Professional Documents

Culture Documents

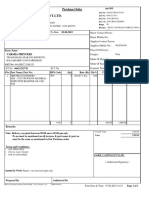

Form GST INV-1 (Tax Invoice)

Form GST INV-1 (Tax Invoice)

Uploaded by

Harsahib SinghCopyright:

Available Formats

You might also like

- Chase 2021Document2 pagesChase 2021dante33% (6)

- Graded Questions On Income Tax in SA 2022 - NodrmDocument747 pagesGraded Questions On Income Tax in SA 2022 - NodrmUzair Ismail100% (4)

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewerms_k_a_y_e96% (25)

- CFPB - Draft Periodic Mortgage Statement PDFDocument1 pageCFPB - Draft Periodic Mortgage Statement PDFtrustar14No ratings yet

- Form GST INV-1 (Tax Invoice)Document1 pageForm GST INV-1 (Tax Invoice)Harsahib SinghNo ratings yet

- shree loknath cr-42Document2 pagesshree loknath cr-42iassitalbanchhorNo ratings yet

- IKEA billPrint23Mar20201018300605Document70 pagesIKEA billPrint23Mar20201018300605Ahsan DharNo ratings yet

- DR KhandalkarDocument1 pageDR Khandalkarumeshpawar411No ratings yet

- TAX0178 SalesInvoiceDocument1 pageTAX0178 SalesInvoiceJassi SinghNo ratings yet

- Nagendra Singh Thekedar-100219Document2 pagesNagendra Singh Thekedar-100219petergr8t1No ratings yet

- Vento Ga1455Document4 pagesVento Ga1455Tinkle BellNo ratings yet

- TAX0179 SalesInvoiceDocument1 pageTAX0179 SalesInvoiceJassi SinghNo ratings yet

- Tax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024Document5 pagesTax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024vishalhardwareandpaintsNo ratings yet

- Sales Quotation Somesh Machinary Majalgaon UpdateDocument2 pagesSales Quotation Somesh Machinary Majalgaon Updateshubhamtayde500No ratings yet

- Keero MeeroDocument1 pageKeero MeeroK D HERBAL & UNANINo ratings yet

- Venkateshwara B. V. Biocorp Private LimitedDocument2 pagesVenkateshwara B. V. Biocorp Private LimitedRishi KatakdhondNo ratings yet

- Invoice 7120075230Document2 pagesInvoice 7120075230kaku131295No ratings yet

- 25.05.2022 EmulsionDocument1 page25.05.2022 EmulsionSBM DGLNo ratings yet

- GST Invoice: Joshada Medical HallDocument1 pageGST Invoice: Joshada Medical Hallrajarshi banerjeeNo ratings yet

- Bhupendra Offer LetterDocument1 pageBhupendra Offer LetterNikhil DeshpandeNo ratings yet

- New Anand PharmaDocument1 pageNew Anand PharmaShri Rani Sati officeNo ratings yet

- Cihsr 6159 PDFDocument1 pageCihsr 6159 PDFNanu JhaNo ratings yet

- Varsha Printers-PoDocument1 pageVarsha Printers-Ponathansta61No ratings yet

- Tax Invoice: Belgaum at TilakwadiDocument1 pageTax Invoice: Belgaum at TilakwadiVinayak BadaskarNo ratings yet

- Einv BD052142Document2 pagesEinv BD052142balaji nobelNo ratings yet

- Tax Invoice: IS9537 25MMDocument1 pageTax Invoice: IS9537 25MMPunit SinghNo ratings yet

- 6 Sales Order Document (Confirmation) 01Document1 page6 Sales Order Document (Confirmation) 01PrabhatNo ratings yet

- A.S.Engineering Corporation: Party DetailsDocument1 pageA.S.Engineering Corporation: Party DetailsMechwell DesignNo ratings yet

- LifelineDocument1 pageLifelineRonak EnterprisesNo ratings yet

- GST FS Service Invoice With Warranty Open - 2024-0 - 240331 - 124444Document2 pagesGST FS Service Invoice With Warranty Open - 2024-0 - 240331 - 124444RAHULNo ratings yet

- Invoice Maa Bhawani Ent. 56Document1 pageInvoice Maa Bhawani Ent. 56bvikash259No ratings yet

- Samsung Invoice 12357051967-7156716887-27W0I0234223Document1 pageSamsung Invoice 12357051967-7156716887-27W0I0234223BarunMondalNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- Chiplun 192 39177Document1 pageChiplun 192 39177Sadik PimpalkarNo ratings yet

- Invoice - No - 1181 - DT - 03112022 Original For RecipientDocument1 pageInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaNo ratings yet

- Fosroc 518Document1 pageFosroc 518vinoth kumar SanthanamNo ratings yet

- Bhupine 003 11906Document1 pageBhupine 003 11906saikat6289025368No ratings yet

- PPM0325Document1 pagePPM0325SANTOSHKUMAR NADUPURUNo ratings yet

- GREENDocument5 pagesGREENjone8kNo ratings yet

- QutotionDocument1 pageQutotionmanishsngh24No ratings yet

- 321 - Satyam - SynergyDocument2 pages321 - Satyam - Synergykaku131295No ratings yet

- 8231326542 Invoice HindwareDocument1 page8231326542 Invoice HindwareKishore UpadhyayNo ratings yet

- Raman Enterprises Performa: Batch: ExpiryDocument4 pagesRaman Enterprises Performa: Batch: ExpiryRAMAN BAJAJNo ratings yet

- Aushadhidham 2074Document1 pageAushadhidham 2074K D HERBAL & UNANINo ratings yet

- Tax Invoice: Original For RecipientDocument2 pagesTax Invoice: Original For RecipientSubhasis MallikNo ratings yet

- DR Ashutosh Kumar-22809Document1 pageDR Ashutosh Kumar-22809K D HERBAL & UNANINo ratings yet

- Tax Invoice: Shri Balaji Enterprises SBE/0950 10-Nov-22Document2 pagesTax Invoice: Shri Balaji Enterprises SBE/0950 10-Nov-22Rdp 4No ratings yet

- S7/22-23/07578 Rudram Medical: GST Invoice NB Marketing PVT LTDDocument1 pageS7/22-23/07578 Rudram Medical: GST Invoice NB Marketing PVT LTDRaj RishiNo ratings yet

- Inv G487Document1 pageInv G487ALOK SINGHNo ratings yet

- Sri Krishna MedicalsDocument1 pageSri Krishna MedicalsRK CHANAL TECHNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- Sales Quotation Shree Traders MukundwadiDocument2 pagesSales Quotation Shree Traders Mukundwadishubhamtayde500No ratings yet

- Invoice - No - 1146 - DT - 27102022 Original For RecipientDocument1 pageInvoice - No - 1146 - DT - 27102022 Original For RecipientAshwani SharmaNo ratings yet

- Mamta Drug Agency-15854Document1 pageMamta Drug Agency-15854K D HERBAL & UNANINo ratings yet

- Sahyog MedicalDocument1 pageSahyog MedicalK D HERBAL & UNANINo ratings yet

- DR R K Sharma 13 FebDocument1 pageDR R K Sharma 13 FebVinay SharmaNo ratings yet

- Pogip 00411 23-24Document1 pagePogip 00411 23-24arun.mittalNo ratings yet

- 73 Dahej-1Document1 page73 Dahej-1nishthaequipments2004No ratings yet

- Under Section 34 of CGST Act Alongwith Rule 53 of CGST Rules, 2017Document1 pageUnder Section 34 of CGST Act Alongwith Rule 53 of CGST Rules, 2017rajnishNo ratings yet

- Pdf&rendition 1 1Document1 pagePdf&rendition 1 1Chennel SwamiNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPunit SinghNo ratings yet

- Gopal Trading Co.Document1 pageGopal Trading Co.tabu 1No ratings yet

- Multiple: (Solved)Document19 pagesMultiple: (Solved)Harsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- THE Darkling Thrush: Thomas HardyDocument20 pagesTHE Darkling Thrush: Thomas HardyHarsahib SinghNo ratings yet

- Dover BeachDocument15 pagesDover BeachHarsahib Singh100% (1)

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- Multiple Choice Questions (Solved) : UniqueDocument15 pagesMultiple Choice Questions (Solved) : UniqueHarsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- UntitledDocument52 pagesUntitledHarsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- Part - A Slip: Unique NoDocument1 pagePart - A Slip: Unique NoHarsahib SinghNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- UntitledDocument4 pagesUntitledHarsahib SinghNo ratings yet

- UntitledDocument2 pagesUntitledHarsahib SinghNo ratings yet

- Consumer Protectioon: Learning O Bjectives Un DerstandDocument15 pagesConsumer Protectioon: Learning O Bjectives Un DerstandHarsahib SinghNo ratings yet

- Form GST INV-1 (Tax Invoice)Document1 pageForm GST INV-1 (Tax Invoice)Harsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- 17 The Impact of The Pandemic Covid-19 On The EnvironmentDocument4 pages17 The Impact of The Pandemic Covid-19 On The EnvironmentHarsahib SinghNo ratings yet

- Years': PreviousDocument25 pagesYears': PreviousHarsahib SinghNo ratings yet

- Xamination Questions: Mark QuestionDocument12 pagesXamination Questions: Mark QuestionHarsahib SinghNo ratings yet

- UntitledDocument10 pagesUntitledHarsahib SinghNo ratings yet

- Oneott Intertainment LTD.: CommentsDocument2 pagesOneott Intertainment LTD.: CommentsBig broad band bbnadminNo ratings yet

- Tax BulletinDocument72 pagesTax BulletinSamuel Mervin NathNo ratings yet

- Salem Five Direct Consumer Banking Fee ScheduleDocument2 pagesSalem Five Direct Consumer Banking Fee ScheduleshoppingonlyNo ratings yet

- Bengaluru City University: Exam Application FormDocument1 pageBengaluru City University: Exam Application FormAbyan younus shariffNo ratings yet

- Computation of Total Income and Income Under H Ad: Chap. 5Document18 pagesComputation of Total Income and Income Under H Ad: Chap. 5Rewant MehraNo ratings yet

- TSH Class Registration Guide 2023 5Document4 pagesTSH Class Registration Guide 2023 5terakaywilliams19No ratings yet

- Delhivery Private Limited Aryan Cargo Movers, Aryan Crago MoversDocument1 pageDelhivery Private Limited Aryan Cargo Movers, Aryan Crago MoversRAVI PRAKASHNo ratings yet

- MT 199 Free Format Message: Click Here To Get FileDocument2 pagesMT 199 Free Format Message: Click Here To Get FileFaNToMツNailNo ratings yet

- PRB TJSB Jul22Document3 pagesPRB TJSB Jul22Adarsh RavindraNo ratings yet

- Project On Goods & Service TaxDocument26 pagesProject On Goods & Service TaxRiddhi SoniNo ratings yet

- SAP - SD - Whitepaper-Down Payment Request With Billing PlanDocument3 pagesSAP - SD - Whitepaper-Down Payment Request With Billing Plansmiti84No ratings yet

- Frankfinn Franchisee ROI - Moradabad - Jan 2020 - Ver 3.0Document1 pageFrankfinn Franchisee ROI - Moradabad - Jan 2020 - Ver 3.0riyaz9999No ratings yet

- VAT-Computation 2Document28 pagesVAT-Computation 2Alvin Dagohoy100% (1)

- 80C - Children Tuition FeesDocument1 page80C - Children Tuition FeesSekh Hosne MobarakNo ratings yet

- B-70/1, SIPCOT Industrial Park, Irungattukottai, SriperumbudurDocument1 pageB-70/1, SIPCOT Industrial Park, Irungattukottai, SriperumbudurGuru MoorthiNo ratings yet

- Trade Confirmation: Pt. RHB Sekuritas IndonesiaDocument1 pageTrade Confirmation: Pt. RHB Sekuritas Indonesiaabu bakarNo ratings yet

- City of Pasig v. RepublicDocument1 pageCity of Pasig v. RepublicAiza OrdoñoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)siva prakashNo ratings yet

- Principles of TaxationDocument25 pagesPrinciples of TaxationceejayeNo ratings yet

- 7th Pay RevisionDocument2 pages7th Pay RevisionAnonymous U9MoBKINo ratings yet

- Income Tax On CorporationsDocument7 pagesIncome Tax On CorporationsKaren Joy Magsayo100% (1)

- Basic Principles of Taxation-1Document82 pagesBasic Principles of Taxation-1Abby Gail Tiongson83% (6)

- Itr Pankaj 2022-23Document1 pageItr Pankaj 2022-23gafoh81124No ratings yet

- Tax Notes On Passive IncomeDocument4 pagesTax Notes On Passive IncomeMaria Anna M LegaspiNo ratings yet

- Jan 2020 WMTDocument1 pageJan 2020 WMTMr RaiNo ratings yet

- Domestic: SMT Supriya ChowdhuryDocument2 pagesDomestic: SMT Supriya ChowdhurySujay HalderNo ratings yet

Form GST INV-1 (Tax Invoice)

Form GST INV-1 (Tax Invoice)

Uploaded by

Harsahib SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form GST INV-1 (Tax Invoice)

Form GST INV-1 (Tax Invoice)

Uploaded by

Harsahib SinghCopyright:

Available Formats

Hardit Singh & Sons Form GST INV-1 (Tax Invoice)

CSA:WINGS PHARMACEUTICALS PVT. LTD.DELHI (See Rule 7 read with Section 31 of the CGST Act 2017)

Ist Floor, 61-M.I.G., North Idgah Colony, GSTIN :09ABJPS5728D1ZD PAN NO: ABJPS5728D

Agra-282010 DL No :160AGR/20B/2025

PHONE No: 9897605427 FSSAI LICENCE No.: 160AGR/21B/2025

Email:wingspharmaagra@gmail.com

IRN

Lotus Pharma-Agra SHIP TO PARTY: Lotus Pharma-Agra Invoice No: 2142100844 Bank Name: AXIS 25-JAN-2023

Shop No.8 , 8/557, Opp, Kotwali Khinni Gali, Fountain Agra,Agra, Thanks Shop No.8 , 8/557, Opp, Kotwali Khinni Gali, Fountain Agra,Agra, Invoice Dt: 25.01.2023 Chq./NEFT 39,926.00

Kotwali, 569 Agra,282003 India Thanks Kotwali, 569 Agra,282003 India Acc. Ref No: 2142100844 Amt.: AXMB23025860499 Original for Recipient

CONTACT NO: 9997173260 CONTACT NO: 9997173260 Acc. Ref. DT. 25.01.2023 NEFT/Cheque: 25.01.2023 Duplicate for Transporter

STATE & CODE: UTTAR PRADESH 09 STATE & CODE: UTTAR PRADESH 09 Cust PO No: hariom Cheque Dt: Triplicate for Supplier

GSTIN: 09AOUPA0401K1Z2 PAN NO: AOUPA0401K GSTIN: 09AOUPA0401K1Z2 PAN NO: AOUPA0401K PO Date: 25.01.2023 Mode of Pay:

DL No. 20B- 210AGR/20B/2015 DL No. 20B- 210AGR/20B/2015 SO. No: 1142101359 Trans:

Standard 2.0

DL No. 21B- 210AGR/21B/2015 DL No. 21B- 210AGR/21B/2015 SO Date:. 25.01.2023 LR No: Mix/Loose 0.0

Customer 11000380 LR Dt: 4,322.700 KGs Total 2

Sr. Material Description of goods HSN UOM MFG Batch No. Exp P.T.S P.T.R MRP Sales Free Total Trade Add. Taxable IGST CGST SGST/ GST

No Date Qty Qty Amount Discount +DSD Amount Rate% Rate% UGST Amount

(TD) Discount Rate%

1 50000222 Diclowin Plus Tab-30X20 30049069 STP WBT LLP PD1TC109 09.2025 8.00 8.80 22.00 4,320 0 34,560.00 0.00 518.40- 34,041.60 0.00 6.00 6.00 4,085.00

2 50000201 Hairshield Anti-lice 30ml 33042000 BTL WBT LLP HSH-377 09.2025 38.52 42.37 60.00 40 20 2,311.20 770.40- 23.11- 1,517.69 0.00 9.00 9.00 273.18

(Comb+B4G2)

SUB TOTAL 36,871.20 770.40- 541.51- 35,559.29 4,358.18

HSNCODE: 30049069:- 34041.60 CGST 6.00%= 2042.50 / SGST 6.00%= 2,042.50 Total Val(Rs.):38126.60 Total : 36,871.20

HSNCODE: 33042000:- 1517.69 CGST 9.00%= 136.59 / SGST 9.00%= 136.59 Total Val(Rs.):1790.87 Additional Discount : 541.51- Freight Amount 0.00

Trade Discount : 770.40- Invoice Value 39,917.47

Dealer Spl. Discount : 0.00 TCS 0.00

Taxable Amount : 35,559.29 Round off 0.47-

GST AMOUNT : 4,358.18 Grand Value 39,917.00

AMOUNT IN WORDS (RUPEES): THIRTY NINE THOUSAND NINE HUNDRED SEVENTEEN ONLY. FOR Hardit Singh & Sons

AUTHORIZED SIGNATORY

TERMS & CONDITIONS: (1) Invoices remaining unpaid for over due date of payment shall become payable alongwith Interest @18% P.A till date of payment.(2) Do not Pay cash or deliver saleable goods to any Sales Personnel against this bill or

otherwise if paid or goods handover, it will be the sole responsibility of Buyer. (3) In case, cheque of any Buyer bounces, bank charges @500/- per cheque bounced & Interest @1.5% P.M. has to be paid by Buyer for delayed days. (4) Subject to Delhi

jurisdiction only. Our responsibility ceases as soon as the goods leave our premises. (5) If Invoice remains unpaid even upto 60 days then further invoicing will be locked. (6) If quantity supplied in invoice is more than ordered then the buyer should inform to

H.O. immediately by email/text or letter. (7) No commitment of discount, compensation, replacement, scheme, incentive etc. is valid until it is given in writing on company letter pad/mail from SCM Head /Commercial received through CSA only. (8) All taxes

which the firm may be obliged to pay now or in future in respect transaction must be born and paid by the Buyer. (9) Any breakage/loss in goods supplied against this invoice should be informed within 7 days with LR copy. (10) Invoice contains the Drug Lic.

and GSTN registration details given by you and this shall be taken as correct and has not been changed. (11) Goods supplied against this Invoice do not contravene the provision of section 18 of Drug and cosmetics act 1940. (12) Without prejudice, we

assuming that the Drug License, GST No., Shipping & Billing Address, Bank Details provided by Buyer is duly valid and renewed in case of any discrepancies Buyer shall be solely liable for all the consequences.

Declarartion (1) The Price & Goods in this Invoice are True & Correct. (2) Warranty under PFA ACT 1954 Form VI-A FL No. PFA/191/09. We hereby certify that goods mentioned in this Invoice are warraned to be of the Nature and Quality which it

purpose to be.

Payments to be made by NEFT/RTGS or any other electronic mode only in favour of M/s Wings Pharmaceuticals Private Limited.

Bank Name: ICICI Bank, VAN No.WPPLIC11000380, IFSC: ICIC0000106 Branch: Punjabi Bagh Wealth Branch,Punjabi Bagh Extension, New Delhi Pin Code:110026

Wings Pharmaceuticals Pvt. Ltd. PAN No. AAACW0963B

Email : shailendra.krishna@wingspharma.co.in = Mobile : 9560453332 = Notes :

Page:1/1

You might also like

- Chase 2021Document2 pagesChase 2021dante33% (6)

- Graded Questions On Income Tax in SA 2022 - NodrmDocument747 pagesGraded Questions On Income Tax in SA 2022 - NodrmUzair Ismail100% (4)

- Tax 1 ReviewerDocument52 pagesTax 1 Reviewerms_k_a_y_e96% (25)

- CFPB - Draft Periodic Mortgage Statement PDFDocument1 pageCFPB - Draft Periodic Mortgage Statement PDFtrustar14No ratings yet

- Form GST INV-1 (Tax Invoice)Document1 pageForm GST INV-1 (Tax Invoice)Harsahib SinghNo ratings yet

- shree loknath cr-42Document2 pagesshree loknath cr-42iassitalbanchhorNo ratings yet

- IKEA billPrint23Mar20201018300605Document70 pagesIKEA billPrint23Mar20201018300605Ahsan DharNo ratings yet

- DR KhandalkarDocument1 pageDR Khandalkarumeshpawar411No ratings yet

- TAX0178 SalesInvoiceDocument1 pageTAX0178 SalesInvoiceJassi SinghNo ratings yet

- Nagendra Singh Thekedar-100219Document2 pagesNagendra Singh Thekedar-100219petergr8t1No ratings yet

- Vento Ga1455Document4 pagesVento Ga1455Tinkle BellNo ratings yet

- TAX0179 SalesInvoiceDocument1 pageTAX0179 SalesInvoiceJassi SinghNo ratings yet

- Tax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024Document5 pagesTax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024vishalhardwareandpaintsNo ratings yet

- Sales Quotation Somesh Machinary Majalgaon UpdateDocument2 pagesSales Quotation Somesh Machinary Majalgaon Updateshubhamtayde500No ratings yet

- Keero MeeroDocument1 pageKeero MeeroK D HERBAL & UNANINo ratings yet

- Venkateshwara B. V. Biocorp Private LimitedDocument2 pagesVenkateshwara B. V. Biocorp Private LimitedRishi KatakdhondNo ratings yet

- Invoice 7120075230Document2 pagesInvoice 7120075230kaku131295No ratings yet

- 25.05.2022 EmulsionDocument1 page25.05.2022 EmulsionSBM DGLNo ratings yet

- GST Invoice: Joshada Medical HallDocument1 pageGST Invoice: Joshada Medical Hallrajarshi banerjeeNo ratings yet

- Bhupendra Offer LetterDocument1 pageBhupendra Offer LetterNikhil DeshpandeNo ratings yet

- New Anand PharmaDocument1 pageNew Anand PharmaShri Rani Sati officeNo ratings yet

- Cihsr 6159 PDFDocument1 pageCihsr 6159 PDFNanu JhaNo ratings yet

- Varsha Printers-PoDocument1 pageVarsha Printers-Ponathansta61No ratings yet

- Tax Invoice: Belgaum at TilakwadiDocument1 pageTax Invoice: Belgaum at TilakwadiVinayak BadaskarNo ratings yet

- Einv BD052142Document2 pagesEinv BD052142balaji nobelNo ratings yet

- Tax Invoice: IS9537 25MMDocument1 pageTax Invoice: IS9537 25MMPunit SinghNo ratings yet

- 6 Sales Order Document (Confirmation) 01Document1 page6 Sales Order Document (Confirmation) 01PrabhatNo ratings yet

- A.S.Engineering Corporation: Party DetailsDocument1 pageA.S.Engineering Corporation: Party DetailsMechwell DesignNo ratings yet

- LifelineDocument1 pageLifelineRonak EnterprisesNo ratings yet

- GST FS Service Invoice With Warranty Open - 2024-0 - 240331 - 124444Document2 pagesGST FS Service Invoice With Warranty Open - 2024-0 - 240331 - 124444RAHULNo ratings yet

- Invoice Maa Bhawani Ent. 56Document1 pageInvoice Maa Bhawani Ent. 56bvikash259No ratings yet

- Samsung Invoice 12357051967-7156716887-27W0I0234223Document1 pageSamsung Invoice 12357051967-7156716887-27W0I0234223BarunMondalNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- Chiplun 192 39177Document1 pageChiplun 192 39177Sadik PimpalkarNo ratings yet

- Invoice - No - 1181 - DT - 03112022 Original For RecipientDocument1 pageInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaNo ratings yet

- Fosroc 518Document1 pageFosroc 518vinoth kumar SanthanamNo ratings yet

- Bhupine 003 11906Document1 pageBhupine 003 11906saikat6289025368No ratings yet

- PPM0325Document1 pagePPM0325SANTOSHKUMAR NADUPURUNo ratings yet

- GREENDocument5 pagesGREENjone8kNo ratings yet

- QutotionDocument1 pageQutotionmanishsngh24No ratings yet

- 321 - Satyam - SynergyDocument2 pages321 - Satyam - Synergykaku131295No ratings yet

- 8231326542 Invoice HindwareDocument1 page8231326542 Invoice HindwareKishore UpadhyayNo ratings yet

- Raman Enterprises Performa: Batch: ExpiryDocument4 pagesRaman Enterprises Performa: Batch: ExpiryRAMAN BAJAJNo ratings yet

- Aushadhidham 2074Document1 pageAushadhidham 2074K D HERBAL & UNANINo ratings yet

- Tax Invoice: Original For RecipientDocument2 pagesTax Invoice: Original For RecipientSubhasis MallikNo ratings yet

- DR Ashutosh Kumar-22809Document1 pageDR Ashutosh Kumar-22809K D HERBAL & UNANINo ratings yet

- Tax Invoice: Shri Balaji Enterprises SBE/0950 10-Nov-22Document2 pagesTax Invoice: Shri Balaji Enterprises SBE/0950 10-Nov-22Rdp 4No ratings yet

- S7/22-23/07578 Rudram Medical: GST Invoice NB Marketing PVT LTDDocument1 pageS7/22-23/07578 Rudram Medical: GST Invoice NB Marketing PVT LTDRaj RishiNo ratings yet

- Inv G487Document1 pageInv G487ALOK SINGHNo ratings yet

- Sri Krishna MedicalsDocument1 pageSri Krishna MedicalsRK CHANAL TECHNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- Sales Quotation Shree Traders MukundwadiDocument2 pagesSales Quotation Shree Traders Mukundwadishubhamtayde500No ratings yet

- Invoice - No - 1146 - DT - 27102022 Original For RecipientDocument1 pageInvoice - No - 1146 - DT - 27102022 Original For RecipientAshwani SharmaNo ratings yet

- Mamta Drug Agency-15854Document1 pageMamta Drug Agency-15854K D HERBAL & UNANINo ratings yet

- Sahyog MedicalDocument1 pageSahyog MedicalK D HERBAL & UNANINo ratings yet

- DR R K Sharma 13 FebDocument1 pageDR R K Sharma 13 FebVinay SharmaNo ratings yet

- Pogip 00411 23-24Document1 pagePogip 00411 23-24arun.mittalNo ratings yet

- 73 Dahej-1Document1 page73 Dahej-1nishthaequipments2004No ratings yet

- Under Section 34 of CGST Act Alongwith Rule 53 of CGST Rules, 2017Document1 pageUnder Section 34 of CGST Act Alongwith Rule 53 of CGST Rules, 2017rajnishNo ratings yet

- Pdf&rendition 1 1Document1 pagePdf&rendition 1 1Chennel SwamiNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPunit SinghNo ratings yet

- Gopal Trading Co.Document1 pageGopal Trading Co.tabu 1No ratings yet

- Multiple: (Solved)Document19 pagesMultiple: (Solved)Harsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- THE Darkling Thrush: Thomas HardyDocument20 pagesTHE Darkling Thrush: Thomas HardyHarsahib SinghNo ratings yet

- Dover BeachDocument15 pagesDover BeachHarsahib Singh100% (1)

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- Multiple Choice Questions (Solved) : UniqueDocument15 pagesMultiple Choice Questions (Solved) : UniqueHarsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- UntitledDocument52 pagesUntitledHarsahib SinghNo ratings yet

- St. Peter's College: ReceiptDocument1 pageSt. Peter's College: ReceiptHarsahib SinghNo ratings yet

- Part - A Slip: Unique NoDocument1 pagePart - A Slip: Unique NoHarsahib SinghNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- UntitledDocument4 pagesUntitledHarsahib SinghNo ratings yet

- UntitledDocument2 pagesUntitledHarsahib SinghNo ratings yet

- Consumer Protectioon: Learning O Bjectives Un DerstandDocument15 pagesConsumer Protectioon: Learning O Bjectives Un DerstandHarsahib SinghNo ratings yet

- Form GST INV-1 (Tax Invoice)Document1 pageForm GST INV-1 (Tax Invoice)Harsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- UntitledDocument1 pageUntitledHarsahib SinghNo ratings yet

- 17 The Impact of The Pandemic Covid-19 On The EnvironmentDocument4 pages17 The Impact of The Pandemic Covid-19 On The EnvironmentHarsahib SinghNo ratings yet

- Years': PreviousDocument25 pagesYears': PreviousHarsahib SinghNo ratings yet

- Xamination Questions: Mark QuestionDocument12 pagesXamination Questions: Mark QuestionHarsahib SinghNo ratings yet

- UntitledDocument10 pagesUntitledHarsahib SinghNo ratings yet

- Oneott Intertainment LTD.: CommentsDocument2 pagesOneott Intertainment LTD.: CommentsBig broad band bbnadminNo ratings yet

- Tax BulletinDocument72 pagesTax BulletinSamuel Mervin NathNo ratings yet

- Salem Five Direct Consumer Banking Fee ScheduleDocument2 pagesSalem Five Direct Consumer Banking Fee ScheduleshoppingonlyNo ratings yet

- Bengaluru City University: Exam Application FormDocument1 pageBengaluru City University: Exam Application FormAbyan younus shariffNo ratings yet

- Computation of Total Income and Income Under H Ad: Chap. 5Document18 pagesComputation of Total Income and Income Under H Ad: Chap. 5Rewant MehraNo ratings yet

- TSH Class Registration Guide 2023 5Document4 pagesTSH Class Registration Guide 2023 5terakaywilliams19No ratings yet

- Delhivery Private Limited Aryan Cargo Movers, Aryan Crago MoversDocument1 pageDelhivery Private Limited Aryan Cargo Movers, Aryan Crago MoversRAVI PRAKASHNo ratings yet

- MT 199 Free Format Message: Click Here To Get FileDocument2 pagesMT 199 Free Format Message: Click Here To Get FileFaNToMツNailNo ratings yet

- PRB TJSB Jul22Document3 pagesPRB TJSB Jul22Adarsh RavindraNo ratings yet

- Project On Goods & Service TaxDocument26 pagesProject On Goods & Service TaxRiddhi SoniNo ratings yet

- SAP - SD - Whitepaper-Down Payment Request With Billing PlanDocument3 pagesSAP - SD - Whitepaper-Down Payment Request With Billing Plansmiti84No ratings yet

- Frankfinn Franchisee ROI - Moradabad - Jan 2020 - Ver 3.0Document1 pageFrankfinn Franchisee ROI - Moradabad - Jan 2020 - Ver 3.0riyaz9999No ratings yet

- VAT-Computation 2Document28 pagesVAT-Computation 2Alvin Dagohoy100% (1)

- 80C - Children Tuition FeesDocument1 page80C - Children Tuition FeesSekh Hosne MobarakNo ratings yet

- B-70/1, SIPCOT Industrial Park, Irungattukottai, SriperumbudurDocument1 pageB-70/1, SIPCOT Industrial Park, Irungattukottai, SriperumbudurGuru MoorthiNo ratings yet

- Trade Confirmation: Pt. RHB Sekuritas IndonesiaDocument1 pageTrade Confirmation: Pt. RHB Sekuritas Indonesiaabu bakarNo ratings yet

- City of Pasig v. RepublicDocument1 pageCity of Pasig v. RepublicAiza OrdoñoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)siva prakashNo ratings yet

- Principles of TaxationDocument25 pagesPrinciples of TaxationceejayeNo ratings yet

- 7th Pay RevisionDocument2 pages7th Pay RevisionAnonymous U9MoBKINo ratings yet

- Income Tax On CorporationsDocument7 pagesIncome Tax On CorporationsKaren Joy Magsayo100% (1)

- Basic Principles of Taxation-1Document82 pagesBasic Principles of Taxation-1Abby Gail Tiongson83% (6)

- Itr Pankaj 2022-23Document1 pageItr Pankaj 2022-23gafoh81124No ratings yet

- Tax Notes On Passive IncomeDocument4 pagesTax Notes On Passive IncomeMaria Anna M LegaspiNo ratings yet

- Jan 2020 WMTDocument1 pageJan 2020 WMTMr RaiNo ratings yet

- Domestic: SMT Supriya ChowdhuryDocument2 pagesDomestic: SMT Supriya ChowdhurySujay HalderNo ratings yet