Professional Documents

Culture Documents

1099-Div 2021 3350349

1099-Div 2021 3350349

Uploaded by

Adam CliftonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1099-Div 2021 3350349

1099-Div 2021 3350349

Uploaded by

Adam CliftonCopyright:

Available Formats

Publix Super Markets, Inc.

P.O. Box 32040

Lakeland, FL 33802

If you have questions contact:

Phone: 863-688-7407

Ext: 52323

ADAM CLIFTON

1680 THORNHILL CIRCLE

OVIEDO, FL 32765

Instructions for Recipient Box 2f. Shows the portion of the amount in box 2a that is section 897 gain attributable to disposition of

USRPI.

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last

four digits of your TIN (SSN, ITIN, ATIN, or EIN). However, the issuer has reported your complete TIN to Note: Boxes 2e and 2f apply only to foreign persons and entities whose income maintains its character

the IRS. when passed through or distributed to its direct or indirect foreign owners or beneficiaries. It is generally

FATCA filing requirement. If the FATCA filing requirement box is checked, the payer is reporting on this treated as effectively connected to a trade or business within the United States. See the instructions for

Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. your tax return.

You may also have a filing requirement. See the Instructions for Form 8938. Box 3. Shows a return of capital. To the extent of your cost (or other basis) in the stock, the distribution

reduces your basis and is not taxable. Any amount received in excess of your basis is taxable to you as

Account number. May show an account or other unique number the payer assigned to distinguish your capital gain. See Pub. 550.

account.

Box 1a. Shows total ordinary dividends that are taxable. Include this amount on the "Ordinary dividends" Box 4. Shows backup withholding. A payer must backup withhold on certain payments if you did not

line of Form 1040 or 1040-SR. Also report it on Schedule B (Form 1040), if required. give your TIN to the payer. See Form W-9 for information on backup withholding. Include this amount on

your income tax return as tax withheld.

Box 1b. Shows the portion of the amount in box 1a that may be eligible for reduced capital gains rates.

Box 5. Shows the portion of the amount in box 1a that may be eligible for the 20% qualified business

See the Instructions for Forms 1040 and 1040-SR for how to determine this amount and where to report.

income deduction under section 199A. See the instructions for Form 8995 and Form 8995-A.

The amount shown may be dividends a corporation paid directly to you as a participant (or beneficiary Box 6. Shows your share of expenses of a nonpublicly offered RIC, generally a nonpublicly offered

of a participant) in an employee stock ownership plan (ESOP). Report it as a dividend on your Form 1040 mutual fund. This amount is included in box 1a.

or 1040-SR but treat it as a plan distribution, not as investment income, for any other purpose.

Box 7. Shows the foreign tax that you may be able to claim as a deduction or a credit on Form 1040 or

Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate

1040-SR. See the Instructions for Forms 1040 and 1040-SR.

investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040). But, if no

amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7.

distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR Boxes 9 and 10. Show cash and noncash liquidation distributions.

rather than Schedule D. See the Instructions for Forms 1040 and 1040-SR. Box 11. Shows exempt-interest dividends from a mutual fund or other RIC paid to you during the

Box 2b. Shows the portion of the amount in box 2a that is unrecaptured section 1250 gain from certain calendar year. See the Instructions for Forms 1040 and 1040-SR for where to report. This amount may

depreciable real property. See the Unrecaptured Section 1250 Gain Worksheet in the Instructions for be subject to backup withholding. See Box 4 above.

Schedule D (Form 1040). Box 12. Shows exempt-interest dividends subject to the alternative minimum tax. This amount is

Box 2c. Shows the portion of the amount in box 2a that is section 1202 gain from certain small business included in box 11. See the Instructions for Form 6251.

stock that may be subject to an exclusion. See the Schedule D (Form 1040) instructions. Boxes 13-15. State income tax withheld reporting boxes.

Box 2d. Shows the portion of the amount in box 2a that is 28% rate gain from sales or exchanges of Nominees. If this form includes amounts belonging to another person, you are considered a nominee

collectibles. If required, use this amount when completing the 28% Rate Gain Worksheet in the recipient. You must file Form 1099-DIV (with a Form 1096) with the IRS for each of the other owners to

Instructions for Schedule D (Form 1040). show their share of the income, and you must furnish a Form 1099-DIV to each. A spouse is not required

Box 2e. Shows the portion of the amount in box 1a that is section 897 gain attributable to disposition of to file a nominee return to show amounts owned by the other spouse. See the 2021 General Instructions

U.S. real property interests (USRPI). for Certain Information Returns.

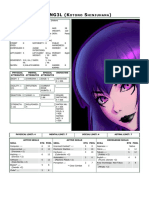

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal 1a Total ordinary dividends

code, and telephone no. OMB No. 1545-0110

Publix Super Markets, Inc. $ 33.34 Dividends and

P.O. Box 32040 1b Qualified dividends À¾¶µ Distributions

Lakeland, FL 33802

$ Form 1099-DIV

2a Total capital gain distr. 2b Unrecap. Sec. 1250 gain

Copy B

$ $ For Recipient

PAYER’S TIN RECIPIENT’S TIN 2c Section 1202 gain 2d Collectibles (28%) gain

$ $

2e Section 897 ordinary dividends 2f Section 897 capital gain

59-0324412 XXX-XX-0828 $ $

RECIPIENT’S name, street address (including apt. no.), city or town, state or province, country, 3 Nondividend distributions 4 Federal income tax withheld

and ZIP or foreign postal code

This is important tax

ADAM CLIFTON $ $

information and is

5 Section 199A dividends 6 Investment expenses

1680 THORNHILL CIRCLE being furnished to

the IRS. If you are

OVIEDO, FL 32765 $ required to file a

7 Foreign tax paid 8 Foreign country or U.S. possession return, a negligence

penalty or other

sanction may be

$ imposed on you if

this income is taxable

9 Cash liquidation distributions 10 Noncash liquidation distributions and the IRS

determines that it has

$ $ not been reported.

FATCA filing 11 Exempt-interest dividends 12 Specified private activity

requirement bond interest dividends

$ $

Account number (see instructions) 13 State 14 State identification 15 State tax withheld

2010128426 no.

FL $

Form 1099-DIV (keep for your records) www.irs.gov/Form1099DIV Department of the Treasury - Internal Revenue Service

1H8019 4.000

You might also like

- Chase 1099int 2013Document2 pagesChase 1099int 2013Srikala Venkatesan100% (1)

- HDFC Statement SampleDocument15 pagesHDFC Statement Samplekhallushaik424No ratings yet

- Scum & Villainy - Handouts & Sheets (Compilation)Document144 pagesScum & Villainy - Handouts & Sheets (Compilation)Adam Clifton100% (1)

- Paula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Document2 pagesPaula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Natural Beauty LaserNo ratings yet

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Document6 pagesU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNo ratings yet

- Victor Benji Wemh Intuit Tax ReturnDocument41 pagesVictor Benji Wemh Intuit Tax ReturnEmo RockstarNo ratings yet

- Importance of Your Tax Withholding: Form 1099Document2 pagesImportance of Your Tax Withholding: Form 1099iceyroses100% (1)

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Bar QuestionsDocument24 pagesBar QuestionsbrendamanganaanNo ratings yet

- Tax Form 1099nec 20230121Document2 pagesTax Form 1099nec 20230121God Is GreatNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- Profit or Loss From Business: Linda Gercken 156-56-8670Document2 pagesProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- DOL RDWSU 2020 Form 5500Document205 pagesDOL RDWSU 2020 Form 5500seanredmondNo ratings yet

- 2021 - Robinhood Securities 1099Document8 pages2021 - Robinhood Securities 1099Estranged GedNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNo ratings yet

- Zax11 Stockbridge Ga 9061Document4 pagesZax11 Stockbridge Ga 9061Frank ValenzuelaNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument1 pageEmployer's Annual Federal Unemployment (FUTA) Tax Returnfortha loveofNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040)Document4 pagesProfit or Loss From Business: Schedule C (Form 1040)adam burd100% (1)

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusKenneth Schackai100% (1)

- Account # 0302080036: Lifegreen SavingsDocument2 pagesAccount # 0302080036: Lifegreen Savingsstorage mediaNo ratings yet

- 2019 TaxReturn PDFDocument23 pages2019 TaxReturn PDFalhajikura2252No ratings yet

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- Rhonda TX RTNDocument18 pagesRhonda TX RTNobriens05No ratings yet

- Tax Return 2023Document2 pagesTax Return 2023jacksonleah313No ratings yet

- Form1095a 2017 PDFDocument8 pagesForm1095a 2017 PDFTina Reyes100% (1)

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- Form 1120 2022Document6 pagesForm 1120 2022DjibzlaeNo ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document1 pageProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rohit dasNo ratings yet

- Identity and Employment Authorization Identity Employment AuthorizationDocument3 pagesIdentity and Employment Authorization Identity Employment AuthorizationAnonymous olIRceaUNo ratings yet

- 2022 Schedule 3 (Form 1040)Document2 pages2022 Schedule 3 (Form 1040)Riley CareNo ratings yet

- fss4 1998Document4 pagesfss4 1998Znsjsh OneNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- Michael Easley 1040 2017Document2 pagesMichael Easley 1040 2017MichaelNo ratings yet

- 5.tax Interview Questions Virtual Interview FiverrDocument4 pages5.tax Interview Questions Virtual Interview Fiverrfrantzloppe05No ratings yet

- Snow Media LLC w9Document6 pagesSnow Media LLC w9Carlos DanielNo ratings yet

- Norma 2021Document13 pagesNorma 2021Norma MichelNo ratings yet

- Ssa 1099 - Ssa 1042s Letter 6 5Document2 pagesSsa 1099 - Ssa 1042s Letter 6 5Dutchavelli5thNo ratings yet

- 2009 Gibbs D Form 1040 Individual Tax Return Tax2009Document23 pages2009 Gibbs D Form 1040 Individual Tax Return Tax2009Jaqueline LeslieNo ratings yet

- UntitledDocument10 pagesUntitledJosh SofferNo ratings yet

- Tax Certificate 2022-2023Document1 pageTax Certificate 2022-2023marco.kozilekgoweNo ratings yet

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- Tax Return 2021Document3 pagesTax Return 2021Mark ThomasNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous YGChV39tfD100% (1)

- Credit ApplicationDocument3 pagesCredit ApplicationShelbyElliottNo ratings yet

- Pay Stub - ROY STEPHENDocument6 pagesPay Stub - ROY STEPHENKeller Brown JnrNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument5 pagesU.S. Individual Income Tax Return: Filing Statuskristen kindleNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- 2019 Form 990 For St. Joseph's/CandlerDocument44 pages2019 Form 990 For St. Joseph's/Candlersavannahnow.comNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- LIBRO 9 Derecho RomanoDocument30 pagesLIBRO 9 Derecho RomanoDomingo VasquezNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- YW - W4 Form-2023Document1 pageYW - W4 Form-2023Whora DoraNo ratings yet

- Activity Example 1040 TaxDocument2 pagesActivity Example 1040 TaxKevin ÁlvarezNo ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- FTF 2024-01-19 1705691319142Document16 pagesFTF 2024-01-19 1705691319142Naty MoralesNo ratings yet

- UnknownDocument24 pagesUnknownanyanwuchigozie560No ratings yet

- UntitledDocument1 pageUntitledAdam CliftonNo ratings yet

- 1095c 2021 InstructionsDocument2 pages1095c 2021 InstructionsAdam CliftonNo ratings yet

- Wildemount Treasures: Unwelcome Spirits Ch. 7: Wildemount BestiaryDocument24 pagesWildemount Treasures: Unwelcome Spirits Ch. 7: Wildemount BestiaryAdam CliftonNo ratings yet

- Anycubic Photon Workshop Slicing Software-EN-V0.1.2Document31 pagesAnycubic Photon Workshop Slicing Software-EN-V0.1.2Adam CliftonNo ratings yet

- Tax Return 2021Document4 pagesTax Return 2021Adam Clifton100% (4)

- Anycubic Photon D2 BenutzerhandbuchDocument21 pagesAnycubic Photon D2 BenutzerhandbuchAdam CliftonNo ratings yet

- Refund Request Case Number 1511789931Document1 pageRefund Request Case Number 1511789931Adam CliftonNo ratings yet

- Kotono CharSheet 2-8-23Document5 pagesKotono CharSheet 2-8-23Adam CliftonNo ratings yet

- Ad Clif 25898283Document4 pagesAd Clif 25898283Adam CliftonNo ratings yet

- Swordmage v7.2Document21 pagesSwordmage v7.2Adam CliftonNo ratings yet

- (SC Sorcerer) Iron SoulDocument1 page(SC Sorcerer) Iron SoulAdam CliftonNo ratings yet

- ShareX Log 2022 01Document36 pagesShareX Log 2022 01Adam CliftonNo ratings yet

- Mutants in The Night (FitD)Document19 pagesMutants in The Night (FitD)Adam Clifton100% (3)

- Wind Domain: Hand of The Wild WindDocument1 pageWind Domain: Hand of The Wild WindAdam CliftonNo ratings yet

- Unitedhealthcare Dental Ppo Plan 2022 Summary of Benefits and CoverageDocument1 pageUnitedhealthcare Dental Ppo Plan 2022 Summary of Benefits and CoverageAdam CliftonNo ratings yet

- Important Questions Answers Why This MattersDocument7 pagesImportant Questions Answers Why This MattersAdam CliftonNo ratings yet

- Beam Saber - Playtest V0.52Document391 pagesBeam Saber - Playtest V0.52Adam CliftonNo ratings yet

- Zweihander - Mishap Tarot Digital v1Document72 pagesZweihander - Mishap Tarot Digital v1Adam CliftonNo ratings yet

- Unitedhealthcare Dental Hmo Plan 2022 Summary of Benefits and CoverageDocument9 pagesUnitedhealthcare Dental Hmo Plan 2022 Summary of Benefits and CoverageAdam CliftonNo ratings yet

- Lab-Current LiabilitiesDocument5 pagesLab-Current LiabilitiesPatrick HarponNo ratings yet

- JIIT Will Function in Online Mode During Odd Sem 2020Document3 pagesJIIT Will Function in Online Mode During Odd Sem 2020bloodseeker GAMINGNo ratings yet

- Profitability at BranchDocument21 pagesProfitability at Branchdabeernaqvi100% (1)

- DRC 03Document2 pagesDRC 03sridhar samalaNo ratings yet

- Bir Form No. Title of The Form Description Filing Date Where To File 1901Document2 pagesBir Form No. Title of The Form Description Filing Date Where To File 1901cessbrightNo ratings yet

- Client Clarification Steel Hypermart TNDocument2 pagesClient Clarification Steel Hypermart TNSURANA1973No ratings yet

- Invitation Training TaxDocument1 pageInvitation Training TaxharoldpsbNo ratings yet

- Income Tax & Corporate Tax Planning: Key Amendments For FYDocument17 pagesIncome Tax & Corporate Tax Planning: Key Amendments For FYAmir SadeeqNo ratings yet

- Icse Class X Maths Practise Sheet 1 GST PDFDocument2 pagesIcse Class X Maths Practise Sheet 1 GST PDFHENA KHAN0% (1)

- Document 243Document4 pagesDocument 243Abhishank BhardwajNo ratings yet

- Merged DocumentDocument93 pagesMerged DocumentsurekhaNo ratings yet

- RMBN Sample Computation 20-20 (11) - 60Document1 pageRMBN Sample Computation 20-20 (11) - 60amiel pugatNo ratings yet

- Account Statement 29-12-2019T11 52 22 PDFDocument2 pagesAccount Statement 29-12-2019T11 52 22 PDFMuhammad RashidNo ratings yet

- Boopathi Citibank Savings Account Statement 01august2019 31october2019Document10 pagesBoopathi Citibank Savings Account Statement 01august2019 31october2019quannbui95No ratings yet

- Oluwale AdebayoDocument1 pageOluwale Adebayowhitneydemetria007No ratings yet

- Abscbn Broadcasting Corp. v. Cta DigestDocument3 pagesAbscbn Broadcasting Corp. v. Cta DigestkathrynmaydevezaNo ratings yet

- ForwardInvoice ORD436802373Document2 pagesForwardInvoice ORD436802373Dibyendu DasNo ratings yet

- Credit Card Terms and ConditionsDocument4 pagesCredit Card Terms and Conditionsfritz frances danielleNo ratings yet

- Aquarius Company Worksheet August 31, 2018: Unadjusted Trial Balance Debit CreditDocument35 pagesAquarius Company Worksheet August 31, 2018: Unadjusted Trial Balance Debit CreditAdam Cuenca100% (1)

- Transfer Pricing Country Profile Indonesia PDFDocument8 pagesTransfer Pricing Country Profile Indonesia PDFYusiMuzialifaNNo ratings yet

- Hotel Booking Ref-0109230128557Document5 pagesHotel Booking Ref-0109230128557Sourabh BhardwajNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- Financial Cards and Payments in VietnamDocument15 pagesFinancial Cards and Payments in VietnamVinh NguyenNo ratings yet

- Invoice 768412885Document3 pagesInvoice 768412885MD Ziaul HaqueNo ratings yet

- Credit Card ActvitiesDocument9 pagesCredit Card ActvitiesNickNo ratings yet

- 17 H F6 Vietnam Tax PIT Answers For Multiple Choice Questions 2015 Exam enDocument8 pages17 H F6 Vietnam Tax PIT Answers For Multiple Choice Questions 2015 Exam endomNo ratings yet

- Module 11 - Dealings in PropertiesDocument17 pagesModule 11 - Dealings in PropertiesRuth Nouelle Sta. CruzNo ratings yet

- 30 Day DiaryDocument2 pages30 Day Diaryapi-3711938No ratings yet