Professional Documents

Culture Documents

Sets Off and Carry Forward of Losses

Sets Off and Carry Forward of Losses

Uploaded by

Raghav BhardwajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sets Off and Carry Forward of Losses

Sets Off and Carry Forward of Losses

Uploaded by

Raghav BhardwajCopyright:

Available Formats

For computation of Gross Total Income (GTI), income from various sources is computed under the five heads

of income. If all the

sources and heads are having positive income (i.e. profit) then the same can simply be added to compute GTI. However, if certain

source(s) or certain head(s) have negative income (i.e. loss) then such loss needs to be adjusted with income of another source(s) or

head(s). Set off means adjustment of loss from one source or one head against income from another source or another head.

If a negative income is not fully set off in the current year, then the unabsorbed loss shall be carried forward to subsequent years subject

to certain restrictions and conditions [e.g. Income from other sources (other than losses from activity of owning and maintaining horse

races) cannot be carried forward.]

Adjustment of Income and loss from all Adjustment of Income under one head and sources covered under one head of

loss from another head of Income is called

Income is called Intra-head Adjustment [Rules are prescribed in Sec. 71] [Rules are prescribed in Sec. 70]

11.2 INTER SOURCE ADJUSTMENT (INTRA-HEAD ADJUSTMENT) [Sec. 70]

When the net result of any source of income is loss, it can be set off against income from any other source under the same head. Sec. 70

deals with the set off of loss from one source against income from another source under the same head of income, subject to the

following exceptions –

(a) Long term capital loss can be set off only against long term capital gain [Sec. 70(3)]. However, short-term capital loss can be set

off against short term as well as long term capital gains [Sec. 70(2)].

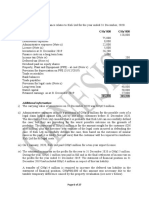

Example: Computation of Income under the head “Capital gains” of Mr. X for the A.Y. 2021-22

Particulars Case A Case B

Short term capital gain 80,000 (90,000)

Long term capital gain (40,000) 1,20,000

Income under the head “Capital gains” 80,000 30,000

(b) Loss of a speculation business can be set off only against the profits of a speculation business, under the head ‘Profits and gains of

business or profession’. However, loss from a non-speculative business can also be set off against income from speculation

business [Sec. 73(1)]

Example: Computation of “Profits & gains of business or profession” of Mr. X for the A.Y. 2021-22

Particulars Case A Case B

Speculation business 80,000 (90,000)

Non speculation business (40,000) 1,00,000

Profits & gains of business or profession 40,000 1,00,000

(c) Loss of a specified business covered u/s 35AD can be set off only against the profits of other specified business. However, loss

from a non-specified business can be set off against income from specified business.

(d) Loss incurred in activity of owning and maintaining race horses can be set off against income from such activity only [Sec. 74A]

Loss which could not

be adjusted shall be

carried forward to

next year subject to

certain conditions and

exceptions

The Institute of Cost Accountants of India 351

Direct Taxation

Example: Computation of “Income from other sources” of Mr. X for the A.Y. 2021-22

Particulars Case A Case B

Activity of owning and maintaining race-horses 80,000 (90,000)

Rent from land (20,000) 1,30,000

Income from other sources 60,000 1,30,000

Taxpoint: Above provisions provides restriction on losses, however income from aforesaid source (i.e. a to d) is available for

setting off any loss from any other source under the same head.

(e) Loss from a source, income of which is exempt u/s 10, cannot be set off against any income.

(f) No loss can be set off against winning from lotteries, crossword puzzles, races, card games, gambling or betting, etc. [Sec. 58(4)

& 115BB]. Similarly, set off of losses is not permissible against unexplained income, investment, money, etc. chargeable u/s 68 /

69A / 69B / 69C / 69D [Sec. 115BBE]

Example: Computation of “Income from other sources” of Mr. X for the A.Y. 2021-22

Particulars Case A Case B

Activity of owning and maintaining race-horses 10,000 (90,000)

Lottery income 20,000 1,30,000

Losses on letting out furniture not related to business (40,000) (50,000)

Income from other sources 20,000 1,30,000

11.3 INTER HEAD ADJUSTMENT [Sec. 71]

Where in respect of any assessment year, the net result of any head of income is a loss, the same can be set off against the income under

any other heads for the same assessment year, subject to the following exceptions:

(a) Capital gains: Loss under the head ‘Capital gains’ cannot be set off against income under any other head. However, loss under any

other head, e.g. business loss, shall be allowed to be set off against income under the head ‘Capital gains’

Example: Computation of “Gross total income” of Mr. X for the A.Y. 2021-22

Particulars Case A Case B

Long term capital gain 80,000 (90,000)

Short term capital gain (60,000) (30,000)

Income from house property (20,000) 1,30,000

Gross total income Nil 1,30,000

(b) Loss of a speculation business: Loss under the head ‘Profits and gains of business or profession’ due to speculation business

cannot be set off against any other income except profits of speculation business. However, loss under any other head, e.g. loss

from house property, shall be allowed to be set off against income of a speculation business.

(c) Loss of a specified business covered u/s 35AD cannot be set off against income taxable under other head. However, loss from

other head can be set off against income from specified business.

(d) Loss from activity of owning and maintaining race-horses: Loss under the head ‘Income from other sources’ due to activity of

owning and maintaining race-horses cannot be set off against any other income except profit from activity of owning and

maintaining race-horses [Sec. 74A]. However, loss under any other head, e.g. business loss, shall be allowed to be set off against

income from activity of owning and maintaining racehorses.

Taxpoint: Above provisions provides restriction on losses, however income from aforesaid source (i.e. a to d) is available for

setting off any loss from any other head of income.

(e) Loss under the head ‘Income from house property’: Loss in excess of ` 2,00,000 under the head ‘Income from house property’

cannot be set off with income under other heads of income.

Example: Computation of “Gross total income” of Ms. M for the A.Y. 2021-22

Particulars Case A Case B

Profit and gains of business or profession 2,80,000 2,80,000

352 The Institute of Cost Accountants of India

Set Off and Carry Forward of Losses

Income from house property (20,000) (2,30,000)

Gross total income 2,60,000 80,000

(f) Income under the head Salaries: Loss under the head “Profits and gains of business or profession” cannot be setoff from income

under the head “Salaries”.

(g) Loss from a source, income of which is exempt u/s 10: Such loss cannot be set off against any taxable income.

(h) Income from winning from lotteries, etc.: Any loss cannot be set off against winning from lotteries, crossword puzzles, races, card

games, gambling, betting, etc. [Sec. 58(4) & 115BB]. Similarly, set off of losses is not permissible against unexplained income,

investment, money, etc. chargeable u/s 68 / 69A / 69B / 69C / 69D [Sec. 115BBE]

Example: Computation of “Gross total income” of Mr. X for the A.Y. 2021-22

Particulars Case A Case B

Salaries 1,20,000 1,20,000

Profits and gains of business or profession (50,000) (30,000)

Income from house property 20,000 (20,000)

Gross total income 1,20,000 1,00,000

11.4 GENERAL NOTES

1. Sec. 70 vs Sec. 71: First, intra head set-off shall be made, thereafter inter head set-off shall be made. In other words, sec. 71

will be applicable after application of sec. 70.

2. Priority of set off u/s 71: The Act does not lay any priority relating to set off of losses, hence, losses which cannot be carried

forward should be adjusted first.

3. Mandatory feature of sec. 70 and 71: Assessee is bound to follow sec. 70 and 71, there is no choice or option whether to set

off the loss or not. Even partial set off is not permissible when entire loss can otherwise be set off.

4. Set-off of clubbed income: From the clubbed income, one can set off the losses.

11.5 CARRY FORWARD OF LOSS

In case where the income of an assessment year is insufficient to set off the losses of the year then such losses (which could not be set

off) can be carried forward to subsequent assessment year(s) for set off against income of such subsequent year(s). However, all losses

cannot be carried forward, e.g. losses under the head ‘Income from other sources’ (other than loss from ‘Activity of owning and

maintaining race-horses’) cannot be carried forward. Following losses can be carried forward:

1. Loss under the head ‘Income from house property’ [Sec. 71B]

2. Loss under head “Profits and gains of business or profession” other than speculation loss [Sec. 72]

3. Loss from speculation business [Sec. 73]

4. Loss from specified business covered u/s 35AD [Sec. 73A]

5. Loss under the head ‘Capital gains’. [Sec. 74]

6. Loss from ‘Activity of owning and maintaining race horses’. [Sec. 74A]

11.6 LOSS UNDER THE HEAD ‘INCOME FROM HOUSE PROPERTY’ [Sec. 71B]

Loss under the head ‘Income from house property’ can be carried forward and can be set off against income under the same head only.

Period for which carry-forward shall be allowed: 8 assessment years immediately succeeding the assessment year in which such loss

is first computed.

The Institute of Cost Accountants of India 353

Direct Taxation

Filing of return: Loss under the head ‘Income from house property’ can be carried forward even when a belated return is filed [as sec.

80 and 139(3) are not applicable to sec. 71B].

11.7 CARRY FORWARD & SET OFF OF BUSINESS LOSS OTHER THAN SPECULATION LOSS [Sec. 72]

Loss under the head “Profits and gains of business or profession” (other than speculation loss) can be carried forward and set off against

income under the same head.

Note: For this purpose business profit includes profits derived from a business activity but assessable under the heads other than ‘Profit

and gains of business or profession’, e.g. Dividend income when shares are held as stock, though taxable under the head ‘Income from

other sources’ but business loss can be set off against such income.

Period for which carry-forward shall be allowed: 8 assessment years immediately succeeding the assessment year in which such loss

is first computed.

Academic note: In the assessment year 2021-22, losses prior to the assessment year 2013-2014 cannot be set off.

Exceptions to the above period

1. Closure of business due to specified reasons [Sec. 33B]

Situation: Where any loss remains unabsorbed of a business undertaking, which is discontinued due to damages caused by -

(i) flood, typhoon, hurricane, cyclone, earthquake or other convulsion of nature; or

(ii) riot or civil disturbance; or

(iii) accidental fire or explosion; or

(iv) action by an enemy or action taken in combating an enemy (whether with / without a declaration of war)

Condition: Such business is re-established, reconstructed or revived by the assessee, within a period of 3 years from the end of the

previous year in which such mishap took place.

Treatment: Losses of such business [including the past eligible losses (to be carried forward)] shall be adjusted with profit of the

year in which business is so revived and if the loss cannot be wholly setoff, then it shall further be allowed to be carried forward

for 7 years.

2. Set off of losses relating to the year of closure of business against deemed profit [Sec. 41(5)]

Situation: Where any part of loss (not being a speculation loss), which arose during the previous year remains

unabsorbed in the previous year in which business ceased to exist.

Treatment: Such loss shall be allowed to be carried forward for any number of years (without restriction of 8 years)

against income chargeable to tax u/s 41(1); (3); (4); (4A).

Taxpoint: Such loss can be set off even if the return of loss is not submitted in time.

Notes:

1. Business need not be continued: The business losses can be carried forward, even the business in respect of which the loss was

originally computed, is not carried on during the previous year.

2. Filing of return in time: As per sec. 80, the business loss cannot be carried forward unless it is determined in pursuance of a return

filed by the assessee u/s 139(3), within time as prescribed u/s 139(1).

3. Treatment of unabsorbed depreciation, etc.: Unabsorbed depreciation, unabsorbed scientific research expenditure and unabsorbed

family planning expenditure are not covered by sec. 72. Such losses can be carried forward for any number of years.

4. Order of set off: In case of insufficient profit, losses shall be set off in the following order:

(a) Current year’s depreciation [Sec. 32(1)], capital expenditure on scientific research [Sec. 35(1)] and capital expenditure on

family planning [Sec. 36(1)(ix)];

(b) Brought forward business or profession losses [Sec. 72(1)],

354 The Institute of Cost Accountants of India

Set Off and Carry Forward of Losses

(c) Unabsorbed depreciation [Sec. 32(2)], unabsorbed expenditure on family planning [Sec. 36(1)(ix)], unabsorbed capital

expenditure on scientific research [Sec. 35(4)]

5. Loss from specified business covered u/s 35AD (i.e, cold chain facility, cross-country natural gas pipeline, etc.) shall be adjusted

only from profit from specified business [Further refer sec.73A].

6. Assessee must be same who incurred the loss: Business losses can be carried forward and set off against the profits of the assessee

who incurred the loss i.e. assessee must be same to carry forward the loss. However, this rule has the following exceptions –

(a) Amalgamation: Business losses and unabsorbed depreciation of an amalgamating company can be setoff against the income

of the amalgamated company if the amalgamation is within the meaning of sec. 72A of the Income tax Act. (Discussed later

in this chapter).

(b) Succession: Business losses and unabsorbed depreciation of a proprietary concern or a partnership firm or a specified

company succeeded by a company or limited liability partnership as per sec. 47(xiii), (xiiib) and (xiv), can be carried forward

by succeeded company or limited liability partnership.

(c) Inheritance: As per sec. 78(2), where the assessee acquires the business through inheritance, losses of such business may be

carried forward for balance number of years.

(d) Demerger: In case of demerger, loss of demerged company shall be carried forward and set-off by resulting company.

(Discussed later in this chapter).

Note: In following case losses cannot be carried forward

(i) Business, of an HUF where the business of the HUF is taken over by the Karta of HUF;

(ii) Proprietorship business taken over by a firm in which proprietor is one of the partner;

(iii) A firm being succeeded by another firm;

(iv) A firm where the business of the firm is taken over by one of the partner of the firm,

11.8 SET OFF AND CARRY FORWARD OF UNABSORBED DEPRECIATION

Set off and carry forward of unabsorbed depreciation shall be governed by sec. 32(2) and not by sec. 72.

Depreciation, which could not be fully absorbed in any previous year, owing to -

• there being no profits or gains chargeable for that previous year; or

• the profits or gains chargeable being less than the amount of depreciation.

Tax treatment: Allowance or the part of the allowance of depreciation which remains unabsorbed shall be (subject to sec. 72 and sec.

73) added to the amount of the depreciation for the following previous year and deemed to be the depreciation-allowance for that

previous year, and so on for the succeeding previous years.

Taxpoint: Unabsorbed depreciation shall be allowed to be carried forward for any number of years and such carried forward

unabsorbed depreciation may be set off against any income, other than -

� Income under the head “Salaries”

� Winning from lotteries, cross word puzzles, etc.

Notes:

1. Continuation of business: Unabsorbed depreciation can be carried forward even if the business in respect of which the loss was

originally computed, is not carried on during the previous year.

2. Filing of return: Unabsorbed depreciation can be carried forward even if the return of income has not been filed within time

Notes:

1. Losses from wholesale of fruits business which arose during the P.Y. 2003-04, being the year in which business ceased to exist

and which could not be set off against any other income of that previous year or any subsequent years can be set off against

income chargeable to tax u/s 41(4) i.e. bad debt recovery. Such loss is allowed to be carried forward for any number of years

The Institute of Cost Accountants of India 355

Direct Taxation

(without restriction of 8 years). However, in case of Optical business, brought forward loss relates to P.Y. 2002-03 whereas

business ceases to exist in P.Y. 2003-04, therefore such loss cannot be set off against income chargeable u/s 41(4).

2. As per sec. 80, business loss cannot be carried forward unless it is determined in pursuance of a return filed by the assessee u/s

139(3), within time as prescribed u/s 139(1)

3.

4. .

11.9 CARRY FORWARD AND SET OFF OF SPECULATION LOSS [Sec. 73] Amended

1. Speculative transaction means a transaction in which contract for purchase and sale of any commodity including stock and shares,

is periodically or ultimately settled otherwise than by the actual delivery or transfer of the commodity or scripts. [Sec. 43(5)]

2. As per explanation to sec. 73, where any part of the business of a company consists of purchase and sale of shares of other

companies, such company shall be deemed to be carrying on speculation business to the extent of purchase and sale of shares.

However, this rule is not applicable in case of companies -

(a) of which gross total income mainly consists of income which is chargeable under the head “Income from house property”,

“Capital gains”, and “Income from other sources”; or

(b) of which principal business is the business of trading in shares or banking or granting of loans and advances.

Notes: Above explanation covers only transactions of purchase and sale of shares. Debentures, units of UTI or of Mutual Funds are not

covered by this explanation.

Treatment

Losses from speculative transactions or business can be carried forward and set off against income from speculative business only.

Period for which carry forward shall be allowed: 4 assessment years immediately succeeding the assessment year in which such loss is

first computed.

Academic note: In the assessment year 2021-22, losses prior to the assessment year 2017-18 cannot be set off.

As per sec. 73(3) in respect of allowance on account of depreciation or capital expenditure on scientific research, the provisions of sec.

73 shall not apply it can be carried forward to any number of years.

Notes:

1. Continuity of business: It is not necessary that the same speculation business must be continued in the year of carry forward and

set off of the losses.

2. Filing of return: As per sec. 80, the loss cannot be carried forward unless it is determined in pursuance of a return filed by the

assessee u/s 139(3), within time as prescribed u/s 139(1)

3. Derivative Trading: An eligible transaction in respect of trading in derivative referred to in sec.2(ac) of the Securities Contracts

(Regulation) Act, 1956 carried out in a recognised stock exchange shall not be treated as speculative transaction. Similarly, an

eligible transaction in respect of trading in commodity derivatives carried out in a recognised stock exchange (and liable for

Commodities Transaction Tax in case of trading in commodity derivatives other than agricultural commodity derivatives) shall not

be treated as speculative transaction.

Taxpoint: In respect of trading in agricultural commodity derivatives, the requirement of chargeability of commodity transaction tax is

not applicable.

4. Losses of illegal speculative business: Loss arising from illegal speculative business cannot be carried forward to the subsequent

years for set off against the profits of another speculative business.

11.10 CARRY FORWARD & SET OFF OF LOSS FROM SPECIFIED BUSINESS COVERED u/s 35AD [Sec.

73A]

Losses from specified business covered u/s 35AD can be carried forward and set off against income from other specified business

(whether eligible for deduction u/s 35AD or not).

Period for which carry-forward shall be allowed: No time limit is prescribed.

356 The Institute of Cost Accountants of India

Set Off and Carry Forward of Losses

Filing of return: As per sec. 80, the loss cannot be carried forward unless it is determined in pursuance of a return filed by the assessee

u/s 139(3), within time as prescribed u/s 139(1).

11.11 CARRY FORWARD AND SET OFF OF CAPITAL LOSS [Sec. 74]

Losses under the head ‘Capital gains’ can be carried forward and set off against income under the same head, subject to the restriction

that the loss on transfer of long-term capital assets can be set off only against long term capital gain.

Taxpoint: Loss on transfer of short-term capital assets can be set off against any income under the head capital gain (whether short-

term or long-term).

Period for which carry-forward shall be allowed: 8 assessment years immediately succeeding the assessment year in which such loss is

first computed.

Academic note: In the assessment year 2021-22, losses prior to the assessment year 2013-2014 cannot be set off.

Filing of return: As per sec. 80, the loss cannot be carried forward unless it is determined in pursuance of a return filed by the assessee

u/s 139(3), within time as prescribed u/s 139(1).

11.12 CARRY FORWARD AND SET OFF OF LOSSES FROM ACTIVITY OF OWNING AND

MAINTAINING RACE HORSES [Sec. 74A]

In case of an assessee, being the owner of horses maintained by him for running in horse races (race horses), the amount of loss incurred

by the assessee in the activity of owning and maintaining race horses in any assessment year shall be set off only against income from

the activity of owning and maintaining race horses.

Period for which carry forward shall be allowed: 4 assessment years immediately succeeding the assessment year in which such loss is

first computed.

Notes:

1. Continuity of activity: Activity of owning and maintaining race horses must be carried on by the assessee in the previous year in

which set off is claimed.

2. Treatment of other race animals: Sec. 74A states only about losses from activity of owning and maintaining race horses, other

race animals are governed by sec. 72.

3. Filing of return: To claim benefit of carry forward, return of loss u/s 139(3) must be filed within time as per sec. 139(1).

4. Horse Race: Horse race means a race upon which wagering or betting on horses may be lawfully made.

5. Amount of loss incurred by the assessee in the activity of owning and maintaining race horses means—

6.

11.13 CARRY FORWARD & SET-OFF OF LOSSES OF FIRM ON CHANGE IN CONSTITUTION OF FIRM [Sec. 78]

Where a change occurs in the constitution of firm, on account of retirement or death of a partner, the proportionate loss of the retired or

deceased partner shall not be carried forward.

Note: This section shall not apply in case of change in profit sharing ratio or admission of partner.

11.14 CARRY FORWARD & SET OFF OF LOSS IN CASE OF CLOSELY HELD COMPANIES [Sec. 79]

In case of a company in which public are not substantially interested (even the same is eligible start-up company), no loss shall be

carried forward and set off against the income of the previous year, unless at least 51% of the voting power of the company are

beneficially held (on the last day of the previous year in which the loss is sought to be set off) by the same person(s) who held at least

51% of the shares on the last day of the financial year in which the loss was incurred.

Taxpoint:

(a) Assessee must be a company in which public are not substantially interested.

(b) 51% of equity shares are to be beneficially held by the same person(s) both -

� on the last day of the previous year in which such loss was occurred; &

The Institute of Cost Accountants of India 357

Direct Taxation

� on the last day of the previous year in which brought forward loss is sought to be set off.

Option for eligible start-up company1

In the case of eligible start-up company, not being a company in which the public are substantially interested, the loss incurred in any

year prior to the previous year shall be carried forward and set off against the income of the previous year, if:

• All the shareholders of such company who held shares carrying voting power on the last day of the year or years in which the

loss was incurred continue to hold those shares on the last day of such previous year; and

• Such loss has been incurred during the period of 7 years beginning from the year in which such company is incorporated:

Exceptions: However, change in the share holding due to following reasons shall not be considered-

1. Transfer due to death: Where a change in the said voting power takes place in a previous year consequent upon the death of a

shareholder

2. Transfer by way of gift: Where a change in the said voting power takes place in a previous year on account of transfer of shares

by way of gift to any relative of the shareholder making such gift

3. Amalgamation or demerger of foreign company: Any change in the shareholding of an Indian company which is a subsidiary of

a foreign company as a result of amalgamation or demerger of a foreign company subject to the condition that 51% shareholders of

the amalgamating or demerged foreign company continues to be the shareholder of the amalgamated or the resulting foreign

company.

4. Insolvency and Bankruptcy Code, 2016: Where a change in the shareholding takes place in a previous year pursuant to a

resolution plan approved under the Insolvency and Bankruptcy Code, 2016, after affording a reasonable opportunity of being heard

to the jurisdictional Principal Commissioner or Commissioner

5. Distressed Company: The provision is not applicable to a company, and its subsidiary and the subsidiary of such subsidiary,

where:

(i) the National Company Law Tribunal (NCLT), on an application moved by the Central Government u/s 241 of the Companies

Act, 2013, has suspended the Board of Directors of such company and has appointed new directors nominated by the Central

Government, u/s 242 of the said Act; and

(ii) a change in shareholding of such company, and its subsidiary and the subsidiary of such subsidiary, has taken place in a

previous year pursuant to a resolution plan approved by the Tribunal u/s 242 of the Companies Act, 2013 after affording a

reasonable opportunity of being heard to the jurisdictional Principal Commissioner or Commissioner.

Notes:

(a) Losses under the head ‘Capital gains’: Sec. 79 applies to all losses, including losses under the head Capital gains.

(b) Unabsorbed depreciation: The above provision is not applicable on unabsorbed depreciation, such unabsorbed depreciation shall

be allowed to be carried forward.

11.15 CARRY FORWARD & SET OFF OF ACCUMULATED LOSSES AND UNABSORBED

DEPRECIATION IN CASE OF AMALGAMATION, DEMERGER OR SUCCESSION, etc. [Sec. 72A]

Sec. 72A can be divided in four parts:

Carry forward & set off of accumulated loss and unabsorbed depreciation in case of amalgamation.

Sec. 72A(1) to 72A(3)

Carry forward & set off of accumulated loss and unabsorbed depreciation in case of demerger.

Sec. 72A(4) & (5)

Carry forward & set off of accumulated loss and unabsorbed depreciation in case of succession.

Sec. 72A(6)

1 As defined in sec. 80-IAC

358 The Institute of Cost Accountants of India

Set Off and Carry Forward of Losses

Carry forward & set off of accumulated loss and unabsorbed depreciation in case of conversion into

Sec. 72A(6A) Limited Liability Partnership.

• “Accumulated Loss” means so much of the loss of the predecessor firm or the proprietary concern or the private company or

unlisted public company before conversion into limited liability partnership or the amalgamating company or the demerged

company, as the case may be, under the head “Profits and gains of business or profession” (not being a loss sustained in a

speculation business) which such predecessor firm or the proprietary concern or the company or amalgamating company or

demerged company, would have been entitled to carry forward and set off under the provisions of section 72 if the

reorganisation of business or conversion or amalgamation or demerger had not taken place

• “Unabsorbed Depreciation” means so much of the allowance for depreciation of the predecessor firm or the proprietary concern

or the private company or unlisted public company before conversion into limited liability partnership or the amalgamating

company or the demerged company, as the case may be, which remains to be allowed and which would have been allowed to the

predecessor firm or the proprietary concern or the company or amalgamating company or demerged company, as the case may

be, under the provisions of this Act, if the reorganisation of business or conversion or amalgamation or demerger had not taken

place

11.16 CARRY FORWARD & SET OFF OF ACCUMULATED LOSS AND UNABSORBED DEPRECIATION

IN CASE OF AMALGAMATION

Applicability: Sec. 72A is applicable on following amalgamation, where -

1. There has been an amalgamation of a company owning -

• an industrial undertaking$; or

• a ship; or

• a hotel, with another company; or

2. There has been amalgamation of a banking company with a specified bank.

3. There has been an amalgamation of one or more public sector company or companies engaged in the business of operation of

aircraft with one or more public sector company or companies engaged in similar business,

$

Industrial undertaking means an undertaking engaged in—

• manufacture or processing of goods; or

• manufacture of computer software; or

• business of generation or distribution of electricity or any other form of power; or

• business of providing telecommunication services, whether basic or cellular, including radio paging, domestic satellite service,

network of trunking, broadband network and internet services; or • mining; or

• the construction of ships, aircrafts or rail systems.

Conditions:

1. The amalgamating company -

• has been engaged in the business (in which the accumulated loss occurred or depreciation remains unabsorbed) for three or

more years;

• has held continuously as on the date of the amalgamation at least 3/4 th of the book value of fixed assets held by it 2 years prior

to the date of amalgamation.

2. The amalgamated company—

• holds continuously for a minimum period of 5 years from the date of amalgamation at least 3/4 th of the book value of fixed

assets of the amalgamating company acquired in a scheme of amalgamation;

• continues the business of the amalgamating company for a minimum period of 5 years from the date of amalgamation;

The Institute of Cost Accountants of India 359

Direct Taxation

• fulfils such other conditions# as may be prescribed to ensure the revival of the business of the amalgamating company or to

ensure that the amalgamation is for genuine business purpose.”

#

Conditions for Carry forward & set off of accumulated loss and unabsorbed depreciation allowable in case of amalgamation

[Rule 9C Notified by Notification No.11169, dated 15-12-1999]

(a) The amalgamated company owns the industrial undertaking of the amalgamating company;

(b) The amalgamated company achieves the level of production of at least 50% of the installed capacity of the said undertaking before

the end of the 4 years from the date of amalgamation and continue to maintain the said minimum level of production till the end of

5 years from the date of amalgamation;

(c) Account must be verified by an accountant & a certificate in Form 62 shall be furnished along with the return of income for the

assessment year relevant to the previous year during which the prescribed level of production is achieved & for subsequent

assessment years relevant to the previous year falling within 5 years from the date of amalgamation.

Note: Installed capacity means the capacity of production existing on the date of amalgamation.

Treatment: The accumulated loss and the unabsorbed depreciation of the amalgamating company shall be deemed to be the loss or

depreciation of the amalgamated company for the previous year in which the amalgamation was effected.

Taxpoint: Accumulated loss of the amalgamating company can be carried forward for further 8 years.

Consequences if the conditions are not satisfied

As per sec. 72A(3), in a case where above conditions are not complied with, the set off of loss or depreciation made in any previous

year by the amalgamated company shall be deemed to be the income of the amalgamated company and chargeable to tax in the year in

which such conditions are violated.

11.17 CARRY FORWARD & SET OFF OF ACCUMULATED LOSS AND UNABSORBED DEPRECIATION

IN CASE OF DEMERGER [Sec. 72A(4)]

In case of demerger, the accumulated loss & unabsorbed depreciation of the demerged company shall be treated as under:

Case Treatment

Where such loss or unabsorbed Such loss shall be allowed to be carried forward and set off in the hands of the resulting

depreciation is directly related to the company

undertakings transferred to the

resulting company

Where such loss or unabsorbed Such loss shall be -

depreciation is not directly related to the • apportioned between the demerged company and the resulting company in the

undertakings transferred to the resulting

same proportion in which the assets of the undertakings have been retained by the

company.

demerged company and transferred to the resulting company; and

• allowed to be carried forward and set off in the hands of the demerged company or

the resulting company.

Taxpoint: Amount to be carried forward -

Asset taken over by resulting company

Loss of undertaking ×

Total asset of the undertaking

As per sec. 72A(5), the Central Government may, for the purposes of this Act, by notification in the Official Gazette, specify such

conditions as it considers necessary to ensure that the demerger is for genuine business purposes.

11.18 CARRY FORWARD & SET OFF OF LOSSES ON CONVERSION OF PROPRIETARY CONCERN OR

PARTNERSHIP FIRM INTO COMPANY [Sec. 72A(6)]

Condition: Where -

• a firm is succeeded by a company fulfilling the conditions laid down in sec. 47(xiii); or

• a proprietary concern is succeeded by a company fulfilling conditions laid down in sec. 47(xiv).

360 The Institute of Cost Accountants of India

Set Off and Carry Forward of Losses

Tax Treatment: The accumulated loss and unabsorbed depreciation of the predecessor firm or the proprietary concern, as the case may

be, shall be deemed to be the loss or allowance for depreciation of the successor company for the purpose of previous year in which

reorganisation of business was effected.

Taxpoint: Accumulated loss of such firm or concern can be carried forward for further 8 years.

Effect of non compliance of conditions given u/s 47(xiii) and (xiv)

If any of the conditions laid down in the sec. 47(xiii) or (xiv) are not complied with, the set off of loss or allowance of depreciation

made in any previous year by the successor company shall be deemed to be the income of the company and chargeable to tax in the year

in which such conditions are violated.

11.19 CARRY FORWARD & SET OFF OF LOSSES ON CONVERSION INTO LIMITED LIABILITY PARTNERSHIP

[Sec. 72A(6A)]

Condition: Where a private company or unlisted public company is succeeded by a limited liability partnership fulfilling the conditions

laid down in the proviso to sec.47(xiiib).

Tax Treatment: The accumulated loss and unabsorbed depreciation of the predecessor concern shall be deemed to be the loss or

allowance for depreciation of the successor firm for the purpose of previous year in which reorganisation of business was effected.

Taxpoint: Accumulated loss of such firm or concern can be carried forward for further 8 years.

Effect of non compliance of conditions given u/s 47(xiiib)

If any of the conditions laid down in the sec. 47(xiiib) are not complied with, the set off of loss or allowance of depreciation made in

any previous year by the successor firm shall be deemed to be the income of the firm and chargeable to tax in the year in which such

conditions are violated.

11.20 C ARRY FORWARD & SET-OFF OF ACCUMULATED LOSS IN SCHEME OF AMALGAMATION OF

BANKING COMPANY OR GENERAL INSURANCE COMPANIES [SEC. 72AA] Amended

Situation: In case of amalgamation of:

(a) one or more banking company with any other banking institution under a scheme sanctioned and brought into force by the Central

Government u/s 45(7) of the Banking Regulation Act, 1949; or

(b) one or more corresponding new bank or banks with any other corresponding new bank under a scheme brought into force by the

Central Government u/s 9 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 or similar provisions

of 1980 Act; or

(c) one or more Government company or companies with any other Government company under a scheme sanctioned and brought

into force by the Central Government u/s 16 of the General Insurance Business (Nationalisation) Act, 1972

Treatment: The accumulated loss and the unabsorbed depreciation of amalgamating concern shall be deemed to be the loss of

amalgamated concern for the previous year in which the scheme of amalgamation was brought into force.

Notes:

1. ‘Accumulated loss’ means so much of the loss under the head “Profits and gains of business or profession” (not being a loss

sustained in a speculation business) which such amalgamating company, would have been entitled to carry forward and set-off u/s

72 if the amalgamation had not taken place.

2. Unabsorbed depreciation means so much of the allowance for depreciation of the amalgamating company, which remains to be

allowed and which would have been allowed to such company if amalgamation had not taken place.

11.21 CARRY FORWARD AND SET OFF OF ACCUMULATED LOSS AND UNABSORBED

DEPRECIATION IN BUSINESS REORGANISATION OF CO-OPERATIVE BANKS [Sec. 72AB]

Applicable on: Co-operative bank

Conditions

The Institute of Cost Accountants of India 361

Direct Taxation

1. The predecessor co-operative bank -

• has been engaged in the business of banking for three or more years; and

• has held at least 3/4th of the book value of fixed assets as on the date of the business reorganisation, continuously for 2 years

prior to the date of business reorganization.

2. The successor co-operative bank —

• holds at least 3/4th of the book value of fixed assets of the predecessor co-operative bank acquired through business

reorganisation, continuously for a minimum period of 5 years immediately succeeding the date of business reorganization.

• continues the business of the predecessor co-operative bank for a minimum period of 5 years from the date of business

reorganisation; and

• fulfils such other conditions as may be prescribed to ensure the revival of the business of the predecessor co-operative bank or

to ensure that the business reorganisation is for genuine business purpose.

Treatment:

Case Treatment

Amalgamation Successor bank shall be allowed to set off the accumulated (business other than speculation) loss and the

unabsorbed depreciation, if any, of the predecessor co-operative bank as if the amalgamation had not taken

place, and all the other provisions of this Act relating to set off and carry forward of loss and allowance for

depreciation shall apply accordingly.

Demerger In the case of a demerger, the accumulated (business other than speculation) loss and unabsorbed depreciation of

the demerged bank shall be treated as under—

Case Treatment

Where such loss or unabsorbed Such loss shall be allowed to be carried forward and set off in the

depreciation is directly related to the hands of the resulting bank

undertakings transferred to the resulting

bank

Where such loss or unabsorbed Such loss shall be -

depreciation is not directly related to the • apportioned between the demerged bank and the resulting bank

undertakings transferred to the resulting in the same proportion in which the assets of the undertakings

bank.

have been retained by the demerged bank and transferred to the

resulting bank; &

• allowed to be carried forward and set off in the hands of the

demerged bank or the resulting bank.

In other words, Amount to be carried forward -

Asset taken over by resulting bank

Loss of undertaking ×

Total asset of the demerged bank

Consequences if the conditions are not satisfied

In a case where above conditions are not complied with, the set off of loss or depreciation made in any previous year by the

amalgamated bank shall be deemed to be the income of the amalgamated bank and chargeable to tax in the year in which such

conditions are violated.

362 The Institute of Cost Accountants of India

You might also like

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Aggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToDocument31 pagesAggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToSivasankariNo ratings yet

- Aggregation of IncomeDocument30 pagesAggregation of Incomeraja naiduNo ratings yet

- Setoff Carry Forward - UnlockedDocument30 pagesSetoff Carry Forward - Unlockedsohamdivekar9867No ratings yet

- IPCC Mock Test Taxation - Only Solution - 25.09.2018Document12 pagesIPCC Mock Test Taxation - Only Solution - 25.09.2018KaustubhNo ratings yet

- Set Off and Carry Forward of LossesDocument23 pagesSet Off and Carry Forward of LossesKartikNo ratings yet

- Aggregation of Income, Set-Off and Carry Forward of LossesDocument18 pagesAggregation of Income, Set-Off and Carry Forward of LossesJoseph SalidoNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 18 Final Examination: Suggested Answers To QuestionDocument39 pagesSuggested Answer - Syl12 - Dec13 - Paper 18 Final Examination: Suggested Answers To QuestionkkpaiNo ratings yet

- 2facc of Corporate Entities AssignmentDocument4 pages2facc of Corporate Entities AssignmentSia VermaNo ratings yet

- Questions On Net Profit Before Tax and Extraordinary ItemsDocument3 pagesQuestions On Net Profit Before Tax and Extraordinary ItemspuxvashuklaNo ratings yet

- International TaxDocument18 pagesInternational TaxriyaNo ratings yet

- Cash Flow Statement Ias 7Document5 pagesCash Flow Statement Ias 7JOSEPH LUBEMBANo ratings yet

- F-1919-B.b.a. - Semester-Iv - Paper - 119-Financial ManagementDocument2 pagesF-1919-B.b.a. - Semester-Iv - Paper - 119-Financial Managementhimanshu ranjanNo ratings yet

- 8567 1st AssignmentDocument14 pages8567 1st AssignmentUbedullah DahriNo ratings yet

- AS Book 1Document4 pagesAS Book 1Vashu ShrivastavNo ratings yet

- Adv MTP A20Document14 pagesAdv MTP A20Pawan AgrawalNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Handout - Statement of Profit or Loss and OCIDocument6 pagesHandout - Statement of Profit or Loss and OCIshamielpeNo ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- DT CPS TEST 2 SolnDocument11 pagesDT CPS TEST 2 SolnMayank GoyalNo ratings yet

- (' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaDocument12 pages(' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaYashNo ratings yet

- 622 Axes: ATE: Module 36 T CorporDocument1 page622 Axes: ATE: Module 36 T CorporEl-Sayed MohammedNo ratings yet

- Handout - Statement of Profit or LossDocument2 pagesHandout - Statement of Profit or LossshamielpeNo ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersDocument9 pagesTAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersMohammad FaridNo ratings yet

- 5 6215195415390715991Document16 pages5 6215195415390715991RITIK AGARWALNo ratings yet

- 3 Module Direct TaxDocument21 pages3 Module Direct TaxVeena GowdaNo ratings yet

- SET OFF AND CARRY FORWARD OF LOSSES RevisedDocument4 pagesSET OFF AND CARRY FORWARD OF LOSSES RevisedprasannacaNo ratings yet

- 5 6336743075766863237 PDFDocument75 pages5 6336743075766863237 PDFshagufta afrin100% (1)

- Isc Mock 2Document14 pagesIsc Mock 2anshikajain3474No ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- CFR400 Mid Sem Suggested Solutions MtendeDocument4 pagesCFR400 Mid Sem Suggested Solutions MtendePenjaniNo ratings yet

- P18 Syl2012 Set1Document22 pagesP18 Syl2012 Set1Aswin KumarNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- MTP II AnswersDocument14 pagesMTP II AnswersEediko ConsultingNo ratings yet

- T2 Revised Ans. (PS & ITA)Document8 pagesT2 Revised Ans. (PS & ITA)alvinmono.718No ratings yet

- Clubbing, Set-Off & Deduction U - C VI-A - SolutionDocument6 pagesClubbing, Set-Off & Deduction U - C VI-A - SolutionBharatbhusan RoutNo ratings yet

- AS Book 1Document1 pageAS Book 1Vashu ShrivastavNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- DT & IT - AnswersDocument13 pagesDT & IT - AnswersAnkit GuptaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument15 pages© The Institute of Chartered Accountants of IndiaRobinxyNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Ratio Analysis Day 4 CWDocument12 pagesRatio Analysis Day 4 CWManav 007No ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument17 pages(In Lakhs) : © The Institute of Chartered Accountants of Indiaarihant bokdiaNo ratings yet

- Learning Unit 8 - Treatments of Dividends During ConsolidationDocument41 pagesLearning Unit 8 - Treatments of Dividends During ConsolidationThulani NdlovuNo ratings yet

- RTP Group-1 For May-2020 (CA Final New Course)Document144 pagesRTP Group-1 For May-2020 (CA Final New Course)Jayendrakumar KatariyaNo ratings yet

- 2542 - Tut1Document14 pages2542 - Tut1(Alumna 2018-6A07) CHUCK LONG YAU 卓朗悠No ratings yet

- Amt Deduction Debjani AnjaliDocument43 pagesAmt Deduction Debjani AnjaliMintuNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- Week 9, CT Losses, 2022-23 - TutorDocument32 pagesWeek 9, CT Losses, 2022-23 - Tutorarpita aroraNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- (Section 70) - Set Off of Loss Under (Intra-Head AdDocument2 pages(Section 70) - Set Off of Loss Under (Intra-Head Adsukantabera215No ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Add: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaDocument15 pagesAdd: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaShubham KumarNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet