Professional Documents

Culture Documents

Note On Tax Rebate On Takaful Contribution 2019 20 Other Than Salaried

Note On Tax Rebate On Takaful Contribution 2019 20 Other Than Salaried

Uploaded by

syed aamir shahCopyright:

Available Formats

You might also like

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- InvoiceDocument1 pageInvoicePankaj TrigunNo ratings yet

- Employee Exit ChecklistDocument9 pagesEmployee Exit ChecklistRudraneel DasNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 SalariedRoy Estate (Sajila Roy)No ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- 3-5yr ProjectionDocument2 pages3-5yr ProjectionKamille SumaoangNo ratings yet

- Main Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleDocument12 pagesMain Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleHussain ImranNo ratings yet

- Output Financial ManagemntDocument8 pagesOutput Financial ManagemntEmzNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- 2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021eDocument1 page2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021evivianclementNo ratings yet

- Proposal Project AyamDocument14 pagesProposal Project AyamIrvan PamungkasNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- 2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount ExceedingDocument2 pages2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount Exceedingsarwar raziNo ratings yet

- Financial AnalysisDocument1 pageFinancial Analysisjay kudiNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Gate of Aden Plan 2020Document1 pageGate of Aden Plan 2020Mohammad HanafyNo ratings yet

- Bank ManagementDocument14 pagesBank ManagementAreeba MalikNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- Edited FSDocument40 pagesEdited FShello kitty black and whiteNo ratings yet

- Tax DefinitionsDocument4 pagesTax DefinitionsrajaNo ratings yet

- FM AssignmentDocument23 pagesFM AssignmentMuskan NagarNo ratings yet

- Salary Tax Calculator Pak-2019-20Document2 pagesSalary Tax Calculator Pak-2019-20Usman HabibNo ratings yet

- Financial Model For Value RetailingDocument1,643 pagesFinancial Model For Value RetailingSaif Ali JamadarNo ratings yet

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazNo ratings yet

- 2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2Document2 pages2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2raskaNo ratings yet

- Project Telehealth - Health at Home: Equipment InformationDocument1 pageProject Telehealth - Health at Home: Equipment InformationSenapati Prabhupada DasNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument4 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialtehreemNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Financial Analysis ModelDocument5 pagesFinancial Analysis ModelShanaya JainNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument7 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialআসিফহাসানখানNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Year Sales Volume Sales VC FC DepDocument8 pagesYear Sales Volume Sales VC FC DepMohammad Umair SheraziNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialEsani DeNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- Analysis of FS PDF Vertical and HorizontalDocument9 pagesAnalysis of FS PDF Vertical and HorizontalJmaseNo ratings yet

- FINANCIAL ANALYSIS Practice 3Document15 pagesFINANCIAL ANALYSIS Practice 3Hallasgo, Elymar SorianoNo ratings yet

- NPS Calculator Free Download ExcelDocument7 pagesNPS Calculator Free Download Excelgroup 19No ratings yet

- Profitability RatioDocument11 pagesProfitability RatioNicole Kate PorrasNo ratings yet

- INR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.0Document7 pagesINR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.057 - Lakshita TanwaniNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Document7 pagesPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNo ratings yet

- Aspira 2 Sum FinDocument5 pagesAspira 2 Sum FinYork Daily Record/Sunday NewsNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Income Statement: USD $000s 2014A 2015A 2016E 2017E 2018EDocument3 pagesIncome Statement: USD $000s 2014A 2015A 2016E 2017E 2018EAgyei DanielNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Otun's WorkDocument4 pagesOtun's WorkoluwapelumiotunNo ratings yet

- Project 1 (PP, NPV, IRR)Document5 pagesProject 1 (PP, NPV, IRR)Yashwini KomagenNo ratings yet

- Budgeting SolutionsDocument9 pagesBudgeting SolutionsPavan Kalyan KolaNo ratings yet

- Mooc FinanzasDocument2 pagesMooc FinanzasAlvaro LainezNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- CamScanner 11-02-2023 09.28Document4 pagesCamScanner 11-02-2023 09.28syed aamir shahNo ratings yet

- Full Stack Web DevelopmentDocument18 pagesFull Stack Web Developmentsyed aamir shahNo ratings yet

- Shaukat Khanum Memorial Cancer Hospital & Research Centre: Liver Abscess Culture and SensitivityDocument1 pageShaukat Khanum Memorial Cancer Hospital & Research Centre: Liver Abscess Culture and Sensitivitysyed aamir shahNo ratings yet

- Corporate Announcement - Change of NameDocument1 pageCorporate Announcement - Change of Namesyed aamir shahNo ratings yet

- UntitledDocument145 pagesUntitledsyed aamir shahNo ratings yet

- EprocurementDocument35 pagesEprocurementsyed aamir shahNo ratings yet

- GeneralinsDocument1 pageGeneralinssyed aamir shahNo ratings yet

- Reduce Your TaxesDocument3 pagesReduce Your Taxessyed aamir shahNo ratings yet

- Rule 47Document1 pageRule 47syed aamir shahNo ratings yet

- Task Force Report On Urban Development: Government of PakistanDocument34 pagesTask Force Report On Urban Development: Government of Pakistansyed aamir shahNo ratings yet

- Flipkart - 1688414120000Document15 pagesFlipkart - 1688414120000Anil ChauhanNo ratings yet

- Account Statement: Theme Engineering Services Private LimitedDocument1 pageAccount Statement: Theme Engineering Services Private LimitedashutoshstepcountNo ratings yet

- RandommmmmDocument8 pagesRandommmmmMmNo ratings yet

- Nra Audit ReportDocument20 pagesNra Audit ReportBampiaNo ratings yet

- Income Tax: Cabria Cpa Review CenterDocument4 pagesIncome Tax: Cabria Cpa Review CenterMaeNo ratings yet

- GST Impact On E-CommerceDocument2 pagesGST Impact On E-CommercePAUL FREDERICK LLMNo ratings yet

- Purchaseorder - 1 Smart Tech Software SolutionDocument1 pagePurchaseorder - 1 Smart Tech Software SolutionEXTECH CERTIFICATIONSNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaShefali MandowaraNo ratings yet

- BIR Ruling 173-99 - Sale or Transfer of Motor VehiclesDocument2 pagesBIR Ruling 173-99 - Sale or Transfer of Motor VehiclesJerwin Dave100% (1)

- I 1040 ScaDocument19 pagesI 1040 Scahgfed4321No ratings yet

- Cancellation Letter For Full AmountDocument1 pageCancellation Letter For Full AmountRahul100% (1)

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- Bir Form 2550Q Summary Alphalist of Withholding Taxes (Sawt)Document2 pagesBir Form 2550Q Summary Alphalist of Withholding Taxes (Sawt)Renz Christopher TangcaNo ratings yet

- Itr File 2023:24Document9 pagesItr File 2023:24Aatif KhanNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument21 pagesChapter 1 Introduction To Consumption TaxesNacpil, Alyssa JesseNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBHarsh GandhiNo ratings yet

- IGL B2003 June 2022Document2 pagesIGL B2003 June 2022shivam_2607No ratings yet

- Shri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDDocument46 pagesShri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDSridharRaoNo ratings yet

- Eagle Security: Your Number One Partner in The Security IndustryDocument2 pagesEagle Security: Your Number One Partner in The Security IndustrySimbarashe MarisaNo ratings yet

- Bir Form 2306 and 2307 MchsDocument3 pagesBir Form 2306 and 2307 Mchschristopher labastidaNo ratings yet

- Income TaxDocument36 pagesIncome Taxnati100% (1)

- Sin TítuloDocument14 pagesSin TítuloTavo MCNo ratings yet

- 2020 S1 Accg3020 L01Document32 pages2020 S1 Accg3020 L01elviraanggrainiNo ratings yet

- AIR CANADA V Cir Final Case DigestDocument2 pagesAIR CANADA V Cir Final Case DigestAnalou Agustin Villeza0% (1)

- For Any Transactional Queries Related To Donations Please ContactDocument1 pageFor Any Transactional Queries Related To Donations Please ContactChristo JeniferNo ratings yet

- Pascual vs. DragonDocument2 pagesPascual vs. DragonRussell John HipolitoNo ratings yet

- 1 - Income Tax Introduction With Lecture NotesDocument14 pages1 - Income Tax Introduction With Lecture NotesdjNo ratings yet

- Filling Up Forms AccuratelyDocument51 pagesFilling Up Forms AccuratelydanteNo ratings yet

Note On Tax Rebate On Takaful Contribution 2019 20 Other Than Salaried

Note On Tax Rebate On Takaful Contribution 2019 20 Other Than Salaried

Uploaded by

syed aamir shahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Note On Tax Rebate On Takaful Contribution 2019 20 Other Than Salaried

Note On Tax Rebate On Takaful Contribution 2019 20 Other Than Salaried

Uploaded by

syed aamir shahCopyright:

Available Formats

Note on Tax Rebate available on Takaful Contribution (Other than salaried)

A person deriving income chargeable to tax under the head “salary” or “income from business” can

reduce his tax liability by claiming a tax credit on Takaful Contribution/Life insurance premium paid in a

tax year.

This credit is allowed under section 62(1) of the Income Tax Ordinance, 2001 (the Ordinance), in respect

of any Takaful Contribution/Life Insurance premium paid on a policy to a life insurance company

registered by the Securities & Exchange Commission of Pakistan under the Insurance Ordinance, 2000

(XXXIX of 2000).

Formula for calculation of rebate:

The rebate calculation as given in section 62(2) of the Ordinance is based on the following formula,

namely:

(A/B) x C

Where-

A is the amount of tax assessed to the person for the tax year before allowance of any tax credit;

B is the person’s taxable income for the tax year; and

C is the lessor of -

a) The total contribution or premium paid by the person;

b) Twenty percent of the person’s taxable income for the tax year; or

c) Two million rupees.

An individual deriving business income can claim this tax credit while filing his annual tax return. A

certificate issued by the takaful/insurance company for collection of contribution/premium in a tax year

would suffice as a documentary evidence for claiming this credit as required under the Ordinance.

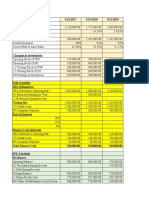

Below is an illustration of rebate allowed on various levels of business income, based on the tax rates

applicable to other than salaried individuals for the Tax Year 2020 (01-Jul-19 to 30-Jun-20).

Rupees

Annual Annual Takaful

Rebate

Taxable Average Tax Contribution Net tax

allowed

Income Tax rate Liability allowed payable

=(A/B) x C

(B) (A) (C)

800,000 3.75 % 30,000 160,000 6,000 24,000

1,000,000 5.00 % 50,000 200,000 10,000 40,000

1,200,000 5.83 % 70,000 240,000 14,000 56,000

1,500,000 7.67 % 115,000 300,000 23,000 92,000

1,800,000 8.89 % 160,000 360,000 32,000 128,000

2,000,000 9.50 % 190,000 400,000 38,000 152,000

2,300,000 10.22 % 235,000 460,000 47,000 188,000

2,500,000 10.80 % 270,000 500,000 54,000 216,000

2,700,000 11.48 % 310,000 540,000 62,000 248,000

3,000,000 12.33 % 370,000 600,000 74,000 296,000

3,500,000 14.14 % 495,000 700,000 99,000 396,000

4,000,000 15.50 % 620,000 800,000 124,000 496,000

5,000,000 18.40 % 920,000 1,000,000 184,000 736,000

6,000,000 20.33 % 1,220,000 1,200,000 244,000 976,000

7,000,000 22.43 % 1,570,000 1,400,000 314,000 1,256,000

8,000,000 24.00 % 1,920,000 1,600,000 384,000 1,536,000

9,000,000 25.22 % 2,270,000 1,800,000 454,000 1,816,000

10,000,000 26.20 % 2,620,000 2,000,000 524,000 2,096,000

11,000,000 27.00 % 2,970,000 2,000,000 540,000 2,430,000

You might also like

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- InvoiceDocument1 pageInvoicePankaj TrigunNo ratings yet

- Employee Exit ChecklistDocument9 pagesEmployee Exit ChecklistRudraneel DasNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 SalariedRoy Estate (Sajila Roy)No ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- 3-5yr ProjectionDocument2 pages3-5yr ProjectionKamille SumaoangNo ratings yet

- Main Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleDocument12 pagesMain Menu Inputs Income Statement Balance Sheet Loan Fixed Asset ScheduleHussain ImranNo ratings yet

- Output Financial ManagemntDocument8 pagesOutput Financial ManagemntEmzNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- 2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021eDocument1 page2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021evivianclementNo ratings yet

- Proposal Project AyamDocument14 pagesProposal Project AyamIrvan PamungkasNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- 2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount ExceedingDocument2 pages2020 Minimum Taxable Income Rate of Tax Maximum Taxable Income Fixed Amount Amount Exceedingsarwar raziNo ratings yet

- Financial AnalysisDocument1 pageFinancial Analysisjay kudiNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Gate of Aden Plan 2020Document1 pageGate of Aden Plan 2020Mohammad HanafyNo ratings yet

- Bank ManagementDocument14 pagesBank ManagementAreeba MalikNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- Edited FSDocument40 pagesEdited FShello kitty black and whiteNo ratings yet

- Tax DefinitionsDocument4 pagesTax DefinitionsrajaNo ratings yet

- FM AssignmentDocument23 pagesFM AssignmentMuskan NagarNo ratings yet

- Salary Tax Calculator Pak-2019-20Document2 pagesSalary Tax Calculator Pak-2019-20Usman HabibNo ratings yet

- Financial Model For Value RetailingDocument1,643 pagesFinancial Model For Value RetailingSaif Ali JamadarNo ratings yet

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazNo ratings yet

- 2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2Document2 pages2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2raskaNo ratings yet

- Project Telehealth - Health at Home: Equipment InformationDocument1 pageProject Telehealth - Health at Home: Equipment InformationSenapati Prabhupada DasNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument4 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialtehreemNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- Financial Analysis ModelDocument5 pagesFinancial Analysis ModelShanaya JainNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument7 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialআসিফহাসানখানNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Year Sales Volume Sales VC FC DepDocument8 pagesYear Sales Volume Sales VC FC DepMohammad Umair SheraziNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- Finacial LabDocument3 pagesFinacial LabGarvit JainNo ratings yet

- Current Year Base Year Base Year X 100Document4 pagesCurrent Year Base Year Base Year X 100Kathlyn TajadaNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialEsani DeNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- Analysis of FS PDF Vertical and HorizontalDocument9 pagesAnalysis of FS PDF Vertical and HorizontalJmaseNo ratings yet

- FINANCIAL ANALYSIS Practice 3Document15 pagesFINANCIAL ANALYSIS Practice 3Hallasgo, Elymar SorianoNo ratings yet

- NPS Calculator Free Download ExcelDocument7 pagesNPS Calculator Free Download Excelgroup 19No ratings yet

- Profitability RatioDocument11 pagesProfitability RatioNicole Kate PorrasNo ratings yet

- INR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.0Document7 pagesINR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.057 - Lakshita TanwaniNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Document7 pagesPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNo ratings yet

- Aspira 2 Sum FinDocument5 pagesAspira 2 Sum FinYork Daily Record/Sunday NewsNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- CFI ModelDocument5 pagesCFI ModelSidharth SainiNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Income Statement: USD $000s 2014A 2015A 2016E 2017E 2018EDocument3 pagesIncome Statement: USD $000s 2014A 2015A 2016E 2017E 2018EAgyei DanielNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Otun's WorkDocument4 pagesOtun's WorkoluwapelumiotunNo ratings yet

- Project 1 (PP, NPV, IRR)Document5 pagesProject 1 (PP, NPV, IRR)Yashwini KomagenNo ratings yet

- Budgeting SolutionsDocument9 pagesBudgeting SolutionsPavan Kalyan KolaNo ratings yet

- Mooc FinanzasDocument2 pagesMooc FinanzasAlvaro LainezNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- CamScanner 11-02-2023 09.28Document4 pagesCamScanner 11-02-2023 09.28syed aamir shahNo ratings yet

- Full Stack Web DevelopmentDocument18 pagesFull Stack Web Developmentsyed aamir shahNo ratings yet

- Shaukat Khanum Memorial Cancer Hospital & Research Centre: Liver Abscess Culture and SensitivityDocument1 pageShaukat Khanum Memorial Cancer Hospital & Research Centre: Liver Abscess Culture and Sensitivitysyed aamir shahNo ratings yet

- Corporate Announcement - Change of NameDocument1 pageCorporate Announcement - Change of Namesyed aamir shahNo ratings yet

- UntitledDocument145 pagesUntitledsyed aamir shahNo ratings yet

- EprocurementDocument35 pagesEprocurementsyed aamir shahNo ratings yet

- GeneralinsDocument1 pageGeneralinssyed aamir shahNo ratings yet

- Reduce Your TaxesDocument3 pagesReduce Your Taxessyed aamir shahNo ratings yet

- Rule 47Document1 pageRule 47syed aamir shahNo ratings yet

- Task Force Report On Urban Development: Government of PakistanDocument34 pagesTask Force Report On Urban Development: Government of Pakistansyed aamir shahNo ratings yet

- Flipkart - 1688414120000Document15 pagesFlipkart - 1688414120000Anil ChauhanNo ratings yet

- Account Statement: Theme Engineering Services Private LimitedDocument1 pageAccount Statement: Theme Engineering Services Private LimitedashutoshstepcountNo ratings yet

- RandommmmmDocument8 pagesRandommmmmMmNo ratings yet

- Nra Audit ReportDocument20 pagesNra Audit ReportBampiaNo ratings yet

- Income Tax: Cabria Cpa Review CenterDocument4 pagesIncome Tax: Cabria Cpa Review CenterMaeNo ratings yet

- GST Impact On E-CommerceDocument2 pagesGST Impact On E-CommercePAUL FREDERICK LLMNo ratings yet

- Purchaseorder - 1 Smart Tech Software SolutionDocument1 pagePurchaseorder - 1 Smart Tech Software SolutionEXTECH CERTIFICATIONSNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaShefali MandowaraNo ratings yet

- BIR Ruling 173-99 - Sale or Transfer of Motor VehiclesDocument2 pagesBIR Ruling 173-99 - Sale or Transfer of Motor VehiclesJerwin Dave100% (1)

- I 1040 ScaDocument19 pagesI 1040 Scahgfed4321No ratings yet

- Cancellation Letter For Full AmountDocument1 pageCancellation Letter For Full AmountRahul100% (1)

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- Bir Form 2550Q Summary Alphalist of Withholding Taxes (Sawt)Document2 pagesBir Form 2550Q Summary Alphalist of Withholding Taxes (Sawt)Renz Christopher TangcaNo ratings yet

- Itr File 2023:24Document9 pagesItr File 2023:24Aatif KhanNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument21 pagesChapter 1 Introduction To Consumption TaxesNacpil, Alyssa JesseNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBHarsh GandhiNo ratings yet

- IGL B2003 June 2022Document2 pagesIGL B2003 June 2022shivam_2607No ratings yet

- Shri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDDocument46 pagesShri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDSridharRaoNo ratings yet

- Eagle Security: Your Number One Partner in The Security IndustryDocument2 pagesEagle Security: Your Number One Partner in The Security IndustrySimbarashe MarisaNo ratings yet

- Bir Form 2306 and 2307 MchsDocument3 pagesBir Form 2306 and 2307 Mchschristopher labastidaNo ratings yet

- Income TaxDocument36 pagesIncome Taxnati100% (1)

- Sin TítuloDocument14 pagesSin TítuloTavo MCNo ratings yet

- 2020 S1 Accg3020 L01Document32 pages2020 S1 Accg3020 L01elviraanggrainiNo ratings yet

- AIR CANADA V Cir Final Case DigestDocument2 pagesAIR CANADA V Cir Final Case DigestAnalou Agustin Villeza0% (1)

- For Any Transactional Queries Related To Donations Please ContactDocument1 pageFor Any Transactional Queries Related To Donations Please ContactChristo JeniferNo ratings yet

- Pascual vs. DragonDocument2 pagesPascual vs. DragonRussell John HipolitoNo ratings yet

- 1 - Income Tax Introduction With Lecture NotesDocument14 pages1 - Income Tax Introduction With Lecture NotesdjNo ratings yet

- Filling Up Forms AccuratelyDocument51 pagesFilling Up Forms AccuratelydanteNo ratings yet