Professional Documents

Culture Documents

Gst-Challan - 2023-04-20T180356.843

Gst-Challan - 2023-04-20T180356.843

Uploaded by

Ashish Gupta0 ratings0% found this document useful (0 votes)

6 views1 pageThis document is a payment challan form for depositing goods and services tax. It provides details of the taxpayer including their GSTIN and contact information. The challan specifies an amount of Rs. 505440 being deposited to the Government of India account, and Rs. 3582042 being deposited to the Uttarakhand SGST account, for a total deposit amount of Rs. 4087482. It lists the mode of payment as E-Payment and includes fields for particulars of the depositor like name, designation, signature and date. The form also has sections to capture paid challan information like GSTIN, bank details, payment reference numbers and dates.

Original Description:

Original Title

GST-CHALLAN - 2023-04-20T180356.843

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a payment challan form for depositing goods and services tax. It provides details of the taxpayer including their GSTIN and contact information. The challan specifies an amount of Rs. 505440 being deposited to the Government of India account, and Rs. 3582042 being deposited to the Uttarakhand SGST account, for a total deposit amount of Rs. 4087482. It lists the mode of payment as E-Payment and includes fields for particulars of the depositor like name, designation, signature and date. The form also has sections to capture paid challan information like GSTIN, bank details, payment reference numbers and dates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageGst-Challan - 2023-04-20T180356.843

Gst-Challan - 2023-04-20T180356.843

Uploaded by

Ashish GuptaThis document is a payment challan form for depositing goods and services tax. It provides details of the taxpayer including their GSTIN and contact information. The challan specifies an amount of Rs. 505440 being deposited to the Government of India account, and Rs. 3582042 being deposited to the Uttarakhand SGST account, for a total deposit amount of Rs. 4087482. It lists the mode of payment as E-Payment and includes fields for particulars of the depositor like name, designation, signature and date. The form also has sections to capture paid challan information like GSTIN, bank details, payment reference numbers and dates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Form GST PMT –06 Payment Challan

(See Rule 87(2) )

Challan for deposit of goods and services tax

CPIN: 23040500064616 Challan Generated on : 20/04/2023 18:03:14 Expiry Date : 05/05/2023

Details of Taxpayer

GSTIN: 05AACCN8913C1ZR E-mail Id: aXXXXXXXXXXXXXXXXXX@XXXXXXXom Mobile No.: 9XXXXX7202

Name(Legal): NAINITAL MOTORS Address : XXXXXXXXXX Uttarakhand,263139

PRIVATE LIMITED

Reason For Challan

Reason: Any other payment

Details of Deposit (All Amount in Rs.)

Government Major Head Minor Head

Tax Interest Penalty Fee Others Total

CGST(0005) 3240 - - - - 3240

Government

IGST(0008) - - - - - -

Of India

CESS(0009) 502200 - - - - 502200

Sub-Total 505440 0 0 0 0 505440

Uttarakhand SGST(0006) 3582042 - - - - 3582042

Total Amount 4087482

Total Amount (in words) Rupees Fourty Lakhs Eighty-Seven Thousand Four hundred Eighty-Two Only

Mode of Payment

E-Payment Over the Counter(OTC) NEFT / RTGS

Particulars of depositor

Name

Designation/Status(Manager,partner etc)

Signature

Date

Paid Challan Information

GSTIN

Taxpayer Name

Name of the Bank

Amount

Bank Reference No.(BRN)/UTR

CIN

Payment Date

Bank Ack No.

(For Cheque / DD deposited at Bank’s counter)

You might also like

- BEL Probationary Engineer Previous Papers & BEL PE Model PapersDocument6 pagesBEL Probationary Engineer Previous Papers & BEL PE Model Papersrakesh_200003No ratings yet

- Challenges Faced by Entrepreneurs of Sari-Sari Stores in Kabankalan CityDocument40 pagesChallenges Faced by Entrepreneurs of Sari-Sari Stores in Kabankalan CityAyeng 1502100% (2)

- Gramática AwáDocument422 pagesGramática AwáJaghu San100% (1)

- GST ChallanDocument1 pageGST Challanrajender kumarNo ratings yet

- GST ChallanDocument1 pageGST ChallanFlish AcademyNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST Challandurgpalsingh2023No ratings yet

- GST ChallanDocument1 pageGST Challandurgpalsingh2023No ratings yet

- GST ChallanDocument1 pageGST ChallanRakesh ZanwarNo ratings yet

- Gst-Challan - 2024-01-06T171130.219Document1 pageGst-Challan - 2024-01-06T171130.219asafintax.consultingNo ratings yet

- GST ChallanDocument1 pageGST ChallanAnkit DalsaniyaNo ratings yet

- PAlod DistributorsDocument1 pagePAlod DistributorsManoharMahajanNo ratings yet

- GST Challan PDFDocument1 pageGST Challan PDFadrtek indiaNo ratings yet

- GST ChallanDocument1 pageGST ChallanHMSNo ratings yet

- GST ChallanDocument1 pageGST ChallanHMSNo ratings yet

- GST ChallanDocument2 pagesGST ChallanRonak PataniNo ratings yet

- GST ChallanDocument2 pagesGST ChallanrajorajisunnyNo ratings yet

- GST ChallanDocument1 pageGST ChallanSanjayThakkarNo ratings yet

- GST ChallanDocument2 pagesGST Challanvk6541803No ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST-CHALLAN (2)Document1 pageGST-CHALLAN (2)aliahmad.090No ratings yet

- GST ChallanDocument1 pageGST Challantaxsachin16No ratings yet

- GST ChallanDocument1 pageGST Challansarah IsharatNo ratings yet

- Gst-Challan - Acube Oct 23Document1 pageGst-Challan - Acube Oct 23Joseph LacsonNo ratings yet

- Gst-Challan Creation FormatDocument2 pagesGst-Challan Creation FormatMANAS KUMAR SAHU100% (1)

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- 0 0 3030 0 197284 SGST (0006)Document2 pages0 0 3030 0 197284 SGST (0006)dipak agarwallaNo ratings yet

- GST-CHALLAN Mar-22Document1 pageGST-CHALLAN Mar-2218veera98No ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- UntitledDocument1 pageUntitledvishalmahale15No ratings yet

- GST ChallanDocument1 pageGST ChallanGaurav AgarwalNo ratings yet

- GST ChallanDocument1 pageGST ChallanAshish GuptaNo ratings yet

- Gst-Challan (13) MeDocument1 pageGst-Challan (13) Meacpandey.lawfirmNo ratings yet

- GST ChallanDocument1 pageGST Challannagesh abbaramainaNo ratings yet

- GST Challan (RCM)Document1 pageGST Challan (RCM)sachinkumar.rkcjNo ratings yet

- GST ChallanDocument1 pageGST ChallanSumit PanchalNo ratings yet

- GST-Challan ReceiptDocument1 pageGST-Challan Receiptnitinupadhyay9821No ratings yet

- GST CHALLAnDocument1 pageGST CHALLAnVibhav AnasaneNo ratings yet

- GST ChallanDocument2 pagesGST Challanarvindindore2No ratings yet

- GST#CHALLANDocument1 pageGST#CHALLANravilakra lakraNo ratings yet

- 2657 0 0 0 0 2657 SGST (0006)Document1 page2657 0 0 0 0 2657 SGST (0006)Bhvunesh AshaliyaNo ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- GST ChallanDocument1 pageGST ChallanbipintradesNo ratings yet

- GST ChallanDocument1 pageGST ChallanAbhi RajputNo ratings yet

- GST Challan ReceiptDocument1 pageGST Challan Receiptits4u365No ratings yet

- GST Challan ReceiptDocument1 pageGST Challan Receiptits4u365No ratings yet

- Get HandsDocument1 pageGet HandsGaurav kumarNo ratings yet

- ACFrOgCjMaVv9U-aUoetTO4Rw9lzJRHoEq64 - y fw7FJijqgK7 RBAeeD8L8eGNkMD1BarUHGiki5PpXEsyR6uErOtTvn-Krjs9G3aPdFpCDPc6TfWxHprULfu44ec PDFDocument2 pagesACFrOgCjMaVv9U-aUoetTO4Rw9lzJRHoEq64 - y fw7FJijqgK7 RBAeeD8L8eGNkMD1BarUHGiki5PpXEsyR6uErOtTvn-Krjs9G3aPdFpCDPc6TfWxHprULfu44ec PDFJitenvora VoraNo ratings yet

- Gst-Challan S S Enterprises AprDocument2 pagesGst-Challan S S Enterprises AprApnaPayment Digital IndiaNo ratings yet

- GST ChallanDocument1 pageGST ChallannavneetNo ratings yet

- GST ChallanDocument2 pagesGST Challanvk6541803No ratings yet

- GST ChallanDocument2 pagesGST Challandevendrakumarrath_26No ratings yet

- Gupta Trading Co. Gst-Challan Payment-1Document1 pageGupta Trading Co. Gst-Challan Payment-1Pradeep G NairNo ratings yet

- GST Challan PDFDocument2 pagesGST Challan PDFSmarttNo ratings yet

- GST ChallanDocument2 pagesGST ChallanDeepak GuptaNo ratings yet

- GST ChallanDocument1 pageGST Challanaman sainNo ratings yet

- GST ChallanDocument1 pageGST Challansachinkumar.rkcjNo ratings yet

- GST ChallanDocument2 pagesGST Challanvk6541803No ratings yet

- Gst-Challan Mahalaxmi Enterprises AprDocument2 pagesGst-Challan Mahalaxmi Enterprises AprApnaPayment Digital IndiaNo ratings yet

- GST-CHALLAN (1)Document1 pageGST-CHALLAN (1)aliahmad.090No ratings yet

- GST ChallanDocument2 pagesGST ChallanAshish ShahNo ratings yet

- SGL 3 (Haematinics)Document32 pagesSGL 3 (Haematinics)raman mahmudNo ratings yet

- Chapter 5 - Object-Oriented Database ModelDocument9 pagesChapter 5 - Object-Oriented Database Modelyoseffisseha12No ratings yet

- A Project Report On CustomerDocument13 pagesA Project Report On CustomerDrishti BhushanNo ratings yet

- Ral Colour ChartDocument7 pagesRal Colour ChartBoda CsabaNo ratings yet

- Workout ChartDocument1 pageWorkout ChartAsadullah JawaidNo ratings yet

- Ullrich Aluminium Walkway Grating Product BrochureDocument2 pagesUllrich Aluminium Walkway Grating Product BrochureLukerider1No ratings yet

- UNIT-4 Key Distribution & ManagementDocument53 pagesUNIT-4 Key Distribution & ManagementBharath Kumar T VNo ratings yet

- Writing Task 11Document2 pagesWriting Task 11julee georgeNo ratings yet

- Classification of HotelsDocument14 pagesClassification of HotelsJeevesh ViswambharanNo ratings yet

- Lexical Semantic Problems in TranslationDocument13 pagesLexical Semantic Problems in Translationvargas199511100% (2)

- Unveiling The Cosmic Canvas: Pre-Order AstroDunia's 2024 Investment OdysseyDocument2 pagesUnveiling The Cosmic Canvas: Pre-Order AstroDunia's 2024 Investment OdysseyastroduniaNo ratings yet

- VIBXPERT II Short Instructions en 052010Document28 pagesVIBXPERT II Short Instructions en 052010Alejandro Jimenez FuentesNo ratings yet

- LOC Taxed Under ITADocument3 pagesLOC Taxed Under ITARizhatul AizatNo ratings yet

- An Information Silo: Management System Information System InformationDocument5 pagesAn Information Silo: Management System Information System InformationGeetanjaliNo ratings yet

- Carbohydrates Discussion Questions and AnswersDocument2 pagesCarbohydrates Discussion Questions and AnswerslolstudentNo ratings yet

- Configure Anyconnect 00Document22 pagesConfigure Anyconnect 00Ruben VillafaniNo ratings yet

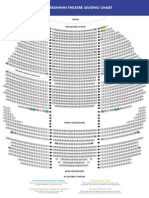

- The Gershwin Theatre Seating Chart: StageDocument1 pageThe Gershwin Theatre Seating Chart: StageCharles DavidsonNo ratings yet

- Bismillah - I Am A Muslim Nasheed Lyrics (Aasiah)Document1 pageBismillah - I Am A Muslim Nasheed Lyrics (Aasiah)begum121100% (1)

- Drill StringDocument72 pagesDrill StringRebar KakaNo ratings yet

- Hydrogeophysical Investigation Using Electrical Resistivity Method Within Lead City University Ibadan, Oyo State, NigeriaDocument1 pageHydrogeophysical Investigation Using Electrical Resistivity Method Within Lead City University Ibadan, Oyo State, NigeriaAdebo BabatundeNo ratings yet

- Shared Information ModelDocument16 pagesShared Information Modelrohitchawandke100% (1)

- English For Academic and Professional Purposes: Learning Module 4: Objectives and Structures of Various Kinds of ReportsDocument6 pagesEnglish For Academic and Professional Purposes: Learning Module 4: Objectives and Structures of Various Kinds of ReportsReymart YagamiNo ratings yet

- EntrepreneurshipDocument21 pagesEntrepreneurshipSK D'janNo ratings yet

- Anatomy of The Lymphatic SystemDocument76 pagesAnatomy of The Lymphatic SystemManisha RaoNo ratings yet

- Ddpa 3092 Reaction of A Continuous BeamDocument4 pagesDdpa 3092 Reaction of A Continuous Beamnurlisa khaleedaNo ratings yet

- Intermediate Thom Spectra, Hopf-Galois Extensions and A New Construction of M UDocument17 pagesIntermediate Thom Spectra, Hopf-Galois Extensions and A New Construction of M Uhuevonomar05No ratings yet

- M4164-C 06-15 - Etrinsa Technical Manual - MN031r2hq PDFDocument142 pagesM4164-C 06-15 - Etrinsa Technical Manual - MN031r2hq PDFMaria Lavinia IordacheNo ratings yet