Professional Documents

Culture Documents

02 Company Announcement

02 Company Announcement

Uploaded by

Thanh-Phu TranCopyright:

Available Formats

You might also like

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- V80Document18 pagesV80es9857No ratings yet

- MAN ACC ProjectDocument7 pagesMAN ACC ProjectNurassylNo ratings yet

- 4MW Platform BrochureDocument24 pages4MW Platform BrochureBenjamin Verusi100% (1)

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Blade ServicesDocument16 pagesBlade Servicesfotopredic100% (1)

- List of Turbine ManufacturersDocument10 pagesList of Turbine ManufacturersRaghu SubranNo ratings yet

- Energjia e Eres PDFDocument14 pagesEnergjia e Eres PDFQamil100% (2)

- Appendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Document21 pagesAppendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Anonymous 6tuR1hzNo ratings yet

- Of A400M and Ticketing ProgrammesDocument11 pagesOf A400M and Ticketing ProgrammesIngegneria Aerospaziale PadovaNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- 2024 02 22 2023 Annual Report RBIDocument273 pages2024 02 22 2023 Annual Report RBIemiliowebster6833No ratings yet

- Interim Financial Report As at September 30 2023Document15 pagesInterim Financial Report As at September 30 2023sofian aitNo ratings yet

- 3VM11165EE320AA0 Datasheet enDocument269 pages3VM11165EE320AA0 Datasheet enomarqasimNo ratings yet

- Finning Q3 2023 Interim Report Nov 6 2023Document64 pagesFinning Q3 2023 Interim Report Nov 6 2023Allan ShepherdNo ratings yet

- Daiwa - Sunonwealth (2421TT) - Lifting TP To 141, Buy Unchanged 20231103Document7 pagesDaiwa - Sunonwealth (2421TT) - Lifting TP To 141, Buy Unchanged 20231103jungiam.wNo ratings yet

- (A) Nature of Business of Cepatwawasan Group BerhadDocument16 pages(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNo ratings yet

- Business CaseDocument11 pagesBusiness CasesomeshNo ratings yet

- Equity Note - Walton Hi-Tech Industries Ltd. - September 2021Document4 pagesEquity Note - Walton Hi-Tech Industries Ltd. - September 2021vjqzjf4m5tNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Siemens Company PresentationDocument35 pagesSiemens Company PresentationOleksandr Ivanov100% (1)

- Global StrategyDocument14 pagesGlobal StrategyclareNo ratings yet

- Indra Press ReleaseDocument13 pagesIndra Press ReleaseTwobirds Flying PublicationsNo ratings yet

- Bayer Annual Report 2018 PDFDocument279 pagesBayer Annual Report 2018 PDFJimena CaycedoNo ratings yet

- Bayer Annual Report 2020Document265 pagesBayer Annual Report 2020Kaushal RajoraNo ratings yet

- .+Energy+and+Other+gross+profit AfterDocument41 pages.+Energy+and+Other+gross+profit AfterAkash ChauhanNo ratings yet

- 6.+Energy+and+Other+revenue BeforeDocument37 pages6.+Energy+and+Other+revenue BeforeThe SturdyTubersNo ratings yet

- 8.+opex BeforeDocument45 pages8.+opex BeforeThe SturdyTubersNo ratings yet

- 6.+Energy+and+Other+Revenue AfterDocument37 pages6.+Energy+and+Other+Revenue AftervictoriaNo ratings yet

- 2.+average+of+price+models BeforeDocument23 pages2.+average+of+price+models BeforeMuskan AroraNo ratings yet

- Seplat Energy Fy 21 Results - Final - 28022022Document180 pagesSeplat Energy Fy 21 Results - Final - 28022022ZAINAB OLADIPONo ratings yet

- Interim Report Q1 2021 (PROT)Document18 pagesInterim Report Q1 2021 (PROT)Derek FrancisNo ratings yet

- Repsol LubeDocument46 pagesRepsol LubeDharshan MylvaganamNo ratings yet

- Factbook 2021 Version XLSXDocument108 pagesFactbook 2021 Version XLSXMohamed KadriNo ratings yet

- Maroc Telecom KPI-Q12022Document9 pagesMaroc Telecom KPI-Q12022Youssef JaafarNo ratings yet

- Bayer Ag Annual Report 2019 PDFDocument239 pagesBayer Ag Annual Report 2019 PDFkrrajanNo ratings yet

- Atos Annual Results 2021Document28 pagesAtos Annual Results 2021Anand TajneNo ratings yet

- GB 2017 en PDFDocument230 pagesGB 2017 en PDFMachita StefanNo ratings yet

- 2024 - 02 - 01 - Ferrari - FY 2023 Results PresentationDocument31 pages2024 - 02 - 01 - Ferrari - FY 2023 Results Presentationriccardosmaldone33No ratings yet

- Budget 2022-2024Document30 pagesBudget 2022-2024Khaled ShangabNo ratings yet

- Midyear Meeting - EMC CKDocument7 pagesMidyear Meeting - EMC CKmaryatinurbayaNo ratings yet

- Vodafone Bid HBS Case - ExhibitsDocument13 pagesVodafone Bid HBS Case - ExhibitsNaman PorwalNo ratings yet

- Thales Reports Its 9m 2023 Order Intake and Sales - Press Release - 31 October 2023 - 0Document8 pagesThales Reports Its 9m 2023 Order Intake and Sales - Press Release - 31 October 2023 - 0jbsNo ratings yet

- 2021 Annual ReportDocument124 pages2021 Annual Reportnilan90531No ratings yet

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Wärtsilä q1 2024 Interim ReportDocument28 pagesWärtsilä q1 2024 Interim ReportKevin ParkerNo ratings yet

- FINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Document6 pagesFINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Hridi RahmanNo ratings yet

- Earnings ReleaseDocument5 pagesEarnings Releaseamira alyNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- Equity Research: Result UpdateDocument8 pagesEquity Research: Result UpdateyolandaNo ratings yet

- SS Cloud Business PlanDocument5 pagesSS Cloud Business Planminhbu114No ratings yet

- Bayer Annual Report 2016Document344 pagesBayer Annual Report 2016Ojo-publico.comNo ratings yet

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- Comcast Model ShareableDocument27 pagesComcast Model Shareablep44153No ratings yet

- YE'22Document12 pagesYE'22parshvaj0312No ratings yet

- Year-End Report 2023: 31 January 2024Document21 pagesYear-End Report 2023: 31 January 2024YOANN HEBRARDNo ratings yet

- Q1 2021 Earning ReleaseDocument4 pagesQ1 2021 Earning ReleaseliNo ratings yet

- Instructor: Assumptions / InputsDocument17 pagesInstructor: Assumptions / InputsJoAnna MonfilsNo ratings yet

- Factbook 2020Document99 pagesFactbook 2020Mohamed KadriNo ratings yet

- Ryanair 2023 Annual ReportDocument244 pagesRyanair 2023 Annual ReportWestCoastAsianNo ratings yet

- Tesla Company AnalysisDocument83 pagesTesla Company AnalysisStevenTsaiNo ratings yet

- Pvatepla q3 2023 enDocument14 pagesPvatepla q3 2023 enrogercabreNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Engineering Procurement Construction EPCDocument2 pagesEngineering Procurement Construction EPCfotopredicNo ratings yet

- V90-1.8 MW & 2.0 MW High Output in Modest WindsDocument6 pagesV90-1.8 MW & 2.0 MW High Output in Modest WindsARUP1976No ratings yet

- Reported Wind Turbine Blade BreaksDocument3 pagesReported Wind Turbine Blade BreaksLuiza ValladaresNo ratings yet

- 4MW Platform BrochureDocument28 pages4MW Platform BrochureChami LiyanageNo ratings yet

- V112-3MW & VTCDocument50 pagesV112-3MW & VTCManuel PalopNo ratings yet

- 196 Vestas Case Study WerstDocument18 pages196 Vestas Case Study WerstAxel DominiqueNo ratings yet

- Aviation Obstruction LightsDocument2 pagesAviation Obstruction LightsfotopredicNo ratings yet

- Vestas Track Record 2019 Q2Document8 pagesVestas Track Record 2019 Q2Squall LeonhartNo ratings yet

- Suzlon Strategic AnalysisDocument78 pagesSuzlon Strategic AnalysisGargiNM88% (24)

- 3 MW Product BrochureDocument16 pages3 MW Product BrochuremaniacfornicNo ratings yet

- Reference List Gearbox 2018 04Document5 pagesReference List Gearbox 2018 04balaNo ratings yet

- File PDFDocument30 pagesFile PDFluluNo ratings yet

- © Liftra Presentation 2016Document16 pages© Liftra Presentation 2016mpk8588No ratings yet

- Global Wind Turbine Markets and Strategies, 2009-2020: New Market StudyDocument6 pagesGlobal Wind Turbine Markets and Strategies, 2009-2020: New Market Studybulk_purchaseNo ratings yet

- VestasOperatingManual 1Document37 pagesVestasOperatingManual 1سامح الجاسمNo ratings yet

- Pitch Versus Stall Wind EnergyDocument3 pagesPitch Versus Stall Wind EnergyUmer AbbasNo ratings yet

- Pip - September 2012 (Second Edition)Document53 pagesPip - September 2012 (Second Edition)Fabio MiguelNo ratings yet

- 4 MW Product BrochureDocument2 pages4 MW Product BrochureAdrian Martin BarrionuevoNo ratings yet

- Simapro ExerciseDocument2 pagesSimapro Exerciseburty1No ratings yet

- Offshore Wind Energy Market Overview: Ian Baring GouldDocument28 pagesOffshore Wind Energy Market Overview: Ian Baring GouldTanna ChangNo ratings yet

- The Power of HR Analytics in Strategic Planning PDFDocument34 pagesThe Power of HR Analytics in Strategic Planning PDFviji100% (1)

- Vestas V47 BladesDocument2 pagesVestas V47 Bladesbala100% (1)

- Realise DEIF Controller Retrofit Information PDFDocument2 pagesRealise DEIF Controller Retrofit Information PDFAbhinav ChoudharyNo ratings yet

- Vestas 8 - 3.3 MWDocument16 pagesVestas 8 - 3.3 MWSebastiánNo ratings yet

- Wind Energy TechnologyDocument15 pagesWind Energy Technologytntntn86No ratings yet

02 Company Announcement

02 Company Announcement

Uploaded by

Thanh-Phu TranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Company Announcement

02 Company Announcement

Uploaded by

Thanh-Phu TranCopyright:

Available Formats

Company announcement from

Vestas Wind Systems A/S

Aarhus, 8 February 2023

Company announcement no. 02/2023

Page 1 of 6

Vestas Annual Report 2022 – A challenging year with negative profitability

Summary: Vestas’ 2022 revenue amounted to EUR 14,486m (outlook: EUR 14.5-15.5bn), with an EBIT

margin before special items of (8) percent (outlook: approx. (5) percent), and total investments 1 of EUR

758m (outlook: approx. EUR 850m). The value of the combined order backlog increased to EUR 49.5bn

across Power Solutions and Service.

As announced on 27 January 2023, Vestas’ outlook for 2023 is as follows: Revenue is expected to range

between EUR 14.0bn and 15.5bn, including Service revenue. Vestas expects to achieve an EBIT margin

before special items of (2)-3 percent, and total investments1 are expected to amount to approx. EUR

1bn in 2023.

In addition to what has already been communicated, revenue in the Service segment is expected to

grow by min. 5 percent in 2023, with a service EBIT margin of approx. 22 percent.

The Board of Directors of Vestas Wind Systems A/S proposes to the Annual General Meeting that no

dividend payment will be distributed to the shareholders in 2023.

Henrik Andersen, Group President & CEO said: “Vestas and the wind industry remained challenged in

2022 as external headwinds and industry immaturity hampered profitability and resulted in unsatisfying

financial results for the full year. In a business environment characterised by unforeseen geo-political

uncertainty, high inflation, and supply chain constraints, Vestas’ more than 28,000 employees helped

achieve EUR 14.5bn in revenue, 13.3 GW of deliveries and a firm order intake of 11.2 GW. Through

strong commercial discipline, we managed to raise the average selling price with 29 percent to EUR

1.07m/MW and finished the year with an all-time high order intake in terms of value in the fourth quarter.

Our Service business progressed well and grew 27 percent year-over-year, continuing to increase its

positive contribution to our revenue and earnings. In 2022, we also made strategic progress within

Offshore by securing more than 5 GW of preferred supplier agreements for the V236-15.0 MW turbine,

while a technological milestone was reached when the V236-15.0 MW prototype produced its first kWh

in late December. Our Development business also progressed well by securing 13 GW of new pipeline.

Throughout 2022, increasing costs, product impairments and increased warranty provisions heavily

impacted our profitability and resulted in an EBIT margin of minus 8 percent. Everyone at Vestas is

therefore fully focused on returning to profitability in 2023 to reaffirm that we are on the right strategic

path. Building a sustainable, scalable, and profitable wind industry also requires we continue to build

industry maturity and commercial discipline, and we want to say a special thanks to our shareholders

for their continuous support during these challenging times.”

1

Excl. acquisitions of subsidiaries, joint ventures, and associates, and financial investments.

Vestas Wind Systems A/S Hedeager 42, 8200 Aarhus, Denmark

Tel: +45 9730 0000, Fax: +45 9730 0001, vestas@vestas.com, vestas.com

Company Reg. No.: 10 40 37 82, Company Reg. Name: Vestas Wind Systems A/S

Page 1 of 6

Key highlights

Revenue of EUR 14.5bn

Revenue decline compared with 2021 driven by Russia/Ukraine exit as well as project delays.

EBIT margin of (8) percent

EBIT hampered by supply chain disruptions, inflation, higher warranty provisions and offshore

impairments.

Total order intake of 11.2 GW with ASP of EUR 1.07m/MW

Wind turbine order intake in GW down 19 percent but increased 3 percent in value due to strong price

increases.

Strong performance in Service

27 percent revenue growth in 2022 at 21.4 percent EBIT margin.

Sustainability progress and recognition

Our circularity solution for wind turbine blades creates industry break-through; #2 Corporate Knights

ranking.

Strategy reaffirmed with progress within core areas and business enablers

Restoring profitability in turbine segment remains the focus while building industry discipline and

maturity.

Information meeting (audiocast)

On Wednesday 8 February 2023 at 10 am CET (9 am GMT), Vestas will host an information meeting

via an audiocast.

The meeting will be held in English and questions may be asked through a conference call. The

telephone numbers for the conference call are:

• Europe: +44 808-101-1183

• USA: +1 785-424-1738

• Denmark: +45 7877 4197

Conference PIN code: 22677#

The presentation used at the information meeting will be available approximately one hour before the

meeting and can be found at www.vestas.com/en/investor, together with the link to the audiocast.

Contact details

Vestas Wind Systems A/S

Investors/analysts: Media:

Mathias Dalsten, Vice President Anders Riis, Vice President

Investor Relations Communications

Tel: +45 2829 5383 Tel: +45 4181 3922

Vestas Wind Systems A/S Hedeager 42, 8200 Aarhus, Denmark

Tel: +45 9730 0000, Fax: +45 9730 0001, vestas@vestas.com, vestas.com

Company Reg. No.: 10 40 37 82, Company Reg. Name: Vestas Wind Systems A/S

Page 2 of 6

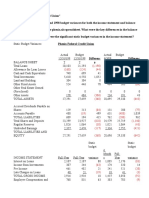

Condensed full-year and Q4 key figures

mEUR

2022 2021 2 Change Q4 2022 Q4 20212 Change

Financial figures

Revenue 14,486 15,587 (7)% 4,783 4,551 5%

- of which service revenue 3,155 2,484 27% 1,015 721 41%

Gross profit 118 1,556 (92)% (162) 393 (141)%

Gross margin (%) 0.8 10.0 (9.2)pp (3.4) 8.6 (12.0)pp

Operating profit (EBIT) before special

items (1,152) 428 (369)% (514) 94 (647)%

EBIT margin (%) before special items (8.0) 2.8 (10.8)pp (10.7) 2.1 (12.8)pp

Profit for the period (1,572) 143 (1,199)% (541) 8 (6,863)%

Total net investments 3 (758) (773) (2)% (253) (247) 2%

Net working capital (1,349) (1,049) 29% (1,349) (1,049) 29%

Free cash flow3 (953) 183 (621)% 1,282 598 114%

Operational figures

Order intake (bnEUR) 11.9 11.6 3% 4.8 2.5 92%

Order intake (MW) 11,189 13,896 (19)% 4,193 2,863 46%

Order backlog – wind turbines

(bnEUR) 19.1 18.1 6% 19.1 18.1 6%

Order backlog – Service (bnEUR) 30.4 27.8 4 9% 30.4 27.84 9%

Produced and shipped wind turbines

(MW) 13,106 17,845 (27)% 2,938 3,595 (18)%

Deliveries (MW) 13,328 16,594 (20)% 4,383 4,882 (10)%

Sustainability figures

Carbon emissions from own

operations (scope 1 & 2) (1,000 t) 100 102 (2)% 27 25 8%

Expected CO₂e avoided over the

lifetime of the capacity produced and

shipped during the period (million t) 408 532 (23)% 91 107 (15)%

Total Recordable Injury Rate (TRIR) 3.3 3.1 6% 3.1 2.7 15%

Outlook 2023

In 2023, we expect high inflation levels throughout the supply chain and reduced wind power installations

to impact revenue and profitability negatively. The lower level of installations is caused by slow

permitting processes in Europe as well as dampened activity levels in the USA due to a steep ramp-up

ahead of a busy 2024 driven by the Inflation Reduction Act. Increasing prices on our order intake is an

offsetting factor, but still leaves Vestas challenged on profitability in 2023. We remain adamant that to

improve industry profitability we must continue to strengthen our commercial discipline and the value

chain together with our partners.

Revenue for full year 2023 is expected to range between EUR 14.0bn and 15.5bn including Service

revenue, which is expected to grow min. 5 percent. Vestas expects to achieve an EBIT margin before

special items of (2)-3 percent with a Service EBIT margin of approx. 22 percent. Total investments3 are

expected to amount to approx. EUR 1bn in 2023. It should be emphasised that, similar to the preceding

years, there is greater uncertainty than usual around forecasts related to execution in 2023, and the

outlook seeks to include the current situation and challenges.

2

Comparative figures for 2021 have been adjusted following the accounting policy change for configuration and customisation costs in cloud computing arrangements, ref.

Note 7.2 in the Annual Report 2022.

3

Excl. acquisitions of subsidiaries, joint ventures, and associates, and financial investments.

4

The Service order backlog value disclosed in the Annual Report 2021 has been corrected from EUR 29.2bn to EUR 27.8bn.

Vestas Wind Systems A/S Hedeager 42, 8200 Aarhus, Denmark

Tel: +45 9730 0000, Fax: +45 9730 0001, vestas@vestas.com, vestas.com

Company Reg. No.: 10 40 37 82, Company Reg. Name: Vestas Wind Systems A/S

Page 3 of 6

The outlook for 2023 includes the impact of the sale of Vestas’ converter factories announced on 10

August 2022 with an expected impact on EBIT before special items of approx. EUR 150m.

Vestas’ Development business continues to grow and to reflect the business area’s increasing financial

and strategic importance, income related to sale of Development projects from joint ventures and

associates is included as part of normal operations from 1 January 2023. The impact on EBIT before

special items from this change is expected to reach a lower double-digit million EUR amount in 2023.

In relation to forecasts on financials from Vestas in general, it should be noted that Vestas’ accounting

policies only allow the recognition of revenue when the control has passed to the customer, either at a

point in time or over time. Disruptions in production and challenges in relation to shipment of wind

turbines and installation hereof, for example bad weather, lack of grid connections, and similar matters,

may thus cause delays that could affect Vestas’ financial results for 2023. Further, the full-year results

may also be impacted by movements in exchange rates from current levels.

Outlook 2023

Revenue (bnEUR) 14.0-15.5

EBIT margin (%) before special items (2)-3

Total investments (bnEUR)

5

approx. 1

Long-term financial ambitions

Wind power has outcompeted fossil fuel alternatives in most parts of the world, and the prospects for

the coming years are promising, with wind power’s increasingly central role as critical infrastructure.

Consequently, forecasts indicate average annual growth in total wind power capacity of 9 percent

towards 2030. 6

Onshore

The demand for onshore wind power globally is expected to decline in 2023. But from 2024, a new

phase of growth is expected driven by new increased ambitions for renewable energy, increased

electrification, and corporate ambitions and activities. Adding to that, Vestas expects to see increasing

contributions from its Development activities. On this background, Vestas maintains its long-term

ambitions to grow faster than the market and be market leader in revenue within Onshore wind.

Offshore

The projections for the offshore business continue to build, and the long-term potential for the market

remains very attractive. Based on the order backlog, Vestas expects to see a decline in activity towards

2025, while necessitating to invest heavily both in the organisation, supply chain, and technology. By

2025, upon the steep increase in annual offshore installations and Vestas’ new platform gaining traction

in the market, Vestas aims to be a leading player in offshore wind power.

Based on these assumptions, Vestas has an ambition to achieve revenue in the Offshore business area

of EUR +3bn by 2025, with an EBIT margin on par with the Onshore business.

Service

The wind power service market is expected to grow at a high single-digit rate, and Vestas maintains its

ambitions for the long term for the Service revenue to grow faster than the market. In the longer term,

the Service EBIT margin is expected at a level of around 25 percent, taking into account the integration

of the Offshore business, which currently generates lower margins than Onshore.

5

Excl. acquisitions of subsidiaries, joint ventures, associates, and financial investments.

6

The forecast does not include China. Source: Wood Mackenzie: Global wind power market outlook update, Q4 2021. November 2021.

Vestas Wind Systems A/S Hedeager 42, 8200 Aarhus, Denmark

Tel: +45 9730 0000, Fax: +45 9730 0001, vestas@vestas.com, vestas.com

Company Reg. No.: 10 40 37 82, Company Reg. Name: Vestas Wind Systems A/S

Page 4 of 6

General ambitions

Our industry needs structural change to increase profitability, especially within the wind turbine segment.

The structural changes primarily entail strengthening the commercial discipline in customer dialogues,

lowering the frequency of new technology introductions as well as maturing the assessment of risk.

In 2022, the gap between our financial results and our long-term financial ambitions increased, but the

year underlined that Vestas is on the right strategic path to improve the industry structurally and build

the commercial and operational maturity to achieve our financial ambitions. In that context, a 10 percent

EBIT margin in 2025 remains realistic, although external headwinds from a challenging business

environment continues to cloud near-term visibility and create uncertainty.

Long-term financial ambitions

Revenue Grow faster than the market and be market leader in revenue

EBIT margin before special items At least 10 percent

Free cash flow 7 Positive

ROCE 20 percent over the cycle

7

Excl. acquisitions of subsidiaries, joint ventures, and associates, and financial investments.

Vestas Wind Systems A/S Hedeager 42, 8200 Aarhus, Denmark

Tel: +45 9730 0000, Fax: +45 9730 0001, vestas@vestas.com, vestas.com

Company Reg. No.: 10 40 37 82, Company Reg. Name: Vestas Wind Systems A/S

Page 5 of 6

Disclaimer and cautionary statement

This document contains forward-looking statements concerning Vestas' financial condition, results of operations

and business. All statements other than statements of historical fact are, or may be deemed to be, forward-looking

statements. Forward-looking statements are statements of future expectations that are based on management’s

current expectations and assumptions and involve known and unknown risks and uncertainties that could cause

actual results, performance, or events to differ materially from those expressed or implied in these statements.

Forward-looking statements include, among other things, statements concerning Vestas' potential exposure to

market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and

assumptions. A number of factors that affect Vestas' future operations and could cause Vestas' results to differ

materially from those expressed in the forward-looking statements included in this document, include (without

limitation): (a) changes in demand for Vestas' products; (b) currency and interest rate fluctuations; (c) loss of market

share and industry competition; (d) environmental and physical risks, including adverse weather conditions; (e)

legislative, fiscal, and regulatory developments, including changes in tax or accounting policies; (f) economic and

financial market conditions in various countries and regions; (g) political risks, including the risks of expropriation

and renegotiation of the terms of contracts with governmental entities, and delays or advancements in the approval

of projects; (h) ability to enforce patents; (i) product development risks; (j) cost of commodities; (k) customer credit

risks; (l) supply of components; and (m) customer-created delays affecting product installation, grid connections

and other revenue-recognition factors.

All forward-looking statements contained in this document are expressly qualified by the cautionary statements

contained or referenced to in this statement. Undue reliance should not be placed on forward-looking statements.

Additional factors that may affect future results are contained in Vestas' annual report for the year ended 31

December 2022 (available at www.vestas.com/en/investor) and these factors also should be considered. Each

forward-looking statement speaks only as of the date of this document. Vestas does not undertake any obligation

to publicly update or revise any forward-looking statement as a result of new information or future events other than

as required by Danish law. In light of these risks, results could differ materially from those stated, implied, or inferred

from the forward-looking statements contained in this document.

Vestas Wind Systems A/S Hedeager 42, 8200 Aarhus, Denmark

Tel: +45 9730 0000, Fax: +45 9730 0001, vestas@vestas.com, vestas.com

Company Reg. No.: 10 40 37 82, Company Reg. Name: Vestas Wind Systems A/S

Page 6 of 6

You might also like

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- V80Document18 pagesV80es9857No ratings yet

- MAN ACC ProjectDocument7 pagesMAN ACC ProjectNurassylNo ratings yet

- 4MW Platform BrochureDocument24 pages4MW Platform BrochureBenjamin Verusi100% (1)

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Blade ServicesDocument16 pagesBlade Servicesfotopredic100% (1)

- List of Turbine ManufacturersDocument10 pagesList of Turbine ManufacturersRaghu SubranNo ratings yet

- Energjia e Eres PDFDocument14 pagesEnergjia e Eres PDFQamil100% (2)

- Appendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Document21 pagesAppendix 4D Results For Announcement To The Market Amcom Telecommunications LTD (ACN 062 046 217)Anonymous 6tuR1hzNo ratings yet

- Of A400M and Ticketing ProgrammesDocument11 pagesOf A400M and Ticketing ProgrammesIngegneria Aerospaziale PadovaNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- 2024 02 22 2023 Annual Report RBIDocument273 pages2024 02 22 2023 Annual Report RBIemiliowebster6833No ratings yet

- Interim Financial Report As at September 30 2023Document15 pagesInterim Financial Report As at September 30 2023sofian aitNo ratings yet

- 3VM11165EE320AA0 Datasheet enDocument269 pages3VM11165EE320AA0 Datasheet enomarqasimNo ratings yet

- Finning Q3 2023 Interim Report Nov 6 2023Document64 pagesFinning Q3 2023 Interim Report Nov 6 2023Allan ShepherdNo ratings yet

- Daiwa - Sunonwealth (2421TT) - Lifting TP To 141, Buy Unchanged 20231103Document7 pagesDaiwa - Sunonwealth (2421TT) - Lifting TP To 141, Buy Unchanged 20231103jungiam.wNo ratings yet

- (A) Nature of Business of Cepatwawasan Group BerhadDocument16 pages(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNo ratings yet

- Business CaseDocument11 pagesBusiness CasesomeshNo ratings yet

- Equity Note - Walton Hi-Tech Industries Ltd. - September 2021Document4 pagesEquity Note - Walton Hi-Tech Industries Ltd. - September 2021vjqzjf4m5tNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Siemens Company PresentationDocument35 pagesSiemens Company PresentationOleksandr Ivanov100% (1)

- Global StrategyDocument14 pagesGlobal StrategyclareNo ratings yet

- Indra Press ReleaseDocument13 pagesIndra Press ReleaseTwobirds Flying PublicationsNo ratings yet

- Bayer Annual Report 2018 PDFDocument279 pagesBayer Annual Report 2018 PDFJimena CaycedoNo ratings yet

- Bayer Annual Report 2020Document265 pagesBayer Annual Report 2020Kaushal RajoraNo ratings yet

- .+Energy+and+Other+gross+profit AfterDocument41 pages.+Energy+and+Other+gross+profit AfterAkash ChauhanNo ratings yet

- 6.+Energy+and+Other+revenue BeforeDocument37 pages6.+Energy+and+Other+revenue BeforeThe SturdyTubersNo ratings yet

- 8.+opex BeforeDocument45 pages8.+opex BeforeThe SturdyTubersNo ratings yet

- 6.+Energy+and+Other+Revenue AfterDocument37 pages6.+Energy+and+Other+Revenue AftervictoriaNo ratings yet

- 2.+average+of+price+models BeforeDocument23 pages2.+average+of+price+models BeforeMuskan AroraNo ratings yet

- Seplat Energy Fy 21 Results - Final - 28022022Document180 pagesSeplat Energy Fy 21 Results - Final - 28022022ZAINAB OLADIPONo ratings yet

- Interim Report Q1 2021 (PROT)Document18 pagesInterim Report Q1 2021 (PROT)Derek FrancisNo ratings yet

- Repsol LubeDocument46 pagesRepsol LubeDharshan MylvaganamNo ratings yet

- Factbook 2021 Version XLSXDocument108 pagesFactbook 2021 Version XLSXMohamed KadriNo ratings yet

- Maroc Telecom KPI-Q12022Document9 pagesMaroc Telecom KPI-Q12022Youssef JaafarNo ratings yet

- Bayer Ag Annual Report 2019 PDFDocument239 pagesBayer Ag Annual Report 2019 PDFkrrajanNo ratings yet

- Atos Annual Results 2021Document28 pagesAtos Annual Results 2021Anand TajneNo ratings yet

- GB 2017 en PDFDocument230 pagesGB 2017 en PDFMachita StefanNo ratings yet

- 2024 - 02 - 01 - Ferrari - FY 2023 Results PresentationDocument31 pages2024 - 02 - 01 - Ferrari - FY 2023 Results Presentationriccardosmaldone33No ratings yet

- Budget 2022-2024Document30 pagesBudget 2022-2024Khaled ShangabNo ratings yet

- Midyear Meeting - EMC CKDocument7 pagesMidyear Meeting - EMC CKmaryatinurbayaNo ratings yet

- Vodafone Bid HBS Case - ExhibitsDocument13 pagesVodafone Bid HBS Case - ExhibitsNaman PorwalNo ratings yet

- Thales Reports Its 9m 2023 Order Intake and Sales - Press Release - 31 October 2023 - 0Document8 pagesThales Reports Its 9m 2023 Order Intake and Sales - Press Release - 31 October 2023 - 0jbsNo ratings yet

- 2021 Annual ReportDocument124 pages2021 Annual Reportnilan90531No ratings yet

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Wärtsilä q1 2024 Interim ReportDocument28 pagesWärtsilä q1 2024 Interim ReportKevin ParkerNo ratings yet

- FINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Document6 pagesFINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Hridi RahmanNo ratings yet

- Earnings ReleaseDocument5 pagesEarnings Releaseamira alyNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- Equity Research: Result UpdateDocument8 pagesEquity Research: Result UpdateyolandaNo ratings yet

- SS Cloud Business PlanDocument5 pagesSS Cloud Business Planminhbu114No ratings yet

- Bayer Annual Report 2016Document344 pagesBayer Annual Report 2016Ojo-publico.comNo ratings yet

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- Comcast Model ShareableDocument27 pagesComcast Model Shareablep44153No ratings yet

- YE'22Document12 pagesYE'22parshvaj0312No ratings yet

- Year-End Report 2023: 31 January 2024Document21 pagesYear-End Report 2023: 31 January 2024YOANN HEBRARDNo ratings yet

- Q1 2021 Earning ReleaseDocument4 pagesQ1 2021 Earning ReleaseliNo ratings yet

- Instructor: Assumptions / InputsDocument17 pagesInstructor: Assumptions / InputsJoAnna MonfilsNo ratings yet

- Factbook 2020Document99 pagesFactbook 2020Mohamed KadriNo ratings yet

- Ryanair 2023 Annual ReportDocument244 pagesRyanair 2023 Annual ReportWestCoastAsianNo ratings yet

- Tesla Company AnalysisDocument83 pagesTesla Company AnalysisStevenTsaiNo ratings yet

- Pvatepla q3 2023 enDocument14 pagesPvatepla q3 2023 enrogercabreNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Engineering Procurement Construction EPCDocument2 pagesEngineering Procurement Construction EPCfotopredicNo ratings yet

- V90-1.8 MW & 2.0 MW High Output in Modest WindsDocument6 pagesV90-1.8 MW & 2.0 MW High Output in Modest WindsARUP1976No ratings yet

- Reported Wind Turbine Blade BreaksDocument3 pagesReported Wind Turbine Blade BreaksLuiza ValladaresNo ratings yet

- 4MW Platform BrochureDocument28 pages4MW Platform BrochureChami LiyanageNo ratings yet

- V112-3MW & VTCDocument50 pagesV112-3MW & VTCManuel PalopNo ratings yet

- 196 Vestas Case Study WerstDocument18 pages196 Vestas Case Study WerstAxel DominiqueNo ratings yet

- Aviation Obstruction LightsDocument2 pagesAviation Obstruction LightsfotopredicNo ratings yet

- Vestas Track Record 2019 Q2Document8 pagesVestas Track Record 2019 Q2Squall LeonhartNo ratings yet

- Suzlon Strategic AnalysisDocument78 pagesSuzlon Strategic AnalysisGargiNM88% (24)

- 3 MW Product BrochureDocument16 pages3 MW Product BrochuremaniacfornicNo ratings yet

- Reference List Gearbox 2018 04Document5 pagesReference List Gearbox 2018 04balaNo ratings yet

- File PDFDocument30 pagesFile PDFluluNo ratings yet

- © Liftra Presentation 2016Document16 pages© Liftra Presentation 2016mpk8588No ratings yet

- Global Wind Turbine Markets and Strategies, 2009-2020: New Market StudyDocument6 pagesGlobal Wind Turbine Markets and Strategies, 2009-2020: New Market Studybulk_purchaseNo ratings yet

- VestasOperatingManual 1Document37 pagesVestasOperatingManual 1سامح الجاسمNo ratings yet

- Pitch Versus Stall Wind EnergyDocument3 pagesPitch Versus Stall Wind EnergyUmer AbbasNo ratings yet

- Pip - September 2012 (Second Edition)Document53 pagesPip - September 2012 (Second Edition)Fabio MiguelNo ratings yet

- 4 MW Product BrochureDocument2 pages4 MW Product BrochureAdrian Martin BarrionuevoNo ratings yet

- Simapro ExerciseDocument2 pagesSimapro Exerciseburty1No ratings yet

- Offshore Wind Energy Market Overview: Ian Baring GouldDocument28 pagesOffshore Wind Energy Market Overview: Ian Baring GouldTanna ChangNo ratings yet

- The Power of HR Analytics in Strategic Planning PDFDocument34 pagesThe Power of HR Analytics in Strategic Planning PDFviji100% (1)

- Vestas V47 BladesDocument2 pagesVestas V47 Bladesbala100% (1)

- Realise DEIF Controller Retrofit Information PDFDocument2 pagesRealise DEIF Controller Retrofit Information PDFAbhinav ChoudharyNo ratings yet

- Vestas 8 - 3.3 MWDocument16 pagesVestas 8 - 3.3 MWSebastiánNo ratings yet

- Wind Energy TechnologyDocument15 pagesWind Energy Technologytntntn86No ratings yet