Professional Documents

Culture Documents

Insurance Claims - Loss of Stock: Concept

Insurance Claims - Loss of Stock: Concept

Uploaded by

Kartik GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Claims - Loss of Stock: Concept

Insurance Claims - Loss of Stock: Concept

Uploaded by

Kartik GuptaCopyright:

Available Formats

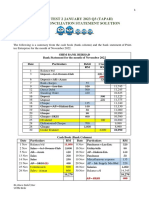

Page |1

INSURANCE CLAIMS – LOSS OF STOCK

CONCEPT BASICS OF INSURANCE

Mechanism

Meaning ✓ It’s a contract between 2 parties that if the first party suffers any loss, the

second party will make such loss good.

CONCEPT LOSS OF STOCK

Insights ✓ Business enterprises get insured against loss of stock on the happening of certain

events such as fire, flood, theft etc.

✓ If the stock records are not available or get destroyed, the value of stock has to

be estimated.

Trading A/c ✓ Value of stock on the date of fire shall be computed by preparing Trading A/c

(Memorandum).

✓ It is prepared from the beginning of year till the date of fire.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |2

Memorandum Trading A/c

Date Particulars Amount Date Particulars Amount

To Opening Stock By Sales

To Purchases By Stock on date of fire

To Direct Expenses

To Gross Profit

Total Total

CONCEPT TYPES OF LOSS

Total Loss Meaning ✓ 100% stock has been destroyed and there is no salvage.

Rule for ✓ Claim is

amount of ❖ Amount of policy, or

claim ❖ Stock on date of fire

whichever is less

Partial Loss Meaning ✓ 100% stock has not been destroyed and there is some salvage.

Loss of Stock ✓

Rule for Without ✓ Claim is

amount of Average ❖ Amount of policy, or

claim Clause ❖ Loss of Stock

whichever is less.

With

Average

Clause

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |3

Other

important

points

CONCEPT TRADING A/C INFORMATION NOT GIVEN IN QUESTION

Sales not given ✓ Prepare Debtors A/c (Memorandum) to find credit sales.

✓

Purchases not ✓ Prepare Creditors A/c (Memorandum) to find credit purchases.

given ✓

Gross Profit Data of single ✓ Prepare the Trading A/c of previous year.

Ratio not given unaffected year ✓ Find out gross profit from such Trading A/c.

given ✓ Find out gross profit ratio.

✓ Such GP Ratio shall be applied in Memorandum Trading A/c.

Data of more ✓ Prepare the Trading A/c of previous years.

than one ✓ Find out gross profit from such Trading A/cs.

unaffected year ✓ Find out gross profit ratios.

given

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |4

CONCEPT UNDER OR OVER VALUATION OF STOCK

If undervalued ✓ Add the amount of undervaluation.

If overvalued ✓ Deduct the amount of overvaluation.

In case of

percentage

data

ADJUSTMENTS W.R.T. PURCHASES, SALES AND DIRECT

CONCEPT

EXPENSES

Purchases ✓ Deduct the amount of following :

❖ Goods given for advertising

❖ Goods distributed as samples

❖ Any capital expenditure (like Purchase of fixed asset)

❖ Goods withdrawn for personal use.

✓ If the goods have been received but invoice is still pending, consider as

purchase.

✓ If the goods have not been received but invoice is received, don’t consider as

purchase.

Sales ✓ Add the amount of unrecorded cash sales (misappropriated by cashier).

✓ If the goods have been dispatched but invoice is still pending, consider as

sales.

✓ If the goods have not been dispatched but invoice is prepared, don’t consider

as sales.

Direct ✓ If any amount of capital expenditure is included in direct expenses, the same

Expenses must be reduced.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |5

CONCEPT GOODS SOLD ON APPROVAL BASIS

Goods ✓ Must be treated as sales.

accepted by ✓ It is already included in sales, so don’t do anything.

customer

Goods not yet ✓ Must not be treated as sales.

accepted by ✓ It is already included in sales, thus reduce it from the value of sales.

customer ✓ Such goods are lying with customer and to be shown as separate item on credit

side in Trading A/c (at cost price).

CONCEPT PRESENCE OF ABNORMAL ITEMS

Abnormal Item ✓ These are those items which are unable to fetch normal profit.

Other notable

points

Trading A/c

Date Particulars Amount Date Particulars Amount

To Opening Stock By Sales

To Purchases By Closing Stock

To Direct Expenses + Amount w/off from

abnormal item

To Gross Profit

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |6

Gross Profit or ✓ Normal GP ratio is to be applied on normal sales only (not on the total sales).

Loss ✓ Profit or loss on abnormal items shall be given by the question. Generally,

there is loss on abnormal item sold.

✓ Sometimes, the abnormal item is left as a part of closing stock also, if it is

already known that such item can be sold only at less than the cost price, the

difference should be booked as “Loss on Revaluation”.

Memorandum Trading A/c

Date Particulars Normal Ab- Total Date Particulars Normal Ab- Total

normal normal

To Opening By Sales

Stock

To Purchases By Loss on

Sale

To Direct By Loss on

Expenses Revaluation

To Gross By Stock on

Profit date of fire

Total Total Total Total Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |7

INSURANCE CLAIMS – LOSS OF PROFIT

CONCEPT LOSS OF PROFIT

Insights ✓ Whenever fire occurs, along with the loss of stock and other assets, the

business activities are also disorganized/ hampered and the normal profits

may not be earned.

✓ To take the protection against such losses of profits, the businessman takes

“Loss of Profits policy” or “Consequential Loss Policy”.

Coverage ✓ This policy covers the following

❖ Loss of Profit

❖ Standing Charges

❖ Additional Expenses

CONCEPT UNDERSTANDING TURNOVERS

Actual T/o in dislocated period

T/o in corresponding period

T/o in previous year

T/o during 12 months immediately preceding the date of fire

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |8

CONCEPT STEPS TO COMPUTE LOSS OF PROFIT

Step 1 Computation of GP Ratio

a. GP (%) =

b. Effective GP Ratio

GP% [Step 1(a)]

+ Increase in Trend

- Decrease in Trend

Step 2 Computation of Short Sales

Particulars Amount (₹)

T/o in Corresponding Period

+ Increase in Trend

- Decrease in Trend

= Expected T/o

- T/o in Dislocated Period

Step 3 Computation of Loss of Profit

= Short Sales x GP (%)

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

Page |9

Step 4 Computation of Insurable Amount

a. Adjusted Annual Turnover

Particulars Amount (₹)

T/o in the 12 months immediately preceding date of fire

+ Increase in Trend

- Decrease in Trend

b. Insurable Amount

= Adjusted Annual Turnover x GP (%)

Step 5 Additional Expenses

S.No. Particulars Amount (₹)

a. Actual Additional Expenses

b. Additional Expenses x Insurable Amt.

Insurable Amt. + Uninsured Standing Charges

c. T/o achieved due to additional expenses x GP (%)

Least of a, b, c is to be considered.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 10

Step 6 Computation of Total Loss

Particulars Amount (₹)

Loss of Profit (Step 3)

+ Additional Expenses (Step 5)

- Savings in insured standing charges

Step 7 Computation of Amount of Claim

S.No. Particulars Amount (₹)

a. Insurable Amount [Step 4(b)]

b. Insured Amount

c. Average Clause If a > b then applicable

If a < b not applicable

d. Amount of Claim

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 11

COMPUTATION OF AMOUNT OF POLICY WHEN THE NET PROFIT

CONCEPT

PERCENTAGE IS GIVEN

Step 1 Find GP Ratio of last year

Step 2 Find Expected GP (₹)

Particulars Amount (₹)

Expected T/o (Previous year T/o +/- Adjustment)

Expected GP (Expected T/o x GP%)

Step 3 Computation of Amount of Policy

Particulars Amount (₹)

Expected GP (₹)

+ Additional Expenses

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 12

COMPUTATION OF AMOUNT OF POLICY WHEN DETAILS OF

CONCEPT

EXPENSES ARE GIVEN AND T/O IS NOT GIVEN

Step 1 Find sales of last year by preparing Trading and P/L A/c

Step 2 Find GP (₹) of previous year

Method 1 Method 2

Sales Net Profit

- Variable Expenses + Standing Charges

- Misc. Income

Step 3 Find GP Ratio

GP (%) =

Step 4 Find Expected GP (₹)

Particulars Amount (₹)

Expected T/o (Previous year T/o +/- Adjustment)

Expected GP (Expected T/o x GP%)

Step 5 Computation of Amount of Policy

Particulars Amount (₹)

Expected GP

+ Additional Expenses

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 13

INVESTMENT ACCOUNTS

CONCEPT MEANING OF INVESTMENT

✓ Investments are assets held by an enterprise for earning income by way of dividends, interest,

and rentals, for capital appreciation, or for other benefits to the investing enterprise.

CONCEPT FIXED INCOME BEARING SECURITIES

Inclusions ✓ Debentures

✓ Bonds

✓ Government Securities

Purchase Insights ✓ Buyer pays for

Transaction ❖ Cost of Investments

❖ Interest

Journal Entry Investment in 12% Debentures of T Ltd. A/c

Interest on Investments A/c

To Bank A/c

Interest Insights ✓ Always computed on Face Value.

Transaction ✓ Investor receives the interest from last date of interest till

current date of interest.

Journal Entry Bank A/c

To Interest on Investments A/c

Sale Insights ✓ Seller receives for

Transaction ❖ Sale value of investments

❖ Interest

Journal Entry Bank A/c

To Investment in 12% Debentures of T Ltd. A/c

To Interest on Investments A/c

Profit or loss ✓ The profit or loss on sale shall be computed by comparing the

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 14

on sale cost of investment with the sales value.

✓ Generally, FIFO method is followed to compute the cost.

Journal Entry Investment A/c

(Profit) To P/L A/c

Journal Entry P/L A/c

(Loss) To Investment A/c

Transfer of Insights ✓ The amount of interest is to be transferred to P/L A/c at the

Interest to year end.

P/L (year-

end) Journal Entry Interest on Investments A/c

To P/L A/c

Types of Ex-interest ✓ Price of transaction and interest are separate.

transactions ✓ Price of transaction doesn’t include interest.

Cum-interest ✓ Price of transaction and interest are not separate.

✓ Price of transaction includes interest.

Incidental Types Stamp Duty ✓ Usually computed on the face value

Expenses

Commission ✓ Usually computed on the transaction value

Treatment Purchase ✓ To be added

Sale ✓ To be deducted

Comparison ✓ If the question provides the market price, then compare it with the cost at the

of Cost Price end.

with Market ✓ The valuation rule “Lower of Cost and Market Price” shall be followed.

Value ✓ If the cost is more, then the difference shall be booked as “Loss on Valuation”.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 15

Books of Investor

Investment A/c

from _______ to _______

(Scrip : __% Debentures of ______)

Date Particulars Nominal Interest Amount Date Particulars Nominal Interest Amount

Value Value

To Balance By Bank –

b/d Receipt of

Interest

To Bank – By Bank –

Purchase Sale

To P/L – By P/L –

Profit on Loss on

Sale Sale

To P/L – By Balance

Interest c/d

Transfer (balance

to P/L investment

in hand)

Total Total Total Total Total Total

CONCEPT VARIABLE INCOME BEARING SECURITIES

Inclusions ✓ It includes the securities having variable return of income.

✓ For example – investment in equity shares.

Other ✓ Stamp duty is computed on transaction value.

notable ✓ Only weighted average method is applicable (not the FIFO).

points ✓ No computation of dividend is made at the time of purchase or sale transaction.

Bonus Issue ✓ Issue of shares by company free of cost.

✓ No amount is entered in Investment A/c.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 16

✓ Bonus shares are given in proportion to existing holding.

Right Issue Insights ✓ Offer by the company to its existing equity shareholders to

subscribe to its shares.

✓ Generally offered at less than the market price.

✓ Right shares are given in proportion to existing holding.

Options with Subscribe ✓ In such case, an entry is passed for the

the purchase of shares.

shareholder

Renounce ✓ Investor sells his “Right to receive the Shares”.

✓ Such profit is not recorded in Investment A/c

but in the P/L A/c.

Dividend Post- Insights ✓ Revenue Nature

Acquisition ✓ Dividend Column

Dividend ✓ Income of investor

Journal Bank A/c

Entry To Dividend A/c

Pre- Insights ✓ Capital Nature

Acquisition ✓ Amount Column

Dividend ✓ Not the income of investor, reduces the cost of

investment.

Journal Bank A/c

Entry To Investment A/c

Profit or loss Insights ✓ The profit or loss on sale shall be computed by comparing the

on sale cost of investment with the sales value.

✓ To compute the relevant cost of investment sold, weighted

average method shall be followed.

Journal Entry Investment A/c

(Profit) To P/L A/c

Journal Entry P/L A/c

(Loss) To Investment A/c

Transfer of Insights ✓ The amount of dividend is to be transferred to P/L A/c at the

Dividend to year end.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 17

P/L (year- Journal Entry Dividend A/c

end) To P/L A/c

Comparison ✓ If the question provides market price, then compare it with the cost at the end.

of Cost Price ✓ The valuation rule “Lower of Cost and Market Price” shall be followed.

with Market ✓ If the cost is more, then the difference shall be booked as “Loss on Valuation”.

Value

Books of Investor

Investment A/c

from _______ to ________

(Scrip : Equity Shares in ___ Ltd.)

Date Particulars No. of Dividend Amount Date Particulars No. of Dividend Amount

Shares Shares

To Balance By Bank –

b/d Dividend

To Bank : By Bank –

Purchase Sale

To Bonus By P/L –

Shares Loss on

Sale

To Bank : By P/L –

Right Loss on

Shares Revaluation

To P/L – By Balance

Profit on c/d

Sale

To P/L –

Transfer

of D/D

Total Total Total Total Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 18

CONCEPT CONVERTIBLE DEBENTURES

Meaning ✓ The debentures which are convertible into equity shares.

Other ✓ At the time of conversion

notable ❖ Find the face value of debentures being converted

points ❖ Find the cost of such debentures being converted

(always follow weighted average method)

✓ As per SEBI Guidelines, interest due (if any) on such debentures is to be paid

at the time of conversion itself.

Journal Entry Investment in Equity Shares A/c

To Investment in __% Debentures A/c

Investment A/c

(Debentures)

Date Particulars Face Interest Amount Date Particulars Face Interest Amount

Value Value

By Inv. in -

Equity

Shares A/c

By Bank – - -

Interest

Investment A/c

(Equity Shares)

Date Particulars No. of Dividend Amount Date Particulars No. of Dividend Amount

shares shares

To Inv. in -

__%

Debentures

A/c

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 19

HIRE PURCHASE

CONCEPT MEANING OF HIRE PURCHASE AGREEMENT

✓ Under the Hire Purchase System, the Hire Purchaser gets possession of the goods at the outset

and pays for it in instalments over a specified period of time as per the agreement.

✓ However, the ownership of goods remains with the Hire Vendor until the hire purchaser has paid

all the instalments.

CONCEPT UNDERSTANDING BASIC TERMS

Cash Price

Down Payment

Installment

Hire Purchase

Price

CONCEPT CASH PRICE, HIRE PURCHASE PRICE AND INTEREST

CASE A – Cash Price given, Rate of Interest given and the amount of installment given which

doesn’t include interest

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 20

CASE B – Cash Price given, Rate of Interest given and the amount of installment given which

includes interest

CASE C – Cash Price not given, Rate of Interest given and the amount of installment given

CASE D – Cash Price given, Rate of Interest not given and the amount of installment given

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 21

CASE E – Cash Price not given, Rate of Interest not given and the amount of installment given

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 22

ACCOUNTING TREATMENT IN BOOKS OF HIRE PURCHASER AND

CONCEPT

HIRE VENDOR UNDER THE CASH PRICE METHOD/ SALES METHOD

S. No. Particulars Books of Hire Purchaser Books of Hire Vendor

1. On agreement Asset A/c Hire Purchaser A/c

To Hire Vendor A/c To HP Sales A/c

2. On down payment Hire Vendor A/c Bank A/c

To Bank A/c To Hire Purchaser A/c

3. Interest being Interest A/c Hire Purchaser A/c

due To Hire Vendor A/c To Interest A/c

4. Installment being Hire Vendor A/c Bank A/c

paid To Bank A/c To Hire Purchaser A/c

5. Depreciation Depreciation A/c -

To Asset A/c

6. Transfer of Profit & Loss A/c Interest A/c

Interest and To Interest A/c To Profit & Loss A/c

Depreciation To Depreciation A/c

7. Transfer of HP - HP Sales A/c

Sales To Trading A/c

Balance Sheet Extract

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 23

Books of Hire Purchaser

Hire Vendor A/c

Date Particulars Amount Date Particulars Amount

To Bank A/c By Asset A/c

To Balance c/d By Interest A/c

Total Total

To Bank A/c By Balance b/d

To Balance c/d By Interest A/c

Total Total

To Bank A/c By Balance b/d

By Interest A/c

Total Total

Asset A/c

Date Particulars Amount Date Particulars Amount

To Hire Vendor A/c By Depreciation A/c

By Balance c/d

Total Total

To Balance b/d By Depreciation A/c

By Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 24

To Balance b/d By Depreciation A/c

By Balance c/d

Total Total

Interest A/c

Date Particulars Amount Date Particulars Amount

To Hire Vendor A/c By Profit & Loss A/c

Total Total

To Hire Vendor A/c By Profit & Loss A/c

Total Total

To Hire Vendor A/c By Profit & Loss A/c

Total Total

Depreciation A/c

Date Particulars Amount Date Particulars Amount

To Asset A/c By Profit & Loss A/c

Total Total

To Asset A/c By Profit & Loss A/c

Total Total

To Asset A/c By Profit & Loss A/c

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 25

Books of Hire Vendor

Hire Purchaser A/c

Date Particulars Amount Date Particulars Amount

To HP Sales A/c By Bank A/c

To Interest A/c By Balance c/d

Total Total

To Balance b/d By Bank A/c

To Interest A/c By Balance c/d

Total Total

To Balance b/d By Bank A/c

To Interest A/c

Total Total

Interest A/c

Date Particulars Amount Date Particulars Amount

To Profit & Loss A/c By Hire Purchaser A/c

Total Total

To Profit & Loss A/c By Hire Purchaser A/c

Total Total

To Profit & Loss A/c By Hire Purchaser A/c

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 26

CONCEPT DEFAULT AND COMPLETE REPOSSESSION

Books of Hire Purchaser

Hire Vendor A/c

Date Particulars Amount Date Particulars Amount

To Asset A/c By Balance b/d

By Interest A/c

Total Total

Asset A/c

Date Particulars Amount Date Particulars Amount

To Balance b/d By Depreciation A/c

By Hire Vendor A/c

To P/L – Profit on By P/L – Loss on

surrender surrender

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 27

Books of Hire Vendor

Hire Purchaser A/c

Date Particulars Amount Date Particulars Amount

To Balance b/d By Goods Repossessed

A/c

To Interest A/c By P/L – Loss on

repossession

To P/L – Profit on

repossession

Total Total

Goods Repossessed A/c

Date Particulars Amount Date Particulars Amount

To Hire Purchaser By Bank A/c

A/c

To Bank A/c By P/L A/c – Loss on

sale

To P/L A/c – Profit By Balance c/d

on sale

Total Total

CONCEPT DEFAULT AND PARTIAL REPOSSESSION

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 28

Books of Hire Purchaser

Hire Vendor A/c

Date Particulars Amount Date Particulars Amount

To Asset A/c By Balance b/d

To Balance c/d By Interest A/c

Total Total

Asset A/c

Date Particulars Amount Date Particulars Amount

To Balance b/d By Depreciation A/c

To P/L – Profit on By Hire Vendor A/c

surrender

By P/L – Loss on

surrender

By Balance c/d

Total Total

Books of Hire Vendor

Hire Purchaser A/c

Date Particulars Amount Date Particulars Amount

To Balance b/d By Goods Repossessed

A/c

To Interest By Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 29

Goods Repossessed A/c

Date Particulars Amount Date Particulars Amount

To Hire Purchaser By Bank A/c

A/c

To Bank A/c By P/L A/c – Loss on

sale

To P/L A/c – Profit By Balance c/d

on sale

Total Total

Working Note

Calculation of

✓ Agreed Value of Goods Repossessed

✓ Profit/ Loss on Surrender

✓ Book Value of Goods not Repossessed

Asset not Repossessed Asset Repossessed

Dep. @ Value as per HP Value as per HV

____% Dep. @ ____% Dep. @ ____%

Cost as on _____ Cost as on _____

- Dep.

‘ - Dep.

‘

BV as on _____ BV as on _____

- Dep.

‘ - Dep.

‘

BV as on _____ BV as on _____

Loss on Surrender

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 30

DEPARTMENTAL ACCOUNTS

CONCEPT BASIC

Departmental Accounts helps in identifying the performance of each department. These are of

great assistance to the management as they provide necessary information for controlling the

business more intelligently and efficiently.

CONCEPT DEPARTMENTAL TRADING A/c and PROFIT & LOSS A/c

In the books of M/s ______

Departmental Trading and Profit & Loss A/c

for year ending ______

Particulars A B Particulars A B

To Opening stock By Sales

To Purchases By Closing Stock

To Direct Expenses

To Gross Profit c/d

Total Total Total Total

To Indirect Expenses By Gross Profit b/d

To Net Profit By Discount Received

Total Total Total Total

Individually identifiable Charged directly to the relevant department

expenditure

Common Expenditure Can be distributed on Charged to the department

some suitable basis

Can be distributed on Transferred to Combined P/L

some suitable basis

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 31

Rent, Rates, Taxes, Repairs & Ins. of Building Floor Area or if not given time basis

Lighting, Heating, Energy expense Consumption of energy

Carriage Inward, Discount Received Purchases

Carriage Outward, B/Debts, Discount Allowed Sales

Wages, Salaries No. of employees or Time devoted to each

department (if common employee working for >1)

Labour welfare expenses No. of employees

PF/ ESI Contribution Wages and salaries

Depreciation, Repairs, Ins. of Cap. Assets Value of Capital Assets

Admin. expenses, Salaries of managers and Time Basis or equally among departments

directors

Interest on loan Value of loan used by each department

Profit/ Loss on sale of investments Value of investments sold by each department

Combined Profit & Loss A/c

Particulars Amt. Particulars Amt.

To Expenses (Common) By Net Profit

To Net Profit (taken to B/S) :A

:B

By Income (Common)

Total Total

PREPARATION OF DEPARTMENTAL TRADING A/c WHEN GP RATIO

CONCEPT

IS SAME FOR ALL DEPARTMENTS

Step 1 ✓ Prepare the Memorandum Trading A/c for each department (Units only)

Particulars A B C Particulars A B C

To Opening stock By Sales

To Purchases By Closing Stock

Total Total Total Total Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 32

Step 2 ✓ Compute the GP Ratio

Particulars Amount (₹)

Sales Value of Purchases

Less : Total Purchase Value

= Gross Profit

GP % =

As GP Ratio is uniform, so all the departments will have same GP Ratio.

Step 3 Find the Cost Price/ unit for all the departments

Particulars Amount (₹)

Selling Price/ Unit

Less : GP Ratio (%)

= Cost Price/ Unit

Step 4 Prepare Departmental Trading A/c and find Gross Profit.

Particulars A B C Particulars A B C

To Opening stock By Sales

To Purchases By Closing Stock

To Gross Profit

Total Total Total Total Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 33

COMPUTATION OF DEPARTMENTAL PROFITS WHEN CERTAIN

CONCEPT

ITEMS DURING THE YEAR ARE SOLD AT DISCOUNT

STEP 1 - Statement showing Departmental Results (Actual Profits)

Particulars A B C

Actual Sales

+ Discount

(Sales at normal price –

Sales as actual price)

= Normal Sales

Normal Gross Profit

- Discount

= Actual Profit/ GP

STEP 2 - Computation of Value of Stock

Departmental Trading A/c of ____

for year ending _______

Particulars A B C Particulars A B C

To Opening stock By Sales

To Purchases By Closing Stock

To Gross Profit

Total Total Total Total Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 34

CONCEPT TRANSFER BETWEEN DEPARTMENTS AND STOCK RESERVE

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 35

VALUE OF TRANSFER OF TRANSFEROR DEPARTMENT IN THE

CONCEPT

STOCK OF TRANSFEREE DEPARTMENT GIVEN

VALUE OF TRANSFER OF TRANSFEROR DEPARTMENT IN THE

CONCEPT STOCK OF TRANSFEREE DEPARTMENT NOT GIVEN BUT CONTENT

RATIO GIVEN

VALUE OF TRANSFER OF TRANSFEROR DEPARTMENT IN THE

CONCEPT STOCK OF TRANSFEREE DEPARTMENT NOT GIVEN, CONTENT

RATIO ALSO NOT GIVEN

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 36

INTER-DEPARTMENTAL TRANSFER BETWEEN MORE THAN 2

CONCEPT

DEPARTMENTS

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 37

COMPUTATION OF MANAGER COMMISSION IN PRESENCE OF

CONCEPT

STOCK RESERVE

Statement showing Correct Departmental Profits after charging Manager’s Commission

Particulars A B C

Departmental Profits (as given) after Manager’s

Commission

+ Manager’s Commission

= Departmental Profits before Unrealised Profits and

Manager’s Commission

- Unrealised Profits

= Departmental Profits after Unrealised Profits

- Manager’s Commission @ 10%

= Correct Departmental Profits

MEMORANDUM STOCK AND MEMORANDUM MARK UP ACCOUNT

CONCEPT

METHOD

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 38

In the Books of Head Office

Departmental Trading A/c

for year ending ________

Particulars Amount Particulars Amount

To Opening stock By Sales

To Purchases By Shortage

To Gross Profit By Closing Stock

Total Total

Memorandum Stock A/c

Particulars Amount Particulars Amount

To Balance b/d By Sales

To Purchases By P/L A/c – Cost of Shortage

By Memo Mark Up A/c – Load on

Shortage

By Memo Mark Up A/c – Mark

Down on Current Purchases

By Memo Mark Up A/c – Mark

Down on Opening Stock

By Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 39

Memorandum Mark Up A/c

Particulars Amount Particulars Amount

To Memo Stock A/c - Load on By Balance b/d – Load in Opening

Shortage Stock

To Memo Stock A/c - Mark Down By Memo Stock A/c - Load in

on Current Purchases Purchases

To Memo Stock A/c - Mark Down

on Opening Stock

To Gross Profit

To Balance c/d

Total Total

Working Note

Computation of Closing Stock

Particulars Amount

Closing Stock (from Memo Stock A/c)

+ Mark Down in closing stock

= Closing Stock at normal price

Mark up in Closing Stock

Net Mark up in Closing Stock Mark up in Closing Stock –

Mark Down in closing stock

Cost of Closing Stock (For Trading A/c)

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 40

BRANCH ACCOUNTING

CONCEPT BASICS

Nature ✓ A branch can be described as any establishment carrying on either the same

or substantially same activity as that carried on by the head office.

Presence of ✓ Branch means existence of the Head Office. There can’t be a branch without

H.O. the head office.

CONCEPT TYPES OF BRANCH

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 41

CONCEPT INLAND DEPENDENT BRANCH : DEBTORS METHOD

In the Books of Head Office

Branch A/c

Particulars Amount Particulars Amount

To Balance b/d By Balance b/d

: Stock : O/s Expenses

: Debtors By Stock Reserve (L)

: Petty Cash By Goods sent to branch (L)

: Fixed Assets By Goods returned to HO

To Goods sent to branch By Bank : Remittance to HO

To Goods returned to HO (L) : Cash Sales

To Bank : Amount sent by HO : Received from Debtors

: Expenses By Balance c/d

: Petty Cash : Stock

To Stock Reserve (L) : Debtors

To Balance c/d : Petty Cash

: O/s Expenses : Fixed Assets

To Net Profit By Net Loss

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 42

Memo Stock A/c

Particulars Amount Particulars Amount

To Balance b/d By Goods returned to HO

To Goods sent to Branch By Sales

To Sales Return By Loss

By Balance c/d

Total Total

Memo Debtors A/c

Particulars Amount Particulars Amount

To Balance b/d By Cash

To Credit Sales By Bad Debts

By Sales Returns

By Discount

By Balance c/d

Total Total

Petty Cash A/c

Particulars Amount Particulars Amount

To Balance b/d By Bank : Expense

To Bank : Amount received from By Balance c/d

HO

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 43

CONCEPT INLAND DEPENDENT BRANCH : FINAL ACCOUNTS METHOD

In the Books of Head Office

Trading and Profit & Loss A/c of Branch for year ending ________

Particulars Amount Particulars Amount

To Opening Stock By Sales

To Goods sent to Branch : Cash

(-) Goods returned by Branch : Credit

To Direct Expenses (-) Sales Returns

To Gross Profit By Abnormal Loss

By Closing Stock

Total Total

To Indirect Expenses By Gross Profit

: Discount to Customers

: Bad Debts

: Salaries & Wages

: Petty Expenses

To Abnormal Loss

To Net Profit

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 44

CONCEPT INLAND DEPENDENT BRANCH : STOCK & DEBTORS METHOD

In the Books of Head Office

Branch Stock A/c

Particulars Amount Particulars Amount

To Balance b/d By Goods returned to HO

To Goods sent to Branch By Bank : Cash Sales

To Br. Debtors : Sales Return By Br. Debtors : Credit Sales

To Br. Adjustment : Surplus By Abnormal Loss

By Normal Loss

By Balance c/d

Total Total

Branch Adjustment A/c

Particulars Amount Particulars Amount

To Goods Returned to HO (L) By Stock Reserve (L)

To Abnormal Loss By Goods Sent to Branch (L)

To Normal Loss By Br. Stock : Surplus

To Stock Reserve (L)

To Br. P/L : Gross Profit

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 45

Branch Debtors A/c

Particulars Amount Particulars Amount

To Balance b/d By Br. P/L

To Br. Stock : Credit Sales : Discount Allowed

: Bad Debts

By Br. Stock : Sales Return

By Bank : Collection

By Balance c/d

Total Total

Branch Expenses A/c

Particulars Amount Particulars Amount

To Bank A/c By Br. P/L

: Salaries & Wages

: Rent, Rates & Taxes

: Sundry Expenses

Total Total

Branch Profit & Loss A/c

Particulars Amount Particulars Amount

To Br. Debtors By Br. Adj – Gross Profit

: Discount to Customers

: Bad Debts

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 46

To Br. Expenses

To Abnormal Loss

To Net Profit

Total Total

Goods Sent to Branch A/c

Particulars Amount Particulars Amount

To Br. Stock A/c By Br. Stock A/c

To Br. Adjustment By Br. Adjustment

To Purchases/ Trading A/c

Total Total

CONCEPT INLAND DEPENDENT BRANCH : WHOLESALE PRICE METHOD

Trading and Profit & Loss A/c for year ending ______

Particulars HO Branch Particulars HO Branch

To Opening Stock By Goods sent to

Branch

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 47

To Goods received By Sales

from HO

To Purchases By Closing Stock

To Gross Profit (WN)

Total Total Total Total

To Indirect Expenses By Gross Profit

To Stock Reserve By Stock Reserve

(closing stock) (opening stock)

To Net Profit

Total Total Total Total

CONCEPT INLAND INDEPENDENT BRANCH

S. No. Particulars Books of Head Office Books of Branch

1. Goods dispatched Branch A/c Goods Received from HO A/c

by Head Office To Goods Sent to Branch A/c To HO A/c

2. Remittance by Cash A/c HO A/c

Branch To Branch A/c To Cash A/c

3. Collection from Cash A/c HO A/c

Debtors directly To Branch A/c To Debtors A/c

by HO

4. Return of goods Sales Return A/c HO A/c

by Debtors to HO To Branch A/c To Debtors A/c

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 48

5. Expenses of Branch A/c Expense A/c

branch paid by To Cash A/c To HO A/c

HO

6. Allocation of Branch A/c Expense A/c

expenses by HO To Expense A/c To HO A/c

to Branch

7. Fixed Asset A/c being maintained at HO

a. Fixed Asset Branch Fixed Asset A/c HO A/c

purchased by To Branch A/c To Cash/ Creditors A/c

Branch

b. Fixed Asset Branch Fixed Asset A/c -

purchased by To Cash/ Creditors A/c

Branch but paid

by HO

c. Depreciation on Branch A/c Depreciation A/c

such fixed asset To Branch Fixed Asset A/c To HO A/c

8. Cash in Transit Cash in Transit A/c -

To Branch A/c

9. Goods in Transit - Goods in Transit A/c

To HO A/c

PASSING SINGLE JOURNAL ENTRY BY HO FOR INTER BRANCH TRANSACTIONS

Statement Showing Inter Branch Transactions

Particulars Delhi Mumbai Chennai Kolkata

Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

(A) Delhi Branch

1. Received Goods

2. Sent Goods

3. B/R Received

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 49

4. Acceptances Sent

(B) Mumbai Branch

1. Received Goods

2. Cash Sent

(C) Chennai Branch

1. Received Goods

2. Cash Sent

(D) Kolkata Branch

1. Sent Goods

2. Paid Cash

Total 340000 400000 240000 228000 480000 200000 268000 500000

c/d 60000 12000 280000 232000

b/d 60000 12000 280000 232000

Books of Head Office

Journal Entry

Date Particulars L.F. Dr. Cr.

- Mumbai Branch A/c 12,000

Chennai Branch A/c 2,80,000

To Delhi Branch A/c 60,000

To Kolkata Branch A/c 2,32,000

INTER UNIT A/C RECONCILIATION

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 50

CONCEPT FOREIGN BRANCH

Exchange Rates Applicable for Conversion of Trial Balance

S. No. Particulars IFO NIFO

1. Opening Stock

2. Expenses

3. Incomes

4. Closing Assets

5. Fixed Assets (including

depreciation)

6. Closing Liabilities

7. Goods received from HO

8. Remittance to HO

9. Inter-Unit A/c

10. Exchange Difference

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 51

Trading and Profit & Loss A/c for year ending ________

Particulars Amount Particulars Amount

To Opening Stock By Sales

To Purchases By Closing Stock

To Goods from H.O.

To Direct Expenses

To Gross Profit

Total Total

To Indirect Expenses By Gross Profit

To Exchange Loss By Exchange Gain

To Net Profit

Total Total

Balance Sheet as at _______

Liabilities Amount Assets Amount

Net Profit Fixed Assets

Head Office A/c Bills Receivable

Trade creditors Trade debtors

Foreign Currency Trans. Reserve Cash at bank

Closing Stock

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 52

ACCOUNTS FROM INCOMPLETE RECORDS

CONCEPT CAPITAL COMPARISON APPROACH

Step 1 Find opening capital by preparing opening statement of affairs

Liabilities Amt. Assets Amt.

Capital Fixed Assets

Outside Liabilities Current Assets

Total Total

Step 2 Find closing capital by preparing closing statement of affairs

Liabilities Amt. Assets Amt.

Capital Fixed Assets

Outside Liabilities Current Assets

Total Total

Step 3 Finding profit by preparing statement of profit or Capital A/c

Capital A/c

Particulars Amt. Particulars Amt.

To Drawings By Balance b/d

To Interest on Drawings By Cash/ Bank

To Loss By Interest on Capital

To Balance c/d By Profit

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 53

Statement of Profit

Particulars Amount (₹)

Closing Capital

+ Drawings

+ Interest on Drawings

- Additional Capital

- Interest on Capital

- Opening Capital

= Profit/ (Loss)

CONCEPT FINAL ACCOUNTS APPROACH

Step 1 Prepare Trading A/c

Step 2 Prepare Profit & Loss A/c

Step 3 Prepare Balance Sheet

Step 4 Prepare Working Notes

I Opening Balance Sheet

II Debtors A/c

III Creditors A/c

IV Bills Receivable A/c

V Bills Payable A/c

VI Cash A/c

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 54

VII Bank A/c

VIII Fixed Asset A/c

IX Expenses A/c

Debtors A/c

Particulars Amount Particulars Amount

To Balance b/d By Cash

To Sales By Bank

To Bank By B/R

To Interest By Discount Allowed

To B/R By Bad Debts

To Bank By Sales Returns

To Bank By Allowances

To Creditor By Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 55

Bills Receivable A/c

Particulars Amount Particulars Amount

To Balance b/d By Bank

To Debtors By Discount

By Creditor

By Bill sent for collection

By Bank

By Debtors

By Balance c/d

Total Total

Creditors A/c

Particulars Amount Particulars Amount

To Cash By Balance b/d

To Bank By Purchases

To B/R By Debtors

To Discount Received By Bank

To Purchase Return By B/P

To B/P By Noting Charges

To Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 56

Bills Payable A/c

Particulars Amount Particulars Amount

To Bank By Balance b/d

To Creditors By Creditors

To Balance c/d

Total Total

Expenses A/c

Particulars Amount Particulars Amount

To Balance b/d By Balance b/d

To Cash/ Bank By P/L A/c

To Balance c/d By Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 57

FINAL ACCOUNTS OF COMPANIES

CONCEPT MANAGERIAL REMUNERATION – ADEQUATE PROFITS

WTD/ MD/ Only 1

Manager

More than 1

Part Time In presence of WTD/ MD/ Manager

Directors

In absence of WTD/ MD/ Manager

Company in general meeting may authorize the payment of remuneration exceeding 11% of net profits.

CONCEPT COMPUTATION OF NET PROFITS

Forward Approach Backward Approach

Gross Profit Net Profit

+ Allowed Incomes + Disallowed Expenses

- Allowed Expenses - Disallowed Incomes

Allowed ✓ All normal business expenses like rent, salaries etc.

Expenses

✓ Interest on debentures/ Loan

✓ Repairs

✓ Loss on sale of fixed asset

✓ Director’s fees

✓ Depreciation

✓ Bonus

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 58

Disallowed ✓ Any type of provision

Expenses

✓ Any appropriation

✓ Capital expenditure

✓ Commission to manager/ director

✓ Salary to manager/ director

Allowed ✓ Subsidies received from government

Incomes

✓ Interest on investment

✓ Transfer fees

✓ Profit on sale of fixed asset (Revenue Nature)

Disallowed ✓ Profit on sale of fixed asset (Capital Nature)

Incomes

✓ Premium on issue of shares/ debentures

✓ Any other capital income

CONCEPT MANAGERIAL REMUNERATION – INADEQUATE or NO PROFITS

Where in any financial year during the currency of tenure of a managerial person, a company has no

profits or its profits are inadequate, it may, pay remuneration to the managerial person as follows :

Effective Capital of Company Maximum yearly Remuneration

Negative or less than 5 crores

5 crores and above but less than 100 crores

100 crores and above but less than 250 crores

250 crores and above

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 59

✓ Remuneration in excess of above limits may be paid if shareholders pass a special resolution.

✓ For a period less than one year, the limits should be pro-rated.

CONCEPT EFFECTIVE CAPITAL

S. No. Particulars Amt. (₹)

1. Paid up Capital

2. Reserves & Surplus

3. Long term borrowings

4. Accumulated Losses

5. Preliminary Expenses not written off

6. Investment

CONCEPT PAYMENT OF DIVIDEND OUT OF RESERVES

General Rule ✓ Dividend can be declared and paid by a company only out of the profits or free

reserves.

Exception ✓ In the event of inadequacy or absence of profits in any year, a company may

declare dividend out of the accumulated profits earned by it in previous years

and transferred by it to the reserves, , subject to the fulfilment of the

following conditions as per Companies (Declaration and Payment of Dividend)

Rules, 2014.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 60

Condition 1

Condition 2

Condition 3

CONCEPT PREPARATION OF FINAL ACCOUNTS

Companies Act, 2013

The Third Schedule

(Section 129)

Part 1

BALANCE SHEET

Name of the Company ____________

Balance Sheet as at _____________

(₹ in _____)

S. No. Particulars Note Figures as at Figures as at

No. the end of the end of

current previous

reporting period reporting period

A. Equity & Liabilities

1. Shareholders' funds

a Share capital

Special Disclosure

✓ Shares issued for consideration other than cash

✓ Shares issued as fully paid bonus shares

✓ Shares bought back

b Reserves and Surplus

✓ Show all types of Reserves here

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 61

✓ Show all the appropriations here only (in Surplus A/c)

✓ Debit balance of statement of P/L shall be shown as a negative figure under the

head ‘Surplus’

c Money received against share warrants

2. Share application money pending

allotment

3. Non-current liabilities

a Long-term borrowings

✓ To be classified as secured or unsecured

✓ If secured, nature of security to be specified

b Deferred tax liabilities (Net)

c Other long term liabilities

d Long-term provisions

✓ Includes provision for employee benefits usually

4. Current liabilities

a Short-term borrowings

✓ Loan from bank repayable on demand

✓ Loans and advances from related parties

✓ To be classified as secured or unsecured

✓ If secured, nature of security to be specified

b Trade Payables

c Other current liabilities

Current liabilities for which there is no specific head. It will generally include following:

✓ Interest accrued but not due on borrowings

✓ Interest accrued and due on borrowings

✓ Current maturities of long-term debt

✓ Unpaid dividends

✓ Share application money pending refund

d Short-term provisions

Total _____________ _____________

B. Assets

1. Non-current assets

a

i Property, Plant and Equipment

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 62

It will mainly include the following :

✓ Land

✓ Building

✓ Plant & Equipment etc.

For each of these, disclose the following :

✓ Original Cost – Accumulated Depreciation = WDV/ BV

✓ Any addition or disposal

ii Intangible assets

It will mainly include the following :

✓ Goodwill

✓ Patents etc.

For each of these, disclose the following :

✓ Amount of amortization

✓ Any addition or disposal

iii Capital Work-in-progress

iv Intangible assets under development

b Non-current investments

It denotes the investments done for long-term. Following shall be disclosed :

✓ Aggregate amount of quoted investments and its market value

✓ Aggregate amount of unquoted investments

✓ Aggregate provision for diminution

c Deferred tax assets (Net)

d Long-term loans and advances

✓ Amount due by others beyond 12 months.

✓ To be classified as secured, unsecured or doubtful.

✓ Amount due by directors should be separately stated.

✓ Loans and advances to the related party to be separately stated.

e Other non-current assets

2. Current assets

a Current investments

It denotes the investments done for short-term. Following shall be disclosed :

✓ Basis of valuation

✓ Aggregate amount of quoted investments and its market value

✓ Aggregate amount of unquoted investments

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 63

✓ Aggregate provision for diminution

b Inventories

Inventories are to be classified as :

✓ Raw Material

✓ WIP

✓ FG

✓ Stock in trade

✓ Stores and spares

✓ Loose Tools

Mode of valuation of inventories must also be stated.

c Trade receivables

✓ It includes debtors and B/R.

✓ Debts due for > 6 months are to be separately stated.

d Cash and cash equivalents

It is to be classified as :

✓ Balance with banks

✓ Cheques or drafts in hand

✓ Cash in hand

Balance with banks is to be stated as

✓ With scheduled banks

✓ With other banks

e Short-term loans and advances

✓ Loans and advances to the related party to be separately stated.

f Other current assets

Current assets for which there is no specific head. It will generally include following:

✓ Prepaid expense

✓ Interest accrued on investments

Total _____________ _____________

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 64

Form II

STATEMENT OF PROFIT AND LOSS

Name of the Company ____________

Profit and loss statement for the year ended _____________

(₹ in _____)

S. No. Particulars Note Current Previous

No. reporting period reporting period

I Revenue from operations

II Other income

III Total Revenue (I + II)

IV Expenses:

Cost of materials consumed

Purchases of Stock-in-Trade

Changes in inventories of finished goods,

work-in-progress and Stock-in-Trade

Employee benefits expense

Finance costs

Depreciation and amortization expense

Other expenses

Total expenses

V Profit before tax (III - IV)

VI Provision for Tax

VII Profit after tax (V - VI)

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 65

CASH FLOW STATEMENT

CONCEPT MEANING OF CASH FLOW STATEMENT

✓ Cash flow Statement (CFS) is an additional information provided to the users of accounts in the

form of an statement, which reflects

❖ the various sources from where cash was generated (inflow of cash) and

❖ how these inflows were utilised (outflow of cash)

by an enterprise during the relevant accounting year.

CONCEPT MEANING OF CASH & CASH EQUIVALENTS

Cash ✓ It comprises

❖ Cash in Hand and

❖ Demand Deposits with the bank (cash at bank)

Cash ✓ These are short term highly liquid investments, readily convertible into known

Equivalents amounts of cash and subject to insignificant risk of change in value.

✓ Any investment will qualify as cash equivalent only if it has short maturity of 3

months or less from the date of acquisition.

✓ Example – Treasury Bill, Marketable Securities etc.

CONCEPT MEANING OF CASH FLOWS

Meaning These are inflows and outflows of cash & cash equivalents.

How does it ✓ Cash flow arises when the net effect of transaction is to

arise? ❖ either increase

❖ or decrease

the amount of cash and cash equivalents.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 66

CONCEPT FORMAT OF CASH FLOW STATEMENT

Name of Company

Cash Flow Statement

For year ending ………………

S.No. Particulars Amount (₹)

A. Cash Flow from Operating Activities

B. Cash Flow from Investing Activities

C. Cash Flow from Financing Activities

Net Cash and Cash Equivalents Generated during the year

+ Opening balance of Cash and Cash Equivalents

= Closing balance of Cash and Cash Equivalents

CONCEPT OPERATING ACTIVITIES

These are the principle revenue producing activities of enterprise and other activities which are not

investing or financing.

Cash Flow from Operating Activities (Direct Method)

Particulars Amount (₹)

Cash Sales

+ Cash received from Debtors

- Cash Purchases

- Cash made to Suppliers

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 67

- Payment made for operating expenses

(Example : Wages & Salaries, Office & Administration expenses, Manufacturing

Overheads, Selling & Distribution Expenses etc.)

= Cash Generated from Operations before Tax

- Income Tax Paid

+ Extraordinary items

(Example : Insurance Claim received w.r.t. stock lost by fire)

Cash Flow from Operating Activities (Indirect Method)

Particulars Amount (₹)

Profit earned during the year

+ Dividend

+ Transfer to Reserve

+ Provision for Tax

- Refund of Tax

- Extra-ordinary item credited to P/L A/c

(Insurance proceeds w.r.t. loss due to earthquake)

+ Extra-ordinary item debited to P/L A/c

(Loss due to earthquake)

= Net Profit before Tax & Extra-ordinary Item

: Adjustment for non-cash and non-operating items

+ Depreciation

+ Interest on Loan/ Debentures

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 68

+ Preliminary Expenses/ Intangible Assets etc. written off

+ Loss on sale of Investments/ Fixed Assets

- Profit on sale of Investments/ Fixed Assets

- Rental/ Dividend/ Interest Income

= Operating Profit before Working Capital Changes

+ Decrease in Current Assets

- Increase in Current Assets

- Decrease in Current Liabilities

+ Increase in Current Liabilities

= Cash Generated from Operations

- Income Tax Paid

+ Extraordinary items

(Insurance claim received w.r.t. stock lost by fire)

CONCEPT INVESTING ACTIVITIES

These are the acquisition and disposal of long-term assets and other investments not included in

cash equivalents.

Cash Flow from Investing Activities

Particulars Amount (₹)

Sale of Fixed Assets/ Investment

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 69

- Purchase of Fixed Assets/ Investment

+ Interest/ Dividend/ Rental Income Received

- Loans and advances granted to others

+ Repayment of Loans and advances received

- Income Tax paid (Capital Gain tax on sale of asset)

+ Extraordinary items

(Example : Insurance Claim received w.r.t. destruction of fixed asset)

CONCEPT FINANCING ACTIVITIES

These are the activities that result in changes in the size and composition of the owners’ capital

(including preference share capital) and borrowings (including short term borrowings) of the

enterprise.

Cash Flow from Financing Activities

Particulars Amount (₹)

Issue of share capital/ debentures for cash

+ Loan raised

- Buy back of equity shares

- Redemption of preference shares/ debentures

- Loan repaid

- Interest/ Dividend paid

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 70

CONCEPT SOME IMPORTANT ASPECTS

Interest & Dividend

Activity Non-Financing Org. Financing Org.

Interest Received

Dividend Received

Interest Paid

Dividend Paid

CONCEPT SOME IMPORTANT ACCOUNTS

Provision for Tax A/c

Particulars Amount Particulars Amount

To Advance Tax By Balance b/d

To Balance c/d By P/L A/c

Total Total

Advance Tax A/c

Particulars Amount Particulars Amount

To Balance b/d By Provision for Tax A/c

To Bank A/c By Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 71

Dividend Payable A/c

Particulars Amount Particulars Amount

To Bank A/c By Balance b/d

To Balance c/d By P/L A/c

Total Total

Investment A/c

Particulars Amount Particulars Amount

To Balance b/d By Bank A/c

To Bank A/c By P/L A/c

To P/L A/c By Dividend

By Balance c/d

Total Total

Fixed Asset A/c

Particulars Amount Particulars Amount

To Balance b/d By Depreciation

To Bank A/c By Bank A/c

To P/L A/c By P/L A/c

By Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 72

Fixed Asset A/c

Particulars Amount Particulars Amount

To Balance b/d By Accumulated Depreciation

To Bank A/c By Bank A/c

To P/L A/c By P/L A/c

By Accumulated Depreciation

By Balance c/d

Total Total

Accumulated Depreciation A/c

Particulars Amount Particulars Amount

To Fixed Asset A/c By Balance b/d

To Fixed Asset A/c By Depreciation

To Balance c/d

Total Total

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 73

PROFIT or LOSS PRE & POST INCORPORATION

CONCEPT PROFIT PRIOR TO INCORPORATION

✓ Usually, in the case of a newly formed company; an existing business is taken over as a going

concern at a date, prior to the date of incorporation of the Company.

✓ Thus; the profit (loss) earned (incurred) from the date of purchase to the date of incorporation

of the company, is called the “Profit (Loss) Prior to Incorporation.”

CONCEPT ACCOUNTING TREATMENT

Profit Prior to Incorporation Profit Post Incorporation

CONCEPT TIME RATIO

CONCEPT SALES RATIO

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 74

CONCEPT BASIS OF APPORTIONMENT

Item Example Basis of Apportionment

Gross Profit or Gross Loss

Expenses Related with the Carriage Outward

turnover Selling & Distribution Expenses

Advertisement Expenses

Discount Allowed

Traveller’s Commission

Sales Promotion

Bad Debts

Tax Audit Fees

Expenses Related with Time Salaries

Office & Administration Expenses

Rent, Rates & Taxes

Printing & Stationery

Depreciation

Travelling Expenses

Expenses Relating Exclusiv- Vendor‘s Salary

ely to Pre-Inc. Period Interest on Vendor‘s Capital

Expenses Relating Director‘s Fees

Exclusively to Post- Debenture Interest

Incorporation Period

Preliminary Expenses

Underwriting Commission

Audit Fees (relating to company)

Interest on Purchase From Date of Purchase - Date of

Consideration to Vendor Incorporation

From Date of Incorporation - Date of

Payment

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 75

CONCEPT COMPUTATION OF PRE & POST INCORPORATION PROFITS

Statement showing Pre and Post Incorporation Profits

for year ended ______

S.No. Particulars Basis of Pre – Post –

Distribution Incorporation Incorporation

A. Gross Profit SR

Total (A)

B. Expenses

1. Rent TR

2. Director’s Fees Only Post

3. Interest on Debentures Only Post

4. Audit Fees Only Post

5. Discount on Sales SR

6. Depreciation TR

7. Advertising SR

8. Interest to Vendor on PC Actual

Total (B)

C. Profit A-B

Transfer to Treated as

Capital Revenue

Reserve

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 76

BONUS & RIGHT ISSUE

CONCEPT BONUS ISSUE - BASICS

✓ Bonus issue means an issue of additional shares to existing shareholders free of cost in

proportion to their existing holding.

✓ Bonus issue is also known as ‘Capitalisation of Profits’. Capitalisation of profits refers to the

process of converting profits or reserves into paid up capital.

CONCEPT TYPES OF BONUS ISSUE

Issuing Fully Paid Bonus Shares Converting Partly paid up shares into fully

paid up

Utilisation of Reserves Issuing Fully Paid Bonus Converting Partly paid-up

Shares shares into fully paid up

CRR

Securities Premium

Capital Reserve

General Reserve/ Revenue Reserve

P/L A/c

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

P a g e | 77

Issuing Fully Paid Bonus Shares Converting Partly paid up shares into fully

paid up