Professional Documents

Culture Documents

Monthly Income Advantage Plan

Monthly Income Advantage Plan

Uploaded by

Gurkirt SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Income Advantage Plan

Monthly Income Advantage Plan

Uploaded by

Gurkirt SinghCopyright:

Available Formats

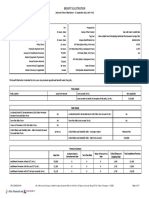

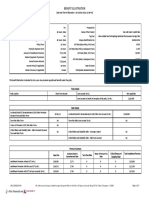

Proposal No:

Name of the Prospect/Policyholder: Mr. Name of the Product: Max Life Monthly Income Advantage Plan

Age & Gender: 31 Years, Male Tag Line: A Non-Linked Participating Individual Life Insurance Savings Plan

Name of the Life Assured: Mr. Unique Identification No: 104N091V06

Age & Gender: 31 Years, Male GST Rate: 4.50%

Policy Term: 18 Years Max Life State: Uttar Pradesh

Premium Payment Term: 8 Years Policyholder Residential State: Uttar Pradesh

Amount of Installment Premium: `1,25,400

Mode of payment of premium: Annual

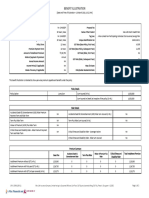

How to read and understand this benefit illustration?

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy, at two assumed rates of interest i.e., 8% p.a. and 4% p.a.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these

will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment returns, of

8%p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including

future investment performance.

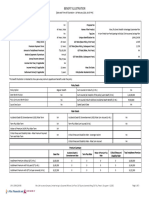

Policy Details

Policy Option Sum Assured (in Rs.) 11,22,860

Bonus Type Compound Reversionary Bonus Sum Assured on Death (at inception of the policy) (in Rs.) 13,20,000

Rider Details

Accidental Death & Dismemberment (ADD) Rider Premium

NA Accidental Death & Dismemberment (ADD) Rider Sum Assured (in Rs.) NA

Payment Term and Rider Term

Term Plus Rider Term NA Term Plus Rider Sum Assured (in Rs.) NA

Critical Illness and Disability Rider Term NA Critical Illness and Disability Rider Variant NA

Critical Illness and Disability Rider Sum Assured NA

Premium Summary

Base Plan Riders Total Installment Premium

Installment Premium without GST (in Rs.) 1,20,000 - 1,20,000

Installment Premium with first year GST (in Rs.) 1,25,400 - 1,25,400

Installment Premium with GST 2nd year onwards (in Rs.) 1,22,700 - 1,22,700

UIN: 104N091V06 Page 1 of 3

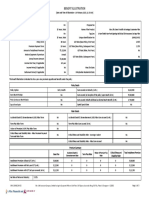

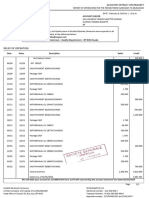

(Amount in Rupees)

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Reversionary Surrender Reversionary Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Bonus Benefit Bonus Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

1 1,20,000 - - - 13,20,000 - - - - - - - - - 13,20,000 13,20,000

2 1,20,000 - - 72,000 13,20,000 - 1,572 - 1,21,236 15,271 - 1,26,136 - - 13,20,000 13,20,000

3 1,20,000 - - 1,26,000 13,20,000 - 1,574 - 2,03,887 15,479 - 2,14,416 - - 13,20,000 13,20,000

4 1,20,000 - - 2,40,000 13,20,000 - 1,576 - 3,03,336 15,689 - 3,20,304 - - 13,20,000 13,20,000

5 1,20,000 - - 3,00,000 13,20,000 - 1,579 - 4,03,468 15,902 - 5,02,602 - - 13,20,000 13,20,000

6 1,20,000 - - 3,60,000 13,20,000 - 1,581 - 5,11,215 16,119 - 6,37,151 - - 13,20,000 13,20,000

7 1,20,000 - - 4,20,000 13,20,000 - 1,583 - 6,27,025 16,338 - 7,82,383 - - 13,20,000 13,20,000

8 1,20,000 - - 5,18,400 13,20,000 - 1,585 - 7,52,727 16,560 - 9,40,167 - - 13,20,000 13,20,000

9 - - 1,12,286 4,44,514 13,20,000 - 1,587 - 7,09,650 16,785 - 9,21,324 - - 13,20,000 13,20,000

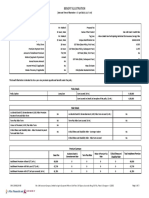

10 - - 1,12,286 3,70,628 13,20,000 - 1,590 - 6,57,264 17,014 - 8,93,896 - - 13,20,000 13,20,000

11 - - 1,12,286 2,96,742 13,20,000 - 1,592 - 5,99,781 17,245 - 8,63,933 - - 13,20,000 13,20,000

12 - - 1,12,286 2,22,856 13,20,000 - 1,594 - 5,46,077 17,480 - 8,57,383 - - 13,20,000 13,20,000

13 - - 1,12,286 1,48,970 13,20,000 - 1,596 - 4,81,806 17,717 - 8,45,205 - - 13,20,000 13,20,000

14 - - 1,12,286 75,084 13,20,000 - 1,599 - 4,09,253 17,958 - 8,26,759 - - 13,20,000 13,20,000

15 - - 1,12,286 1,198 13,20,000 - 1,601 - 3,28,023 18,202 - 8,01,335 - - 13,20,000 13,20,000

16 - - 1,12,286 - 13,20,000 - 1,603 - 2,37,687 18,450 - 7,68,169 - - 13,20,000 13,20,000

17 - - 1,12,286 - 13,20,000 - 1,605 - 1,37,818 18,701 - 7,26,408 - - 13,20,000 13,20,000

18 - - 1,12,286 - 13,20,000 - 1,608 - 27,025 18,955 - 6,76,246 27,025 6,76,246 13,20,000 13,20,000

UIN: 104N091V06 Page 2 of 3

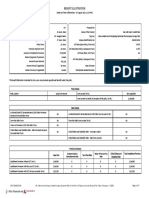

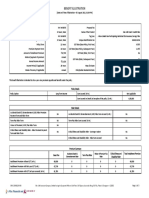

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods and Service Tax. Refer Sales literature for explanation of terms used in

this illustration.

I, ……………………………………………. (name), have explained the premiums, and benefits I, ……………………………………………. (name), having received the information with respect

under the product fully to the prospect / policyholder. to the above, have understood the above statement before entering into the contract.

Place:

Date: 3/15/23 Signature / OTP Confirmation Date / Thumb Impression / Date:3/15/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104N091V06 Page 3 of 3

93,31,1122859,R,120000.00,M,a93

You might also like

- Chap 018Document27 pagesChap 018Xeniya Morozova Kurmayeva100% (3)

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3Aman SaxenaNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- DownloadDocument3 pagesDownloadKiran JohnNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3babunidoniNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- Illustration 5Document4 pagesIllustration 5logicloverbharatNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- RaspDocument4 pagesRaspsamvil2007No ratings yet

- UIN: 104N113V02 Page 1 of 4Document4 pagesUIN: 104N113V02 Page 1 of 4NagarjunaNo ratings yet

- SWP 12 Pay 15, 44 Age, 5 LacDocument2 pagesSWP 12 Pay 15, 44 Age, 5 LacShivaji ReddyNo ratings yet

- Benefit IllustrationDocument2 pagesBenefit IllustrationusefulNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- ILLUSTRATION OF BENEFITS FOR Bharti AXA Life Guaranteed Wealth ProDocument4 pagesILLUSTRATION OF BENEFITS FOR Bharti AXA Life Guaranteed Wealth ProThe Why MindNo ratings yet

- UIN: 104L082V04 Page 1 of 4Document4 pagesUIN: 104L082V04 Page 1 of 4Indhug SharathNo ratings yet

- Sampoorna Raksha Supreme - 2023-09-15T150349.974Document4 pagesSampoorna Raksha Supreme - 2023-09-15T150349.974Karthikeyan SakthivelNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- Benefit Illustration: Tata AIA Life Insurance Smart Value Income PlanDocument3 pagesBenefit Illustration: Tata AIA Life Insurance Smart Value Income PlanPrakash SinghNo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001722290821Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001722290821Sankalp SrivastavaNo ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- The Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowFrom EverandThe Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowRating: 5 out of 5 stars5/5 (1)

- Bank Account DetailsDocument2 pagesBank Account DetailsInakshi TillekeratneNo ratings yet

- Deposit Product Record Form LOBO2023Document2 pagesDeposit Product Record Form LOBO2023Arnel GalitNo ratings yet

- What Is U.S. Rule?Document2 pagesWhat Is U.S. Rule?millemillare@yahoo,comNo ratings yet

- DownloadDocument6 pagesDownloadShivshankar KhondeNo ratings yet

- Bank Reconciliation StatementsDocument7 pagesBank Reconciliation StatementsLeon ElblingNo ratings yet

- Shipping Company Valuation-Case Study-141128Document17 pagesShipping Company Valuation-Case Study-141128nelvyNo ratings yet

- Withdrawal SlipDocument3 pagesWithdrawal SlipSufmpc SanguitNo ratings yet

- Corporate Finance Session-3Document3 pagesCorporate Finance Session-3Pandy PeriasamyNo ratings yet

- SSS BenefitsDocument2 pagesSSS BenefitsALIAHDAYNE POLIDARIONo ratings yet

- Quantitative Aptitude Test 4Document4 pagesQuantitative Aptitude Test 4Kanimozhi PonnuchamyNo ratings yet

- Booklet Toolbox Basel4Document74 pagesBooklet Toolbox Basel4Rahajeng PramestiNo ratings yet

- Derivative Loan - Gold Loan Strategy To Counter RiskDocument2 pagesDerivative Loan - Gold Loan Strategy To Counter RiskRaghu.GNo ratings yet

- Oq JR3 Pa LG2 Ug QYe KDocument9 pagesOq JR3 Pa LG2 Ug QYe KSurendra SuriNo ratings yet

- List of Market Makers and Primary DealersDocument38 pagesList of Market Makers and Primary DealersJP Tarud-KubornNo ratings yet

- Chapter Three-Time Value of MoneyDocument52 pagesChapter Three-Time Value of MoneySamuel AbebawNo ratings yet

- Types of AccountDocument4 pagesTypes of AccountArslan AshfaqNo ratings yet

- Jeevan Utsav (Sridhar) 2023Document66 pagesJeevan Utsav (Sridhar) 2023VENUGOPAL VNo ratings yet

- 4.2. AnnuitiesDocument7 pages4.2. AnnuitiesIsagaki RikuNo ratings yet

- AA015 Chap 2 LectureDocument5 pagesAA015 Chap 2 Lecturenorismah isaNo ratings yet

- HDFCDocument1 pageHDFCRakeshNo ratings yet

- Simple Mortgage DeedDocument6 pagesSimple Mortgage DeedKiran VenugopalNo ratings yet

- Room & Board Maximum Benefit Limit (PHP) Annual Premium (PHP) Room & Board Maximum Benefit Limit (PHP) Annual Premium (PHP)Document1 pageRoom & Board Maximum Benefit Limit (PHP) Annual Premium (PHP) Room & Board Maximum Benefit Limit (PHP) Annual Premium (PHP)erap0217No ratings yet

- List of Things Available in Deficieny AccountDocument11 pagesList of Things Available in Deficieny AccountDhanush SNo ratings yet

- AMORTIZATIONDocument10 pagesAMORTIZATIONManuella RyanNo ratings yet

- Account Extract On RequestDocument1 pageAccount Extract On Requestbenoit sophieNo ratings yet

- Proof of CashDocument2 pagesProof of CashRhea Mae CarantoNo ratings yet

- Surat Cuti SakitDocument1 pageSurat Cuti SakitFateyha AhmadNo ratings yet

- Star Gifts and Promotions CC Postnet Suite 435 Privatebag X Lynnwoodrif 0040 Samanthak@Decadentgp - Co.ZaDocument4 pagesStar Gifts and Promotions CC Postnet Suite 435 Privatebag X Lynnwoodrif 0040 Samanthak@Decadentgp - Co.ZaEmira FilaNo ratings yet