Professional Documents

Culture Documents

Future Dec

Future Dec

Uploaded by

Mano HarCopyright:

Available Formats

You might also like

- HDFC ERGO General Insurance Company Limited: Date: 27/07/2017Document6 pagesHDFC ERGO General Insurance Company Limited: Date: 27/07/2017rajupetalokesh100% (1)

- Self Declaration For Future ProofDocument1 pageSelf Declaration For Future ProofHarish KumarNo ratings yet

- Tax CertificateDocument3 pagesTax Certificateamrita50% (2)

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof FormsguruNo ratings yet

- PWC - PWC - Future Proof DeclarationDocument1 pagePWC - PWC - Future Proof Declarationiqtehdar saiyedNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof FormsKUNAL AMAZONNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof Formssaika tabbasumNo ratings yet

- Self Declaration For Future Proof2Document2 pagesSelf Declaration For Future Proof2Mohan kishoreNo ratings yet

- D091963615 16928640576314369 ProposalDocument5 pagesD091963615 16928640576314369 ProposalDevanshu GoswamiNo ratings yet

- Declaration For Future ProofsDocument1 pageDeclaration For Future ProofsMohamed NazimNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticenielNo ratings yet

- Self Declaration For Future ProofDocument1 pageSelf Declaration For Future ProofjasNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAmit KumarNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Document DetailsDocument10 pagesDocument DetailsRajubhai JasoliyaNo ratings yet

- 0662 HPDocument1 page0662 HPzaid AhmedNo ratings yet

- Declaration For Future PaymentDocument4 pagesDeclaration For Future PaymentsrikanthNo ratings yet

- Policy Number: 517400016843 Plan Name: Aegon Life Iterm Insurance PlanDocument2 pagesPolicy Number: 517400016843 Plan Name: Aegon Life Iterm Insurance Planpashmina pNo ratings yet

- 周年通知书 1704605594716Document6 pages周年通知书 1704605594716georgetooyoungNo ratings yet

- GPA PolicyDocument11 pagesGPA PolicysravsofficalNo ratings yet

- 40-23-0012664-00 20230820 PCDocument1 page40-23-0012664-00 20230820 PCMukesh ThakurNo ratings yet

- Health Ins ReceiptDocument3 pagesHealth Ins ReceiptAayush KaulNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Self Declaration For Future PFDocument1 pageSelf Declaration For Future PFrrajrenjithNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsSHUBHAM KUMAR JHANo ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- GPA PolicyDocument10 pagesGPA Policyparas INSURANCENo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Ubum FranchiseDocument77 pagesUbum FranchiseShah PratikNo ratings yet

- Policy NN012203163316 PrintNewDocument22 pagesPolicy NN012203163316 PrintNewPrabhakar bhaleraoNo ratings yet

- D087904101 409497248753592 ScheduleDocument5 pagesD087904101 409497248753592 ScheduleRanjith PatelNo ratings yet

- INSURANCE ShivomDocument3 pagesINSURANCE Shivomhardev31808No ratings yet

- Ratnakar Bhanj InsuranceDocument14 pagesRatnakar Bhanj InsurancedigitalworldjnkpNo ratings yet

- Renewal of Your Energy-Gold Insurance PolicyDocument12 pagesRenewal of Your Energy-Gold Insurance Policyavinashgomkale1No ratings yet

- Renewal Notice: Policy No.P/141126/01/2019/003974Document1 pageRenewal Notice: Policy No.P/141126/01/2019/003974manoharNo ratings yet

- HaldiaDocument17 pagesHaldiarextundNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAarti BalmikiNo ratings yet

- Sumanth - Medical Insurance-ParentsDocument2 pagesSumanth - Medical Insurance-ParentsMohan kishoreNo ratings yet

- PolicySoftCopy 170991426Document3 pagesPolicySoftCopy 170991426Shabbir ChallawalaNo ratings yet

- Policy Information PageDocument31 pagesPolicy Information PageGanesh MohiteNo ratings yet

- Bjaz GC Policy Schedule EwDocument2 pagesBjaz GC Policy Schedule EwGautam PriyadarshiNo ratings yet

- Tata Aia Endowment Op With 15071984-1Document35 pagesTata Aia Endowment Op With 15071984-1atul0070No ratings yet

- CAR Policy Package - 6 Validity 17012024Document2 pagesCAR Policy Package - 6 Validity 17012024sudheer kumarNo ratings yet

- Insurance 1Document4 pagesInsurance 1Muaaz Muntassir0% (1)

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Agent Name: HDFC BANK Agency Code: 004621612 Agent Contact Details: 1860-266-9966Document35 pagesAgent Name: HDFC BANK Agency Code: 004621612 Agent Contact Details: 1860-266-9966maheshNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNerissa JainNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticerajaNo ratings yet

- Policy Information PageDocument34 pagesPolicy Information Pagesumant_2512No ratings yet

- FRM Policy Schedule CHLDocument12 pagesFRM Policy Schedule CHLKapil KhandelwalNo ratings yet

- 4010ip-03083292001 QTDocument4 pages4010ip-03083292001 QTMayank SharmaNo ratings yet

- Annexure IV Future Investment DeclarationDocument2 pagesAnnexure IV Future Investment DeclarationBhooma Shayan100% (1)

- ADW Self Declaration For Future ProofDocument1 pageADW Self Declaration For Future Proofabbajpai38No ratings yet

- Premium Receipt: Monthly 5,000.00 18-JUL-2023 To 13-AUG-2023 14-AUG-2023Document1 pagePremium Receipt: Monthly 5,000.00 18-JUL-2023 To 13-AUG-2023 14-AUG-2023avdhesh12347No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- KFD New14022024162942806 E28Document5 pagesKFD New14022024162942806 E28Mayur NagdiveNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

Future Dec

Future Dec

Uploaded by

Mano HarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Future Dec

Future Dec

Uploaded by

Mano HarCopyright:

Available Formats

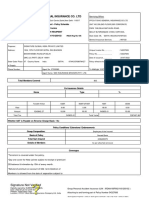

DECLARATION FOR INSURANCE PREMIUM, INVESTMENTS & RENT DUE

AFTER 1st JANUARY 2023

Employee Name:Nitish N

Employee Code:102243452

PAN A S N P N 8 9 5 9 N

Rema

Particulars Policy No. / Folio No. / Account No. Amount

rks

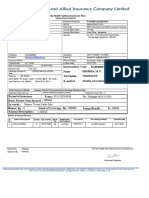

Star Health and Allied insurance Company Limited &

80D - Medical Insurance *

P/111120/01/2019/004314

January 23 February 23 March 23

Rent payable Rs.13000 Rs.13000 Rs.13000

I hereby confirm that the following investments are due for payment after the cutoff dates laid out by you for proof submission

and therefore request you to consider the same for the tax computation purpose for the financial year 2022-2023. I unde rtake

that I will be depositing these premium /investment/rent payments and obtain the receipts as per the due dates or by 31st March

2023. I will be held responsible for any consequences of not remitting these payments and any liabilities arise out of th is.

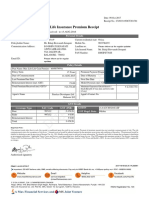

Declaration: I certify that all the above details are true and correct and I am fully aware of the relevant income tax laws in force

regarding the nature of proof required to claim exemption under the above heads.

Signature of the employee

Date:

*Encl: For all investments, please attach the relevant receipt of previous (FY 21-22) financial year / premium notice to prove that the policy is in force.

Exemption will be provided only in case of the prem ium receipt provided for the previous year and not otherwise.

You might also like

- HDFC ERGO General Insurance Company Limited: Date: 27/07/2017Document6 pagesHDFC ERGO General Insurance Company Limited: Date: 27/07/2017rajupetalokesh100% (1)

- Self Declaration For Future ProofDocument1 pageSelf Declaration For Future ProofHarish KumarNo ratings yet

- Tax CertificateDocument3 pagesTax Certificateamrita50% (2)

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof FormsguruNo ratings yet

- PWC - PWC - Future Proof DeclarationDocument1 pagePWC - PWC - Future Proof Declarationiqtehdar saiyedNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof FormsKUNAL AMAZONNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof Formssaika tabbasumNo ratings yet

- Self Declaration For Future Proof2Document2 pagesSelf Declaration For Future Proof2Mohan kishoreNo ratings yet

- D091963615 16928640576314369 ProposalDocument5 pagesD091963615 16928640576314369 ProposalDevanshu GoswamiNo ratings yet

- Declaration For Future ProofsDocument1 pageDeclaration For Future ProofsMohamed NazimNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticenielNo ratings yet

- Self Declaration For Future ProofDocument1 pageSelf Declaration For Future ProofjasNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAmit KumarNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Document DetailsDocument10 pagesDocument DetailsRajubhai JasoliyaNo ratings yet

- 0662 HPDocument1 page0662 HPzaid AhmedNo ratings yet

- Declaration For Future PaymentDocument4 pagesDeclaration For Future PaymentsrikanthNo ratings yet

- Policy Number: 517400016843 Plan Name: Aegon Life Iterm Insurance PlanDocument2 pagesPolicy Number: 517400016843 Plan Name: Aegon Life Iterm Insurance Planpashmina pNo ratings yet

- 周年通知书 1704605594716Document6 pages周年通知书 1704605594716georgetooyoungNo ratings yet

- GPA PolicyDocument11 pagesGPA PolicysravsofficalNo ratings yet

- 40-23-0012664-00 20230820 PCDocument1 page40-23-0012664-00 20230820 PCMukesh ThakurNo ratings yet

- Health Ins ReceiptDocument3 pagesHealth Ins ReceiptAayush KaulNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Self Declaration For Future PFDocument1 pageSelf Declaration For Future PFrrajrenjithNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsSHUBHAM KUMAR JHANo ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- GPA PolicyDocument10 pagesGPA Policyparas INSURANCENo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Ubum FranchiseDocument77 pagesUbum FranchiseShah PratikNo ratings yet

- Policy NN012203163316 PrintNewDocument22 pagesPolicy NN012203163316 PrintNewPrabhakar bhaleraoNo ratings yet

- D087904101 409497248753592 ScheduleDocument5 pagesD087904101 409497248753592 ScheduleRanjith PatelNo ratings yet

- INSURANCE ShivomDocument3 pagesINSURANCE Shivomhardev31808No ratings yet

- Ratnakar Bhanj InsuranceDocument14 pagesRatnakar Bhanj InsurancedigitalworldjnkpNo ratings yet

- Renewal of Your Energy-Gold Insurance PolicyDocument12 pagesRenewal of Your Energy-Gold Insurance Policyavinashgomkale1No ratings yet

- Renewal Notice: Policy No.P/141126/01/2019/003974Document1 pageRenewal Notice: Policy No.P/141126/01/2019/003974manoharNo ratings yet

- HaldiaDocument17 pagesHaldiarextundNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAarti BalmikiNo ratings yet

- Sumanth - Medical Insurance-ParentsDocument2 pagesSumanth - Medical Insurance-ParentsMohan kishoreNo ratings yet

- PolicySoftCopy 170991426Document3 pagesPolicySoftCopy 170991426Shabbir ChallawalaNo ratings yet

- Policy Information PageDocument31 pagesPolicy Information PageGanesh MohiteNo ratings yet

- Bjaz GC Policy Schedule EwDocument2 pagesBjaz GC Policy Schedule EwGautam PriyadarshiNo ratings yet

- Tata Aia Endowment Op With 15071984-1Document35 pagesTata Aia Endowment Op With 15071984-1atul0070No ratings yet

- CAR Policy Package - 6 Validity 17012024Document2 pagesCAR Policy Package - 6 Validity 17012024sudheer kumarNo ratings yet

- Insurance 1Document4 pagesInsurance 1Muaaz Muntassir0% (1)

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Agent Name: HDFC BANK Agency Code: 004621612 Agent Contact Details: 1860-266-9966Document35 pagesAgent Name: HDFC BANK Agency Code: 004621612 Agent Contact Details: 1860-266-9966maheshNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNerissa JainNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticerajaNo ratings yet

- Policy Information PageDocument34 pagesPolicy Information Pagesumant_2512No ratings yet

- FRM Policy Schedule CHLDocument12 pagesFRM Policy Schedule CHLKapil KhandelwalNo ratings yet

- 4010ip-03083292001 QTDocument4 pages4010ip-03083292001 QTMayank SharmaNo ratings yet

- Annexure IV Future Investment DeclarationDocument2 pagesAnnexure IV Future Investment DeclarationBhooma Shayan100% (1)

- ADW Self Declaration For Future ProofDocument1 pageADW Self Declaration For Future Proofabbajpai38No ratings yet

- Premium Receipt: Monthly 5,000.00 18-JUL-2023 To 13-AUG-2023 14-AUG-2023Document1 pagePremium Receipt: Monthly 5,000.00 18-JUL-2023 To 13-AUG-2023 14-AUG-2023avdhesh12347No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- KFD New14022024162942806 E28Document5 pagesKFD New14022024162942806 E28Mayur NagdiveNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet