Professional Documents

Culture Documents

Additional Information Regarding Revenue and Collection: Revenue Revenue Recognition Point

Additional Information Regarding Revenue and Collection: Revenue Revenue Recognition Point

Uploaded by

wakoy answersOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Information Regarding Revenue and Collection: Revenue Revenue Recognition Point

Additional Information Regarding Revenue and Collection: Revenue Revenue Recognition Point

Uploaded by

wakoy answersCopyright:

Available Formats

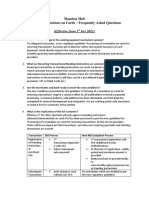

Additional information regarding Revenue and Collection:

Revenue Revenue Recognition Point

Licenses When services are rendered or when

Supervision and Regulation tickets or relevant document representing

Enforcement Fees violation are issued or if not practicable,

when fees are collected

Spectrum Usage Fees When bills are rendered for the use,

allocation and assignment of radio frequency

wave lengths or if not practicable,

when fees are collected

Inspection Fees When bills are rendered for the conduct of

inspection by authorized government

official or if not practicable, when fees are

collected.

Legal Fees, Verification and When filing fees are billed or if not

Authentication Fees, practicable, when fees are collected

Passport and Visa Fees, When fees are billed upon issuance of the

passport and visa or if not practicable,

when fees are collected

Processing Fees When fees are billed or collected for the

processing of documents for securing

permits/applications.

Other Service Income When fees are billed or if not practicable,

when fees are collected

Business Income

School Fees, Affiliation Fees, When fees are billed or if not practicable,

Examination Fees, Seminar/ when fees are collected.

Training Fees

Rent/Lease Income,

Communication Network Fees,

Transportation System Fees, When fees are billed for earned revenue from

Road Network Fees, Waterworks use of government property facilities or if

System Fees, Power Supply not practicable, when fees are collected.

System Fees, Seaport System

Fees, Landing and Parking Fees,

Income from Hostels/

Dormitories and Other Like

Facilities, Slaughterhouse, and

Other Service Income

Sales Revenue When the significant risks and rewards of

ownership have been transferred to the

buyer as indicated in the sales invoice

Hospital Fees When fees are billed for hospital and

related services rendered, or if not

practicable, when fees are collected

Share in the Profit of Joint When share in the profit is earned

Venture

Other Business Income When earned or if not practicable,

When fees are collected.

Further reading from GAM, Vol I:

Sec. 5. Sources of Revenue and Other Receipts

Sec. 6. Revenue from Exchange Transactions

Sec. 7. Recognition and Measurement of Revenue

Sec. 9. Impairment Losses and Allowance for Impairment Losses.

Sec. 10. Disclosure

Sec. 11. Revenue from Non-Exchange Transactions

Sec. 12. Recognition of Revenue from Non-Exchange Transactions.

Sec. 13. Measurement of Revenue from Non-Exchange Transactions

Sec. 13. Measurement of Revenue from Non-Exchange Transactions. Revenue from non-exchange

transactions shall be measured at the amount of the increase in net assets recognized by the

entity, unless it is also required to recognize a liability. Where a liability is recognized and

subsequently reduced, because the taxable event occurs, or a condition is satisfied, the amount

of the reduction in the liability will be recognized as revenue. (Pars. 48 and 49,PPSAS 23)

Sec. 14. Measurement of Assets on Initial Recognition from Non-Exchange Transactions.

An asset acquired through a non-exchange transaction shall initially be measured at its fair

value as at the date of acquisition. (Par. 42, PPSAS 33)

Sec. 15. Measurement of Liabilities on Initial Recognition.

Where the time value of money is material, the liability will be measured at the present value

of the amount expected to be required to settle the obligation. (Par. 58, PPSAS 23)

Sec. 16. Tax Revenue.

Taxes are economic benefits or service potential compulsory paid or payable to public sector

agencies, in accordance with laws and or regulations, established to provide revenue to the

government. Taxes do not include fines or other penalties imposed for breaches of the law,

unless otherwise specified in laws and regulations.

You might also like

- Financial Accounting I: Exercises: Exercise 1: Company H Applies The Deductible VAT Method and The Perpetual InventoryDocument16 pagesFinancial Accounting I: Exercises: Exercise 1: Company H Applies The Deductible VAT Method and The Perpetual InventoryKinomoto Sakura33% (3)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Lewisham Council Parking Enforcement Guidance NotesDocument21 pagesLewisham Council Parking Enforcement Guidance NotesMisterMustardNo ratings yet

- Chapter 4 Revenues and Other Receipts PDFDocument5 pagesChapter 4 Revenues and Other Receipts PDFSteffany Roque100% (1)

- Introduction To Liabilities: Topic OverviewDocument45 pagesIntroduction To Liabilities: Topic OverviewAngelie60% (5)

- RevenueDocument15 pagesRevenuePATRICIA PALADANNo ratings yet

- Chapter 5Document40 pagesChapter 5Celine ClaudioNo ratings yet

- Government Accounting Chapter 6Document33 pagesGovernment Accounting Chapter 6Charlagne LacreNo ratings yet

- Revenue and Other ReceiptsDocument17 pagesRevenue and Other ReceiptsMark Angelo BustosNo ratings yet

- Revenue and Other Receipts Sec. 1. Scope. This Chapter Provides The Standards, Policies, Guidelines, andDocument5 pagesRevenue and Other Receipts Sec. 1. Scope. This Chapter Provides The Standards, Policies, Guidelines, andimsana minatozakiNo ratings yet

- Reviewer in AccountingDocument180 pagesReviewer in AccountingJohn Kenneth YutatcoNo ratings yet

- TAXATION LAW 2019 Bar Exam Suggested AnswersDocument16 pagesTAXATION LAW 2019 Bar Exam Suggested AnswersRoxanne Peña100% (2)

- The Financial Reporting Workshop 6 February 2015 Laico Regency, NairobiDocument48 pagesThe Financial Reporting Workshop 6 February 2015 Laico Regency, Nairobicauseway.isNo ratings yet

- A.) Prea5 Module 3.1Document18 pagesA.) Prea5 Module 3.1Hana SukoshiNo ratings yet

- Payment Agreement Revised October 2013Document3 pagesPayment Agreement Revised October 2013ayudoemprendedoresNo ratings yet

- Share-Based Payment Transaction Is A Transaction in Which The EntityDocument3 pagesShare-Based Payment Transaction Is A Transaction in Which The EntityAryan LeeNo ratings yet

- CCC Agnpo Lesson5 2021 2022Document4 pagesCCC Agnpo Lesson5 2021 2022Jr PedidaNo ratings yet

- AS-Revenue RecognitionDocument15 pagesAS-Revenue RecognitionPRASHANT DASHNo ratings yet

- Government Accounting NotesDocument12 pagesGovernment Accounting NotesJAPNo ratings yet

- AGB Ab 10 - 2017 - ENGDocument2 pagesAGB Ab 10 - 2017 - ENGKathryn QuinnNo ratings yet

- Chap 5-Revenue Other ReceiptsDocument30 pagesChap 5-Revenue Other ReceiptsSarina Amor Paderan Cabacaba100% (1)

- Changes in Service Tax Laws: Prepared By: CA - Narottam Rawat & CA - Ritesh DagaDocument12 pagesChanges in Service Tax Laws: Prepared By: CA - Narottam Rawat & CA - Ritesh DagaAkhil PrasharNo ratings yet

- Netspend All-Access AccountDocument35 pagesNetspend All-Access Accountchristopherhowell269100% (1)

- Revenues and Other ReceiptsDocument45 pagesRevenues and Other ReceiptsFrank James100% (1)

- Also Refer Ppts & Annual Reports and You May Add A Few More Points Educational InstitutesDocument4 pagesAlso Refer Ppts & Annual Reports and You May Add A Few More Points Educational InstitutesMADHURAM SHARMANo ratings yet

- ReportDocument18 pagesReportMargaux CornetaNo ratings yet

- IFRS vs. IFRS For SMEsDocument33 pagesIFRS vs. IFRS For SMEsLohraine DyNo ratings yet

- Chapter 3 Accounting For Revenue Other ReceiptsDocument15 pagesChapter 3 Accounting For Revenue Other ReceiptsSuzanne SenadreNo ratings yet

- Chapter 4Document46 pagesChapter 4Clove Wall100% (1)

- Mandate Hub Standing Instructions On Cards - Frequently Asked QuestionsDocument4 pagesMandate Hub Standing Instructions On Cards - Frequently Asked QuestionsHarpreet singh SinghNo ratings yet

- Revenue and Other Receipts: Revenue From Exchange TransactionsDocument6 pagesRevenue and Other Receipts: Revenue From Exchange TransactionsMaria Cecilia ReyesNo ratings yet

- SC Caa PDFDocument33 pagesSC Caa PDFLoveth BethelNo ratings yet

- 4 Franchise Ifrs 15 2020Document15 pages4 Franchise Ifrs 15 2020natalie clyde matesNo ratings yet

- Remedies: of The GovernmentDocument51 pagesRemedies: of The GovernmentRay John Uy-Maldecer AgregadoNo ratings yet

- GST PresentationDocument22 pagesGST PresentationSakshi SinghNo ratings yet

- Paytm Agreement - GLOOMING DIGITAL PRIVATE LIMITED - EncryptedDocument30 pagesPaytm Agreement - GLOOMING DIGITAL PRIVATE LIMITED - EncryptedEshaan AnandNo ratings yet

- Chapter 4Document8 pagesChapter 4ShantalNo ratings yet

- Accounting Standards 7,9,10Document10 pagesAccounting Standards 7,9,10Nishita ShivkarNo ratings yet

- SC CaaDocument39 pagesSC CaaLucas ToralessNo ratings yet

- Chapter 5 Accounting For Revenue and Other ReceiptsDocument49 pagesChapter 5 Accounting For Revenue and Other ReceiptsKapoy-eeh Lazan100% (1)

- Accounting Standard-9: Revenue RecognitionDocument9 pagesAccounting Standard-9: Revenue RecognitionTanvi GuptaNo ratings yet

- Lecture Notes: Afar 2817 Franchise Accounting (New) Batch May 2020Document3 pagesLecture Notes: Afar 2817 Franchise Accounting (New) Batch May 2020Justine TadeoNo ratings yet

- It Return SopDocument2 pagesIt Return SopTushar AmruskarNo ratings yet

- Client Account Agreement: Windsor Brokers (SC) LimitedDocument40 pagesClient Account Agreement: Windsor Brokers (SC) LimitedElamo OfficialNo ratings yet

- SimonDocument4 pagesSimonelklote89No ratings yet

- Transact in Trust AccountDocument31 pagesTransact in Trust AccountSachNo ratings yet

- PH Gam - Revenues and Other ReceiptsDocument7 pagesPH Gam - Revenues and Other ReceiptsNabelah OdalNo ratings yet

- Chapter-5 (Input Tax Credit)Document30 pagesChapter-5 (Input Tax Credit)pronab sarkerNo ratings yet

- Hadee Lutful & Co.: Presented byDocument7 pagesHadee Lutful & Co.: Presented byColors of LifeNo ratings yet

- Chapter 4 Revenue and Other ReceiptsDocument46 pagesChapter 4 Revenue and Other Receiptsroselynm18100% (1)

- TAX-1501 (Documentary Stamp Tax)Document11 pagesTAX-1501 (Documentary Stamp Tax)Ferb CruzadaNo ratings yet

- Government Accounting ReviewerDocument8 pagesGovernment Accounting ReviewerJoana loize CapistranoNo ratings yet

- Acctg For Revenue and Other ReceiptsDocument6 pagesAcctg For Revenue and Other ReceiptsLeonard CanamoNo ratings yet

- Policy For Evaluation of Claims 0Document3 pagesPolicy For Evaluation of Claims 0Suraj Kumar AanandNo ratings yet

- MUS MandateDocument4 pagesMUS MandateOneMinuteVideosNo ratings yet

- CCC Agnpo Lesson4 2021 2022Document4 pagesCCC Agnpo Lesson4 2021 2022Jr PedidaNo ratings yet

- P4 - Corporate Financial Reporting: Ifrs 2 Share Base PaymentsDocument41 pagesP4 - Corporate Financial Reporting: Ifrs 2 Share Base PaymentsnasirNo ratings yet

- Pas 2Document2 pagesPas 2MMBRIMBAPNo ratings yet

- Chapter 6 - Accounting For Revenue and Other ReceiptsDocument7 pagesChapter 6 - Accounting For Revenue and Other ReceiptsAdan EveNo ratings yet

- 8 FranchiseDocument8 pages8 FranchiseDJAN IHIAZEL DELA CUADRANo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Intacc Chapter 49-50Document17 pagesIntacc Chapter 49-50Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- IntroBusTax QuestsDocument9 pagesIntroBusTax QuestsTwish BarriosNo ratings yet

- Organization and Management: Module 4: Quarter 1, Week 3 & 4Document18 pagesOrganization and Management: Module 4: Quarter 1, Week 3 & 4juvelyn luegoNo ratings yet

- Personal Finance 2nd Edition Walker Solutions ManualDocument25 pagesPersonal Finance 2nd Edition Walker Solutions ManualElaineStewartrbdt100% (58)

- FCFF Formula Excel - TemplateDocument5 pagesFCFF Formula Excel - TemplateSakshi KatochNo ratings yet

- Cash Management at Sbi BankDocument75 pagesCash Management at Sbi BankNivesh GurungNo ratings yet

- Tax RemediesDocument22 pagesTax RemediesJezreel CastañagaNo ratings yet

- Castrol - Annual Report - 2015Document115 pagesCastrol - Annual Report - 2015Navneet YadavNo ratings yet

- FIA MA1 Course Exam MOCK 3 QuestionsDocument12 pagesFIA MA1 Course Exam MOCK 3 QuestionsBharat Kabariya67% (3)

- 07 Budget ReportDocument2 pages07 Budget ReportTijana DoberšekNo ratings yet

- Fundamentals of Accounting II, Chapter 4Document71 pagesFundamentals of Accounting II, Chapter 4Mohammed AbdulselamNo ratings yet

- Practice Sheet Session 11Document11 pagesPractice Sheet Session 11Savana AndiraNo ratings yet

- 025259000101011Document48 pages025259000101011Bruno EnriqueNo ratings yet

- W2020 ACC100 Financial Statement AnalysisDocument5 pagesW2020 ACC100 Financial Statement AnalysisMahmoud ZizoNo ratings yet

- Class XII Macro Economics Chapter 2 VedantuDocument9 pagesClass XII Macro Economics Chapter 2 VedantuMagic In the airNo ratings yet

- Ipr2020 - Rosales, Josha IzzavelleDocument2 pagesIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanNo ratings yet

- Tybaf Sem6 Ca-Iv Apr19Document3 pagesTybaf Sem6 Ca-Iv Apr19kg704939No ratings yet

- FYBCOM MCQ AllDocument9 pagesFYBCOM MCQ AllRevati kulkarniNo ratings yet

- Taxes On Natural ResourcesDocument28 pagesTaxes On Natural ResourcesObeng CliffNo ratings yet

- Fa - IiDocument8 pagesFa - IiMesele AdemeNo ratings yet

- Proof of IncomeDocument3 pagesProof of IncomeKenan DuranNo ratings yet

- Deceased Depositor Information: Traditional/Roth IRA Plan Beneficiary Distribution Election FormDocument2 pagesDeceased Depositor Information: Traditional/Roth IRA Plan Beneficiary Distribution Election FormJohn Christian ReyesNo ratings yet

- Mughal Mansabdari SystemDocument8 pagesMughal Mansabdari SystemLettisha LijuNo ratings yet

- International Transfer PricingDocument60 pagesInternational Transfer Pricingeconomic life - الحياة الاقتصاديةNo ratings yet

- Computation 22-23Document2 pagesComputation 22-23Ruloans VaishaliNo ratings yet

- Confidential MR James Muster Sample Street 11 8000 Zürich: Human ResourcesDocument1 pageConfidential MR James Muster Sample Street 11 8000 Zürich: Human ResourcesPramod BhosaleNo ratings yet

- FABM 2 QuizDocument2 pagesFABM 2 QuizShann 2No ratings yet

- Case Study 1Document1 pageCase Study 1Pau AderinNo ratings yet

- Accounting Standard of Mahindra and Mahindra LTDDocument9 pagesAccounting Standard of Mahindra and Mahindra LTDDheeraj shettyNo ratings yet