Professional Documents

Culture Documents

Thandi's: Life Stage

Thandi's: Life Stage

Uploaded by

Zandile Angeline DhlomonseleCopyright:

Available Formats

You might also like

- Stages of Retirement, Robert AtchleyDocument18 pagesStages of Retirement, Robert Atchleyvitasta100% (2)

- Csit321 Project Requirements v2Document15 pagesCsit321 Project Requirements v2api-544270691No ratings yet

- 5Document31 pages5Alex liao0% (1)

- I-Great Jannah: An Enduring Gift, An Act of Hibah, Only For YouDocument26 pagesI-Great Jannah: An Enduring Gift, An Act of Hibah, Only For Youbwc kamuntingNo ratings yet

- Takaful I Great JannahDocument26 pagesTakaful I Great JannahHishamNo ratings yet

- Bandhan Retirement Fund - NFO PresentationDocument24 pagesBandhan Retirement Fund - NFO Presentationdvg6363238970No ratings yet

- Edelweiss Retirement Plan Investor PresentationDocument28 pagesEdelweiss Retirement Plan Investor Presentationnarayan.mitNo ratings yet

- Elite Life Feb09Document60 pagesElite Life Feb09agnel78100% (4)

- Muhamad Wawan - Progress LDPDocument13 pagesMuhamad Wawan - Progress LDPmuhamadwawan01No ratings yet

- Retirement Workshop2Document2 pagesRetirement Workshop2The Five O'Clock ClubNo ratings yet

- Planning Your Retirement - 25 July 2023Document1 pagePlanning Your Retirement - 25 July 2023Times MediaNo ratings yet

- Kotak PresentationDocument43 pagesKotak Presentationsiva prasadNo ratings yet

- Find Out Which Annuity Option Suits You The Best - The Economic TimesDocument4 pagesFind Out Which Annuity Option Suits You The Best - The Economic TimesMadhupam KrishnaNo ratings yet

- Training Deck - ABSLI Saral Pension - TTTv1.ppsxDocument44 pagesTraining Deck - ABSLI Saral Pension - TTTv1.ppsxavniakamdarNo ratings yet

- Retirement WorksheetDocument55 pagesRetirement WorksheetRich AbuNo ratings yet

- CH1 Fs PDFDocument7 pagesCH1 Fs PDFwejdazoNo ratings yet

- July Issue2021Document8 pagesJuly Issue2021Nayan BhowmickNo ratings yet

- Retirement Planning: From Start To FinishDocument9 pagesRetirement Planning: From Start To FinishbvbenhamNo ratings yet

- Life Vision BoardDocument6 pagesLife Vision Board5qvzbqwcrfNo ratings yet

- Chapter - 6: The Intrapreneurial Culture and Entrepreneurial Training and DevelopmentDocument8 pagesChapter - 6: The Intrapreneurial Culture and Entrepreneurial Training and DevelopmentEasy E learning WebNo ratings yet

- Star Union Plan CA1 PDFDocument27 pagesStar Union Plan CA1 PDFfatoumata coulibalyNo ratings yet

- Unit 4 - Retirement Savings PlansDocument9 pagesUnit 4 - Retirement Savings Plansaparnajha3008No ratings yet

- Sharing Knowledge KPIDocument16 pagesSharing Knowledge KPIyulithNo ratings yet

- How To Through Uncertainty: InspireDocument14 pagesHow To Through Uncertainty: InspireYadira Hernández InzaNo ratings yet

- Supplementary Income Sanchay Plus RetailDocument5 pagesSupplementary Income Sanchay Plus RetailSampras DsouzaNo ratings yet

- Senior LivingDocument16 pagesSenior LivingWatertown Daily TimesNo ratings yet

- Retirement PlanningDocument4 pagesRetirement Planningakshaygupta55555411No ratings yet

- Retirement PlanningDocument11 pagesRetirement PlanningIan Miles TakawiraNo ratings yet

- A Guide To AnnuitiesDocument16 pagesA Guide To AnnuitiesRobert OtienoNo ratings yet

- Ebook Financial Reality Coping GuideDocument56 pagesEbook Financial Reality Coping GuideShel MarieNo ratings yet

- Meta MorphosisDocument1 pageMeta MorphosisTnumNo ratings yet

- Sociology Proyect Group 8Document11 pagesSociology Proyect Group 8genesis martinezNo ratings yet

- Wcms 882984Document13 pagesWcms 882984homepcalzadjalifamilyNo ratings yet

- Sudlifear2019 (L)Document268 pagesSudlifear2019 (L)Sam SNo ratings yet

- China DailyDocument11 pagesChina DailyJohn Viondi MendozaNo ratings yet

- NOW I KNOW ! Cikaldana Newsletter No. 03-2015 (On Retirement Planning)Document5 pagesNOW I KNOW ! Cikaldana Newsletter No. 03-2015 (On Retirement Planning)CikaldanaNo ratings yet

- Retirement Plan & Benefits 102Document46 pagesRetirement Plan & Benefits 102mycelynNo ratings yet

- A View From The Field: Retiring From Case Management - Some Thoughts On TimingDocument2 pagesA View From The Field: Retiring From Case Management - Some Thoughts On Timingacma2010No ratings yet

- Mind The Moment: An Innovative Training ProgramDocument10 pagesMind The Moment: An Innovative Training ProgramPaweł RumińskiNo ratings yet

- India: Key Country Indicators Profile of Indian Self-EmployedDocument2 pagesIndia: Key Country Indicators Profile of Indian Self-Employedvikalp123123No ratings yet

- VHTC Phc-Plan-Terms-And-ConditionsDocument52 pagesVHTC Phc-Plan-Terms-And-ConditionsarthurNo ratings yet

- VHTC017X Plan Terms and ConditionsDocument56 pagesVHTC017X Plan Terms and ConditionsarthurNo ratings yet

- Investment Plan For RetirementDocument70 pagesInvestment Plan For RetirementyopoNo ratings yet

- Emotional Intelligence Do's and Tips For Each Subscale 2022Document17 pagesEmotional Intelligence Do's and Tips For Each Subscale 2022begum1likNo ratings yet

- Grade 10 Health q4 ModuleDocument4 pagesGrade 10 Health q4 Modulenuera.christilahNo ratings yet

- Abhishek Kumar PPT Roll No 62Document28 pagesAbhishek Kumar PPT Roll No 62aksjsimrNo ratings yet

- Do You Know What to Expect?: A Retirement Adjustment GuideFrom EverandDo You Know What to Expect?: A Retirement Adjustment GuideNo ratings yet

- 7 Retirement PlanningDocument44 pages7 Retirement PlanningIsmail FaizelNo ratings yet

- Mental SelfDocument35 pagesMental SelfCzandro NavidaNo ratings yet

- Secrets To Retire RichDocument41 pagesSecrets To Retire RichBarun SinghNo ratings yet

- EDS 111 Week 2 An Entrepreneur - 2Document18 pagesEDS 111 Week 2 An Entrepreneur - 2NitestreamNo ratings yet

- What Is A Pension?Document5 pagesWhat Is A Pension?MajorlyNo ratings yet

- Exploring The Wellbeing and Sustainability of IC24 Staff Working From HomeDocument1 pageExploring The Wellbeing and Sustainability of IC24 Staff Working From Homeapi-286232866No ratings yet

- Thriving in the Golden Years: Life Coaching for Seniors and RetireesFrom EverandThriving in the Golden Years: Life Coaching for Seniors and RetireesNo ratings yet

- IndiaFirst Life MahaJeevan Plus Plan - BrochureDocument19 pagesIndiaFirst Life MahaJeevan Plus Plan - BrochureChirag BhardwajNo ratings yet

- OutlineDocument2 pagesOutlineDuy Anh NguyễnNo ratings yet

- BESR BuddhismDocument9 pagesBESR BuddhismKrisselyn ReigneNo ratings yet

- Purpose - We Must Think DeeperDocument9 pagesPurpose - We Must Think DeeperNicolas MaldonadoNo ratings yet

- Binus CareerDocument61 pagesBinus CareerWasita AnggaraNo ratings yet

- Pat Joel Vergara PenullarDocument5 pagesPat Joel Vergara PenullarMarvin TerceroNo ratings yet

- Shantilal Shah Engineering College: Contributor Personality Development ProgramDocument33 pagesShantilal Shah Engineering College: Contributor Personality Development ProgramDeep ChhatbarNo ratings yet

- Celebrate: Each OtherDocument1 pageCelebrate: Each OtherZandile Angeline DhlomonseleNo ratings yet

- Canberra Hospital: Post Operative Handover and Observations - Adult Patients (First 24 Hours)Document7 pagesCanberra Hospital: Post Operative Handover and Observations - Adult Patients (First 24 Hours)Zandile Angeline DhlomonseleNo ratings yet

- UntitledDocument5 pagesUntitledZandile Angeline DhlomonseleNo ratings yet

- Precourse Self-Assessment Results Congratulations Zandile Angeline Dhlomo-Nsele !Document3 pagesPrecourse Self-Assessment Results Congratulations Zandile Angeline Dhlomo-Nsele !Zandile Angeline DhlomonseleNo ratings yet

- PALS Precourse Self-Assessment and Precourse WorkDocument1 pagePALS Precourse Self-Assessment and Precourse WorkZandile Angeline DhlomonseleNo ratings yet

- SPCA Says... : Take Care of Your PigsDocument2 pagesSPCA Says... : Take Care of Your PigsZandile Angeline DhlomonseleNo ratings yet

- Proof of Delivery: Pharmacy Direct (Pty) LTDDocument2 pagesProof of Delivery: Pharmacy Direct (Pty) LTDZandile Angeline DhlomonseleNo ratings yet

- Module 1 - The Development of Human ResourcesDocument24 pagesModule 1 - The Development of Human ResourcesNicolle JungNo ratings yet

- AxiomDocument13 pagesAxiomFrancis Dave Peralta BitongNo ratings yet

- DepreciationDocument14 pagesDepreciationEdielyn VillarandaNo ratings yet

- Aggregate Demand For Labor and Aggregate Supply of LaborDocument18 pagesAggregate Demand For Labor and Aggregate Supply of LaborSibghat RehmanNo ratings yet

- Proton MM CombinedDocument42 pagesProton MM CombinedaquistarNo ratings yet

- SM QBDocument178 pagesSM QBRaj veer100% (1)

- Work Breakdown StructureDocument44 pagesWork Breakdown Structuremo0onshah100% (1)

- Liforme v. Schedule A - ComplaintDocument39 pagesLiforme v. Schedule A - ComplaintSarah BursteinNo ratings yet

- Iphone InvoiceDocument1 pageIphone InvoiceKalai ManiNo ratings yet

- Implementation Docu SAP S4HANA Loc Extension Belarus EPAM ENDocument31 pagesImplementation Docu SAP S4HANA Loc Extension Belarus EPAM ENksoleti8254No ratings yet

- Boston Matrix - ToyotaDocument7 pagesBoston Matrix - Toyotaabdullrahmanalzein2No ratings yet

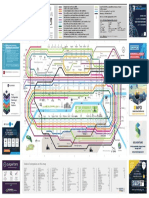

- IT Subway Map Europe 2021Document1 pageIT Subway Map Europe 2021Chandrani GuptaNo ratings yet

- Company ProfileDocument20 pagesCompany ProfileMuhammad DzulqarnainNo ratings yet

- CONCURRENT ENGINEERING Q BankDocument5 pagesCONCURRENT ENGINEERING Q BankNagamani RajeshNo ratings yet

- Postage and Courier Exp ChecklistDocument2 pagesPostage and Courier Exp ChecklistMichelle Domanacal UrsabiaNo ratings yet

- BISMARK YEBOAH KsTU 2022 FULL WORKDocument68 pagesBISMARK YEBOAH KsTU 2022 FULL WORKBismark YeboahNo ratings yet

- The Globalization of StarbucksDocument3 pagesThe Globalization of StarbucksBin Ahmed100% (1)

- BY LawsDocument6 pagesBY LawsJig-jig AbanNo ratings yet

- Revenue Models For Social-Networking SitesDocument40 pagesRevenue Models For Social-Networking Sitesmariyam_amreen100% (1)

- IR Subscription-Form PrepaidDocument2 pagesIR Subscription-Form PrepaidTouseefSayfullahNo ratings yet

- M1 C2 Case Study WorkbookDocument25 pagesM1 C2 Case Study WorkbookfenixaNo ratings yet

- Grand Strategies: Zakir PatelDocument36 pagesGrand Strategies: Zakir Patelzakirno19248No ratings yet

- Top Cities in Saudi Arabia To Start A Small BusinessDocument12 pagesTop Cities in Saudi Arabia To Start A Small BusinessexpresservicesofficialNo ratings yet

- Tesco CaseDocument20 pagesTesco CaseEzhil Vendhan PalanisamyNo ratings yet

- ADILI LOANPOLICY OperationDocument20 pagesADILI LOANPOLICY OperationPaschal KunambiNo ratings yet

- Fortune 500Document60 pagesFortune 500Harsh DodNo ratings yet

- Sanjaya Raju Kunder: APAR Industries Limited Corporate Office: Regd. OfficeDocument181 pagesSanjaya Raju Kunder: APAR Industries Limited Corporate Office: Regd. Officeshreya.agrawalNo ratings yet

Thandi's: Life Stage

Thandi's: Life Stage

Uploaded by

Zandile Angeline DhlomonseleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thandi's: Life Stage

Thandi's: Life Stage

Uploaded by

Zandile Angeline DhlomonseleCopyright:

Available Formats

Retirement

Thandi’s

By now you would have received

communication explaining the enhancements

the trustees are making to the fund’s

life stage story goals-based lifestage strategy. To help you

understand what the enhancements mean on

a practical level, we would like to introduce

you to our friend Thandi.

Thandi is 25 years old and has recently

qualified as an accountant. As you can

Meet imagine, she was very excited to start her

Thandi!

very first job at Innovation Insights.

Yay Thandi!

Let’s follow Thandi on her

goals-based lifestage

journey.

Innovation Insights

has a normal

retirement

age of 65.

25

years old

60 65

years old years old

Pre-retirement

Growth phase – 35 years Retirement

phase

The

growth phase

Thandi is in the growth phase of her retirement savings journey and has a long

way (35 years) to go before she has to start thinking about her retirement. This

means that Thandi can afford to invest her retirement savings in riskier assets

that are expected to grow her money faster in the long term.

The

pre-retirement phase

At this point, Thandi has to consider Thandi is invested The pre-retirement Thandi has taken

Thandi is her circumstances in the goals-based portfolio that the time to gather

turning 60. She both financially and lifestage model Thandi chooses information about

needs to start personally to develop and needs to select now will align each option and taken

planning for her goals at retirement. one of three pre- with the type of into account her goals

her retirement, By understanding retirement portfolios pension she buys at and circumstances.

which is five and planning for her to go into. She must retirement. This will Where necessary,

years away. retirement, Thandi choose a portfolio ensure that she has Thandi has also

can have peace of according to her a smooth transition discussed the options

mind when she is retirement goals. at retirement. with a professional

approaching retirement. financial planner.

Scenario 1 AF Houseview Income Target portfolio

This default portfolio targets a with-profit annuity. It

guarantees Thandi income for the rest of her life, no matter

how long she lives or what happens in the investment markets.

Her monthly income will not grow smaller. This gives Thandi

certainty for the rest of her life.

It means that if you don’t choose one

Thandi is not sure which pre-retirement portfolio to choose. of the three pre-retirement portfolios,

The trustees understand that there will be members who won’t the fund will automatically choose this

make a choice. Thandi, like these members, will be defaulted option for you. Although this is the default

into this portfolio. The default pre-retirement portfolio is portfolio if no choice is made, you can

structured to suit the majority of members. also choose to invest in this portfolio.

AF Inflation Income Target portfolio Scenario 2

Thandi prides herself on living a very healthy lifestyle because she wants to live a

long life. She would therefore like to make sure that she gets an income from her

retirement savings for the rest of her life.

Thandi has also made sure that her family has sufficient death cover, through a

separate policy, if she passes away. Thandi decides that a guaranteed pension

will best suit her retirement needs and selects the AF Inflation Income Target portfolio which will align her

risk profile to that of an inflation-linked guaranteed annuity.

Scenario 3 AF Flexible Income Target portfolio

Thandi decides that she would like to like any remaining money from her

choose the amount she gets from her retirement savings to be paid to her

pension every month (her drawdown family if she passes away.

rate).

Thandi has been advised that there

Thandi believes she is knowledgeable is a risk of outliving her money.

about her finances and is worried Therefore, Thandi feels a flexible

that she will not finish her money pension (living annuity) best suits

before her death. She is also her circumstances and retirement

concerned that her life cover will not needs and chooses the AF Flexible

be enough for her family and would Income Target portfolio.

Disclaimer:

These scenarios are for illustrative purposes only. Every member is different and has individual circumstances. You need to speak to a licensed financial adviser

to understand your options.

alexforbes.com

You might also like

- Stages of Retirement, Robert AtchleyDocument18 pagesStages of Retirement, Robert Atchleyvitasta100% (2)

- Csit321 Project Requirements v2Document15 pagesCsit321 Project Requirements v2api-544270691No ratings yet

- 5Document31 pages5Alex liao0% (1)

- I-Great Jannah: An Enduring Gift, An Act of Hibah, Only For YouDocument26 pagesI-Great Jannah: An Enduring Gift, An Act of Hibah, Only For Youbwc kamuntingNo ratings yet

- Takaful I Great JannahDocument26 pagesTakaful I Great JannahHishamNo ratings yet

- Bandhan Retirement Fund - NFO PresentationDocument24 pagesBandhan Retirement Fund - NFO Presentationdvg6363238970No ratings yet

- Edelweiss Retirement Plan Investor PresentationDocument28 pagesEdelweiss Retirement Plan Investor Presentationnarayan.mitNo ratings yet

- Elite Life Feb09Document60 pagesElite Life Feb09agnel78100% (4)

- Muhamad Wawan - Progress LDPDocument13 pagesMuhamad Wawan - Progress LDPmuhamadwawan01No ratings yet

- Retirement Workshop2Document2 pagesRetirement Workshop2The Five O'Clock ClubNo ratings yet

- Planning Your Retirement - 25 July 2023Document1 pagePlanning Your Retirement - 25 July 2023Times MediaNo ratings yet

- Kotak PresentationDocument43 pagesKotak Presentationsiva prasadNo ratings yet

- Find Out Which Annuity Option Suits You The Best - The Economic TimesDocument4 pagesFind Out Which Annuity Option Suits You The Best - The Economic TimesMadhupam KrishnaNo ratings yet

- Training Deck - ABSLI Saral Pension - TTTv1.ppsxDocument44 pagesTraining Deck - ABSLI Saral Pension - TTTv1.ppsxavniakamdarNo ratings yet

- Retirement WorksheetDocument55 pagesRetirement WorksheetRich AbuNo ratings yet

- CH1 Fs PDFDocument7 pagesCH1 Fs PDFwejdazoNo ratings yet

- July Issue2021Document8 pagesJuly Issue2021Nayan BhowmickNo ratings yet

- Retirement Planning: From Start To FinishDocument9 pagesRetirement Planning: From Start To FinishbvbenhamNo ratings yet

- Life Vision BoardDocument6 pagesLife Vision Board5qvzbqwcrfNo ratings yet

- Chapter - 6: The Intrapreneurial Culture and Entrepreneurial Training and DevelopmentDocument8 pagesChapter - 6: The Intrapreneurial Culture and Entrepreneurial Training and DevelopmentEasy E learning WebNo ratings yet

- Star Union Plan CA1 PDFDocument27 pagesStar Union Plan CA1 PDFfatoumata coulibalyNo ratings yet

- Unit 4 - Retirement Savings PlansDocument9 pagesUnit 4 - Retirement Savings Plansaparnajha3008No ratings yet

- Sharing Knowledge KPIDocument16 pagesSharing Knowledge KPIyulithNo ratings yet

- How To Through Uncertainty: InspireDocument14 pagesHow To Through Uncertainty: InspireYadira Hernández InzaNo ratings yet

- Supplementary Income Sanchay Plus RetailDocument5 pagesSupplementary Income Sanchay Plus RetailSampras DsouzaNo ratings yet

- Senior LivingDocument16 pagesSenior LivingWatertown Daily TimesNo ratings yet

- Retirement PlanningDocument4 pagesRetirement Planningakshaygupta55555411No ratings yet

- Retirement PlanningDocument11 pagesRetirement PlanningIan Miles TakawiraNo ratings yet

- A Guide To AnnuitiesDocument16 pagesA Guide To AnnuitiesRobert OtienoNo ratings yet

- Ebook Financial Reality Coping GuideDocument56 pagesEbook Financial Reality Coping GuideShel MarieNo ratings yet

- Meta MorphosisDocument1 pageMeta MorphosisTnumNo ratings yet

- Sociology Proyect Group 8Document11 pagesSociology Proyect Group 8genesis martinezNo ratings yet

- Wcms 882984Document13 pagesWcms 882984homepcalzadjalifamilyNo ratings yet

- Sudlifear2019 (L)Document268 pagesSudlifear2019 (L)Sam SNo ratings yet

- China DailyDocument11 pagesChina DailyJohn Viondi MendozaNo ratings yet

- NOW I KNOW ! Cikaldana Newsletter No. 03-2015 (On Retirement Planning)Document5 pagesNOW I KNOW ! Cikaldana Newsletter No. 03-2015 (On Retirement Planning)CikaldanaNo ratings yet

- Retirement Plan & Benefits 102Document46 pagesRetirement Plan & Benefits 102mycelynNo ratings yet

- A View From The Field: Retiring From Case Management - Some Thoughts On TimingDocument2 pagesA View From The Field: Retiring From Case Management - Some Thoughts On Timingacma2010No ratings yet

- Mind The Moment: An Innovative Training ProgramDocument10 pagesMind The Moment: An Innovative Training ProgramPaweł RumińskiNo ratings yet

- India: Key Country Indicators Profile of Indian Self-EmployedDocument2 pagesIndia: Key Country Indicators Profile of Indian Self-Employedvikalp123123No ratings yet

- VHTC Phc-Plan-Terms-And-ConditionsDocument52 pagesVHTC Phc-Plan-Terms-And-ConditionsarthurNo ratings yet

- VHTC017X Plan Terms and ConditionsDocument56 pagesVHTC017X Plan Terms and ConditionsarthurNo ratings yet

- Investment Plan For RetirementDocument70 pagesInvestment Plan For RetirementyopoNo ratings yet

- Emotional Intelligence Do's and Tips For Each Subscale 2022Document17 pagesEmotional Intelligence Do's and Tips For Each Subscale 2022begum1likNo ratings yet

- Grade 10 Health q4 ModuleDocument4 pagesGrade 10 Health q4 Modulenuera.christilahNo ratings yet

- Abhishek Kumar PPT Roll No 62Document28 pagesAbhishek Kumar PPT Roll No 62aksjsimrNo ratings yet

- Do You Know What to Expect?: A Retirement Adjustment GuideFrom EverandDo You Know What to Expect?: A Retirement Adjustment GuideNo ratings yet

- 7 Retirement PlanningDocument44 pages7 Retirement PlanningIsmail FaizelNo ratings yet

- Mental SelfDocument35 pagesMental SelfCzandro NavidaNo ratings yet

- Secrets To Retire RichDocument41 pagesSecrets To Retire RichBarun SinghNo ratings yet

- EDS 111 Week 2 An Entrepreneur - 2Document18 pagesEDS 111 Week 2 An Entrepreneur - 2NitestreamNo ratings yet

- What Is A Pension?Document5 pagesWhat Is A Pension?MajorlyNo ratings yet

- Exploring The Wellbeing and Sustainability of IC24 Staff Working From HomeDocument1 pageExploring The Wellbeing and Sustainability of IC24 Staff Working From Homeapi-286232866No ratings yet

- Thriving in the Golden Years: Life Coaching for Seniors and RetireesFrom EverandThriving in the Golden Years: Life Coaching for Seniors and RetireesNo ratings yet

- IndiaFirst Life MahaJeevan Plus Plan - BrochureDocument19 pagesIndiaFirst Life MahaJeevan Plus Plan - BrochureChirag BhardwajNo ratings yet

- OutlineDocument2 pagesOutlineDuy Anh NguyễnNo ratings yet

- BESR BuddhismDocument9 pagesBESR BuddhismKrisselyn ReigneNo ratings yet

- Purpose - We Must Think DeeperDocument9 pagesPurpose - We Must Think DeeperNicolas MaldonadoNo ratings yet

- Binus CareerDocument61 pagesBinus CareerWasita AnggaraNo ratings yet

- Pat Joel Vergara PenullarDocument5 pagesPat Joel Vergara PenullarMarvin TerceroNo ratings yet

- Shantilal Shah Engineering College: Contributor Personality Development ProgramDocument33 pagesShantilal Shah Engineering College: Contributor Personality Development ProgramDeep ChhatbarNo ratings yet

- Celebrate: Each OtherDocument1 pageCelebrate: Each OtherZandile Angeline DhlomonseleNo ratings yet

- Canberra Hospital: Post Operative Handover and Observations - Adult Patients (First 24 Hours)Document7 pagesCanberra Hospital: Post Operative Handover and Observations - Adult Patients (First 24 Hours)Zandile Angeline DhlomonseleNo ratings yet

- UntitledDocument5 pagesUntitledZandile Angeline DhlomonseleNo ratings yet

- Precourse Self-Assessment Results Congratulations Zandile Angeline Dhlomo-Nsele !Document3 pagesPrecourse Self-Assessment Results Congratulations Zandile Angeline Dhlomo-Nsele !Zandile Angeline DhlomonseleNo ratings yet

- PALS Precourse Self-Assessment and Precourse WorkDocument1 pagePALS Precourse Self-Assessment and Precourse WorkZandile Angeline DhlomonseleNo ratings yet

- SPCA Says... : Take Care of Your PigsDocument2 pagesSPCA Says... : Take Care of Your PigsZandile Angeline DhlomonseleNo ratings yet

- Proof of Delivery: Pharmacy Direct (Pty) LTDDocument2 pagesProof of Delivery: Pharmacy Direct (Pty) LTDZandile Angeline DhlomonseleNo ratings yet

- Module 1 - The Development of Human ResourcesDocument24 pagesModule 1 - The Development of Human ResourcesNicolle JungNo ratings yet

- AxiomDocument13 pagesAxiomFrancis Dave Peralta BitongNo ratings yet

- DepreciationDocument14 pagesDepreciationEdielyn VillarandaNo ratings yet

- Aggregate Demand For Labor and Aggregate Supply of LaborDocument18 pagesAggregate Demand For Labor and Aggregate Supply of LaborSibghat RehmanNo ratings yet

- Proton MM CombinedDocument42 pagesProton MM CombinedaquistarNo ratings yet

- SM QBDocument178 pagesSM QBRaj veer100% (1)

- Work Breakdown StructureDocument44 pagesWork Breakdown Structuremo0onshah100% (1)

- Liforme v. Schedule A - ComplaintDocument39 pagesLiforme v. Schedule A - ComplaintSarah BursteinNo ratings yet

- Iphone InvoiceDocument1 pageIphone InvoiceKalai ManiNo ratings yet

- Implementation Docu SAP S4HANA Loc Extension Belarus EPAM ENDocument31 pagesImplementation Docu SAP S4HANA Loc Extension Belarus EPAM ENksoleti8254No ratings yet

- Boston Matrix - ToyotaDocument7 pagesBoston Matrix - Toyotaabdullrahmanalzein2No ratings yet

- IT Subway Map Europe 2021Document1 pageIT Subway Map Europe 2021Chandrani GuptaNo ratings yet

- Company ProfileDocument20 pagesCompany ProfileMuhammad DzulqarnainNo ratings yet

- CONCURRENT ENGINEERING Q BankDocument5 pagesCONCURRENT ENGINEERING Q BankNagamani RajeshNo ratings yet

- Postage and Courier Exp ChecklistDocument2 pagesPostage and Courier Exp ChecklistMichelle Domanacal UrsabiaNo ratings yet

- BISMARK YEBOAH KsTU 2022 FULL WORKDocument68 pagesBISMARK YEBOAH KsTU 2022 FULL WORKBismark YeboahNo ratings yet

- The Globalization of StarbucksDocument3 pagesThe Globalization of StarbucksBin Ahmed100% (1)

- BY LawsDocument6 pagesBY LawsJig-jig AbanNo ratings yet

- Revenue Models For Social-Networking SitesDocument40 pagesRevenue Models For Social-Networking Sitesmariyam_amreen100% (1)

- IR Subscription-Form PrepaidDocument2 pagesIR Subscription-Form PrepaidTouseefSayfullahNo ratings yet

- M1 C2 Case Study WorkbookDocument25 pagesM1 C2 Case Study WorkbookfenixaNo ratings yet

- Grand Strategies: Zakir PatelDocument36 pagesGrand Strategies: Zakir Patelzakirno19248No ratings yet

- Top Cities in Saudi Arabia To Start A Small BusinessDocument12 pagesTop Cities in Saudi Arabia To Start A Small BusinessexpresservicesofficialNo ratings yet

- Tesco CaseDocument20 pagesTesco CaseEzhil Vendhan PalanisamyNo ratings yet

- ADILI LOANPOLICY OperationDocument20 pagesADILI LOANPOLICY OperationPaschal KunambiNo ratings yet

- Fortune 500Document60 pagesFortune 500Harsh DodNo ratings yet

- Sanjaya Raju Kunder: APAR Industries Limited Corporate Office: Regd. OfficeDocument181 pagesSanjaya Raju Kunder: APAR Industries Limited Corporate Office: Regd. Officeshreya.agrawalNo ratings yet