Professional Documents

Culture Documents

Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary Compliance

Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary Compliance

Uploaded by

Arvind Kumar GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary Compliance

Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary Compliance

Uploaded by

Arvind Kumar GuptaCopyright:

Available Formats

BSNL Taxation UPE <aotdsupetc@gmail.

com>

TDS on Provison of Expenses (TAX GLs OPEN for DIRECT Manual POSTING on

17.04.23 & 18.04.23 Only BY Corporate Office) *URGENT & Statuary Compliance*

BSNL Taxation UPE <aotdsupetc@gmail.com> Mon, Apr 17, 2023 at 11:46 AM

To: GM-MS <aoclaimgmmsupe2@gmail.com>, "aoclaimscgmtupe@gmail.com" <aoclaimscgmtupe@gmail.com>, aocash

Allahabad <aocgmbaald@gmail.com>, AO Claims Faizabad <aocgmtdfzb@gmail.com>, AO CLAIMs GORAKHPUR

<aoclaimgkp@gmail.com>, GMTD JHANSI <aoclaimsjhi@gmail.com>, AO CLAIMS GMTD KANPUR

<aocknp@gmail.com>, AO CLAIM SITAPUR <aocgmbastp@gmail.com>, GMTD - LKO

<aoclaimpgmtdlko1819@gmail.com>, AO Claims Sultanpur <aocgmtdsultanpur@gmail.com>, AO Claims GMTD VNS

<aocgmtdvns@gmail.com>, PRASOON BAJPAI <upecapex2022@gmail.com>

Cc: CA Section UPE <caotaupe2021@gmail.com>

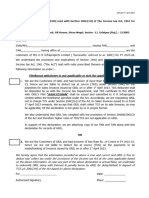

Kindly refer to this office letter dated 01.04.23 *Portal ID 96118* regarding *TDS on Provision of Expenses* all

Business Areas were shared data for TDS on Provision of Expenses. In this regard data of GRIR GL 1311201 was

also shared with all units for doing TDS Provision. Most of the units have done TDS Provision for items pending in

GRIR GL 1311201. Those who have not completed must complete TDS Provision immediately to avoid locking of

GLs.

Further Manual TDS Provision have also been done by Business Areas for which It was instructed to prepare party

wise details of expenses for which provision is made and ensure TDS posting as applicable. For this purpose

the corporate office is opening Tax GLs for direct Posting in Tax GLs on 17.04.2023 & 18.04.2023.

Hence all Business Areas are requested to post TDS on Provision of Expenses on priority basis and submit Party

wise details along with TDS Posted to this office for submission of data to Corporate Office for filing of return.

Entry will be as follow:

GL 1311205 Dr

Respective Tax GL ie. 1310802, 1310803, 1310805, 1310806, 1310812 CR (as Applicable)

TDS Provision for 194Q supplies where Tax is applicable on supplies may also be booked manually & PO wise details

should be provided for return purposes.

BA's are required to complete TDS on Provision of Expenses in given time line by corporate office ie. by

18.04.2023 and submit a certificate to this office under signature of IFA of BA that "TDS have been booked on

all Expenses Provision where TDS is applicable for Business Area ----------"

Regards,

AO (Tax)

M. 9415880300

Copy to: CA Section

You might also like

- A Peacock in The Land of Penguins - A Tale of Diversity and Discovery (PDFDrive)Document164 pagesA Peacock in The Land of Penguins - A Tale of Diversity and Discovery (PDFDrive)Zeenat ZahirNo ratings yet

- PO - Upkeeping Mota Dahisara 236-2018Document17 pagesPO - Upkeeping Mota Dahisara 236-2018Vivek DekavadiyaNo ratings yet

- Changes in GtaDocument5 pagesChanges in GtaTushar SuriNo ratings yet

- Sri Chowdeshwari Rice TradersDocument2 pagesSri Chowdeshwari Rice Tradershemanth1234No ratings yet

- Request For Quotation: Collective RFQ Number/ Purchase GroupDocument27 pagesRequest For Quotation: Collective RFQ Number/ Purchase GroupQCTS FaridabadNo ratings yet

- Go 67 - GSTDocument4 pagesGo 67 - GSTPrabhakar PothunuriNo ratings yet

- 1.pooshya Exports DRC 07Document9 pages1.pooshya Exports DRC 07bhanuprakash.ctoNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- 5254 - Tax Regime - 2024 - 240408 - 212256Document3 pages5254 - Tax Regime - 2024 - 240408 - 212256sunil78No ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- B2B To B2C CertificateDocument1 pageB2B To B2C Certificatebhaseen photostateNo ratings yet

- Invoice Details: Recovery NoticeDocument1 pageInvoice Details: Recovery NoticeLITTLE ANGELS ACADEMY TRALNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Mamatha Traders Adjuducation Order Us 73 - CompressedDocument31 pagesMamatha Traders Adjuducation Order Us 73 - Compressedurmilachoudhary1999No ratings yet

- GST Update130620Document23 pagesGST Update130620Raju SomaniNo ratings yet

- KMC Proshayan ChatterjeeDocument1 pageKMC Proshayan ChatterjeemdnathNo ratings yet

- Annx C Communication To TaxpayerDocument2 pagesAnnx C Communication To TaxpayerjitendraktNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- GST 12 To 18 EDDocument3 pagesGST 12 To 18 EDcivtect indiaNo ratings yet

- Sri ByraveshwaraDocument3 pagesSri Byraveshwarahemanth1234No ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNo ratings yet

- Signed SCN of PP PlasticsDocument4 pagesSigned SCN of PP PlasticsADARSH TIWARINo ratings yet

- Composition Scheme RulesDocument10 pagesComposition Scheme Rulesnallarahul86No ratings yet

- Sri Ram Tech Asmt-10 Cto Sec 2021-22-9Document1 pageSri Ram Tech Asmt-10 Cto Sec 2021-22-9Sunil KumarNo ratings yet

- A Simple Guide To Resolve Your Rejected GST Registration ApplicationDocument6 pagesA Simple Guide To Resolve Your Rejected GST Registration ApplicationRam ADCANo ratings yet

- Job Work Under GSTDocument2 pagesJob Work Under GSTVivek JainNo ratings yet

- ST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesDocument9 pagesST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesTaruna BajajNo ratings yet

- TVL. PSARGUNAM - 2022-23 - ASMT-10Document2 pagesTVL. PSARGUNAM - 2022-23 - ASMT-10lekhankan.taxNo ratings yet

- 08 - LH221098100573 SCR SecundrabadDocument2 pages08 - LH221098100573 SCR SecundrabadAbhishek DahiyaNo ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- Article - Jobwork Under GST - Ready ReckonerDocument4 pagesArticle - Jobwork Under GST - Ready ReckonersupdtconflNo ratings yet

- Circular-ITR of Salaried Employees-Suspicious Claims..Document9 pagesCircular-ITR of Salaried Employees-Suspicious Claims..Damodar SurisettyNo ratings yet

- 2013 Itr1 PR11Document9 pages2013 Itr1 PR11Akshay Kumar SahooNo ratings yet

- Calling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFDocument1 pageCalling of Option For New Personal Taxation Regime S - Extension of Last Date For Opting Reg 23-04-20 PDFnsreddy3613No ratings yet

- DECLARATIONDocument1 pageDECLARATIONMandeep SodhiNo ratings yet

- GST Update124Document6 pagesGST Update124suhani singhNo ratings yet

- Reply-Gst G SDocument2 pagesReply-Gst G SZaheer MalikNo ratings yet

- Nporc 900075535Document1 pageNporc 900075535Chippa SrikanthNo ratings yet

- BGMG & Associates: Chartered AccountantsDocument33 pagesBGMG & Associates: Chartered AccountantsAjit GuptaNo ratings yet

- Same Calculation To Be Done For The Resale Buyers.: 1. Delay in Possession Compensation - This Is Go in HRERADocument9 pagesSame Calculation To Be Done For The Resale Buyers.: 1. Delay in Possession Compensation - This Is Go in HRERAAnanya PatilNo ratings yet

- RTO ProcessDocument5 pagesRTO Processashutosh mauryaNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- GST AmendmentDocument14 pagesGST Amendmentbcomh2103012No ratings yet

- Refund of IGST On Export of Goods PDFDocument7 pagesRefund of IGST On Export of Goods PDFCA Rahul ModiNo ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- E-Book On GST Late FeesDocument19 pagesE-Book On GST Late FeesSourav ThakyalNo ratings yet

- Issues of Compliance in GSTDocument8 pagesIssues of Compliance in GSTMahiya Ahmad100% (1)

- Composition SchemeDocument9 pagesComposition Schemenallarahul86No ratings yet

- Annexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersDocument1 pageAnnexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersJhalak JainNo ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- Mobile Services: Your Account SummaryDocument27 pagesMobile Services: Your Account Summarymarksaha0% (1)

- Report Accompanying The Revised GST & Embedded Tax: Palamoor - Ranga Reddy Lift Irrigation Scheme - Package - 5Document2 pagesReport Accompanying The Revised GST & Embedded Tax: Palamoor - Ranga Reddy Lift Irrigation Scheme - Package - 5Naveenkumar AdirintiNo ratings yet

- GST Changes Effective From January 01, 2022Document9 pagesGST Changes Effective From January 01, 2022p.kunduNo ratings yet

- Telephone No Amount Payable Due Date: Nbms/Bms Postage Paid in AdvanceDocument5 pagesTelephone No Amount Payable Due Date: Nbms/Bms Postage Paid in AdvanceDicpandiarajaNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- Revision of GST - Orders IssuedDocument4 pagesRevision of GST - Orders IssuedSE PR MedakNo ratings yet

- Internship Report: Department of CommerceDocument23 pagesInternship Report: Department of CommerceSriram SriramNo ratings yet

- PANELISTS Comment SheetDocument4 pagesPANELISTS Comment SheetMyka BibalNo ratings yet

- Zimbra To Office 365 Migration GuideDocument6 pagesZimbra To Office 365 Migration GuideEDSON ARIEL AJÚ GARCÍANo ratings yet

- (1996) JOSA 13 Space-Bandwidth Product of Optical Signals and SyDocument4 pages(1996) JOSA 13 Space-Bandwidth Product of Optical Signals and Sythanhevt92No ratings yet

- MOEP - Public-Private Partnership Development in Thermal Power Generation, Thermal Power Department, Myanmar Electric Power EnterpriseDocument15 pagesMOEP - Public-Private Partnership Development in Thermal Power Generation, Thermal Power Department, Myanmar Electric Power EnterpriseTim DingNo ratings yet

- RV A. Paler: Technical SkillsDocument5 pagesRV A. Paler: Technical SkillsRv PalerNo ratings yet

- Instruction of Installation The Operating Manual For The 220kv TransformerDocument12 pagesInstruction of Installation The Operating Manual For The 220kv TransformerArman PracoyoNo ratings yet

- Contribution of Visionary Leadership, Lecturer Performance, and Academic CultureDocument17 pagesContribution of Visionary Leadership, Lecturer Performance, and Academic CulturedelaNo ratings yet

- Kuwait STC 2020 MBB Project: Huawei Technologies Co., LTDDocument4 pagesKuwait STC 2020 MBB Project: Huawei Technologies Co., LTDGayas ShaikNo ratings yet

- Metercat 6.1.1.0 Release NotesDocument7 pagesMetercat 6.1.1.0 Release NotesCarlos Guzman BonifacioNo ratings yet

- REPORT OptimizCapacityDocument24 pagesREPORT OptimizCapacityJosé Agustín Moreno DíazNo ratings yet

- A Study On Students Buying Behavior Towards LaptopsDocument43 pagesA Study On Students Buying Behavior Towards LaptopsShashank Tripathi100% (3)

- Quick Charge Device ListDocument16 pagesQuick Charge Device Listlimited0% (1)

- Mae4326 Lesson Plan 1 TemplateDocument7 pagesMae4326 Lesson Plan 1 Templateapi-445512320No ratings yet

- CAESAR II® How To Solve Friction ForceDocument2 pagesCAESAR II® How To Solve Friction Forcefurqan100% (1)

- Enrichment Activities 1Document2 pagesEnrichment Activities 1Maden betoNo ratings yet

- Ekc 204aDocument24 pagesEkc 204aPreot Andreana CatalinNo ratings yet

- Setting Product Strategy: Marketing Management, 13 EdDocument43 pagesSetting Product Strategy: Marketing Management, 13 EdEucharistia Yacoba NugrahaNo ratings yet

- Weight and Mass SEDocument5 pagesWeight and Mass SEGabriel LouimaNo ratings yet

- For Teachers of English: Vol. 29 No. 1 - January/June 2022 ISSN 0120-5927Document243 pagesFor Teachers of English: Vol. 29 No. 1 - January/June 2022 ISSN 0120-5927Luisa CalderónNo ratings yet

- A Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedDocument8 pagesA Study On Effective Cash Management System Performance in Abc Techno Labs India Private LimitedBabasaheb JawalgeNo ratings yet

- Unit 1 - Theories of Origin of Human LanguageDocument7 pagesUnit 1 - Theories of Origin of Human LanguageHerford Guibang-Guibang100% (1)

- Speech System For Dumb PeopleDocument32 pagesSpeech System For Dumb PeopleJaspreet Singh WaliaNo ratings yet

- MNL H8DCL (I) (6) (F)Document79 pagesMNL H8DCL (I) (6) (F)ericfgregoryNo ratings yet

- Crusader Communicator: "Safer at Home" Edition #5: Sheboygan Lutheran High SchoolDocument7 pagesCrusader Communicator: "Safer at Home" Edition #5: Sheboygan Lutheran High SchoolMatt ThielNo ratings yet

- ECELAWSDocument14 pagesECELAWSGilbey's Jhon LadionNo ratings yet

- Virtual Lab-Water QualityDocument7 pagesVirtual Lab-Water Qualityapi-268159571No ratings yet

- MTP44001Document63 pagesMTP44001Dong-seob ParkNo ratings yet

- Junior Agronomist - On Contract: Gujarat State Fertilizers and Chemicals LTDDocument2 pagesJunior Agronomist - On Contract: Gujarat State Fertilizers and Chemicals LTDZayn AliNo ratings yet

- Medieval PhilosophyDocument39 pagesMedieval PhilosophyJorhen PanisNo ratings yet