Professional Documents

Culture Documents

AFAR 06-06 Joint Arrangement

AFAR 06-06 Joint Arrangement

Uploaded by

Live LoveCopyright:

Available Formats

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Chapter 29 - Shareholders' EquityDocument59 pagesChapter 29 - Shareholders' EquityDee100% (2)

- Presentation 1 INTRODUCTION TO DIGITAL AGE PDFDocument15 pagesPresentation 1 INTRODUCTION TO DIGITAL AGE PDFLive Love100% (1)

- Investment in AssocociateDocument10 pagesInvestment in AssocociateShaina SamonteNo ratings yet

- Module 10 Globalization and Human DevelopmentDocument6 pagesModule 10 Globalization and Human DevelopmentLive LoveNo ratings yet

- Investments (FAR)Document30 pagesInvestments (FAR)James CantorneNo ratings yet

- Intermediate Accounting Second Sem ReviewerDocument7 pagesIntermediate Accounting Second Sem ReviewerchxrlttxNo ratings yet

- Consolidated Financial StatementsDocument27 pagesConsolidated Financial StatementsAlyssa CasimiroNo ratings yet

- MS 06-06 Process CostingDocument6 pagesMS 06-06 Process CostingxernathanNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument27 pagesAnalysis and Interpretation of Financial StatementspatilgscribdNo ratings yet

- Contractually Agreed Sharing Relevant Activities Unanimous ConsentDocument3 pagesContractually Agreed Sharing Relevant Activities Unanimous ConsentKathleen MarcialNo ratings yet

- Notes Chapter 3 FARDocument4 pagesNotes Chapter 3 FARcpacfa100% (7)

- Operating Activities Are The Transactions From The Revenue Generating ActivitiesDocument3 pagesOperating Activities Are The Transactions From The Revenue Generating ActivitiesRaym FelixNo ratings yet

- Financial Statements of Sole Trader (Unit-04) PDFDocument3 pagesFinancial Statements of Sole Trader (Unit-04) PDFImadNo ratings yet

- On GoodwillDocument23 pagesOn GoodwillNabanita GhoshNo ratings yet

- Chapter 3 - Statement of Comprehensive IncomeDocument7 pagesChapter 3 - Statement of Comprehensive IncomeKarylle EntinoNo ratings yet

- Investment in Equity and Debt SecuritiesDocument3 pagesInvestment in Equity and Debt SecuritiesBryan ReyesNo ratings yet

- Introduction To Financial Statement Analysis ReviewwerDocument3 pagesIntroduction To Financial Statement Analysis ReviewwerMatthew PanganNo ratings yet

- Notes of Financial Statements or Final AccountsDocument11 pagesNotes of Financial Statements or Final Accountsrxcha.josephNo ratings yet

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Document8 pagesInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument27 pagesAnalysis and Interpretation of Financial StatementsRajesh PatilNo ratings yet

- Types of Business: Sole ProprietorshipDocument4 pagesTypes of Business: Sole ProprietorshipedrianclydeNo ratings yet

- CFR ProblemsDocument28 pagesCFR ProblemsMadhu kumarNo ratings yet

- Unit 02 Preparation of Financial Statement As Per IND AS 01Document13 pagesUnit 02 Preparation of Financial Statement As Per IND AS 01Deepak LNo ratings yet

- Week 1 - FAR 6804 NotesDocument1 pageWeek 1 - FAR 6804 NotesKent Raysil PamaongNo ratings yet

- FAR 15 Investment in AssociatesDocument2 pagesFAR 15 Investment in AssociatesShaira Mae DausNo ratings yet

- Joint ArrangementsDocument9 pagesJoint Arrangementscarlos antonio IbuanNo ratings yet

- 1344515616valuation of GoodwillDocument23 pages1344515616valuation of GoodwillvishalmehandirattaNo ratings yet

- Diya 1Document4 pagesDiya 1Vipul I PanchasarNo ratings yet

- H.09 Accounting For InvestmentsDocument14 pagesH.09 Accounting For Investmentschen.abellar.swuNo ratings yet

- FinUnderstandingacialn StatementsDocument77 pagesFinUnderstandingacialn StatementsrookeeNo ratings yet

- Ratio Analysis Part 1Document27 pagesRatio Analysis Part 1RAVI KUMARNo ratings yet

- Chapter 4 - CompleteDocument15 pagesChapter 4 - Completemohsin razaNo ratings yet

- 10532lectuer 5 FADocument28 pages10532lectuer 5 FANajia SalmanNo ratings yet

- Jurnal Eliminasi - Inter Company ProfitDocument14 pagesJurnal Eliminasi - Inter Company ProfitIrfan JayaNo ratings yet

- EyyyyDocument48 pagesEyyyyYsabel ApostolNo ratings yet

- Buscom NotesDocument2 pagesBuscom NotesLiza SoberanoNo ratings yet

- Marginal Costs (Extra Reading)Document15 pagesMarginal Costs (Extra Reading)Gabriel BelmonteNo ratings yet

- Summary of EliminationsDocument7 pagesSummary of EliminationsSella DestikaNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- Balance SheetDocument22 pagesBalance SheetKunal Khaparkar patilNo ratings yet

- Joint Arrangement PFRS 11Document4 pagesJoint Arrangement PFRS 11Mary Shiela Garcia MalayaNo ratings yet

- Statement of Comprehensive IncomeDocument6 pagesStatement of Comprehensive IncomeChinchin Ilagan DatayloNo ratings yet

- FAR NotesDocument11 pagesFAR NotesJhem Montoya OlendanNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- Actg101 Fs Prepa TemplateDocument16 pagesActg101 Fs Prepa TemplateJaira ClavoNo ratings yet

- Day 2 Dipifrs Weekend Batch 19022022Document21 pagesDay 2 Dipifrs Weekend Batch 19022022Kathleen De JesusNo ratings yet

- Cash Flow Statements6Document28 pagesCash Flow Statements6kimuli FreddieNo ratings yet

- Pertemuan 2: 18 September 2012Document21 pagesPertemuan 2: 18 September 2012Anonymous yMOMM9bsNo ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- Fund From OperationDocument1 pageFund From OperationGood VibesNo ratings yet

- Chapter 29Document35 pagesChapter 29Patty PaguianNo ratings yet

- Theory Capital GainDocument6 pagesTheory Capital GainRuthvik RevanthNo ratings yet

- Audit of Shareholders EquityDocument4 pagesAudit of Shareholders EquityVic BalmadridNo ratings yet

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- Financil Leverage, Operating Leverage, Combined LeverageDocument12 pagesFinancil Leverage, Operating Leverage, Combined LeverageChandan SinghNo ratings yet

- 6 - Consolidated Financial Statements P2 PDFDocument5 pages6 - Consolidated Financial Statements P2 PDFDarlene Faye Cabral RosalesNo ratings yet

- Profit and Loss AccountDocument10 pagesProfit and Loss AccountbaniNo ratings yet

- Investments For Investments in Equity Securities (Shares)Document2 pagesInvestments For Investments in Equity Securities (Shares)Carms St ClaireNo ratings yet

- Absorption MarginalDocument17 pagesAbsorption MarginalSHIVANSH BANSALNo ratings yet

- Quiz 1Document4 pagesQuiz 1Jannah Richel Dela PeñaNo ratings yet

- Dec. 31, 2016 Dec. 31, 2017Document1 pageDec. 31, 2016 Dec. 31, 2017Live LoveNo ratings yet

- Business Combinations: The New Basis, No Longer The PFRS 3Document7 pagesBusiness Combinations: The New Basis, No Longer The PFRS 3Live LoveNo ratings yet

- Home Office and BranchDocument9 pagesHome Office and BranchLive LoveNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Mavis Pinera Problem #1Document3 pagesMavis Pinera Problem #1Live LoveNo ratings yet

- Exercise 2Document1 pageExercise 2Live LoveNo ratings yet

- Final Exam Taxation 101Document8 pagesFinal Exam Taxation 101Live LoveNo ratings yet

- Audit of The Kai CorporationDocument1 pageAudit of The Kai CorporationLive LoveNo ratings yet

- Types ProbabilityDocument38 pagesTypes ProbabilityLive LoveNo ratings yet

- Pricing DecisionsDocument29 pagesPricing DecisionsLive Love100% (1)

- Financial Reporting and Management Reporting SystemsDocument40 pagesFinancial Reporting and Management Reporting SystemsLive LoveNo ratings yet

- Presentation 4 Social Evolution PDFDocument20 pagesPresentation 4 Social Evolution PDFLive Love0% (1)

- Presentation 3 Technological ChangeDocument15 pagesPresentation 3 Technological ChangeLive LoveNo ratings yet

- Cpa Review School of The Philippines Manila Management Advisory Services Relevant CostingDocument13 pagesCpa Review School of The Philippines Manila Management Advisory Services Relevant CostingLive LoveNo ratings yet

- Module 1 & 2 - Business Ethics and GovernanceDocument87 pagesModule 1 & 2 - Business Ethics and GovernanceLive LoveNo ratings yet

- Module 8-9 Big Data and E-ScienceDocument4 pagesModule 8-9 Big Data and E-ScienceLive LoveNo ratings yet

- Module 11-13b What Is Human DevelopmentDocument4 pagesModule 11-13b What Is Human DevelopmentLive LoveNo ratings yet

- Payment by Cession: Art 1255 ART 1255Document1 pagePayment by Cession: Art 1255 ART 1255Kyla BalboaNo ratings yet

- 6.daily Delivery ReportDocument3 pages6.daily Delivery ReportSridhar KodaliNo ratings yet

- 1Document5 pages1kyiu16 temuNo ratings yet

- NTNI - Statement of Management Responsibility - 2022 PDFDocument2 pagesNTNI - Statement of Management Responsibility - 2022 PDFmario j padillaNo ratings yet

- Title:-Growth and Survival Strategies: Subject: - Turnaround ManagementDocument10 pagesTitle:-Growth and Survival Strategies: Subject: - Turnaround ManagementAditya WarankarNo ratings yet

- Simulation of Queueing SystemDocument12 pagesSimulation of Queueing SystemSaikatNo ratings yet

- Network Tokenization Guide en UsDocument16 pagesNetwork Tokenization Guide en UsAbiy MulugetaNo ratings yet

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- Creating Marketing Magic and Innovative Future Marketing TrendsDocument1,319 pagesCreating Marketing Magic and Innovative Future Marketing TrendsWAN MUHAMMAD AZIM BIN WAN ABDUL AZIZNo ratings yet

- MCS NotesDocument3 pagesMCS Notesvijayadarshini vNo ratings yet

- Lean Playbook Series - The TPM Playbook - A Step-By-step Guideline For The Lean PractitionerDocument37 pagesLean Playbook Series - The TPM Playbook - A Step-By-step Guideline For The Lean PractitionerMatheus NascimentoNo ratings yet

- NEW! F&B Package - Higi Creative LabDocument15 pagesNEW! F&B Package - Higi Creative LabMédanais CroissanterieNo ratings yet

- AIDC - T11 - 21 22 Canteen Refurbishment Tender BOQ - 24 FEB 2022Document108 pagesAIDC - T11 - 21 22 Canteen Refurbishment Tender BOQ - 24 FEB 2022Ninetysix MultiserveNo ratings yet

- ESKOM RT D Research Direction ReportDocument111 pagesESKOM RT D Research Direction ReportOnthatileNo ratings yet

- Cooperative Strategy: Strategic Alliances: Prof. Supriti MishraDocument40 pagesCooperative Strategy: Strategic Alliances: Prof. Supriti MishraSiddharth Singh TomarNo ratings yet

- 7 - Conversion of Single Entry To Double Entry PDFDocument6 pages7 - Conversion of Single Entry To Double Entry PDFmiftah fauzi100% (2)

- Invoice 1382705917Document2 pagesInvoice 1382705917Comercializadora Manuel Valdes Alegria EIRLNo ratings yet

- Molty Foam PakistanDocument8 pagesMolty Foam Pakistankiranbakhtawar10No ratings yet

- 04 - 2019 Ealc Aer Deck - Palo AltoDocument112 pages04 - 2019 Ealc Aer Deck - Palo AltoCristiano MarquesNo ratings yet

- Money Habits - Saddleback ChurchDocument80 pagesMoney Habits - Saddleback ChurchAndriamihaja MichelNo ratings yet

- Sajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillDocument1 pageSajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillMuzammal HamadNo ratings yet

- Cost of CapitalDocument166 pagesCost of Capitalmruga_12350% (2)

- MODULE 1 - ECONOMIC GLOBALIZATION - CONTEMPORARY WORLD - PotDocument21 pagesMODULE 1 - ECONOMIC GLOBALIZATION - CONTEMPORARY WORLD - PotRyan PatarayNo ratings yet

- Media Planning Notes Module 1Document14 pagesMedia Planning Notes Module 1Shadow hackerNo ratings yet

- Preparing For Interview ICICIDocument2 pagesPreparing For Interview ICICIShaikh ShoebNo ratings yet

- End Term Exam ScheduleDocument3 pagesEnd Term Exam ScheduleSakshi ShardaNo ratings yet

- E BillDocument1 pageE BillparamgkNo ratings yet

- The Siaya County Water and Sanitation Bill 2018Document29 pagesThe Siaya County Water and Sanitation Bill 2018Dennis MwangiNo ratings yet

- The North Face Brand-GuidelineDocument42 pagesThe North Face Brand-GuidelinewayneNo ratings yet

- Hand Outs For RevalidaDocument97 pagesHand Outs For RevalidaMyrna B RoqueNo ratings yet

AFAR 06-06 Joint Arrangement

AFAR 06-06 Joint Arrangement

Uploaded by

Live LoveOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR 06-06 Joint Arrangement

AFAR 06-06 Joint Arrangement

Uploaded by

Live LoveCopyright:

Available Formats

AFAR 06-06 JOINT ARRANGEMENT

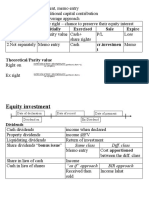

IFRS 11: Equity vs. Cost vs. Fair Value

IFRS 11 supersedes IAS 31 (Interest in JV) and SIC 13 (Jointly Controlled Entities)

IAS 31 & SIC 13 IFRS 11

Jointly Controlled Assets

Joint Operations

Jointly Controlled Operations

Jointly Controlled Entities Joint Ventures

IAS 24 Related Parties

Related Party/ies?

Ventures and Joint

Yes allocate UG/UL on Related Party Transactions

Venture

Venturer and Venturer No No Separate Vehicle Joint Operation

Joint Control – Collective Control of the Arrangement; and W/ Separate Vehicle Joint Venture/Joint

unanimous consent Operation

Separate vehicle – a newly formed entity (juridical entity)

Rights to the:

1. Legal Form

Net Assets Joint Venture 2. Terms of Arrangement

Assets and Liabilities Joint Operation 3. Other Factors or circumstances

Joint Venture Subject to Impairment Loss?

Publicly-listed Equity Method only Equity Method Yes

Corporations or Full

PFRS Cost Method Yes

SMEs Any of the ff: FV Method No – because the amount of UG/UL

• Equity Method represents the change in Carrying

• Cost Method Value of the Asset

• FV Method

Equity Method Applicable computation for:

Purchase Price XXX • IFRS 11 – CV of Investment in JV

• IFRS 3 & 10 – CV of Investment in

+ Transaction Cost XXX Subsidiary

+/- (Investment Income) • IAS 28 – CV of Investment on

Share in Net Income or Share XXX (XXX) Associate

in Net Loss

- Dividend Income (XXX)

- Impairment Loss (XXX) Investment Income includes:

• Share in Net Income or Share in

+ Gain on Reversal XXX Net Loss

Carrying Value of Investment XXX • Amortization of undervalued or

overvalued asset

P/L - Equity Method • Realized Profit or Realized Loss

(Investment Income) Share in • Unrealized Gain or Unrealized

Net Income or Share in Net XXX (XXX) Loss

Loss

Journal Entry:

- Impairment Loss (XXX)

Cash or Receivable XXX

+ Gain on Reversal XXX Investment XXX

P/L – Equity Method XXX

Cost Method

P/L - Cost Method

Purchase Price XXX

Dividend Income XXX

+ Transaction Cost XXX

- Impairment Loss (XXX)

- Impairment Loss (XXX)

+ Gain on Reversal XXX

+ Gain on Reversal XXX

P/L – Cost Method XXX

Carrying Value of Investment XXX

Fair Value Method P/L - FV Method

Purchase Price XXX Dividend Income XXX

+ Unrealized Gain XXX - Transaction Cost (XXX)

- Unrealized Loss (XXX) + Unrealized Gain XXX

Carrying Value of Investment XXX - Unrealized Loss (XXX)

P/L – FV Method XXX

CV of Investment = FV at December 31

If an SME opted to use Cost Method but there is a published price quotation or quoted market price -> the standard

requires the entity to use FAIR VALUE METHOD

If an SME opted to use FV Method but the FV cannot be determined reliably without undue cost and effort -> the

standard requires the entity to use COST METHOD

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Chapter 29 - Shareholders' EquityDocument59 pagesChapter 29 - Shareholders' EquityDee100% (2)

- Presentation 1 INTRODUCTION TO DIGITAL AGE PDFDocument15 pagesPresentation 1 INTRODUCTION TO DIGITAL AGE PDFLive Love100% (1)

- Investment in AssocociateDocument10 pagesInvestment in AssocociateShaina SamonteNo ratings yet

- Module 10 Globalization and Human DevelopmentDocument6 pagesModule 10 Globalization and Human DevelopmentLive LoveNo ratings yet

- Investments (FAR)Document30 pagesInvestments (FAR)James CantorneNo ratings yet

- Intermediate Accounting Second Sem ReviewerDocument7 pagesIntermediate Accounting Second Sem ReviewerchxrlttxNo ratings yet

- Consolidated Financial StatementsDocument27 pagesConsolidated Financial StatementsAlyssa CasimiroNo ratings yet

- MS 06-06 Process CostingDocument6 pagesMS 06-06 Process CostingxernathanNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument27 pagesAnalysis and Interpretation of Financial StatementspatilgscribdNo ratings yet

- Contractually Agreed Sharing Relevant Activities Unanimous ConsentDocument3 pagesContractually Agreed Sharing Relevant Activities Unanimous ConsentKathleen MarcialNo ratings yet

- Notes Chapter 3 FARDocument4 pagesNotes Chapter 3 FARcpacfa100% (7)

- Operating Activities Are The Transactions From The Revenue Generating ActivitiesDocument3 pagesOperating Activities Are The Transactions From The Revenue Generating ActivitiesRaym FelixNo ratings yet

- Financial Statements of Sole Trader (Unit-04) PDFDocument3 pagesFinancial Statements of Sole Trader (Unit-04) PDFImadNo ratings yet

- On GoodwillDocument23 pagesOn GoodwillNabanita GhoshNo ratings yet

- Chapter 3 - Statement of Comprehensive IncomeDocument7 pagesChapter 3 - Statement of Comprehensive IncomeKarylle EntinoNo ratings yet

- Investment in Equity and Debt SecuritiesDocument3 pagesInvestment in Equity and Debt SecuritiesBryan ReyesNo ratings yet

- Introduction To Financial Statement Analysis ReviewwerDocument3 pagesIntroduction To Financial Statement Analysis ReviewwerMatthew PanganNo ratings yet

- Notes of Financial Statements or Final AccountsDocument11 pagesNotes of Financial Statements or Final Accountsrxcha.josephNo ratings yet

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Document8 pagesInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument27 pagesAnalysis and Interpretation of Financial StatementsRajesh PatilNo ratings yet

- Types of Business: Sole ProprietorshipDocument4 pagesTypes of Business: Sole ProprietorshipedrianclydeNo ratings yet

- CFR ProblemsDocument28 pagesCFR ProblemsMadhu kumarNo ratings yet

- Unit 02 Preparation of Financial Statement As Per IND AS 01Document13 pagesUnit 02 Preparation of Financial Statement As Per IND AS 01Deepak LNo ratings yet

- Week 1 - FAR 6804 NotesDocument1 pageWeek 1 - FAR 6804 NotesKent Raysil PamaongNo ratings yet

- FAR 15 Investment in AssociatesDocument2 pagesFAR 15 Investment in AssociatesShaira Mae DausNo ratings yet

- Joint ArrangementsDocument9 pagesJoint Arrangementscarlos antonio IbuanNo ratings yet

- 1344515616valuation of GoodwillDocument23 pages1344515616valuation of GoodwillvishalmehandirattaNo ratings yet

- Diya 1Document4 pagesDiya 1Vipul I PanchasarNo ratings yet

- H.09 Accounting For InvestmentsDocument14 pagesH.09 Accounting For Investmentschen.abellar.swuNo ratings yet

- FinUnderstandingacialn StatementsDocument77 pagesFinUnderstandingacialn StatementsrookeeNo ratings yet

- Ratio Analysis Part 1Document27 pagesRatio Analysis Part 1RAVI KUMARNo ratings yet

- Chapter 4 - CompleteDocument15 pagesChapter 4 - Completemohsin razaNo ratings yet

- 10532lectuer 5 FADocument28 pages10532lectuer 5 FANajia SalmanNo ratings yet

- Jurnal Eliminasi - Inter Company ProfitDocument14 pagesJurnal Eliminasi - Inter Company ProfitIrfan JayaNo ratings yet

- EyyyyDocument48 pagesEyyyyYsabel ApostolNo ratings yet

- Buscom NotesDocument2 pagesBuscom NotesLiza SoberanoNo ratings yet

- Marginal Costs (Extra Reading)Document15 pagesMarginal Costs (Extra Reading)Gabriel BelmonteNo ratings yet

- Summary of EliminationsDocument7 pagesSummary of EliminationsSella DestikaNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsRositaNo ratings yet

- Balance SheetDocument22 pagesBalance SheetKunal Khaparkar patilNo ratings yet

- Joint Arrangement PFRS 11Document4 pagesJoint Arrangement PFRS 11Mary Shiela Garcia MalayaNo ratings yet

- Statement of Comprehensive IncomeDocument6 pagesStatement of Comprehensive IncomeChinchin Ilagan DatayloNo ratings yet

- FAR NotesDocument11 pagesFAR NotesJhem Montoya OlendanNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- Actg101 Fs Prepa TemplateDocument16 pagesActg101 Fs Prepa TemplateJaira ClavoNo ratings yet

- Day 2 Dipifrs Weekend Batch 19022022Document21 pagesDay 2 Dipifrs Weekend Batch 19022022Kathleen De JesusNo ratings yet

- Cash Flow Statements6Document28 pagesCash Flow Statements6kimuli FreddieNo ratings yet

- Pertemuan 2: 18 September 2012Document21 pagesPertemuan 2: 18 September 2012Anonymous yMOMM9bsNo ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- Fund From OperationDocument1 pageFund From OperationGood VibesNo ratings yet

- Chapter 29Document35 pagesChapter 29Patty PaguianNo ratings yet

- Theory Capital GainDocument6 pagesTheory Capital GainRuthvik RevanthNo ratings yet

- Audit of Shareholders EquityDocument4 pagesAudit of Shareholders EquityVic BalmadridNo ratings yet

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- Financil Leverage, Operating Leverage, Combined LeverageDocument12 pagesFinancil Leverage, Operating Leverage, Combined LeverageChandan SinghNo ratings yet

- 6 - Consolidated Financial Statements P2 PDFDocument5 pages6 - Consolidated Financial Statements P2 PDFDarlene Faye Cabral RosalesNo ratings yet

- Profit and Loss AccountDocument10 pagesProfit and Loss AccountbaniNo ratings yet

- Investments For Investments in Equity Securities (Shares)Document2 pagesInvestments For Investments in Equity Securities (Shares)Carms St ClaireNo ratings yet

- Absorption MarginalDocument17 pagesAbsorption MarginalSHIVANSH BANSALNo ratings yet

- Quiz 1Document4 pagesQuiz 1Jannah Richel Dela PeñaNo ratings yet

- Dec. 31, 2016 Dec. 31, 2017Document1 pageDec. 31, 2016 Dec. 31, 2017Live LoveNo ratings yet

- Business Combinations: The New Basis, No Longer The PFRS 3Document7 pagesBusiness Combinations: The New Basis, No Longer The PFRS 3Live LoveNo ratings yet

- Home Office and BranchDocument9 pagesHome Office and BranchLive LoveNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Mavis Pinera Problem #1Document3 pagesMavis Pinera Problem #1Live LoveNo ratings yet

- Exercise 2Document1 pageExercise 2Live LoveNo ratings yet

- Final Exam Taxation 101Document8 pagesFinal Exam Taxation 101Live LoveNo ratings yet

- Audit of The Kai CorporationDocument1 pageAudit of The Kai CorporationLive LoveNo ratings yet

- Types ProbabilityDocument38 pagesTypes ProbabilityLive LoveNo ratings yet

- Pricing DecisionsDocument29 pagesPricing DecisionsLive Love100% (1)

- Financial Reporting and Management Reporting SystemsDocument40 pagesFinancial Reporting and Management Reporting SystemsLive LoveNo ratings yet

- Presentation 4 Social Evolution PDFDocument20 pagesPresentation 4 Social Evolution PDFLive Love0% (1)

- Presentation 3 Technological ChangeDocument15 pagesPresentation 3 Technological ChangeLive LoveNo ratings yet

- Cpa Review School of The Philippines Manila Management Advisory Services Relevant CostingDocument13 pagesCpa Review School of The Philippines Manila Management Advisory Services Relevant CostingLive LoveNo ratings yet

- Module 1 & 2 - Business Ethics and GovernanceDocument87 pagesModule 1 & 2 - Business Ethics and GovernanceLive LoveNo ratings yet

- Module 8-9 Big Data and E-ScienceDocument4 pagesModule 8-9 Big Data and E-ScienceLive LoveNo ratings yet

- Module 11-13b What Is Human DevelopmentDocument4 pagesModule 11-13b What Is Human DevelopmentLive LoveNo ratings yet

- Payment by Cession: Art 1255 ART 1255Document1 pagePayment by Cession: Art 1255 ART 1255Kyla BalboaNo ratings yet

- 6.daily Delivery ReportDocument3 pages6.daily Delivery ReportSridhar KodaliNo ratings yet

- 1Document5 pages1kyiu16 temuNo ratings yet

- NTNI - Statement of Management Responsibility - 2022 PDFDocument2 pagesNTNI - Statement of Management Responsibility - 2022 PDFmario j padillaNo ratings yet

- Title:-Growth and Survival Strategies: Subject: - Turnaround ManagementDocument10 pagesTitle:-Growth and Survival Strategies: Subject: - Turnaround ManagementAditya WarankarNo ratings yet

- Simulation of Queueing SystemDocument12 pagesSimulation of Queueing SystemSaikatNo ratings yet

- Network Tokenization Guide en UsDocument16 pagesNetwork Tokenization Guide en UsAbiy MulugetaNo ratings yet

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- Creating Marketing Magic and Innovative Future Marketing TrendsDocument1,319 pagesCreating Marketing Magic and Innovative Future Marketing TrendsWAN MUHAMMAD AZIM BIN WAN ABDUL AZIZNo ratings yet

- MCS NotesDocument3 pagesMCS Notesvijayadarshini vNo ratings yet

- Lean Playbook Series - The TPM Playbook - A Step-By-step Guideline For The Lean PractitionerDocument37 pagesLean Playbook Series - The TPM Playbook - A Step-By-step Guideline For The Lean PractitionerMatheus NascimentoNo ratings yet

- NEW! F&B Package - Higi Creative LabDocument15 pagesNEW! F&B Package - Higi Creative LabMédanais CroissanterieNo ratings yet

- AIDC - T11 - 21 22 Canteen Refurbishment Tender BOQ - 24 FEB 2022Document108 pagesAIDC - T11 - 21 22 Canteen Refurbishment Tender BOQ - 24 FEB 2022Ninetysix MultiserveNo ratings yet

- ESKOM RT D Research Direction ReportDocument111 pagesESKOM RT D Research Direction ReportOnthatileNo ratings yet

- Cooperative Strategy: Strategic Alliances: Prof. Supriti MishraDocument40 pagesCooperative Strategy: Strategic Alliances: Prof. Supriti MishraSiddharth Singh TomarNo ratings yet

- 7 - Conversion of Single Entry To Double Entry PDFDocument6 pages7 - Conversion of Single Entry To Double Entry PDFmiftah fauzi100% (2)

- Invoice 1382705917Document2 pagesInvoice 1382705917Comercializadora Manuel Valdes Alegria EIRLNo ratings yet

- Molty Foam PakistanDocument8 pagesMolty Foam Pakistankiranbakhtawar10No ratings yet

- 04 - 2019 Ealc Aer Deck - Palo AltoDocument112 pages04 - 2019 Ealc Aer Deck - Palo AltoCristiano MarquesNo ratings yet

- Money Habits - Saddleback ChurchDocument80 pagesMoney Habits - Saddleback ChurchAndriamihaja MichelNo ratings yet

- Sajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillDocument1 pageSajawara S/O Keema P.No.1429 Bilal Town: Web Generated BillMuzammal HamadNo ratings yet

- Cost of CapitalDocument166 pagesCost of Capitalmruga_12350% (2)

- MODULE 1 - ECONOMIC GLOBALIZATION - CONTEMPORARY WORLD - PotDocument21 pagesMODULE 1 - ECONOMIC GLOBALIZATION - CONTEMPORARY WORLD - PotRyan PatarayNo ratings yet

- Media Planning Notes Module 1Document14 pagesMedia Planning Notes Module 1Shadow hackerNo ratings yet

- Preparing For Interview ICICIDocument2 pagesPreparing For Interview ICICIShaikh ShoebNo ratings yet

- End Term Exam ScheduleDocument3 pagesEnd Term Exam ScheduleSakshi ShardaNo ratings yet

- E BillDocument1 pageE BillparamgkNo ratings yet

- The Siaya County Water and Sanitation Bill 2018Document29 pagesThe Siaya County Water and Sanitation Bill 2018Dennis MwangiNo ratings yet

- The North Face Brand-GuidelineDocument42 pagesThe North Face Brand-GuidelinewayneNo ratings yet

- Hand Outs For RevalidaDocument97 pagesHand Outs For RevalidaMyrna B RoqueNo ratings yet