Professional Documents

Culture Documents

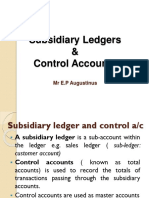

Topic 1 - Control Accounts

Topic 1 - Control Accounts

Uploaded by

Varsha Ghanash0 ratings0% found this document useful (0 votes)

18 views17 pagesThe document discusses control accounts for debtors (accounts receivable) and creditors (accounts payable). It provides:

1) Control accounts act as a trial balance for amounts owed by debtors and owed to creditors.

2) Examples of sales ledger and purchases ledger control accounts, including transaction formats and example entries.

3) Practice questions involving preparing control account entries based on provided transactions.

Original Description:

Helpful notes on Control Accounts for CSEC

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses control accounts for debtors (accounts receivable) and creditors (accounts payable). It provides:

1) Control accounts act as a trial balance for amounts owed by debtors and owed to creditors.

2) Examples of sales ledger and purchases ledger control accounts, including transaction formats and example entries.

3) Practice questions involving preparing control account entries based on provided transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views17 pagesTopic 1 - Control Accounts

Topic 1 - Control Accounts

Uploaded by

Varsha GhanashThe document discusses control accounts for debtors (accounts receivable) and creditors (accounts payable). It provides:

1) Control accounts act as a trial balance for amounts owed by debtors and owed to creditors.

2) Examples of sales ledger and purchases ledger control accounts, including transaction formats and example entries.

3) Practice questions involving preparing control account entries based on provided transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 17

Control Accounts

Creditors & Debtors Control Accounts

The purpose

The control accounts act as a trial balance for

your debtor’s (accounts receivable) and

creditor’s (accounts payable) accounts.

Types of control accounts

a.) Sales Debtors (Account Receivable) Control

Account

b.) Purchases Creditors (Accounts Payable)

Control Account

Sales Ledger (Debtors or accounts Receivable)

Control Account

The sales ledger records the information relating to ALL

debtors or account receivables into ONE SINGLE ACCOUNT.

Since the debtor is located on the debit side, anything

that will increase the amount owed by them WILL BE

RECORDED ON THE DEBIT SIDE and anything that will

decrease the amount owed by them WILL BE

RECORDED ON THE CREDIT SIDE.

It is one method of internal control used by a business.

Example 1

Sales Ledger (Debtors)

Date Particular (+) Amount Date Particular (-) Amount

Peter Lake a/c

July 1 Balance b/d 600 July 3 Return-in 50

July 5 Sales 400 July 15 Cash 125

July 31 Balance c/d 825

1000 1000

Also:

Date Particular Amount Date Particular Amount

Diana Sims a/c

July 1 Balance b/d 415 July 1 Balance b/d* 20

July 10 Sales 300 July 8 Cash 200

July 8 Discount allowed 40

July 20 Bank 100

July 31 Balance c/d 355

715 715

*Can be owed by the business to the debtor for an overpayment.

Sales Ledger (Debtors) Control A/c

Date Particular Amount Date Particular Amount

July 1 Balance b/d 1015 July 1 Balance b/d* 20

Sales 700 Return-inwards 50

Cash 325

Discount allowed 40

Bank 100

July 31 Balance c/d 1180

(debit balance)

1715 1715

August 1 Balance b/d 1180

*Can be owed by the business to the debtor for an overpayment.

Sales Ledger (Debtors) Control A/c

(FORMAT)

Date Particular (+) Amount Date Particular (-) Amount

Balance b/d xx Balance b/d* xx

(Debit balance) (Credit balance)

Sales xx Return-inwards xx

Late fees xx Cash xx

Dishonoured xx Discount allowed xx

cheques

Bank xx

Set off to purchases xx

ledger (Cancel debt)

Balance c/d xx Balance c/d xx

(Credit balance) (debit balance)

XX XX

Balance b/d

*Can be owed by the business to the debtor for an overpayment.

Practice question

1. S. Melon maintains a self-balancing ledger system. From the

following information, prepare the sales ledger control account

for the month of January 2018:

Debit balance on January 1 $33, 490

Credit balance on January 1 155

Sales during the month 65,884

Cash received from customers 53,861

Discount allowed 4,580

Returns from customers 2,314

Bad debts 890

Credit balance on January 31 63

Purchases (Creditors or accounts payable)

Control Account

The purchases ledger records the information relating to

ALL creditors or account payables into ONE SINGLE

ACCOUNT.

Since the creditor is located on the credit side, anything

that will increase the amount owed by them WILL BE

RECORDED ON THE CREDIT SIDE and anything that will

decrease the amount owed by them WILL BE

RECORDED ON THE DEBIT SIDE.

It is one method of internal control used by a business.

Example 2

Purchases Ledger (Creditors)

Date Particular (-) Amount Date Particular (+) Amount

Josh May a/c

May 15 Bank 1300 May 1 Balance b/d 2,100

(Credit balance)

May 15 Discount allowed 75 May 5 Purchases 825

May 31 Balance c/d 1,550

(Credit balance)

2,925 2,925

June 1 Balance b/d 1,550

Also:

Date Particular Amount Date Particular Amount

Jazz Lion a/c

May 1 Balance b/d* 60 May 1 Balance b/d 1,620

(Debit balance) (Credit balance)

May 6 Return-out 45 May 4 Purchases 1,100

May 12 Cash 390

May 24 Set off against 105

sales ledger

(Cancel debt)

May 31 Balance c/d 2,120

(Credit balance)

2,720 2,720

June 1 Balance b/d 2,120

*Can be owed by the business to the debtor for an overpayment.

Purchases Ledger (Creditors) Control A/c

Date Particular Amount Date Particular Amount

May 1 Balance b/d* 60 May 1 Balance b/d 3,720

(Debit balance) (Credit balance)

Bank 1,300 Purchases 1,925

Discount received 75

Return-out 45

Cash 390

Set off 105

May 31 Balance c/d 3,670

(Credit balance)

1715 5,645

June 1 Balance b/d 3,670

*Can be owed by the business to the debtor for an overpayment.

Purchases Ledger (Creditors) Control A/c

(FORMAT)

Date Particular (-) Amount Date Particular (+) Amount

Balance b/d* xx Balance b/d xx

(Debit balance) (Credit balance)

Bank xx Purchases xx

Discount received xx

Return-out xx

Cash xx

Set off xx

Balance c/d

(Credit balance)

xx xx

*Can be owed by the business to the debtor for an overpayment.

Practice question

2. From the following information, prepare the purchases

control ledger control of Marcy Melfried for the month of

July 2017:

Credit balance on July 1 $84,902

Purchases for the month 72,466

Return-out 6,339

Cheques paid to creditors 78,885

Discount received 7,539

Sales ledger transferred to purchases

Ledger 322

Practice question

3. Using the following provided below, prepare the:

a. Sales ledger control account

b. Purchases ledger control account

April 1 Credit balance in purchases ledger $7,868

Debit balance in purchases ledger 48

Debit balance in sales ledger 6,742

Credit balance in sales ledger 67

Purchases for the month 44,394

Sales for the month 50,048

Sales returns 3,284

Purchases returns 2,166

Receipts from debtors 49,668

Payments to creditors 45,612

Bad debts written off 846

Interest charged on late debtors 914

April 30 Sales ledger debits transferred to

purchases ledger $105

Credit balance in sales ledger $79

Debit balance in purchases ledger $104

You might also like

- Coursebook Answers: Answers To Test Yourself QuestionsDocument5 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument6 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii73% (11)

- Coursebook Section 3 Practice Question AnswersDocument9 pagesCoursebook Section 3 Practice Question AnswersAhmed Zeeshan92% (12)

- Accounting Workbook Section 1 AnswersDocument24 pagesAccounting Workbook Section 1 AnswersAhmed Zeeshan94% (35)

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 AnswersAhmed Zeeshan100% (25)

- The Signs Were There: The clues for investors that a company is heading for a fallFrom EverandThe Signs Were There: The clues for investors that a company is heading for a fallRating: 4.5 out of 5 stars4.5/5 (2)

- Asme A112.18.6-2003Document16 pagesAsme A112.18.6-2003Said HappyyNo ratings yet

- May 2018 and 2017 SolutionsDocument43 pagesMay 2018 and 2017 SolutionsgNo ratings yet

- Chap 11Document2 pagesChap 11Luqman KMNo ratings yet

- Control AccountsDocument8 pagesControl AccountsMohamed WishahNo ratings yet

- Control AccountsDocument17 pagesControl AccountsSteven RaintungNo ratings yet

- Double Entry SystemDocument8 pagesDouble Entry SystemTayyaba TariqNo ratings yet

- Control AccountsDocument8 pagesControl Accountsdayna davisNo ratings yet

- Assignment 1 Principles of AccountingDocument13 pagesAssignment 1 Principles of AccountingMmonie MotseleNo ratings yet

- Control AccountsDocument19 pagesControl AccountsRavindran MenonNo ratings yet

- Cash Book - AnswersDocument6 pagesCash Book - AnswersJoshNo ratings yet

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 Answersalya mahaputriNo ratings yet

- Sudsidiary Ledger and Control AccountsDocument20 pagesSudsidiary Ledger and Control AccountsPetrinaNo ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- Acc136 Module GuideDocument36 pagesAcc136 Module Guidemcskelta8No ratings yet

- Answers-Accounting CB 2nd Ed CambridgeDocument119 pagesAnswers-Accounting CB 2nd Ed Cambridgebk4t7j8g92No ratings yet

- Accounts Textbook AnswersDocument84 pagesAccounts Textbook AnswersVidhi Patel100% (4)

- Chapter 23 AnswersDocument9 pagesChapter 23 AnswersAnusree SivasamyNo ratings yet

- Week - 10 Workbook - SolutionsDocument5 pagesWeek - 10 Workbook - SolutionsThi Van Anh VUNo ratings yet

- Cambridge IGCSE and O Level Accouting Workbook AnswersDocument107 pagesCambridge IGCSE and O Level Accouting Workbook Answersღ꧁Lizzy X Roxiie꧂ღ100% (4)

- 16 Control Accounts NewDocument8 pages16 Control Accounts NewFrieda Twamonomuntu TaapopiNo ratings yet

- Unit 2: Ledgers: Learning OutcomesDocument12 pagesUnit 2: Ledgers: Learning OutcomesTanya100% (1)

- Chapter 2 - Control AccountsDocument9 pagesChapter 2 - Control Accountsmelody shayanwakoNo ratings yet

- Activity #5Document72 pagesActivity #5JEWELL ANN PENARANDA0% (1)

- Double Entry Book-Keeping Part IDocument7 pagesDouble Entry Book-Keeping Part IHsu Lae NandarNo ratings yet

- Special Accounting JournalsDocument7 pagesSpecial Accounting JournalsHo Ming LamNo ratings yet

- The Four Types of Special JournalsDocument18 pagesThe Four Types of Special JournalsJob Castones100% (1)

- Special Journals Accounting)Document15 pagesSpecial Journals Accounting)Ardialyn100% (3)

- Accrual and ProvisionDocument66 pagesAccrual and ProvisionVeronica Bailey100% (1)

- KC Toyland WorksheetDocument13 pagesKC Toyland WorksheettakycabrejasNo ratings yet

- 2250 Chapter 14Document3 pages2250 Chapter 14fp4jcjnsr4No ratings yet

- 74607bos60479 FND cp2 U2Document111 pages74607bos60479 FND cp2 U2adityatiwari122006No ratings yet

- Interm - Financ.acc-Acc1232 - Updated On 27may 2019Document214 pagesInterm - Financ.acc-Acc1232 - Updated On 27may 2019Théotime HabinezaNo ratings yet

- Topic 3 - Recording Transactions (STU)Document80 pagesTopic 3 - Recording Transactions (STU)Kim ChiNo ratings yet

- Coursebook Chapter 11 AnswersDocument4 pagesCoursebook Chapter 11 AnswersAhmed Zeeshan100% (9)

- Control Account NotesDocument2 pagesControl Account NotesNipuni PereraNo ratings yet

- Sample Worksheet K204050266 P3.5Document16 pagesSample Worksheet K204050266 P3.5Trâm Mai Thị ThùyNo ratings yet

- IrrecoverablwDocument11 pagesIrrecoverablwgunasekarasugeethaNo ratings yet

- Book Keeping ProcessDocument8 pagesBook Keeping ProcessNagarathna KulkarniNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- Final Act110Document169 pagesFinal Act110JJ XX100% (4)

- Control Accounts NotesDocument7 pagesControl Accounts NotesRithvik SangilirajNo ratings yet

- MIT2 96F12 Lec05Document43 pagesMIT2 96F12 Lec05BishwoNo ratings yet

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- S3 MYE QP 2019-20 (Final)Document13 pagesS3 MYE QP 2019-20 (Final)XinYi ChenNo ratings yet

- Coursebook Chapter 16 AnswersDocument3 pagesCoursebook Chapter 16 AnswersAhmed Zeeshan83% (6)

- 6 The Trial BalanceDocument4 pages6 The Trial Balanceayshaneasrin08No ratings yet

- Ch07 Cash and Receivables HexanaDocument178 pagesCh07 Cash and Receivables HexanapinantiNo ratings yet

- Three Column Cash Book NotesDocument7 pagesThree Column Cash Book NotesTrishana GreenNo ratings yet

- Accounting AssignmentDocument11 pagesAccounting Assignmentsnehabawa810No ratings yet

- Subsidiary Ledgers and Special JournalsDocument11 pagesSubsidiary Ledgers and Special JournalsMohamed ZakyNo ratings yet

- Fun EMS Grade 9 SampleDocument32 pagesFun EMS Grade 9 SampleLuyandaNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Margin Trading from A to Z: A Complete Guide to Borrowing, Investing and RegulationFrom EverandMargin Trading from A to Z: A Complete Guide to Borrowing, Investing and RegulationNo ratings yet

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinFrom EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinNo ratings yet

- Data Integrity and SecurityDocument4 pagesData Integrity and SecurityVarsha GhanashNo ratings yet

- Data Communication, Networks and The InternetDocument45 pagesData Communication, Networks and The InternetVarsha GhanashNo ratings yet

- Form 4 Study Guide-2021-2022Document65 pagesForm 4 Study Guide-2021-2022Varsha GhanashNo ratings yet

- INTRODUCTION TO ACCOUNTING Lesson 1Document11 pagesINTRODUCTION TO ACCOUNTING Lesson 1Varsha GhanashNo ratings yet

- Topic 2C - Part 2 - Provision For Depreciation Account - Disposal AccountDocument23 pagesTopic 2C - Part 2 - Provision For Depreciation Account - Disposal AccountVarsha GhanashNo ratings yet

- Source Documents AccountsDocument4 pagesSource Documents AccountsVarsha GhanashNo ratings yet

- Topic 2C - Provision For Depreciation AccountDocument22 pagesTopic 2C - Provision For Depreciation AccountVarsha GhanashNo ratings yet

- POA 2023-CSEC ReviewDocument105 pagesPOA 2023-CSEC ReviewVarsha Ghanash100% (3)

- Topic 2A & B - Adjustments - Prepaid and Accrued Expenses & IncomeDocument15 pagesTopic 2A & B - Adjustments - Prepaid and Accrued Expenses & IncomeVarsha GhanashNo ratings yet

- Family Law - I - LLB - Notes PDFDocument42 pagesFamily Law - I - LLB - Notes PDFAbhishek KommeNo ratings yet

- IPRO Mock Exam - 2021 - QDocument21 pagesIPRO Mock Exam - 2021 - QKevin Ch Li100% (1)

- General Ledger ORACLEDocument5 pagesGeneral Ledger ORACLEBala RanganathNo ratings yet

- CH 3 Diokno On TrialDocument12 pagesCH 3 Diokno On TrialRAFAEL FRANCESCO SAAR GONZALESNo ratings yet

- Case Study PPDocument18 pagesCase Study PPNabila IbrahimNo ratings yet

- BMC Act 1888Document346 pagesBMC Act 1888Akshay Ramade100% (1)

- New Rationalization GO - 2011Document7 pagesNew Rationalization GO - 2011Ramachandra RaoNo ratings yet

- 914010001051417 (3)Document3 pages914010001051417 (3)ShawnDhineshNo ratings yet

- Jimenez v. Canizares, G.R. No. L-12790, Aug. 31, 1960Document2 pagesJimenez v. Canizares, G.R. No. L-12790, Aug. 31, 1960Martin SNo ratings yet

- Thesis Abstract 1. TitleDocument50 pagesThesis Abstract 1. TitleHuay ZiNo ratings yet

- Accounting GuessDocument5 pagesAccounting GuessjhouvanNo ratings yet

- Bangladesh Building Systems LTDocument24 pagesBangladesh Building Systems LTLouay Ali HasanNo ratings yet

- Durga Prasad V/s BaldeoDocument4 pagesDurga Prasad V/s Baldeofarheen_memon5No ratings yet

- American Media Bias FinalDocument8 pagesAmerican Media Bias Finalapi-286287370No ratings yet

- Banai Adam TenDocument19 pagesBanai Adam TenMohsin MalkiNo ratings yet

- Basic CaseletsDocument3 pagesBasic CaseletsErika delos Santos0% (1)

- L&GDocument122 pagesL&Gtycoonshan24No ratings yet

- ABORTIONDocument4 pagesABORTIONInah EndiapeNo ratings yet

- Business Ethics (Group Assignment)Document14 pagesBusiness Ethics (Group Assignment)NaSz Yue-IoNo ratings yet

- Richard Kivert (1958)Document1 pageRichard Kivert (1958)punktlichNo ratings yet

- Nemo Outdoor 8.40 User Guide PDFDocument392 pagesNemo Outdoor 8.40 User Guide PDFXxbugmenotxXNo ratings yet

- Province of Camarines Sur v. CADocument3 pagesProvince of Camarines Sur v. CAAira Marie M. AndalNo ratings yet

- Cs-Osman-Elnor GregorioDocument2 pagesCs-Osman-Elnor GregoriomizpahNo ratings yet

- Critical Success Factors For Effective Monitoring of Child Rights in UgandaDocument55 pagesCritical Success Factors For Effective Monitoring of Child Rights in Ugandakeisha babyNo ratings yet

- Inventories ReviewDocument33 pagesInventories ReviewReginald ValenciaNo ratings yet

- US Vs Ah Chong DigestDocument3 pagesUS Vs Ah Chong DigestelCrisNo ratings yet

- Note For Approval FormatDocument1 pageNote For Approval FormatGiridhar Kumar NanduriNo ratings yet

- Lawsuit Against Lakewood Yeshiva Rabbi Joel FalkDocument10 pagesLawsuit Against Lakewood Yeshiva Rabbi Joel FalkAsbury Park PressNo ratings yet