Professional Documents

Culture Documents

Tally

Tally

Uploaded by

PrasanjitOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tally

Tally

Uploaded by

PrasanjitCopyright:

Available Formats

Tally Prime full course in Hindi - Practice sample assessment

@Tally Technical, Presented by Virendra kukreti

Tally Technical: https://www.youtube.com/channel/UCjh7EQ4S4c49BMuog8cq9EA

Tally_Technical: https://www.facebook.com/VirenTallytechnical/

Tally_Technical: https://www.facebook.com/VirenTallytechnical/

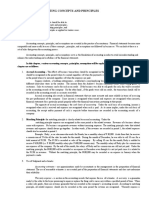

Credit limit and interst calulation

1. INTROD UCTION

Read the below-given business scenario and implement it in Tally.ERP 9 by creating a company for

Kumar Stores

1.1. BUSINESS SCENARIO I

Kumar Stores was facing few issues in tracking the outstanding of its Clients. Some customers were buying

regularly but not paying the dues on time and there was no control during invoicing which was leading to

huge outstanding.

Kumar Stores then decided to implement the control system for billing:

1. Allocate the credit limit for each customer

2. Warning the data entry operator in case any bills are overdue.

3. Should not allow the data entry person if the bill amount crosses the credit limit.

Set the credit limit for the customer Rs. 1,00,000

Record 3 sales transactions on different dates and specify the credit days as 10 days.

Date Amount Due date

01-Apr-2019 23,000 11-Apr-2019

05-Apr-2019 33,000 15-Apr-2019

15-Apr-2019 35,000 25-Apr-2019

Record 4th sales transactions, ensure total outstanding amount crosses the limit, check the

behaviour of Tally during sales entry.

1.2. BUSINESS SCENARIO II

Interest calculation

Despite Kumar Stores giving 10 days of credit for their credit customers, few customers not paying on time.

Hence, it has now decided to enforce the collection of interest on the overdue amount to impose a penalty

for late payments and systematize the collection from their customers.

S e t 1% as interest percentage per calendar month and it is charged if a customer fails to pay within due

date, interest is on a total number of days after the due date.

Set interest calculation for customers and record Sales Invoices with 10 days credit period. Then see interest

report extending the period out of due dates.

Raise interest accrual voucher for below sales invoice and receive total amount i.e., Invoice amount plus

Interest amount from the customer.

Amount Received No of Days

Date Amount Due date

Date delayed

01-Apr-2019 23,000 11-Apr-2019 15-Apr-2019 4 Days

You might also like

- 2021-2024 Semester-I Division-A Accounting Standard-9 Revenue Recognition Subject:Financial AccountingDocument8 pages2021-2024 Semester-I Division-A Accounting Standard-9 Revenue Recognition Subject:Financial AccountingTushar NarangNo ratings yet

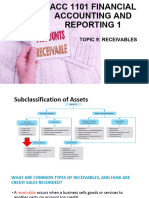

- Topic9 Account ReceivableDocument52 pagesTopic9 Account ReceivableAbd AL Rahman Shah Bin Azlan ShahNo ratings yet

- Accrual Basis Simplified AccountingDocument4 pagesAccrual Basis Simplified AccountingArberrrr100% (1)

- RecivablesDocument12 pagesRecivablesGizaw BelayNo ratings yet

- Horngrens Accounting 10th Edition Nobles Solutions ManualDocument38 pagesHorngrens Accounting 10th Edition Nobles Solutions Manualtortrixintonate6rmbc100% (17)

- Exercise Receivables 1Document8 pagesExercise Receivables 1Asyraf AzharNo ratings yet

- 6business Transactions and Their Analysis-For Observation4Document38 pages6business Transactions and Their Analysis-For Observation4Marilyn Nelmida TamayoNo ratings yet

- Incomplete RecordsDocument31 pagesIncomplete Recordskimuli FreddieNo ratings yet

- Fabm 1 Ak 11 Q3 0402Document5 pagesFabm 1 Ak 11 Q3 0402Tin CabosNo ratings yet

- Ch.3 - Accrual Accounting and The Financial Statements (Pearson 6th Edition) - MHDocument85 pagesCh.3 - Accrual Accounting and The Financial Statements (Pearson 6th Edition) - MHSamZhao100% (1)

- Chapter 7 SolutionsDocument64 pagesChapter 7 SolutionssevtenNo ratings yet

- 10 Bbfa1103 T6Document31 pages10 Bbfa1103 T6djaljdNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesRocel DomingoNo ratings yet

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Document4 pagesChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoNo ratings yet

- Jim Turin & Sons, Inc., v. Commissioner of Internal Revenue Case AnalysisDocument5 pagesJim Turin & Sons, Inc., v. Commissioner of Internal Revenue Case AnalysisFloyd SeremNo ratings yet

- Admas University: Individual Assignment Prepare Financial ReportDocument7 pagesAdmas University: Individual Assignment Prepare Financial ReportephaNo ratings yet

- Exercise Receivables 1Document9 pagesExercise Receivables 1Asyraf AzharNo ratings yet

- Revenue Recognition: 12/18/20 Intermediate 2Document5 pagesRevenue Recognition: 12/18/20 Intermediate 2Om BasimNo ratings yet

- FIN AC 1 - Module 4Document5 pagesFIN AC 1 - Module 4Ashley ManaliliNo ratings yet

- ABM FABM1 AIRs LM Q3 W7 M7.2JounalizingDocument15 pagesABM FABM1 AIRs LM Q3 W7 M7.2JounalizingKarl Vincent DulayNo ratings yet

- Assignment Based FT - Introduction To Financial Accounting - BSAF (1) (Shahzad Channa)Document8 pagesAssignment Based FT - Introduction To Financial Accounting - BSAF (1) (Shahzad Channa)Shahzad C7No ratings yet

- Account Receivable ManagementDocument24 pagesAccount Receivable ManagementMaKayla De JesusNo ratings yet

- Chap 008Document51 pagesChap 008Chan Ka KeiNo ratings yet

- Revenue RecognitionDocument8 pagesRevenue RecognitionBharathNo ratings yet

- 01 - Accounting For Trades and Other ReceivablesDocument5 pages01 - Accounting For Trades and Other ReceivablesCatherine CaleroNo ratings yet

- AR - Work FlowDocument14 pagesAR - Work FlowVinayNo ratings yet

- APARNote 1560149945966Document4 pagesAPARNote 1560149945966Rinesh ChandNo ratings yet

- Chapter 14 - The Receivables LedgerDocument34 pagesChapter 14 - The Receivables Ledgershemida100% (2)

- (SAPP) Case Study F3 ACCA Báo Cáo Tài Chính Cơ BảnDocument4 pages(SAPP) Case Study F3 ACCA Báo Cáo Tài Chính Cơ BảnTài VõNo ratings yet

- A1 Correction of ErrorsDocument21 pagesA1 Correction of ErrorsdiggywilldoitNo ratings yet

- FDNACCT Quiz-2 Answer-Key Set-ADocument4 pagesFDNACCT Quiz-2 Answer-Key Set-APia DigaNo ratings yet

- Ch2 - Exercises PDFDocument54 pagesCh2 - Exercises PDFBassam AlyeserNo ratings yet

- Business Accounting (PAF3113)Document26 pagesBusiness Accounting (PAF3113)LIM LEE THONGNo ratings yet

- Session 5 and 6 - Accounting For RevenueDocument47 pagesSession 5 and 6 - Accounting For RevenueKashish Manish JariwalaNo ratings yet

- 2100 Solutions - CH8Document58 pages2100 Solutions - CH8ds hhNo ratings yet

- Adjusting EntryDocument48 pagesAdjusting EntryKentoy Serezo Villanura100% (1)

- Slides CH 05 UpdatedDocument44 pagesSlides CH 05 Updatedakshitnagpal9119No ratings yet

- ACC 103 CH 8 Lecture Part1Document6 pagesACC 103 CH 8 Lecture Part1Muhammad Farhan AliNo ratings yet

- Accounting 1 Prelim Quiz 2Document4 pagesAccounting 1 Prelim Quiz 2Uy SamuelNo ratings yet

- ACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Document18 pagesACC 01 - Completion of The Accounting Cycle For Merchandising - Notes 7Hans MosquedaNo ratings yet

- Adjusting Journal Entry PracticeDocument2 pagesAdjusting Journal Entry PracticeCharrisse CamposNo ratings yet

- Accounting Journal EntriesDocument16 pagesAccounting Journal EntriesMridulDutta0% (1)

- Week 7 - FABM1Document8 pagesWeek 7 - FABM1atashamorganvlynxenteNo ratings yet

- Ac101 ch7Document15 pagesAc101 ch7infinite_dreamsNo ratings yet

- Accounting Concepts and Principles-Module 3Document4 pagesAccounting Concepts and Principles-Module 3gerlie gabrielNo ratings yet

- Financial Acctg Reporting 1 Chapter 10Document18 pagesFinancial Acctg Reporting 1 Chapter 10Charise Jane ZullaNo ratings yet

- Mba025 Set1 Set2 520929319Document16 pagesMba025 Set1 Set2 520929319tejas2111No ratings yet

- Deferred Revenue OverviewDocument4 pagesDeferred Revenue OverviewritikaktandonNo ratings yet

- Math11 Q3Wk2B FABM1Document9 pagesMath11 Q3Wk2B FABM1Marlyn LotivioNo ratings yet

- Accounts Receivable Vs Accounts PayableDocument12 pagesAccounts Receivable Vs Accounts PayableRaviSankarNo ratings yet

- Accounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonDocument6 pagesAccounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonbikilahussenNo ratings yet

- Cabaron, P - Module#1 - Fabm1 - Week3Document9 pagesCabaron, P - Module#1 - Fabm1 - Week3Jeje BalsoteNo ratings yet

- IMI.04 Installment AccountingDocument17 pagesIMI.04 Installment AccountingWilsonNo ratings yet

- Financial and Managerial Accounting 10th Edition Needles Test Bank DownloadDocument68 pagesFinancial and Managerial Accounting 10th Edition Needles Test Bank Downloadelainecannonjgzifkyxbe100% (30)

- Abm 1-W6.M3.T1.L3Document21 pagesAbm 1-W6.M3.T1.L3mbiloloNo ratings yet

- Assignment 1Document4 pagesAssignment 1malihaNo ratings yet

- Menagement of ReceiveableDocument5 pagesMenagement of ReceiveableMuhammad Furqan AkramNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- The Obama Hate Machine The Lies, Distortions, and Personal Attacks On The President - and Who Is Behind ThemDocument12 pagesThe Obama Hate Machine The Lies, Distortions, and Personal Attacks On The President - and Who Is Behind ThemMacmillan Publishers33% (6)

- TorsionDocument18 pagesTorsionMuhammadTaufikAliRahmanNo ratings yet

- Administrative Procedure ActDocument13 pagesAdministrative Procedure ActRam100% (2)

- Reliance General Insurance Company Limited: Reliance Private Car Package Policy-ScheduleDocument9 pagesReliance General Insurance Company Limited: Reliance Private Car Package Policy-ScheduleMasarath ali KhanNo ratings yet

- NBA Draft Eligibility PaperDocument7 pagesNBA Draft Eligibility PaperMartin DunhamNo ratings yet

- 1 Simple InterestDocument15 pages1 Simple InterestcutiepieNo ratings yet

- A G E N D A: Committee On HealthDocument5 pagesA G E N D A: Committee On Healthmr. oneNo ratings yet

- Mansbridge 2003, Rethinking RepresentationDocument15 pagesMansbridge 2003, Rethinking RepresentationKadenianNo ratings yet

- CFLM Reviewer For FinalsDocument3 pagesCFLM Reviewer For FinalsDaniela SegundoNo ratings yet

- PalnarDocument6 pagesPalnarAaditya VasnikNo ratings yet

- Ed 2007.003.CFDocument3 pagesEd 2007.003.CFTony C.No ratings yet

- Fortnightly Thoughts - Cashing in On The Future of MoneyDocument25 pagesFortnightly Thoughts - Cashing in On The Future of Moneyak8784No ratings yet

- Upper-Intermediate TestsDocument3 pagesUpper-Intermediate Testsvsakareva100% (2)

- Loi Steam CoalDocument3 pagesLoi Steam CoalAchmad DjunaidiNo ratings yet

- Tung Lok Annual Report 2014Document126 pagesTung Lok Annual Report 2014WeR1 Consultants Pte LtdNo ratings yet

- BillDocument4 pagesBillRed GraphicsNo ratings yet

- DPS 304 Course OutlineDocument2 pagesDPS 304 Course OutlineAnonymous vct70yb100% (1)

- Article-1182-Catungal-vs-RodriguezDocument2 pagesArticle-1182-Catungal-vs-RodriguezJeffrey Dela cruzNo ratings yet

- PNB v. RitrattoDocument3 pagesPNB v. RitrattoSha SantosNo ratings yet

- Politics & Governments in AfricaDocument6 pagesPolitics & Governments in Africacriss BasigaraNo ratings yet

- Discuss Role of Metternich in Vienna Congress HIST-143Document2 pagesDiscuss Role of Metternich in Vienna Congress HIST-143Kunaal SaxenaNo ratings yet

- 100 Holy One VersesDocument7 pages100 Holy One VersesKaye LaurenteNo ratings yet

- AIPDM ArticleDocument8 pagesAIPDM Articleacademic workNo ratings yet

- Resolution Endorsing PoultryDocument3 pagesResolution Endorsing PoultryRosely Pascua67% (3)

- Women Rights SyllausDocument7 pagesWomen Rights Syllaussekar_smrNo ratings yet

- SBD - Health Sector Goods (ICB) - November-FinalDocument107 pagesSBD - Health Sector Goods (ICB) - November-FinalFowzi MohammedNo ratings yet

- Vineet Narain & Others Vs Union of India & Another On 18 December, 1997Document38 pagesVineet Narain & Others Vs Union of India & Another On 18 December, 1997sreevarshaNo ratings yet

- Business Law and TaxationDocument21 pagesBusiness Law and TaxationAndrew Benedict PardilloNo ratings yet

- Nios Deled Exam Fee Payment ReceiptDocument10 pagesNios Deled Exam Fee Payment ReceiptMonu PuniaNo ratings yet

- United States Court of Appeals, Third Circuit.: Nos. 91-5617 and 92-5309Document7 pagesUnited States Court of Appeals, Third Circuit.: Nos. 91-5617 and 92-5309Scribd Government DocsNo ratings yet