Professional Documents

Culture Documents

MBA Accounts For Manager

MBA Accounts For Manager

Uploaded by

Gayathri GopiramnathCopyright:

Available Formats

You might also like

- Third Day Tally Contents (Journal Entry Part - 1)Document12 pagesThird Day Tally Contents (Journal Entry Part - 1)Kamlesh Kumar100% (1)

- Financial Accounting: I Term - MbaDocument39 pagesFinancial Accounting: I Term - MbaShujath SharieffNo ratings yet

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- 110-Chapter 3 - Books of Original Entry-Journal - WMDocument21 pages110-Chapter 3 - Books of Original Entry-Journal - WMaaditya kumar jhaNo ratings yet

- JDocument13 pagesJpalash khannaNo ratings yet

- Prob No 2Document4 pagesProb No 2Neha MahajanNo ratings yet

- Profit and Loss P&L Statement StatementDocument3 pagesProfit and Loss P&L Statement StatementShreepathi AdigaNo ratings yet

- Tally Module 1 Assignment SolutionDocument6 pagesTally Module 1 Assignment Solutioncharu bishtNo ratings yet

- Unit 7 PDFDocument22 pagesUnit 7 PDFSatti NagendrareddyNo ratings yet

- TallyDocument23 pagesTallySatya PalNo ratings yet

- 3 - Trial Balance To PL Account - ExamplesDocument49 pages3 - Trial Balance To PL Account - ExamplesDivyansh Pandey100% (2)

- AccountsDocument13 pagesAccountspalash khannaNo ratings yet

- Type of Account TallyDocument20 pagesType of Account TallyVERMA NEERAJ100% (2)

- Journal EntryDocument7 pagesJournal Entryshreyu14796No ratings yet

- 11 Ac JournalDocument3 pages11 Ac Journalidumban_chandraNo ratings yet

- Hire Purchase, Lease and Instalment PurchaseDocument30 pagesHire Purchase, Lease and Instalment PurchaseMunmun MishraNo ratings yet

- Class 11 Accountancy Chapter-3 Revision NotesDocument11 pagesClass 11 Accountancy Chapter-3 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Key Terms and Chapter Summary 8Document3 pagesKey Terms and Chapter Summary 8Devansh DwivediNo ratings yet

- Financial Accounting - Journal EntriesDocument28 pagesFinancial Accounting - Journal EntriesPraneeth KumarNo ratings yet

- Prob No 4Document4 pagesProb No 4Neha MahajanNo ratings yet

- Manual Accounting NotesDocument14 pagesManual Accounting NotesAbaan SalimNo ratings yet

- Prob No 3Document3 pagesProb No 3Neha MahajanNo ratings yet

- Journal ProblemsDocument40 pagesJournal Problemskarthikeyan01No ratings yet

- Accounting Equation Class 11thDocument7 pagesAccounting Equation Class 11thAtul Kumar SamalNo ratings yet

- Types of Accounts & DiscountDocument10 pagesTypes of Accounts & Discountsarvesh kumarNo ratings yet

- Chapter 8Document18 pagesChapter 8Mishu GuptaNo ratings yet

- Lesson 1 - Introduction To LedgerDocument18 pagesLesson 1 - Introduction To LedgerNikhita MehraNo ratings yet

- 1 BasicConceptDocument9 pages1 BasicConceptVinod RathodNo ratings yet

- Basic Account 1Document10 pagesBasic Account 1COMPUTER WORLDNo ratings yet

- CCP102Document17 pagesCCP102api-3849444No ratings yet

- Types of Transaction: Being Name of Person's Cheque Returned ChequeDocument2 pagesTypes of Transaction: Being Name of Person's Cheque Returned ChequeDipendra GiriNo ratings yet

- TallyDocument27 pagesTallyRonak JainNo ratings yet

- Chap 03 Double EntryDocument6 pagesChap 03 Double Entry465jgbgcvfNo ratings yet

- Tally Repor1Document74 pagesTally Repor1Ronak JainNo ratings yet

- Accounting Cycle Problems & SolutionsDocument18 pagesAccounting Cycle Problems & Solutionsurandom101100% (4)

- Basic Accounting Complete TheoryDocument10 pagesBasic Accounting Complete TheoryKamlesh KumarNo ratings yet

- Chapter 13Document12 pagesChapter 13palash khanna100% (1)

- MAA Assignment RKDocument9 pagesMAA Assignment RKKrishna RayasamNo ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- Lect 1 MS Semester I Paper IIDocument9 pagesLect 1 MS Semester I Paper IIloveaute15No ratings yet

- Question # 01Document15 pagesQuestion # 01SZANo ratings yet

- Basic Accounting Terms.1Document5 pagesBasic Accounting Terms.1k srinivasNo ratings yet

- Basic Accounting Terms.1Document5 pagesBasic Accounting Terms.1k srinivasNo ratings yet

- What Is Accounting???Document15 pagesWhat Is Accounting???Modassar NazarNo ratings yet

- Journal NotesDocument5 pagesJournal NotesAryan JainNo ratings yet

- Basic Terms in Accounts: Assets: Something That You OwnDocument46 pagesBasic Terms in Accounts: Assets: Something That You OwnLeo GladwinNo ratings yet

- Debit Credit RulesDocument9 pagesDebit Credit RulesMubeen JavedNo ratings yet

- Tally-1Document61 pagesTally-1vidya gubbala50% (2)

- Correction of Errors2020Document14 pagesCorrection of Errors2020Parvatee RamessurNo ratings yet

- Acct Practice PaperDocument11 pagesAcct Practice PaperKrish BajajNo ratings yet

- Test Papers AccountsDocument16 pagesTest Papers Accountsmamta.bdvrrmaNo ratings yet

- What Are The Golden Rules For AccountingDocument28 pagesWhat Are The Golden Rules For AccountingWong KianTatNo ratings yet

- Comman Journal EntriesDocument3 pagesComman Journal EntriesDISHANNo ratings yet

- Accountancy NotesDocument23 pagesAccountancy NotesAlbana QemaliNo ratings yet

- Journal Entry For AccountingDocument12 pagesJournal Entry For AccountingpoornapavanNo ratings yet

- Tally Prime-1Document8 pagesTally Prime-1Sanjeev kumarNo ratings yet

- Double Entry SystemDocument17 pagesDouble Entry SystemDastaan Ali100% (1)

- Accounts Test Paper From JeegyasaDocument6 pagesAccounts Test Paper From JeegyasaAnushka KunduNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- 74 20 03Document6 pages74 20 03vanmorrison69No ratings yet

- Lecture 5 PDFDocument8 pagesLecture 5 PDFMuhammad Hamza EjazNo ratings yet

- Herbert SpencerDocument1 pageHerbert Spencerng kamchungNo ratings yet

- MUXDocument5 pagesMUXAmit SahaNo ratings yet

- W2AEW Videos (Apr 29, 2017) : Topics Listed NumericallyDocument12 pagesW2AEW Videos (Apr 29, 2017) : Topics Listed Numericallyamol1agarwalNo ratings yet

- Aquagen: Recombination System For Stationary BatteriesDocument2 pagesAquagen: Recombination System For Stationary BatteriestaahaNo ratings yet

- Anand RathiDocument95 pagesAnand Rathivikramgupta195096% (25)

- Building Construction and Materials Report: Curtain Wall Building Type Building Name: Seagrams BuildingDocument6 pagesBuilding Construction and Materials Report: Curtain Wall Building Type Building Name: Seagrams BuildingAyushi AroraNo ratings yet

- Audio 4 - 1 Travelling 1Document15 pagesAudio 4 - 1 Travelling 1Farewell03311No ratings yet

- The 2021 EY Scholarship: The Bahamas, Bermuda, British Virgin Islands and The Cayman IslandsDocument3 pagesThe 2021 EY Scholarship: The Bahamas, Bermuda, British Virgin Islands and The Cayman IslandsKingshuk MukherjeeNo ratings yet

- Server Poweredge t610 Tech Guidebook PDFDocument65 pagesServer Poweredge t610 Tech Guidebook PDFMarouani AmorNo ratings yet

- YL Clarity - Chromatography SW: YOUNG IN ChromassDocument4 pagesYL Clarity - Chromatography SW: YOUNG IN Chromasschâu huỳnhNo ratings yet

- Employee Background Verification SystemDocument5 pagesEmployee Background Verification SystemPayal ChauhanNo ratings yet

- BNC - Dana Gas PipelineDocument4 pagesBNC - Dana Gas PipelinesebincherianNo ratings yet

- EU Imports of Organic Agri-Food Products: Key Developments in 2019Document17 pagesEU Imports of Organic Agri-Food Products: Key Developments in 2019Dani FrancoNo ratings yet

- Assessment For Learning A Practical GuideDocument108 pagesAssessment For Learning A Practical Guidesh1999100% (1)

- Chapter 10 Dealing With Uncertainty: General ProcedureDocument15 pagesChapter 10 Dealing With Uncertainty: General ProcedureHannan Mahmood TonmoyNo ratings yet

- Info Sheet IndivDocument2 pagesInfo Sheet IndivFRAULIEN GLINKA FANUGAONo ratings yet

- 9 Cir vs. Baier-Nickel DGSTDocument2 pages9 Cir vs. Baier-Nickel DGSTMiguelNo ratings yet

- FonaDocument36 pagesFonaiyadNo ratings yet

- Ex Lecture1Document2 pagesEx Lecture1AlNo ratings yet

- Gammagard Us PiDocument4 pagesGammagard Us Pibmartindoyle6396No ratings yet

- Neonatal Resuscitation. Advances in Training and PracticeDocument10 pagesNeonatal Resuscitation. Advances in Training and PracticeFer45No ratings yet

- Energy and Energy Transformations: Energy Makes Things HappenDocument8 pagesEnergy and Energy Transformations: Energy Makes Things HappenLabeenaNo ratings yet

- Knowledge, Creativity and Communication in Education: Multimodal DesignDocument11 pagesKnowledge, Creativity and Communication in Education: Multimodal DesignMartín VillagraNo ratings yet

- CAT Test Series 2015Document2 pagesCAT Test Series 2015Nikhil SiddharthNo ratings yet

- Factoring HandoutDocument2 pagesFactoring HandoutJordan SenkoNo ratings yet

- Advanced Digital Controls Improve PFC PerformanceDocument18 pagesAdvanced Digital Controls Improve PFC Performancediablo diablolordNo ratings yet

- 08-01-17 EditionDocument28 pages08-01-17 EditionSan Mateo Daily JournalNo ratings yet

- Training Activity Matrix: Training Activities Trainees Facilities/Tools/Equip Venue Date RemarksDocument3 pagesTraining Activity Matrix: Training Activities Trainees Facilities/Tools/Equip Venue Date RemarksCharleneNo ratings yet

MBA Accounts For Manager

MBA Accounts For Manager

Uploaded by

Gayathri GopiramnathOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA Accounts For Manager

MBA Accounts For Manager

Uploaded by

Gayathri GopiramnathCopyright:

Available Formats

ACCOUNTING FOR MANAGERS

Accounting definition:

Accounting is an art of recording, classifying and summarizing the day-to-day

economic activities of business in a systematic manner through which

interpretations will be made.

key points:

- accounting is an art

- the first process of accounting is - recording

- the second process of accounting is - classifying

- the final process of accounting is - summarizing

- recording cassifying and summarising ofeconomic activities of business

- systematic manner

- interpretations (reveals facts and figures from the final statement or summary)

GOLDEN RULES OF ACCOUNTING :

personal account : debit the receiver, credit the giver

ex. Indian bank, Mr.Gopi, LIC

real account : debit what comes in, credit what goes out

ex. cash, furniture, machinery, land

nominal account : debit all expenses and losses, credit all incomes and gains

ex. rent, salary, commission, interest, dividend

DUAL ASPECT : each transaction will have two impacts

JOURNAL ENTRIES :

1. On 01.04.2021 Ganesh started business with cash Rs. 10,000 , Land worth Rs.

1,00,000 and Machine worth Rs. 75000

cash a/c Dr 10,000

land a/c Dr 1,00,000

machine a/c Dr 75,000

To Ganesh Capital a/c

1,85,000

2. Sold goods worth Rs. 25000 to Mr.X for cash on 02.04.2021 (Cash sales)

cash a/c Dr 25000

To sales 25000

3. Above transaction on (credit sales)

Mr.X Dr 25000

To Sales 25000

4. Purchase goods on cash for Rs. 25000

purchase a/c Dr 25000

To Cash a/c 25000

5. Purchase goods on credit from Mr.X for Rs. 25000

Purchase a/c Dr 25000

To Mr.X a/c 25000

6. Purchase return of goods

cash a/c Dr

To purchase return

7. Sales return of goods

sales return a/c Dr

To cash a/c

8. sales return of goods bought on credit from Mr.X

sales return a/c Dr

To Mr.X a/c

9. Purchase return of goods returned to Mr.X

Mr.X a/c Dr

To Purchase return a/c

10. Drawings

Cash a/c Dr

To Bank a/c

11. Drawings for personal use

Ganesh Drawings a/c Dr

To Cash a/c

12. Cash deposited in Bank

Bank a/c Dr

To Cash a/c

13. Purchased goods and paid in cheque

Purchase a/c Dr

To Bank a/c

14. Sold goods and received Cheque

Bank a/c Dr

To sales a/c

15. Sale of Land

cash a/c Dr

To Land a/c

16. discount allowed - debit and discount received - credit

17. commission received - credit and commission allowed - debit

18. assets - debit

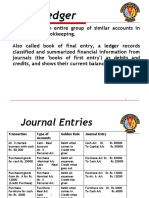

LEDGER :

YK, Discount allowed and received journal will have 3 entries and you have to

create the ledger accounts

If, dis allowed account is prepared - write only the opposite (to) and give the

amount in the allowed a/c

TRIAL BALANCE :

Reserve on Bad debts - credit

Bank O/D - credit

Rent received - credit ( income )

Capital - credit

Return inwards - debit and Return outwards - credit

Carriage inwards and outwards both - debit

Duty on purchase - debit

Bills payable - credit and Bills receivable - debit

You might also like

- Third Day Tally Contents (Journal Entry Part - 1)Document12 pagesThird Day Tally Contents (Journal Entry Part - 1)Kamlesh Kumar100% (1)

- Financial Accounting: I Term - MbaDocument39 pagesFinancial Accounting: I Term - MbaShujath SharieffNo ratings yet

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- 110-Chapter 3 - Books of Original Entry-Journal - WMDocument21 pages110-Chapter 3 - Books of Original Entry-Journal - WMaaditya kumar jhaNo ratings yet

- JDocument13 pagesJpalash khannaNo ratings yet

- Prob No 2Document4 pagesProb No 2Neha MahajanNo ratings yet

- Profit and Loss P&L Statement StatementDocument3 pagesProfit and Loss P&L Statement StatementShreepathi AdigaNo ratings yet

- Tally Module 1 Assignment SolutionDocument6 pagesTally Module 1 Assignment Solutioncharu bishtNo ratings yet

- Unit 7 PDFDocument22 pagesUnit 7 PDFSatti NagendrareddyNo ratings yet

- TallyDocument23 pagesTallySatya PalNo ratings yet

- 3 - Trial Balance To PL Account - ExamplesDocument49 pages3 - Trial Balance To PL Account - ExamplesDivyansh Pandey100% (2)

- AccountsDocument13 pagesAccountspalash khannaNo ratings yet

- Type of Account TallyDocument20 pagesType of Account TallyVERMA NEERAJ100% (2)

- Journal EntryDocument7 pagesJournal Entryshreyu14796No ratings yet

- 11 Ac JournalDocument3 pages11 Ac Journalidumban_chandraNo ratings yet

- Hire Purchase, Lease and Instalment PurchaseDocument30 pagesHire Purchase, Lease and Instalment PurchaseMunmun MishraNo ratings yet

- Class 11 Accountancy Chapter-3 Revision NotesDocument11 pagesClass 11 Accountancy Chapter-3 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Key Terms and Chapter Summary 8Document3 pagesKey Terms and Chapter Summary 8Devansh DwivediNo ratings yet

- Financial Accounting - Journal EntriesDocument28 pagesFinancial Accounting - Journal EntriesPraneeth KumarNo ratings yet

- Prob No 4Document4 pagesProb No 4Neha MahajanNo ratings yet

- Manual Accounting NotesDocument14 pagesManual Accounting NotesAbaan SalimNo ratings yet

- Prob No 3Document3 pagesProb No 3Neha MahajanNo ratings yet

- Journal ProblemsDocument40 pagesJournal Problemskarthikeyan01No ratings yet

- Accounting Equation Class 11thDocument7 pagesAccounting Equation Class 11thAtul Kumar SamalNo ratings yet

- Types of Accounts & DiscountDocument10 pagesTypes of Accounts & Discountsarvesh kumarNo ratings yet

- Chapter 8Document18 pagesChapter 8Mishu GuptaNo ratings yet

- Lesson 1 - Introduction To LedgerDocument18 pagesLesson 1 - Introduction To LedgerNikhita MehraNo ratings yet

- 1 BasicConceptDocument9 pages1 BasicConceptVinod RathodNo ratings yet

- Basic Account 1Document10 pagesBasic Account 1COMPUTER WORLDNo ratings yet

- CCP102Document17 pagesCCP102api-3849444No ratings yet

- Types of Transaction: Being Name of Person's Cheque Returned ChequeDocument2 pagesTypes of Transaction: Being Name of Person's Cheque Returned ChequeDipendra GiriNo ratings yet

- TallyDocument27 pagesTallyRonak JainNo ratings yet

- Chap 03 Double EntryDocument6 pagesChap 03 Double Entry465jgbgcvfNo ratings yet

- Tally Repor1Document74 pagesTally Repor1Ronak JainNo ratings yet

- Accounting Cycle Problems & SolutionsDocument18 pagesAccounting Cycle Problems & Solutionsurandom101100% (4)

- Basic Accounting Complete TheoryDocument10 pagesBasic Accounting Complete TheoryKamlesh KumarNo ratings yet

- Chapter 13Document12 pagesChapter 13palash khanna100% (1)

- MAA Assignment RKDocument9 pagesMAA Assignment RKKrishna RayasamNo ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- Lect 1 MS Semester I Paper IIDocument9 pagesLect 1 MS Semester I Paper IIloveaute15No ratings yet

- Question # 01Document15 pagesQuestion # 01SZANo ratings yet

- Basic Accounting Terms.1Document5 pagesBasic Accounting Terms.1k srinivasNo ratings yet

- Basic Accounting Terms.1Document5 pagesBasic Accounting Terms.1k srinivasNo ratings yet

- What Is Accounting???Document15 pagesWhat Is Accounting???Modassar NazarNo ratings yet

- Journal NotesDocument5 pagesJournal NotesAryan JainNo ratings yet

- Basic Terms in Accounts: Assets: Something That You OwnDocument46 pagesBasic Terms in Accounts: Assets: Something That You OwnLeo GladwinNo ratings yet

- Debit Credit RulesDocument9 pagesDebit Credit RulesMubeen JavedNo ratings yet

- Tally-1Document61 pagesTally-1vidya gubbala50% (2)

- Correction of Errors2020Document14 pagesCorrection of Errors2020Parvatee RamessurNo ratings yet

- Acct Practice PaperDocument11 pagesAcct Practice PaperKrish BajajNo ratings yet

- Test Papers AccountsDocument16 pagesTest Papers Accountsmamta.bdvrrmaNo ratings yet

- What Are The Golden Rules For AccountingDocument28 pagesWhat Are The Golden Rules For AccountingWong KianTatNo ratings yet

- Comman Journal EntriesDocument3 pagesComman Journal EntriesDISHANNo ratings yet

- Accountancy NotesDocument23 pagesAccountancy NotesAlbana QemaliNo ratings yet

- Journal Entry For AccountingDocument12 pagesJournal Entry For AccountingpoornapavanNo ratings yet

- Tally Prime-1Document8 pagesTally Prime-1Sanjeev kumarNo ratings yet

- Double Entry SystemDocument17 pagesDouble Entry SystemDastaan Ali100% (1)

- Accounts Test Paper From JeegyasaDocument6 pagesAccounts Test Paper From JeegyasaAnushka KunduNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- 74 20 03Document6 pages74 20 03vanmorrison69No ratings yet

- Lecture 5 PDFDocument8 pagesLecture 5 PDFMuhammad Hamza EjazNo ratings yet

- Herbert SpencerDocument1 pageHerbert Spencerng kamchungNo ratings yet

- MUXDocument5 pagesMUXAmit SahaNo ratings yet

- W2AEW Videos (Apr 29, 2017) : Topics Listed NumericallyDocument12 pagesW2AEW Videos (Apr 29, 2017) : Topics Listed Numericallyamol1agarwalNo ratings yet

- Aquagen: Recombination System For Stationary BatteriesDocument2 pagesAquagen: Recombination System For Stationary BatteriestaahaNo ratings yet

- Anand RathiDocument95 pagesAnand Rathivikramgupta195096% (25)

- Building Construction and Materials Report: Curtain Wall Building Type Building Name: Seagrams BuildingDocument6 pagesBuilding Construction and Materials Report: Curtain Wall Building Type Building Name: Seagrams BuildingAyushi AroraNo ratings yet

- Audio 4 - 1 Travelling 1Document15 pagesAudio 4 - 1 Travelling 1Farewell03311No ratings yet

- The 2021 EY Scholarship: The Bahamas, Bermuda, British Virgin Islands and The Cayman IslandsDocument3 pagesThe 2021 EY Scholarship: The Bahamas, Bermuda, British Virgin Islands and The Cayman IslandsKingshuk MukherjeeNo ratings yet

- Server Poweredge t610 Tech Guidebook PDFDocument65 pagesServer Poweredge t610 Tech Guidebook PDFMarouani AmorNo ratings yet

- YL Clarity - Chromatography SW: YOUNG IN ChromassDocument4 pagesYL Clarity - Chromatography SW: YOUNG IN Chromasschâu huỳnhNo ratings yet

- Employee Background Verification SystemDocument5 pagesEmployee Background Verification SystemPayal ChauhanNo ratings yet

- BNC - Dana Gas PipelineDocument4 pagesBNC - Dana Gas PipelinesebincherianNo ratings yet

- EU Imports of Organic Agri-Food Products: Key Developments in 2019Document17 pagesEU Imports of Organic Agri-Food Products: Key Developments in 2019Dani FrancoNo ratings yet

- Assessment For Learning A Practical GuideDocument108 pagesAssessment For Learning A Practical Guidesh1999100% (1)

- Chapter 10 Dealing With Uncertainty: General ProcedureDocument15 pagesChapter 10 Dealing With Uncertainty: General ProcedureHannan Mahmood TonmoyNo ratings yet

- Info Sheet IndivDocument2 pagesInfo Sheet IndivFRAULIEN GLINKA FANUGAONo ratings yet

- 9 Cir vs. Baier-Nickel DGSTDocument2 pages9 Cir vs. Baier-Nickel DGSTMiguelNo ratings yet

- FonaDocument36 pagesFonaiyadNo ratings yet

- Ex Lecture1Document2 pagesEx Lecture1AlNo ratings yet

- Gammagard Us PiDocument4 pagesGammagard Us Pibmartindoyle6396No ratings yet

- Neonatal Resuscitation. Advances in Training and PracticeDocument10 pagesNeonatal Resuscitation. Advances in Training and PracticeFer45No ratings yet

- Energy and Energy Transformations: Energy Makes Things HappenDocument8 pagesEnergy and Energy Transformations: Energy Makes Things HappenLabeenaNo ratings yet

- Knowledge, Creativity and Communication in Education: Multimodal DesignDocument11 pagesKnowledge, Creativity and Communication in Education: Multimodal DesignMartín VillagraNo ratings yet

- CAT Test Series 2015Document2 pagesCAT Test Series 2015Nikhil SiddharthNo ratings yet

- Factoring HandoutDocument2 pagesFactoring HandoutJordan SenkoNo ratings yet

- Advanced Digital Controls Improve PFC PerformanceDocument18 pagesAdvanced Digital Controls Improve PFC Performancediablo diablolordNo ratings yet

- 08-01-17 EditionDocument28 pages08-01-17 EditionSan Mateo Daily JournalNo ratings yet

- Training Activity Matrix: Training Activities Trainees Facilities/Tools/Equip Venue Date RemarksDocument3 pagesTraining Activity Matrix: Training Activities Trainees Facilities/Tools/Equip Venue Date RemarksCharleneNo ratings yet