Professional Documents

Culture Documents

Stocks & Commodities V. 11:9 (381) : Sidebar: Calculating Bollinger Bands

Stocks & Commodities V. 11:9 (381) : Sidebar: Calculating Bollinger Bands

Uploaded by

Ouwehand OrgOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stocks & Commodities V. 11:9 (381) : Sidebar: Calculating Bollinger Bands

Stocks & Commodities V. 11:9 (381) : Sidebar: Calculating Bollinger Bands

Uploaded by

Ouwehand OrgCopyright:

Available Formats

Stocks & Commodities V.

11:9 (381): Sidebar: Calculating Bollinger Bands

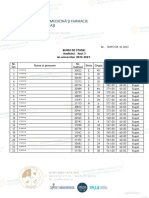

SIDEBAR FIGURE 1

CALCULATING BOLLINGER BANDS

A B C D E F G H I J

1 Date High Low Close Typical Price

2 910924 3043.38 2995.97 2995.97 3011.77 CALCULATING BOLLINGER BANDS

3 910925 3048.52 3004.92 3004.92 3019.45 An Excel spreadsheet is used to calculate Bollinger Bands for the DJIA.

4 910926 3040.70 2996.87 2996.87 3011.48

5 910927 3040.70 2989.49 2989.49 3006.56

The actual formula for each cell is shown at the bottom of the column; the

6 910930 3032.87 2982.78 2982.78 2999.48 formula presented is specific for the location of that cell.

7 911001 3043.60 3002.46 3018.34 3021.47 First, determine the typical price (column E), which is the high, low and

8 911002 3040.25 2992.40 3012.52 3015.06 close summed and divided by three. Then calculate the 20-day simple

9 911003 3021.24 2972.50 2984.79 2992.84

1 0 911004 3007.16 2956.17 2961.76 2975.03

moving average (column F). Next, the standard deviation of the typical

1 1 911007 2973.17 2926.21 2942.75 2947.38 price over the 20-day period is calculated using the population formula in

1 2 911008 2983.68 2927.77 2963.77 2958.41 the spreadsheet (column G). The standard deviation of the population

1 3 911009 2984.79 2925.54 2946.33 2952.22 formula is used. The upper Bollinger Band is the 20-day moving average

1 4 911010 2985.47 2930.23 2976.52 2964.07

1 5 911011 3000.89 2957.51 2983.68 2980.69

plus two times the standard deviation (column H). The middle band is the

1 6 911014 3026.39 2975.85 3019.45 3007.23 20-day simple moving average (column I). The lower band is the 20-day

1 7 911015 3057.69 3000.22 3041.37 3033.09 simple moving average minus two times the standard deviation.

1 8 911016 3082.29 3016.10 3061.72 3053.37

1 9 911017 3077.15 3027.06 3053.00 3052.40 Upper Middle Lower

2 0 911018 3089.45 3045.62 3077.15 3070.74 20 day Average Standard Deviation Bollinger Band Bollinger Band Bollinger Band

2 1 911021 3085.20 3042.49 3060.38 3062.69 3006.77 35.54 3077.85 3006.77 2935.70

2 2 911022 3084.53 3020.57 3039.80 3048.30 3008.60 36.67 3081.94 3008.60 2935.26

2 3 911023 3065.52 3015.21 3040.92 3040.55 3009.65 37.26 3084.18 3009.65 2935.12

2 4 911024 3047.63 2991.73 3016.32 3018.56 3010.01 37.31 3084.63 3010.01 2935.38

2 5 911025 3034.44 2983.01 3004.92 3007.46 3010.05 37.31 3084.67 3010.05 2935.43

2 6 911028 3055.23 3001.57 3045.62 3034.14 3011.79 37.58 3086.95 3011.79 2936.62

2 7 911029 3077.82 3020.13 3061.94 3053.30 3013.38 38.62 3090.61 3013.38 2936.14

2 8 911030 3090.12 3038.24 3071.78 3066.71 3015.96 40.33 3096.63 3015.96 2935.29

2 9 911031 3091.01 3045.62 3069.10 3068.58 3019.75 41.52 3102.79 3019.75 2936.70

3 0 911101 3091.91 3031.75 3056.35 =(B30+C30+D30)/3 =AVERAGE(E11:E30) =STDEVP(E11:E30) =F30+(2*G30) =F30 =F30-(2*G30)

Copyright (c) Technical Analysis Inc.

You might also like

- Affidavit of Loss Orcr Lto FormDocument1 pageAffidavit of Loss Orcr Lto FormArlene Jill VidamoNo ratings yet

- ICFR Day 1Document70 pagesICFR Day 1Toni Triyulianto100% (1)

- Tax Pre-Week ReviewerDocument29 pagesTax Pre-Week ReviewerJuris TantumNo ratings yet

- Balut Pumping Station Mwss Flow Meter Reading and Consumption For The Month of February 2018Document2 pagesBalut Pumping Station Mwss Flow Meter Reading and Consumption For The Month of February 2018Robert RodoyNo ratings yet

- Final List WebDocument7 pagesFinal List WebSushaiNo ratings yet

- Caminos CurvasDocument1 pageCaminos Curvasjhonatan manallay montalvoNo ratings yet

- Bushing FEA AnalysisDocument5 pagesBushing FEA Analysisshan07011984No ratings yet

- Table 1- Calculation of χ2 for Graph 1Document3 pagesTable 1- Calculation of χ2 for Graph 1Jonique MajorNo ratings yet

- Product Cut Sheet: Universal Horizontal Cable ManagerDocument1 pageProduct Cut Sheet: Universal Horizontal Cable ManagerAlberto MartinezNo ratings yet

- TABLA EXCEL - Shirley Stephanie Méndez Hong-1Document3 pagesTABLA EXCEL - Shirley Stephanie Méndez Hong-1Marcos RiveraNo ratings yet

- BernoluiDocument7 pagesBernoluiThushanNo ratings yet

- Gek-131024 ModbusDocument610 pagesGek-131024 Modbusruizprado71No ratings yet

- Praktikum PP Dan HeDocument100 pagesPraktikum PP Dan HeFadvilahNo ratings yet

- BHUSHANProfile LVLLDocument8 pagesBHUSHANProfile LVLLSahil WadhwaniNo ratings yet

- Tensile TestDocument5 pagesTensile TestNabeel J. AwadNo ratings yet

- (Mpa) (Mpa) (Mpa) (KN) (KN) : CRL CRD Y Y Uexp L D NL ND NLD NDLDocument1 page(Mpa) (Mpa) (Mpa) (KN) (KN) : CRL CRD Y Y Uexp L D NL ND NLD NDLshaik mohammed ArshadNo ratings yet

- (Mpa) (Mpa) (Mpa) (KN) (KN) : CRL CRD Y Y Uexp L D NL ND NLD NDLDocument1 page(Mpa) (Mpa) (Mpa) (KN) (KN) : CRL CRD Y Y Uexp L D NL ND NLD NDLshaik mohammed ArshadNo ratings yet

- Griddatareport-Lalitude Longitude AltitudeDocument7 pagesGriddatareport-Lalitude Longitude AltitudeYusrilNo ratings yet

- Latihan 3 Linear RegressionDocument3 pagesLatihan 3 Linear RegressionilhamNo ratings yet

- Experiment ResultDocument27 pagesExperiment ResultkidaneNo ratings yet

- HHHHHDocument8 pagesHHHHHmuhammadyafizhambatubaraNo ratings yet

- Kucing HitamDocument1 pageKucing HitamEdi HandoyoNo ratings yet

- Densitas: No S (%) T (C) Əst/ƏS ΔstDocument1 pageDensitas: No S (%) T (C) Əst/ƏS ΔstEdi HandoyoNo ratings yet

- Kucing HitamDocument1 pageKucing HitamEdi HandoyoNo ratings yet

- Rain Water Basin DesignDocument11 pagesRain Water Basin DesignSturza AnastasiaNo ratings yet

- Reservoir Engineering 4th 1st FinalDocument8 pagesReservoir Engineering 4th 1st Finalghofran.hassan.falhNo ratings yet

- Sample Tensiometer ReportDocument21 pagesSample Tensiometer ReportMohd Firdaus WahabNo ratings yet

- Calculo de Curva HipsometricaDocument2 pagesCalculo de Curva HipsometricaCesar Gutierrez NinahuamanNo ratings yet

- R AbalDocument13 pagesR AbalzeroxfaceNo ratings yet

- Grafik - KimfisDocument3 pagesGrafik - Kimfisditta antNo ratings yet

- Physical ChemistryDocument4 pagesPhysical ChemistrySmit PatelNo ratings yet

- Physics 1Document13 pagesPhysics 1Pratham KatariyaNo ratings yet

- AitkenDocument2 pagesAitkenKatherine MayteNo ratings yet

- Medicina An 3 - Burse de StudiuDocument2 pagesMedicina An 3 - Burse de StudiuAndrei CosovanuNo ratings yet

- Gridding Report - : Data SourceDocument7 pagesGridding Report - : Data SourceWaariss HasanNo ratings yet

- Book 1Document4 pagesBook 1M.IDRIS2 ARPNo ratings yet

- Session6 SolutionsDocument12 pagesSession6 Solutionsdhruv mahashayNo ratings yet

- EXP: 1) ) tensile test: Force (P) Elongation ΔL Stress (σ) Strain (ε) kN (mm) (N/mm²) =MpaDocument4 pagesEXP: 1) ) tensile test: Force (P) Elongation ΔL Stress (σ) Strain (ε) kN (mm) (N/mm²) =MpaSaif QasemNo ratings yet

- Interval Mi Fi Fixmi X Bar Mi-X BarDocument3 pagesInterval Mi Fi Fixmi X Bar Mi-X BarShabrina PutriNo ratings yet

- Brinell Hardness Test LabDocument9 pagesBrinell Hardness Test LabAlec ThaemlitzNo ratings yet

- Lab Report - Determination of The Stability Constant of A Metal ComplexDocument18 pagesLab Report - Determination of The Stability Constant of A Metal ComplexValerie MangasarNo ratings yet

- Tarea 1 U5 Est. Inf. IiDocument10 pagesTarea 1 U5 Est. Inf. IiCristhian Leon ReyesNo ratings yet

- Macaraeg, Czarina Mae - Bsabe 3-1 - Lab Exercise 7Document11 pagesMacaraeg, Czarina Mae - Bsabe 3-1 - Lab Exercise 7Czarina Mae MacaraegNo ratings yet

- 160 F (X) 0.0007239939x 2 + 1.6784769504x + 48.3736250115 R 0.9937237502Document3 pages160 F (X) 0.0007239939x 2 + 1.6784769504x + 48.3736250115 R 0.9937237502lala arNo ratings yet

- Canada Customs TarrifDocument1,791 pagesCanada Customs TarrifnickNo ratings yet

- Steel AllDocument30 pagesSteel AllKhin Maung SoeNo ratings yet

- Housing Prices Observation Price ($000) Square Feet Price ($000) Error Bedrooms Bathrooms Actual Forecasted (Residual)Document31 pagesHousing Prices Observation Price ($000) Square Feet Price ($000) Error Bedrooms Bathrooms Actual Forecasted (Residual)jodi setya pratamaNo ratings yet

- Modul Ii Peramalan PPPTLFDocument12 pagesModul Ii Peramalan PPPTLFthonzz cbaroedakz undergoundNo ratings yet

- 009 en Boge Sof Data 20210721 1Document2 pages009 en Boge Sof Data 20210721 1MAZENNo ratings yet

- Chua Test 2Document11 pagesChua Test 2Phạm Thu HòaNo ratings yet

- Determination of Critical Micelle ConcentrationDocument8 pagesDetermination of Critical Micelle ConcentrationthikamenituyeniNo ratings yet

- Menghitung Indek Musim Dan Peramalan DG DekomposisiDocument5 pagesMenghitung Indek Musim Dan Peramalan DG Dekomposisimarcellryz1No ratings yet

- Tribhuvan University Khwopa College of Engineering: Survey Instruction CommitteeDocument4 pagesTribhuvan University Khwopa College of Engineering: Survey Instruction CommitteeSudip ShresthaNo ratings yet

- MoharDocument3 pagesMoharharisranazjcNo ratings yet

- Block No Time Period (Sec) Rs Factor Max Torsion Max Displacement X Y X Y X YDocument2 pagesBlock No Time Period (Sec) Rs Factor Max Torsion Max Displacement X Y X Y X YDipeshNo ratings yet

- PM FC0205 Sample1 Checked Jan27 15Document602 pagesPM FC0205 Sample1 Checked Jan27 15Sugrib K ShahaNo ratings yet

- BHUSHANBlock (Merge)Document6 pagesBHUSHANBlock (Merge)Sahil WadhwaniNo ratings yet

- Ejer 44 ProbabilidadDocument3 pagesEjer 44 ProbabilidadDaniel MontoyaNo ratings yet

- Ejercicios de Peso MolecularDocument5 pagesEjercicios de Peso Molecularjessamyn_correa71% (7)

- R8C 13Document7 pagesR8C 13Ouwehand OrgNo ratings yet

- The Triumphant March: 30-Year Old Design Still Inspires ThousandDocument4 pagesThe Triumphant March: 30-Year Old Design Still Inspires ThousandOuwehand OrgNo ratings yet

- Development Kits 2Document1 pageDevelopment Kits 2Ouwehand OrgNo ratings yet

- Development KitsDocument5 pagesDevelopment KitsOuwehand OrgNo ratings yet

- FPGADocument4 pagesFPGAOuwehand OrgNo ratings yet

- Currency TraderDocument29 pagesCurrency TraderOuwehand OrgNo ratings yet

- 30 - Everyone Loves A Winner But Should They A Look at The Loser ApproachDocument4 pages30 - Everyone Loves A Winner But Should They A Look at The Loser ApproachOuwehand OrgNo ratings yet

- An Intelligent Business Advisor System For Stock InvestmentDocument11 pagesAn Intelligent Business Advisor System For Stock InvestmentOuwehand OrgNo ratings yet

- 05 - Face Off Mutual Funds Vs EtfsDocument4 pages05 - Face Off Mutual Funds Vs EtfsOuwehand OrgNo ratings yet

- 20 - A Top Line Approach The Price To Sales Ratio ScreenDocument4 pages20 - A Top Line Approach The Price To Sales Ratio ScreenOuwehand OrgNo ratings yet

- 52 - Offbeat Offerings Fixed Rate Capital SecuritiesDocument3 pages52 - Offbeat Offerings Fixed Rate Capital SecuritiesOuwehand OrgNo ratings yet

- 15 - Will The Real P e Please Stand UpDocument3 pages15 - Will The Real P e Please Stand UpOuwehand OrgNo ratings yet

- 05 - Style Diversification Using The James o Shaughnessy ApproachDocument4 pages05 - Style Diversification Using The James o Shaughnessy ApproachOuwehand OrgNo ratings yet

- Solvell 2015 - On Strategy & CompetitivenessDocument130 pagesSolvell 2015 - On Strategy & CompetitivenessAnonymous TD96rCNo ratings yet

- Abm 2 (Week 2)Document4 pagesAbm 2 (Week 2)testing padasNo ratings yet

- Excel Fundamentals - Formulas For Finance (Template)Document7 pagesExcel Fundamentals - Formulas For Finance (Template)jitaNo ratings yet

- BT-Reply Show Cause - GTADocument2 pagesBT-Reply Show Cause - GTAapi-3822396No ratings yet

- Bajaj Finserv Quick Fact SheetDocument1 pageBajaj Finserv Quick Fact SheetAnil KiniNo ratings yet

- Chapter 6 Ethiopian Financial MarketDocument30 pagesChapter 6 Ethiopian Financial Marketyebegashet87% (31)

- Will - LeanDocument3 pagesWill - LeanAdele LeanNo ratings yet

- HM-Ch05 Job OrderDocument45 pagesHM-Ch05 Job OrderMc KeteqmanNo ratings yet

- Personal Loan Application Form: Salaried Self-EmployedDocument3 pagesPersonal Loan Application Form: Salaried Self-EmployedThee BouyyNo ratings yet

- Investing 101: How To Make Your Money Work For YouDocument49 pagesInvesting 101: How To Make Your Money Work For YouTeodorescu Ana MariaNo ratings yet

- MRSK Initiation RAB Roll-Out OffeDocument111 pagesMRSK Initiation RAB Roll-Out Offevini0784No ratings yet

- Oil & Gas Project FinanceDocument22 pagesOil & Gas Project Finance78arthurNo ratings yet

- Access The Financial Statements of Magna International Inc For The PDFDocument1 pageAccess The Financial Statements of Magna International Inc For The PDFHassan JanNo ratings yet

- Impacts of The World Recession and Economic Crisis On Tourism North AmericaDocument11 pagesImpacts of The World Recession and Economic Crisis On Tourism North AmericairohsabNo ratings yet

- Individual Assignment Acct 232 Management Accounting 2Document3 pagesIndividual Assignment Acct 232 Management Accounting 2pfungwaNo ratings yet

- TUA - Investment and Portfolio Management Insights - Activity 4Document4 pagesTUA - Investment and Portfolio Management Insights - Activity 4Angelica Arceno0% (1)

- Press Question Mark To See Available Shortcut KeysDocument13 pagesPress Question Mark To See Available Shortcut KeysAntzee DanceeNo ratings yet

- Financial Accounting Ifrs 4e Solution Ch04Document50 pagesFinancial Accounting Ifrs 4e Solution Ch04蔡宜欣No ratings yet

- Fiori AppDocument26 pagesFiori Appamguna4056No ratings yet

- Power of CompoundingDocument5 pagesPower of CompoundingDasher_No_150% (2)

- Hotel and Restaurant at Blue Nile FallsDocument26 pagesHotel and Restaurant at Blue Nile Fallsbig johnNo ratings yet

- Advanced Accounting Solutions Chapter-6Document2 pagesAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- GR No. 172231 CIR V Isabela Cultural CorporationDocument9 pagesGR No. 172231 CIR V Isabela Cultural CorporationRene ValentosNo ratings yet

- Roshan POA - OdtDocument3 pagesRoshan POA - OdtVivek VinayakumarNo ratings yet

- Business Plan Talha & Co A Trading BusinessDocument14 pagesBusiness Plan Talha & Co A Trading BusinessRana Haris -280No ratings yet

- EBIT Revenue COGS Operating Expenses or EBIT Net Income + Interest + Taxes Where: COGS Cost of Goods SoldDocument3 pagesEBIT Revenue COGS Operating Expenses or EBIT Net Income + Interest + Taxes Where: COGS Cost of Goods SoldLeahC.No ratings yet

- Quiz 1Document1 pageQuiz 1geraldabubopaduaNo ratings yet