Professional Documents

Culture Documents

Financial Accounting: The Institute of Chartered Accountants of Pakistan

Financial Accounting: The Institute of Chartered Accountants of Pakistan

Uploaded by

Shakeel IshaqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting: The Institute of Chartered Accountants of Pakistan

Financial Accounting: The Institute of Chartered Accountants of Pakistan

Uploaded by

Shakeel IshaqCopyright:

Available Formats

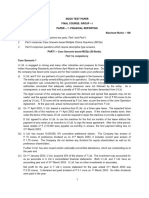

The Institute of Chartered Accountants of Pakistan

Financial Accounting

Intermediate Examination Spring 2011 Module C March 10, 2011 100 marks - 3 hours

Q.1

Earth, Jupiter and Mars carry on business in partnership sharing profits and losses in the ratio of 5:4:3 respectively. They decided to form a company, Universe Limited (UL). The firms statement of financial position on the date of incorporation of UL i.e. January 1, 2011 is as follows: Rs. in million Capital Accounts Earth Jupiter Mars Current Liabilities Trade creditors Other liabilities Bank overdraft 100 79 60 239 45 12 6 63 302 Non Current Assets Machines and equipment Vehicles Furniture Current Assets Stock-in-trade Trade debtors Short term investments Rs. in million 90 17 15 122 62 70 48 180 302

The conversion scheme was executed on the following terms and conditions: Mars owned the freehold premises which he had let to the partnership. He agreed to sell it to UL for Rs. 40 million against a consideration of 4 million 11% preference shares at par. (ii) Machines having carrying value of Rs. 25 million were taken over by Jupiter at an agreed price of Rs. 23 million. (iii) Earth agreed to discharge the other liabilities against cash payment of Rs. 10 million from his own resources. (iv) It was agreed to appoint Venus as a director in the new company. He subscribed Rs. 20 million and was issued 2 million ordinary shares of Rs. 10 each. (v) The value of goodwill of the partnership firm was agreed at Rs. 50 million. (vi) The details of assets and liabilities taken-over by UL are as under: Stocks- in- trade was taken over at the estimated value of Rs. 60 million. 90% of the trade debts were considered recoverable. All other assets and liabilities were taken over at book value. (vii) The partners balances were settled as follows: Jupiter, who was not willing to continue as an equity-holder, received 0.6 million 12% debentures of Rs. 100 each. 16 million ordinary shares of Rs. 10 each were issued to Earth and Mars in proportion to their final capital balances after incorporating all adjustments. The remaining balances of each partner were settled in cash. Required: Prepare the following: (a) Realization Account (b) Partners Capital Accounts (c) Opening Statement of Financial Position of Universe Limited. (i)

(18 marks)

FinancialAccounting

Page2of4

Q.2

Following is the summarized trial balance of Moonlight Pakistan Limited (MPL), a listed company, for the year ended December 31, 2010: Rs. in million Debit Credit 2,600 2,104 702 758 354 1,784 220 250 210 400 670 1,200 510 1,600 8 22 544 420 3,608 8,982 8,982

Land and buildings - at cost Plants at cost Trade receivables Stock in trade at December 31, 2010 Cash and bank Cost of sales Selling expenses Administrative expenses Financial charges Accumulated depreciation as on January 1, 2010 Buildings Accumulated depreciation as on January 1, 2010 Plants Ordinary shares of Rs. 10 each fully paid Retained earnings as at January 1, 2010 12% Long term loan Provision for gratuity Deferred tax on January 1, 2010 Trade payables Right subscription received Revenue

Additional Information (i) The land and buildings were acquired on January 1, 2006. The cost of land was Rs. 600 million. On January 1, 2010 a professional valuer firm valued the buildings at Rs. 1,840 million with no change in the value of land. The estimated life at acquisition was 20 years and the remaining life has not changed as a result of the valuation. 60% of depreciation on buildings is allocated to manufacturing, 25% to selling and 15% to administration. (ii) Plants are depreciated at 20% per annum using the reducing balance method. (iii) On March 31, 2010 MPL made a bonus issue of one share for every six held. The issue has not been recorded in the books of account. (iv) Right shares were issued on September 1, 2010 at Rs. 12 per share. (v) The interest on long term loan is payable on the first day of July and January. No accrual has been made for the interest payable on January 1, 2011. (vi) MPL operates an unfunded gratuity scheme for all its eligible employees. The provision required as on December 31, 2010 is estimated at Rs. 23 million. Rs. 3 million were paid during the year and debited to the provision for gratuity account. Cost of gratuity is allocated to production, selling and administration expenses in the ratio of 60% : 20% : 20%. (vii) The tax charge for the current year after making all related adjustments is estimated at Rs. 37 million. The timing differences related to taxation are estimated to increase by Rs. 80 million, over the last year. The applicable income tax rate is 35%. Required: In accordance with the requirements of Companies Ordinance, 1984 and International Financial Reporting Standards, prepare the following: (a) Statement of Financial Position as of December 31, 2010. (b) Income Statement for the year ended December 31, 2010. (Comparative figures and notes to the financial statements are not required) (22 marks)

FinancialAccounting

Page3of4

Q.3

The following information relates to Galaxy International (GI), a listed company, which was incorporated on January 1, 2009. (i) (ii) The (loss) / profit before taxation for the years ended December 31, 2009 and 2010 amounted to (Rs. 1.75 million) and Rs. 23.5 million respectively. The details of accounting and tax depreciation on fixed assets is as follows: 2010 2009 Rs. in million 15 15 6 45

Accounting depreciation Tax depreciation (iii) (iv) (v) (vi)

In 2009, GI accrued certain expenses amounting to Rs. 2 million which were disallowed by the tax authorities. However, these expenses are expected to be allowed on the basis of payment in 2010. GI earned interest on Special Investment Bonds amounting to Rs. 1.0 million and Rs. 1.25 million in the years 2009 and 2010 respectively. This income is exempt from tax. GI operates an unfunded gratuity scheme. The provision during the years 2009 and 2010 amounted to Rs. 1.7 million and Rs. 2.2 million respectively. No payment has so far been made on account of gratuity. The applicable tax rate is 35%.

Required: Prepare a note on taxation for inclusion in the companys financial statements for the year ended December 31, 2010 giving appropriate disclosures relating to current and deferred tax expenses including a reconciliation to explain the relationship between tax expense and accounting profit. (20 marks) Q.4 Sunshine Education Systems (SES) has a network of schools in major cities of Pakistan. It has entered into a franchise agreement with Neptune Schooling Systems (NSS). SES would charge franchise fee of Rs. 9 million. Of this amount, Rs. 1.8 million is payable at the time of signing the agreement and the balance in four annual installments of Rs. 1.8 million each. In return, SES would provide the following services/benefits: Allow NSS to use SESs brand name. Offer expert advice in selecting the location for the schools, selection of teachers, management training and quality control. Provide initial set up comprising of books, unlimited access to teachers resources available on the SESs website, etc. at a discount of 20%. Generally, SES provides these rights to nonfranchisee at a cost of Rs. 1.2 million. Carry out promotional activities for the benefit of NSS during the next five years at Rs. 9,000 per month which is included in the franchise fee. It is the policy of SES to charge Rs. 7,500,180 from those franchisees who opt to pay the full amount upfront, which is the present value of five installments discounted at the rate of 10%. Required: Suggest the journal entry in the books of SES at the time of signing of the agreement, under each of the following situations: (a) (b) The collectability of the future installments is reasonably assured and significant portion of the services have already been performed. Substantial portion of services are yet to be performed and collectability of future installments is very uncertain. However, down payment has been received and is not refundable. (08 marks)

FinancialAccounting

Page4of4

Q.5

Star-Bright Pharmaceutical Limited (SPL), a listed company, purchased a brand on January 1, 2005 at a cost of Rs. 382 million. It has incurred a substantial amount on further development of the brand, in subsequent years. It is the policy of SPL to amortize the development expenditures which meet the recognition criteria as given in IAS-38 Intangible Assets, over a period of ten years. The amortization commences when the development expenditures first meet the recognition criteria. However, it was discovered during the year 2010 that the development expenditure incurred after acquisition had erroneously been written-off to the profit and loss account, details of which are as follows: Year ended December 31, 2007 December 31, 2008 December 31, 2009 December 31, 2010 Rs. in million 24 54 38 43

The draft financial statements (before correction of error) show that retained earnings as at December 31, 2010 was Rs. 1,950 million (2009: Rs. 1,785 million). Required: In accordance with the requirements of International Financial Reporting Standards, prepare relevant extracts of the Statement of Financial Position along with the note on intangible assets after incorporating the required corrections. (Ignore tax) (16 marks) Q.6 The following information pertains to Skyline Limited (SL) for the financial year ended December 31, 2010: A customer who owed Rs. 1 million was declared bankrupt after his warehouse was destroyed by fire on February 10, 2011. It is expected that the customer would be able to recover 50% of the loss from the insurance company. (ii) An employee of SL forged the signatures of directors and made cash withdrawals of Rs. 7.5 million from the bank. Of these, Rs. 1.5 million were withdrawn before December 31, 2010. Investigations revealed that an employee of the bank was also involved and therefore, under a settlement arrangement, the bank paid 60% of the amount to SL on January 27, 2011. (iii) SL has filed a claim against one of its vendors for supplying defective goods. SLs legal consultant is confident that damages of Rs. 1 million would be paid to SL. The supplier has already reimbursed the actual cost of the defective goods. (iv) A suit for infringement of patents, seeking damages of Rs. 2 million, was filed by a third party. SLs legal consultant is of the opinion that an unfavorable outcome is most likely. On the basis of past experience he has advised that there is 60% probability that the amount of damages would be Rs. 1 million and 40% likelihood that the amount would be Rs. 1.5 million. Required: Advise SL about the amount of provision that should be incorporated and the disclosures that are required to be made in the financial statements for the year ended December 31, 2010. (16 marks) (THE END) (i)

You might also like

- Paper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Document52 pagesPaper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Anonymous duzV27Mx3No ratings yet

- MetabankDocument3 pagesMetabanktempmailNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- Milagro Excel ExhibitsDocument15 pagesMilagro Excel ExhibitsRazi Ullah0% (1)

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- Summer 2010 QuestionsDocument5 pagesSummer 2010 QuestionstaubushNo ratings yet

- 7 Af 301 Fa - QPDocument5 pages7 Af 301 Fa - QPMuhammad BilalNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- ARM - FAR 1 Mock For March 2024 With Solution - FinalDocument26 pagesARM - FAR 1 Mock For March 2024 With Solution - FinalTooba MaqboolNo ratings yet

- FAR-I Borrowing Cost IAS-23 Sir MMDocument7 pagesFAR-I Borrowing Cost IAS-23 Sir MMarhamNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Paper 2011 SumerDocument3 pagesPaper 2011 SumerMuhammad Ajmal GillNo ratings yet

- CFAP 1 AFR Winter 2021Document5 pagesCFAP 1 AFR Winter 2021Taqweem KhanNo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- CA Final FR Q MTP 1 May 2024 Castudynotes ComDocument11 pagesCA Final FR Q MTP 1 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- Financial Accounting and Reporting-IIDocument6 pagesFinancial Accounting and Reporting-IISYED ANEES ALINo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- CFAP 5 ATAX Model PaperDocument5 pagesCFAP 5 ATAX Model PaperMuhammad Usama SheikhNo ratings yet

- Quarter Test 2 QPDocument7 pagesQuarter Test 2 QPOmair HasanNo ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- Deferred Tax QsDocument4 pagesDeferred Tax QsDaood AbdullahNo ratings yet

- BFDDocument4 pagesBFDaskermanNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- Suggested Answers Global Financial Reporting StandardsDocument49 pagesSuggested Answers Global Financial Reporting StandardsNagabhushanaNo ratings yet

- Group II AccountsDocument14 pagesGroup II AccountsPardeep GuptaNo ratings yet

- QR Sept10Document1 pageQR Sept10Sagar PatilNo ratings yet

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Document8 pagesCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- Accounting For RevenuesDocument7 pagesAccounting For Revenuesvijayranjan1983No ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Crescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadDocument124 pagesCrescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadAr Sal AnNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument4 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- pcc-2011 TaxDocument19 pagespcc-2011 TaxHeena NigamNo ratings yet

- Financial Accounting: RequiredDocument3 pagesFinancial Accounting: RequiredbanglauserNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: AccountingSatyajit PandaNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- FR Phase 2 - TestDocument5 pagesFR Phase 2 - TestMayank GoyalNo ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Cfap 1 Afr Winter 2020Document5 pagesCfap 1 Afr Winter 2020ANo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- FR 2 QDocument14 pagesFR 2 QG INo ratings yet

- Questions On Accounting StandardsDocument6 pagesQuestions On Accounting StandardsDEENo ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- Specific Financial Reporting Ac413 May19cDocument5 pagesSpecific Financial Reporting Ac413 May19cAnishahNo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- FR QB 1Document14 pagesFR QB 1Tanya AgarwalNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- BCM 2104 - Intermediate Accounting I - October 2013Document12 pagesBCM 2104 - Intermediate Accounting I - October 2013Behind SeriesNo ratings yet

- Specific Financial Reporting Ac413 May19aDocument4 pagesSpecific Financial Reporting Ac413 May19aAnishahNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- 2nd TQ With Tos He 6Document7 pages2nd TQ With Tos He 6Raymund BondeNo ratings yet

- Chapter 1 - MCQsDocument4 pagesChapter 1 - MCQsHải LinhNo ratings yet

- Tute-9 FMTDocument6 pagesTute-9 FMTHiền NguyễnNo ratings yet

- Working Capital ManagementDocument11 pagesWorking Capital ManagementNirav ShahNo ratings yet

- Reliance IndustriesDocument32 pagesReliance IndustriesZia AhmadNo ratings yet

- f9 Paper 2012Document8 pagesf9 Paper 2012Shuja UmerNo ratings yet

- WEO DataDocument14 pagesWEO DataPrypiat 0No ratings yet

- Accounting Form 2Document3 pagesAccounting Form 2Nashy DamarisNo ratings yet

- TQ Third Quarter Examination ENTREP 10Document4 pagesTQ Third Quarter Examination ENTREP 10MARICHO SITONNo ratings yet

- Unit 4 Valuation of Bonds and SharesDocument33 pagesUnit 4 Valuation of Bonds and SharesvinayakbankarNo ratings yet

- Nestle Pakistan Limited Financial Ratio AnalysisDocument5 pagesNestle Pakistan Limited Financial Ratio AnalysisMaarij KhanNo ratings yet

- A. Financial Management 13Document5 pagesA. Financial Management 13Honey EditsNo ratings yet

- Renuka Karntaka Bank Education Loan-1Document57 pagesRenuka Karntaka Bank Education Loan-1Praveena B RNo ratings yet

- 04.practice Set SSC-CGL TIER I PDFDocument16 pages04.practice Set SSC-CGL TIER I PDFmanuNo ratings yet

- Small Business Loans ICICI BankDocument4 pagesSmall Business Loans ICICI BankAyush BishtNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeDocument2 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeHarsh MishraNo ratings yet

- Dul 3154778Document2 pagesDul 3154778Aditya ShahNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- BLAWREG QUIZ 2 (Bank Secrecy Law) : Related TitlesDocument26 pagesBLAWREG QUIZ 2 (Bank Secrecy Law) : Related TitlesSaoxalo ONo ratings yet

- FAP 3e 2021 PPT CH 9 Accounting For ReceivablesDocument46 pagesFAP 3e 2021 PPT CH 9 Accounting For Receivablestrinhnq22411caNo ratings yet

- QUAMTO - Mercantile Law (1990-2013)Document74 pagesQUAMTO - Mercantile Law (1990-2013)Julchen ReyesNo ratings yet

- Car Policy: Salient FeaturesDocument2 pagesCar Policy: Salient FeaturesZahid Shaikh100% (1)

- 691011818912_e-StatementBRImo_805901002844500_Mar2024_20240531_110828Document2 pages691011818912_e-StatementBRImo_805901002844500_Mar2024_20240531_110828aldopranata229No ratings yet

- Mergers Acquisitions and Other Restructuring Activities 8th Edition Depamphilis Test BankDocument32 pagesMergers Acquisitions and Other Restructuring Activities 8th Edition Depamphilis Test Bankwolfgangmagnusyya100% (27)

- NEW LOAN-APPLICATION-FORM November 2021 v2 PDFDocument4 pagesNEW LOAN-APPLICATION-FORM November 2021 v2 PDFjohnson mwauraNo ratings yet

- International Financial Management 8Document31 pagesInternational Financial Management 8胡依然No ratings yet

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocument8 pagesRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNo ratings yet

- 1.1 Petroleum Economics IntroDocument17 pages1.1 Petroleum Economics IntroPRIYAH CoomarasamyNo ratings yet