Professional Documents

Culture Documents

Distinguish Between

Distinguish Between

Uploaded by

DilippndtOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Distinguish Between

Distinguish Between

Uploaded by

DilippndtCopyright:

Available Formats

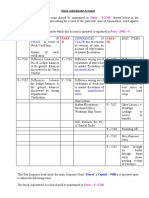

Vetting Concurrence

It involves factual verification of data It is an agreement to the proposal after

scrutinizing, the financial implication and need

of the work to be done.

Estimates and variation statement requires to Any proposal to carry out works require

be vetted before it is sanctioned by the concurrence before it is sanctioned by

competent authority. competent authority.

Vetting precedes concurrence Concurrence is accorded after vetting.

STOCK ADJUSTMENT ACCOUNT STORES IN TRANSIT

Operated to record (a) the temporary fluctuation Operated to watch the movement of stock

in the book value of stores items held in stock (b) transferred from one depot to another depot, if

adjustment of differences discovered in the course the said material is not received in receiving

of stock verification and (c) difference arising due depot in the same month.

to revision of rates.

Posting is made from the various Journal Slips Debited with the cost of stores transferred from

prepared for different transactions one depot by contra credit to stores suspense

pertaining to issuing depot.

Cleared in six months. Items of small value will be It is eventually cleared when the stores is

cleared by debits to final heads of account. Items received in receiving depot by necessary credit

remaining unclear at quarter ending reported to per contra debit to stores suspense pertaining to

GM and cleared by contra debit/credit to various receiving depot.

revenue abstracts.

It is write off with the sanction of General No need of sanction as it is cleared automatically

Manager. at receipt of stock.

As it is adjusted between revenue demands It will not affect Operating Ratio.

Operating Ratio will be affected.

SURPLUS STOCK DEAD STOCK

Items which are not been issued from stock for Dead stock is the stock purchased for the purpose

mote than 2 years are called surplus stock of use in office.

Surplus due to change in design or specification Examples are table, chair, rakes etc.

etc. or unanticipated fall of consumption.

It is of two kind (a) Moveable Surplus, (b) Dead Separate register is maintained named as Dead

Surplus. Stock Register.

EXTRA ORDINARY LEAVE LEAVE NOT DUE

It is granted (a) when no other leave is due or (b) It is granted when no other leave si due and there

when other leave is due yet the employee applies is reasonable prospect of employees coming back

for it. on duty.

It cannot exceed 5 years at a stretch for Maximum can be 360 days in one's career. Not

permanent and 3 month to temporary employee. more than 90 days at a time or 180 days on

medical ground.

May be combined at other kind of leave As there is no leave at the credit, it can not be

combined.

No leave salary is given Leave salary is given.

SHOP ON COST GENERAL ON COST

Includes all on cost charges incurred within the Denotes all on cost charges that is incurred in

shop or department, which cannot be directly common with more than one shop or department

charges to the work. within the workshop

Charges includes: Charges includes:

i) Wages, OT etc. of staff such as Workshop i) Wages, OT etc. of staff such as

apprentices, tool keepers attached to particular Workshop apprentices, tool keepers NOT

shop. attached to particular shop.

ii) Stationery and forms used in shop. ii) Freight charges that cannot be directly

iii) Hammer driving in shops. allocated to job.

iv) Power charges, whether electric, gas or iii) Working expenses of central work

hydraulic which can be directly allocated to shop. pumping station.

v) Shop scrap (credit) i.e. scrap which cannot iv) Electric Power which it is not possible

be allocated to jobs. to allocate to shops.

v) Replacement of articles stolen or lost.

GOVERNMENT ACCOUNTS COMMERCIAL ACCOUNTS

1. The Govt. Accounts are technically known The Commercial Accounts are technically

as "FINANCIAL ACCOUNTS" and maintained in known as "CAPITAL AND REVENUE

accordance with the requirements of the ACCOUNTS". These are governed by the

constitution and instructions of the parliament standard accounting practices and conventions

through its committees. and laws like company law, income tax act. etc

2. Government Accounts are maintained Commercial Accounts are maintained

on CASH basis. It accounts Actual cash receipts on, ACCRUAL basis. That means Accrued

and actual cash payments during the financial earnings, whether realized or not, and the

year. liabilities incurred, whether actually disbursed

or not.

3. Mostly Government Accounts are Commercial Accounts are maintained

maintained on Single entry system. on Double entry system. (For every Debit,

corresponding credit)

4. Government prepares Accounts of its Commercial firms prepares Profit & Loss A/c

incomings and outgoings only i.e. Statements f and Balance Sheet to know how much profit

receipts and expenditure. (Not Profit & Loss they earned during the year and what is their

A/c and Balance Sheet, since it is not position (Assets and Liabilities) at the end of

commercial oriented) the year

5. Government Accounts are designed on the Commercial Accounts are designed to

principle "How little money it (Govt) need to show how much money the firm can put into

take out of the pocket of the tax payer the pockets of the owner/business in the

(citizen) in order to maintain its necessary form of Profit.

activities i.e., welfare of the people, defence

of the country etc".

IRCA transactions IRFA transactions

1. Expand : Indian Railway Conference 1. Expand: Indian Railway Financial

Association. Adjustments.

2. Chargeable to : Demand No.09G-740-33 2. Chargeable to Demand No.09G-750-33

3. IRCA is authority for carrying out adjustments 3. Zonal Railways are responsible for raising

among all Zonal Railways. Debits are raised by charges on other Railways.

Northern Railway on other Zonal Railways

based on the advice of IRCA.

4. Pertaining to Goods Wagons only 4. Pertaining to Locos (Dsl & Electrical) &

( for Pakistan & Bangladesh Rly – All Rolling Coaches.

Stock)

5. 5..Will record the receipt / charges on

A.Charges / Receipts relating to inter charged account of adjustments carried out amongst

Stock (Goods wagons only) of Indian Railways- Indian Govt. Railways on account of (i)

(i) Repairs, (ii) maintenance (iii) Depreciation Repairs, (ii) Maintenance and (iii)

Depreciation in respect of rolling stock (other

B. Charges relating to Inter-change of all than goods wagons i.e., Locos & Coaches) of

Rolling Stock with Foreign one Railway in use on other Railways.

Railways(e.g. Pakistan and Bangla Desh

Railways)

6.Basis for calculation: 6. Basis for calculation:

Wagon balance is the net difference between (A) Locos : Debits will be passed on by the

the ownership and the actual holding of owning Railway to the using Railway at the

wagons of Zonal Railway. On a particular day, if unit cost based on the total engine hour on

a particular Rly holds less number of wagons outage basis (i.e. from the time it leaves from

that it owns on a particular day, it is entitles to the shed & till it returns to the shed) earned

hire charges for balance of the Wagons. by the engines on the using Railway.

Conversely the Rly holding more wagons that (B) Coaches: The credit/debit adjustments

its own is liable to pay hire charges for the should be worked out on the basis of

excess number of Wagons it holds. kilometres earned by through

rakes/passenger coaches running on more

than one railway system. Vehicle kilometres

in respect of through coaches should be

worked out on the basis of the working time

table periods and the rake links.

BLOCK ACCOUNTS AND LOAN ACCOUNT

REVISED ESTIMATE AND MATERIAL MODIFICATION

MISC ADV. CAPITAL AND MISC ADV REVENUE

CAPITAL FUND AND CAPITAL AT CHARGE

LETTER OF CREDIT AND CREDIT NOTE

COMPLETION REPORT AND COMPLETION ESTIMATE

TEMPORARY ESTABLISHMENT AND WORK CHARGE ESTABLISHMENT

ENGINEERING SURPLUS AND IMPREST STORES

LIQUIDATED DAMAGES AND GENERAL DAMAGES

PRELIMINARY ENGINEERING SURVEY AND FINAL LOCATION SURVEY

JOB COSTING AND PROCESS COSTING

REMITTANCE TRANSACTION AND TRANSFER TRANSACTION

You might also like

- Corometrics 250cx User and Operating ManualDocument194 pagesCorometrics 250cx User and Operating ManualRonnelSerranoNo ratings yet

- Your Trip: MR Ahmed Mohamed Ragab KhalifaDocument1 pageYour Trip: MR Ahmed Mohamed Ragab KhalifaAhmad ArfeenNo ratings yet

- Catalog AMK FastenerDocument196 pagesCatalog AMK FastenerBillNo ratings yet

- MSFT CertPoster DigitalDocument1 pageMSFT CertPoster DigitalHunter S. TylerNo ratings yet

- Marketing Plan For FTTHDocument5 pagesMarketing Plan For FTTHsheinmin thuNo ratings yet

- ZONE OFFICE ADVISORY NO. 2021-017 Update On Filing The Information Technology Sector - Report Compliance System Form Through Httpfirb - Peza.gov - PhfirbDocument2 pagesZONE OFFICE ADVISORY NO. 2021-017 Update On Filing The Information Technology Sector - Report Compliance System Form Through Httpfirb - Peza.gov - PhfirbJob De LeonNo ratings yet

- Steag O&M Business in Gas & Coal Based Power PlantsDocument5 pagesSteag O&M Business in Gas & Coal Based Power Plants8103 Anshu PatilNo ratings yet

- School of Education - Scholarly WritingDocument3 pagesSchool of Education - Scholarly WritingJohn M. NdunguNo ratings yet

- Our Focus Will Always Be You!Document10 pagesOur Focus Will Always Be You!jgaeqNo ratings yet

- FTTH New PlanDocument12 pagesFTTH New Plansheinmin thuNo ratings yet

- Legal Metrology and ConsumerDocument94 pagesLegal Metrology and ConsumernoonskieNo ratings yet

- Model: Avr - 102: Micro Controller Based Automatic Voltage Regulating RelayDocument2 pagesModel: Avr - 102: Micro Controller Based Automatic Voltage Regulating RelayMohar Singh/UPBG/PantnagarNo ratings yet

- Unit 1 - Bonus Features - Solution WalkthroughDocument34 pagesUnit 1 - Bonus Features - Solution WalkthroughТропников ЕгорNo ratings yet

- ChibiOS ConceptsDocument14 pagesChibiOS ConceptsKurnia WanNo ratings yet

- Faq Security Dms External 2410255Document6 pagesFaq Security Dms External 2410255tareqfrakNo ratings yet

- Accounts & AdminDocument4 pagesAccounts & AdminJames JamesNo ratings yet

- 001 Bizgram Asia Pricelist December 31CDocument16 pages001 Bizgram Asia Pricelist December 31CBizgram AsiaNo ratings yet

- UTS Abstract G23Document10 pagesUTS Abstract G23priyachoudhary1No ratings yet

- CGAP Appraisal Report For The Selection of MFIs Along The SNNP Region of Ethiopia.Document31 pagesCGAP Appraisal Report For The Selection of MFIs Along The SNNP Region of Ethiopia.Diana Nabukenya KattoNo ratings yet

- Form 601-Partial Withdrawal Under NPSDocument3 pagesForm 601-Partial Withdrawal Under NPSRanga Nayak PaltyaNo ratings yet

- A Modified Reinforcement Learning Algorithm For Solving Coordinated Signalized NetworksDocument16 pagesA Modified Reinforcement Learning Algorithm For Solving Coordinated Signalized NetworksAnıl Akçakaya100% (1)

- Cloud ComputingDocument4 pagesCloud ComputingjeffNo ratings yet

- BLUECAT Data Sheet ADAPTIVE DNSDocument5 pagesBLUECAT Data Sheet ADAPTIVE DNSTa MendozaNo ratings yet

- Design and Evaluation of A Smart-Glasses-based Service Support SystemDocument15 pagesDesign and Evaluation of A Smart-Glasses-based Service Support SystemAl-Mahmudur RahmanNo ratings yet

- Explain How Files and Databases Are Used in OrganizationsDocument5 pagesExplain How Files and Databases Are Used in OrganizationsTyrick MinottNo ratings yet

- Olam Interview QuestionsDocument1 pageOlam Interview QuestionsMuruli MohanNo ratings yet

- Manual For Recondioning of MM Steel Points & CrossingsDocument41 pagesManual For Recondioning of MM Steel Points & CrossingsLakshmanNo ratings yet

- Grand Traverse Band of Ottawa and Chippewa Indians Gaming RevenueDocument11 pagesGrand Traverse Band of Ottawa and Chippewa Indians Gaming RevenueRoxanne WerlyNo ratings yet

- IndusInd Bank Credit Card Bill PaymentsDocument2 pagesIndusInd Bank Credit Card Bill PaymentspritamjaanNo ratings yet

- Common Application Form For Debt and Liquid Schemes (Please Fill in Block Letters)Document3 pagesCommon Application Form For Debt and Liquid Schemes (Please Fill in Block Letters)Anand NiyogiNo ratings yet

- FMMI Programmes Fees - Aug2020Document1 pageFMMI Programmes Fees - Aug2020Afiq AazmiNo ratings yet

- Induction Into The Armed Forces Guidelines FinalDocument6 pagesInduction Into The Armed Forces Guidelines FinalAtul KhatriNo ratings yet

- Ec8791 Erts QBDocument8 pagesEc8791 Erts QBRajarajeswari KannanNo ratings yet

- HC Enus MTP850 FuG Product Information ManualDocument116 pagesHC Enus MTP850 FuG Product Information Manualmiciek2 KrakówNo ratings yet

- A Translation Approach To Teaching LinearDocument18 pagesA Translation Approach To Teaching LinearDika DevintasariNo ratings yet

- Internship Report of Rafsun Jani SarkerDocument17 pagesInternship Report of Rafsun Jani SarkerRafsun JaniNo ratings yet

- Mel GiriDocument40 pagesMel GiriChethan ChaiNo ratings yet

- AckoPolicy-DBCR00710701739 00Document2 pagesAckoPolicy-DBCR00710701739 00Rajendra MoreNo ratings yet

- Bunch Microtechnologies InvoiceDocument3 pagesBunch Microtechnologies Invoiceshrey kukadeNo ratings yet

- Data Security in Cloud ComputingDocument5 pagesData Security in Cloud ComputingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- OCI Introduction: Presented By: Rahul MiglaniDocument21 pagesOCI Introduction: Presented By: Rahul Miglanisss pppNo ratings yet

- Letter of Authorization & Letter Showing Authorized SignatoryDocument2 pagesLetter of Authorization & Letter Showing Authorized SignatoryRaj KumarNo ratings yet

- Advanced High-Capacity Synchronization Solution: Your BenefitsDocument6 pagesAdvanced High-Capacity Synchronization Solution: Your BenefitsTuan MANo ratings yet

- Datasheet Financial Management APDocument5 pagesDatasheet Financial Management APALHNo ratings yet

- GRADATION - Final - AS ON 01.01.2023Document190 pagesGRADATION - Final - AS ON 01.01.2023Arindam Das (Ari)No ratings yet

- DFM SK DFM DFM I Operation ManualDocument105 pagesDFM SK DFM DFM I Operation ManualBrion Bara IndonesiaNo ratings yet

- Load Balancing in Cloud ComputingDocument14 pagesLoad Balancing in Cloud ComputingAnonymous CwJeBCAXpNo ratings yet

- Humidifier ManualDocument48 pagesHumidifier ManualNarcís Guinart i SirventNo ratings yet

- Typing Work Details - AnushkaDocument7 pagesTyping Work Details - AnushkaSàï GúbbälãNo ratings yet

- Admission Offer For IMT's Post Graduate ProgramDocument3 pagesAdmission Offer For IMT's Post Graduate ProgramManvendra SinghNo ratings yet

- Sakala Acknowledgement/ಸ ಲDocument1 pageSakala Acknowledgement/ಸ ಲKushalRNo ratings yet

- British Council LevelsDocument47 pagesBritish Council LevelsOmarNo ratings yet

- 15EC33 - Digital Electronics - Module 4Document24 pages15EC33 - Digital Electronics - Module 4saralaNo ratings yet

- BODAS-service: RE 95087/2021-07-16 Replaces: 2021-03-05Document10 pagesBODAS-service: RE 95087/2021-07-16 Replaces: 2021-03-05OHW SERNo ratings yet

- Lukas Erzett - Catalog - 2018 GBDocument443 pagesLukas Erzett - Catalog - 2018 GBGabriel DobrescuNo ratings yet

- Example of Cover Letter + Resume PDFDocument4 pagesExample of Cover Letter + Resume PDFrougailtonioNo ratings yet

- Gesture Controlled Virtual MouseDocument8 pagesGesture Controlled Virtual MouseIJRASETPublicationsNo ratings yet

- TicketDocument2 pagesTicketChetan AgrawalNo ratings yet

- Case Scenario MCQs RTP MTP May24Document14 pagesCase Scenario MCQs RTP MTP May24manikantaav964No ratings yet

- Adv. Acc. All Case Studies and McqsDocument8 pagesAdv. Acc. All Case Studies and Mcqsjust.saiyuNo ratings yet

- Risk PurchaseDocument13 pagesRisk PurchaseDilippndtNo ratings yet

- Workshop AccountsDocument2 pagesWorkshop AccountsDilippndtNo ratings yet

- Stores AccountsDocument11 pagesStores AccountsDilippndtNo ratings yet

- Traffic Costing NotesDocument3 pagesTraffic Costing NotesDilippndtNo ratings yet

- GeneralexpDocument13 pagesGeneralexpDilippndtNo ratings yet

- Financial JustificationDocument5 pagesFinancial JustificationDilippndtNo ratings yet

- Official LanguageDocument2 pagesOfficial LanguageDilippndtNo ratings yet

- Financial Justification of ProjectsDocument5 pagesFinancial Justification of ProjectsDilippndtNo ratings yet