Professional Documents

Culture Documents

Capital Structure - Balance Sheet Problems

Capital Structure - Balance Sheet Problems

Uploaded by

Shripradha AcharyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Structure - Balance Sheet Problems

Capital Structure - Balance Sheet Problems

Uploaded by

Shripradha AcharyaCopyright:

Available Formats

UNIT- 3 FINANCIAL DECISION 11/25/2020

Problem 29

ABC ltd capitalized with 1000000 divided into 10000 equity shares of Rs.100

each. The management decided to raise additional capital Rs.1000000 to fiancé

major expansion programme.

All in equity shares

All in debentures carrying 8% interest

Rs.500000 in equity shares and Rs.500000 in debentures carrying

8% dentures.

Rs.500000 in equity and Rs.500000 in 10% preference shares.

You are required to calculate EPS. If the company EBIT is Rs.600000 assuming

that corporate tax 50%.

Solution:

Calculation of EPS under various capital structure

Particulars Plan I Plan II Plan III Plan IV

1000000eq.sh 1000000 8% 500000 eq+ 5L Eq sh

debs 8% 500000 +5L 10% prfe

debs

EBIT 600000 600000 600000 600000

Less: interest on debs nil 80000 40000 nil

EBT 600000 520000 560000 600000

Less: Tax on 50% 300000 260000 280000 300000

EAT/PAT 300000 260000 280000 300000

Less: Preference nil nil nil 50000

dividend

UNIT- 3 FINANCIAL DECISION PROF.NAGASHREE R PUJARI

SIMS

UNIT- 3 FINANCIAL DECISION 11/25/2020

Amount available to 300000 260000 280000 250000

equity shareholders

Number of equity 20000 10000 15000 15000

share

EPS 300000/20000 260000/10000 280000/15000 250000/15000

EPS 15 26 18.6 16.66

Recommend:

In case of plan II Where additional capital of Rs.1000000 funds collected by the

issue of debentures. EPS is maximum is Rs.26. therefore Plan II is recommended

and it’s suitable to shareholder point of view.

Problem 30:

The balance sheet of a company is as under:

liabilities amount Assets amount

Equity shares capital of 600000 Fixed assets 1500000

Rs.10 each

10% debentures 800000 Current assets 500000

Profit and loss a/c 200000

Creditors 400000

2000000 2000000

The company’s total assets turnover is 5times its fixed operating cost is

Rs.1000000 and variable cost is 30% of sales. Tax rate is 50%.

Calculate 1. Operating and financial and combined leverages

1. Show the likely level of EBIT if EPS is Rs.5 Rs.3 and Rs.2.

Solution:

UNIT- 3 FINANCIAL DECISION PROF.NAGASHREE R PUJARI

SIMS

UNIT- 3 FINANCIAL DECISION 11/25/2020

Calculation of sales

Total assets turnover ratio= sales

Total assets

5= sales

2000000

Sales= 2000000X 5

SALES = 10000000

INCOME STATEMENT

Particulars Amount

Sales 10000000

Less: variable cost (30% on 10000000) 3000000

Contribution 7000000

Less: fixed cost 1000000

EBIT 6000000

Less: interest on debt (800000x 10%) 80000

EBT 5920000

Less: Tax @50% 2960000

EAT/PAT 2960000

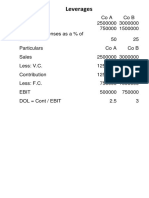

1. Calculation of operating leverages

Contribution/ EBIT

7000000/6000000

1.16TIMES

2. Calculation of financial leverages

EBIT/EBT

6000000/5920000

1.01Times

UNIT- 3 FINANCIAL DECISION PROF.NAGASHREE R PUJARI

SIMS

UNIT- 3 FINANCIAL DECISION 11/25/2020

3. Calculation of Combined Leverages

Operating X financial Leverage

1.16 X1.01

1.17Times

2. When EPS is Rs.5

Calculation of EBIT

EPS= Amount available equity shareholders

No. of Equity shares

5=(EBIT-Interest)(1- tax)-preference dividend

No. of equity shares

5 =(EBIT-80000)(1-50/100)-NIL

60000

5=(EBIT-80000)(1-0.5)-NIL

60000

5x 60000= EBIT x 0.5 – 80000 x 0.5

300000= EBIT x 0.5 – 40000

300000+40000= EBIT x 0.5

340000 = EBIT x 0.5

EBIT =340000/0.5

EBIT = Rs.680000

UNIT- 3 FINANCIAL DECISION PROF.NAGASHREE R PUJARI

SIMS

UNIT- 3 FINANCIAL DECISION 11/25/2020

3. When EPS is Rs.3

Calculation of EBIT

EPS= Amount available equity shareholders

No. of Equity shares

Rs.3 = (EBIT-Interest)(1- tax)-preference dividend

No. of equity shares

Rs.3= (EBIT-80000)(1-0.5)-nil

60000

Rs.3 x 60000= (EBIT x 0.5 -80000 x0.5

180000=EBIT x 0.5 – 40000

180000+40000= EBIT x 0.5

220000= EBIT x 0.5

EBIT =220000/0.5

EBIT = Rs.440000

4. When EPS Rs.2

EPS= Amount available equity shareholders

No. of Equity shares

Rs.2 = (EBIT-Interest)(1- tax)-preference dividend

No. of equity shares

Rs.2= (EBIT-80000)(1-0.5)-nil

60000

Rs.2 x 60000= (EBIT x 0.5 -80000 x0.5

120000=EBIT x 0.5 – 40000

120000+40000= EBIT x 0.5

160000= EBIT x 0.5

EBIT =160000/0.5

EBIT = Rs.320000

UNIT- 3 FINANCIAL DECISION PROF.NAGASHREE R PUJARI

SIMS

You might also like

- Integrated Review May 2020 Batch Second Monthly Exams AfarDocument94 pagesIntegrated Review May 2020 Batch Second Monthly Exams AfarKriztle Kate Gelogo100% (5)

- HRM AssignmentDocument3 pagesHRM AssignmentakshitNo ratings yet

- 2018 Global Private Equity & Venture Capital Report - Single Licence - pdf82263Document147 pages2018 Global Private Equity & Venture Capital Report - Single Licence - pdf82263wkNo ratings yet

- Financing Decision - Questions OnlyDocument7 pagesFinancing Decision - Questions OnlySHANMUGHA SHETTY S SNo ratings yet

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- Numericals On Financial ManagementDocument4 pagesNumericals On Financial ManagementDhruv100% (1)

- Ealities of Ufism And: Adariyah AwiyahDocument42 pagesEalities of Ufism And: Adariyah AwiyahYusufAliBahrNo ratings yet

- Custodial Torture and Its RemediesDocument6 pagesCustodial Torture and Its RemediesKaramjeet Singh BajwaNo ratings yet

- Delay Defeats EquityDocument5 pagesDelay Defeats EquityMercy NamboNo ratings yet

- Andrew J. Spieles Plea AgreementDocument11 pagesAndrew J. Spieles Plea AgreementWSETNo ratings yet

- Problems On Capital SturctureDocument6 pagesProblems On Capital SturctureShripradha AcharyaNo ratings yet

- Capital StructureDocument7 pagesCapital StructureShripradha AcharyaNo ratings yet

- Problems On EpsDocument5 pagesProblems On EpsShripradha AcharyaNo ratings yet

- 2nd Assignment of Financial ManagementDocument6 pages2nd Assignment of Financial Managementpratiksha24No ratings yet

- Financial Leverage Excel Template: Visit: EmailDocument4 pagesFinancial Leverage Excel Template: Visit: EmailAsad MuhammadNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Unit 2 LeveragesDocument4 pagesUnit 2 Leveragesbhargavayg1915No ratings yet

- Financial Management Chapter-3 Financial DecisionDocument11 pagesFinancial Management Chapter-3 Financial DecisionYashaswini JettyNo ratings yet

- Capital Structure.Document22 pagesCapital Structure.Puneet ShirahattiNo ratings yet

- Mba 104 PDFDocument2 pagesMba 104 PDFSimanta KalitaNo ratings yet

- LEVERAGESDocument96 pagesLEVERAGESNaman LadhaNo ratings yet

- Notes CA Int GMDocument51 pagesNotes CA Int GMDharmateja ChakriNo ratings yet

- FM Assignment1Document6 pagesFM Assignment1Rishi Kumar SainiNo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Management Accounting SchemeDocument8 pagesManagement Accounting SchemeSpandana Madhan SmrbNo ratings yet

- Total Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityDocument29 pagesTotal Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityshabNo ratings yet

- Cash and Credit ManagementDocument11 pagesCash and Credit Managementaoishic2025No ratings yet

- Leverage: Prepared By:-Priyanka GohilDocument23 pagesLeverage: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- LEVERAGE - Hons.Document7 pagesLEVERAGE - Hons.BISHAL ROYNo ratings yet

- ST-1 (Analysis of Recessionary Cash Flows) ADocument4 pagesST-1 (Analysis of Recessionary Cash Flows) AGA ZinNo ratings yet

- Afm Long - Term Financing - LeveragesDocument8 pagesAfm Long - Term Financing - LeveragesDaniel HaileNo ratings yet

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- OLC Chap 20Document5 pagesOLC Chap 20NeelNo ratings yet

- Tutorial QuestionsDocument3 pagesTutorial QuestionsNishika KaranNo ratings yet

- FM Questions RevisedDocument15 pagesFM Questions RevisedRajarshi DaharwalNo ratings yet

- Capital Structure Theories 5 VivaDocument34 pagesCapital Structure Theories 5 VivaPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Accounting 2 - Chapter 14 - Notes - MiuDocument4 pagesAccounting 2 - Chapter 14 - Notes - MiuAhmad Osama MashalyNo ratings yet

- Leverages: Raksha Khetan-23 Saumitra Kumar-26 Saqib Azam Qadri-42Document21 pagesLeverages: Raksha Khetan-23 Saumitra Kumar-26 Saqib Azam Qadri-42sampdalvi07No ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- FM NumericalDocument3 pagesFM NumericalNitin KumarNo ratings yet

- Leverages PDFDocument7 pagesLeverages PDFVaishnavi ShigvanNo ratings yet

- Leverage Unit-4 Part - IIDocument34 pagesLeverage Unit-4 Part - IIAstha ParmanandkaNo ratings yet

- Chapter 5 LectureDocument6 pagesChapter 5 LectureSaadNo ratings yet

- District Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management AccountingDocument5 pagesDistrict Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management Accountingtadepalli patanjaliNo ratings yet

- LeverageDocument4 pagesLeverageKhushi RaniNo ratings yet

- Ratio Analysis Liquidity Ratios Solvency RatiosDocument55 pagesRatio Analysis Liquidity Ratios Solvency Ratiossarika gurjarNo ratings yet

- 3A. Capital Structure Leverages Numerical MarkedDocument3 pages3A. Capital Structure Leverages Numerical MarkedSundeep MogantiNo ratings yet

- Leverage AnalysisDocument3 pagesLeverage AnalysisYusuf TakliwalaNo ratings yet

- Leverage & Risk AnalysisDocument11 pagesLeverage & Risk AnalysisAnkush ChoudharyNo ratings yet

- Capital Structure and Leverages-ProblemsDocument7 pagesCapital Structure and Leverages-ProblemsUday GowdaNo ratings yet

- Chapter 5 Leverages - PracticeDocument10 pagesChapter 5 Leverages - PracticeAkshat SinghNo ratings yet

- MANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIIDocument5 pagesMANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIItadepalli patanjaliNo ratings yet

- Ebit Eps AnalysisDocument22 pagesEbit Eps AnalysisPiyuksha PargalNo ratings yet

- Capital StructureDocument9 pagesCapital StructureDEVNo ratings yet

- Simple Problems On NCIDocument8 pagesSimple Problems On NCIKiran Kumar KBNo ratings yet

- Financial and Management AccountingDocument2 pagesFinancial and Management AccountingHarshithNo ratings yet

- Problems On Leverage AnalysisDocument4 pagesProblems On Leverage AnalysisMandar SangleNo ratings yet

- MaDocument6 pagesMaAashayNo ratings yet

- 6 - Dividend - DividendPolicy - FM - Mahesh MeenaDocument9 pages6 - Dividend - DividendPolicy - FM - Mahesh MeenaIshvinder SinghNo ratings yet

- MB0041 Accounts Assingment FinalDocument20 pagesMB0041 Accounts Assingment FinalRati BhanNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- New ProjectDocument10 pagesNew Projectvishal soniNo ratings yet

- Final Exam 2020 CorrectionDocument4 pagesFinal Exam 2020 Correctionmonaatallah1No ratings yet

- SYBBA Assignments (2019 Pattern) - Tri 4,5 & 6 - September 2021-1Document12 pagesSYBBA Assignments (2019 Pattern) - Tri 4,5 & 6 - September 2021-1Vaidehi sonawaniNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Capital StructureDocument7 pagesCapital StructureShripradha AcharyaNo ratings yet

- Problems On Capital SturctureDocument6 pagesProblems On Capital SturctureShripradha AcharyaNo ratings yet

- Problems On EpsDocument5 pagesProblems On EpsShripradha AcharyaNo ratings yet

- TempDocument2 pagesTempShripradha AcharyaNo ratings yet

- TempDocument14 pagesTempShripradha AcharyaNo ratings yet

- TempDocument14 pagesTempShripradha AcharyaNo ratings yet

- Cucho PoemDocument9 pagesCucho PoemShripradha AcharyaNo ratings yet

- ED CH 2 NotesDocument16 pagesED CH 2 NotesShripradha AcharyaNo ratings yet

- ED CH 1 NotesDocument12 pagesED CH 1 NotesShripradha AcharyaNo ratings yet

- How Philip Morris Conquered TurkeyDocument7 pagesHow Philip Morris Conquered TurkeyjoaobastoNo ratings yet

- Appellant's BriefDocument13 pagesAppellant's BriefJojo Navarro100% (1)

- 103-SSS Employees Association vs. Court of Appeals (G.R. No. 85279, July 28, 1989) - AtienzaDocument2 pages103-SSS Employees Association vs. Court of Appeals (G.R. No. 85279, July 28, 1989) - AtienzaAdrian Gabriel S. AtienzaNo ratings yet

- Carter Cleaning Centres Chapter 2 Questions 1-5, Chapter 4 Questions 1-4 - MD Tarik Alam ShobujDocument3 pagesCarter Cleaning Centres Chapter 2 Questions 1-5, Chapter 4 Questions 1-4 - MD Tarik Alam ShobujTarik Alam ShobujNo ratings yet

- Census Into Local Government Representatives in TasmaniaDocument38 pagesCensus Into Local Government Representatives in TasmaniaThe ExaminerNo ratings yet

- Finals Land Titles No CasesDocument20 pagesFinals Land Titles No CasesMikaela PamatmatNo ratings yet

- Commission For Africa 11-03-05 - CR - ReportDocument464 pagesCommission For Africa 11-03-05 - CR - ReportyigsNo ratings yet

- Effect On Demonetization On Indian BanksDocument26 pagesEffect On Demonetization On Indian BanksDivyam DoshiNo ratings yet

- Script (Passion of Christ) : Scene 1 - PALM SUNDAY (Sisters House)Document9 pagesScript (Passion of Christ) : Scene 1 - PALM SUNDAY (Sisters House)Gabriele EmanueleNo ratings yet

- M Com Tax PDFDocument336 pagesM Com Tax PDFakshNo ratings yet

- Career As LawyerDocument3 pagesCareer As LawyerDenisa CalinaNo ratings yet

- Business Ethics 1Document3 pagesBusiness Ethics 1Aravind 9901366442 - 99027872240% (2)

- Rules of BasketballDocument5 pagesRules of BasketballzortolafyuNo ratings yet

- Settlement Agreement CEDIRESDocument5 pagesSettlement Agreement CEDIRESkalaiNo ratings yet

- AudirecallDocument3 pagesAudirecallistaknut.otkucaji0aNo ratings yet

- Law and EthicsDocument52 pagesLaw and EthicsJanani PriyaNo ratings yet

- Case Study DigicelDocument14 pagesCase Study DigicelSS JerryNo ratings yet

- Indian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolDocument44 pagesIndian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- Chapter-6: Letter of Credit Chapter-6: Letter of CreditDocument39 pagesChapter-6: Letter of Credit Chapter-6: Letter of CreditNazmul H. PalashNo ratings yet

- MA Edition Doha V5sentDocument82 pagesMA Edition Doha V5sentMohamed ElkammahNo ratings yet

- Calculating LDDocument13 pagesCalculating LDk1l2d3No ratings yet

- Some of Rizal's Cultural Observation During The Travel:: By-Jose-Rizal-Los-ViajesDocument20 pagesSome of Rizal's Cultural Observation During The Travel:: By-Jose-Rizal-Los-ViajesSheena SangalangNo ratings yet

- Amnf2011 Invitation LetterDocument8 pagesAmnf2011 Invitation LetterLam Kian YipNo ratings yet