Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsCredit and Collection Reviewer

Credit and Collection Reviewer

Uploaded by

Albiz, Vanessa R.- International credit policies are important but often overlooked or not updated regularly given changing global conditions.

- Establishing a formal written international credit policy with management approval gives credit professionals leverage to enforce guidelines and avoid bad debts when sales pushes questionable deals.

- Key elements of an effective policy include thorough customer risk analysis, payment terms, political and event risk assessments, and early warning signs of financial difficulties for international customers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- ch14 Exercises (Written Q) Q+A - WACCDocument4 pagesch14 Exercises (Written Q) Q+A - WACCNurayGulNo ratings yet

- Loan Delinquency ManagementDocument32 pagesLoan Delinquency ManagementAyomideNo ratings yet

- Unit III Receivables Management - Concept of Credit PolicyDocument16 pagesUnit III Receivables Management - Concept of Credit PolicyYash Raj Tripathi0% (1)

- Printicomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentDocument103 pagesPrinticomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentKunal MehtaNo ratings yet

- Credit Policy Sample637225320210415Document7 pagesCredit Policy Sample637225320210415o'brianNo ratings yet

- Credit PolicyDocument84 pagesCredit PolicyDan John Karikottu100% (6)

- Internship Report of BopDocument52 pagesInternship Report of Bopbbaahmad89100% (4)

- Introduction To Risk Management and MCQ L 1Document21 pagesIntroduction To Risk Management and MCQ L 1FarooqChaudhary92% (13)

- Construction Management AgreementDocument4 pagesConstruction Management AgreementRocketLawyer100% (2)

- Credit PolicyDocument24 pagesCredit PolicyCHRISTINE JADUCANANo ratings yet

- Account Receivable Management OverviewDocument21 pagesAccount Receivable Management OverviewLlyod Daniel Paulo0% (1)

- Receivables Management: Dr.K.P.Malathi ShiriDocument19 pagesReceivables Management: Dr.K.P.Malathi ShiriSruthy KrishnaNo ratings yet

- ABL & Factoring Basics 1 PDFDocument146 pagesABL & Factoring Basics 1 PDFDale ChangNo ratings yet

- Account Receivable ManagementDocument49 pagesAccount Receivable ManagementAli Mubin FitranandaNo ratings yet

- Lecture 1 Banking, Financial Services Industry and RegulationsDocument29 pagesLecture 1 Banking, Financial Services Industry and Regulationseugene etwireNo ratings yet

- Commercial and Industrial LendingDocument64 pagesCommercial and Industrial LendingSanjeela JoshiNo ratings yet

- 1424 Receivables ManagementDocument13 pages1424 Receivables ManagementBhavika_Patel_8085No ratings yet

- PMC FM5 Unit-4Document7 pagesPMC FM5 Unit-4npwrettiieeNo ratings yet

- Credit Collection Policy Procedures and PracticesDocument28 pagesCredit Collection Policy Procedures and Practicescheska.movestorageNo ratings yet

- Mergers and Acquisitions - Another LookDocument57 pagesMergers and Acquisitions - Another LookTubagus Donny SyafardanNo ratings yet

- Chapter 13 Financial Management by CabreraDocument25 pagesChapter 13 Financial Management by CabreraLars FriasNo ratings yet

- Credit RatingDocument3 pagesCredit Ratingsanjay parmar100% (4)

- Financing - Debt Finance: Chapter Learning ObjectivesDocument9 pagesFinancing - Debt Finance: Chapter Learning ObjectivesDINEO PRUDENCE NONGNo ratings yet

- Final Microfinance Lending and Risk ManagementDocument241 pagesFinal Microfinance Lending and Risk ManagementSabelo100% (2)

- Final Microfinance Lending and Risk ManagementDocument241 pagesFinal Microfinance Lending and Risk ManagementSabelo100% (2)

- Current Issues in Financial MarketsDocument31 pagesCurrent Issues in Financial MarketsNg Win WwaNo ratings yet

- MADocument37 pagesMAYogeshDeoraNo ratings yet

- Presentation DCMDocument5 pagesPresentation DCMsuvarna27No ratings yet

- Module 1 - Introduction To Credit and CollectionDocument23 pagesModule 1 - Introduction To Credit and CollectionAllan Cris RicafortNo ratings yet

- Receivables Management: Presented by Group 10Document10 pagesReceivables Management: Presented by Group 10Anonymous GuyNo ratings yet

- 4 Corporate BankingDocument31 pages4 Corporate BankingKartik BhartiaNo ratings yet

- GRP 7 - Successful Projects Dos DontsDocument29 pagesGRP 7 - Successful Projects Dos DontsABHYUDAYA BHARADWAJ MBA W 2021-24No ratings yet

- Corporate BankingDocument21 pagesCorporate BankingPadma NarayananNo ratings yet

- Chapter 2 - Asset Allocation DecisionDocument24 pagesChapter 2 - Asset Allocation DecisionImejah FaviNo ratings yet

- TCF GapDocument3 pagesTCF Gapmm_mayfairNo ratings yet

- Module 4Document17 pagesModule 4Andrea AbellanozaNo ratings yet

- Topic 3 - CREDIT MANAGEMENTDocument43 pagesTopic 3 - CREDIT MANAGEMENTeogollaNo ratings yet

- Untitled DocumentDocument8 pagesUntitled DocumentSartoriNo ratings yet

- Credit Rating: Presentation OnDocument14 pagesCredit Rating: Presentation OnPankaj KhatriNo ratings yet

- Group 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita DavidDocument66 pagesGroup 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita Davidnita davidNo ratings yet

- Corporate Banking: by Prof. Santosh KumarDocument60 pagesCorporate Banking: by Prof. Santosh KumarAditya RajNo ratings yet

- Understanding Credit RatingDocument37 pagesUnderstanding Credit RatingSanjeev BansalNo ratings yet

- Lecture 8 Metrics For Entrepreneurs and Startup Funding PDFDocument28 pagesLecture 8 Metrics For Entrepreneurs and Startup Funding PDFBhagavan BangaloreNo ratings yet

- 180+ Tech面试题 Study CardsDocument92 pages180+ Tech面试题 Study CardswinnieNo ratings yet

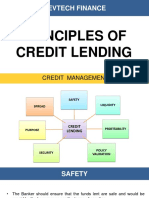

- Principles of Credit LendingDocument10 pagesPrinciples of Credit LendingRa'fat JalladNo ratings yet

- Components of A Good Credit PolicyDocument29 pagesComponents of A Good Credit PolicyAyomideNo ratings yet

- Chapter 1Document49 pagesChapter 1Sami JattNo ratings yet

- Account Receivables Management & Credit Policy: Presented byDocument37 pagesAccount Receivables Management & Credit Policy: Presented byKhalid Khan100% (1)

- B2&C1 Conceptual FrameworkDocument34 pagesB2&C1 Conceptual Frameworkpaul sagudaNo ratings yet

- TOPIC 9 Chapter 19 Accounts Receivable and Inventory ManagementDocument17 pagesTOPIC 9 Chapter 19 Accounts Receivable and Inventory ManagementIrene Kim100% (1)

- Unit III. Implementing The Financial PlanDocument18 pagesUnit III. Implementing The Financial PlanShreya NairNo ratings yet

- Corporate BankingDocument57 pagesCorporate BankingSoumya TiwaryNo ratings yet

- Credit and Collection PA1Document109 pagesCredit and Collection PA1Lorey Joy IdongNo ratings yet

- Sai Kiran Print PDFDocument53 pagesSai Kiran Print PDFThanuja BhaskarNo ratings yet

- Foreign Market Entry StrategiesDocument33 pagesForeign Market Entry StrategiesSoumendra RoyNo ratings yet

- Accounts ReceivableDocument52 pagesAccounts Receivablemarget100% (3)

- Risk ManagementDocument23 pagesRisk ManagementMonal ChawdaNo ratings yet

- Credit RatingDocument56 pagesCredit RatingRaman Gupta100% (1)

- Credit Rating: Dr. Kanhaiya SinghDocument30 pagesCredit Rating: Dr. Kanhaiya SinghVidisha SinghalNo ratings yet

- Presentation On FactoringDocument32 pagesPresentation On Factoringjigs44100% (2)

- What Do You Already Know?Document18 pagesWhat Do You Already Know?Albiz, Vanessa R.No ratings yet

- Albiz, Vanessa R. Bafm 1-E Lesson 1: Presentation of The Letter ProperDocument7 pagesAlbiz, Vanessa R. Bafm 1-E Lesson 1: Presentation of The Letter ProperAlbiz, Vanessa R.No ratings yet

- Albiz, Vanessa R. Bafm 1-E Unit 5 Entrepreneurship Development Process PretestDocument5 pagesAlbiz, Vanessa R. Bafm 1-E Unit 5 Entrepreneurship Development Process PretestAlbiz, Vanessa R.No ratings yet

- REVISED Social Media Use Perceived Effects of Social MDocument61 pagesREVISED Social Media Use Perceived Effects of Social MAlbiz, Vanessa R.No ratings yet

- Unit 2. Post-Test (Principles of Writing)Document13 pagesUnit 2. Post-Test (Principles of Writing)Albiz, Vanessa R.No ratings yet

- UntitledDocument24 pagesUntitledAlbiz, Vanessa R.No ratings yet

- Case Study On Lehmans Brothers Group 3Document22 pagesCase Study On Lehmans Brothers Group 3Albiz, Vanessa R.No ratings yet

- Venture Capital ReviewerDocument18 pagesVenture Capital ReviewerAlbiz, Vanessa R.No ratings yet

- Cox and Kings Final ProspectusDocument518 pagesCox and Kings Final ProspectusRaj ThakurNo ratings yet

- Module 4 of Becg Mba Sem 1Document29 pagesModule 4 of Becg Mba Sem 112Twinkal ModiNo ratings yet

- CONCURRENT ENGINEERING Q BankDocument5 pagesCONCURRENT ENGINEERING Q BankNagamani RajeshNo ratings yet

- Customer Buying Behaviour With A Focus On Market SegmentationDocument5 pagesCustomer Buying Behaviour With A Focus On Market SegmentationRohit PNo ratings yet

- Asset Specificity and Economic OrganizationDocument14 pagesAsset Specificity and Economic OrganizationAjla CerićNo ratings yet

- AP Training ManualDocument156 pagesAP Training ManualLaeeq AhmedNo ratings yet

- SW and ASSIGNMENT - TUGOTDocument9 pagesSW and ASSIGNMENT - TUGOTAndrea TugotNo ratings yet

- AxiomDocument13 pagesAxiomFrancis Dave Peralta BitongNo ratings yet

- Executive Summary: Colegio de SebastianDocument36 pagesExecutive Summary: Colegio de SebastianEina Rivera TapnioNo ratings yet

- Virtual Content SOPDocument11 pagesVirtual Content SOPAnezwa MpetaNo ratings yet

- Purchasing Manager CV TemplateDocument2 pagesPurchasing Manager CV TemplatePritu SinhaNo ratings yet

- Transactional Vs Transformational LeadershipDocument21 pagesTransactional Vs Transformational LeadershipSnam KhanNo ratings yet

- Entfin f2010Document24 pagesEntfin f2010Toni MartinezNo ratings yet

- Final Exam Project - Amazon - Kholoud MohsenDocument19 pagesFinal Exam Project - Amazon - Kholoud MohsenChristine EskanderNo ratings yet

- Research Paper Section 1Document19 pagesResearch Paper Section 1Bcd AllidealstuffsNo ratings yet

- 12-ACCA-FA2-Chp 12Document26 pages12-ACCA-FA2-Chp 12SMS PrintingNo ratings yet

- Textile Uzbekistan 1 PDFDocument12 pagesTextile Uzbekistan 1 PDFmoNo ratings yet

- Test - Cost Accounting Chapter 3 TB - QuizletDocument9 pagesTest - Cost Accounting Chapter 3 TB - QuizletAbhishek AbhiNo ratings yet

- SEO Company in PuneDocument14 pagesSEO Company in PuneVinod MohiteNo ratings yet

- Supply Chain ManagementDocument16 pagesSupply Chain ManagementManasi Dighe DiasNo ratings yet

- NIST Information Security HandbookDocument176 pagesNIST Information Security HandbooknemonbNo ratings yet

- Strategic Management (Nestle)Document12 pagesStrategic Management (Nestle)San Htet AungNo ratings yet

- Entrepreneurship Theories - UnlockedDocument28 pagesEntrepreneurship Theories - UnlockedShifat Hasan100% (1)

- Student Counseling Management SystemDocument3 pagesStudent Counseling Management Systemtamil630561No ratings yet

- Project Report Balaji WafersDocument30 pagesProject Report Balaji WafersDev Dev27% (11)

- Startup Business Plan TemplateDocument36 pagesStartup Business Plan TemplateMohammad SowadNo ratings yet

Credit and Collection Reviewer

Credit and Collection Reviewer

Uploaded by

Albiz, Vanessa R.0 ratings0% found this document useful (0 votes)

8 views7 pages- International credit policies are important but often overlooked or not updated regularly given changing global conditions.

- Establishing a formal written international credit policy with management approval gives credit professionals leverage to enforce guidelines and avoid bad debts when sales pushes questionable deals.

- Key elements of an effective policy include thorough customer risk analysis, payment terms, political and event risk assessments, and early warning signs of financial difficulties for international customers.

Original Description:

Original Title

Credit and Collection reviewer

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- International credit policies are important but often overlooked or not updated regularly given changing global conditions.

- Establishing a formal written international credit policy with management approval gives credit professionals leverage to enforce guidelines and avoid bad debts when sales pushes questionable deals.

- Key elements of an effective policy include thorough customer risk analysis, payment terms, political and event risk assessments, and early warning signs of financial difficulties for international customers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views7 pagesCredit and Collection Reviewer

Credit and Collection Reviewer

Uploaded by

Albiz, Vanessa R.- International credit policies are important but often overlooked or not updated regularly given changing global conditions.

- Establishing a formal written international credit policy with management approval gives credit professionals leverage to enforce guidelines and avoid bad debts when sales pushes questionable deals.

- Key elements of an effective policy include thorough customer risk analysis, payment terms, political and event risk assessments, and early warning signs of financial difficulties for international customers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

CREDIT & COLLECTION of export factoring, forfaiting, and everybody’s

favorite: letters of credit.

INTERNATIONAL CREDIT

The importance of credit when dealing in the

international arena cannot be overstated. It is an ENFORCING THE POLICY

area that many overlook until this neglect comes

• Getting a policy set down is one thing. As credit

back to hit them in the face.

professionals are only too well aware, getting the

Credit professionals need to understand is that sales force to live with it is another. The job is

they cannot take their domestic credit policy and only half done until it becomes crystal clear to

credit application and use it internationally and everyone within the company that the policy

expect everything to work just fine—it will not must be adhered to.

happen.

• “Protecting our assets,” says one international

Credit analysis on international customers needs credit manager of a consumer manufacturing

to be thorough company, “means not being too lenient with

terms for customers that sales wants to sell.”

• To make sure the policy is understood, this

INTERNATIONAL CREDIT POLICY

resolute credit manager says he states the

• A workable international credit policy is the first company’s credit position and function and

step to ensuring the collection of international ensures there is a clear understanding. While this

receivables. Although most companies have a is a little difficult in the beginning, the net result

formal credit policy for domestic sales, many do is a smoother-running operation.

not have one for international transactions.

• They either use the domestic policy to cover

POINTS COVERED BY POLICY

international sales, the result is granting credit,

often on open-account terms, to international When establishing an international credit policy,

companies whose ratings would earn them a take into account the following general

quick and automatic pass if they were domestic. considerations:

• Even those companies that have a formal policy • The longer time period for delivery, fund transfer

have not reviewed it in eons. Given the ever- (payment), and the credit extension period

changing international landscape and technology

• The need for terms that provide for security for

innovations, international credit policies should

the risks of time and distance

be updated periodically—in any event no less

frequently than every two or three years. Thus, • The competition created by credit terms from the

establishing and enforcing a strict credit policy domestic market and other foreign competitors

for international sales is a challenge facing many

international credit professionals today • The competition from other countries having

different costs and governmental policies

• The correct use of international terminology such

ESTABLISHING THE POLICY as shipping and payment terms, especially the

use of INCOTERMs

• Once there is agreement that the policy needs to

be established, the next debate typically revolves • The assessment of political transfer and event

around what goes in the policy. risk, including: identifying sources of

information, establishing procedures for

• Often, it is the same old credit-versus-sales

assessing and spreading the risk, and evaluating

debate. Many successful international credit

and verifying the sources and reliability of

policies work because they contain a number of

information obtained

options. Potential risk and the exposure to bad

debt are just two typical concerns. • The assessment of customer risk

• Formulating a policy for establishing sound

credit limits addresses these issues. Incorporate

certain techniques not typically used with CUSTOMER RISK

domestic sales. These might include credit The crux of any credit analysis is, of course, the

insurance, the sale of certain receivables, the use ability and willingness of the customer ultimately to

pay for the goods shipped to it by the company.

This is difficult enough in the case of a domestic sales force the ammunition it needs to jam

transaction. In the case of a company in another questionable sales down the throats of the credit

country, the process of analyzing credit becomes department.

more difficult. Additional considerations are:

• Credit professionals in these companies must do

• Identify, verify, and understand the customer’s what they can to insist on a policy. At a

financial condition. minimum, international companies should

conform to domestic requirements. Even this

• Compare current performance with past

provision is difficult to enforce, as other

performance.

countries do not require financial statements that

• Compare performance with other customers from conform to GAAP.

the same country or region.

• Additionally, often long time lags exist before

• Assess the customer’s ability to pay. such statements are available; once they are, they

may or may not be audited and they may be

written in a foreign language. By insisting on a

EARLY WARNING SIGNS written approved international credit policy,

credit managers will be in a position to establish

The ability to recognize the indications of financial some reasonable guidelines for all to adhere to.

difficulty as early as possible is key to successfully

limiting losses. Doing so is especially difficult when • It will not be an easy or quick process to get an

dealing with companies in other countries, as international credit policy established and

“normal” behavior patterns often are quite different approved, but once the policy is written and

from what credit professionals might be accustomed approved it will be easier, but not easy, to

to when dealing with their domestic customers. enforce.

Focus on the following when monitoring accounts • Keep track of all transactions that are approved

for signs of trouble: against the advice of the credit department. Track

• Changes in the general behavior of the account those sales to see if and when they are paid. Any

time a large international debt is written off,

• Changes in the payment patterns make management and sales aware of the write-

• News reports off and that this was not a transaction that credit

approved.

• Financial ratio analysis

• If this is done in a nonoffensive manner,

• Increase in the number of disputed transactions eventually the point will be made and those who

prefer no policy will cooperate. Strike while the

iron is hot and have the policy written dow

WRITTEN POLICIES

• A number of companies are establishing formal

written international credit policies. They are INTERNATIONAL CREDIT POLICY TIPS

requiring the sales force to adhere to these • Produce a coherent credit policy for selling

policies when selling internationally. international accounts and make sure the sales

• Once a policy is put down in writing and force and sales reps, if they are used, understand

management approves it, the credit professionals it.

have some teeth when attempting to get it • Begin accepting corporate procurement cards for

adhered to. A number of respondents indicated international sales. Be aware, however, of the

that they got buy-in from the sales department fees charged by most service providers and make

when establishing their policies. sure prices cover these fees. Otherwise, you may

• Not only does this avoid friction when trying to be giving away all your profits. Procurement

implement the policy at a later date, it also is a cards are a particularly attractive option for

good step toward building a stronger relationship smaller sales and allow companies to sell to

with the sales department customers who might not meet ordinary credit

standards. Most salespeople love this option.

• Develop a simple, but complete, credit

WHAT TO DO WHEN THERE IS NO POLICY application that can be faxed. Leave adequate

• Lack of such a policy not only causes confusion space for the customer to fill in needed

but also conflict. It also gives a manipulative information. Then accept signed applications that

are faxed back. Doing so will make you a hero everyone involved.” The old KISS (Keep It

with the sales department. Simple, Stupid) approach really works.

• For smaller accounts, use a scoring system to • Get sales involved in the establishment of the

determine which method of account to use for new credit policy. Find out what gives them

each sale: letters of credit, open account, difficulty and see if they can be accommodated.

documentary collections, and so on. Some report Sometimes a simple adjustment in the credit

success using this technique on larger sales as policy can make their lives much easier. Often

well. However, you may want to review large what is needed becomes clear if the credit

sales individually. manager goes on some sales calls with the sales

force.

• Document your policies and procedures in a

manual. Doing so will help the credit staff • Hire agents who will get paid only after the

implement them. Give a copy to the sales company is paid. This will prevent reps from

department, if that is appropriate. selling to companies that they know either will

not pay or will pay only after a good deal of

• Require letters of credit only when absolutely

follow-up and trouble. No one wants to waste his

necessary. Companies that have demanded all

or her time.

customers provide letters of credit are beginning

to rethink that requirement. Such requirements • Use a matrix that employs third-party credit

often lose sales as letters of credit are expensive reports to evaluate international customers’ credit

for customers and a hassle for everyone involved. risk.

• Within limits, let the selling unit closest to the • Ship to new accounts only on cash-in-advance or

market set terms. After all, these are the letter-of-credit terms.

individuals in the best position to know what is

• Standardize guidelines regarding which

typical for that country. The companies that have

companies you will sell to on open account. This

had the best success with this approach are those

will stop the ongoing conflict between sales and

requiring these same units to follow up on late

credit.

payments and those that pay commissions only

after the company collects its money. • Use letters of credit designed to meet established

seller criteria.

• Limit export credit to companies with ties in the

continental United States. While not everyone • Incorporate into every international sales contract

will agree with this approach, the few companies the letter-of-credit requirements, terms, and

that do use it report they have better control over conditions of sale. Doing so saves both time and

marketing conflicts. This might work for those money at the negotiation stage.

firms that are just starting to export.

• Begin using international accounts receivable

• Have the international credit policy formalized insurance. Doing so generally permits companies

and approved by senior management. While this to offer their customers longer terms and larger

may take a bit of time in the beginning, it will credit limits.

save time and aggravation in the long run.

• Rewrite any old, staid policies so they are more

• Ship goods to a bonded warehouse for release to user friendly. This does not necessarily mean

distributors in countries where international sales loosening terms but rather rewriting the policy in

are to be made. (Only if the distributor’s account a manner that is easy for the end user to

is current, of course.) This approach offers understand.

freight payment savings as well.

• Do not let the sales force establish terms of sale.

• Upgrade credit policies when key personnel turn The credit department or someone who fully

over. Several firms have reported stumbling understands and appreciates the ramifications of

blocks in the form of employees (some of them such policies should handle this. One company

quite senior) who insist on doing things “the way that implemented such a policy was able to

we always have.” Strike while the iron is hot and reduce its Days Sales Outstanding (DSO) by 20

before newcomers get too entrenched in the old days.

way.

• Create a credit risk model to score customers’

• Rewrite the credit policy as simply as possible. audited financial statement figures. Use this to

One flexible credit pro reports that he “broke ascertain whether specific customers can be

down rules of thumb, which confused everyone, offered open-account terms. Customers who do

into a few simple categories and then educated

not meet the open account standards can be • Monitor the political situation in each of the

offered secured terms countries where you are doing business. Many

recent troubles stem from internal political and

• In order to give operating units more latitude in

economic inefficiencies. The reaction to

the decision-making process, involve the unit

economic strife can be the reaction of one

heads in determining whether to accept or reject

individual or family, thus, making it difficult to

“unusual” terms and conditions of sale.

predict a stable pattern of behavior. This is

• Develop innovative international financing especially true in the case of dictatorships.

programs to help the sales force meet goals

INTERNATIONAL CREDIT INFORMATION

without increasing credit risk. Some credit

managers have used receivables discounting in • Evaluating the creditworthiness of customers is

order to offer extended terms. Doing so is never an easy task. When the customer is located

especially important to those selling in the Far in another country, the issue becomes more

East. complicated. International credit professionals

must deal with the fact that accounting standards

• Identify customers who also work with other

in other countries are not the same as generally

units of the company. Involve upper management

accepted accounting procedures (GAAP) and are

in developing a unified approach to establishing

typically less rigorous. Additionally, information

credit limits for such entities so that reasonable

available from credit agencies may not be as

amounts of credit are extended in total. The goal

complete or as up-to-date as one would like.

is not to overextend without realizing it.

• The country risk issue must be evaluated,

separate and apart from customer risk. Customers

ONGOING MONITORING could be of the highest quality but if it is

impossible to get good funds out of a country,

Luckily for international credit managers, the world then international credit professionals are back at

is a continually changing place. We say “luckily,” square one. Some companies establish not only

because continual movement translates into an credit lines for individual companies but overall

ongoing need for international credit professionals. credit exposure credit limits by country. These

Here is what should be done regularly: country limits are raised or lowered depending

• Don’t assume: “It’s a big company, nothing can on the economic outlook of the country in

hurt it.” question

• Obtain updated information from trading partners

to ascertain their liquidity and to determine INTERNATIONAL CREDIT REPORTS

whether they will have trouble meeting their

obligations during the course of the next year. If • Most credit executives begin their credit

you are having trouble getting new information, evaluations by requesting an international credit

go back to the balance sheet statements that you report from one of the agencies offering this

already possess to ascertain the company’s debt information. This information is often simply

position when you last reviewed its account. pulled from a database. While this allows the

credit report company to provide a report

• Divide accounts by country. Not all countries are quickly, the information in the report is dated,

in the same position; do not treat the entire sometimes by as much as two or three years.

Pacific Rim equally. Additional factors to be considered when using

• Divide the companies into public and private and international credit reports include:

then look at their payment history with the

⚬ Database versus updated information. Do

company and with others, if available. Doing so

you need current data or will information

may allow you to attribute risk appropriately in a

two to three years old suffice?

market that has risk written all over it.

• Continue to ask for letters of credit if this was the ⚬ When should reports be ordered—at the

practice in the past. Be careful about the issuing time of shipment, for the annual review, or

bank and the confirming bank. Analyze, or at when a new customer is being considered

least review, the position of the customer’s bank ⚬ Does the annual review coincide with the

if it is involved in the transaction. Do not assume financial statement filing requirements

that banks cannot fail. within the country?

⚬ The lead time required between ordering the Subsidiary, affiliate, and parent information is

report and receiving it, especially if updated useful as well. Innovative credit professionals

information is required. Remember, the have been able to structure transactions with

customer is not in Peoria—getting the report customers located in countries deemed to be

will take time. financial unstable by arranging payments from an

affiliate located in a more stable country

⚬ Financial statement filing requirements

within the country.

⚬ Does the country (or province) maintain

requirements for filing financial statements?

• What is the timing of the requirements—

quarterly/annually? IMPACT OF EXCHANGE RATE

FLUCTUATIONS

⚬ What is the quality of the information? Are

When analyzing financial statements from

the statements audited or prepared

customers in other countries, note the currency used

internally?

in the report. Fluctuations in that currency and the

⚬ What information is available through court impact this may have on financial information

registries and public filings? This can should be noted. This is especially important if

include: customers are paying in U.S. dollars. On the face of

it, payment in U.S. dollars may seem to protect the

• bankruptcies U.S. seller, but this is not always the case. If the

• date home currency plunges, a customer may have

difficulty getting enough funds to pay for the goods.

• established Imagine what would happen if your monthly

• ownership and organizational/legal mortgage payment suddenly went up 50 percent,

structure especially if the value of the house did not go up.

This is effectively what happens to the customer.

• liens/suits/judgments/charges The price it pays for goods goes up, but the price

the goods are sold at cannot be increased enough to

• authorization to sign

offset the additional unexpected cost.

• other

LACK OF GOOD FINANCIAL

OTHER SOURCES OF CREDIT INFORMATION

INFORMATION

Often, international credit executives simply do not

• International credit professionals often get have adequate information. The problem may be

references from banks for customers’ due to the unwillingness of companies to release

international banks as part of their credit information, or the information just may not be

investigation. When obtaining such information, available. Many companies keep more than one set

the first step is to ascertain whether it is of books—one for the taxing authorities and another

available. Before requesting the reference, get for the owners. Also, some customers are vaguely

permission in writing from customers to do so. connected with other companies, making it difficult

Otherwise, bankers may refuse to provide the to get an accurate financial picture. These factors

information requested should be factored into the ultimate credit

evaluation and the decision as to whether to ask for

• While not as common as with domestic accounts,

a letter of credit or other security.

international trade groups do exist. Membership

and participation in the international trade groups

can be invaluable. Both the FCIB (an association

QUALITY OF INFORMATION

of executives in Finance, Credit and International

Business) and the Riemer organization have It is not uncommon to hear that credit information

international group in the rest of the world is not as good as it is in the

United States. Is this true, or is this boasting just

• Information about the individuals who own the

another case of Americans believing that they do

customer is invaluable. Often, these same

everything better than the rest of the world? The

individuals own other companies, and it is

“quality issue” in the international arena definitely

possible to check on those other entities.

warrants discussion. These remarks are

generalizations, and there are country-by-country COURT RECORDS AND PUBLIC FILINGS

variations in the quality of information available. In

• For the most part, the information available from

general, the farther north one goes in Europe, the

public records is good. Government offices do

better the information becomes. Conversely, the

not compile all information available from public

data becomes sketchier the farther south a country is

records. In many instances the task has been

located.

subcontracted out to private enterprises. In

The most important thing to realize is that, while the another exciting development for creditors, trade

data in the rest of the world is not up to U.S. tapes are beginning to be used extensively.

standards, it is getting better. Some information Database listings of all companies are also

from other countries is just as good as what you available.

could get in the United States. In a number of cases,

• The only requirements in most Asian countries is

information that was not possible to obtain just a

that there be a corporate registration. Information

few years ago is now available or will be in the next

about public filings and bankruptcy is not

few years

available. At this time, trade tapes do not exist,

and database information is limited mostly to

larger companies.

FINANCIAL INFORMATION

• The likelihood of getting accurate information

• Most countries require that financial information

from public records is much better in large

be filed six to eight months after the end of a

industrialized regions than it is in rural areas. For

company’s fiscal year. Companies that miss the

the most parade tape data does not exist, and

filing date are fined. Unfortunately, in many

database information is a hit-or-miss affair,

countries, it is possible to pay the fine and never

although database information usually can be

file the reports—and that is what some

found about largest companies. Mexican banks

companies do intentionally. Even when financial

have recently announced the adoption of credit

statements are filed, the information included

reporting practices similar to those used in the

may be minimal, as many file on the old English

United States. With many loans tied to an

system, which lets a company show sale,

inflation rate that occasionally has approached

expenses, and a net profit without the

100 percent, this information is critical in

accompanying details and footnotes. However,

Mexico. Trans Union is a large investor in a joint

many companies are providing more information

venture with BC Buro de Credito and has

now. Statements from Belgian companies are

compiled information about 25 million loans,

quite good. Information from German companies

while Equifax says it has information about 8

varies, because each province has its own

million loans and hopes to have the information

requirements. Italian requirements are not

on 20 million loans in less than one year

stringent, making the data mediocre.

• Once again, in most countries companies are

required to file limited financial information. The OTHER DIFFERENCES

quality varies from country to country, but the

• Cultural differences should have an impact on

information from Australian and Japanese

the way financial data is viewed regarding

companies is particularly good.

nonsufficient funds (NSF). In this country most

• he most important thing to realize is that most creditors do not see the notation of an NSF check

Latin Americans have a cultural reluctance to in a credit file as a big deal, as long as the

share financial information with vendors. For payment was made. In most of Latin America,

whatever reason, many Latin Americans believe especially Brazil, it is considered a serious

that if their financial statements show they are problem. Therefore, most companies will go to

profitable, North American vendors will charge great lengths to avoid a situation that would give

higher prices. Thus, they would rather show a rise to an NSF check. So, credit professionals

loss or minimal profit in the hope of getting a who run into one should be aware that it could

better price. Of course, this thinking contradicts indicate serious financial problems because the

what U.S. credit professionals believe. There are debtor would have avoided it if possible.

no filing requirements in Latin American

• With ever-improving financial information

countries. Companies in Brazil, Argentina,

available about their international customers,

Mexico, and Chile provide the best information.

credit executives are now in a better position than

ever to get that data and make intelligent credit

decisions. However, the data available is limited;

international credit professionals still need to rely advance were it a domestic company. Similarly,

not only on the data but on other sources of at these firms, international collection efforts are

information. much weaker and start much later than with

domestic accounts. Thus, it is important to

establish separate international credit policies

OTHER FACTORS AFFECTING THE and procedures.

CREDIT PROCESS

• Each country has its own rules and regulations

• Even if international credit professionals do surrounding collection activity, especially as it

everything correctly, the company may still not relates to third-party collectors. Some countries

collect all that it is owed because other factors, permit interest on late payments and others do

beyond the control of the credit professionals, not. Specifically, when setting a collection

affect the eventual outcome. These factors need policy, the following issues should be

to be considered when making the final credit considered:

decision.

• Jurisdiction

• Even after making the perfect credit evaluation,

• Legal system

the sale can still be derailed by others in the

company who do not handle their functions • Documentation requirements

effectively. While this is true in all sales, it is

• Standard terms

many times more important with international

sales simply because there are so many things • Interest provision

that can go wrong. By asking “Do we have

internal staff capable of handling these

responsibilities?” and “Are we working with

other companies that can manage these tasks?”

international credit professionals will be able to

determine if any adjustments need to be made.

Specifically, the areas of concern include:

• Logistics/Transportation

• Air/ocean shipments

• Warehouse/storage

• Documentation

• Contract or purchase order

• Payment method

• Evidence of shipment

• Collection efforts

• Government requirements—Both United

States and buyer’s country

• Insurance

• Marine/cargo policy

• Risk management

• Sales Representatives/Agents/Distributors

• Location

• Coordination

• Amazingly enough, many companies with

strong domestic credit standards have no

international credit policy. On an international

basis they extend credit on open-account terms

to a company that would qualify only for cash in

You might also like

- ch14 Exercises (Written Q) Q+A - WACCDocument4 pagesch14 Exercises (Written Q) Q+A - WACCNurayGulNo ratings yet

- Loan Delinquency ManagementDocument32 pagesLoan Delinquency ManagementAyomideNo ratings yet

- Unit III Receivables Management - Concept of Credit PolicyDocument16 pagesUnit III Receivables Management - Concept of Credit PolicyYash Raj Tripathi0% (1)

- Printicomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentDocument103 pagesPrinticomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentKunal MehtaNo ratings yet

- Credit Policy Sample637225320210415Document7 pagesCredit Policy Sample637225320210415o'brianNo ratings yet

- Credit PolicyDocument84 pagesCredit PolicyDan John Karikottu100% (6)

- Internship Report of BopDocument52 pagesInternship Report of Bopbbaahmad89100% (4)

- Introduction To Risk Management and MCQ L 1Document21 pagesIntroduction To Risk Management and MCQ L 1FarooqChaudhary92% (13)

- Construction Management AgreementDocument4 pagesConstruction Management AgreementRocketLawyer100% (2)

- Credit PolicyDocument24 pagesCredit PolicyCHRISTINE JADUCANANo ratings yet

- Account Receivable Management OverviewDocument21 pagesAccount Receivable Management OverviewLlyod Daniel Paulo0% (1)

- Receivables Management: Dr.K.P.Malathi ShiriDocument19 pagesReceivables Management: Dr.K.P.Malathi ShiriSruthy KrishnaNo ratings yet

- ABL & Factoring Basics 1 PDFDocument146 pagesABL & Factoring Basics 1 PDFDale ChangNo ratings yet

- Account Receivable ManagementDocument49 pagesAccount Receivable ManagementAli Mubin FitranandaNo ratings yet

- Lecture 1 Banking, Financial Services Industry and RegulationsDocument29 pagesLecture 1 Banking, Financial Services Industry and Regulationseugene etwireNo ratings yet

- Commercial and Industrial LendingDocument64 pagesCommercial and Industrial LendingSanjeela JoshiNo ratings yet

- 1424 Receivables ManagementDocument13 pages1424 Receivables ManagementBhavika_Patel_8085No ratings yet

- PMC FM5 Unit-4Document7 pagesPMC FM5 Unit-4npwrettiieeNo ratings yet

- Credit Collection Policy Procedures and PracticesDocument28 pagesCredit Collection Policy Procedures and Practicescheska.movestorageNo ratings yet

- Mergers and Acquisitions - Another LookDocument57 pagesMergers and Acquisitions - Another LookTubagus Donny SyafardanNo ratings yet

- Chapter 13 Financial Management by CabreraDocument25 pagesChapter 13 Financial Management by CabreraLars FriasNo ratings yet

- Credit RatingDocument3 pagesCredit Ratingsanjay parmar100% (4)

- Financing - Debt Finance: Chapter Learning ObjectivesDocument9 pagesFinancing - Debt Finance: Chapter Learning ObjectivesDINEO PRUDENCE NONGNo ratings yet

- Final Microfinance Lending and Risk ManagementDocument241 pagesFinal Microfinance Lending and Risk ManagementSabelo100% (2)

- Final Microfinance Lending and Risk ManagementDocument241 pagesFinal Microfinance Lending and Risk ManagementSabelo100% (2)

- Current Issues in Financial MarketsDocument31 pagesCurrent Issues in Financial MarketsNg Win WwaNo ratings yet

- MADocument37 pagesMAYogeshDeoraNo ratings yet

- Presentation DCMDocument5 pagesPresentation DCMsuvarna27No ratings yet

- Module 1 - Introduction To Credit and CollectionDocument23 pagesModule 1 - Introduction To Credit and CollectionAllan Cris RicafortNo ratings yet

- Receivables Management: Presented by Group 10Document10 pagesReceivables Management: Presented by Group 10Anonymous GuyNo ratings yet

- 4 Corporate BankingDocument31 pages4 Corporate BankingKartik BhartiaNo ratings yet

- GRP 7 - Successful Projects Dos DontsDocument29 pagesGRP 7 - Successful Projects Dos DontsABHYUDAYA BHARADWAJ MBA W 2021-24No ratings yet

- Corporate BankingDocument21 pagesCorporate BankingPadma NarayananNo ratings yet

- Chapter 2 - Asset Allocation DecisionDocument24 pagesChapter 2 - Asset Allocation DecisionImejah FaviNo ratings yet

- TCF GapDocument3 pagesTCF Gapmm_mayfairNo ratings yet

- Module 4Document17 pagesModule 4Andrea AbellanozaNo ratings yet

- Topic 3 - CREDIT MANAGEMENTDocument43 pagesTopic 3 - CREDIT MANAGEMENTeogollaNo ratings yet

- Untitled DocumentDocument8 pagesUntitled DocumentSartoriNo ratings yet

- Credit Rating: Presentation OnDocument14 pagesCredit Rating: Presentation OnPankaj KhatriNo ratings yet

- Group 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita DavidDocument66 pagesGroup 1: Members: - Sujeet Pandey (Group Leader) - Rahul Kumar Gupta - Daya Jaiswal - Nita Davidnita davidNo ratings yet

- Corporate Banking: by Prof. Santosh KumarDocument60 pagesCorporate Banking: by Prof. Santosh KumarAditya RajNo ratings yet

- Understanding Credit RatingDocument37 pagesUnderstanding Credit RatingSanjeev BansalNo ratings yet

- Lecture 8 Metrics For Entrepreneurs and Startup Funding PDFDocument28 pagesLecture 8 Metrics For Entrepreneurs and Startup Funding PDFBhagavan BangaloreNo ratings yet

- 180+ Tech面试题 Study CardsDocument92 pages180+ Tech面试题 Study CardswinnieNo ratings yet

- Principles of Credit LendingDocument10 pagesPrinciples of Credit LendingRa'fat JalladNo ratings yet

- Components of A Good Credit PolicyDocument29 pagesComponents of A Good Credit PolicyAyomideNo ratings yet

- Chapter 1Document49 pagesChapter 1Sami JattNo ratings yet

- Account Receivables Management & Credit Policy: Presented byDocument37 pagesAccount Receivables Management & Credit Policy: Presented byKhalid Khan100% (1)

- B2&C1 Conceptual FrameworkDocument34 pagesB2&C1 Conceptual Frameworkpaul sagudaNo ratings yet

- TOPIC 9 Chapter 19 Accounts Receivable and Inventory ManagementDocument17 pagesTOPIC 9 Chapter 19 Accounts Receivable and Inventory ManagementIrene Kim100% (1)

- Unit III. Implementing The Financial PlanDocument18 pagesUnit III. Implementing The Financial PlanShreya NairNo ratings yet

- Corporate BankingDocument57 pagesCorporate BankingSoumya TiwaryNo ratings yet

- Credit and Collection PA1Document109 pagesCredit and Collection PA1Lorey Joy IdongNo ratings yet

- Sai Kiran Print PDFDocument53 pagesSai Kiran Print PDFThanuja BhaskarNo ratings yet

- Foreign Market Entry StrategiesDocument33 pagesForeign Market Entry StrategiesSoumendra RoyNo ratings yet

- Accounts ReceivableDocument52 pagesAccounts Receivablemarget100% (3)

- Risk ManagementDocument23 pagesRisk ManagementMonal ChawdaNo ratings yet

- Credit RatingDocument56 pagesCredit RatingRaman Gupta100% (1)

- Credit Rating: Dr. Kanhaiya SinghDocument30 pagesCredit Rating: Dr. Kanhaiya SinghVidisha SinghalNo ratings yet

- Presentation On FactoringDocument32 pagesPresentation On Factoringjigs44100% (2)

- What Do You Already Know?Document18 pagesWhat Do You Already Know?Albiz, Vanessa R.No ratings yet

- Albiz, Vanessa R. Bafm 1-E Lesson 1: Presentation of The Letter ProperDocument7 pagesAlbiz, Vanessa R. Bafm 1-E Lesson 1: Presentation of The Letter ProperAlbiz, Vanessa R.No ratings yet

- Albiz, Vanessa R. Bafm 1-E Unit 5 Entrepreneurship Development Process PretestDocument5 pagesAlbiz, Vanessa R. Bafm 1-E Unit 5 Entrepreneurship Development Process PretestAlbiz, Vanessa R.No ratings yet

- REVISED Social Media Use Perceived Effects of Social MDocument61 pagesREVISED Social Media Use Perceived Effects of Social MAlbiz, Vanessa R.No ratings yet

- Unit 2. Post-Test (Principles of Writing)Document13 pagesUnit 2. Post-Test (Principles of Writing)Albiz, Vanessa R.No ratings yet

- UntitledDocument24 pagesUntitledAlbiz, Vanessa R.No ratings yet

- Case Study On Lehmans Brothers Group 3Document22 pagesCase Study On Lehmans Brothers Group 3Albiz, Vanessa R.No ratings yet

- Venture Capital ReviewerDocument18 pagesVenture Capital ReviewerAlbiz, Vanessa R.No ratings yet

- Cox and Kings Final ProspectusDocument518 pagesCox and Kings Final ProspectusRaj ThakurNo ratings yet

- Module 4 of Becg Mba Sem 1Document29 pagesModule 4 of Becg Mba Sem 112Twinkal ModiNo ratings yet

- CONCURRENT ENGINEERING Q BankDocument5 pagesCONCURRENT ENGINEERING Q BankNagamani RajeshNo ratings yet

- Customer Buying Behaviour With A Focus On Market SegmentationDocument5 pagesCustomer Buying Behaviour With A Focus On Market SegmentationRohit PNo ratings yet

- Asset Specificity and Economic OrganizationDocument14 pagesAsset Specificity and Economic OrganizationAjla CerićNo ratings yet

- AP Training ManualDocument156 pagesAP Training ManualLaeeq AhmedNo ratings yet

- SW and ASSIGNMENT - TUGOTDocument9 pagesSW and ASSIGNMENT - TUGOTAndrea TugotNo ratings yet

- AxiomDocument13 pagesAxiomFrancis Dave Peralta BitongNo ratings yet

- Executive Summary: Colegio de SebastianDocument36 pagesExecutive Summary: Colegio de SebastianEina Rivera TapnioNo ratings yet

- Virtual Content SOPDocument11 pagesVirtual Content SOPAnezwa MpetaNo ratings yet

- Purchasing Manager CV TemplateDocument2 pagesPurchasing Manager CV TemplatePritu SinhaNo ratings yet

- Transactional Vs Transformational LeadershipDocument21 pagesTransactional Vs Transformational LeadershipSnam KhanNo ratings yet

- Entfin f2010Document24 pagesEntfin f2010Toni MartinezNo ratings yet

- Final Exam Project - Amazon - Kholoud MohsenDocument19 pagesFinal Exam Project - Amazon - Kholoud MohsenChristine EskanderNo ratings yet

- Research Paper Section 1Document19 pagesResearch Paper Section 1Bcd AllidealstuffsNo ratings yet

- 12-ACCA-FA2-Chp 12Document26 pages12-ACCA-FA2-Chp 12SMS PrintingNo ratings yet

- Textile Uzbekistan 1 PDFDocument12 pagesTextile Uzbekistan 1 PDFmoNo ratings yet

- Test - Cost Accounting Chapter 3 TB - QuizletDocument9 pagesTest - Cost Accounting Chapter 3 TB - QuizletAbhishek AbhiNo ratings yet

- SEO Company in PuneDocument14 pagesSEO Company in PuneVinod MohiteNo ratings yet

- Supply Chain ManagementDocument16 pagesSupply Chain ManagementManasi Dighe DiasNo ratings yet

- NIST Information Security HandbookDocument176 pagesNIST Information Security HandbooknemonbNo ratings yet

- Strategic Management (Nestle)Document12 pagesStrategic Management (Nestle)San Htet AungNo ratings yet

- Entrepreneurship Theories - UnlockedDocument28 pagesEntrepreneurship Theories - UnlockedShifat Hasan100% (1)

- Student Counseling Management SystemDocument3 pagesStudent Counseling Management Systemtamil630561No ratings yet

- Project Report Balaji WafersDocument30 pagesProject Report Balaji WafersDev Dev27% (11)

- Startup Business Plan TemplateDocument36 pagesStartup Business Plan TemplateMohammad SowadNo ratings yet