Professional Documents

Culture Documents

TermsKFS 8977767811

TermsKFS 8977767811

Uploaded by

Anime SensaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TermsKFS 8977767811

TermsKFS 8977767811

Uploaded by

Anime SensaiCopyright:

Available Formats

Personal Loan Term & Overdraft Agreement

Terms and Conditions – Personal Loan Facility

(A) The Borrower has represented to the Lender that the Borrower is in need of initial finance facility from the Lender

and requested the Lender to provide such initial finance facility. The Borrower has further requested the Lender

to provide for an additional top-up facility also.

(B) The Lender has agreed to grant the said initial finance facility for an amount specified in the Loan details section

(“Initial Facility”) on the terms and conditions contained herein and the Master Terms and Conditions registered

as Document No. 8980-2018 on November 6, 2018 with the Sub-Registrar at Mumbai City - 3 (hereinafter severally

referred to as “Master T&Cs”). Based on the request of the Borrower, the Lender has agreed, that, upon the

completion of 12 months from the date of first disbursement under the Initial Facility (“Period”) or such other

period as may be agreed, subject to the Borrower meeting the credit and other criteria of the Lender, the Borrower

shall be entitled to an additional facility not exceeding the amount as specified in the Loan details section

(“Additional Facility”), without further act or deed and the same may be disbursed to the Borrower at any time

after the said Period at the discretion of the Lender on the terms and conditions contained herein and the Master

T&Cs.

(C) The Lender shall, at its sole discretion, without assigning any reason, be entitled to cancel or reduce the Additional

Facility. The term “Facility” shall include the Initial Facility and also the Additional Facility and unless repugnant to

the context, references to the term ‘Facility’ in the Master T&Cs shall be read and construed accordingly.

(D) The Lender has agreed to extend the Facility to the Borrower, on the faith of the undertakings, representation and

warranties made by the Borrower (as more particularly stated in the Facility Documents).

1. Definitions and Interpretation:

(a) The capitalised terms wherever used in these Terms and Conditions, unless the context otherwise requires, have the

meanings ascribed to them in the Master T&Cs.

(b) The rules of interpretation as set out in the Master T&Cs shall apply mutatis mutandis to these Terms and Conditions.

2. Facility

(a) The Borrower agrees to borrow, and the Lender agrees to grant to the Borrower, the Facility, being the amount

specified in Loan details section and on such terms and conditions contained herein and in the Master T&Cs for the

Purpose as mentioned in the Facility Documents.

(b) The Borrower shall not be entitled to cancel or refuse to accept Disbursement of the Facility upon acceptance of these

Terms and Conditions except with prior written approval of the Lender and upon payment of such cancellation charges

as set out in the Loan details section. Further, such cancellation shall take effect only when the Borrower has paid to

the Lender the Outstanding in full to the Lender’s satisfaction.

(c) Borrower understands and agrees that no deferment of instalments or moratorium on account of Covid-19 as

contemplated by the COVID-19 – Regulatory Package announced by RBI or the relevant policy of Tata Capital shall be

available for this loan and borrower shall not apply for the same.

3. Repayment and Interest

(a) The Instalments and all other Outstanding from time to time with respect to the Initial Facility shall be paid / repaid

by the Borrower on or before the respective Due Dates in accordance with the Repayment Schedule as set out in the

Loan details section. The details of tenure, repayment etc. in respect of the Additional Facility shall be provided to the

Borrower at the time of availing the Additional Facility and shall be payable by the Borrower on or before their

respective Due Dates.

(b) Without prejudice to the rights of the Lender under the Facility Documents, the Interest shall be computed at a fixed

rate and shall be payable at such rate as set out in the Loan details section and the Interest shall be computed on the

actual daily outstanding principal balance of the Facility on the basis of a 360 days’ year and actual number of days

elapsed and compounded with monthly rests on the outstanding balance of the Facility at the end of every calendar

month.

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

4. Additional Interest

In case of default by the Borrower in the repayments of the Facility on the relevant Due Date or any other delay/

default/ breach committed by the Borrower, the Lender shall have a right at its option to charge Additional Interest

as set out in the Loan details section, over and above the prevailing interest rate for the period during which such

default continues.

5. Prepayment

The Borrower may be permitted to make part or full prepayment of the Outstanding on the terms and conditions

contained in the Master T&Cs and by making payment of applicable Prepayment / Foreclosure charges as set out in

the Loan details section and as may be revised by the Lender from time to time at its sole discretion.

6. Costs and Expenses

The Borrower shall be liable to pay Dishonour Charges and such other charges, costs, expenses related to and arising

out of the Facility as set out in the Loan details section. The Lender in its sole and absolute discretion reserves the

right to periodically review, revise, re-negotiate, waive any such charges or levy any new charges which shall be

updated by the Lender on its website (www.tatacapital.com) or otherwise intimated to the Borrower. The Borrower

shall be liable to pay such charges without any demur or delay and shall not be entitled to raise any objections. The

Borrower shall be liable to pay the Processing Fee set out in the Loan details section in respect of the Initial Facility as

also the Additional Facility.

7. Disclosure

The Borrower hereby agree and consent for disclosure and sharing of the information and data and for being

contacted vide various communication modes notwithstanding their names and / or numbers appearing in the Do Not

Call or Do Not Disturb registry, as per the terms and conditions contained in the Master T&Cs.

8. Lien, Set-off, Cross Default

Any default by the Obligors or by any Affiliate of the Obligors or any entity related to or connected with the Obligors

under any agreement, arrangement, guarantee, and/or under any of its/their indebtedness (whether actual or

contingent, or whether primary or collateral, or whether joint and/ or several), with the Lender or its

subsidiaries/fellow subsidiaries/Affiliates/any other entity forming part of Tata Group, shall constitute an Event of

Default under the Facility and vice-versa. The Lender, its Affiliates and entities/persons in the Tata Group shall have a

paramount lien and right of set-off on/against all other, present as well as future monies, securities, deposits of any

kind and nature, all other assets and properties belonging to the Obligors’ credit (whether held singly or jointly with

any other person), which are deposited with/under the control of the Lender its Affiliates and/or entities/persons in

the Tata Group pursuant to any contract entered/to be entered into by the Obligors in any capacity, notwithstanding

that such deposits may not be expressed in the same currency as the indebtedness. The Lender, its Affiliates and

entities/persons in the Tata Group shall be entitled and authorized to exercise such right of lien and set-off against all

such amounts/assets/properties for settlement of any amounts due or liabilities owed to them or any of them with or

without any further notice to any Obligor. In this regard, any discharge given by the Lender to its Affiliates and/or

entities/persons in the Tata Group shall be valid and binding on the Obligors. It shall be the Obligors’ sole responsibility

and liability to settle all disputes/objections with such joint account holders. If so required, the Lender, its Affiliates

and entities/persons in the Tata Group shall be well within their rights to exercise the right of set-off against the money

lying in the joint account(s) or in any deposit/bond/other assets held jointly, for settlement of any amounts due or

liabilities owed to them or any of them. Further, the Obligors hereby authorize the Lender to make payments to the

Lender’s Affiliates and/or entities/persons in the Tata Group, for any amounts owed by an Obligor to such Affiliates of

the Lender and/or entities/persons in the Tata Group, out of any excess moneys received/recovered by the Lender

from the Obligors.

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

9. Other Conditions

(a) The Borrower shall abide by all terms and conditions as specified in the Master T&Cs including without limitation

general and special covenants mentioned therein, which shall form an integral part of these Terms and Conditions

as if incorporated herein. In case of any inconsistency or repugnancy between the terms of these Terms and

Conditions and the Master T&Cs, the terms of these Terms and Conditions shall prevail. It is hereby clarified that

Clause 1.1(v) and Clause 11 as appearing in the Master T&Cs shall be deemed to be deleted from the Master T&Cs.

(b) Nothing contained herein shall limit the rights of the Lender to enforce these Terms and Conditions independently

and in exclusivity to the Facility Documents.

(c) The Borrower hereby state that the Borrower has read and understood the Master T&Cs, a copy of which is available

on the website (i.e. www.tatacapital.com), and hereby agree to be bound by the terms and conditions as contained

in the Master T&Cs read with these Terms and Conditions.

(d) The Borrower shall adhere to the timelines set out in the Loan details section.

(e) Notwithstanding anything contained in the Facility Documents, the Lender may at its sole and absolute discretion,

without assigning reasons, and without notice to the Borrower, cancel the Facility or any part thereof and/or demand

immediate repayment of all Outstanding under/in relation to the Facility. The Lender shall intimate the Borrower

regarding such cancellation.

10. Arbitration

If any dispute, difference or claim arises between any of the Borrower and the Lender in connection with the Facility or

as to the interpretation, validity, implementation or effect of the Facility Documents or as to the rights and liabilities of

the parties under the Facility Documents or alleged breach of the Facility Documents or anything done or omitted to be

done pursuant to the Facility Documents, the same shall be settled by arbitration by a sole arbitrator to be appointed

by any of the following institutions:

(a) The Council for National and International Commercial Arbitration having its office at Unit No.208, 2nd Floor,

Beta Wing, Raheja Towers, Nos.113-134, Anna Salai, Chennai – 600002

(b) Centre for Online Resolution of Disputes having its office at F-14, 3rd Cross, Manyata Residency, Manyata

Tech Park, Bengaluru – 560045

(c) The Centre for Alternative Dispute Resolution Excellence having its office at 107C, Mulberry Woods, Janatha

Colony, Carmeleram Station Road, Doddakanneli, Bengaluru -560035.

(d) ADR E-Sarvatra Private Limited having its office at 63, Palace Road, Vasanth Nagar, Bengaluru- 560052

(e) Any arbitral institution designated under the provisions of the Arbitration or Conciliation Act, 1996 (“the Act”)

or any panel of arbitrators maintained under the provisions of that Act.

Hereinafter referred to as (“Institution”) in accordance with the rules of the Institution as prevailing and as

amended from time to time.

The arbitration proceedings shall be based on documents only which shall be conducted through exchange of e-

mail and/or any other mode of electronic communication as permitted by the rules of the Institution or through

an online dispute resolution by the web portal offered by the Institution. The parties hereby agree that the arbitral

proceeding shall be conducted in electronic mode and all pleadings and documents will be exchanged

electronically. There shall be no in-person and/or oral hearings except in certain exceptional circumstances as the

sole arbitrator may deem fit upon the request of either of the parties. In such instances, the hearings shall be

conducted virtually at the sole discretion of the arbitrator. The seat of arbitration for all purposes shall be at

Chennai. The language of arbitral proceedings shall be English.

In the event the arbitrator to whom the matter is originally referred, resigns or dies or is unable to act for any

reason, the Institution shall appoint another person in his/her place to act as arbitrator who shall proceed with the

reference from the stage at which it was left by his/her predecessor.

The arbitrator so appointed shall have the power to pass an award and also to pass interim orders/directions as

may be appropriate to protect the interest of the parties pending resolution of the dispute. A certified copy of the

award passed by the arbitrator, a digitally signed copy of the same or a scan copy of the same shall be sent to the

parties through e-mail or any other electronic mode including the web portal as the Institution deems fit which

shall be considered as a signed copy.

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

All notices, processes and communications between the parties with respect to the arbitration proceedings shall

be through e-mail or any other mode of communication permitted by the Institution notwithstanding the notice

clause contained in the Agreement which shall continue to apply to all other communications between the parties.

It shall be the responsibility of the Lender and Borrower(s) to maintain sufficient space in the e-mail account and/or

in any other mode of electronic account(s) and also to have supporting applications/software in their

computer/mobile/any other electronic device to access the electronic documents sent to them. It shall also be the

responsibility of the Lender and Borrower(s) to save the emails in the address book. The delivery of emails to spam,

promotion, etc., shall also be a deemed delivery.

The courts at Chennai shall have exclusive jurisdiction in respect of matters arising under this Agreement including

any application for setting aside the award/appeal and the Lender/ Borrower(s) shall not object to such jurisdiction.

The arbitration shall be conducted under the provisions of the Arbitration and Conciliation Act, 1996 together with

its amendments, any statutory modifications or re-enactment thereof for the time being in force. The award of

the arbitrator shall be final and binding on all parties concerned. The cost of arbitration shall be borne by the

Borrower.

11. Jurisdiction

Subject to Clause 10 above, the Parties hereto agree that all disputes arising out of and/or in relation to these Terms

and Conditions, shall be subject to exclusive jurisdiction of the courts/tribunals at Chennai. The Lender may, however,

in its absolute discretion commence any legal action or proceedings arising out of these Terms and Conditions in any

other court, tribunal or other appropriate forum and the Borrower hereby consents to that jurisdiction.

12. Miscellaneous Terms

(a) This Terms and Conditions is the Specific Agreement as referred to in the Master T&Cs

(b) The Borrower hereby agree that this is a legally binding document between the Borrower and the Lender

(c) In the event any amount is not paid when due, the account will be flagged as overdue as part of day-end process

as SMA or NPA (as the case may be) in accordance with the extant RBI Circular. Examples of classification of an

account as SMA/ NPA categories are provided on our website www.tatacapital.com at POLICIES, CODES & OTHER

DOCUMENTS --- TATA Capital Financial Services limited ----- RBI Circular on Provisioning. You may also browse the

link at:

https://www.tatacapital.com/content/dam/tata-capital/pdf/tcfsl/regulatory-

policies/Examples_of_SMA_NPA_Classification_TCFSL.pdf

Examples_of_SMA_NPA_Classification_TCFSL.pdf. The Obligors confirm that they have read, understood and

accepted the same”.

Signed and delivered by the within named Lender Signed and delivered by the within named

Tata Capital Financial Services Limited BORROWER/S Mr./Ms./M/s.

by the hands of its Authorized Signatory/ Constituted CHILUKURI DEVI SIVA SAIKUMAR

Attorney Mr Deepak Aggarwal

For Tata Capital Financial Services Limited

IPAddress: 49.205.106.131:52640

Signature Not Verified

Signed by : DS TATA CAPITAL FINANCIAL SERVICES LTD 4

Reason : Loan Purpose

Location : Mumbai

Date : 2023-04-19 16:36:55 IST Date 19-04-2023 16:36:42

Authorised Signatory/ies

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

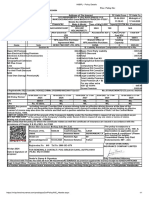

Personal Loan - Key Fact Statement & Loan Details

1) Place of Execution Vijayawada

2) Date of Execution 19/04/2023

3) Name of Regulated Tata Capital Financial Services Limited

Entity

4) Details of the a) Name: CHILUKURI DEVI SIVA SAIKUMAR

Borrower/s & Co- b) Constitution: Individual

Borrower/s c) Address 49 3 188cBUDAMERU MADYAKATTA MURALI NAGAR NEAR LALITHAPARMESWARI TEMP GUNADALA city VIJAY

a) Name NA

b) Constitution NA

c) Address NA

5) Purpose Personal Use

6) a. Amount of the Rs. _______________________

770900 /- (Rupees

Initial Facility/ ______________________________________________________________

SEVEN LAKH SEVENTY THOUSAND NINE HUNDRED only)

Loan Amount

b. Amount of Rs. _______________________ /-

Additional Facility (Rupees ______________________________________________________________only)

7) Processing Fees ________%

1.50 of the Loan Amount/ Facility amount Rs. 13644.93

8) Other Deductions a) Insurance & Third-Party Product Charges Rs. 5599

b) Stamp Duty Rs. 0.00

c) Broken Period Interest Rs. 0.0

d) Other Charges (if any) Rs. 0.00

e) Total Deductions (a + b + c + d) Rs. 5599

9) Net Disbursed

Amount (6) less (7 + 8.e) Rs. 751656.07

10) Type of Facility Term Loan Facility:

✔ or Revolving Facility: Tenure (in Months): _____________

60

opted

If Revolving Facility, then

a)

Maximum Credit Limit Rs. _________________/-

(Rupees____________________________________________________________)

b) Dropline Facility

Flexi Facility (Combination of Fixedline + Dropline) of which Fixedline tenure of

___________ months.

c) Frequency at which the Maximum Credit Limit shall be reduced: Monthly

d) Amount by which Maximum Credit Line shall be Maximum Credit Limit

reduced on the frequency specified in (c) above: Remaining Tenure

11) Repayment a) First EMI due on 05/06/2023

Schedule b) Last EMI Date 05/05/2028

c) Instalment Due Date 5th of every month

d) No. of Instalments of Repayment 60

e) Monthly Instalment payable (including insurance in case of Rs. ______________

21291.42 per

insurance provision) under term loan facility month

f) Repayment frequency by the Borrower Monthly

12) Moratorium period

(if any)

13) Interest Payable a) Interest Type: Fixed

b) Rate of Interest: 22.00 % p.a.

c) Total interest charge during the entire tenor of the loan 506585.0

14) Additional Interest a) For default in payment of interest and/ or principal amounts – 3% per month on

overdue amount (Annualized penal charge of 36%)

b) For delay or non-submission of the financial statements or such other documents as

required under the Facility Documents - 3% per month (Annualized penal charge of

36%)

15) Part Prepayment:

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

Part-Prepayment/ Lock-in Period: 12 months from the date of first disbursement

Prepayment/ a) Part Prepayment is allowed once per year and the minimum gap between two-part

Foreclosure prepayments to be six months.

Charges b) A maximum of 50% of the principal outstanding is allowed by way of part prepayment during

a single year.

c) A part prepayment charge of 2.5% shall be applicable on amount over and above 25% of

principal outstanding and upto maximum 50% of principal outstanding.

d) No part payment is allowed during the Lock-in period

e) Minimum Part prepayment amount to be greater than or equal to 2 months EMI

Foreclosure charges on Term Loan Facility:

a) 4.5% on the principal outstanding at the time of foreclosure.

b) In case the Borrower forecloses the Facility within 12 months after doing part-prepayment,

foreclosure charges of 4.5% will be levied on the principal outstanding plus part

prepayment amount.

c) Any prepayment/foreclosure made during the Lock-in period will attract additional 2% over

and above the prepayment/ foreclosure charges mentioned in (a) above on the principal

outstanding at the time of foreclosure.

Foreclosure charges on Top-up:

a) 2.50% on the principal outstanding at the time of foreclosure.

b) Foreclosure charges shall be levied only if new rate is lower than existing rate.

c) Any prepayment/ foreclosure made during the Lock-in Period will attract prepayment/

foreclosure charges of 4.5% on the principal outstanding.

Foreclosure Charges in Dropline Facility:

a) 4.5% on the Dropped down limit amount.

b) Any prepayment/ foreclosure made during the Lock-in Period will attract additional 2% over

and above the prepayment/ foreclosure charges mentioned in (a) above on the Dropped

down limit

16) Charges a) Payment Instruments Rs. 550/- per instance

swapping

b) Dishonour Charges Rs. 600/- for every Cheque/ Payment Instrument Dishonour

c) Mandate Rejection Rs. 450/-

Service Charges (Charges will be levied if new mandate form is not registered

within 30 days from the date of rejection of previous mandate form

by Borrower’s bank for any reasons whatsoever.)

d) Annual Maintenance 0.25% on Dropline Amount + GST or Rs. 1000, (whichever is

Charges for PL higher) per year will be deducted from the limit and shall be

Overdraft (Dropline payable at the end of the 13th month.

facility)

e) Cancellation charges 2% of the Loan Amount/ Facility amount OR

Rs. 5750/-

Whichever is higher

f) Duplicate Repayment Rs. 550/-

Schedule

g) Duplicate NOC Rs. 550/-

h) Outstation collection Rs.100 /- + GST per repayment instrument

charges

i) Statement of Account Customer portal – Nil

(SOA) Branch walk in – Rs. 250/-

j) Foreclosure Letter Customer portal – Nil

Charge Branch walk in – Rs 199/-

Legal Charges

a) SEC 138 & Sec 25 Rs. 3400/-

filing

b) Arbitration Filing Rs. 4000/-

c) Receiver Order District Court: Rs. 4000/- and High court: Rs. 13,500/-

d) Notice Rs. 125/-

e) Legal Notice Rs. 300/-

f) Charge for Notice & Rs. 3000/-

another legal notice

g) Execution of award Rs. 5600/-

17) Insurance & Third- a) Life Insurance Premium

Party Product b) General Insurance Premium

Charges

c) Health Insurance Premium

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

d) IHO Plan Amount 0

e) One Assist Plan Amount 5599

f) CPP Plan Amount 0

18) Other Important a) Total Amount to be paid by the borrower (6 + 13.c) Rs. 1277485.0

Details b) Annual Percentage Rate % - Effective annualized interest 23.23 % p.a.

rate (in percentage) (computed on net disbursed amount

using IRR approach and reducing balance method)

Note: APR may change in case there is change in the

Scheme opted.

19) Other Disclosures a) Cooling off/ look-up period during which borrower shall not 5 days from the date of

be charged any penalty on prepayment of loan loan disbursal

b) Details of LSP acting as recovery agent and authorized to Not Applicable

approach the borrower

c) Details of Nodal Grievance Redressal Officer:

i) Name Francyna Dias

ii) Designation, Grievance Redressal Officer

iii) Address 11th Floor, Tower A, Peninsula Business Park, Ganpatrao

Kadam Marg, Lower Parel, Mumbai - 400013

iv) Phone No. 18602676060

If you are not satisfied with the resolution, please visit the link: https://www.tatacapital.com/contact-

us/customer-grievances.html and submit your grievances.

Note: (GST, other government taxes and levies as applicable, will be levied on all fees and charges in

this document)

20) Place of Arbitration Delhi Chennai Mumbai Kolkata Bangalore

(Tick, whichever is

applicable)

21) Jurisdiction Delhi Chennai Mumbai Kolkata Bangalore

(Tick, whichever is

applicable)

22) Timelines Sr. Conditions Relevant Provisions Timelines

No. in T&Cs

a) End use certificate shall be Clause 2(C)(i) Within 30 days

provided by the Obligors to

the Lender

b) Fresh Payment Instruments Clause 5.14 and/or Within 7 days

shall be delivered by the Clause 5.18

Obligors to the Lender

c) TDS certificate in the Form Clause 5.25.5 Within 45 days from the end of

No. 16A of the IT Act the relevant quarter in which

downloaded from the TDS tax is deducted and within 75

Reconciliation Analysis and days from the end of the last

Correction Enabling System quarter of the financial year

(“TRACES”) website shall be

provided by the Obligors to

the Lender

d) An amount equivalent to the Clause 5.25.5 Within 90 days

TDS amount paid by the

Obligors shall be refunded to

the Borrower by the Lender

upon receipt of the TDS

certificate and subject to

compliance with the

conditions stipulated in the

relevant provision of the

T&Cs.

e) TDS refund claim will not be Clause 5.25.5 after the 30 days of the

entertained by the Lender. succeeding financial year

f) Credit of the TDS amount Clause 5.25.9 not later than 60 days of the

may be requested by the succeeding financial year

Obligors by furnishing of the

TDS certificate.

g) Joint and several liability of Clause 11 within 15 days from the date of

the Obligors to indemnify demand

and keep the Indemnified

Person(s) indemnified and

harmless.

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

Signed and delivered by the within named Lender Signed and delivered by the within named BORROWER/S Mr./Ms./M/s.

Tata Capital Financial Services Limited CHILUKURI DEVI SIVA SAIKUMAR

by the hands of its Authorized Signatory/ Constituted

Attorney Mr. Deepak Aggarwal

For Tata Capital Financial Services Limited

Signature Not Verified IPAddress: 49.205.106.131:52640

Signed by : DS TATA CAPITAL FINANCIAL SERVICES LTD 4

Reason : Loan Purpose

Location : Mumbai

Date : 2023-04-19 16:36:55 IST Date: 19-04-2023 16:36:43

Authorised Signatory/ies

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

Installment or Repayment Schedule Chart

Amount (Rs.)

Effective

Opening

Instl. # Due Date Installment Principal Interest Rate (%) /

Balance Days

1 05/06/2023 770,900 21,291 7,158 14,133 22.00/30

2 05/07/2023 763,742 21,291 7,289 14,002 22.00/30

3 05/08/2023 756,452 21,291 7,423 13,868 22.00/30

4 05/09/2023 749,029 21,291 7,559 13,732 22.00/30

5 05/10/2023 741,470 21,291 7,698 13,594 22.00/30

6 05/11/2023 733,772 21,291 7,839 13,452 22.00/30

7 05/12/2023 725,933 21,291 7,983 13,309 22.00/30

8 05/01/2024 717,951 21,291 8,129 13,162 22.00/30

9 05/02/2024 709,822 21,291 8,278 13,013 22.00/30

10 05/03/2024 701,544 21,291 8,430 12,862 22.00/30

11 05/04/2024 693,114 21,291 8,584 12,707 22.00/30

12 05/05/2024 684,529 21,291 8,742 12,550 22.00/30

13 05/06/2024 675,788 21,291 8,902 12,389 22.00/30

14 05/07/2024 666,886 21,291 9,065 12,226 22.00/30

15 05/08/2024 657,821 21,291 9,231 12,060 22.00/30

16 05/09/2024 648,589 21,291 9,401 11,891 22.00/30

17 05/10/2024 639,189 21,291 9,573 11,718 22.00/30

18 05/11/2024 629,616 21,291 9,748 11,543 22.00/30

19 05/12/2024 619,867 21,291 9,927 11,364 22.00/30

20 05/01/2025 609,940 21,291 10,109 11,182 22.00/30

21 05/02/2025 599,831 21,291 10,295 10,997 22.00/30

22 05/03/2025 589,536 21,291 10,483 10,808 22.00/30

23 05/04/2025 579,053 21,291 10,675 10,616 22.00/30

24 05/05/2025 568,377 21,291 10,871 10,420 22.00/30

25 05/06/2025 557,506 21,291 11,070 10,221 22.00/30

26 05/07/2025 546,436 21,291 11,273 10,018 22.00/30

27 05/08/2025 535,162 21,291 11,480 9,811 22.00/30

28 05/09/2025 523,682 21,291 11,691 9,601 22.00/30

29 05/10/2025 511,992 21,291 11,905 9,387 22.00/30

30 05/11/2025 500,087 21,291 12,123 9,168 22.00/30

31 05/12/2025 487,964 21,291 12,345 8,946 22.00/30

32 05/01/2026 475,618 21,291 12,572 8,720 22.00/30

33 05/02/2026 463,046 21,291 12,802 8,489 22.00/30

34 05/03/2026 450,244 21,291 13,037 8,254 22.00/30

35 05/04/2026 437,207 21,291 13,276 8,015 22.00/30

36 05/05/2026 423,931 21,291 13,519 7,772 22.00/30

37 05/06/2026 410,412 21,291 13,767 7,524 22.00/30

38 05/07/2026 396,645 21,291 14,020 7,272 22.00/30

39 05/08/2026 382,625 21,291 14,277 7,015 22.00/30

40 05/09/2026 368,349 21,291 14,538 6,753 22.00/30

41 05/10/2026 353,810 21,291 14,805 6,487 22.00/30

42 05/11/2026 339,005 21,291 15,076 6,215 22.00/30

43 05/12/2026 323,929 21,291 15,353 5,939 22.00/30

44 05/01/2027 308,576 21,291 15,634 5,657 22.00/30

45 05/02/2027 292,942 21,291 15,921 5,371 22.00/30

46 05/03/2027 277,021 21,291 16,213 5,079 22.00/30

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

47 05/04/2027 260,809 21,291 16,510 4,781 22.00/30

48 05/05/2027 244,299 21,291 16,813 4,479 22.00/30

49 05/06/2027 227,486 21,291 17,121 4,171 22.00/30

50 05/07/2027 210,365 21,291 17,435 3,857 22.00/30

51 05/08/2027 192,930 21,291 17,754 3,537 22.00/30

52 05/09/2027 175,176 21,291 18,080 3,212 22.00/30

53 05/10/2027 157,096 21,291 18,411 2,880 22.00/30

54 05/11/2027 138,685 21,291 18,749 2,543 22.00/30

55 05/12/2027 119,936 21,291 19,093 2,199 22.00/30

56 05/01/2028 100,843 21,291 19,443 1,849 22.00/30

57 05/02/2028 81,401 21,291 19,799 1,492 22.00/30

58 05/03/2028 61,602 21,291 20,162 1,129 22.00/30

59 05/04/2028 41,440 21,291 20,532 760 22.00/30

60 05/05/2028 20,908 21,291 20,908 383 22.00/30

Total 1,277,485 770,900 506,585

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

Disclaimer:

First EMI date depends on the date of disbursal. It may vary, in case the disbursal happens till 18 th of the month (for

Term Loan) and 8th of the month (for PL Overdraft) then the First EMI date will be on the 4 of the next month, else the

first EMI date will be on the 4 of the next to next month.

Net Disbursed Amount may change if there is a difference in agreement execution date and actual loan disbursal date

on account of change in Broken Period Interest or any changes opted post execution of the agreement.

This Repayment Schedule and its figures and calculation are as on _________

19/04/2023 and may vary based on the

applicable date of disbursement

Signed and delivered by the within named Lender Signed and delivered by the within named BORROWER/S Mr./Ms./M/s.

Tata Capital Financial Services Limited CHILUKURI DEVI SIVA SAIKUMAR

by the hands of its Authorized Signatory/ Constituted

Attorney Mr. Deepak Aggarwal

For Tata Capital Financial Services Limited

Signature Not Verified IPAddress: 49.205.106.131:52640

Signed by : DS TATA CAPITAL FINANCIAL SERVICES LTD 4

Reason : Loan Purpose

Location : Mumbai

Date : 2023-04-19 16:36:55 IST Date: 19-04-2023 16:36:43

Authorised Signatory/ies

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

Personal Loan Term & Overdraft Agreement

Privacy Policy

For TCFSL privacy policy, please click on link below

https://www.tatacapital.com/content/dam/tata-capital/pdf/footer/Privacy_Commitment.pdf

For LSP privacy policy and GRO detail, please click on link below

Signed and delivered by the within named Lender Signed and delivered by the within named BORROWER/S Mr./Ms./M/s.

Tata Capital Financial Services Limited

CHILUKURI DEVI SIVA SAIKUMAR

by the hands of its Authorized Signatory/ Constituted

Attorney Mr. Deepak Aggarwal

For Tata Capital Financial Services Limited

Signature Not Verified IPAddress: 49.205.106.131:52640

Signed by : DS TATA CAPITAL FINANCIAL SERVICES LTD 4

Reason : Loan Purpose

Location : Mumbai

Date : 2023-04-19 16:36:55 IST Date: 19-04-2023 16:36:43

Authorised Signatory/ies

TATA CAPITAL FINANCIAL SERVICES LIMITED

IP Address:49.205.106.131:52640 Date & Time: 19-04-2023 16:36:44

You might also like

- MMMM WorkbookDocument120 pagesMMMM WorkbookSnezha Asenova100% (1)

- INBDEBooster Patient Management NotesDocument19 pagesINBDEBooster Patient Management NotessuryathatiNo ratings yet

- 2D Benedict On Admiralty Carriage of Goods by Sea Chapters XVIII - XXVDocument723 pages2D Benedict On Admiralty Carriage of Goods by Sea Chapters XVIII - XXVBradNo ratings yet

- Dear Applicant,: Tata Capital Financial Services LimitedDocument9 pagesDear Applicant,: Tata Capital Financial Services LimitedeamumeshNo ratings yet

- TermsKFS 9582497548Document10 pagesTermsKFS 9582497548dheerajpa009No ratings yet

- TermsKFS 7558186721Document11 pagesTermsKFS 7558186721Vicky VimalNo ratings yet

- TermsKFS 7652940900Document11 pagesTermsKFS 7652940900pankajprajapati000078666No ratings yet

- Loan Agreement of Hinduja Leyland FinanceDocument14 pagesLoan Agreement of Hinduja Leyland FinanceAtaur Rahman HashmiNo ratings yet

- Loan AgreementDocument10 pagesLoan AgreementMukesh VNo ratings yet

- Loan - Contract - LIQUILOANS - AGREEMENT - 6821750 5Document17 pagesLoan - Contract - LIQUILOANS - AGREEMENT - 6821750 5zy6btrz6qkNo ratings yet

- LoanagreementDocument13 pagesLoanagreementKiran KumarNo ratings yet

- DlaDocument7 pagesDlasurendraNo ratings yet

- Loan AgreementDocument16 pagesLoan AgreementReliable VideosNo ratings yet

- UntitledDocument13 pagesUntitledAMARJEET YADAVNo ratings yet

- AgreementDocument21 pagesAgreementdevgdev2023No ratings yet

- Personal Loan Agreement 060623Document9 pagesPersonal Loan Agreement 060623Abhishek ChauhanNo ratings yet

- Loan AgreementDocument24 pagesLoan Agreementsuman prakashNo ratings yet

- 7 Personal Loan Agreement To Be Taken On Stamp PaperDocument10 pages7 Personal Loan Agreement To Be Taken On Stamp Paperpranshu goelNo ratings yet

- Preview AgreementDocument6 pagesPreview AgreementdivyaNo ratings yet

- Agreement Personal LoanDocument8 pagesAgreement Personal LoanAnkush KotakNo ratings yet

- Sanction LetterDocument23 pagesSanction LetterAYUSH MishraNo ratings yet

- Sanction LetterDocument2 pagesSanction Letter313 65 Cheithanya Kumar MNo ratings yet

- Preview AgreementDocument6 pagesPreview AgreementBankloan easyNo ratings yet

- LAP and SME Loan AgreementDocument31 pagesLAP and SME Loan AgreementDeepali RajputNo ratings yet

- Loan Agreement Bank 2.dotDocument20 pagesLoan Agreement Bank 2.dotlily kamwanaNo ratings yet

- NikeDocument22 pagesNikeaadharsevameNo ratings yet

- LdsDocument16 pagesLdsRavi Rudr MishraNo ratings yet

- LDSDocument17 pagesLDSVenkataramana SarellaNo ratings yet

- DMI DMI0022846733 Agreement 1715403302588Document17 pagesDMI DMI0022846733 Agreement 1715403302588reghuvelanNo ratings yet

- Bank Loan ContractDocument6 pagesBank Loan ContractSiddharth BaxiNo ratings yet

- Loan AgreementDocument20 pagesLoan AgreementAnjani DeviNo ratings yet

- DMI DMI0030179395 Agreement 1704150274296Document17 pagesDMI DMI0030179395 Agreement 1704150274296debnathdebabrata123No ratings yet

- DMI DMI0031838999 Agreement 1709179676414Document18 pagesDMI DMI0031838999 Agreement 1709179676414hinglajsteel2No ratings yet

- DMI DMI0032140135 Agreement 1709123645690Document17 pagesDMI DMI0032140135 Agreement 1709123645690razarahil369No ratings yet

- DMI DMI0035392313 Agreement 1704702866776Document18 pagesDMI DMI0035392313 Agreement 1704702866776farhaan0091No ratings yet

- DmiDocument16 pagesDmiprecisioncalibration2023No ratings yet

- Loan AgreementDocument6 pagesLoan AgreementV KiranNo ratings yet

- Loan Agreement: Transaction Details ScheduleDocument12 pagesLoan Agreement: Transaction Details ScheduleVamsi ThallapaneniNo ratings yet

- RML Application FormDocument17 pagesRML Application Formkirubaharan2022No ratings yet

- UntitledDocument5 pagesUntitledKhatuJi HandicraftsNo ratings yet

- Loan AgreementDocument20 pagesLoan AgreementRANJIT BISWAL (Ranjit)No ratings yet

- Loanagreement DE7T8195A3A0Document19 pagesLoanagreement DE7T8195A3A0Santosh KumarNo ratings yet

- Loan Agreement: For Rudrapur Nidhi LTD Borrower Co-Borrower/Guarantor Signature SignatureDocument7 pagesLoan Agreement: For Rudrapur Nidhi LTD Borrower Co-Borrower/Guarantor Signature SignatureMiddha Law Firm Rudrapur100% (1)

- AGREEMDocument4 pagesAGREEMshree.shree10010No ratings yet

- Personal Loan Agreement Loan Amount Less Than 5 LakhsDocument14 pagesPersonal Loan Agreement Loan Amount Less Than 5 LakhsShivam KumarNo ratings yet

- 4 - Loan AgreementDocument14 pages4 - Loan AgreementKavit ThakkarNo ratings yet

- This Sundaram Credit Line Loan Agreement ("Agreement") Is Made at Chennai BetweenDocument15 pagesThis Sundaram Credit Line Loan Agreement ("Agreement") Is Made at Chennai BetweenPrasanna KumaraNo ratings yet

- IDFC Personal Loan AgreementDocument16 pagesIDFC Personal Loan Agreementpritamjangir75No ratings yet

- Loan Agreement: Opp Andhra Bank Rudrapur RoadDocument7 pagesLoan Agreement: Opp Andhra Bank Rudrapur RoadMiddha Law Firm RudrapurNo ratings yet

- 1647868900.750639 - Signed Contract Application 240687Document11 pages1647868900.750639 - Signed Contract Application 240687Tricia Faith Dela CruzNo ratings yet

- 14 Loan Agreement - TEMPLATEDocument6 pages14 Loan Agreement - TEMPLATEMay&BenNo ratings yet

- Shriram City Union Finance - Shriramcity - inDocument20 pagesShriram City Union Finance - Shriramcity - inRamesh GaonkarNo ratings yet

- Ang Tibuok Mong KinabuhiDocument6 pagesAng Tibuok Mong KinabuhiJuliet PanogalinogNo ratings yet

- South Indian Bank LADocument10 pagesSouth Indian Bank LAAsim HussainNo ratings yet

- Personal Loan Agreement: Bajaj Finance LimitedDocument12 pagesPersonal Loan Agreement: Bajaj Finance LimitedShafiah SheikhNo ratings yet

- Loan AgreementDocument20 pagesLoan Agreementhussainminnu_3533740No ratings yet

- Romissory OTE F (Project Name) C P L A B M P N ("N ") E D: OR Onstruction and Ermanent OAN GreementDocument3 pagesRomissory OTE F (Project Name) C P L A B M P N ("N ") E D: OR Onstruction and Ermanent OAN GreementAnonymous FZKqZqRNo ratings yet

- Welcome Letter IDEP1817543492886BDW 573179184512158Document14 pagesWelcome Letter IDEP1817543492886BDW 573179184512158srivastavashivay0No ratings yet

- CF BILPL ClickWrapTermsAndConditionDocument13 pagesCF BILPL ClickWrapTermsAndConditionNiaz RNo ratings yet

- FN1683347094 Loan AgreementDocument7 pagesFN1683347094 Loan AgreementAbhranil BiswasNo ratings yet

- Loan AgreementDocument25 pagesLoan Agreementreddyskyblue1No ratings yet

- Welcome LetterDocument14 pagesWelcome LettershubhamNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Materi 1Document10 pagesMateri 1Nurul Rifqah FahiraNo ratings yet

- HIBIPL - Policy DetailsDocument1 pageHIBIPL - Policy DetailsBrijesh EnterprisesNo ratings yet

- Ejercito, Et - Al. v. Oriental Assurance CorpDocument9 pagesEjercito, Et - Al. v. Oriental Assurance Corpcharmagne cuevasNo ratings yet

- Gems From Warren Buffett Wit and Wisdom From 34 Years of Letters To ShareholdersDocument81 pagesGems From Warren Buffett Wit and Wisdom From 34 Years of Letters To ShareholderskanNo ratings yet

- Exam P Sample QuestionsDocument136 pagesExam P Sample QuestionsKarimaNo ratings yet

- A Project On Insurance and Pension: by KuldeepDocument26 pagesA Project On Insurance and Pension: by KuldeepdhimankuldeepNo ratings yet

- Dio Insurance Policy PDFDocument10 pagesDio Insurance Policy PDFHarshit Vasani100% (1)

- Benefit Illustration For SBI LIFE - Poorna Suraksha (UIN No - 111N110V01)Document13 pagesBenefit Illustration For SBI LIFE - Poorna Suraksha (UIN No - 111N110V01)Souma MazumdarNo ratings yet

- Celebrating 60 Years of Excellence, Sri Lanka Insurance PresentsDocument2 pagesCelebrating 60 Years of Excellence, Sri Lanka Insurance PresentsSivaneswaran ChandrasekaranNo ratings yet

- Whole of Life Insurance+: Policy SummaryDocument16 pagesWhole of Life Insurance+: Policy SummaryChristos YerolemouNo ratings yet

- Policy 7100643751Document14 pagesPolicy 7100643751Urban Mystique Homes LLPNo ratings yet

- Auctions Handholding and Post-Auction Facilitation: 4th National Conclave On Mines & MineralsDocument33 pagesAuctions Handholding and Post-Auction Facilitation: 4th National Conclave On Mines & MineralsshaileshsjNo ratings yet

- Ye Tolerart InfopackDocument19 pagesYe Tolerart InfopackMartina MartinaNo ratings yet

- 2020 Registered Insurance Intermediaries As at 19th October 2020-MergedDocument202 pages2020 Registered Insurance Intermediaries As at 19th October 2020-MergedericmNo ratings yet

- Wwwroot WP Content Uploads Download Manager Files OA INBenefitDocument6 pagesWwwroot WP Content Uploads Download Manager Files OA INBenefitAlexia MorganNo ratings yet

- Pioneer Insurance & Surety Corp. v. CADocument8 pagesPioneer Insurance & Surety Corp. v. CARee EneNo ratings yet

- (Confirmation of Insurance (Tenant) ) Policy 3718446-V1Document1 page(Confirmation of Insurance (Tenant) ) Policy 3718446-V1iasbaba0507No ratings yet

- Insurance Product Information Document: What Is This Type of Insurance? What Is Insured? What Is Not Insured?Document2 pagesInsurance Product Information Document: What Is This Type of Insurance? What Is Insured? What Is Not Insured?barryNo ratings yet

- Night Funeral in Harlem2Document1 pageNight Funeral in Harlem2Mariana CozenzaNo ratings yet

- Screenshot 2022-11-03 at 10.04.15 PMDocument11 pagesScreenshot 2022-11-03 at 10.04.15 PMHasenat AhmedNo ratings yet

- Need For Indemnity in Commercial ContractsDocument13 pagesNeed For Indemnity in Commercial ContractsUdit KapoorNo ratings yet

- Public & Product Liability ACA (Isi)Document10 pagesPublic & Product Liability ACA (Isi)marqycaNo ratings yet

- Term Paper On Affordable Care ActDocument4 pagesTerm Paper On Affordable Care Actc5p8vze7100% (1)

- Examination: Subject SA2 - Life Insurance Specialist ApplicationsDocument3 pagesExamination: Subject SA2 - Life Insurance Specialist Applicationsdickson phiriNo ratings yet

- What Is Primer LanguageDocument2 pagesWhat Is Primer LanguageKen BiNo ratings yet

- Happy Family Floater 2021 Policy WordingsDocument49 pagesHappy Family Floater 2021 Policy Wordings7Trep RadioNo ratings yet

- Offer Letter - Rohan AggarwalDocument6 pagesOffer Letter - Rohan Aggarwalamanaggarwal1708No ratings yet