 Email: Daman - Ito@Incometax - Gov.InDocument2 pagesHotel Diwanki Building, Daman, INCOME TAX OFFICE, Hotel Diwanji Building, Devkanand, DAMAN, Gujarat, 396210 Email: Daman - Ito@Incometax - Gov.Insanjiv kumarNo ratings yet

- Interlocutory Section 54 of IT Act 1961 1715774290Document16 pagesInterlocutory Section 54 of IT Act 1961 1715774290advsakthinathanNo ratings yet

- Adarsh Credit Co-Operative Society LTDDocument7 pagesAdarsh Credit Co-Operative Society LTDdeepakNo ratings yet

- Fitness by Design, Inc., Petitioner, vs. Commissioner of INTERNAL REVENUE, RespondentDocument11 pagesFitness by Design, Inc., Petitioner, vs. Commissioner of INTERNAL REVENUE, RespondentRae ManarNo ratings yet

- DRS Industries - (2021)Document33 pagesDRS Industries - (2021)vedaprakashmNo ratings yet

- Naresh Sunderlal Chug Versus The Income Tax Officer, Ward 8 (1), PuneDocument5 pagesNaresh Sunderlal Chug Versus The Income Tax Officer, Ward 8 (1), PuneAshish GoelNo ratings yet

- Assessee WS JDocument17 pagesAssessee WS JSidhaarthNo ratings yet

- Uma Maheswari - ITAT ChennaiDocument6 pagesUma Maheswari - ITAT ChennaiLakshmivenkataraman T.SNo ratings yet

- Gold Investment TrustDocument8 pagesGold Investment Trusttanuj.agarwalNo ratings yet

- Gurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019Document27 pagesGurvinder Kaur Bhatia Indore Vs PR Cit 2 Indore On 18 December 2019praveen chokhaniNo ratings yet

- 2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioDocument7 pages2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioThe Chartered Professional NewsletterNo ratings yet

- Greounds of Appeal To The Commissioner Appeal Against 122Document3 pagesGreounds of Appeal To The Commissioner Appeal Against 122Mian Muhammad Jazib50% (2)

- ITA No.298SRT2023AY.2017-18Document11 pagesITA No.298SRT2023AY.2017-18ys9874145No ratings yet

- Holy Heart Educational Society ITAT RaipurDocument11 pagesHoly Heart Educational Society ITAT RaipurJK JasmatiyaNo ratings yet

- Revfenues MemoDocument6 pagesRevfenues MemoSidhaarthNo ratings yet

- Direct Tax Online: Cited inDocument5 pagesDirect Tax Online: Cited inMukesh RathodNo ratings yet

- Bureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamFrom EverandBureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamNo ratings yet

- 2022 AUSL Omnibus Notes - Civil LawDocument78 pages2022 AUSL Omnibus Notes - Civil LawronaldNo ratings yet

- Election Officer Jobs 2017 All Solved Mcqs Tests Model Papers PDF Book Free Download Election Officers (Bs-17) Course Outline Written Syllabus PaperDocument7 pagesElection Officer Jobs 2017 All Solved Mcqs Tests Model Papers PDF Book Free Download Election Officers (Bs-17) Course Outline Written Syllabus PaperTalha AkhtarNo ratings yet

- Gwennitt County Magistrate Court & MP Somerset LLC UpdatedDocument7 pagesGwennitt County Magistrate Court & MP Somerset LLC Updateddawud beyNo ratings yet

- Document - Military Engineer ServicesDocument14 pagesDocument - Military Engineer ServicesSaChin VermaNo ratings yet

- Civil Appeal (Appli) 24 of 2004Document2 pagesCivil Appeal (Appli) 24 of 2004Day VidNo ratings yet

- History Chapter 1 The Rise of Nationalism in Europe Notes Amp Study MaterialDocument12 pagesHistory Chapter 1 The Rise of Nationalism in Europe Notes Amp Study MaterialAnil KumarNo ratings yet

- Case No. 33 W. Cameron Forbes, J. E. Harding Vs Chuoco Tiaco NotesDocument3 pagesCase No. 33 W. Cameron Forbes, J. E. Harding Vs Chuoco Tiaco NotesLaila Ismael SalisaNo ratings yet

- Who Made Jose Rizal Our Foremost National Hero, and Why?: Group 1Document12 pagesWho Made Jose Rizal Our Foremost National Hero, and Why?: Group 1Richard SanchezNo ratings yet

- EN ISO 648 (2008) (E) CodifiedDocument5 pagesEN ISO 648 (2008) (E) CodifiedKaren HernandezNo ratings yet

- African Centre For Media Excellence (ACME) Annual Lecture On Media and Politics in Africa 2017 - Politics, The Media and Judicial Independence - A Personal FootnoteDocument16 pagesAfrican Centre For Media Excellence (ACME) Annual Lecture On Media and Politics in Africa 2017 - Politics, The Media and Judicial Independence - A Personal FootnoteAfrican Centre for Media ExcellenceNo ratings yet

- General BH Rules Within The PremisesDocument5 pagesGeneral BH Rules Within The Premisesultrakill rampageNo ratings yet

- Labor Law OutlineDocument21 pagesLabor Law OutlinejazzieycpNo ratings yet

- Beo/Licenses & PermissionsDocument2 pagesBeo/Licenses & PermissionsJayant RayNo ratings yet

- BADACDocument8 pagesBADACdesiree joy corpuzNo ratings yet

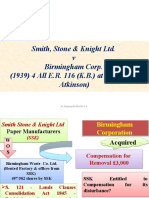

- 10 Smith, Stone & Knight Ltd.Document37 pages10 Smith, Stone & Knight Ltd.gauravNo ratings yet

- Sumaila Bielbiel v. Adamu Dramani & or PDFDocument21 pagesSumaila Bielbiel v. Adamu Dramani & or PDFsbaakpan776No ratings yet

- PP Vs Guilllermo MatantanDocument6 pagesPP Vs Guilllermo MatantanDat Doria PalerNo ratings yet

- Book SM LL.B Tort Law 2023 CH 01Document12 pagesBook SM LL.B Tort Law 2023 CH 01HarshanaaNo ratings yet

- Law Thesis Topics AustraliaDocument6 pagesLaw Thesis Topics Australiacatherinebitkerrochester100% (2)

- Chapter 1 - ObligationsDocument3 pagesChapter 1 - ObligationscartyeolNo ratings yet

- June 12, 1956: March 5Document39 pagesJune 12, 1956: March 5John RyNo ratings yet

- F.M Hammerle RejoinderDocument22 pagesF.M Hammerle RejoinderHarryNo ratings yet

- Constitution and ConstitutionalismDocument26 pagesConstitution and Constitutionalismvnrk585ndzNo ratings yet

- Ben Shapiro NLRB DismissalDocument6 pagesBen Shapiro NLRB DismissalLaw&CrimeNo ratings yet

- Nigeria Is A Founding Member ofDocument3 pagesNigeria Is A Founding Member ofRashid AliNo ratings yet

- MCQs Session 1Document13 pagesMCQs Session 1Harshil MehtaNo ratings yet

- ParsikDocument1 pageParsikkiranNo ratings yet

- GEED 10013: Life and Works of Jose Rizal (Buhay, Mga Gawain at Sinulat Ni Jose Rizal)Document62 pagesGEED 10013: Life and Works of Jose Rizal (Buhay, Mga Gawain at Sinulat Ni Jose Rizal)Maria Fe Noda Casanova100% (1)