Professional Documents

Culture Documents

Problem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances On

Problem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances On

Uploaded by

Panda Erar0 ratings0% found this document useful (0 votes)

25 views1 pageL Company entered liquidation on January 1, 2020 with partner capital balances of $125,000 for A (25%), $270,000 for C (35%), and $185,000 for J (40%). The partnership had $220,000 in liabilities including a $30,000 loan from C and $40,000 in cash on hand. Certain assets were sold for $370,000, other non-cash assets were sold for $210,000, resulting in $430,000 of cash to be distributed to partners: $80,000 for A, $237,000 for C, and $113,000 for J.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentL Company entered liquidation on January 1, 2020 with partner capital balances of $125,000 for A (25%), $270,000 for C (35%), and $185,000 for J (40%). The partnership had $220,000 in liabilities including a $30,000 loan from C and $40,000 in cash on hand. Certain assets were sold for $370,000, other non-cash assets were sold for $210,000, resulting in $430,000 of cash to be distributed to partners: $80,000 for A, $237,000 for C, and $113,000 for J.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views1 pageProblem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances On

Problem 4: On January 1, 2020, L Company Entered Into Liquidation. The Partner's Capital Balances On

Uploaded by

Panda ErarL Company entered liquidation on January 1, 2020 with partner capital balances of $125,000 for A (25%), $270,000 for C (35%), and $185,000 for J (40%). The partnership had $220,000 in liabilities including a $30,000 loan from C and $40,000 in cash on hand. Certain assets were sold for $370,000, other non-cash assets were sold for $210,000, resulting in $430,000 of cash to be distributed to partners: $80,000 for A, $237,000 for C, and $113,000 for J.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

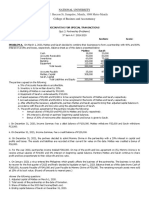

Problem 4: On January 1, 2020, L Company entered into liquidation.

The partner’s capital balances on

this date are as follows:

A (25%) 125,000

C (35%) 270,000

J (40%) 185,000

The partnership has liabilities amounting to 220,000, including a loan from C (30,000), cash on hand

before the start of liquidation is 40,000. With the information given, answer the following independent

situation:

a. Certain assets were sold for 370,000 and the rest of the non-cash assets were sold at 210,000.

How much is the cash to be distributed to the partners? 430,000 – 80K for A; 237K for C; 113K

for J

b. After exhausting the noncash assets of the partnership, how much cash must be invested by the

partners to satisfy the claims of the outside creditors and to pat the amount due to the partners?

184,000

c. If C received 112,750, how much was loss from the realization of the noncash assets?

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- UntitledDocument10 pagesUntitledJanna Mari Frias100% (1)

- Question 1Document15 pagesQuestion 1Cale HenituseNo ratings yet

- Partnership LiquidationDocument4 pagesPartnership LiquidationBianca Iyiyi100% (1)

- FIL 124 - Final TestDocument16 pagesFIL 124 - Final TestChavey Jean V. RenidoNo ratings yet

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Partnership ProbsDocument3 pagesPartnership Probsmartinfaith958No ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- Partnership Liquidation - SeatworkDocument3 pagesPartnership Liquidation - SeatworkTEOPE, EMERLIZA DE CASTRONo ratings yet

- 9404 - Partnership LiquidationDocument4 pages9404 - Partnership LiquidationLuzviminda SaspaNo ratings yet

- Acc Ws Dissolution of Part - FirmDocument12 pagesAcc Ws Dissolution of Part - FirmDhivegaNo ratings yet

- 8904 - Partnership LiquidationDocument4 pages8904 - Partnership Liquidationxara mizpahNo ratings yet

- CH 6 MCQ AccDocument7 pagesCH 6 MCQ AccNikunj NandwaniNo ratings yet

- Liquidation PracticeDocument1 pageLiquidation PracticeelijahejtolentinoNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- S Partnership LiquidationDocument2 pagesS Partnership Liquidationandzie09876No ratings yet

- BAFACR1X - Quiz No. 1 - Finals - 3TAY2324 - Questionaire 1Document5 pagesBAFACR1X - Quiz No. 1 - Finals - 3TAY2324 - Questionaire 1acena968No ratings yet

- Partnership ReviewDocument5 pagesPartnership ReviewAirille CarlosNo ratings yet

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDocument11 pagesSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNo ratings yet

- BAM 201 p2 Quiz 2 With AnswersDocument9 pagesBAM 201 p2 Quiz 2 With AnswersPascua, Colleene Faye DG.No ratings yet

- MID-TERM Adv - Actg. 1 (No Answer)Document10 pagesMID-TERM Adv - Actg. 1 (No Answer)Jose Benzon100% (1)

- St. Lawrence Convent, Sr. Sec, School Class XII (2021-2022) Accounts UT-1 Time - 1hr 30mins Maximum Marks 40 General InstructionsDocument3 pagesSt. Lawrence Convent, Sr. Sec, School Class XII (2021-2022) Accounts UT-1 Time - 1hr 30mins Maximum Marks 40 General Instructionsshahnawaz alamNo ratings yet

- Dissolution and Liquidation Sample ProblemsDocument5 pagesDissolution and Liquidation Sample ProblemsShaz NagaNo ratings yet

- Quiz 3Document2 pagesQuiz 3halagochristinejeanelle14No ratings yet

- Lesson 4 Partnership DissolutionDocument17 pagesLesson 4 Partnership DissolutionheyheyNo ratings yet

- De Thi 2020Document5 pagesDe Thi 2020Kim HồngNo ratings yet

- Alom Ia FoDocument18 pagesAlom Ia FoLea Yvette SaladinoNo ratings yet

- 21-22 Comprehensive Exam Solution Part-ADocument4 pages21-22 Comprehensive Exam Solution Part-Af20221197No ratings yet

- Problem 1: Rizal Review CenterDocument6 pagesProblem 1: Rizal Review CenterrenoNo ratings yet

- P2 Exam ParCor Questionnaire 1Document7 pagesP2 Exam ParCor Questionnaire 1peter paker100% (1)

- Retire Death Dissolution SheetDocument6 pagesRetire Death Dissolution SheetTanvi SisodiaNo ratings yet

- Chapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oDocument9 pagesChapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oabi100% (1)

- Accounts Extra QuestionsDocument4 pagesAccounts Extra Questionsaguptakochi314No ratings yet

- Partnership DissolutionDocument7 pagesPartnership DissolutionAngel Frolen B. RacinezNo ratings yet

- Premidterm ExaminationDocument5 pagesPremidterm ExaminationAnne Camille AlfonsoNo ratings yet

- Partnership Liquidation - Notes & Illustrative ProblemsDocument4 pagesPartnership Liquidation - Notes & Illustrative ProblemsTEOPE, EMERLIZA DE CASTRONo ratings yet

- 858 Accounts - Isc SpecimenDocument15 pages858 Accounts - Isc SpecimenUmesh JaiswalNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- 1Document3 pages1PerdanaMenteriNo ratings yet

- Partnership Dissolution SeatworksDocument7 pagesPartnership Dissolution Seatworkscali cdNo ratings yet

- LiquiDocument3 pagesLiquiPremium Netflix0% (1)

- Preboard - 1 Session - 2021 - 22 Grade: XIIDocument6 pagesPreboard - 1 Session - 2021 - 22 Grade: XIIVAIBHAV BADOLANo ratings yet

- FA & FFA Mock Exam Questions Set 1Document15 pagesFA & FFA Mock Exam Questions Set 1miss ainaNo ratings yet

- Dissolution 2024 SPCC PDFDocument66 pagesDissolution 2024 SPCC PDFdollpees01No ratings yet

- Class 12 EnglishDocument15 pagesClass 12 EnglishKhushi GoyalNo ratings yet

- F3 - Consolidation, RatiosDocument11 pagesF3 - Consolidation, RatiosArslan AlviNo ratings yet

- 12 Accountancy PDFDocument7 pages12 Accountancy PDFGaurang AgarwalNo ratings yet

- 12 20 Ca Appl Q ADocument119 pages12 20 Ca Appl Q AHassaniNo ratings yet

- Partnership Liquidation Name: Date: Professor: Section: Score: QuizDocument3 pagesPartnership Liquidation Name: Date: Professor: Section: Score: QuizKimberly Quin CañasNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- F3 Mock 4Document14 pagesF3 Mock 4Man Ish K DasNo ratings yet

- Afar302 A - PD 3Document5 pagesAfar302 A - PD 3Nicole TeruelNo ratings yet

- Class 12 Mock Test AccountancyDocument13 pagesClass 12 Mock Test AccountancyLPS ANJALI SHARMANo ratings yet

- Barrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Document4 pagesBarrett Hodgson University Departments of Management Science Midterm Semester Examination - Fall 2019Alishba KhanNo ratings yet

- Problem A James, Wade, Allen and Bosh Are Partners Sharing Profits and Losses Equally. The Partnership IsDocument4 pagesProblem A James, Wade, Allen and Bosh Are Partners Sharing Profits and Losses Equally. The Partnership Ispatrise siosonNo ratings yet

- Assignment Dissolution NEWERDocument3 pagesAssignment Dissolution NEWERsakshamagnihotri0No ratings yet

- Rev SheetDocument2 pagesRev Sheetnazia7nagiNo ratings yet

- Quiz3 HolyeDocument35 pagesQuiz3 HolyegoamankNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Case Studies - EstafaDocument36 pagesCase Studies - EstafaPanda ErarNo ratings yet

- Ra 8293 Intellectual Property Code of The Philippines Case Studies Via Supreme Court of The PhilippinesDocument27 pagesRa 8293 Intellectual Property Code of The Philippines Case Studies Via Supreme Court of The PhilippinesPanda ErarNo ratings yet

- Afar 2 - Installment SalesDocument1 pageAfar 2 - Installment SalesPanda ErarNo ratings yet

- UntitledDocument1 pageUntitledPanda ErarNo ratings yet

- Pas 12Document1 pagePas 12Panda ErarNo ratings yet

- Afar 2 - 8Document1 pageAfar 2 - 8Panda ErarNo ratings yet

- Afar 2 - 10Document1 pageAfar 2 - 10Panda ErarNo ratings yet

- Audit of Shareholders' EquityDocument1 pageAudit of Shareholders' EquityPanda ErarNo ratings yet

- Afar 2 - 11Document1 pageAfar 2 - 11Panda ErarNo ratings yet

- Activity in Discounted Cash Flows MethodDocument2 pagesActivity in Discounted Cash Flows MethodPanda ErarNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- Problem 1Document1 pageProblem 1Panda ErarNo ratings yet

- Quiz 8Document2 pagesQuiz 8Panda ErarNo ratings yet

- AFAR 2 - FranchiseDocument1 pageAFAR 2 - FranchisePanda ErarNo ratings yet

- AFAR 3 - Intercompany TransactionsDocument2 pagesAFAR 3 - Intercompany TransactionsPanda ErarNo ratings yet

- AFAR 3 - Quiz On Intercompany TransactionsDocument1 pageAFAR 3 - Quiz On Intercompany TransactionsPanda ErarNo ratings yet

- Shareholders EquityDocument1 pageShareholders EquityPanda ErarNo ratings yet

- Quiz 2Document1 pageQuiz 2Panda ErarNo ratings yet

- Problem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofDocument1 pageProblem 3: The Statement of Financial Position of KPR Partnership Shows The Following Information As ofPanda ErarNo ratings yet

- Quiz 8Document1 pageQuiz 8Panda ErarNo ratings yet

- Acctg 3B Activity On PAS 20 and 23Document1 pageAcctg 3B Activity On PAS 20 and 23Panda ErarNo ratings yet

- Quiz 10Document1 pageQuiz 10Panda ErarNo ratings yet

- Afar 2 - 2Document1 pageAfar 2 - 2Panda ErarNo ratings yet

- Problem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atDocument1 pageProblem 5: B and W Formed A Partnership On July 1, 2017, B Invested 20,000 Cash Inventories Valued atPanda ErarNo ratings yet

- Afar 2 - 1Document1 pageAfar 2 - 1Panda ErarNo ratings yet

- Problem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesDocument1 pageProblem 2: L Is Entering Into Liquidation and You Are Given The Following Account BalancesPanda ErarNo ratings yet

- Afar 2 - 4Document1 pageAfar 2 - 4Panda ErarNo ratings yet

- Problem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsDocument1 pageProblem 1: After A Long Dispute, C, A and N Decided To Liquidate Their Partnership. Their Total Interest AsPanda ErarNo ratings yet

- Afar 2 - 3Document1 pageAfar 2 - 3Panda ErarNo ratings yet

- Acctg 7 - Activity For Everybody (Joint and By-Product Costing)Document1 pageAcctg 7 - Activity For Everybody (Joint and By-Product Costing)Panda ErarNo ratings yet