Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsBlack and Scholes

Black and Scholes

Uploaded by

fxn fndThe document calculates call and put option values using the Black-Scholes model given stock price, time to expiration, risk-free interest rate, standard deviation, and exercise price. It determines the values of d1 and d2, then uses these to calculate the call value as Rs. 18.11 and put value as Rs. 10.27 through two different methods that yield the same result.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Answer Key CHP 18 Derivatives MarketDocument5 pagesAnswer Key CHP 18 Derivatives MarketMuhammad Luthfi Al AkbarNo ratings yet

- Q P P P P P P P P P P: Fall 2003 Society of Actuaries Course 3 Solutions Question #1 Key: EDocument40 pagesQ P P P P P P P P P P: Fall 2003 Society of Actuaries Course 3 Solutions Question #1 Key: EHông HoaNo ratings yet

- Assignment 1Document6 pagesAssignment 1Uroona MalikNo ratings yet

- Quiz MarchDocument2 pagesQuiz Marchanon_31948370No ratings yet

- SOA MFE 76 Practice Ques SolsDocument70 pagesSOA MFE 76 Practice Ques SolsGracia DongNo ratings yet

- Adcorp 4Document10 pagesAdcorp 4rtchuidjangnanaNo ratings yet

- 09 Questions SolutionsDocument3 pages09 Questions SolutionsMilan BabovicNo ratings yet

- April 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LDocument9 pagesApril 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LHông HoaNo ratings yet

- Final SBE-FINALSDocument11 pagesFinal SBE-FINALSVika BodokiaNo ratings yet

- Tugas BiostatistikDocument6 pagesTugas BiostatistikWiwi Okta RezaNo ratings yet

- Tolerance Accumulation and Analysis (GD&T)Document80 pagesTolerance Accumulation and Analysis (GD&T)Kishor kumar Bhatia50% (4)

- Problem Set 2 - SolutionsDocument3 pagesProblem Set 2 - Solutionshoi chingNo ratings yet

- B - S ModelDocument3 pagesB - S ModelMos MasNo ratings yet

- Chap 11 IBFDocument6 pagesChap 11 IBFSamra EjazNo ratings yet

- Option Valuation: Numerical ExampleDocument15 pagesOption Valuation: Numerical ExampleMarwa HassanNo ratings yet

- FandI CT3 200709 ReportDocument9 pagesFandI CT3 200709 ReportTuff BubaNo ratings yet

- TA112.BQA F.L Solution CMA May 2022 Examination PDFDocument6 pagesTA112.BQA F.L Solution CMA May 2022 Examination PDFMohammed Javed UddinNo ratings yet

- Assingnment: Ch#4 (Options Market and Contracts)Document10 pagesAssingnment: Ch#4 (Options Market and Contracts)Mahnoor ShahbazNo ratings yet

- 1.) T-Test For Differences of Two Means (Separate Variance)Document5 pages1.) T-Test For Differences of Two Means (Separate Variance)ncm_citNo ratings yet

- Tugas Ke 3 Statistika TerapanDocument11 pagesTugas Ke 3 Statistika TerapanIsma Muslihati SNo ratings yet

- Options PricingDocument17 pagesOptions Pricingvodakaa100% (1)

- Inferential StatsDocument11 pagesInferential Statsvisu009No ratings yet

- Answer 4.1Document22 pagesAnswer 4.1Ankit AgarwalNo ratings yet

- BS Assignment 2: σ given, z−test, H HDocument28 pagesBS Assignment 2: σ given, z−test, H HNiharika AnandNo ratings yet

- Chapter 6Document23 pagesChapter 6Majd AbukharmahNo ratings yet

- SFE1.6.2 - UDJ - (SOL) MBA March 2021 UDJ Final Exam Solutions - UpdatedDocument5 pagesSFE1.6.2 - UDJ - (SOL) MBA March 2021 UDJ Final Exam Solutions - UpdatedGonçalo RibeiroNo ratings yet

- Solutions To End-of-Section and Chapter Review Problems 225Document33 pagesSolutions To End-of-Section and Chapter Review Problems 225Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Practice 09Document6 pagesPractice 09daddy bobaNo ratings yet

- Number Systems: Chapter - 3Document8 pagesNumber Systems: Chapter - 3Anonymous 20No ratings yet

- Assignment 2Document9 pagesAssignment 2Shreya SingiNo ratings yet

- EEE212 Week1Document66 pagesEEE212 Week1melikeNo ratings yet

- Term I, 10/11Document1 pageTerm I, 10/11Xue Jing CongNo ratings yet

- Hint To A8Document2 pagesHint To A8whatever152207No ratings yet

- Data Storage in Computer System: BITS PilaniDocument30 pagesData Storage in Computer System: BITS PilaniKARTIK KUMAR GOYALNo ratings yet

- Banking Risk Management - Homework 3Document3 pagesBanking Risk Management - Homework 3Bảo Ngọc LêNo ratings yet

- Module 3 - Homework AssignmentDocument7 pagesModule 3 - Homework Assignmentkjoel.ngugiNo ratings yet

- Corporate Finance II Problem Set 4Document11 pagesCorporate Finance II Problem Set 4Joana Azevedo PereiraNo ratings yet

- Nsbe9ege Ism ch10Document35 pagesNsbe9ege Ism ch10高一二No ratings yet

- 05-Arithmetic Progression (AP) - SolutionDocument9 pages05-Arithmetic Progression (AP) - SolutionAmit SinghNo ratings yet

- Ilovepdf Merged 2Document232 pagesIlovepdf Merged 2Dani ShaNo ratings yet

- ECOR 2606 Lecture 12 w16Document13 pagesECOR 2606 Lecture 12 w16Ryan HiraniNo ratings yet

- ComputerArithmetic-and-Interpolation 2023Document29 pagesComputerArithmetic-and-Interpolation 2023Angus WhitnallNo ratings yet

- Edu Exam Mfe 0507 SolDocument14 pagesEdu Exam Mfe 0507 SolguidobambinoNo ratings yet

- Sampling Distribution Second Set of Exercises September 22Document9 pagesSampling Distribution Second Set of Exercises September 22Juank Z BkNo ratings yet

- MATH 1281 - Unit 2 AssignmentDocument6 pagesMATH 1281 - Unit 2 AssignmentRegNo ratings yet

- Tolerance Analysis 09.04.03Document26 pagesTolerance Analysis 09.04.03maddy_scribdNo ratings yet

- Answer Part II SpillwayDocument3 pagesAnswer Part II SpillwayFiromsa EntertainmentNo ratings yet

- 12 Sim Hw2 SolDocument3 pages12 Sim Hw2 SolJohnny TimoneyNo ratings yet

- HW 5 SolnDocument2 pagesHW 5 SolnMansi JainNo ratings yet

- Stat 234 Chang. Section 02, 391255: Ben Jacobson March 6, 2012Document4 pagesStat 234 Chang. Section 02, 391255: Ben Jacobson March 6, 2012Ben JacobsonNo ratings yet

- MA2177 Ex6 SolDocument3 pagesMA2177 Ex6 Solkyle cheungNo ratings yet

- Decimal FractionDocument15 pagesDecimal Fractionsathish14singhNo ratings yet

- Answers To Activities 1 2 3 (Chap 4 Lesson 3-7)Document2 pagesAnswers To Activities 1 2 3 (Chap 4 Lesson 3-7)Miguel AsuncionNo ratings yet

- CJC h2 Math p2 SolutionDocument14 pagesCJC h2 Math p2 SolutionjimmytanlimlongNo ratings yet

- TamDocument1 pageTamyeng botzNo ratings yet

- Intro To Stats AssignmentDocument10 pagesIntro To Stats AssignmentAlexandrite Jem PearlNo ratings yet

- AP Maths 2020 P2 MemoDocument13 pagesAP Maths 2020 P2 MemoramalalemohapijrNo ratings yet

- MIT18 05S14 ps9 Solutions PDFDocument5 pagesMIT18 05S14 ps9 Solutions PDFMd CassimNo ratings yet

- BinomialDocument1 pageBinomialfxn fndNo ratings yet

- Future ContractDocument2 pagesFuture Contractfxn fndNo ratings yet

- StraddleDocument1 pageStraddlefxn fndNo ratings yet

- UntitledDocument1 pageUntitledfxn fndNo ratings yet

- Transaction and Economic Risk ExampleDocument1 pageTransaction and Economic Risk Examplefxn fndNo ratings yet

- Butterfly SpreadDocument1 pageButterfly Spreadfxn fndNo ratings yet

- Futures HedgingDocument1 pageFutures Hedgingfxn fndNo ratings yet

- Replacement Decision ExampleDocument1 pageReplacement Decision Examplefxn fndNo ratings yet

- Facility LocationDocument1 pageFacility Locationfxn fndNo ratings yet

- Average Rate of Return ExampleDocument1 pageAverage Rate of Return Examplefxn fndNo ratings yet

- Foreign Exchange RiskDocument2 pagesForeign Exchange Riskfxn fndNo ratings yet

- MQP For MBA I Semester Students of SPPUDocument2 pagesMQP For MBA I Semester Students of SPPUfxn fndNo ratings yet

- Working CapitalDocument3 pagesWorking Capitalfxn fndNo ratings yet

Black and Scholes

Black and Scholes

Uploaded by

fxn fnd0 ratings0% found this document useful (0 votes)

16 views1 pageThe document calculates call and put option values using the Black-Scholes model given stock price, time to expiration, risk-free interest rate, standard deviation, and exercise price. It determines the values of d1 and d2, then uses these to calculate the call value as Rs. 18.11 and put value as Rs. 10.27 through two different methods that yield the same result.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document calculates call and put option values using the Black-Scholes model given stock price, time to expiration, risk-free interest rate, standard deviation, and exercise price. It determines the values of d1 and d2, then uses these to calculate the call value as Rs. 18.11 and put value as Rs. 10.27 through two different methods that yield the same result.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views1 pageBlack and Scholes

Black and Scholes

Uploaded by

fxn fndThe document calculates call and put option values using the Black-Scholes model given stock price, time to expiration, risk-free interest rate, standard deviation, and exercise price. It determines the values of d1 and d2, then uses these to calculate the call value as Rs. 18.11 and put value as Rs. 10.27 through two different methods that yield the same result.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

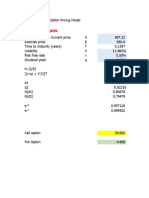

Example: Using the given data calculate the value of a call and put

option as per Black and Scholes model.

Stock Price `120

Time to expire 3 Months (t = 0.25 years)

Risk free rate of interest 10% p.a. continuously compounded

Standard deviation of 0.6

stock

Exercise price `115

Ans: The values of d1 and d2 as shown below:

2

1 n(120/115 )+(0 .10+0 .5×0 .6 )(0. 25 )

d1= =0 .37

0 .6 √ 0 . 25

2

1 n(120 /115 )+(0 . 10−0 .5×0 . 6 )(0 . 25)

d 2= =0 . 07

0 . 6 √ 0. 25

From the table of the area under a normal curve, z = 0.37 (= d 1), the area

= 0.1443 and for z(= d2) = 0.07, the area = 0.0279.

These values give the areas between mean and the specified values of d 1

and d2.

The total areas under the normal curve to the left of d 1 and d2, which are

respectively 0.5 + 0.1443 = 0.6443 and 0.5 + 0.0279 = 0.5279. Thus,

N(d1) = N(0.37) = 0.6443, N(d2) = N(0.07) = 0.5279.

115

0 .10( 0. 25 )

The value of the call is: C = 120 × (0.6443) – e (0.5279)

= `18.11

Calculation of Put Option Value

Using the put-call parity, the put option value as follows:

P = C + Ee–rt – S0 = 18.11 + 115 e– (0.10) (0.25) – 120 = `10.27

Using the put-call parity model, the put option value is given below:

P = Ee– rt N(– d2) – S0 N(– d1)

where, E = `115, r = 0.10, t = 0.25, S0 = `120, d1 = 0.37 and d2 = 0.07.

Accordingly, N(– d1) = N(– 0.37) = 0.3557 and N(– d 2) = N(– 0.07) =

0.4721

Now, P = 115 × e– 0.10 × 0.25 × 0.4721 – 120 × 0.3557 = 52.95 – 42.68 =

`10.27

* *

You might also like

- Answer Key CHP 18 Derivatives MarketDocument5 pagesAnswer Key CHP 18 Derivatives MarketMuhammad Luthfi Al AkbarNo ratings yet

- Q P P P P P P P P P P: Fall 2003 Society of Actuaries Course 3 Solutions Question #1 Key: EDocument40 pagesQ P P P P P P P P P P: Fall 2003 Society of Actuaries Course 3 Solutions Question #1 Key: EHông HoaNo ratings yet

- Assignment 1Document6 pagesAssignment 1Uroona MalikNo ratings yet

- Quiz MarchDocument2 pagesQuiz Marchanon_31948370No ratings yet

- SOA MFE 76 Practice Ques SolsDocument70 pagesSOA MFE 76 Practice Ques SolsGracia DongNo ratings yet

- Adcorp 4Document10 pagesAdcorp 4rtchuidjangnanaNo ratings yet

- 09 Questions SolutionsDocument3 pages09 Questions SolutionsMilan BabovicNo ratings yet

- April 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LDocument9 pagesApril 2014 MLC Multiple Choice Solutions: L L L L L L D Q L L LHông HoaNo ratings yet

- Final SBE-FINALSDocument11 pagesFinal SBE-FINALSVika BodokiaNo ratings yet

- Tugas BiostatistikDocument6 pagesTugas BiostatistikWiwi Okta RezaNo ratings yet

- Tolerance Accumulation and Analysis (GD&T)Document80 pagesTolerance Accumulation and Analysis (GD&T)Kishor kumar Bhatia50% (4)

- Problem Set 2 - SolutionsDocument3 pagesProblem Set 2 - Solutionshoi chingNo ratings yet

- B - S ModelDocument3 pagesB - S ModelMos MasNo ratings yet

- Chap 11 IBFDocument6 pagesChap 11 IBFSamra EjazNo ratings yet

- Option Valuation: Numerical ExampleDocument15 pagesOption Valuation: Numerical ExampleMarwa HassanNo ratings yet

- FandI CT3 200709 ReportDocument9 pagesFandI CT3 200709 ReportTuff BubaNo ratings yet

- TA112.BQA F.L Solution CMA May 2022 Examination PDFDocument6 pagesTA112.BQA F.L Solution CMA May 2022 Examination PDFMohammed Javed UddinNo ratings yet

- Assingnment: Ch#4 (Options Market and Contracts)Document10 pagesAssingnment: Ch#4 (Options Market and Contracts)Mahnoor ShahbazNo ratings yet

- 1.) T-Test For Differences of Two Means (Separate Variance)Document5 pages1.) T-Test For Differences of Two Means (Separate Variance)ncm_citNo ratings yet

- Tugas Ke 3 Statistika TerapanDocument11 pagesTugas Ke 3 Statistika TerapanIsma Muslihati SNo ratings yet

- Options PricingDocument17 pagesOptions Pricingvodakaa100% (1)

- Inferential StatsDocument11 pagesInferential Statsvisu009No ratings yet

- Answer 4.1Document22 pagesAnswer 4.1Ankit AgarwalNo ratings yet

- BS Assignment 2: σ given, z−test, H HDocument28 pagesBS Assignment 2: σ given, z−test, H HNiharika AnandNo ratings yet

- Chapter 6Document23 pagesChapter 6Majd AbukharmahNo ratings yet

- SFE1.6.2 - UDJ - (SOL) MBA March 2021 UDJ Final Exam Solutions - UpdatedDocument5 pagesSFE1.6.2 - UDJ - (SOL) MBA March 2021 UDJ Final Exam Solutions - UpdatedGonçalo RibeiroNo ratings yet

- Solutions To End-of-Section and Chapter Review Problems 225Document33 pagesSolutions To End-of-Section and Chapter Review Problems 225Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Practice 09Document6 pagesPractice 09daddy bobaNo ratings yet

- Number Systems: Chapter - 3Document8 pagesNumber Systems: Chapter - 3Anonymous 20No ratings yet

- Assignment 2Document9 pagesAssignment 2Shreya SingiNo ratings yet

- EEE212 Week1Document66 pagesEEE212 Week1melikeNo ratings yet

- Term I, 10/11Document1 pageTerm I, 10/11Xue Jing CongNo ratings yet

- Hint To A8Document2 pagesHint To A8whatever152207No ratings yet

- Data Storage in Computer System: BITS PilaniDocument30 pagesData Storage in Computer System: BITS PilaniKARTIK KUMAR GOYALNo ratings yet

- Banking Risk Management - Homework 3Document3 pagesBanking Risk Management - Homework 3Bảo Ngọc LêNo ratings yet

- Module 3 - Homework AssignmentDocument7 pagesModule 3 - Homework Assignmentkjoel.ngugiNo ratings yet

- Corporate Finance II Problem Set 4Document11 pagesCorporate Finance II Problem Set 4Joana Azevedo PereiraNo ratings yet

- Nsbe9ege Ism ch10Document35 pagesNsbe9ege Ism ch10高一二No ratings yet

- 05-Arithmetic Progression (AP) - SolutionDocument9 pages05-Arithmetic Progression (AP) - SolutionAmit SinghNo ratings yet

- Ilovepdf Merged 2Document232 pagesIlovepdf Merged 2Dani ShaNo ratings yet

- ECOR 2606 Lecture 12 w16Document13 pagesECOR 2606 Lecture 12 w16Ryan HiraniNo ratings yet

- ComputerArithmetic-and-Interpolation 2023Document29 pagesComputerArithmetic-and-Interpolation 2023Angus WhitnallNo ratings yet

- Edu Exam Mfe 0507 SolDocument14 pagesEdu Exam Mfe 0507 SolguidobambinoNo ratings yet

- Sampling Distribution Second Set of Exercises September 22Document9 pagesSampling Distribution Second Set of Exercises September 22Juank Z BkNo ratings yet

- MATH 1281 - Unit 2 AssignmentDocument6 pagesMATH 1281 - Unit 2 AssignmentRegNo ratings yet

- Tolerance Analysis 09.04.03Document26 pagesTolerance Analysis 09.04.03maddy_scribdNo ratings yet

- Answer Part II SpillwayDocument3 pagesAnswer Part II SpillwayFiromsa EntertainmentNo ratings yet

- 12 Sim Hw2 SolDocument3 pages12 Sim Hw2 SolJohnny TimoneyNo ratings yet

- HW 5 SolnDocument2 pagesHW 5 SolnMansi JainNo ratings yet

- Stat 234 Chang. Section 02, 391255: Ben Jacobson March 6, 2012Document4 pagesStat 234 Chang. Section 02, 391255: Ben Jacobson March 6, 2012Ben JacobsonNo ratings yet

- MA2177 Ex6 SolDocument3 pagesMA2177 Ex6 Solkyle cheungNo ratings yet

- Decimal FractionDocument15 pagesDecimal Fractionsathish14singhNo ratings yet

- Answers To Activities 1 2 3 (Chap 4 Lesson 3-7)Document2 pagesAnswers To Activities 1 2 3 (Chap 4 Lesson 3-7)Miguel AsuncionNo ratings yet

- CJC h2 Math p2 SolutionDocument14 pagesCJC h2 Math p2 SolutionjimmytanlimlongNo ratings yet

- TamDocument1 pageTamyeng botzNo ratings yet

- Intro To Stats AssignmentDocument10 pagesIntro To Stats AssignmentAlexandrite Jem PearlNo ratings yet

- AP Maths 2020 P2 MemoDocument13 pagesAP Maths 2020 P2 MemoramalalemohapijrNo ratings yet

- MIT18 05S14 ps9 Solutions PDFDocument5 pagesMIT18 05S14 ps9 Solutions PDFMd CassimNo ratings yet

- BinomialDocument1 pageBinomialfxn fndNo ratings yet

- Future ContractDocument2 pagesFuture Contractfxn fndNo ratings yet

- StraddleDocument1 pageStraddlefxn fndNo ratings yet

- UntitledDocument1 pageUntitledfxn fndNo ratings yet

- Transaction and Economic Risk ExampleDocument1 pageTransaction and Economic Risk Examplefxn fndNo ratings yet

- Butterfly SpreadDocument1 pageButterfly Spreadfxn fndNo ratings yet

- Futures HedgingDocument1 pageFutures Hedgingfxn fndNo ratings yet

- Replacement Decision ExampleDocument1 pageReplacement Decision Examplefxn fndNo ratings yet

- Facility LocationDocument1 pageFacility Locationfxn fndNo ratings yet

- Average Rate of Return ExampleDocument1 pageAverage Rate of Return Examplefxn fndNo ratings yet

- Foreign Exchange RiskDocument2 pagesForeign Exchange Riskfxn fndNo ratings yet

- MQP For MBA I Semester Students of SPPUDocument2 pagesMQP For MBA I Semester Students of SPPUfxn fndNo ratings yet

- Working CapitalDocument3 pagesWorking Capitalfxn fndNo ratings yet