Professional Documents

Culture Documents

Appendix

Appendix

Uploaded by

StarterrrsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix

Appendix

Uploaded by

StarterrrsCopyright:

Available Formats

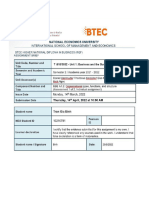

Appendix 63

APPENDIX

03salma_appendix_ver2.indd Sec4:63 2011/12/20 12:22:18

64 Appendix

Table A: Background Details of the Sampled SRFIs

Type of Market Launch

SRFI Assets Brief Description

Institution Spread Date

The Co-operative Bank, set up in 1971,

was the first high street British bank to

have announced a customer-derived ethical

stance in 1992. It falls under the Co-

operative Financial Services (CFS) which

in turn forms part of The Co-operative

The Co- Group, the UK's largest consumer co-

£45.6 billion

operative Bank UK 1971 operat ive. CFS compr ises T he Co -

(as at 2010)1

Bank Plc operative Ban k and its inter net ban k,

smile, Britannia Building Society, The

Co-operative Insurance, The Co-operative

Investments and The Co-operative Asset

Management. In 2009, CFS employed

12,000 staff, operated over 300 branches

and achieved net revenue of £2.0 billion.

The Bank is officially registered in the

Netherlands (1980), with branches in

Belg iu m (1993), t he U K (1995), a nd

Euro 5,617

Spain (2004). Its mission is to promote

million (for

Triodos sustainable banking by financing socially

Bank the Triodos Europe 1980

Bank worthwhile projects as well as lending

Group, as at

to social busi nesses, char ities and

2010)2

organisations pursuing positive social,

environmental and cultural goals. By 2010,

the bank has a total of 285,000 customers.

It is the first SRFI set up in the UK to

finance ecology-friendly properties. It is

Ecology Mutual a mutual building society which aims at

£95,687,000

Building Building UK 1981 providing loans to promote sustainable

million 3

Society Society housing and sustainable communities. 4

Cur rently, it has over 10,000 account

holders.

Unity Tr ust Bank describes itself as a

£620.7 specialist bank offering banking services

Unity Trust million (as at to social enterprises, charities, councils,

Bank UK 1984

Bank 31 December trade unions and small businesses. It has

2010) 5 its roots in the co-operative and trade

union movements.

1 The Co-operative Bank Plc, Building a better society, Financial Statements 2010, http://www.co-

operativebank.co.uk/corp/pdf/Bank_Final2010.pdf

2 Triodos Bank Annual Report 2010, http://report.triodos.com/en/2010/servicepages/downloads/files/

annual_report_triodos_ar10.pdf

3 Ecology Building Society, Annual Report 2010, http://www.ecology.co.uk/downloads/aboutus/

reports/2010-annual-report.pdf

4 www.ecology.co.uk

5 Unity Trust Bank, Summary Report and Accounts 2010, http://www.unity.co.uk/upload/pdf/Summa

ry_Report_and_Accounts_2010.pdf

03salma_appendix_ver2.indd Sec4:64 2011/12/20 12:22:50

Appendix 65

Type of Market Launch

SRFI Assets Brief Description

Institution Spread Date

A X A I M is a key player i n the asset

AXA Investment Euro 516 International ma n ageme nt i ndu st r y. I n 2010 A X A

Investment Management billion (as at (23 1994 Investment Managers was ranked the 14th

6

Managers Company 2010) Countries) largest asset manager worldwide in terms

of assets under management.

It is a specialist insurance and financial

services company, established in 1887,

Specialist

to protect the Anglican Church. Over the

Ecclesiastical and £1,694,441

years it has grown to provide tailored

Investment Financial (as at Dec International 1887

i nsu rance solut ions for char it ies and

Management Services 2009)7

heritage property owners. It also offers

Company

risk management and ethical investment

management.

F&C A s s e t M a n a ge m e nt i s a mu lt i-

specialist asset management group. It

Investment Over £100 traces its origins to the launch of the first-

F&C Asset

Management billion (as at International 1868 ever listed pooled investment fund, the

Management

Company 2010)8 Foreign & Colonial Investment Trust, in

1868. It has offices in seven countries,

including the UK.

Fr iend s Life br i ngs toget her t he U K

Friends

operations of Friends Provident and the

Provident

Ethical Unit £111 billion International life assurance businesses acquired from

plc (now 1810

Trust (as at 2010)9 (8 Countries) Bupa and AXA UK. The Friends Life set

known as

up the first ethical unit trust in the UK in

Friends Life)

1984 – the Stewardship family of funds.

Henderson Global Investors is a leading

independent global asset management

£60,452 f ir m. The company provides its

Henderson Investment

million (as institutional, retail and high net-worth

Global Management International 1934

at 31 March cl ie nt s a c c e s s t o sk i l le d i nve st me nt

Investors Company

2011)10 professionals representing a broad range

of asset classes, including equities, fixed

income, property and private equity.

Insight Investment is one of the leading

U K i nvest ment ma nagers. It of fers a

£116 billion

full range of asset types from equities to

Insight Investment under

bonds, property, hedge funds, and private

Investment Management management International 2002

equit y. I n addition to its mainst ream

Management Company (as at 31

funds, Insight Investment has two ethical

March 2009)11

funds: Insight European Ethical Fund and

Insight Evergreen Fund.

6 AXA Investment Managers Results 2010, http://www.axa-im.com/index.cfm?pagepath=pressandkn

owledgecentre/newsID=2604C890-BCDF-3CCE-16323F9CFDD72C27/news_release_02032011

7 Ecclesiastical Insurance Office Plc Annual Financial Report For The Year Ended 31 December 2009, http://

www.ecclesiastical.com/Images/PDF%20-%20EIO%20Annual%20Financial%20Report%202009.

8 http://www.fandc.com/portal/?reset

9 http://www.friendslife.co.uk/common/layouts/subSectionLayout.jhtml?pageId=fpcouk/SitePageSi

mple%3Aabout_us_fastfacts#

10 http://www.henderson.com/sites/henderson/aboutus.aspx

11 European SRI Transparency Guidelines, Insight Investment, http://www.insightinvestment.com/

global/documents/riliterature/821270/Euro_SRI_Transp_Guide_2009.pdf

03salma_appendix_ver2.indd Sec4:65 2011/12/20 12:22:50

66 Appendix

Type of Market Launch

SRFI Assets Brief Description

Institution Spread Date

Jupiter Asset Management

manages assets across a wide range of

international and UK based mutual funds,

multi-manager products, hedge funds,

Investment institutional mandates, and a variety of

Jupiter Asset £538.2

Management International 1985 portfolios specialising in markets such

Management million

Company as the UK, Europe, Asia and Emerging

Europe, as well as specialist thematic

investments such as socially responsible

investments (SRI) and global financial

equities.

T he asset ma nagement busi nesses of

Morley Fu nd Management Ltd and

Norwich Union Investment Management

Lt d we r e m e r ge d i n Ju ly 2 0 0 0, a n d

Norwich Savings, subsequently became Aviva Investors

£380 billion

Union Insurance, Global Services Ltd in September 2008.

(as at 31 Dec International 1797

(now, known Fund Aviva is a leading provider of life and

2009)12

as Aviva) Management pension products in Europe (including

the U K) with substantial positions in

other markets around the world. Its main

activities are long-ter m savings, fund

management and general insurance.

Rathbone Unit Tr ust Management is a

wholly-owned, London-based subsidiary

Rathbone Investment £1.1 billion

of Rathbone Brothers plc. It is a leading

Unit Trust Management (as at 31 UK 1999

UK fund manager, offering a range of

Management Company March 2011)13

equity and bond unit trusts and a multi

asset portfolio.

£156.9 Standard Life Investment has a global

Standard Investment billion investment network and has off ices in

Life Management (as at 31 International 1995 several international markets. It aims to

Investments Company December meet its clients’ expectations and offers a

2010)14 range of products and services.

12 http://www.aviva.co.uk/about-us/

13 http://www.rutm.com/about-us.aspx

14 http://uk.standardlifeinvestments.com/consumer/about_us/index.html

03salma_appendix_ver2.indd Sec4:66 2011/12/20 12:22:50

Appendix 67

Table B: Summary of the Observed Practices of the SRFIs

SRFIs Observed Practices

• Corporate responsibility is integrated into business practices.

• Corporate responsibility is seen as a safeguarding measure for the business.

• A wide range of CSR values is endorsed, including governance, social, ethical and

environmental issues.

• Processes for stakeholder dialogue are in place.

• There is special involvement of customers in the development of the Bank’s ethical

policy.

• Transparency is endorsed and full disclosure on CSR is adopted. The bank has a

The Co-operative well-grounded corporate reporting policy, which includes publication of Partnership

Bank Plc reports, Sustainability reports, Ethical Consumerism Report, Financial Statements,

Eurosif Transparency Guidelines.

• The Bank has developed “specific, measurable, achievable, realistic and timely”

indicators to measure its progress against the triple bottom lines of delivery of value,

social responsibility and ecological sustainability. This shows the Bank’s efforts in

quantifying the reporting of its performance.

• The Bank has a sustainable development policy and is proactive in pursuing the

sustainability agenda.

• It can be rated as a ‘leader’ in its approach towards CSR.

• Triodos Bank recognises CSR as part of its business policy.

• CSR is taken to incorporate social, ethical, environmental and cultural values. The

Bank endorses policies like micro-credit and fair trade financing in developing

countries. It lends to organisations like charities, social businesses and supports the

financing of community projects and environmental initiatives.

• The Bank pursues sustainable banking which takes account of people, the planet and

profit.

Triodos Bank • It believes in taking positive action in order to contribute towards sustainability and in

instilling socially responsible businesses.

• It believes in taking a more active role in the engagement of companies it invests in.

• The bank publishes its approach to lending and an annual list of projects which it

finances. No quantitative social reporting or indicators have been developed. Its

reporting system is still of a descriptive nature.

• On basis of the above, its CSR approach can be described as being at the

‘integrating’ stage.

• Unity Trust Bank acknowledges that social responsibility is integrated within its

business practices. It states “When we were first established, in 1984, our vision was

to put social change, social benefit and community involvement at the core of our

business...We are proud to have been one of the early adopters as we have watched

Corporate Social Responsibility (CSR) become increasingly important for just about

every type of business.”15

• It focuses its policies on the third sector – trade unions, charities, voluntary

organisations, credit unions and social enterprises – which is taken as a key sector for

the bank’s financing.

• Its reporting policies are still descriptive. It describes its customers, shareholders,

Unity Trust Bank

products, history and challenges. The Bank does not report on the management of

its CSR responsibilities. Nonetheless, it publishes a quarterly bulletin to provide

information on developments in the social economy. It also reports the activities

the Bank and its staff are involved in on an annual basis through its Unity in the

Community initiative.

• No engagement in stakeholder dialogue has been mentioned, except that special efforts

appear to be made by the bank to know the organisation it finances and it works with

other organizations to bring about change in the community. It works closely with its

customers in an attempt to understand their needs, aims and future plans.

• CSR performance can be said to be in a ‘developing’ stage.

15 http://www.unity.co.uk/csr

03salma_appendix_ver2.indd Sec4:67 2011/12/20 12:22:50

68 Appendix

SRFIs Observed Practices

• The Ecology Building Society considers the environment its key sector of focus.

Environmental policies are embedded within the business.

• It practises what it believes in – which is commitment to ecological and sustainable

living. This is reflected through the construction of its own ecological building.

• It provides details on the projects it finances (e.g. case studies of ethical mortgages)

Ecology Building

on its website and through newsletters. However, its reporting is still of a descriptive

Society

nature.

• It publishes a Corporate Social Responsibility Policy where emphasis is placed on its

environmental policy. The CSR statement also discusses its initiatives vis-à-vis its

stakeholders.

• Its CSR policy can be described as ‘developing’.

• CSR is believed as an important step in winning the preference of all its stakeholders.

CSR is not seen as being a choice for asset managers but is a necessity.

• CSR is broadly defined as incorporating ESG values. No specific description is

publicized except for AXA’s negative screening of cluster bombs and land mines.

• Engagement is also adopted as a CSR strategy as a means to sharing best practice and

learning from peers. It has publicized its voting and engagement policies.

• AXA has invested in an “RI search tool” – an IT package – to implement its CSR

strategy across all its areas of expertise. The organization also has a SRI unit. These

AXA Investment

show commitment to implementing CSR by the organization.

Managers

• CSR international initiatives are adopted – e.g. UN Stewardship Code, Eurosif

Transparency Guideline as a means of “lending credibility to our responsible

investment offering”. Reflects a more compliance focused CSR strategy.

• Reporting level appears to be still developing. No additional reports published besides

the write-ups on the company website.

• The CSR model adopted by the institution appears more compliance focused and

financially-oriented rather than as a means of being truly “socially responsible”.

• CSR policy can be described as ‘reacting’.

• Believes CSR and SRI add to long term shareholder value.

• SRI fund strategy is clearly defined – negative and positive screening criteria;

engagement policies; has established internal SRI research analysis; and have an

Independent Supervisory Panel.

• A number of ethical funds have been established.

Ecclesiastical • Donates all surplus profits to charity and collaborates with community partners to

Investment bring about change. Perceives partnership as being more than making a donation.

Management • Reporting levels are frequent though still descriptive – publishes regular ‘Amity

Insight SRI research’ publications and a thrice yearly ‘Investment Watch’ investment

newsletter for client-investors. Monthly Fund Sheets are also provided detailing Fund

performance and Fund Manager commentary. The Annual and Interim Fund Reports

provide additional detailed information on SRI fund policy.

• CSR policy can be described as being ‘developing’.

• Considers SRI and CSR as fundamental to creating value for investors.

• CSR policy is widely defined, incorporating various ESG issues. The company

subscribes to the sustainability agenda and takes account of environmental issues

within its SRI criteria. Formal system in place to manage CSR responsibilities.

• It details out its ethical policies, company selection, company research, company

approval and company monitoring procedure.

F&C Asset • It describes itself as a “market leader in the f ield of Governance & Socially

Management Responsible Investment” and through its engagement policy (called reo®) it promotes

its governance and SRI values with companies, government, regulators and the wider

community.

• Transparency in reporting, although only descriptive and no quantified reporting

noted. It publishes quarterly reports on its shareholder engagement and annual voting

and governance reports.

• The CSR policy of F&C can be viewed as ‘developing’.

03salma_appendix_ver2.indd Sec4:68 2011/12/20 12:22:50

Appendix 69

SRFIs Observed Practices

• Corporate responsibility is well integrated into business practices.

• A number of ESG issues are endorsed. CSR embraces community as well as

philanthropic activities.

• Friends Provident recognises the impact of CSR on different stakeholders including

the workplace, marketplace, the environment and the community. Descriptive reports

are published to indicate performance in these areas of influence.

• It has a well grounded CSR reporting policy. The following reports are published: (i)

CSR reports, (ii) various fund literatures to explain what the company does, what are

Friends

its ethical and social policies, how it executes its CSR policies, which companies it

Provident

invests in and how it engages with other companies (the reo® approach), (iii) Eurosif

Transparency Guidelines, (iv) a newsletter entitled “Principles”, (v) remuneration

reports, (vi) annual financial reports.

• It has a detailed engagement process in place.

• It has a sustainable development policy and is proactive in pursuing the sustainability

agenda.

• In the absence of quantified reporting, its CSR strategy can be described as

‘integrating’.

• It recognises its CSR responsibilities towards its different stakeholders and

incorporates CSR within its business practices.

• This is reflected in its SRI criteria and through the good governance policies adopted

by its funds. Its SRI fund process was given AAA rating by Novethic in 2004.

• Among its positive screening criteria is its endeavour to invest in industries of the

future.

• It subscribes to and proactively pursues the sustainability agenda.

• It promotes an engagement policy with clearly defined aims – e.g. holding regular

Henderson

dialogues with companies to review their CSR performance; selecting a number of

Global Investors

sectors for particular investigation; and pursuing company specific issues.

• Transparency is promoted through its reporting mechanisms. It publishes (i) a

Sustainable and Responsible Investment Annual Review, (ii) a Code of conduct for

its employees, (iii) the Eurosif Transparency Guidelines, (iv) the SRI criteria for each

of its funds, (v) its financial reports. However, although it recognises the different

aspects of CSR, there is no quantified reporting on its CSR performance. However

there is a good disclosure track record.

• Henderson’s CSR approach can be described as ‘integrating’.

• Corporate responsibility is integrated into business practices. Insight Investment

pursues a high standard of corporate responsibility and corporate governance as part

of its aims to improve financial performance. It also considers CSR as part of its

responsibility towards investors.

• It defines its CSR/SRI policies as well as its engagement strategies. It also clearly

stipulates its ways of achieving its objective of high standards of corporate governance

and corporate responsibility: (i) company monitoring; (ii) dialogue; (iii) voting; (iv)

policy research; (v) public statements; (vi) sponsoring debates; (vii) working with

Insight

others.

Investment

• It subscribes to the sustainability agenda and proactively pursues it.

• It has formal policies and systems in place to manage its CSR responsibilities.

• The company is transparent in its reporting. It publishes (i) a statement of policy

with regard to corporate responsibility and corporate governance, (ii) various funds

literature to explain what its aims are and how it achieves them, (iii) the Eurosif

Transparency Guidelines, (iv) a detailed report on the criteria for implementing its

ethical policies, and (v) general literature on SRI and global business principles.

• Its CSR approach can be classified within the ‘integrating’ category.

16 www.henderson.com/global_includes/pdf/sri/SRIAnnualReport2004.pdf

03salma_appendix_ver2.indd Sec4:69 2011/12/20 12:22:50

70 Appendix

SRFIs Observed Practices

• Corporate responsibility is incorporated into business practices. Its CSR policies

also include charitable activities in the form of a matched employee giving scheme,

charitable fund raising, sponsoring of arts.

• The SRI & Governance Team manages its CSR/SRI policies and it has in place

an external Advisory Committee Board to determine any review of policies. The

Compliance Department ensures the funds’ holdings remain compliant with its

policies.

• It engages in positive and ongoing dialogue with senior management of companies to

encourage the addressing of environmental and social impacts on their businesses.

Jupiter Asset

• It subscribes to the sustainability agenda and proactively pursues it through the

Management

management of its three environmentally-geared funds.

• It has a well grounded reporting policy. Publishes the following reports: (i) a number

of fund’s literature to explain SRI at Jupiter, its negative and positive criteria of

investment, its fund facts and products, its performance in companies that address

environmental concerns; (ii) Eurosif Transparency Guidelines, (iii) Jupiter’s approach

to responsible shareholder – Voting and Engagement Report; (iv) Jupiter’s Corporate

Governance and Voting Policy 2005; and (v) an SRI Bulletin to inform its stakeholders

of any latest developments in the SRI sector.

• Its CSR approach can be viewed as ‘integrating’.

• Aviva promotes good governance policies and subscribes to the principles under the

Stewardship code. “The purpose of the Code is to improve the quality of engagement

between institutional investors and companies to help improve long-term returns to

shareholders and the efficient exercise of governance responsibilities.”

Norwich Union

• No ESG values are promoted per se. But emphasis is placed on environmental and

(Aviva)

social issues besides governance issues.

• Reporting levels are still low. Corporate Governance and Corporate Responsibility

Voting Policy disclosures are published. Stewardship policy is also published.

• Overall, CSR policy appears to be ‘reacting’

• CSR policies are related to environmental impacts, employee welfare, and community

involvement.

• Negative and positive SRI criteria are detailed out. No formal engagement policy is

adopted.

• Reporting is more on financial performance of the ethical funds rather than on social

Rathbone

responsibility issues (e.g. Rathbone Ethical Bond Fund Factsheet, Rathbone Ethical

Unit Trust

Bond Fund Quarterly investment report, Rathbone Ethical Bond Fund Manager

Management

Report).

• Signatories of the U N Principles for Responsible Investment and the Carbon

Disclosure Project. As such, CSR and SRI policies appear to be more compliance

focused.

• CSR policy appears to be at a ‘reacting’ stage.

• Management is committed to include CSR within its business practices.

• It considers environmental effects when examining companies’ policies and practices

of SRI. It further commits itself to an engagement approach to encourage best

practices in ESG issues.

• Some of its publications are: (i) an annual newsletter, (ii) a corporate governance

Standard Life

guidelines booklet, (iii) its Eurosif Transparency Guidelines, (iv) funds literature

Investments

relating to SRI, financial returns, rules of engagement.

• No CSR reports are published. No CSR performance indicators have been developed

to assess the fund’s impacts on its various stakeholder groups. Its reporting measures

can be said to be of a descriptive nature.

• The fund’s CSR approach appears to be at a ‘developing’ stage.

Source: Author’s Own

03salma_appendix_ver2.indd Sec4:70 2011/12/20 12:22:51

Appendix 71

03salma_appendix_ver2.indd Sec4:71 2011/12/20 12:22:51

72 Appendix

03salma_appendix_ver2.indd Sec4:72 2011/12/20 12:22:51

You might also like

- Niles Chp1 2021Document22 pagesNiles Chp1 2021Trent HardestyNo ratings yet

- Life Cycle CostingDocument21 pagesLife Cycle CostingmcoyooNo ratings yet

- Questions OnlyDocument3 pagesQuestions Onlyapi-529669983No ratings yet

- Acko Car Policy - DCTR00313714357 - 00 PDFDocument1 pageAcko Car Policy - DCTR00313714357 - 00 PDFSmarttNo ratings yet

- Case Study (Portfolio)Document6 pagesCase Study (Portfolio)WinniferTeohNo ratings yet

- Single Premium VUL Product VariantsDocument6 pagesSingle Premium VUL Product VariantsNorman Laxamana SantosNo ratings yet

- Central Provident Fund Board: Ms Fikriah Binte Samani 767 Woodlands Circle #07 - 338 SINGAPORE 730767Document6 pagesCentral Provident Fund Board: Ms Fikriah Binte Samani 767 Woodlands Circle #07 - 338 SINGAPORE 730767Fikriah SamaniNo ratings yet

- MN5F13FB - Work-Based LearningDocument14 pagesMN5F13FB - Work-Based LearningSouvik DasNo ratings yet

- Growth and Jobs: Inspire Plenary 1Document5 pagesGrowth and Jobs: Inspire Plenary 1AshepNo ratings yet

- Efficiency in Japanese Banking An Empirical AnalysisDocument27 pagesEfficiency in Japanese Banking An Empirical AnalysisKaran SinghNo ratings yet

- 36-Enablon & WK - IB - What To Expect Under The New Corporate Sustainability Reporting Directive - 2022Document6 pages36-Enablon & WK - IB - What To Expect Under The New Corporate Sustainability Reporting Directive - 2022huss fuzzNo ratings yet

- Business and Business Environment (ACK00046-06-22) NewDocument13 pagesBusiness and Business Environment (ACK00046-06-22) NewRafsunIslamNo ratings yet

- 2022 - ABI Climate Change RoadmapDocument28 pages2022 - ABI Climate Change Roadmapjherrera32No ratings yet

- Essential To Our Communities: Annual Report 2020Document140 pagesEssential To Our Communities: Annual Report 2020Sơn BadGuyNo ratings yet

- Cooperative BankingDocument14 pagesCooperative Bankingbristirakshit5No ratings yet

- Green Bond Framework Junio PDFDocument22 pagesGreen Bond Framework Junio PDFJulia Navas GómezNo ratings yet

- 03 Appendix 2 Financial Statements 2010-11Document13 pages03 Appendix 2 Financial Statements 2010-11quinten0stezziocNo ratings yet

- Organisational Types, Functions and StructuresDocument11 pagesOrganisational Types, Functions and Structuressayan GoswamiNo ratings yet

- The Social Economy in The UK: Roger Spear, CRU, Open University, UKDocument20 pagesThe Social Economy in The UK: Roger Spear, CRU, Open University, UKjisansalehin1No ratings yet

- British Council - SocialEnterprises-TeresaBirksDocument16 pagesBritish Council - SocialEnterprises-TeresaBirksLuqmanSudradjatNo ratings yet

- Cooperative Banking: Jump To Navigationjump To SearchDocument13 pagesCooperative Banking: Jump To Navigationjump To SearchmanikantaNo ratings yet

- Bendigo Final ReportDocument26 pagesBendigo Final ReportHumayra Sharif0% (1)

- Bonos Verdes ICODocument17 pagesBonos Verdes ICOXabier CormenzanaNo ratings yet

- Mopani Copper Mine - A Scandal in ZambiaDocument15 pagesMopani Copper Mine - A Scandal in ZambiaChola MukangaNo ratings yet

- The German Cooperatives in Europe - EnglDocument9 pagesThe German Cooperatives in Europe - EnglKarthik AnantharamuNo ratings yet

- SONY Case Report - Group Assignment CBA300 AF62CDocument26 pagesSONY Case Report - Group Assignment CBA300 AF62CNhi HuơngNo ratings yet

- GreenTaxonomy Note FINAL Apr2022Document3 pagesGreenTaxonomy Note FINAL Apr2022Davi DrummondNo ratings yet

- "CSR" Program in Banking Sector: An Indian PerspectiveDocument13 pages"CSR" Program in Banking Sector: An Indian PerspectiveSumit Thakur88% (8)

- Smcbup Iec MaterialsDocument2 pagesSmcbup Iec MaterialsMark Kevin IIINo ratings yet

- SML AR 2017 (Final) Low ResDocument178 pagesSML AR 2017 (Final) Low ResRatih Q AnjilniNo ratings yet

- C. Evaluate The Social Development Aspect of The CooperativeDocument3 pagesC. Evaluate The Social Development Aspect of The CooperativeGlendale GadorNo ratings yet

- Multinational Business Finance in Times of Global Financial Crisis: Looking at Alternative StrategiesDocument28 pagesMultinational Business Finance in Times of Global Financial Crisis: Looking at Alternative Strategiessimhamsiddu1No ratings yet

- ICICI Bank Business Responsibility Report 2021Document12 pagesICICI Bank Business Responsibility Report 2021Kartik IyerNo ratings yet

- 1317200-IfRC The Way We Finance-En-LRDocument16 pages1317200-IfRC The Way We Finance-En-LRHenry DHNo ratings yet

- CSFRD ProposalDocument66 pagesCSFRD ProposalAnna HonorataNo ratings yet

- First Direct Marketing PlanDocument16 pagesFirst Direct Marketing PlancocoxiaoranNo ratings yet

- Investment Bank - Fixed Income and Currencies: Claire CoustarDocument7 pagesInvestment Bank - Fixed Income and Currencies: Claire CoustarFelixNo ratings yet

- Leaflet About EBRDDocument2 pagesLeaflet About EBRDВладимир РыжиковNo ratings yet

- 1704881175957Sustainable Finance FrameworkDocument42 pages1704881175957Sustainable Finance Frameworkagrocoop1996No ratings yet

- Private Finance Initiative - Its Rationale and Accounting TreatmentDocument40 pagesPrivate Finance Initiative - Its Rationale and Accounting TreatmentDNNo ratings yet

- Social AccountsDocument4 pagesSocial Accountsshamanth shettyNo ratings yet

- Vedanta Report Group5Document10 pagesVedanta Report Group5Anay BhaleraoNo ratings yet

- The Nature Conservancy - 2023 Endowment Impact Report (40p)Document40 pagesThe Nature Conservancy - 2023 Endowment Impact Report (40p)Aza O'Leary - SEE The Change ProductionsNo ratings yet

- Worksheet - Section 1 - Mixed BagDocument3 pagesWorksheet - Section 1 - Mixed BagAnavi KhoslaNo ratings yet

- Binza BBE A1.2Document17 pagesBinza BBE A1.2Minh PhíNo ratings yet

- Bubble Soap BB Plan DashboardDocument1 pageBubble Soap BB Plan DashboardDavid Jamwa ChandiNo ratings yet

- Tokyo Century Group With The Joint Credit MechanismDocument14 pagesTokyo Century Group With The Joint Credit MechanismAlezNgNo ratings yet

- BII Early Careers Graduate Brochure FinalDocument21 pagesBII Early Careers Graduate Brochure Finalviswajithv66No ratings yet

- Land Development Banks: by RegionDocument12 pagesLand Development Banks: by RegionmanikantaNo ratings yet

- 2020 Hochtief Group ReportDocument283 pages2020 Hochtief Group ReportMIRZAT ADELNo ratings yet

- Project 1Document52 pagesProject 1Anurima BanerjeeNo ratings yet

- 2018 UCPB Annual Report PDFDocument324 pages2018 UCPB Annual Report PDFPat Dela CruzNo ratings yet

- Wuolah Free Unit 7 ImprimirDocument35 pagesWuolah Free Unit 7 ImprimirFranz Von KarmaNo ratings yet

- Wallstreetjournaleurope 20160311 The Wall Street Journal EuropeDocument38 pagesWallstreetjournaleurope 20160311 The Wall Street Journal EuropestefanoNo ratings yet

- Corporate Social Responsibility of Banking SectorDocument10 pagesCorporate Social Responsibility of Banking SectorShailendra ChowdhuryNo ratings yet

- The EU Taxonomy 1650572210 PDFDocument3 pagesThe EU Taxonomy 1650572210 PDFJesús Blázquez MulasNo ratings yet

- Hard Times 6 (5 - 1 - 11)Document4 pagesHard Times 6 (5 - 1 - 11)David GreenNo ratings yet

- Cooperative Banking: Jump To Navigationjump To SearchDocument16 pagesCooperative Banking: Jump To Navigationjump To SearchmanikantaNo ratings yet

- CSR Report 2009: Konica MinoltaDocument44 pagesCSR Report 2009: Konica MinoltaAbhinay AbhiNo ratings yet

- Tourism Policy ofDocument11 pagesTourism Policy ofVaishnavi Padmanabha ReddyNo ratings yet

- 9ci Ki6pquli9ef6ayjk.1Document106 pages9ci Ki6pquli9ef6ayjk.1Thanh NhanNo ratings yet

- 51 Million EU Funding For EnterprisesDocument10 pages51 Million EU Funding For EnterprisesGaetano MinardiNo ratings yet

- 1-86 MayDocument6 pages1-86 MayMwChrisNo ratings yet

- PRINCIPIOS BANCA RESPONSABLE Eng - Cleaned PDFDocument10 pagesPRINCIPIOS BANCA RESPONSABLE Eng - Cleaned PDFDiego BRNo ratings yet

- Annual Report 2004Document17 pagesAnnual Report 2004SolidariteInternationale100% (2)

- European Investment Bank Group Sustainability Report 2020From EverandEuropean Investment Bank Group Sustainability Report 2020No ratings yet

- Expenditure Program, by Object, Fy 2019 - 2021 (In Thousand Pesos) Table B.1Document5 pagesExpenditure Program, by Object, Fy 2019 - 2021 (In Thousand Pesos) Table B.1Anna TaylorNo ratings yet

- RM-MTP M22Document10 pagesRM-MTP M22Mani ganesanNo ratings yet

- Lic Form No 5204&5205Document3 pagesLic Form No 5204&5205Study Notes50% (4)

- Policy ScheduleDocument2 pagesPolicy ScheduleAshokNo ratings yet

- Investment Property Calculator v1.0.2024Document5 pagesInvestment Property Calculator v1.0.2024rahulkandepaneniNo ratings yet

- Benefits For Children With Disabilities: Socialsecurity - GovDocument20 pagesBenefits For Children With Disabilities: Socialsecurity - GovIrappa HosamaniNo ratings yet

- Tallest Buildings in The PhilippinesDocument12 pagesTallest Buildings in The Philippinesjendel manahanNo ratings yet

- PRESENTATION: Inclusive Business Forum's Health Panel SessionDocument6 pagesPRESENTATION: Inclusive Business Forum's Health Panel SessionADB Health Sector GroupNo ratings yet

- IAS 19 - Employee BenefitDocument33 pagesIAS 19 - Employee BenefitlaaybaNo ratings yet

- Industry vs. Sector What's The DifferenceDocument15 pagesIndustry vs. Sector What's The DifferenceYan Lin KyawNo ratings yet

- Jawaban Survey VCS Li-FingDocument3 pagesJawaban Survey VCS Li-Fingrizky rahmanNo ratings yet

- en 20220825141030Document2 pagesen 20220825141030mokhtarNo ratings yet

- Research and Development Activities of Life Insurance CompaniesDocument15 pagesResearch and Development Activities of Life Insurance CompaniesHtet Lynn HtunNo ratings yet

- Economics of Money Banking and Financial Markets 9th Edition Mishkin Test BankDocument25 pagesEconomics of Money Banking and Financial Markets 9th Edition Mishkin Test BankCraigGonzalezaxzgd100% (15)

- Ayush Gaur First Internship Project ReportDocument43 pagesAyush Gaur First Internship Project Report777 FamNo ratings yet

- Research Paper On General InsuranceDocument8 pagesResearch Paper On General Insurancegzzjhsv9100% (1)

- Freight Rate StructureDocument2 pagesFreight Rate StructureAly HassanNo ratings yet

- Introducing-Welfin ReposeDocument3 pagesIntroducing-Welfin ReposeIndranilGhoshNo ratings yet

- Signature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Document36 pagesSignature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Ganesh PrasadNo ratings yet

- BeeKeeping For Profit Business Plan SpreadsheetDocument18 pagesBeeKeeping For Profit Business Plan SpreadsheetAllan Z McMakenNo ratings yet

- MutualDocument7 pagesMutualKumar SatishNo ratings yet

- Application Form of Legion Limited Medical - EncryptedDocument18 pagesApplication Form of Legion Limited Medical - EncryptedAbinashNo ratings yet

- Confidential Financial Guarantee FA24 SP25 (Fillable)Document1 pageConfidential Financial Guarantee FA24 SP25 (Fillable)villedelron7No ratings yet

- 2021 - 22 Is Welcome GuideDocument53 pages2021 - 22 Is Welcome GuideRaj KamaniNo ratings yet