Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsUnknown 20230116

Unknown 20230116

Uploaded by

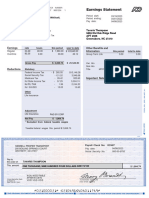

KeliThis employee payslip summarizes payroll information for an employee paid bi-weekly at an hourly rate of $23.50. It includes federal and state tax withholding details for the employee classified as single with no dependents. Gross pay of $2,749.50 was earned from 87 regular hours at straight time and 20 hours at time and a half. Total deductions of $1,021.45 were withheld including taxes, Social Security, Medicare, California state taxes, and state disability insurance, leaving a take home pay of $1,728.05.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Paystub 01.06.2023Document1 pagePaystub 01.06.2023Crystal SimonNo ratings yet

- Employee Information Pay Stub InformationDocument1 pageEmployee Information Pay Stub Informationrenato pimentelNo ratings yet

- Military Pay Stub TemplateDocument1 pageMilitary Pay Stub TemplateCasper HemingwayNo ratings yet

- CVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneDocument2 pagesCVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneJeremy WhiteNo ratings yet

- 4:30:21 PaystubDocument1 page4:30:21 PaystubRhoderlande JosephNo ratings yet

- Pay StubsDocument2 pagesPay StubsmatthewmerricksNo ratings yet

- w2 Form 2022-PdffillerDocument11 pagesw2 Form 2022-PdffillerKeliNo ratings yet

- Payroll-Calculator FDocument22 pagesPayroll-Calculator FRavi Kumar ManraNo ratings yet

- Pay Stub - 1 PDFDocument1 pagePay Stub - 1 PDFPankaj DesaiNo ratings yet

- Document 1Document1 pageDocument 1fehijan689No ratings yet

- Soones12 31 23Document1 pageSoones12 31 23Arianna GarciaNo ratings yet

- California State Controller'S Office Paycheck Calculator - 2021 Tax RatesDocument1 pageCalifornia State Controller'S Office Paycheck Calculator - 2021 Tax RatesSamantha JahansouzshahiNo ratings yet

- Paystub 2024Document1 pagePaystub 2024Shaggy ShagNo ratings yet

- In This File Are The May 2022 August 2022 June 2020 March 2021 August 2021Document41 pagesIn This File Are The May 2022 August 2022 June 2020 March 2021 August 2021Candy ValentineNo ratings yet

- Full Payroll Summary: Net PayDocument2 pagesFull Payroll Summary: Net PayJuan Ignacio Ramirez JaramilloNo ratings yet

- 161.5 Nov 2022 Feb 2020 Feb 2021 CompletedDocument4 pages161.5 Nov 2022 Feb 2020 Feb 2021 CompletedCandy ValentineNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- Pay SlipDocument1 pagePay SlipAbulkalam PashaNo ratings yet

- Income StatementDocument3 pagesIncome Statementmichelle.marsh82No ratings yet

- Paystub Moss 3Document1 pagePaystub Moss 3raheemtimo1No ratings yet

- Paystub For 07-14-2023Document1 pagePaystub For 07-14-2023luisra15No ratings yet

- Pay Stub - 2 - 28 - 2020Document1 pagePay Stub - 2 - 28 - 2020mtjoya09No ratings yet

- Statement of EarningsDocument2 pagesStatement of EarningsMeejoy PaglinawanNo ratings yet

- 178.5 x7 March 2022 January 2020 August 2020 June 2021 July 2021 September 2021 December 2021Document8 pages178.5 x7 March 2022 January 2020 August 2020 June 2021 July 2021 September 2021 December 2021Candy ValentineNo ratings yet

- Amcs 04 26Document1 pageAmcs 04 26amatobertrumNo ratings yet

- Coward Stub 2Document1 pageCoward Stub 2raheemtimo1No ratings yet

- Paystub For 03-01-2024Document1 pagePaystub For 03-01-2024Lisandro HernándezNo ratings yet

- Statement of EarningsDocument2 pagesStatement of EarningsMeejoy PaglinawanNo ratings yet

- Composition of Projected FY 2010 Federal Government Revenues and OutlaysDocument21 pagesComposition of Projected FY 2010 Federal Government Revenues and Outlaysstop2011No ratings yet

- Understanding A PaycheckDocument10 pagesUnderstanding A PaycheckAshfak Hossain Khan MimNo ratings yet

- 170 X 7 Feb 2022 June 2022 Sept 2022 Nov 2020 May 2021 Oct 2021 Nov 2021 CompletedDocument8 pages170 X 7 Feb 2022 June 2022 Sept 2022 Nov 2020 May 2021 Oct 2021 Nov 2021 CompletedCandy ValentineNo ratings yet

- Tax-Estimate 2022Document1 pageTax-Estimate 2022mdeecash042No ratings yet

- Houshang StubDocument1 pageHoushang StubCandy CookiesNo ratings yet

- See Wong June 23 StubDocument1 pageSee Wong June 23 Stubjohn yorkNo ratings yet

- Earnings Register: User Id: Lessonuser1Document1 pageEarnings Register: User Id: Lessonuser1Diana JuanNo ratings yet

- Pay SlipDocument1 pagePay Sliprossiboss71No ratings yet

- Budget 2002Document11 pagesBudget 2002api-3703821No ratings yet

- Claim Summary Page - 1Document1 pageClaim Summary Page - 1Holly StarksNo ratings yet

- ALBA PP 14 Paystub July 7 2017 PDFDocument1 pageALBA PP 14 Paystub July 7 2017 PDFayoubarade1No ratings yet

- Earnings StatementDocument1 pageEarnings Statementtavoludo1035No ratings yet

- Paystub Original 101111Document1 pagePaystub Original 101111SafeBit ProsNo ratings yet

- Family Dollar Paystub 24-04-2020 PDFDocument1 pageFamily Dollar Paystub 24-04-2020 PDFLuis MartinezNo ratings yet

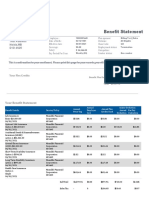

- Benefit Statement: Test Retro 62 Test Address Noida, MB D1D 4S25Document3 pagesBenefit Statement: Test Retro 62 Test Address Noida, MB D1D 4S25007shivangNo ratings yet

- Screenshot 2021-09-16 at 11.56.11 AMDocument1 pageScreenshot 2021-09-16 at 11.56.11 AMMartinez BryanNo ratings yet

- Earnings Statement: Labor Solutions - Staff Right, LLCDocument1 pageEarnings Statement: Labor Solutions - Staff Right, LLCCoro'naado LinNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- Paystub 2Document2 pagesPaystub 2heaven.edwards2No ratings yet

- Kines 2Document1 pageKines 2raheemtimo1No ratings yet

- Paystatement 3Document1 pagePaystatement 3gamaliel.lomeNo ratings yet

- UKG ProDocument1 pageUKG Prohugginsdemetrius44No ratings yet

- Paystub KDocument1 pagePaystub KMorris RuzNo ratings yet

- Paystub 404769Document4 pagesPaystub 404769foreveralonemovementNo ratings yet

- Xenya Guzmán Verón Tarea6Document4 pagesXenya Guzmán Verón Tarea6xenya guzman VeronNo ratings yet

- Paycheck 12.21 PDFDocument1 pagePaycheck 12.21 PDFJared RoseNo ratings yet

- Payroll Calculator With Pay Stubs1Document3 pagesPayroll Calculator With Pay Stubs1Bassam MokhtarNo ratings yet

- Reyna or Feb StubDocument1 pageReyna or Feb Stubjohn yorkNo ratings yet

- Income and Asset Statement (Financial Planner) - J310981511 2Document2 pagesIncome and Asset Statement (Financial Planner) - J310981511 2meychea83No ratings yet

- PDF 1Document1 pagePDF 11lilmister1No ratings yet

- Tina Stub 2Document1 pageTina Stub 2john yorkNo ratings yet

- Food RecoveryDocument2 pagesFood RecoveryKeliNo ratings yet

- Brownie Cookies - Sugar and SoulDocument2 pagesBrownie Cookies - Sugar and SoulKeliNo ratings yet

- Invoice: Shannon Stockton 421 Montalvo Drive Bakersfield, CA 93309 USADocument2 pagesInvoice: Shannon Stockton 421 Montalvo Drive Bakersfield, CA 93309 USAKeliNo ratings yet

- Point Combining RequestForm enDocument1 pagePoint Combining RequestForm enKeliNo ratings yet

- Statement of Facts: A Public Service AgencyDocument2 pagesStatement of Facts: A Public Service AgencyJerry BeckNo ratings yet

- Self-Attestation: 1. IncomeDocument6 pagesSelf-Attestation: 1. IncomeKeliNo ratings yet

Unknown 20230116

Unknown 20230116

Uploaded by

Keli0 ratings0% found this document useful (0 votes)

8 views1 pageThis employee payslip summarizes payroll information for an employee paid bi-weekly at an hourly rate of $23.50. It includes federal and state tax withholding details for the employee classified as single with no dependents. Gross pay of $2,749.50 was earned from 87 regular hours at straight time and 20 hours at time and a half. Total deductions of $1,021.45 were withheld including taxes, Social Security, Medicare, California state taxes, and state disability insurance, leaving a take home pay of $1,728.05.

Original Description:

W-2 1099 template

Original Title

Unknown_20230116 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis employee payslip summarizes payroll information for an employee paid bi-weekly at an hourly rate of $23.50. It includes federal and state tax withholding details for the employee classified as single with no dependents. Gross pay of $2,749.50 was earned from 87 regular hours at straight time and 20 hours at time and a half. Total deductions of $1,021.45 were withheld including taxes, Social Security, Medicare, California state taxes, and state disability insurance, leaving a take home pay of $1,728.05.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views1 pageUnknown 20230116

Unknown 20230116

Uploaded by

KeliThis employee payslip summarizes payroll information for an employee paid bi-weekly at an hourly rate of $23.50. It includes federal and state tax withholding details for the employee classified as single with no dependents. Gross pay of $2,749.50 was earned from 87 regular hours at straight time and 20 hours at time and a half. Total deductions of $1,021.45 were withheld including taxes, Social Security, Medicare, California state taxes, and state disability insurance, leaving a take home pay of $1,728.05.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Employee Information

Check Date January 16, 2023

Pay Frequency Bi-Weekly (26 Times per Year)

Hourly Rate $23.5000

Federal Withholding

Effective: January 1, 2023

W4 2020 or later (Box 2c checked)

Withholding Type Supplemental

Marital Status Single

3. Claim dependents $0.00

State Withholding

Effective: January 1, 2023

State California

Withholding Type Supplemental

Marital Status Single

Allowances 0

Additional allowances 0

State Disability Insurance (SDI)

Withhold? Yes

Pay Type Hours Amount

Straight Time 87.0000 $2,044.50

Time & 1/2 20.0000 $705.00

Gross Pay $2,749.50

Deduction Type Amount

Federal Income Tax $604.89

Social Security $170.47

Medicare $39.87

California $181.47

State Disability Insurance (SDI) $24.75

Total Deductions $1,021.45

This Check (Take Home) $1,728.05

You might also like

- Paystub 01.06.2023Document1 pagePaystub 01.06.2023Crystal SimonNo ratings yet

- Employee Information Pay Stub InformationDocument1 pageEmployee Information Pay Stub Informationrenato pimentelNo ratings yet

- Military Pay Stub TemplateDocument1 pageMilitary Pay Stub TemplateCasper HemingwayNo ratings yet

- CVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneDocument2 pagesCVS Health Earnings Statement: SSN: Taxable Marital Status: Exemptions/Allowances: Yasmine Bastien 12818 Early Run LaneJeremy WhiteNo ratings yet

- 4:30:21 PaystubDocument1 page4:30:21 PaystubRhoderlande JosephNo ratings yet

- Pay StubsDocument2 pagesPay StubsmatthewmerricksNo ratings yet

- w2 Form 2022-PdffillerDocument11 pagesw2 Form 2022-PdffillerKeliNo ratings yet

- Payroll-Calculator FDocument22 pagesPayroll-Calculator FRavi Kumar ManraNo ratings yet

- Pay Stub - 1 PDFDocument1 pagePay Stub - 1 PDFPankaj DesaiNo ratings yet

- Document 1Document1 pageDocument 1fehijan689No ratings yet

- Soones12 31 23Document1 pageSoones12 31 23Arianna GarciaNo ratings yet

- California State Controller'S Office Paycheck Calculator - 2021 Tax RatesDocument1 pageCalifornia State Controller'S Office Paycheck Calculator - 2021 Tax RatesSamantha JahansouzshahiNo ratings yet

- Paystub 2024Document1 pagePaystub 2024Shaggy ShagNo ratings yet

- In This File Are The May 2022 August 2022 June 2020 March 2021 August 2021Document41 pagesIn This File Are The May 2022 August 2022 June 2020 March 2021 August 2021Candy ValentineNo ratings yet

- Full Payroll Summary: Net PayDocument2 pagesFull Payroll Summary: Net PayJuan Ignacio Ramirez JaramilloNo ratings yet

- 161.5 Nov 2022 Feb 2020 Feb 2021 CompletedDocument4 pages161.5 Nov 2022 Feb 2020 Feb 2021 CompletedCandy ValentineNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- Pay SlipDocument1 pagePay SlipAbulkalam PashaNo ratings yet

- Income StatementDocument3 pagesIncome Statementmichelle.marsh82No ratings yet

- Paystub Moss 3Document1 pagePaystub Moss 3raheemtimo1No ratings yet

- Paystub For 07-14-2023Document1 pagePaystub For 07-14-2023luisra15No ratings yet

- Pay Stub - 2 - 28 - 2020Document1 pagePay Stub - 2 - 28 - 2020mtjoya09No ratings yet

- Statement of EarningsDocument2 pagesStatement of EarningsMeejoy PaglinawanNo ratings yet

- 178.5 x7 March 2022 January 2020 August 2020 June 2021 July 2021 September 2021 December 2021Document8 pages178.5 x7 March 2022 January 2020 August 2020 June 2021 July 2021 September 2021 December 2021Candy ValentineNo ratings yet

- Amcs 04 26Document1 pageAmcs 04 26amatobertrumNo ratings yet

- Coward Stub 2Document1 pageCoward Stub 2raheemtimo1No ratings yet

- Paystub For 03-01-2024Document1 pagePaystub For 03-01-2024Lisandro HernándezNo ratings yet

- Statement of EarningsDocument2 pagesStatement of EarningsMeejoy PaglinawanNo ratings yet

- Composition of Projected FY 2010 Federal Government Revenues and OutlaysDocument21 pagesComposition of Projected FY 2010 Federal Government Revenues and Outlaysstop2011No ratings yet

- Understanding A PaycheckDocument10 pagesUnderstanding A PaycheckAshfak Hossain Khan MimNo ratings yet

- 170 X 7 Feb 2022 June 2022 Sept 2022 Nov 2020 May 2021 Oct 2021 Nov 2021 CompletedDocument8 pages170 X 7 Feb 2022 June 2022 Sept 2022 Nov 2020 May 2021 Oct 2021 Nov 2021 CompletedCandy ValentineNo ratings yet

- Tax-Estimate 2022Document1 pageTax-Estimate 2022mdeecash042No ratings yet

- Houshang StubDocument1 pageHoushang StubCandy CookiesNo ratings yet

- See Wong June 23 StubDocument1 pageSee Wong June 23 Stubjohn yorkNo ratings yet

- Earnings Register: User Id: Lessonuser1Document1 pageEarnings Register: User Id: Lessonuser1Diana JuanNo ratings yet

- Pay SlipDocument1 pagePay Sliprossiboss71No ratings yet

- Budget 2002Document11 pagesBudget 2002api-3703821No ratings yet

- Claim Summary Page - 1Document1 pageClaim Summary Page - 1Holly StarksNo ratings yet

- ALBA PP 14 Paystub July 7 2017 PDFDocument1 pageALBA PP 14 Paystub July 7 2017 PDFayoubarade1No ratings yet

- Earnings StatementDocument1 pageEarnings Statementtavoludo1035No ratings yet

- Paystub Original 101111Document1 pagePaystub Original 101111SafeBit ProsNo ratings yet

- Family Dollar Paystub 24-04-2020 PDFDocument1 pageFamily Dollar Paystub 24-04-2020 PDFLuis MartinezNo ratings yet

- Benefit Statement: Test Retro 62 Test Address Noida, MB D1D 4S25Document3 pagesBenefit Statement: Test Retro 62 Test Address Noida, MB D1D 4S25007shivangNo ratings yet

- Screenshot 2021-09-16 at 11.56.11 AMDocument1 pageScreenshot 2021-09-16 at 11.56.11 AMMartinez BryanNo ratings yet

- Earnings Statement: Labor Solutions - Staff Right, LLCDocument1 pageEarnings Statement: Labor Solutions - Staff Right, LLCCoro'naado LinNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- Paystub 2Document2 pagesPaystub 2heaven.edwards2No ratings yet

- Kines 2Document1 pageKines 2raheemtimo1No ratings yet

- Paystatement 3Document1 pagePaystatement 3gamaliel.lomeNo ratings yet

- UKG ProDocument1 pageUKG Prohugginsdemetrius44No ratings yet

- Paystub KDocument1 pagePaystub KMorris RuzNo ratings yet

- Paystub 404769Document4 pagesPaystub 404769foreveralonemovementNo ratings yet

- Xenya Guzmán Verón Tarea6Document4 pagesXenya Guzmán Verón Tarea6xenya guzman VeronNo ratings yet

- Paycheck 12.21 PDFDocument1 pagePaycheck 12.21 PDFJared RoseNo ratings yet

- Payroll Calculator With Pay Stubs1Document3 pagesPayroll Calculator With Pay Stubs1Bassam MokhtarNo ratings yet

- Reyna or Feb StubDocument1 pageReyna or Feb Stubjohn yorkNo ratings yet

- Income and Asset Statement (Financial Planner) - J310981511 2Document2 pagesIncome and Asset Statement (Financial Planner) - J310981511 2meychea83No ratings yet

- PDF 1Document1 pagePDF 11lilmister1No ratings yet

- Tina Stub 2Document1 pageTina Stub 2john yorkNo ratings yet

- Food RecoveryDocument2 pagesFood RecoveryKeliNo ratings yet

- Brownie Cookies - Sugar and SoulDocument2 pagesBrownie Cookies - Sugar and SoulKeliNo ratings yet

- Invoice: Shannon Stockton 421 Montalvo Drive Bakersfield, CA 93309 USADocument2 pagesInvoice: Shannon Stockton 421 Montalvo Drive Bakersfield, CA 93309 USAKeliNo ratings yet

- Point Combining RequestForm enDocument1 pagePoint Combining RequestForm enKeliNo ratings yet

- Statement of Facts: A Public Service AgencyDocument2 pagesStatement of Facts: A Public Service AgencyJerry BeckNo ratings yet

- Self-Attestation: 1. IncomeDocument6 pagesSelf-Attestation: 1. IncomeKeliNo ratings yet